Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269268

PROSPECTUS SUPPLEMENT NO. 12

(to the Prospectus dated March 24, 2023)

MariaDB plc

16,351,314 Ordinary Shares Underlying Warrants

56,414,951 Ordinary Shares by selling holders

7,310,297 Warrants to Purchase Ordinary Shares

by selling holders

This prospectus supplement updates, amends and

supplements the prospectus, dated March 24, 2023 (the “Prospectus”), which forms a part of our registration statement on Form

S-1 (No. 333-269268), with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission

on September 22, 2023 (“Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement

relate to the issuance by us of an aggregate of up to 16,351,314 Ordinary Shares (as defined in the Prospectus), consisting of:

| |

· |

|

up to 7,310,297 Ordinary Shares that are issuable upon the exercise of the Private Placement Warrants (as defined in the Prospectus); |

| |

· |

|

up to 8,850,458 Ordinary Shares that are issuable upon the exercise of the Public Warrants (as defined in the Prospectus); and |

| |

· |

|

up to 190,559 Ordinary Shares that are issuable upon exercise of the Kreos Warrants (as defined in the Prospectus). |

The Public Warrants,

which are exercisable at a price of $11.50 per share, were originally sold as part of the APHC Public Units (as defined in the Prospectus)

purchased by public investors in the APHC IPO (as defined in the Prospectus) at a price of $10.00 per APHC Public Unit. The Private Placement

Warrants, which are exercisable at a price of $11.50 per share, were originally purchased by the Sponsor (as defined in the Prospectus)

concurrent with the consummation of the APHC IPO at a price of $1.00 per warrant. Prior to the consummation of the Irish Domestication

Merger (as defined in the Prospectus), 1,600,000 Private Placement Warrants were transferred by the Sponsor to the Syndicated Investors

(as defined in the Prospectus) pursuant to the At Risk Capital Syndication (as defined in the Prospectus) (at a price per warrant of $1.00),

and 5,710,297 Private Placement Warrants were transferred to the Sponsor’s co-founders, Lionyet International Ltd. (an entity owned

and controlled by Shihuang “Simon” Xie) and Theodore T. Wang. The Kreos Warrants, which are exercisable at a price of €2.29

per share, were originally issued to Kreos (as defined in the Prospectus) by Legacy MariaDB (as defined in the Prospectus) in connection

with a loan facility that is no longer outstanding. The Private Placement Warrants, the Public Warrants and the Kreos Warrants are sometimes

referred to collectively in the Prospectus as the “Warrants.” To the extent that the Warrants are exercised for cash, we will

receive the proceeds from such exercises.

The Prospectus and this

prospectus supplement also relate to the offer and sale from time to time by the selling holders named in the Prospectus or their permitted

transferees (the “selling holders”) of (i) up to 7,310,297 Private Placement Warrants and (ii) up to 56,414,951 Ordinary

Shares, consisting of:

| |

· |

|

1,915,790 Ordinary Shares held by the PIPE Investors (as defined in the Prospectus), which they purchased in connection with the consummation of the PIPE Investment (as defined in the Prospectus) at a price of $9.50 per share; |

| |

· |

|

4,857,870 Founder Shares (as defined in the Prospectus) currently held by the Sponsor’s co-founders, Lionyet International Ltd. (an entity owned and controlled by Shihuang “Simon” Xie) and Theodore T. Wang, which were originally acquired by the Sponsor at a price of approximately $0.004 per share and transferred to its co-founders prior to the consummation of the Irish Domestication Merger; |

| |

· |

|

65,000 Founder Shares held by individuals who served as independent directors of APHC or otherwise provided services prior to the consummation of the Business Combination (as defined in the Prospectus), which were transferred from the Sponsor (who originally acquired such shares at a price of approximately $0.004 per share) in consideration of such services; |

| |

· |

|

1,550,000 Founders Shares held by certain Syndicated Investors, which were originally acquired by the Sponsor at a price of approximately $0.004 per share and transferred to such Syndicated Investors prior to the consummation of the Irish Domestication Merger in connection with the At Risk Capital Syndication (at a price of $3.00 per share); |

| |

· |

|

38,897,106 Ordinary Shares held by former affiliates and certain other shareholders of Legacy MariaDB, which, upon consummation of the Merger, were issued to them pursuant to the terms of the Merger Agreement in exchange for shares of (i) Legacy MariaDB they had previously purchased from Legacy MariaDB in private placement transactions or on exercise of Legacy MariaDB Equity Awards or warrants, at prices per share ranging from $0.38 to $7.50, as adjusted based on the Exchange Ratio (as defined in the Prospectus); |

| |

· |

|

1,818,888 Ordinary Shares issuable upon exercise of stock options held by certain of our executive officers and directors, at exercise prices ranging from $0.38 to $4.15 per Ordinary Share; and |

| |

· |

|

7,310,297 Ordinary Shares issuable upon exercise of the Private Placement Warrants held by Lionyet International Ltd. and Dr. Wang, the Sponsor’s co-founders, and the Syndicated Investors. |

We are registering the

Ordinary Shares and Private Placement Warrants that may be offered and sold by selling holders from time to time pursuant to their registration

rights under certain agreements between us and the selling holders or their affiliates, as applicable.

