Bear of the Day: Martin Marietta (MLM) - Bear of the Day

August 26 2013 - 4:52AM

Zacks

Weak results have led to

sharp downward estimates revisions, sending this construction

materials company to a Zacks Rank # 5 (Strong Sell).

About the Company

Headquartered in Raleigh,

North Carolina, Martin Marietta

Materials (MLM) is the country’s second largest producer

of construction aggregates, used primarily for construction of

roads, highways and other infrastructure projects and in the

domestic commercial and residential construction

industries.

The company operates

through approximately 300 quarries, distribution yards and plants

located in 28 states, Canada, the Bahamas and the Caribbean

Islands.

Disappointing Results

MLM reported its second

quarter FY 2013 results on July 30, 2013. Diluted EPS for the

quarter came in at $0.88 per share, down substantially from the

Zacks Consensus Estimate of $1.11 per share. The company said that

the results were affected by excessive rainfall in most of their

key markets-- particularly in the midwestern and

southeastern states.

According to company

estimates that the precipitation reduced shipment volumes between

1.5 million and 1.7 million tons, lowering net earnings by up

to $0.11 per diluted share in addition to significantly

affecting the operational productivity.

For the full-year, the

company anticipates aggregates product line shipments to increase

by 1% to 3%.

Downwards Revisions

Due to disappointing

results and uninspiring guidance, quarterly and annual estimates

have been revised sharply downwards in the past few weeks. Zacks

consensus estimates for the current quarter and year are now $1.47

and $2.55 per share respectively, down substantially from $1.60 and

$2.92 per share, 30 days ago.

The company has missed

estimates in three of the past four quarters, with an average

negative surprise of 23.9%.

The Bottom Line

MLM is currently Zacks

Rank # 5 (Strong Sell) stock and it has a longer-term

recommendation of “Underperform”. Further, uninspiring

guidance from the management regarding the volumes has resulted in

weak outlook for the stock for the time being.

Better Play?

Investors seeking

exposure to Construction industry could look at some of the

homebuilders instead of construction materials suppliers. Among the

Homebuilders—Meritage

Homes (MTH) beat

the Zacks Consensus Estimate for both revenues and earnings. This

Zacks Rank# 2 (Buy) stock saw increasing demand and pricing in most

housing markets during the recent quarter.

However, we may add that

rising mortgage rates seem to have started impacting the housing

market and as a result, estimates for homebuilders may come down

slightly if the trend continues.

Want the latest

recommendations from Zacks Investment Research? Today, you can

download7 Best Stocks for the Next 30

Days.Click to get this free report >>

MARTIN MRT-MATL (MLM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

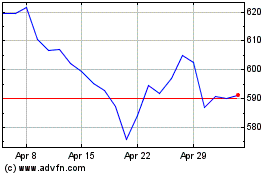

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

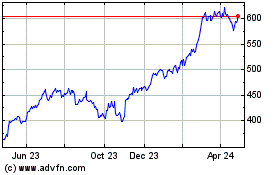

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024