- Revenues for the first quarter increased 5.8% to $192.6

million, compared to $182.1 million in the same period in

2023.

- Net loss was $26.5 million in the first quarter, compared to a

net loss of $42.9 million in the same period last year. Adjusted

EBITDA was $39.5 million, a 7.9% increase from $36.6 million in the

same period last year.

- Income from operations margin was (2.5)% in the first quarter,

compared to (7.5)% in the same period last year. Adjusted EBITDA

margin was 20.5% in the first quarter, compared to 20.1% in the

same period last year.

- GAAP net loss per share for the first quarter was $0.13,

compared to $0.22 in the first quarter of 2023. Adjusted earnings

per share for the quarter was $0.06, in-line with the same period

last year.

- The company reaffirmed full year 2024 guidance and continues to

expect revenue growth of 5% to 7%, adjusted EBITDA of $193 million

to $203 million, and adjusted EPS of $0.37-$0.42.

Mirion (“we” or the “company”) (NYSE: MIR), a global provider of

radiation detection, measurement, analysis and monitoring solutions

to the medical, nuclear, defense, and research end markets, today

announced results for the first quarter ended March 31, 2024.

“The first quarter was a solid start for Mirion in 2024,” stated

Thomas Logan, Mirion’s Chief Executive Officer. “Revenue growth was

in-line with our expectations, led by a strong quarter from our

Technologies segment. I am pleased with the Adjusted EBITDA margin

expansion we delivered compared to the same period last year and

believe we are well-positioned heading into the rest of 2024.

Engagement remains strong across our end markets and I am

particularly excited by the macro trends taking shape in nuclear

power and cancer care.”

Reaffirmed 2024 Outlook

“We are reaffirming our 2024 financial outlook today,” continued

Mr. Logan. “I am encouraged by the commercial and operational

momentum across the business and believe that we have the right

strategy in place to deliver against our expectations.”

Mirion is reaffirming its guidance for the fiscal year and

12-month period ending December 31, 2024:

- Revenue growth of 5% - 7%

- Organic revenue growth of 4% - 6%

- Medical +MSD organic

- Technologies +MSD organic

- Inorganic revenue growth of approximately 1%, primarily as a

result of the ec2 acquisition

- Minimal impact from foreign exchange rates

- Adjusted EBITDA of $193 million - $203 million

- Adjusted EPS of $0.37 - $0.42

- Adjusted free cash flow of $65 million - $85 million

The guidance for organic revenue growth excludes the impact of

foreign exchange rates as well as mergers, acquisitions and

divestitures.

Other modeling and guidance assumptions include the

following:

- Depreciation of approximately $33 million for the year

- Net interest expense of approximately $55 million

(approximately $52 million of cash interest)

- Effective tax rate between 26% and 28%

- Capital expenditures of approximately $40 million

- Cash taxes of approximately $35 million

- Approximately 204 million shares of Class A common stock

outstanding (excludes 7.3 million shares of Class B common stock,

18.7 million public warrants (which were called for redemption on

April 18, 2024), 8.5 million private placement warrants, 18.8

million founder shares, subject to vesting, 2.2 million restricted

stock units, 1.2 million performance stock units and a further 34.3

million shares reserved for future equity awards (subject to annual

automatic increases)) (all numbers as of March 31, 2024)

- Euro to U.S. Dollar foreign exchange conversion rate of

1.08

- Cash non-operating expenses of approximately $9 million

- Stock-based compensation of approximately $11 million

The Company’s guidance contains forward-looking statements and

actual results may differ materially as a result of known and

unknown uncertainties and risks, including those set forth below

under the heading “Forward-Looking Statements.” In addition,

forward-looking non-GAAP financial measures are presented on a

non-GAAP basis without reconciliations of such forward-looking

non-GAAP measures due to the inherent difficulty in projecting and

quantifying the various adjusting items necessary for such

reconciliations, such as stock-based compensation expense,

amortization and depreciation expense, merger and acquisition

activity and purchase accounting adjustments, that have not yet

occurred, are out of Mirion’s control, or cannot be reasonably

predicted. Accordingly, reconciliations of our guidance for organic

and inorganic revenue, adjusted EBITDA, adjusted EPS and adjusted

free cash flow are not available without unreasonable effort.