This prospectus supplement is not complete without

the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, including any amendments or supplements

thereto, which is to be delivered with this prospectus supplement., This prospectus supplement is qualified by reference to the Prospectus,

including any amendments or supplements thereto, except to the extent that the information in this prospectus supplement updates or supersedes

the information contained therein. Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings

specified in the Prospectus.

Our Ordinary Shares and Public Warrants are listed

on The New York Stock Exchange (“NYSE”) under the symbols “MRDB” and “MRDBW”, respectively. On September

21, 2023, the closing sale prices of our Ordinary Shares and Public Warrants were $0.4619 and $0.065, respectively.

We are an “emerging growth company”

and a “smaller reporting company” as defined under the U.S. federal securities laws and, as such, may elect to comply with

certain reduced public company reporting requirements for this and future filings.

Investing in our Ordinary Shares and Warrants

involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 9 of the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the Prospectus

or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is September

22, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): September 19, 2023

MariaDB plc

(Exact name of registrant as specified in its

charter)

| Ireland |

|

001-41571 |

|

N/A |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

699 Veterans Blvd

Redwood City, CA 94063

(Address of principal executive offices, including

zip code)

(855) 562-7423

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Ordinary Shares, nominal value $0.01 per share |

|

MRDB |

|

New York Stock Exchange |

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share |

|

MRDBW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing

Rule or Standard; Transfer of Listing |

On September 19, 2023, MariaDB plc (the “Company”)

received written notice (the “Notice”) from the New York Stock Exchange (“NYSE”) that the Company was not in compliance

with the continued listing standard set forth in Section 802.01B of the NYSE’s Listed Company Manual because the average global

market capitalization of the Company over a consecutive 30 trading-day period was less than $50 million and, at the same time, the Company’s

last reported stockholders’ equity was less than $50 million.

In accordance with applicable NYSE procedures,

the Company plans to notify the NYSE that it intends to submit a plan to cure the deficiency and to return to compliance with the NYSE

continued listing standards. Under the NYSE rules, the Company has 45 days from receipt of the Notice to submit a business plan advising

the NYSE of the definitive action(s) the Company has taken, is taking, or will take that would bring it into compliance with continued

listing standards within 18 months of receipt of the Notice. The NYSE will review the plan and, within 45 days of its receipt, determine

whether the Company has made a reasonable demonstration of an ability to conform to the relevant standards in the 18-month period.

The Notice has no immediate impact on the listing

of the Company’s ordinary shares. If the NYSE accepts the plan, the Company’s ordinary shares will continue to be listed and

traded on the NYSE during the applicable cure period, subject to the Company’s compliance with the continued listing requirements

of the NYSE and continued periodic review by NYSE of the Company’s progress with respect to its plan. If the plan is not submitted

on a timely basis or is not accepted by the NYSE, the NYSE could initiate delisting proceedings.

As previously disclosed in the Company’s

Current Report on Form 8-K filed on June 30, 2023, the Company also received written notice from the NYSE on June 28, 2023

that it was not in compliance with Section 802.01C of the NYSE Listed Company Manual because the average closing price of the Company’s

ordinary shares was less than $1.00 over a consecutive 30 trading-day period. In connection with the June notice, the Company notified

the NYSE that it intends to cure the stock price deficiency and to return to compliance with the NYSE continued listing standard with

respect to the deficiency under Section 802.01C. The Company is currently within the six-month cure period for this deficiency following

receipt of the June notice.

| Item 7.01 | Regulation FD Disclosure. |

As required by the NYSE rules, the Company issued a press release on

September 22, 2023, announcing that it had received the Notice from the NYSE described in Item 3.01. A copy of this press release

is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and incorporated herein

by reference.

The information contained in Item 7.01 of this Current Report, including

Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of section 18 of the Securities Exchange Act

of 1934, as amended, nor shall it be deemed incorporated by reference into any registration statement or other filing pursuant to the securities

act of 1933, as amended, except as otherwise expressly stated in such filing.

Forward-Looking Statements

Certain statements in this periodic report are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words indicating future events and actions,

such as “will,” “intend,” “plan,” and “may,” and variations of such words, and similar

expressions and future-looking language identify forward-looking statements, but their absence does not mean that the statement is not

forward-looking. The forward-looking statements in this periodic report include statements regarding our continued listing of securities

on the NYSE and related actions and events. Forward-looking statements are not guarantees of future events and actions, which may vary

materially from those expressed or implied in such statements. Differences may result from, among other things, actions taken by the Company

or its management or board or third parties (including the NYSE), including those beyond the Company’s control. Such differences

and uncertainties and related risks include, but are not limited to, the possibility that our securities may be suspended or delisted

from the NYSE, the possibility that the Company may not file a plan with the NYSE that is acceptable, even if the NYSE accepts the Company’s

plan there may be negative effects due to actions taken pursuant to the plan on the market price of Company securities and the Company

in general, and potentially significant related costs to structuring and implementing the plan. The foregoing list of differences

and risks and uncertainties is illustrative, but by no means exhaustive. For more information on factors that may affect the continued

listing of Company securities on NYSE and related actions and events, please review “Risk Factors” described in the Company’s

filings and records filed with the United States Securities and Exchange Commission. These forward-looking statements reflect the Company’s

expectations as of the date hereof. The Company undertakes no obligation to update the information provided herein.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MariaDB plc |

| Dated:

