Syniverse Corporation (“Syniverse” or the “Company”), the “world’s most

connected company”TM and a premier global technology provider of

mission-critical mobile platforms for carriers and enterprises, is

pleased to announce the publication of its inaugural Environmental,

Social and Governance (“ESG”) Annual Report (“The Report”),

detailing the company’s ESG strategy and performance for the 2020

calendar year.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220126005926/en/

Andrew Davies, Chief Executive Officer,

Syniverse (Photo: Business Wire)

“We are proud to publish our inaugural ESG report, which

reflects our commitment to communicating with our stakeholders

transparently and providing regular updates on the progress we are

making in reducing our environmental impact and improving the

impact our technology has on the planet and the communities we

serve,” said Syniverse CEO Andrew Davies. “Syniverse plays a

critical role in the global mobile ecosystem, and as such we have a

responsibility to ensure our business operates sustainably and

benefits all stakeholders.”

“Syniverse’s strategic approach to ESG is focused on driving

long-term business value, which requires sustainability and

responsible business practices to be embedded in everything we do,”

said Kevin Beebe, Chairman of Syniverse’s Nominating and Corporate

Governance Committee and Board member with responsibility for ESG

topics. “As a company whose technologies connect the world, we take

very seriously our responsibility to connect with our employees,

communities and environment to support their development and

protect their well-being.”

Syniverse conducted an inaugural materiality assessment to

identify and prioritize key non-financial topics for its business

and stakeholders. The Company’s resulting ESG strategy and

framework is titled “RISE,” an acronym that identifies the four

areas critical to its long-term sustainability and success. These

comprise:

- Responsibility to promote ethical practices

- Inclusive culture for employees and global

community

- Service integrity in performance, security, and

privacy

- Environmental performance that protects the world

Highlights of The Report include:

Responsibility:

- 100% of employees completed anti-bribery and corruption and

Code of Conduct training

- No legal proceedings initiated and no monetary losses from

anti-competitive behavior

- Adoption of and adherence to the UK Modern Slavery Act of

2015

Inclusivity:

- 71% of employees described Syniverse as a “great place to

work”

- 87% of employees felt they can be their “authentic selves” at

work

- Established objectives to improve employee and Board of

Directors’ diversity

Service integrity:

- 16% Improvement in Net Promoter Score from 2019 (36 to 42)

- Average service uptime of 99.85%

- 97% Customer support rating (Good or Excellent)

Environmental:

- 39% reduction in Scope 1 Greenhouse gas emissions from 2019 and

by 20% from 2010 (baseline year)

- Improved Carbon Disclosure score from C to B-

- Continued disclosure of Scope 1, 2, and 3 emissions to CDP

The full report is available here. Reporting methodology is

informed by leading sustainability and reporting frameworks

including Global Reporting Initiative Standards, United Nations

Sustainability Goals, Sustainability Accounting Standards Board and

Carbon Disclosure Project (CDP).

In August 2021, Syniverse announced its plan to go public

through a merger agreement with M3-Brigade Acquisition II Corp.

(NYSE: MBAC) (“MBAC”) a special purpose acquisition company, or

SPAC. Syniverse and MBAC announced on January 10, 2022, that MBAC’s

special meeting of shareholders to approve the merger is scheduled

to be held on February 9, 2022. On January 7, 2022, MBAC commenced

mailing of its definitive proxy statement to its shareholders of

record as of January 6, 2022. Upon closing of the transaction, the

renamed Syniverse Technologies Corporation will be listed on the

New York Stock Exchange under the ticker “SYNV.”

About Syniverse

Syniverse is a leading global provider of unified,

mission-critical platforms enabling seamless interoperability

across the mobile ecosystem. Syniverse makes global mobility work

by enabling consumers and enterprises to connect, engage, and

transact seamlessly and securely. Syniverse offers a premier

communications platform that serves both enterprises and carriers

globally and at scale. Syniverse’s proprietary software, protocols,

orchestration capabilities and network assets have allowed

Syniverse to address the changing needs of the mobile ecosystem for

over 30 years. Syniverse continues to innovate by harnessing the

potential of emerging technologies such as 5G, IoT, RCS and CPaaS

for its customers.

About M3-Brigade Acquisition II Corp

MBAC is a special purpose acquisition corporation formed for the

purpose of effecting a merger, stock purchase or similar business

combination with one or more businesses. MBAC is led by key

executives of M3 Partners, LP, a leading financial advisory

services firm that specializes in assisting companies at inflection

points in their growth cycle, and Brigade Capital Management, LP, a

leading global investment advisor that was founded in 2006 to

specialize in credit-focused investment strategies and has

approximately $30 billion in assets under management.

Forward-Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. The expectations,

estimates and projections of the businesses of MBAC or Syniverse

may differ from their actual results and consequently you should

not rely on these forward-looking statements as predictions of

future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,”

“will,” “would,” “could,” “should,” “believes,” “predicts,”

“potential,” “continue,” and similar expressions are intended to

identify such forward-looking statements. These forward-looking

statements include, without limitation, expectations with respect

to future performance of Syniverse and anticipated impacts of the

proposed transaction, the satisfaction of the closing conditions to

the proposed transaction and the timing of the completion of the

proposed transaction.

