- Revenues for the fourth quarter increased 5.7% to $230.4

million, compared to $217.9 million in the same period last

year.

- Net loss was $15.2 million in the fourth quarter, compared to a

net loss of $153.4 million in the same period last year, a 90.1%

improvement. Adjusted EBITDA was $61.0 million, a 8.2% increase

from $56.4 million in the same period last year.

- Net loss per share for the fourth quarter was $0.08, compared

to $0.85 in the fourth quarter of 2022. Adjusted earnings per share

for the quarter was $0.15, compared to $0.11 in the same period

last year.

- The company initiated full year 2024 guidance for revenue

growth of 5% to 7%, adjusted EBITDA of $193 million to $203

million, adjusted EPS of $0.37 to $0.42 and adjusted free cash flow

of $65 million to $85 million.

Mirion ("we" or the "company") (NYSE: MIR), a global provider of

radiation detection, measurement, analysis and monitoring solutions

to the medical, nuclear, defense, and research end markets, today

announced results for the fourth quarter and full year ended

December 31, 2023. Related materials will be available online at

ir.mirion.com.

“2023 was an excellent year for Mirion. We delivered record

revenue and adjusted EBITDA, and substantially improved cash

generation and leverage,” stated Thomas Logan, Mirion’s Chief

Executive Officer. “Looking at our fourth quarter results, both

business segments generated organic growth against tough

comparisons from the same period last year. Customer engagement

across our end markets remains strong and we enter 2024 with solid

top-line coverage accruing from a record backlog position.”

2024 Outlook

“Today, we are initiating financial guidance for 2024 that

reflects sustained momentum in the business,” continued Mr. Logan.

“Vertical market conditions are positive, and we are

well-positioned to deliver solid organic growth. We expect to

expand margins and free cash flow this year, as we drive continued

operational improvement across the enterprise. I am confident in

our strategic positioning and believe we have the right plans in

place to deliver the financial expectations we have published

today.”

Mirion has issued the following guidance for the fiscal year and

12-month period ending December 31, 2024:

- Revenue growth of 5% - 7%

- Organic revenue growth of 4% - 6%

- Inorganic revenue growth of ~1%, primarily ec2 acquisition

- Minimal impact from foreign exchange rates

- Adjusted EBITDA of $193 million - $203 million

- Adjusted EPS of $0.37 - $0.42

- Adjusted free cash flow of $65 million - $85 million

The guidance for organic revenue growth excludes the impact of

foreign exchange rates as well as mergers, acquisitions and

divestitures.

Other modeling and guidance assumptions include the

following:

- Depreciation of ~$33 million for the year

- Net interest expense of approximately $55 million

(approximately $52 million of cash interest)

- Effective tax rate between 26% and 28%

- Capital expenditures of ~$37 million

- Cash taxes of ~$37 million

- Approximately 200 million shares of Class A common stock

outstanding (excludes 7.8 million shares of Class B common stock,

27.2 million warrants, 18.8 million founder shares, subject to

vesting, 1.8 million restricted stock units, 0.7 million

performance stock units and a further 28.8 million shares reserved

for future equity awards (subject to annual automatic increases)

(all numbers as of December 31, 2023))

- Euro to U.S. Dollar foreign exchange conversion rate of

1.08

- Cash non-operating expenses of ~$9 million

- Stock-based compensation of ~$11 million

The Company’s guidance contains forward-looking statements and

actual results may differ materially as a result of known and

unknown uncertainties and risks, including those set forth below

under the heading “Forward-Looking Statements.” In addition,

forward-looking non-GAAP financial measures are presented on a

non-GAAP basis without reconciliations of such forward-looking

non-GAAP measures due to the inherent difficulty in projecting and

quantifying the various adjusting items necessary for such

reconciliations, such as stock-based compensation expense,

amortization and depreciation expense, merger and acquisition

activity and purchase accounting adjustments, that have not yet

occurred, are out of Mirion’s control, or cannot be reasonably

predicted. Accordingly, reconciliations of our guidance for organic

revenue growth, adjusted EBITDA, adjusted EPS and adjusted free

cash flow are not available without unreasonable effort.

