Current Report Filing (8-k)

January 03 2023 - 4:02PM

Edgar (US Regulatory)

0001839175

false

0001839175

2022-12-30

2022-12-30

0001839175

MBAC:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneRedeemableRedeemableWarrantMember

2022-12-30

2022-12-30

0001839175

MBAC:ClassCommonStockParValue0.0001PerShareMember

2022-12-30

2022-12-30

0001839175

MBAC:PublicWarrantsEachWholePublicWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2022-12-30

2022-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest

event reported): December 30, 2022

M3-BRIGADE ACQUISITION II CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40162 |

|

86-1359752 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

1700 Broadway, 19th Floor

New York, New

York 10019

(Address of principal executive

offices, including zip code)

(212) 202-2200

(Registrant’s telephone number,

including area code)

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communication pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A common stock and one-third of one redeemable redeemable warrant |

|

MBAC.U |

|

New York Stock Exchange |

| Class A Common Stock, par value $0.0001 per share |

|

MBAC |

|

New York Stock Exchange |

| Public warrants, each whole public warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

MBAC.WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

On December 30, 2022, M3-Brigade Acquisition II Corp. (“MBAC”

or the “Company”) received notice from M3-Brigade Sponsor I, LP (the “Sponsor”) that the Sponsor has determined

to irrevocably and unconditionally abandon its interest in the 7,500,000 private placement warrants held by it (the “Private Warrants”)

and permanently surrender and relinquish all rights in such warrants, with no consideration being provided to the Sponsor in exchange

therefor. In light of this determination by the Sponsor, the Company has instructed Continental Stock Transfer & Trust Company, as

the Company’s transfer agent, to cancel and retire the Private Warrants with effectiveness as of the date hereof.

Forward Looking Statements

This communication includes forward-looking statements that

involve risks and uncertainties. Forward-looking statements are statements that are not historical facts. Such forward-looking statements

are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements.

These forward-looking statements and factors that may cause

such differences include, without limitation, uncertainties relating our ability to complete our initial business combination and other

risks and uncertainties indicated from time to time in filings with the SEC, including “Risk Factors” in the Definitive Proxy

Statement and in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on April 15, 2022,

and our Quarterly Reports on Form 10-Q filed with the SEC on May 23, 2022, August 12, 2022 and November 14, 2022 and in other reports

we file with the SEC. MBAC expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in MBAC’s expectations with respect thereto or any change in events, conditions

or circumstances on which any statement is based.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

M3-BRIGADE

ACQUISITION II CORP. |

| |

|

|

| Date:

January 3, 2023 |

By: |

/s/ Mohsin Y. Meghji |

| |

|

Name: Mohsin Y. Meghji |

| |

|

Title: Chairman and Chief

Executive Officer |

-2-

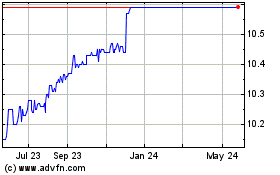

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

From Jan 2024 to Jan 2025