UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: May, 2024

Commission file number: 001-41788

Lithium Americas Corp.

(Translation of Registrant’s name into English)

400-900 West Hastings Street,

Vancouver, British Columbia,

Canada V6C 1E5

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 to this Form 6-K of Lithium Americas Corp. (the “Company”) are hereby incorporated by reference as exhibits to the Registration Statements on Form F-3 (File No. 333-274883) and Form S-8 (File No. 333-274884) of the Company, as amended or supplemented, and to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Lithium Americas Corp. |

(Registrant) |

|

|

By: |

|

/s/ Jonathan Evans |

Name: |

|

Jonathan Evans |

Title: |

|

Chief Executive Officer |

Dated: May 13, 2024

|

|

|

Exhibit 99.1

(Formerly 1397468 B.C. Ltd.) |

|

|

|

Management's Discussion and Analysis For the three months ended March 31, 2024 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

BACKGROUND

On January 23, 2023, 1397468 B.C. Ltd (“New LAC,” “Lithium Americas” or the “Company”) was incorporated under the Business Corporations Act (British Columbia) for the sole purpose of acquiring ownership of the North American business assets and investments (“LAC North America”) of Lithium Americas Corp. (“Old LAC”), which is now named Lithium Americas (Argentina) Corp. (“Lithium Argentina”), pursuant to a separation transaction (the “Separation”) that was undertaken on October 3, 2023. Upon consummation of the Separation, New LAC was re- named Lithium Americas Corp., and its common shares were listed on the Toronto Stock Exchange (“TSX”) and on the New York Stock Exchange (“NYSE”) under the symbol “LAC.”

The Separation was implemented by way of a plan of arrangement (the “Arrangement”) under the laws of British Columbia pursuant to an arrangement agreement between the Company and Old LAC. Upon completion of the Separation, Old LAC contributed to the Company, among other assets and liabilities, its interest in the Thacker Pass project (“Thacker Pass”), its investments in Green Technology Metals Limited (“GT1”) and Ascend Elements, Inc. (“Ascend Elements”), certain intellectual property rights, its loan to 1339480 B.C. Ltd., and cash of $275.5 million, including $75 million to establish sufficient working capital. The Company then distributed its common shares to shareholders of Old LAC in a series of share exchanges. The Separation was pro rata to the shareholders of Old LAC, so that the holders maintained the same proportionate interest in Old LAC (upon the Separation, Lithium Argentina) and the Company both immediately before and immediately after the Separation.

This Management’s Discussion and Analysis (“MD&A”) of the Company, prepared as of May 10, 2024, should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and the notes thereto for the three months ended March 31, 2024 (“Q1 2024 financial statements”), and the Company’s audited consolidated financial statements for the year ended December 31, 2023 and the related notes thereto (“2023 annual financial statements”), which have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IFRS”). For further information on the Company, including key risk factors, reference should be made to its public filings on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. These consolidated financial statements should also be read in conjunction with LAC North Americas’ audited carve-out financial statements and notes thereto for the year ended December 31, 2022 which may be found in Lithium Argentina's Management Information Circular dated June 16, 2023 filed on SEDAR+ at www.sedarplus.ca. All amounts are expressed in US dollars, unless otherwise stated. References to CDN$ are to Canadian dollars. This MD&A contains “forward-looking statements,” and readers should read the cautionary note contained in the section entitled “Forward-Looking Statements” of this MD&A regarding such forward-looking statements.

OUR BUSINESS

Lithium Americas is a Canadian-based resource company focused on the advancement of significant lithium projects. The Company strives to operate under the highest environmental, social, governance and safety (“ESG-S”) standards to foster the sustainable advancement of projects that support the vital lithium supply chain and the global transition to cleaner energy. Our flagship project is Thacker Pass, a sedimentary-based lithium deposit located in the McDermitt Caldera in Humboldt County, Nevada. The Company owns 100% of Thacker Pass through its wholly-owned subsidiary, Lithium Nevada Corp. (“Lithium Nevada”). The Company also holds investments in GT1 and Ascend Elements, and exploration properties in the United States and Canada. The Company’s head office and principal address is Suite 400, 900 West Hastings Street, Vancouver, British Columbia, Canada, V6C 1E5.