Conference Call

Mirion will host a conference call tomorrow, February 14, 2024,

at 10:00 a.m. ET to discuss its financial results. Participants may

access the call by dialing 1-877-407-9208 or 1-201-493-6784, and

requesting to join the Mirion Technologies, Inc. earnings call. A

presentation containing additional information is available, and a

live webcast will also be available, at

https://ir.mirion.com/news-events.

A telephonic replay will be available shortly after the

conclusion of the call and until February 28, 2024. Participants

may access the replay at 1-844-512-2921, international callers may

use 1-412-317-6671, and enter access code 13743957. An archived

replay of the call and an accompanying webcast will also be

available on the Investors section of the Mirion website at

https://ir.mirion.com/.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended. Words such as “anticipate,” “believe,” “continue,”

“could,” “estimate”, “expect”, “hope”, “intend”, “may”, “might”,

“should”, “would”, “will”, “understand” and similar words are

intended to identify forward looking statements. These

forward-looking statements include but are not limited to,

statements regarding our future operating results and financial

position, our business strategy and plans, our objectives for

future operations, macroeconomic trends, foreign exchange, interest

rate and inflation expectations, any mergers, acquisitions,

divestitures and strategic investments, including the completion

and integration of previously completed transactions, our future

share capitalization and any exercise, exchange or other settlement

of our outstanding warrants and other securities. There are a

significant number of factors that could cause actual results to

differ materially from statements made in this press release,

including changes in domestic and foreign business, market,

economic, financial, political and legal conditions, including

related to matters affecting Russia, the relationship between the

United States and China, conflict in the Middle East and risks of

slowing economic growth or economic recession in the United States

and globally; developments in the government budgets (defense and

non-defense) in the United States and other countries, including

budget reductions, sequestration, implementation of spending limits

or changes in budgetary priorities, delays in the government budget

process, a U.S. government shutdown or the U.S. government’s

failure to raise the debt ceiling; risks related to the public’s

perception of nuclear radiation and nuclear technologies; risks

related to the continued growth of our end markets; our ability to

win new customers and retain existing customers; our ability to

realize sales expected from our backlog of orders and contracts;

risks related to governmental contracts; our ability to mitigate

risks associated with long-term fixed price contracts, including

risks related to inflation; risks related to information technology

system failures or other disruptions or cybersecurity, data

security or other security threats; risks related to the

implementation and enhancement of information systems; our ability

to manage our supply chain or difficulties with third-party

manufacturers; risks related to competition; our ability to manage

disruptions of, or changes in, our independent sales

representatives, distributors and original equipment manufacturers;

our ability to realize the expected benefit from strategic

transactions, such as acquisitions, divestitures and investments,

including any synergies, or internal restructuring and improvement

efforts; our ability to issue debt, equity or equity-linked

securities in the future; risks related to changes in tax law and

ongoing tax audits; risks related to future legislation and

regulation both in the United States and abroad; risks related to

the costs or liabilities associated with product liability claims;

our ability to attract, train and retain key members of our

leadership team and other qualified personnel; risks related to the

adequacy of our insurance coverage; risks related to the global

scope of our operations, including operations in international and

emerging markets; risks related to our exposure to fluctuations in

foreign currency exchange rates, interest rates and inflation,

including the impact on our debt service costs; our ability to

comply with various laws and regulations and the costs associated

with legal compliance; risks related to the outcome of any

litigation, government and regulatory proceedings, investigations

and inquiries; risks related to our ability to protect or enforce

our proprietary rights on which our business depends or third-party

intellectual property infringement claims; liabilities associated

with environmental, health and safety matters; our ability to

predict our future operational results; risks associated with our

limited history of operating as an independent company; and the

effects of health epidemics, pandemics and similar outbreaks may

have on our business, results of operations or financial condition.

Further information on risks, uncertainties and other factors that

could affect our financial results are included in the filings we

make with the Securities and Exchange Commission (the “SEC”) from

time to time, including our Annual Report on Form 10-K, our

Quarterly Reports on Form 10-Q and other periodic reports filed or

to be filed with the SEC.

You should not rely on these forward-looking statements, as

actual outcomes and results may differ materially from those

contemplated by these forward- looking statements as a result of

such risks and uncertainties. All forward-looking statements in

this press release are based on information available to us as of

the date hereof, and we do not assume any obligation to update the

forward-looking statements provided to reflect events that occur or

circumstances that exist after the date on which they were

made.