Conference Call

Mirion will host a conference call tomorrow, May 1, 2024 at 9:00

a.m. ET to discuss its financial results. Participants may access

the call by dialing 1-844-826-3035 or 1-412-317-5195, and

requesting to join the Mirion Technologies, Inc. earnings call. A

live webcast will also be available at

https://ir.mirion.com/news-events.

A telephonic replay will be available shortly after the

conclusion of the call and until May 15, 2024. Participants may

access the replay at 1-844-512-2921, international callers may use

1-412-317-6671, and enter access code 10188006. An archived replay

of the call and an accompanying presentation will also be available

on the Investors section of the Mirion website at

https://ir.mirion.com/.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended. Words such as “anticipate,” “believe,” “continue,”

“could,” “estimate”, “expect”, “hope”, “intend”, “may”, “might”,

“should”, “would”, “will”, “understand” and similar words are

intended to identify forward looking statements. These

forward-looking statements include but are not limited to,

statements regarding our future operating results, financial

position and guidance, our business strategy and plans, our

objectives for future operations, macroeconomic trends and macro

trends in nuclear power and cancer care, foreign exchange, interest

rate and inflation expectations, any future mergers, acquisitions,

divestitures and strategic investments, including the completion

and integration of previously completed transactions, our future

share capitalization and any exercise, exchange, redemption or

other settlement of our outstanding warrants and other securities.

There are a significant number of factors that could cause actual

results to differ materially from statements made in this press

release, including changes in domestic and foreign business,

market, economic, financial, political and legal conditions,

including related to matters affecting Russia, the relationship

between the United States and China, conflict in the Middle East

and risks of slowing economic growth or economic recession in the

United States and globally; developments in the government budgets

(defense and non-defense) in the United States and other countries,

including budget reductions, sequestration, implementation of

spending limits or changes in budgetary priorities, delays in the

government budget process, a U.S. government shutdown or the U.S.

government’s failure to raise the debt ceiling; risks related to

the public’s perception of nuclear radiation and nuclear

technologies; risks related to the continued growth of our end

markets; our ability to win new customers and retain existing

customers; our ability to realize sales expected from our backlog

of orders and contracts; risks related to governmental contracts;

our ability to mitigate risks associated with long-term fixed price

contracts, including risks related to inflation; risks related to

information technology system failures or other disruptions or

cybersecurity, data security or other security threats; risks

related to the implementation and enhancement of information

systems; our ability to manage our supply chain or difficulties

with third-party manufacturers; risks related to competition; our

ability to manage disruptions of, or changes in, our independent

sales representatives, distributors and original equipment

manufacturers; our ability to realize the expected benefit from

strategic transactions, such as acquisitions, divestitures and

investments, including any synergies, or internal restructuring and

improvement efforts; our ability to issue debt, equity or

equity-linked securities in the future; risks related to changes in

tax law and ongoing tax audits; risks related to future legislation

and regulation both in the United States and abroad; risks related

to the costs or liabilities associated with product liability

claims; our ability to attract, train and retain key members of our

leadership team and other qualified personnel; risks related to the

adequacy of our insurance coverage; risks related to the global

scope of our operations, including operations in international and

emerging markets; risks related to our exposure to fluctuations in

foreign currency exchange rates, interest rates and inflation,

including the impact on our debt service costs; our ability to

comply with various laws and regulations and the costs associated

with legal compliance; risks related to the outcome of any

litigation, government and regulatory proceedings, investigations

and inquiries; risks related to our ability to protect or enforce

our proprietary rights on which our business depends or third-party

intellectual property infringement claims; liabilities associated

with environmental, health and safety matters; our ability to

predict our future operational results; risks associated with our

limited history of operating as an independent company; and the

effects of health epidemics, pandemics and similar outbreaks may

have on our business, results of operations or financial condition.

