UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-39601

MINISO Group Holding Limited

8F, M Plaza, No. 109, Pazhou Avenue

Haizhu District, Guangzhou 510000, Guangdong Province

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

MINISO Group Holding Limited |

| |

|

| |

By |

: |

/s/ Jingjing Zhang |

| |

Name |

: |

Jingjing Zhang |

| |

Title |

: |

Chief Financial Officer |

Date: May 23, 2024

Exhibit 99.1

MINISO Announces Change of Venue for Annual

General Meeting on June 20, 2024

GUANGZHOU, China, May 23, 2024 /PRNewswire/ -- MINISO Group Holding

Limited (NYSE: MNSO; HKEX: 9896) (“MINISO”, “MINISO Group” or the “Company”), a global value retailer

offering a variety of trendy lifestyle products featuring IP design, today announced that due to administrative reasons, the venue of

its annual general meeting of shareholders to be held on June 20, 2024 has been changed to Flats B-D, 35/F, Plaza 88, 88 Yeung Uk Road,

Tsuen Wan, the New Territories, Hong Kong.

About MINISO Group

MINISO Group is a global value retailer offering a variety of trendy

lifestyle products featuring IP design. The Company serves consumers primarily through its large network of MINISO stores, and promotes

a relaxing, treasure-hunting and engaging shopping experience full of delightful surprises that appeals to all demographics. Aesthetically

pleasing design, quality and affordability are at the core of every product in MINISO’s wide product portfolio, and the Company

continually and frequently rolls out products with these qualities. Since the opening of its first store in China in 2013, the Company

has built its flagship brand “MINISO” as a globally recognized consuming brand and established a massive store network worldwide.

For more information, please visit https://ir.miniso.com/.

Investor Relations Contact:

Raine Hu

MINISO Group Holding Limited

Email: ir@miniso.com

Phone: +86 (20) 36228788 Ext.8039

Exhibit 99.2

Hong Kong Exchanges and Clearing

Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation

as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance

upon the whole or any part of the contents of this announcement.

MINISO

Group Holding Limited

名創優品集團控股有限公司

(A company incorporated in

the Cayman Islands with limited liability)

(Stock Code: 9896)

CHANGE

OF VENUE OF ANNUAL GENERAL MEETING AND

REVISED NOTICE OF ANNUAL GENERAL MEETING

Reference

is made to (i) the notice (the “AGM Notice”) of the annual general meeting (the “AGM”) of MINISO

Group Holding Limited (the “Company”) dated April 16, 2024; (ii) the circular (the “Circular”)

of the AGM of the Company dated April 16, 2024; and (iii) the proxy form (the “Proxy Form”) of the Company

in relation to the AGM to be held on Thursday, June 20, 2024. Unless otherwise indicated, capitalised terms used herein shall have

the same meanings as those defined in the Circular.

The Board hereby announces that

due to administrative reasons, the venue of the AGM will be changed to Flats B-D, 35/F, Plaza 88, 88 Yeung Uk Road, Tsuen Wan, the New

Territories, Hong Kong.

Save for the above change of venue

of the AGM, the information as set out in the AGM Notice, the Circular and the Proxy Form, including, among others, the date and time

of the AGM, the record date of ordinary shares (the “Shares”), the record date of American Depositary Shares (the “ADSs”),

and the resolutions to be considered at the AGM, remains unchanged. Please also refer to the revised notice of the AGM of the Company

in this announcement. The Proxy Form remains valid for and applicable to the AGM and the shareholders of the Company (the “Shareholders”)

are not required to re-submit the Proxy Form if they have already done so.

Shareholders who intend to attend

the AGM in person are advised to pay attention to the above- mentioned change of the venue of the AGM.

REVISED NOTICE OF ANNUAL GENERAL

MEETING

This revised notice of AGM supersedes

the AGM Notice dated April 16, 2024.

NOTICE IS HEREBY GIVEN THAT

the AGM of the Company will be held at Flats B-D, 35/F, Plaza 88, 88 Yeung Uk Road, Tsuen Wan, the New Territories, Hong Kong on Thursday,

June 20, 2024 at 9:00 a.m. for the following purposes:

ORDINARY RESOLUTIONS

| 1. | To receive and adopt the audited consolidated financial statements of the Company for the six months ended December 31, 2023

and the reports of the directors and auditor thereon. |

| 2. | (A) |

To re-elect the following directors of the Company (the “Directors”): |

| (i) | To re-elect Mr. Ye Guofu as an executive Director; and |

| (ii) | To re-elect Mr. Wang Yongping as an independent non-executive Director. |

| |

| (B) | To authorise the board of Directors

to fix the remuneration of the Directors. |

| 3. | To re-appoint KPMG as auditor of the Company and authorise the board of Directors to fix its remuneration for the year ending December 31,

2024. |

| 4. | To consider and, if thought fit, pass with or without modification the following resolutions as ordinary resolutions: |

| (i) | subject to paragraph (iii) below, pursuant to the Rules Governing the Listing of Securities (the “Listing Rules”)

on The Stock Exchange of the Hong Kong Limited (the “Hong Kong Stock Exchange”), a general mandate be and is hereby

generally and unconditionally given to the Directors during the Relevant Period (as defined hereinafter) to exercise all the powers of

the Company to allot, issue and/ or otherwise deal with additional Shares of the Company (including any sale or transfer of treasury Shares