Additional information relating to the Company, including the Company’s then-current “AIF” (as such term is defined under National Instrument 51-102 – Continuous Disclosure Obligation) ("AIF”), is available on the Company’s website at www.lithiumamericas.com and on SEDAR+ at www.sedarplus.ca.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

HIGHLIGHTS

Thacker Pass

•Site preparation for major earthworks has been completed and Thacker Pass is prepared for the commencement of major construction, expected in the second half of 2024.

•The Company continues to focus on increasing the level of detailed engineering, alongside advancing procurement and execution planning, in advance of issuing full notice to proceed (“FNTP”), which is expected in the second half of 2024. Detailed engineering is over 30% design complete to date.

•On March 12, 2024, the Company received a conditional commitment (“Conditional Commitment”) from the U.S. Department of Energy (“DOE”) for a $2.26 billion loan under the Advanced Technology Vehicles Manufacturing (“ATVM”) Loan Program for a $1.97 billion loan in aggregate principal to fund eligible construction costs of the processing facilities at Thacker Pass, targeting to produce an initial 40,000 tonnes per year of battery grade lithium carbonate ("Phase 1"), plus interest to be accrued during construction, which is estimated to be $290 million over a three-year period, together totaling a $2.26 billion loan (the "DOE Loan").

•On March 12, 2024, the Company provided an update to the estimated total capital cost (“CAPEX”) for Phase 1 construction. CAPEX has been revised to $2.93 billion to reflect estimates of key updated quantities and execution planning tied to increased engineering progress, use of union labor through a National Construction Agreement (Project Labor Agreement) (“PLA”) with North America’s Building Trades Unions (“NABTU”) for construction of Thacker Pass, development of an all-inclusive housing facility for construction workers, updated equipment pricing and a larger project contingency.

•During the three months ended March 31, 2024, $62.5 million of construction capital costs and other project-related costs were capitalized.

Corporate

•As of March 31, 2024, the Company had approximately $147 million in cash and cash equivalents.

•On April 22, 2024, the Company completed an underwritten public offering (the “Offering”) of 55 million common shares (the “Common Shares”) at a price of $5.00 per Common Share (the “Issue Price”) for aggregate gross proceeds of $275 million, resulting in net proceeds to the Company of approximately $263 million.

•The Offering, together with the DOE Loan, satisfies the funding condition to closing General Motors Holdings LLC ("GM") second tranche investment. At the same time, the Offering and GM funding will allow the Company to meet the financing-related condition related to closing the DOE Loan Conditional Commitment. These financings are expected to fund Thacker Pass Phase 1 construction capital expenditures.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

THACKER PASS

Q1 2024 Progress Photos

|

|

Figure A: The first phase of major earthworks including site clearing and plant pad excavation has been completed at Thacker Pass in preparation for major construction expected in the second half of 2024.

|

Figure B: The Workforce Hub is a temporary full-service housing facility for construction workers in the nearby City of Winnemucca. Earthworks for the facility are complete and the housing modules are currently stored in-place to allow for staged erection to align with the Phase 1 construction timeline.

|

Figure C: Two concrete armor barriers were built to Bureau of Land Management standards on our pipeline right-of-way in the Quinn Valley at Crowley Creek crossing. These concrete creek crossings are designed to survive projected 100-year storms, prevent erosion and preserve the original flow of water, while making it safer and more efficient to access the Quinn Valley wells.

|

Figure D: On January 18, 2024, we gathered with the Humboldt County community for a ribbon-cutting ceremony of the new Lithium Americas Winnemucca Office. The office has space for up to 30 people and is a small representation of moving Thacker Pass towards production.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

Health and Safety

In Q1 2024, the Company continued to emphasize safety efforts and develop a proactive safety culture and program, emphasizing zero harm to all employees, contractors, vendors and visitors. As of March 31, 2024, 169,000 hours were completed at Thacker Pass without a lost time incident.

The Company continues to implement safety protocols to prepare for heavy construction at Thacker Pass. Additional safety initiatives implemented during Q1 2024 included:

•Developed an implementation timeline for the Company's Safety Roadmap, a sustainable and achievable health and safety management system, with full implementation targeted by the end of 2024.

•Commenced preparations to adopt and implement Health and Safety Programs from the Company's engineering, procurement and construction management ("EPCM") contractor, Bechtel.

