Martin Marietta Materials, Inc. - Growth & Income

February 14 2012 - 7:00PM

Zacks

Estimates have been rising for

Martin Marietta Materials,

Inc. (MLM) after the company reported solid fourth quarter

results on February 7.

It is a Zacks #2 Rank (Buy) stock.

Based on consensus estimates, analysts project 26%

EPS growth this year and 40% growth next year. On top of this, the

company pays a dividend that yields 1.8%.

Company Description

Martin Marietta Materials, Inc. is the second

largest producer of construction aggregates in the United States

and a producer of magnesia-based chemical and dolomitic lime.

The company derives the majority of its revenue

from its Aggregates segment, which processes and sells granite,

limestone, and other products from a network of 283 quarries,

distribution facilities and plants to customers in North America.

These products are primarily used by commercial customers in the

domestic construction of highways and other infrastructure projects

and for non-residential and residential building development.

It is headquartered in Raleigh, North Carolina and

has a market cap of $4.0 billion.

Fourth Quarter Results

Martin reported solid fourth quarter results on

February 7. Total revenue rose 8% year-over-year to $421.1 million,

ahead of the Zacks Consensus Estimate of $378.0 million. A small

decline in volumes was more than offset by higher prices.

Revenue was mixed by geography. Growth was

strongest in the Mideast Group, which increased 11%. Sales in the

West Group were up 7%, while the Southeast Group saw a 1%

decline.

The gross profit margin declined 100 basis points

from the same quarter in 2010 to 16.6% of total revenue. But this

was more than offset by a decline in selling, general and

administrative expenses as a percentage of revenue - from 8.7% to

7.5%.

Earnings per share came in at 39 cents, in-line

with the Zacks Consensus Estimate.

Outlook

Despite Q4 EPS coming in-line, analysts revised

their estimates higher significantly higher for both 2012 and 2013,

sending the stock to a Zacks #2 Rank (Buy).

Based on consensus estimates, analysts expect

strong double-digit EPS growth over the next two years. The Zacks

Consensus Estimate for 2012 is $2.44, representing 26% EPS growth.

And the 2013 consensus estimate is 40% higher at $3.42.

Analysts expect a modest recovery in the

construction industry to drive increases in both pricing and

volumes. This should lead to strong top and bottom line growth over

the next two years.

Dividend

In addition to strong earnings growth, the company

pays a dividend that yields a solid 1.8%. The company has paid the

same 40 cent per share quarterly dividend since 2008.

Valuation

Shares of MLM have soared 17% year-to-date, leading

to higher valuations. The stock now trades at 34.5x 12-month

forward earnings, well ahead of its 10-year median of 18.5x, and a

premium to the industry median of 28.5x.

But its price to book ratio of 2.8 is much more

reasonable, and in-line with its historical median. Its price to

cash flow ratio is also a reasonable 15.8.

The Bottom Line

With rising earnings estimates, strong growth

projections, and a solid 1.8% dividend yield, Martin Marietta

Materials offers plenty to like.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Co-Editor of the

Reitmeister Value Investor.

MARTIN MRT-MATL (MLM): Free Stock Analysis Report

To read this article on Zacks.com click here.

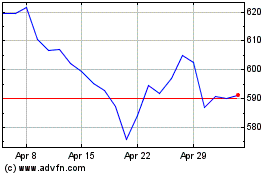

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

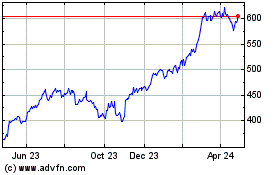

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024