Use of Non-GAAP Financial Information

We believe that the presentation of non-GAAP financial

information provides important supplemental information to

management and investors regarding financial and business trends

relating to our financial condition and results of operations. For

further information regarding these non-GAAP measures, including

the reconciliation of these non-GAAP financial measures to their

most directly comparable GAAP financial measures, please refer to

the financial tables below, as well as the “Reconciliation of

Non-GAAP Financial Measures” section of this press release.

Non-GAAP financial information is not a substitute for GAAP

financial information and undue reliance should not be placed on

such non-GAAP financial information. In addition, similarly titled

items used by other companies may not be comparable due to

variations in how they are calculated and how terms are

defined.

Channels for Disclosure of Information

Mirion intends to announce material information to the public

through the Mirion Investor Relations website ir.mirion.com, SEC

filings, press releases, public conference calls and public

webcasts, including additional information in Mirion’s earnings

conference call and related presentation. Mirion uses these

channels, as well as social media, to communicate with its

investors, customers, and the public about the company, its

offerings, and other issues. It is possible that the information

Mirion posts on social media could be deemed to be material

information. As such, Mirion encourages investors, the media, and

others to follow the channels listed above, including the social

media channels listed on Mirion’s investor relations website, and

to review the information disclosed through such channels. Any

updates to the list of disclosure channels through which Mirion

will announce information will be posted on the investor relations

page on Mirion’s website.

About Mirion

Mirion (NYSE: MIR) is a global leader in radiation safety,

science and medicine, empowering innovations that deliver vital

protection while harnessing the transformative potential of

ionizing radiation across a diversity of end markets. The Mirion

Technologies group provides proven radiation safety technologies

that operate with precision – for essential work within R&D

labs, critical nuclear facilities, and on the front lines. The

Mirion Medical group solutions help enhance the delivery and ensure

safety in healthcare, powering the fields of Nuclear Medicine,

Radiation Therapy QA, Occupational Dosimetry, and Diagnostic

Imaging. Headquartered in Atlanta (GA – USA), Mirion employs

approximately 2,700 people and operates in 12 countries. Learn more

at mirion.com.

Mirion Technologies,

Inc.

Consolidated Balance

Sheets

(Unaudited)

(In millions, except share

data)

December 31, 2023

December 31, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

128.8

$

73.5

Restricted cash

0.6

0.5

Accounts receivable, net of allowance for

doubtful accounts

172.3

171.2

Costs in excess of billings on uncompleted

contracts

48.7

50.0

Inventories

144.1

143.3

Prepaid expenses and other current

assets

44.1

33.6

Assets held for sale

—

8.5

Total current assets

538.6

480.6

Property, plant, and equipment, net

134.5

124.3

Operating lease right-of-use assets

32.8

40.1

Goodwill

1,447.6

1,418.0

Intangible assets, net

538.8

650.4

Restricted cash

1.1

1.0

Other assets

25.1

24.3

Total assets

$

2,718.5

$

2,738.7

LIABILITIES AND STOCKHOLDERS’ EQUITY

(DEFICIT)

Current liabilities:

Accounts payable

$

58.7

$

67.7

Deferred contract revenue

103.4

83.0

Notes payable to third parties,

current

1.2

5.3

Operating lease liability, current

6.8

8.5

Accrued expenses and other current

liabilities

84.9

79.8

Total current liabilities

255.0

244.3

Notes payable to third parties,

non-current

684.7

801.5

Warrant liabilities

55.3

30.5

Operating lease liability, non-current

28.1

34.3

Deferred income taxes, non-current

84.0

116.3

Other liabilities

61.4

44.6

Total liabilities

1,168.5

1,271.5

Commitments and contingencies (Note

11)

Stockholders’ equity (deficit):

Class A common stock; $0.0001 par value,

500,000,000 shares authorized; 218,177,832 shares issued and

outstanding at December 31, 2023; 200,298,834 shares issued and

outstanding at December 31, 2022

—

—

Class B common stock; $0.0001 par value,

100,000,000 shares authorized; 7,787,333 issued and outstanding at

December 31, 2023 and 8,040,540 issued and outstanding at December

31, 2022

—

—

Treasury stock

(1.3

)

—

Additional paid-in capital

2,056.5

1,882.4

Accumulated deficit

(505.4

)

(408.5

)

Accumulated other comprehensive loss

(65.3

)

(75.7

)

Mirion Technologies, Inc. stockholders’

equity (deficit)

1,484.5

1,398.2

Noncontrolling interests

65.5

69.0

Total stockholders’ equity

1,550.0

1,467.2

Total liabilities and stockholders’

equity

$

2,718.5

$

2,738.7

Mirion Technologies,

Inc.