•Worked with the Company's insurance brokers to provide project updates, promote a proactive approach to health and safety and share best practices.

•Expanded the Company's health and safety monitoring program to include leading indicators and key performance indicators to support a proactive approach to safety leadership and performance.

Safety Highlights

In March 2024, the Safety Consultation and Training Section ("SCATS") of the State of Nevada's Division of Industrial Relations recognized the Company’s Lithium Technical Development Center (the “Tech Center”) in Reno, Nevada for the successful entry into the Safety and Health Achievement Recognition Program (“SHARP”). SCATS consultants provide companies with confidential hazard identification, program development, implementation assistance and training. Companies who implement effective safety programs and have a days-away restricted transfer (“DART”) rate below the national average for their industry may be recognized by SCATS. Successful SHARP participants may receive up to a three-year deferral from the Occupational Safety and Health Administration's ("OSHA") general schedule inspections.

Construction Workforce

Construction Labor and Economic Impact

Thacker Pass Phase 1 is expected to create approximately 1,800 direct jobs during its three-year construction period and approximately 360 jobs in operations for its 40-year mine life.

The Company commissioned the University of Nevada, Reno to complete an economic impact assessment, which estimated that every direct job created by the Company’s construction investment will generate an additional 1.5 local jobs during construction.

The Company and its EPCM contractor, Bechtel, entered into a PLA with NABTU for construction of Thacker Pass Phase 1. The parties agreed to utilize the form of a National Construction Agreement with a project specific addendum as the PLA for the Thacker Pass construction.

Workforce Hub

The Workforce Hub is a temporary full-service housing facility for construction workers located in the nearby City of Winnemucca. The Company purchased the land and completed earthworks for the facility. Delivery of the housing modules was completed in Q1 2024, and the modules are currently stored in-place to allow for staged erection to align with the Thacker Pass Phase 1 construction timeline.

Construction and Engineering Progress

In late 2022, the Company awarded the EPCM contract to Bechtel for the design, procurement and execution of Phase 1. Over the past year, Bechtel has provided significant expertise based on its experience with global capital projects to improve execution planning and to de-risk the construction phase.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

Following the start of early works construction activities at Thacker Pass in early 2023, the following actions have been completed to prepare for major construction following FNTP:

•Completed the first phase of major earthworks including site clearing and plant pad excavation;

•Stockpiled all growth media for future reclamation;

•Commissioned a water supply system consisting of pipelines, pumps and ponds in July 2023;

•Improved State Route 293 with acceleration and deceleration lanes, conforming to Nevada Department of Transportation specifications to improve safety and traffic flow for vehicles entering and exiting Thacker Pass; and

•Completed site infrastructure including erection of temporary offices, fencing, security gates and systems.

The Company continues to take steps to further de-risk the project construction, including:

•Progressing minor earthworks to the plant pad; and

•Progressing detailed engineering above the current level, of over 30% design complete, prior to FNTP. A higher level of advanced engineering prior to commencing major construction mitigates the potential for field rework and supports well-planned construction execution.

Major Construction Contracts

In addition to awarding the EPCM contract to Bechtel for the design, procurement and execution of Phase 1, other major construction contracts awarded included:

•Aquatech International LLC was awarded the contract for the magnesium sulfate and lithium carbonate chemical plants;

•EXP Global Inc. was awarded the contract for the engineering, procurement, construction support, commissioning and start-up services for the sulfuric acid plant; and

•MECS, Inc. was awarded the contract for the technology license, engineering and equipment for the sulfuric acid plant including their state-of-the-art MECS® Heat Recovery System, to harness waste heat to generate steam from the sulfuric acid plant, which will subsequently be converted into carbon-free electricity for the processing plant.

Transloading Terminal

The Company has leased a parcel of land adjacent to the mainline railroad from the City of Winnemucca and purchased an adjacent property with access to State Route 796, approximately 60 miles from Thacker Pass, for the development of a transloading terminal (“TLT”).

The TLT will provide direct access to the railroad for shipping of reagents during operations and is expected to create approximately 50 jobs for Phase 1. Expected benefits of direct access to the mainline railroad during operations include reduced transportation costs for reagents, such as liquid sulfur and soda ash, and minimizing Scope 3 emissions by utilizing lower carbon intensity transportation methods.