(which shall have the meaning ascribed to it under the Listing Rules coming into effect on June 11, 2024) out of treasury) or

securities convertible into Shares, or options, warrants or similar rights to subscribe for Shares or such convertible securities of the

Company and to make or grant offers, agreements and/or options (including bonds, warrants and debentures convertible into Shares of the

Company); |

| (ii) | the mandate in paragraph (i) above shall be in addition to any other authorisation given to the Directors and shall authorise

the Directors during the Relevant Period (as defined hereinafter) to make or grant offers, agreements and/or options which may require

the exercise of such powers after the end of the Relevant Period; |

| (iii) | the aggregate number of Shares allotted and issued or agreed conditionally or unconditionally to be allotted and issued (whether pursuant

to options or otherwise) by the Directors during the Relevant Period (as defined hereinafter) pursuant to paragraph (i) above, otherwise

than pursuant to: |

| (a) | any Rights Issue (as defined hereinafter); |

| (b) | the grant or exercise of any option under any Share option scheme of the Company (if applicable) or any other option, scheme or similar

arrangements for the time being adopted for the grant or issue to the Directors, officers and/or employees of the Company and/or any of

its subsidiaries and/or other eligible participants specified thereunder of options to subscribe for Shares or rights to acquire Shares

of the Company; |

| (c) | the vesting of restricted Shares and restricted Share units granted or to be granted pursuant to the Share incentive plan of the Company; |

| (d) | any scrip dividend scheme or similar arrangement providing for the allotment and issue of Shares in lieu of the whole or part of a

dividend on Shares of the Company in accordance with the articles of association of the Company; or |

| (e) | a specific authority granted by the Shareholders in general meeting, shall not exceed 5% of the total number of issued Shares of the

Company (excluding any treasury Shares) as at the date of the passing of this resolution (such total number to be subject to adjustment

in the case of any consolidation or subdivision of any of the Shares of the Company into a smaller or larger number of Shares of the Company

respectively after the passing of this resolution) and the said mandate shall be limited accordingly. |

| (iv) | for the purpose of this resolution: |

| (a) | “Relevant Period” means the period from the passing of this resolution until whichever is the earliest of: |

| (1) | the conclusion of the next annual general meeting of the Company; |

| (2) | the expiry of the period within which the next annual general meeting of the Company is required by any applicable laws or the articles

of association of the Company to be held; and |

| (3) | the passing of an ordinary resolution by the Shareholders in general meeting revoking or varying the authority given to the Directors

by this resolution; and |

| (b) | “Rights Issue” means an offer of Shares of the Company or an issue of warrants, options or other securities giving

rights to subscribe for Shares of the Company, open for a period fixed by the Directors to holders of Shares of the Company on the register

of members on a fixed record date in proportion to their then holdings of such Shares of the Company (subject to such exclusions or other

arrangements as the Directors may deem necessary or expedient in relation to fractional entitlements or, having regard to any restrictions

or obligations under the laws of, or the requirements of, or the expense or delay which may be involved in determining the exercise or

extent of any restrictions or obligations under the laws of, or the requirements of, any jurisdiction, any recognised regulatory body

or any stock exchange applicable to the Company).” |

| (i) | subject to paragraph (ii) of this resolution, a general mandate be and is hereby generally and unconditionally given to the Directors

during the Relevant Period (as defined hereinafter) to exercise all the powers of the Company to repurchase Shares of the Company on the

Hong Kong Stock Exchange or on any other stock exchange on which the Shares of the Company may be listed and which is recognized for this

purpose by the Securities and Futures Commission of Hong Kong and the Hong Kong Stock Exchange and, subject to and in accordance with

all applicable laws, rules and regulations; |

| (ii) | the aggregate number of Shares to be repurchased pursuant to the mandate in paragraph (i) of this resolution shall not exceed

10% of the total number of issued Shares of the Company as at the date of passing this resolution, and if any subsequent consolidation

or subdivision of Shares is conducted, the maximum number of Shares that may be repurchased under the mandate in paragraph (i) above

as a percentage of the total number of issued Shares at the date immediately before and after such consolidation and subdivision shall

be the same, and the mandate shall be limited accordingly; and |

| (iii) | for the purpose of this resolution: |

“Relevant Period” means

the period from the passing of this resolution until whichever is the earliest of:

| (a) | the conclusion of the next annual general meeting of the Company; |

| (b) | the expiry of the period within which the next annual general meeting of the Company is required by any applicable laws or the articles

of association of the Company to be held; and |

| (c) | the passing of an ordinary resolution by the Shareholders in general meeting revoking or varying the authority given to the Directors

by this resolution.” |

| (C) | “That conditional upon the resolutions numbered 4(A) and 4(B) set out in this notice being passed, the general

mandate granted to the Directors to exercise the powers of the Company to allot, issue and/or otherwise deal with new Shares of the Company