These forward-looking statements are not guaranteeing of future

performance, conditions, or results, and involve significant risks

and uncertainties that could cause the actual results to differ

materially from the expected results. Most of these factors are

outside of the control of MBAC and Syniverse and are difficult to

predict. Factors that may cause such differences include, but are

not limited to: (1) the inability to complete the transactions

contemplated by the agreement and plan of merger with respect to

the proposed transaction (the “Merger Agreement”), including due to

failure to obtain approval of the stockholders of MBAC or other

conditions to closing in the Merger Agreement; (2) the outcome of

any legal proceedings that may be instituted against the parties

following announcement of the Merger Agreement and the proposed

transactions contemplated thereby; (3) the ability to recognize the

anticipated benefits of the proposed business combination, which

may be affected by, among other things, competition, the ability of

the post-combination company to grow and manage growth profitably,

maintain relationships with customers and suppliers and retain its

management and key employees; (4) the occurrence of any event,

change or other circumstances that could give rise to the

termination of the Merger Agreement and the proposed transactions

contemplated thereby; (5) risks related to the uncertainty of the

projected financial information with respect to Syniverse; (6) the

inability to obtain or maintain the listing of the post-acquisition

company’s Class A Stock and public warrants on the NYSE following

the proposed business combination; (7) risks related to the

post-combination company’s ability to raise financing in the

future; (8) the post-combination company’s success in retaining or

recruiting, or changes required in, our officers, key employees or

directors following the proposed business combination; (9) our

directors and officers potentially having conflicts of interest

with our business or in approving the proposed business

combination; (10) intense competition and competitive pressures

from other companies in the industry in which the post-combination

company will operate; (11) the business, operations and financial

performance of Syniverse, including market conditions and global

and economic factors beyond Syniverse’s control; (12) the effect of

legal, tax and regulatory changes; (13) the receipt by MBAC or

Syniverse of an unsolicited offer from another party for an

alternative business transaction that could interfere with the

proposed business combination; (14) the risk that the proposed

business combination disrupts current plans and operations of MBAC

or Syniverse as a result of the announcement and consummation of

the transactions described herein; (15) costs related to the

proposed business combination; (16) changes in applicable laws or

regulations; (17) the possibility that MBAC or Syniverse may be

adversely affected by other economic, business, and/or competitive

factors; (18) the amount of redemption requests made by MBAC’s

public stockholders; (19) the impact of the continuing COVID-19

pandemic on MBAC, Syniverse and Syniverse’s projected results of

operations, financial performance or other financial metrics or on

any of the foregoing risks; and (20) other risks and uncertainties

disclosed in MBAC’s definitive proxy statement, including those

under “Risk Factors,” and other documents filed or to be filed with

the SEC by MBAC.

MBAC and Syniverse caution that the foregoing list of factors is

not exclusive. You should not place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Syniverse and MBAC do not undertake or accept any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in their

expectations or any change in events, conditions or circumstances

on which any such statement is based.

Information About the Proposed Business Merger and Where to

Find It

In connection with the proposed transaction, MBAC has filed a

definitive proxy statement with the SEC. MBAC’S STOCKHOLDERS AND

OTHER INTERESTED PERSONS ARE ADVISED TO READ THE DEFINITIVE PROXY

STATEMENT AND DOCUMENTS INCORPORATED BY REFERENCE THEREIN FILED IN

CONNECTION WITH THE PROPOSED TRANSACTION, AS THESE MATERIALS

CONTAIN IMPORTANT INFORMATION ABOUT MBAC, SYNIVERSE AND THE

PROPOSED TRANSACTION. MBAC HAS COMMENCED MAILING OF THE DEFINITIVE

PROXY STATEMENT TO THE STOCKHOLDERS OF MBAC AS OF JANUARY 6, 2022.

THE RECORD DATE ESTABLISHED FOR THE PROPOSED TRANSACTION. MBAC

Stockholders will also be able to obtain copies of the definitive

proxy statement and other documents filed with the SEC that will be

incorporated by reference therein, without charge, at the SEC’s

website at www.sec.gov, or by directing a request to: M3-Brigade

Acquisition II Corp., 1700 Broadway – 19th Floor, New York, New

York 10019.

Participants in the Solicitation

MBAC and its directors and executive officers may be deemed

participants in the solicitation of proxies of MBAC’s stockholders

with respect to the proposed transaction. A list of those directors

and executive officers and a description of their interests in MBAC

have been filed in the proxy statement for the proposed transaction

and are available at www.sec.gov. Additional information regarding

the interests of such participants is contained in the proxy

statement.

Syniverse and its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the

stockholders of MBAC in connection with the proposed transaction. A

list of the names of such directors and executive officers and

information regarding their interests in the proposed transaction

have been included in the proxy statement for the proposed business

combination.

No Offer or Solicitation

This press release shall not constitute a solicitation of a

proxy, consent, or authorization with respect to any securities or

in respect of the proposed transaction. This press release shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any states or jurisdictions in which such offer, solicitation, or

sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as

amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220126005926/en/

Media and Press: Brooke Gordon /

Kelsey Markovich Sard Verbinnen & Co.

syniverse-svc@sardverb.com +1.212.687.8080

Investor Relations: Stanley

Martinez, CFA, IRC Syniverse ir@syniverse.com

+1.813.614.1070

Kristin Celauro M3-Brigade Acquisition II Corp.

kcelauro@m3-partners.com +1.212.202.2223

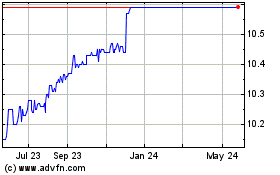

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

From Feb 2024 to Feb 2025