The TLT design has been advanced to approximately 20% design complete.

Capital Cost Estimate

Together with Bechtel and other major mining and processing plant contractors, the Company has further refined the Thacker Pass Phase 1 estimated total CAPEX, following the November 2022 Feasibility Study estimate. The revised CAPEX estimate of $2.93 billion reflects steps the Company has taken to de-risk construction, including:

•Achieving a higher degree of engineering, advancing estimates of key quantities and execution plans;

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

•Increasing project contingency to 15%;

•Updating labor costs due to an increase in estimated number of construction workers to approximately 1,800 and substantially de-risking skilled labor availability with the PLA;

•Securing land and temporary housing facility for the Workforce Hub in Winnemucca for construction workers; and

•Updating pricing for over 70% of procurement packages to reflect current market conditions.

During the three months ended March 31, 2024, $62.5 million of construction capital costs and other project-related costs were capitalized. The majority of capital expenditures are expected in 2025 as the project ramps up to peak construction.

Project Timeline

Mechanical completion of Thacker Pass Phase 1 is targeted for 2027 following a three-year construction period. Major construction is expected to commence in the second half of 2024 following the anticipated closing of the DOE Loan and issuance of FNTP. The Company anticipates a commissioning and ramp-up period of six to twelve months, targeting achieving full capacity production in 2028.

Regulatory and Permitting

All state and federal permits to begin construction are in place and the Company commenced construction on February 28, 2023, following receipt of a notice to proceed from the Bureau of Land Management ("BLM").

On February 6, 2023, the Company received a favorable ruling from the U.S. District Court for the appeal filed to challenge the BLM with the court upholding the BLM’s environmental review processes. A limited remand to address the validity of certain mining claims was resolved by BLM, concluding that tailings and other waste storage areas have sufficient mineralization to meet BLM’s standards, with the exception of limited acreage at the two waste rock facilities where the BLM indicated the Company could instead proceed with alternative measures to establish suitable mining-claim tenure, which the Company intends to pursue in due course. A subsequent appeal of the U.S. District Court’s ruling was filed in the U.S. Court of Appeals for the Ninth Circuit ("Ninth Circuit") in February 2023. The appellants’ motions for an injunction pending appeal were all denied by the court, and construction at Thacker Pass commenced. On July 17, 2023, the Ninth Circuit unanimously affirmed the U.S. District Court’s decision.

A new lawsuit was filed in U.S. District Court in February 2023 by three tribes asserting, among other claims, inadequate consultation by the BLM prior to the issuance of the Record of Decision ("ROD"). The Company intervened in this new lawsuit in support of the ROD. On November 11, 2023, the U.S. District Court dismissed all claims. After the plaintiffs did not seek to amend their complaint, the court issued a final order and judgment dismissing the case in December 2023, and that decision has not been appealed.

The Company’s application with the State of Nevada Division of Water Resources for the transfer of certain water rights for Phase 1 of Thacker Pass was approved by the State Engineer in February 2023. The State Engineer’s Office issued the final water rights permits on June 30 and July 3, 2023, authorizing the Company to use its water production wells. The State Engineer’s decision was appealed in state court by a local ranching company in March 2023. The case is currently pending. The Company has commenced using the water rights for construction activities at the Thacker Pass project site in accordance with the State Engineer’s authorization.

The State approved a Water Pollution Control Permit minor modification in January 2024. Additional permit modifications to reflect design updates are currently pending, and modifications to conform to any other design updates may be pursued as warranted.

Feasibility Study Reports

On October 3, 2023, following Separation, the Company re-issued the feasibility study titled “Feasibility Study: National Instrument 43-101 Technical Report for the Thacker Pass Project, Humboldt County, Nevada, USA” dated effective

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

November 2, 2022 (the “Nov 2022 Feasibility Study”). The Company also previously issued the "Preliminary Feasibility Study S-K 1300 Technical Report Summary for the Thacker Pass Project Humboldt County, Nevada, USA" with an effective date of December 31, 2022 (the “Thacker Pass S-K 1300 Report” and collectively with the Nov 2022 Feasibility Study, the “Reports”). The Reports are available on SEDAR+ at www.sedarplus.ca and the Company’s website.