(including any sale or transfer of treasury Shares out of treasury) and to make or grant offers, agreements and/or options which might

require the exercise of such powers pursuant to the resolution numbered 4(A) set out in this notice be and is hereby extended by

the addition to the number of the issued Shares of the Company which may be allotted and issued or agreed conditionally or unconditionally

to be allotted and issued by the Directors pursuant to such general mandate of an amount representing the number of Shares of the Company

repurchased by the Company under the mandate granted pursuant to the resolution numbered 4(B) set out in this notice, provided that

such extended amount shall not exceed 10% of the total number of issued Shares of the Company (excluding any treasury Shares) as at the

date of passing of the said resolution.” |

SHARE RECORD DATE AND ADS RECORD

DATE

The board of Directors has fixed

the close of business on May 6, 2024 (Hong Kong Time) as the record date (the “Share Record Date”) of the Company’s

Shares. Holders of record of the Company’s Shares (as of the Share Record Date) are entitled to attend and vote at the AGM and any

adjourned meeting thereof.

Holders of ADSs as of the close

of business on May 6, 2024 (New York Time) (the “ADS Record Date”), who wish to exercise their voting rights for

the underlying Shares must give voting instructions either directly to The Bank of New York Mellon, the depositary of the ADSs, if ADSs

are held directly on the books and records of The Bank of New York Mellon, or indirectly through a bank, brokerage or other securities

intermediary if ADSs are held by any of them on behalf of holders, as the case may be.

ATTENDING THE AGM

Only holders of record of the

Company’s Shares as of the Share Record Date are entitled to attend and vote at the AGM. All officers and agents of the Company

reserve the right to refuse any person entry to the AGM venue, or to instruct any person to leave the AGM venue, where such officer or

agent reasonably considers that such refusal or instruction is or may be required for the Company or any other person to be able to comply

with applicable laws and regulations. The exercise of such right to refuse entry or instruct to leave shall not invalidate the proceedings

at the AGM.

PROXY FORMS AND ADS VOTING

CARDS

A holder of the Company’s

Shares as of the Share Record Date may appoint a proxy to exercise his or her rights at the AGM. A holder of ADSs as of the ADS Record

Date will need to directly instruct The Bank of New York Mellon, the depositary of the ADSs, if ADSs are held directly by holders on the

books and records of The Bank of New York Mellon, or instruct a holder’s bank, brokerage or other securities intermediary if the

ADSs are held by any of them on behalf of holders, as the case may be, as to how to vote the Shares represented by the ADSs. Please refer

to the Proxy Form (for holders of the Shares) which is available on our website at https://ir.miniso.com.

Holders of record of the Company’s

Shares on the Company’s register of members as of the Share Record Date are cordially invited to attend the AGM in person. Your

vote is important. You are urged to complete, sign, date, and return the accompanying Proxy Form to the Company’s Share registrar

in Hong Kong, Computershare Hong Kong Investor Services Limited (for holders of the Shares) or your voting instructions to The Bank of

New York Mellon, if your ADSs are held directly on the books and records of The Bank of New York Mellon, or to your bank, brokerage or

other securities intermediary, if your ADSs are held by any of them on your behalf, as the case may be (for holders of the ADSs) as promptly

as possible and before the prescribed deadline if you wish to exercise your voting rights. Computershare Hong Kong Investor Services Limited

must receive the Proxy Form by no later than 9:00 a.m. (Hong Kong Time) on Tuesday, June 18, 2024 at 17M Floor, Hopewell

Centre, 183 Queen’s Road East, Wanchai, Hong Kong to ensure your representation at the AGM; and The Bank of New York Mellon must

receive your voting instructions by the time and date specified in the ADS voting instruction card to enable the votes attaching to the

Shares represented by your ADSs to be cast at the AGM. For the avoidance of doubt, holders of treasury Shares of the Company (if any)

are not entitled to vote at the AGM.

| | By order of the Board |

| MINISO Group Holding Limited

YE Guofu |

| | Executive Director and Chairman |

| Hong Kong, May 23, 2024 | |

| | |

| Registered office: | Headquarters and principal place of business in

China: |

| Maples Corporate Services | 8F, M Plaza |

| Limited PO Box 309, Ugland House | No.109, Pazhou Avenue |

| Grand Cayman, | Haizhu District, |

| KY1-1104 Cayman Islands | Guangzhou 510000 Guangdong Province |

| | China |

As of the date of this announcement,

the board of directors of the Company comprises Mr. YE Guofu as executive director, Ms. XU Lili, Mr. ZHU Yonghua and Mr. WANG

Yongping as independent non-executive directors.

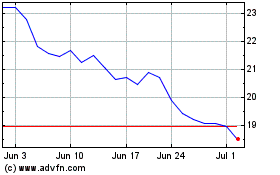

MINISO (NYSE:MNSO)

Historical Stock Chart

From May 2024 to Jun 2024

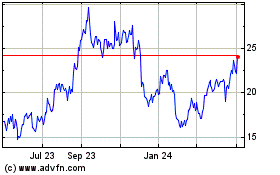

MINISO (NYSE:MNSO)

Historical Stock Chart

From Jun 2023 to Jun 2024