Consolidated Statements of

Operations

(Unaudited)

(In millions, except per share

data)

Successor

Predecessor

Fiscal Year Ended

December 31, 2023

Fiscal Year Ended

December 31, 2022

From October 20, 2021 through

December 31, 2021

From July 1, 2021 through

October 19, 2021

Fiscal Year Ended June

30, 2021

Revenues:

Product

$

597.8

$

533.0

$

120.9

$

123.4

$

459.3

Service

203.1

184.8

33.2

44.6

152.3

Total revenues

800.9

717.8

154.1

168.0

611.6

Cost of revenues:

Product

339.7

307.5

83.1

74.0

284.1

Service

104.8

100.2

17.1

23.7

75.7

Total cost of revenues

444.5

407.7

100.2

97.7

359.8

Gross profit

356.4

310.1

53.9

70.3

251.8

Operating expenses:

Selling, general and administrative

340.1

362.3

70.1

101.6

211.2

Research and development

31.7

30.3

6.7

10.3

29.4

Goodwill impairment

—

211.8

—

—

—

Impairment loss on business held for

sale

—

3.5

—

—

—

Loss on disposal of business

6.5

—

—

—

—

Total operating expenses

378.3

607.9

76.8

111.9

240.6

(Loss) income from operations

(21.9

)

(297.8

)

(22.9

)

(41.6

)

11.2

Other expense (income):

Third-party interest expense

61.9

42.5

6.2

12.5

41.2

Third-party interest income

(4.8

)

(0.6

)

—

—

(0.2

)

Related-party interest expense (Note

9)

—

—

—

40.3

122.2

Loss on debt extinguishment

2.6

—

—

15.9

—

Foreign currency (gain) loss, net

(0.3

)

4.9

1.6

(0.6

)

13.4

Increase (decrease) in fair value of

warrant liabilities

24.8

(37.6

)

(1.2

)

—

—

Other (income) expense, net

(0.8

)

(0.4

)

0.3

1.6

(1.1

)

Loss before income taxes

(105.3

)

(306.6

)

(29.8

)

(111.3

)

(164.3

)

Benefit from income taxes

(6.6

)

(18.2

)

(6.8

)

(5.6

)

(5.9

)

Net loss

(98.7

)

(288.4

)

(23.0

)

(105.7

)

(158.4

)

Loss attributable to noncontrolling

interests

(1.8

)

(11.5

)

(0.8

)

—

(0.1

)

Net loss attributable to Mirion

Technologies, Inc. (Successor) / Mirion Technologies (TopCo), Ltd.

(Predecessor) stockholders

$

(96.9

)

$

(276.9

)

$

(22.2

)

$

(105.7

)

$

(158.3

)

Net loss per common share attributable to

Mirion Technologies, Inc. (Successor) / Mirion Technologies

(TopCo), Ltd. (Predecessor) stockholders — basic and diluted

$

(0.49

)

$

(1.53

)

$

(0.12

)

$

(15.81

)

$

(24.18

)

Weighted average common shares outstanding

— basic and diluted

196.369

181.149

180.773

6.685

6.549

Mirion Technologies,

Inc.

Consolidated Statements of

Cash Flows

(Unaudited)

(In millions)

Successor

Predecessor

Fiscal Year Ended December 31,

2023

Fiscal Year Ended December 31,

2022

From October 20, 2021 through

December 31, 2021

From July 1, 2021 through

October 19, 2021

Fiscal Year Ended June 30,

2021

OPERATING ACTIVITIES:

Net loss

$

(98.7

)

$

(288.4

)

$

(23.0

)

$

(105.7

)