Mineral Reserve and Mineral Resource Estimates

The Reports include a Mineral Reserve estimate for Thacker Pass of 3.7 million tonnes (“Mt”) of LCE grading at 3,160 parts per million (“ppm”) lithium (“Li”) of Proven and Probable Mineral Reserves, comprised of 3.3 Mt LCE Proven Reserves at 192.9 Mt and 3,180 ppm Li and 0.4 Mt LCE of Probable Reserves at 24.4 Mt and 3,010 ppm Li.

The Thacker Pass S-K 1300 Report includes a Mineral Resource estimate, exclusive of reserves, of 12.1 Mt of LCE grading 1,860 ppm Li of M&I, comprised of 3.4 Mt LCE Measured Resources at 1,990 ppm Li and 8.7 Mt LCE Indicated Resources at 1,820 ppm Li. The Nov 2022 Feasibility Study includes a Mineral Resource estimate, inclusive of reserves, of 16.1 Mt of LCE grading 2,070 ppm Li of M&I, comprised of 7.0 Mt LCE Measured Resources at 534.7 Mt and 2,450 ppm Li, and 9.1 Mt LCE Indicated Resources at 922.5 Mt and 1,850 ppm Li. The Mineral Resource estimate in both Reports also included 3.0 Mt LCE of Inferred Resources grading 1,870 ppm. Mineral Reserves have been converted from Measured and Indicated Mineral Resources in the Reports and have demonstrated economic viability. The effective date of the estimates in the Nov 2022 Feasibility Study was November 2, 2022 and in the Thacker Pass S-K 1300 Report was December 31, 2022. See the Reports filed on SEDAR+ and EDGAR, as applicable, for further details. The Thacker Pass S-K 1300 Report is also discussed in more detail in the Company’s Form 20-F registration statement which was originally filed with the SEC on August 22, 2023.

Exploration Program

The 2023 drilling program at Thacker Pass to further define and expand the resource estimate concluded successfully in December 2023. A total of 97 core holes totaling 50,099 feet were drilled and the process of sampling and analysis is currently underway. The exploration program continues to confirm that sedimentary deposits are common throughout Thacker Pass.

Lithium Technical Development Center

The Tech Center’s Quality Management System was awarded the ISO 9001:2015 certification, which is a globally recognized standard for quality management. Implementation of ISO 9001:2015 demonstrates the Company’s commitment to quality in the development of lithium products.

The ISO 9001:2015 certification was issued by American Systems Registrar, a provider of third-party system registration and accredited by the ANSI National Accreditation Board. The process to become ISO 9001:2015 certified took place over seven months and involved the creation of policies, processes and training procedures, a document management system, key performance indicators and review processes. A pre-audit was conducted in July 2023, with the final audit taking place in November 2023. The certification is valid for three years and requires annual surveillance audits and a recertification audit in three years.

Social Responsibility

The Company continues to work collaboratively with the Fort McDermitt Paiute Shoshone Tribe (the “Tribe”) and communities closest to Thacker Pass to advance our shared priorities.

Community Benefits Agreement with Fort McDermitt Tribe

A key commitment of the Community Benefits Agreement (“CBA”) signed in October 2022 with the Tribe, located approximately 48 miles by road from Thacker Pass, is to build a new community center with on-site preschool, daycare, playground, cultural facility and communal greenhouse. Tribe leadership identified a building site location for the community center and finalized building designs. The CBA will also provide the Tribe with training and employment opportunities for members of the Tribe; funding to support cultural education and preservation work by the Tribe; and business and contracting opportunities between the parties.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

Skills Training and Job Opportunities

The Company is committed to hiring locally where possible and has been working with Great Basin College to offer a Workforce Development Training program to local communities and the Tribe. In Q2 2023, a Tribe member and a McDermitt resident were among the first local people hired to help the geophysics team prepare for major construction.

Community Engagement

The communities of Orovada and Kings Valley are the closest communities to Thacker Pass, located approximately 18 and 5 miles from the site, respectively. For nearly two years, the Company has met regularly with local community members for the purpose of identifying community concerns and developing ways to address them. As construction activities began, the Company increased its community outreach through open houses, one-on-one meetings and tours of the Lithium Technical Development Center in Reno, Nevada.