Further information on risks, uncertainties and other factors that

could affect our financial results are included in the filings we

make with the United States Securities and Exchange Commission (the

“SEC”) from time to time, including our Annual Report on Form 10-K,

our Quarterly Reports on Form 10-Q and other periodic reports filed

or to be filed with the SEC.

You should not rely on these forward-looking statements, as

actual outcomes and results may differ materially from those

contemplated by these forward- looking statements as a result of

such risks and uncertainties. All forward-looking statements in

this press release are based on information available to us as of

the date hereof, and we do not assume any obligation to update the

forward-looking statements provided to reflect events that occur or

circumstances that exist after the date on which they were

made.

Use of Non-GAAP Financial Information

In addition to our results determined in accordance with GAAP,

we believe that the presentation of non-GAAP financial information

provides important supplemental information to management and

investors regarding financial and business trends relating to our

financial condition and results of operations. For further

information regarding these non-GAAP measures, including the

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP financial measures, please refer to the

financial tables below, as well as the “Reconciliation of Non-GAAP

Financial Measures” section of this press release. Non-GAAP

financial information is not a substitute for GAAP financial

information and undue reliance should not be placed on such

non-GAAP financial information. In addition, similarly titled items

used by other companies may not be comparable due to variations in

how they are calculated and how terms are defined.

Channels for Disclosure of Information

Mirion intends to announce material information to the public

through the Mirion Investor Relations website ir.mirion.com, SEC

filings, press releases, public conference calls and public

webcasts. Mirion uses these channels, as well as social media, to

communicate with its investors, customers, and the public about the

company, its offerings, and other issues. It is possible that the

information Mirion posts on social media could be deemed to be

material information. As such, Mirion encourages investors, the

media, and others to follow the channels listed above, including

the social media channels listed on Mirion’s investor relations

website, and to review the information disclosed through such

channels. Any updates to the list of disclosure channels through

which Mirion will announce information will be posted on the

investor relations page on Mirion’s website.

About Mirion

Mirion (NYSE: MIR) is a global leader in radiation safety,

science and medicine, empowering innovations that deliver vital

protection while harnessing the transformative potential of

ionizing radiation across a diversity of end markets. The Mirion

Technologies group provides proven radiation safety technologies

that operate with precision – for essential work within R&D

labs, critical nuclear facilities, and on the front lines. The

Mirion Medical group solutions help enhance the delivery and ensure

safety in healthcare, powering the fields of Nuclear Medicine,

Radiation Therapy QA, Occupational Dosimetry, and Diagnostic

Imaging. Headquartered in Atlanta (GA – USA), Mirion employs

approximately 2,800 people and operates in 12 countries. Learn more

at mirion.com.

Mirion Technologies,

Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

(In millions, except share

data)

March 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

120.2

$

128.8

Restricted cash

0.4

0.6

Accounts receivable, net of allowance for

doubtful accounts

146.1

172.3

Costs in excess of billings on uncompleted

contracts

62.6

48.7

Inventories

146.8

144.1

Prepaid expenses and other current

assets

38.5

44.1

Total current assets

514.6

538.6

Property, plant, and equipment, net

138.3

134.5

Operating lease right-of-use assets

31.1

32.8

Goodwill

1,440.2

1,447.6

Intangible assets, net

504.3

538.8

Restricted cash

1.1

1.1

Other assets

19.1

25.1

Total assets

$

2,648.7

$

2,718.5

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$

53.1

$

58.7

Deferred contract revenue

95.8

103.4

Notes payable to third-parties,

current

0.1

1.2

Operating lease liability, current

6.6

6.8

Accrued expenses and other current

liabilities

79.0

95.6

Total current liabilities

234.6

265.7

Notes payable to third-parties,

non-current

685.3

684.7

Warrant liabilities

61.0

55.3

Operating lease liability, non-current

26.5

28.1

Deferred income taxes, non-current

77.3

84.0

Other liabilities

46.1

50.7

Total liabilities

1,130.8

1,168.5

Commitments and contingencies (Note

10)