$

(158.4

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Accrual of in-kind interest on notes

payable to related parties

—

—

—

40.2

121.2

Depreciation and amortization expense

162.8

174.5

37.3

25.9

83.6

Stock-based compensation expense

21.9

31.8

5.3

9.3

—

Loss on debt extinguishment

—

—

—

15.9

—

Amortization of debt issuance costs

5.7

3.5

0.7

1.1

3.2

Provision for doubtful accounts

1.8

0.3

(0.8

)

0.3

2.1

Inventory obsolescence write down

2.3

0.9

0.3

—

0.7

Change in deferred income taxes

(30.9

)

(37.2

)

(11.2

)

(8.4

)

(16.6

)

Loss (gain) on disposal of property, plant

and equipment

0.6

3.4

0.8

1.6

(0.1

)

(Gain) loss on foreign currency

transactions

(0.3

)

4.9

1.6

(0.6

)

13.4

Increase (decrease) in fair values of

warrant liabilities

24.8

(37.6

)

(1.2

)

—

—

Amortization of deferred revenue

step-down

—

—

2.3

4.5

8.0

Amortization of inventory step-up

—

6.3

15.8

—

5.2

Goodwill impairment

—

211.8

—

—

—

Loss on disposal of business

6.5

—

—

—

—

Other

(0.6

)

3.6

(0.1

)

—

1.4

Changes in operating assets and

liabilities:

Accounts receivable

(5.0

)

(14.8

)

(42.5

)

18.2

(4.2

)

Costs in excess of billings on uncompleted

contracts

1.9

(4.5

)

6.3

(5.7

)

(3.8

)

Inventories

(0.5

)

(34.8

)

5.1

(10.2

)

(4.2

)

Deferred cost of revenue

0.7

(0.8

)

(0.3

)

(0.4

)

6.6

Prepaid expenses and other current

assets

(14.0

)

(2.4

)

(2.5

)

2.6

(10.1

)

Accounts payable

(10.6

)

4.5

(8.9

)

19.2

2.6

Accrued expenses and other current

liabilities

1.9

5.5

(8.4

)

0.4

(2.2

)

Deferred contract revenue

23.9

6.9

10.6

4.5

(2.8

)

Other assets

(0.6

)

5.4

(6.1

)

(2.2

)

0.5

Other liabilities

(0.2

)

(3.4

)

6.7

2.6

7.5

Net cash provided by (used in)

operating activities

93.4

39.4

(12.2

)

13.1

53.6

INVESTING ACTIVITIES:

Acquisition of Mirion, net of cash and

cash equivalents acquired

—

—

(2,124.8

)

—

—

Acquisitions of businesses, net of cash

and cash equivalents acquired

(31.4

)

(6.6

)

(58.6

)

(0.9

)

(290.1

)

Purchases of property, plant, and

equipment and badges

(35.7

)

(34.2

)

(6.0

)

(11.6

)

(23.2

)

Sales of property, plant, and

equipment

—

0.8

—

—

—

Proceeds from net investment hedge

derivative contracts

3.8

0.5

—

—

—

Proceeds from business disposal

1.0

—

—

—

—

Other investing

(1.0

)

—

—

—

—

Net cash used in investing

activities

(63.3

)

(39.5

)

(2,189.4

)

(12.5

)

(313.3

)

FINANCING ACTIVITIES:

Issuances of common stock

150.0

—

900.0

—

—

Common stock issuance costs

(0.3

)

—

(13.3

)

—

—

Treasury stock issuance costs

(0.6

)

—

—

—

—

Transaction fees reimbursed by Sellers

—

—

18.7

—

—

Payment of deferred underwriting costs

—

—

(26.3

)

—

—

SPAC share redemption

—

—

(146.3

)

—

—

Borrowings from notes payable to

third-parties, net of discount and issuance costs

—

—

807.3

1.9

218.8

Principal repayments

(127.3

)

(6.6

)

(1.7

)

(2.4

)

(14.8

)

Deferred financing costs

—

—

(0.9

)

—

—

Borrowings from notes payable – related

parties

—

—

—

—

70.0

Payment on revolving term loan

—

—

—

—

(35.0

)

Proceeds from net cash flow hedge

derivative contracts

0.6

—

—

—

—

Other financing

0.6

(0.4

)

0.2

1.5

—

Net cash provided by (used in)

financing activities

23.0

(7.0

)

1,537.7

1.0

239.0

Effect of exchange rate changes on

cash, cash equivalents, and restricted cash

2.4

(3.2

)