The Company collaborated with the Humboldt County School District and the BLM to finalize the design and location of a new K-8 school in Orovada. Construction of the new school is expected to be 100% funded by the Company. Detailed engineering and construction planning work is currently underway.

The traffic improvements at the intersection of US-95 and SR293 in the Town of Orovada were developed in consultation with the local communities and completed in July 2023 in coordination with the Nevada Department of Transportation.

Acceleration and deceleration lanes were added at the entrances into Thacker Pass. The new lanes conform to Nevada Department of Transportation specifications and ensure local traffic is not hindered by construction activity.

CORPORATE

Project Financing

The Offering, together with the DOE Loan, satisfies the funding condition to closing the GM Tranche 2 Investment. At the same time, the Offering and GM funding will allow the Company to meet the financing-related condition relating to closing the DOE Loan Conditional Commitment. These financings are expected to fund Thacker Pass Phase 1 construction capital expenditures.

Common Share Offering

On April 22, 2024, the Company completed an Offering of 55 million Common Shares at an Issue Price of $5.00 per Common Share for aggregate gross proceeds to the Company of $275 million. The net proceeds from the Offering of approximately $263 million are intended to fund the advancement of construction and development of Thacker Pass.

The Company has granted the underwriters an option to purchase up to 8,250,000 additional Common Shares (the "Over-Allotment Option") at the Issue Price, exercisable, in whole or in part, for up to 30 days after the closing of the Offering.

DOE ATVM Loan Program

On March 12, 2024, the Company received a Conditional Commitment from the U.S. DOE for a DOE Loan for financing the construction of the processing facilities at Thacker Pass for Phase 1. Based on the terms of the Conditional Commitment, the DOE Loan for $1.97 billion in aggregate principal to fund eligible construction costs of Thacker Pass, plus interest to be accrued during construction, which is estimated to be $290 million over a three-year period, together totaling a $2.26 billion loan will have a 24-year maturity with interest rates fixed from the date of each monthly advance for the term of the loan at applicable U.S. Treasury rates, without any additional credit spread.

The DOE Loan Conditional Commitment follows receipt of the Letter of Substantial Completion in February 2023. Over the past year, the DOE undertook a robust due diligence process to review all key aspects of Thacker Pass and complete term sheet details. While this Conditional Commitment represents a significant milestone and demonstrates the DOE’s intent to finance Thacker Pass, certain technical, legal and financial conditions, including negotiation of definitive financing documents, must be satisfied before funding of the Loan.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

Once the DOE Loan agreement is finalized, the Company expects to begin to draw on the Loan in early 2025. Conditions precedent to the first draw under the Loan include, but are not limited to, project finance model bring down, letters of credit to support reserve accounts, and securing additional corporate working capital to fund pre-commissioning general and operating expenses, commissioning costs through production and financing-related fees and expenses. We expect the $195 million reserve account requirements to be satisfied with letters of credit or similar credit support facilities. The Company is in active discussions with our key project partners and other third parties to have these in place later this year. The Company is evaluating various financing alternatives to fund corporate working capital to facilitate first drawdown on the Loan.

General Motors Investment and Offtake

On January 30, 2023, Old LAC entered into a purchase agreement with GM, pursuant to which GM agreed to make a $650 million equity investment (the “Transaction”), the proceeds of which are to be used for the construction and development of Thacker Pass. The Transaction is comprised of two tranches, with the $320 million first tranche investment (the “Tranche 1 Investment”) and a second tranche investment of up to $330 million (the "Tranche 2 Investment”). The Tranche 1 Investment closed on February 16, 2023 when GM subscribed for 15,002,000 subscription receipts of Old LAC, which were automatically converted into 15,002,000 units comprising 15,002,000 shares and 11,891,000 warrants of Old LAC which became 15,002,000 common shares of the Company post-Separation. The subscription proceeds were paid to Old LAC and the remaining unspent proceeds were distributed to the Company on October 3, 2023 pursuant to the Arrangement.

On October 3, 2023 pursuant to the Separation, the full amount of the remaining unspent proceeds of the Tranche 1 investment were included in the net assets distributed by Old LAC to the Company.