Stockholders’ equity (deficit):

Class A common stock; $0.0001 par value,

500,000,000 shares authorized; 218,735,333 shares issued and

outstanding at March 31, 2024; 218,177,832 shares issued and

outstanding at December 31, 2023

—

—

Class B common stock; $0.0001 par value,

100,000,000 shares authorized; 7,326,423 issued and outstanding at

March 31, 2024; 7,787,333 issued and outstanding at December 31,

2023

—

—

Treasury stock, at cost; 149,076 shares at

March 31, 2024 and December 31, 2023

(1.3

)

(1.3

)

Additional paid-in capital

2,063.9

2,056.5

Accumulated deficit

(531.2

)

(505.4

)

Accumulated other comprehensive loss

(74.2

)

(65.3

)

Mirion Technologies, Inc. stockholders’

equity

1,457.2

1,484.5

Noncontrolling interests

60.7

65.5

Total stockholders’ equity

1,517.9

1,550.0

Total liabilities and stockholders’

equity

$

2,648.7

$

2,718.5

Mirion Technologies,

Inc.

Condensed Consolidated Statements

of Operations

(Unaudited)

(In millions, except per share

data)

Three Months

Ended March 31,

2024

Three Months

Ended March 31,

2023

Revenues:

Product

$

140.0

$

132.4

Service

52.6

49.7

Total revenues

192.6

182.1

Cost of revenues:

Product

79.0

76.8

Service

26.5

26.2

Total cost of revenues

105.5

103.0

Gross profit

87.1

79.1

Operating expenses:

Selling, general and administrative

84.1

85.1

Research and development

7.9

7.6

Total operating expenses

92.0

92.7

Loss from operations

(4.9

)

(13.6

)

Other expense (income):

Interest expense

15.5

16.0

Interest income

(1.7

)

(1.1

)

Loss on debt extinguishment

—

2.6

Foreign currency loss (gain), net

0.8

(0.3

)

Increase in fair value of warrant

liabilities

5.7

13.4

Other expense (income), net

0.1

(0.2

)

Loss before income taxes

(25.3

)

(44.0

)

Loss (benefit) from income taxes

1.2

(1.1

)

Net loss

(26.5

)

(42.9

)

Loss attributable to noncontrolling

interests

(0.7

)

(1.0

)

Net loss attributable to Mirion

Technologies, Inc.

$

(25.8

)

$

(41.9

)

Net loss per common share attributable to

Mirion Technologies, Inc. — basic and diluted

$

(0.13

)

$

(0.22

)

Weighted average common shares outstanding

— basic and diluted

199.729

187.701

Mirion Technologies,

Inc.

Condensed Consolidated Statements

of Cash Flows

(Unaudited)

(In millions)

Three Months

Ended March 31,

2024

Three Months

Ended March 31,

2023

OPERATING ACTIVITIES:

Net loss

$

(26.5

)

$

(42.9

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization expense

38.8

41.3

Stock-based compensation expense

3.6

5.5

Amortization of debt issuance costs

0.7

3.5

Provision for doubtful accounts

0.8

0.8

Inventory obsolescence write down

1.2

1.0

Change in deferred income taxes

(7.5

)

(7.1

)

Loss on disposal of property, plant and

equipment

0.3

0.8

Loss (gain) on foreign currency

transactions

0.8

(0.3

)

Increase in fair values of warrant

liabilities

5.7

13.4

Changes in operating assets and

liabilities:

Accounts receivable

24.2

19.1

Costs in excess of billings on uncompleted

contracts

(8.2

)

(8.6

)

Inventories

(5.6

)

(13.9

)

Prepaid expenses and other current

assets

4.2

(0.3

)

Accounts payable

(5.4

)

(2.5

)

Accrued expenses and other current

liabilities

(12.3

)

