Mirion ("we" or the "Company") (NYSE: MIR, MIR.WS), a global

provider of radiation detection, measurement, analysis and

monitoring solutions to the medical, nuclear, defense, and research

end markets, today announced that it will redeem all of its

publicly traded warrants to purchase shares of Class A common

stock, par value $0.0001 per share (the “Common Stock”), that

remain outstanding at 5:00 pm New York City time on Monday, May 20,

2024 (the “Redemption Date”), for a redemption price of $0.10 per

warrant (the “Redemption Price”).

Mirion has directed its warrant agent, Continental Stock

Transfer & Trust Company (the “Warrant Agent”) or its

authorized information agent, to deliver a notice of redemption

(the “Notice of Redemption”) to the registered holders of

outstanding warrants pursuant to the Warrant Agreement, dated as of

June 29, 2020 (the “Warrant Agreement”), by and between Mirion

(f/k/a GS Acquisition Holdings Corp II) and the Warrant Agent.

Under the Warrant Agreement, Mirion is entitled to redeem its

public warrants at a redemption price of $0.10 per warrant if the

last sale price of the Common Stock equals or exceeds $10.00 per

share on the trading day before the Company issues the notice of

redemption (the “Stock Price Condition”), among other

conditions.

The stock price condition was satisfied on April 17, 2024, the

day before the Notice of Redemption is being sent to warrant

holders. Warrants to purchase Common Stock that were issued under

the Warrant Agreement in a private placement simultaneously with

Mirion’s (f/k/a GS Acquisition Holdings Corp II) initial public

offering and still held by the initial holders thereof or their

permitted transferees are not subject to the Notice of

Redemption.

Exercise Procedures and Deadline for Warrant Exercise

Warrant holders may continue to exercise their warrants to

purchase shares of Common Stock until immediately before 5:00 p.m.

New York City time on the Redemption Date. Holders may exercise

their warrants and receive Common Stock (i) in exchange for a

payment in cash of the $11.50 per warrant exercise price, or (ii)

on a “cashless” basis in which case the exercising holder will

receive a number of shares of Common Stock determined under the

Warrant Agreement based on the redemption date and the redemption

fair market value, as determined in accordance with the Warrant

Agreement. The “fair market value” is based on the average last

price per share of Common Stock for the 10 trading days ending on

the third trading day prior to the date on which the Notice of

Redemption is sent. In accordance with the Warrant Agreement,

exercising holders will receive 0.220 of a share of Common Stock

for each Warrant surrendered for exercise. If a holder of warrants

would, after taking into account all of such holders’ warrants

exercised at one time, be entitled to receive a fractional interest

in a share of Common Stock, the number of shares of Common Stock

the holder is entitled to receive will be rounded down to the

nearest whole number of shares.

Holders wishing to exercise their warrants should follow the

procedures described in the Notice of Redemption and the Election

to Purchase form included with the notice. Holders of warrants held

in “street name” should immediately contact their brokers to

determine exercise procedures. Since the act of exercising is

voluntary, holders must instruct their brokers to submit the

warrants for exercise.

Termination of Warrant Rights

The warrants are listed on the NYSE under the ticker symbol “MIR

WS.” Any outstanding Mirion public warrants that remain unexercised

at 5:00 p.m. New York City time on the Redemption Date will be void

and no longer exercisable, except to receive the Redemption Price

or as otherwise described in the Notice of Redemption.

How to Redeem

The shares of Common Stock underlying the public warrants have

been registered by the Company under the Securities Act of 1933, as

amended, and are covered by a registration statement filed on Form

S-3, as amended, with, and declared effective by, the Securities

and Exchange Commission (Registration No. 333-268445). Exercise of

public warrants should be directed through the broker of the

warrant holder. In addition to the broker, questions may also be

directed to Morrow Sodali at (800) 662-5200 (for individuals) /

(203) 658-9400 (for banks and brokerages) or at

mir@info.morrowsodali.com. Or contact Continental Stock Transfer

& Trust Company, One State Street, 30th Floor, New York, New

York 10004, Attention: Compliance Department, Telephone Number

(212) 509-4000.

Additional information can be found on Mirion’s Investor

Relations website: https://ir.mirion.com/

About Mirion

Mirion (NYSE: MIR) is a global leader in

radiation safety, science and medicine, empowering innovations that

deliver vital protection while harnessing the transformative

potential of ionizing radiation across a diversity of end markets.

The Mirion Technologies group provides proven radiation safety

technologies that operate with precision – for essential work

within R&D labs, critical nuclear facilities, and on the front

lines. The Mirion Medical group solutions help enhance the delivery

and ensure safety in healthcare, powering the fields of Nuclear

Medicine, Radiation Therapy QA, Occupational Dosimetry, and

Diagnostic Imaging. Headquartered in Atlanta (GA – USA), Mirion

employs approximately 2,700 people and operates in 12 countries.

Learn more at mirion.com.

No Offer or Solicitation

This press release shall not constitute an

offer to sell or the solicitation of an offer to buy any Mirion

securities and shall not constitute an offer, solicitation or sale

in any jurisdiction in which such offer, solicitation or sale would

be unlawful.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. Words such as “anticipate,”

“believe,” “continue,” “could,” “estimate”, “expect”, “hope”,

“intend”, “may”, “might”, “should”, “would”, “will”, “understand”

and similar words are intended to identify forward looking

statements. These forward-looking statements include, but are not

limited to, statements regarding redemption of the warrants.

Further information on risks, uncertainties and other factors that

could affect our financial results are included in the filings we

make with the Securities and Exchange Commission (the “SEC”) from

time to time, including our Annual Report on Form 10-K, our

Quarterly Reports on Form 10-Q and other periodic reports filed or

to be filed with the SEC.

You should not rely on these forward-looking

statements, as actual outcomes and results may differ materially

from those contemplated by these forward-looking statements as a

result of such risks and uncertainties. All forward-looking

statements in this press release are based on information available

to us as of the date hereof, and we do not assume any obligation to

update the forward-looking statements provided to reflect events

that occur or circumstances that exist after the date on which they

were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418640915/en/

For investor inquiries: Jerry Estes ir@mirion.com

For media inquiries: Erin Schesny media@mirion.com

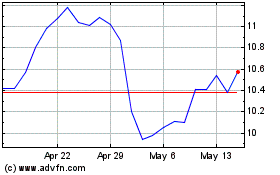

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Nov 2023 to Nov 2024