September 22, 2023 |

|

| |

By: |

/s/ Paul O’Brien |

| |

|

Paul O’Brien |

| |

|

Chief Executive Officer |

Exhibit 99.1

MariaDB

Receives NYSE Continued Listing Standards Notice

REDWOOD

CITY, Calif. and DUBLIN – September 22, 2023 – MariaDB

plc (NYSE: MRDB) (the “Company”) today announced that it was notified on September 19, 2023 (the

“Notice”) by the New York Stock Exchange (“NYSE”) that the Company is not in compliance with Section 802.01B

of the NYSE Listed Company Manual because the Company’s average global market capitalization over a consecutive 30 trading-day

period was less than $50 million and, at the same time, the Company’s last reported stockholders’ equity was less than $50

million.

The

Company plans to notify the NYSE that it intends to submit a plan to cure the deficiency and to return to compliance with the NYSE continued

listing standards. Under the NYSE rules, the Company has 45 days from receipt of the Notice to submit a business plan advising the NYSE

of the definitive action(s) the Company has taken, is taking, or will take that would bring it into compliance with the NYSE continued

listing standards within 18 months of receipt of the Notice (the “Cure Period”). The NYSE will review the plan and, within

45 days of its receipt, determine whether the Company has made a reasonable demonstration of an ability to conform to the relevant standards

in the Cure Period.

The

Notice has no immediate impact on the listing of the Company’s ordinary shares. If the NYSE accepts the plan, the Company’s

ordinary shares will continue to be listed and traded on the NYSE during the Cure Period, subject to the Company’s compliance with

the continued listing standards of the NYSE and the NYSE’s review of the Company’s progress with respect to its plan. If

the plan is not submitted on a timely basis or is not accepted by the NYSE, the NYSE could initiate delisting proceedings.

As

previously disclosed on June 30, 2023, the Company received written notice from the NYSE on June 28, 2023, that it was not

in compliance with Section 802.01C of the NYSE Listed Company Manual because the average closing price of the Company’s ordinary

shares was less than $1.00 over a consecutive 30 trading-day period. In connection with the June notice, the Company notified the

NYSE that it intends to cure the stock price deficiency and to return to compliance with the NYSE continued listing standard with respect

to the deficiency under Section 802.01C. The Company is currently within the six-month cure period for this deficiency following

receipt of the June notice.

About

MariaDB

MariaDB

is a new generation cloud database company whose products are used by companies big and small, reaching more than a billion users through

Linux distributions and have been downloaded over one billion times. Deployed in minutes and maintained with ease, leveraging cloud automation,

MariaDB database products are engineered to support any workload, any cloud and any scale – all while saving up to 90% of proprietary

database costs. Trusted by organizations such as Bandwidth, DigiCert, InfoArmor, Oppenheimer and Samsung, MariaDB’s software

is the backbone of critical services that people rely on every day. For more information, please visit mariadb.com.

Forward-Looking

Statements

Certain

statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Words indicating future events and actions, such as “will,” “intend,” “plan,”

and “may,” and variations of such words, and similar expressions and future-looking language identify forward-looking statements,

but their absence does not mean that the statement is not forward-looking. The forward-looking statements in this press release include

statements regarding our continued listing of securities on the NYSE and related actions and events. Forward-looking statements are not

guarantees of future events and actions, which may vary materially from those expressed or implied in such statements. Differences may

result from, among other things, actions taken by the Company or its management or board or third parties (including the NYSE), including

those beyond the Company’s control. Such differences and uncertainties and related risks include, but are not limited to, the

possibility that our securities may be suspended or delisted from the NYSE, the possibility that the Company may not file a plan with

the NYSE that is acceptable, even if the NYSE accepts the Company’s plan there may be negative effects due to actions taken pursuant

to the plan on the market price of Company securities and the Company in general, and potentially significant related costs to structuring

and implementing the plan. The foregoing list of differences and risks and uncertainties is illustrative, but by no means exhaustive.

For more information on factors that may affect the continued listing of Company securities on NYSE and related actions and events, please

review “Risk Factors” described in the Company’s filings and records filed with the United States Securities and Exchange

Commission. These forward-looking statements reflect the Company’s expectations as of the date hereof. The Company undertakes no

obligation to update the information provided herein.

Contacts

Investors:

ir@mariadb.com

Media:

pr@mariadb.com

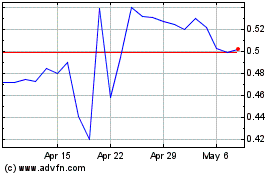

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Jul 2023 to Jul 2024