Vulcan Materials Company (VMC) posted a loss of

42 cents per share in the first quarter of 2012 narrower than a

loss of 62 cents per share in the same quarter of 2011 (excluding

special items) and the Zacks Consensus Estimate of a loss of 44

cents share. Improved top line and gross margins led to the

curtailed loss in the quarter.

Total revenue in the quarter rose 10% to $535.9 million driven

by meaningful gains in every segment, especially the Aggregates

business. Revenues were also higher than the Zacks Consensus

Estimate of $487 million.

Vulcan serves both the private and public sectors. Demand for

public construction projects, such as bridges, dams and roads

remains strong. The public sector projects are responsible for more

than half of Vulcan's business. Management believes that the

private sector is slowly recovering.

The consolidated gross margins improved 600 basis points in the

quarter due to top-line growth and improved productivity and cost

savings. Total Selling, Administrative and General (SAG) expense

declined 16.3% in quarter to $64.9 million due to the company’s

cost-reduction efforts. Adjusted EBITDA was $46.1 million, up

significantly from $5.3 million in the prior year quarter, driven

by improved gross margins and lower SAG costs.

The nation’s largest producer of construction aggregates has

four operating segments going by the principal product lines:

Aggregates, Concrete, Asphalt mix and Cement.

Segment Results

Aggregates: The construction Aggregates segment includes crushed

stone, sand and gravel and recycled concrete. Revenues in the

Aggregates segment inched up 7.5% to $324.5 million in the quarter

driven by increased volume.

Gross profit rose 217% to $34.1 million, led by revenue growth

and improved productivity despite a rise in cost of fuel.

Aggregates shipments increased 10% from the prior year. However,

average sales price declined 1% from the prior year due to an

unfavorable product mix.

Concrete: The Concrete segment deals with the production and

sale of ready-mixed concrete and other products such as block,

pre-stressed and pre-cast beams. Revenues in the Concrete segment

scaled up 11.9% to $92.0 million.

Ready-mixed concrete volumes increased 12% while average sales

price increased 1% versus the prior-year quarter. The segment

recorded a gross loss of $12.3 million narrower than a loss of

$14.4 million due to improved revenues.

Asphalt Mix: The segment produces asphalt mix. Revenues in the

Asphalt Mix segment rose 10.4% to $71.4 million. The segment

recorded a gross loss of $0.7 million wider than a loss of $0.2

million in the prior-year quarter, due mainly to higher liquid

asphalt costs. Asphalt mix volume increased 3% from the prior year.

The average sales price escalated 6%.

Cement: The Cement segment produces mainly for Vulcan’s Concrete

segment Revenues in the Cement segment surged 57.3% to $12.0

million. The segment recorded a gross profit of $0.9 million versus

a loss of $3.2 million in the prior-year quarter due to increased

volumes and lower operating costs.

Restructuring Initiatives

The company announced at the first quarter conference call that

the Profit Enhancement Plan (“PEP”) discussed in February 2012

remains on track. In February this year, the company announced its

PEP program and planned asset sales, in order to improve earnings

and cash flows, pay off debt and thereby strengthen its overall

credit profile.

The PEP plan is designed to reduce costs as well as enhance

profitability by streamlining the management structure over the

next 18 months. The plan is expected to improve EBITDA by $100

million on an annual basis by 2014.

Under the planned assets sale, the company shall divest its

non-core assets in order to improve the company’s liquidity

position and earnings. These sales are expected to generate

after-tax net proceeds of $500 million by mid-2013 later than prior

expectations of within 12-18 months. Though these initiatives will

hurt the company’s earnings in the near term, they will improve the

company’s earnings overall growth profile in the long term.

Outlook

Vulcan expects each product line to deliver improved earnings in

2012 from the prior year due to better pricing, modest volume

growth and lower expenses.

The company continues to maintain that the Aggregates segment

earnings will improve substantially in 2012. This will be driven by

2% to 4% increase in aggregates shipments versus prior expectations

of 1%-2%.

However, pricing is now expected to contribute just 1% to 3%

versus prior expectations of 2% to 4% pricing growth. Reduced costs

from PEP, improved productivity, and restructuring of overhead

support functions are also expected to boost earnings.

The company anticipates Asphalt Mix segment earnings to increase

due to higher pricing and modest volume growth. Earnings in the

Concrete segment are expected to improve from better ready-mixed

concrete pricing and improved shipments. Meanwhile, Cement earnings

are expected to approach break-even levels in 2012.

As regards costs, Vulcan expects SAG costs to be approximately

$270 million in 2012. Energy costs, especially for diesel fuel and

liquid asphalt, are expected to increase 5%-10% in 2012, higher

than prior expectations of the costs remaining flat from 2011

levels.

For the year, Vulcan continues to anticipate EBITDA of $500

million, including $25 million from PEP. However, the EBITDA

guidance now excludes the impact from planned asset sales and costs

associated with the Martin Marietta Materials, Inc

(MLM) unsolicited exchange offer which were previously included in

the outlook. Capital expenditures are expected to be $100 million

in 2012.

Our Recommendation

We currently have a Neutral recommendation on Vulcan. The stock

carries a Zacks #3 Rank in the near term (Hold rating).

We are encouraged by the company’s better-than-forecast results,

in particular the impressive performance at the Aggregates segment

which is slowly gaining momentum. We also like the company’s

expanded cost initiatives which will improve the overall credit

profile of the company in the long run.

Though public construction spending remains stable, low levels

of growth in the private sector are still a concern. This, combined

with rising costs of energy and other raw materials as well as the

company’s high debt load, keeps us on the sidelines. In the end, we

maintain our Neutral recommendation on the stock.

MARTIN MRT-MATL (MLM): Free Stock Analysis Report

VULCAN MATLS CO (VMC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

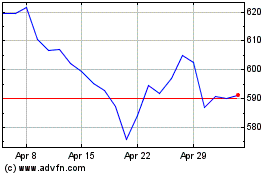

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

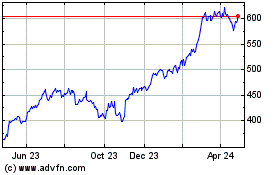

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024