(1.0

)

(0.9

)

3.1

Net increase (decrease) in cash, cash

equivalents, and restricted cash

55.5

(10.3

)

(664.9

)

0.7

(17.6

)

Cash, cash equivalents, and restricted

cash at beginning of period

75.0

85.3

750.2

102.4

120.0

Cash, cash equivalents, and restricted

cash at end of period

$

130.5

$

75.0

$

85.3

$

103.1

$

102.4

Share Count

199,427,832 shares of Class A common stock were outstanding as

of December 31, 2023. This excludes (1) 7,787,333 shares of Class B

common stock outstanding as of December 31, 2023; 18,750,000

founder shares which are shares of Class A common stock subject to

vesting in three equal tranches, based on the volume-weighted

average price of our Class A common stock being greater than or

equal to $12.00, $14.00 and $16.00 per share for any 20 trading

days in any 30 consecutive trading day period, and such shares will

be forfeited to us if they fail to vest by October 20, 2026; (2)

27,249,779 shares of Class A common stock issuable upon the

exercise of 8,500,000 private placement warrants and 18,749,779

publicly-traded warrants; (3) 1.8 million shares of Class A common

stock underlying restricted stock units and 0.7 million shares of

Class A common stock underlying performance stock units; and (4)

any other shares issuable from awards under our 2021 Omnibus

Incentive Plan, which had 28,805,002 shares reserved for future

equity awards (subject to annual automatic increases). The

7,787,333 shares of Class B common stock are paired on a

one-for-one basis with shares of Class B common stock of Mirion

Intermediate Co., Inc. (the "paired interests"). Holders of the

paired interests have the right to have their interests redeemed

for, at the option of Mirion, shares of Class A common stock on a

one-for-one basis or cash based on a trailing stock price average.

All share data is of December 31, 2023 unless otherwise noted.

Reconciliation of Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP,

we believe the following non-GAAP measures are useful in evaluating

our operating performance. We use the following non-GAAP financial

information to evaluate our ongoing operations and for internal

planning and forecasting purposes. We believe that non-GAAP

financial information, when taken collectively, may be helpful to

investors because it provides consistency and comparability with

past financial performance. However, non-GAAP financial information

is presented for supplemental informational purposes only, has

limitations as an analytical tool, and should not be considered in

isolation or as a substitute for financial information presented in

accordance with GAAP. Other companies, including companies in our

industry, may calculate similarly titled non-GAAP measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison.

Investors are encouraged to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures

and not rely on any single financial measure to evaluate our

business.

Organic Revenues is defined as revenues excluding the

impact of foreign exchange rates as well as mergers, acquisitions

and divestitures in the period.

Adjusted EBITDA is defined as net income before interest

expense, income tax expense, depreciation and amortization adjusted

to remove the impact of foreign currency gains and losses,

amortization of acquired intangible assets, the impact of purchase

accounting on the recognition of deferred revenue, changes in the

fair value of warrants, certain non-operating expenses (certain

purchase accounting impacts related to revenues and inventory,

restructuring and costs to achieve operational synergies, merger,

acquisition and divestiture expenses and IT project implementation

expenses), stock-based compensation expense, debt extinguishment

and income tax impacts of these adjustments.

Adjusted Net Income is defined as net income adjusted for

foreign currency gains and losses, amortization of acquired

intangible assets, the impact of purchase accounting on the

recognition of deferred revenue, changes in the fair value of

warrants, certain non-operating expenses (certain purchase

accounting impacts related to revenues and inventory, restructuring

and costs to achieve operational synergies, merger, acquisition and

divestiture expenses and IT project implementation expenses),

stock-based compensation expense, debt extinguishment and income

tax impacts of these adjustments.

Adjusted EPS is defined as adjusted net income divided by

weighted average common shares outstanding — basic and diluted.

Adjusted Free Cash Flow is defined as free cash flow

adjusted to include the impact of cash used to fund non-operating

expenses described above. We believe that the inclusion of

supplementary adjustments to free cash flow applied in presenting

adjusted free cash flow is appropriate to provide additional

information to investors about our cash flows that management

utilizes on an ongoing basis to assess our ability to generate cash

for use in acquisitions and other investing and financing

activities.