(8.5

)

Deferred contract revenue and

liabilities

(9.1

)

(3.6

)

Other assets

(0.2

)

0.4

Other liabilities

0.5

(0.8

)

Net cash provided by (used in)

operating activities

6.0

(2.7

)

INVESTING ACTIVITIES:

Acquisitions of businesses, net of cash

and cash equivalents acquired

(1.0

)

—

Purchases of property, plant, and

equipment and badges

(12.8

)

(7.5

)

Proceeds from net investment hedge

derivative contracts

0.9

—

Net cash used in investing

activities

(12.9

)

(7.5

)

FINANCING ACTIVITIES:

Issuances of common stock

—

150.0

Common stock issuance costs

—

(0.2

)

Principal repayments

—

(125.0

)

Proceeds from net cash flow hedge

derivative contracts

0.3

—

Other financing

(0.1

)

(0.2

)

Net cash provided by financing

activities

0.2

24.6

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(2.1

)

0.7

Net (decrease) increase in cash, cash

equivalents, and restricted cash

(8.8

)

15.1

Cash, cash equivalents, and restricted

cash at beginning of period

130.5

75.0

Cash, cash equivalents, and restricted

cash at end of period

$

121.7

$

90.1

Share Count

Consists of 199,985,333 shares of Class A common stock

outstanding as of March 31, 2024. Excludes (1) 7,326,423 shares of

Class B common stock outstanding as of March 31, 2024; 18,750,000

founder shares which are shares of Class A common stock subject to

vesting in three equal tranches, based on the volume-weighted

average price of our Class A common stock being greater than or

equal to $12.00, $14.00 and $16.00 per share for any 20 trading

days in any 30 consecutive trading day period, and such shares will

be forfeited to us for no consideration if they fail to vest within

five years after October 20, 2021; (2) 27,249,779 shares of Class A

common stock issuable upon the exercise of 8,500,000 private

placement warrants and 18,749,779 publicly-traded warrants, all of

which publicly-traded warrants were called for redemption on April

18, 2024; (3) 2.2 million shares of Class A common stock underlying

restricted stock units and 1.2 million shares of Class A common

stock underlying performance stock units; and (4) any shares

issuable from awards under our 2021 Omnibus Incentive Plan, which

had 34,340,921 shares reserved for future equity awards (subject to

annual automatic increases). The 7,326,423 shares of Class B common

stock are paired on a one-for-one basis with shares of Class B

common stock of Mirion Intermediate Co., Inc. (the "paired

interests"). Holders of the paired interests have the right to have

their interests redeemed for, at the option of Mirion, shares of

Class A common stock on a one-for-one basis or cash based on a

trailing stock price average. All share data is of March 31, 2024

unless otherwise noted.

Reconciliation of Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP,

we believe the following non-GAAP measures are useful in evaluating

our operating performance. We use the following non-GAAP financial

information to evaluate our ongoing operations and for internal

planning and forecasting purposes. We believe that non-GAAP

financial information, when taken collectively, may be helpful to

investors because it provides consistency and comparability with

past financial performance. However, non-GAAP financial information

is presented for supplemental informational purposes only, has

limitations as an analytical tool, and should not be considered in

isolation or as a substitute for financial information presented in

accordance with GAAP. Other companies, including companies in our

industry, may calculate similarly titled non-GAAP measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison.

Investors are encouraged to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures

and not rely on any single financial measure to evaluate our

business.

Organic Revenues is defined as Revenues excluding the

impact of foreign exchange rates as well as mergers, acquisitions

and divestitures in the period.

Adjusted EBITDA is defined as net income before interest

expense, income tax expense, depreciation and amortization adjusted

to remove the impact of foreign currency gains and losses,

amortization of acquired intangible assets, changes in the fair

value of warrants, certain non-operating expenses (restructuring

and costs to achieve operational synergies, merger, acquisition and

divestiture expenses and IT project implementation expenses),

stock-based compensation expense, debt extinguishment and income

tax impacts of these adjustments.