As the Separation was completed before the closing of the Tranche 2 Investment, on October 3, 2023, the agreement for the Tranche 2 Investment in Old LAC was terminated and replaced by a corresponding subscription agreement between GM and the Company whereby the proceeds of the Tranche 2 Investment will be received by the Company.

Pursuant to the second tranche subscription agreement, GM will purchase common shares of the Company subject to the satisfaction of certain conditions precedent, including the condition that the Company secures sufficient funding to complete the development of Phase 1 for Thacker Pass (the “Funding Condition”). The subscription agreement calls for an aggregate purchase price of up to $330 million, with the number of shares to be determined using a conversion price equal to the lower of (a) the 5-day volume weighted average share price (which is determined as of the date the notice that the Funding Condition has been met) and (b) $17.36 per share. The conditions precedent under the second tranche subscription agreement must be met by August 16, 2024.

As part of the Arrangement, the agreement to supply GM with lithium carbonate production from Thacker Pass (the “Offtake Agreement”) was assigned by Old LAC to the Company.

Pursuant to the Offtake Agreement, GM may purchase up to 100% of Thacker Pass Phase 1 production at a price based on prevailing market rates. The term of the arrangement for Phase 1 production is ten years, subject to a five-year extension at GM’s option and other limited extensions. Pursuant to the Offtake Agreement, the Company has also granted GM a right of first offer on Thacker Pass Phase 2 production. The volume available under the Offtake Agreement is subject to the receipt of the second tranche of GM’s investment and may be reduced proportionately in certain circumstances if GM’s remaining investment is less than $330 million.

SELECTED FINANCIAL INFORMATION

Quarterly Information

The following table sets out selected financial information for each of the eight most recent quarters, the latest of which ended March 31, 2024. Financial information prior to Q4 2023 has been derived from the historical carve-out financial statements of the Company and was prepared as if the Company had operated as a stand-alone entity throughout those reporting periods. The information should be read in conjunction with the Company’s audited consolidated financial statements for the FY 2023 and the Company’s unaudited interim carve-out financials statements for the relevant periods, the notes thereto and the related management discussion and analysis for the relevant periods.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in US$ millions) |

|

2024 |

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Total assets |

|

|

436.5 |

|

|

|

439.5 |

|

|

|

363.5 |

|

|

|

358.7 |

|

|

|

351.8 |

|

|

|

27.8 |

|

|

|

28.2 |

|

|

|

22.1 |

|

Property, plant and equipment |

|

|

268.3 |

|

|

|

206.1 |

|

|

|

132.0 |

|

|

|

83.4 |

|

|

|

29.4 |

|

|

|

3.9 |

|

|

|

3.8 |

|

|

|

4.1 |

|

Working capital |

|

|

131.2 |

|

|

|

181.3 |

|

|

|

154.0 |

|

|

|

197.6 |

|

|

|

216.5 |

|

|

|

(52.3 |

) |

|

|

0.8 |

|

|

|

(0.7 |

) |

Total liabilities |

|

|

30.0 |

|

|

|

32.0 |

|

|

|

69.8 |

|

|

|

71.1 |

|

|

|

99.7 |

|

|

|

62.3 |

|

|

|

50.7 |

|

|

|

52.2 |

|

Expenses |

|

|

(5.5 |

) |

|

|

(13.7 |

) |

|

|

(3.2 |

) |

|

|

(5.1 |

) |

|

|

(5.6 |

) |

|

|

(23.1 |

) |

|

|

(11.8 |

) |

|

|

(14.5 |

) |

Net income/(loss) for the period |

|

|

(6.0 |

) |

|

|

(12.9 |

) |

|

|

(0.2 |

) |

|

|

10.9 |

|

|

|

(1.7 |

) |

|

|

(23.5 |

) |

|

|

(12.1 |

) |

|

|

(19.8 |

) |

Basic income/(loss) per common |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

share |

|

|

(0.04 |

) |

|

|

(0.08 |

) |

|

|

(0.00 |

) |

|

|

0.07 |

|

|

|

(0.01 |

) |

|

|

(0.15 |

) |

|

|

(0.08 |

) |

|

|

(0.12 |

) |

Notes:

1.Quarterly amounts added together may not equal to the total reported for the period due to rounding or reclassifications.

2.Working capital is the difference between current assets and current liabilities (refer to section “Use of Non-GAAP Financial Measures and Ratios”).