Free Cash Flow is defined as net cash provided by

operating activities adjusted to include the impact of purchases of

property, plant, and equipment, purchases of badges and proceeds

from derivative contracts.

Net Leverage is defined as net debt (debt minus cash and

cash equivalents) divided by Adjusted EBITDA plus contributions to

Adjusted EBITDA if acquisitions made during the applicable period

had been made before the start of the applicable period.

Operating Metrics

Order Growth is defined as the amount of revenue earned

in a given period and estimated to be earned in future periods from

contracts entered into in a given period as compared with such

amount for a prior period. Order growth was calculated excluding

the impact of the Hanhikivi project termination in the second

quarter of 2022. Foreign exchange rates are based on the applicable

rates as reported for the time period.

The following tables presents reconciliations of certain

non-GAAP financial measures for the applicable periods.

Mirion Technologies,

Inc.

Reconciliation of Revenue

& Adjusted EBITDA

(In millions)

Three Months Ended

Year Ended

December 31,

December 31,

2023

2022

2023

2022

Revenue

$

230.4

$

217.9

$

800.9

$

717.8

Income (Loss) from Operations

$

13.4

$

(161.9

)

$

(21.9

)

$

(297.8

)

Amortization

31.8

34.3

131.3

145.8

Depreciation - core

6.6

6.3

25.1

22.3

Depreciation - Mirion Business Combination

step-up

1.6

1.5

6.4

6.4

Cost of revenues impact from inventory

valuation purchase accounting

—

—

—

6.3

Stock compensation

4.2

7.0

21.9

31.8

Goodwill impairment

—

156.6

—

211.8

Other impairments

—

4.5

—

7.0

Non-operating expenses

3.4

8.5

18.2

31.0

Other income/expense

—

(0.4

)

(0.3

)

0.1

Adjusted EBITDA

$

61.0

$

56.4

$

180.7

$

164.7

Income from operations as a % of

Revenue

5.8

%

(74.3

)%

(2.7

)%

(41.5

)%

Adjusted EBITDA as a % of Revenue

26.5

%

25.9

%

22.6

%

22.9

%

Mirion Technologies,

Inc.

Reconciliation of Adjusted

Earnings per Share

(In millions, except per share

values)

Three Months Ended

Year Ended

December 31,

December 31,

2023

2022

2023

2022

Net loss attributable to Mirion

Technologies, Inc.

$

(15.2

)

$

(153.4

)

$

(96.9

)

$

(276.9

)

Gain/(loss) attributable to

non-controlling interests

0.7

(6.3

)

(1.8

)

(11.5

)

GAAP net loss

$

(14.5

)

$

(159.7

)

$

(98.7

)

$

(288.4

)

Cost of revenues impact from inventory

valuation purchase accounting

—

—

—

6.3

Foreign currency (gain) loss, net

(1.3

)

(3.0

)

(0.3

)

4.9

Amortization of acquired intangibles

31.8

34.3

131.3

145.8

Stock based compensation

4.2

7.0

21.9

31.8

Change in fair value of warrant

liabilities

18.5

(10.1

)

24.8

(37.6

)

Goodwill impairment

—

156.6

—

211.8

Loss on debt extinguishment

—

—

2.6

—

Other impairments

—

4.5

—

7.0

Non-operating expenses

3.2

8.2

17.1

30.7

Tax impact of adjustments above

(12.0

)

(17.5

)

(32.1

)

(44.5

)

Adjusted net income

$

29.9

$

20.3

$

66.6

$

67.8

Weighted average common shares

outstanding — basic and diluted

199.280

181.387

196.369

181.149

Dilutive Potential Common Shares -

RSU's

0.528

0.080

0.388

0.049

Adjusted weighted average common shares

— diluted

199.808

181.467

196.757

181.198

GAAP loss per share

$

(0.08

)

$

(0.85

)

$

(0.49

)

$

(1.53

)

Adjusted earnings per share

$

0.15

$

0.11

$

0.34

$

0.37

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213916469/en/

For investor inquiries: Jerry Estes ir@mirion.com For

media inquiries: Erin Schesny media@mirion.com

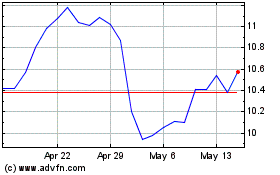

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Nov 2023 to Nov 2024