Adjusted EBITDA Margin is defined as Adjusted EBITDA

divided by Revenue.

Adjusted Net Income is defined as GAAP net income

adjusted for foreign currency gains and losses, amortization of

acquired intangible assets, changes in the fair value of warrants,

certain non-operating expenses (restructuring and costs to achieve

operational synergies, merger, acquisition and divestiture expenses

and IT project implementation expenses), stock-based compensation

expense, debt extinguishment and income tax impacts of these

adjustments.

Adjusted EPS is defined as adjusted net income divided by

weighted average common shares outstanding — basic and diluted.

Adjusted Free Cash Flow is defined as free cash flow

adjusted to include the impact of cash used to fund non-operating

expenses. We believe that the inclusion of supplementary

adjustments to free cash flow applied in presenting adjusted free

cash flow is appropriate to provide additional information to

investors about our cash flows that management utilizes on an

ongoing basis to assess our ability to generate cash for use in

acquisitions and other investing and financing activities.

Free Cash Flow is defined as U.S. GAAP net cash provided

by operating activities adjusted to include the impact of purchases

of property, plant, and equipment, purchases of badges and proceeds

from derivative contracts.

Net Leverage is defined as Net Debt (debt minus cash and

cash equivalents) divided by Adjusted EBITDA plus contributions to

Adjusted EBITDA if acquisitions made during the applicable period

had been made before the start of the applicable period.

Operating Metrics

Order Growth is defined as the amount of revenue earned

in a given period and estimated to be earned in future periods from

contracts entered into in a given period as compared with such

amount for a prior period. Foreign exchange rates are based on the

applicable rates as reported for the time period.

The following tables present reconciliations of certain non-GAAP

financial measures for the applicable periods.

Mirion Technologies,

Inc.

Reconciliation of Adjusted

EBITDA

(In millions)

Three Months Ended

March 31,

2024

2023

Income from operations

$

(4.9

)

$

(13.6

)

Amortization

31.5

33.6

Depreciation - core

5.7

6.2

Depreciation - Mirion Business Combination

step-up

1.6

1.6

Stock-based compensation

3.6

5.6

Non-operating expenses

2.1

3.1

Other Income / Expense

(0.1

)

0.1

Adjusted EBITDA

$

39.5

$

36.6

Income from operations margin

(2.5

)%

(7.5

)%

Adjusted EBITDA margin

20.5

%

20.1

%

Mirion Technologies,

Inc.

Reconciliation of Adjusted

Earnings per Share

(In millions, except per share

values)

Three Months Ended

March 31,

2024

2023

Net loss attributable to Mirion

Technologies, Inc.

$

(25.8

)

$

(41.9

)

Loss attributable to non-controlling

interests

(0.7

)

(1.0

)

GAAP net loss

$

(26.5

)

$

(42.9

)

Foreign currency (gain) loss, net

0.8

(0.3

)

Amortization of acquired intangibles

31.5

33.6

Stock-based compensation

3.6

5.6

Change in fair value of warrant

liabilities

5.7

13.4

Debt extinguishment

—

2.6

Non-operating expenses

2.1

3.0

Tax impact of adjustments above

(4.5

)

(4.4

)

Adjusted Net Income

$

12.7

$

10.6

Weighted average common shares

outstanding — basic and diluted

199.729

187.701

Dilutive Potential Common Shares -

RSU's

0.758

0.248

Adjusted weighted average common shares

— diluted

200.487

187.949

GAAP loss per share

$

(0.13

)

$

(0.22

)

Adjusted earnings per share

$

0.06

$

0.06

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430915009/en/

For investor inquiries: Jerry Estes ir@mirion.com

For media inquiries: Erin Schesny media@mirion.com

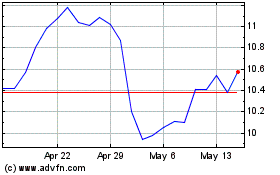

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Nov 2023 to Nov 2024