Over the eight most recent quarters, changes in the Company’s total assets, working capital, liabilities and net income/(loss) were driven mainly by the Tranche 1 Investment, $75 million of cash distributed to the Company pursuant to the Arrangement, capitalization of construction costs at Thacker Pass commencing on February 1, 2023, and changes in the fair value of financial instruments.

In Q1 2024, property, plant and equipment increased due to the capitalization of Thacker Pass construction costs including engineering, earthworks and the delivery of the final Workforce Hub modules. The impact on total assets of this increase in capitalized Thacker Pass construction costs was offset by a reduction in cash and settlement of prepaids at December 31, 2023, that were capitalized as construction costs in Q1 2024.

In Q4 2023, property, plant and equipment increased due to the capitalization of Thacker Pass construction costs including engineering, earthworks and the acquisition of a portion of the Workforce Hub. The decrease in total liabilities is mainly attributable to the elimination of the $46.3 million loan when the receivable by Old LAC was contributed to the Company pursuant to the Arrangement. As a result of this contribution, this intercompany loan eliminates on consolidation at December 31, 2023.

In Q3 2023, property, plant and equipment increased due to capitalization of Thacker Pass construction costs, including engineering and earthworks.

In Q2 2023, property, plant and equipment increased due to capitalization of Thacker Pass construction costs including engineering. Total liabilities decreased primarily due to a decrease of $19.0 million in the fair value of the derivative liability embedded in the Tranche 2 Investment.

In Q1 2023, total assets and working capital increased primarily due to cash proceeds from the Tranche 1 Investment and property, plant and equipment increased due to commencement of construction of Thacker Pass and, as a result, capitalization of the related project construction costs. Total liabilities increased primarily due to the Tranche 2 Agreement derivative liability of $24.1 million and an increase of $15.0 million in accounts payable and accrued liabilities due to increased activities related to the commencement of construction on February 1, 2023.

In Q4 2022, total expenses increased due to increased engineering costs in preparation for construction. Liabilities increased as a result of the increased activity.

In Q3 2022, total assets increased primarily due to the $5.0 million investment in Ascend Elements.

RESULTS OF OPERATIONS – NET LOSS ANALYSIS

Three Months Ended March 31, 2024 Compared with Three Months Ended March 31, 2023

The following table summarizes the results of operations for the three months ended March 31, 2024 (“Q1 2024”) compared with the three months ended March 31, 2023 (“Q1 2023”):

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial results |

|

Three Months Ended March 31, |

|

|

Change |

|

(in US$ million) |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

Exploration and evaluation expenditures |

|

- |

|

|

|

3.7 |

|

|

3.7 |

|

General and administrative expenses |

|

|

4.3 |

|

|

|

1.6 |

|

|

|

(2.7 |

) |

Equity compensation |

|

|

1.2 |

|

|

|

0.2 |

|

|

|

(1.0 |

) |

Transaction costs |

|

|

0.9 |

|

|

|

4.0 |

|

|

|

3.1 |

|

Loss/(gain) on financial instruments held at fair value |

|

|

1.5 |

|

|

|

(8.2 |

) |

|

|

(9.7 |

) |

Finance costs |

|

- |

|

|

|

0.4 |

|

|

|

0.4 |

|

Finance and other income |

|

|

(1.9 |

) |

|

- |

|

|

|

1.9 |

|

NET LOSS |

|

|

6.0 |

|

|

|

1.7 |

|

|

|

(4.3 |

) |

Higher net loss of $6.0 million in Q1 2024 compared with $1.7 million in Q1 2023 is primarily attributable to:

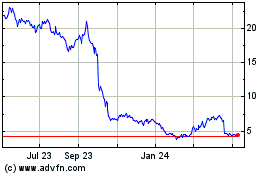

•Loss on change in fair value of the GM transaction derivative liability of $0.2 million compared with a gain of $9.0 million in Q1 2023. The derivative is attributable to the variability in thenumber of shares to be issued pursuant to the Tranche 2 Investment. The $0.2 million loss in Q1 2024 is driven by an increase in the market value of the Company’s share price and an increase in the volatility assumption from December 31, 2023 to March 31, 2024. In Q1 2023, the $9.0 million gain on change in fair value of the derivative liability reflected a decrease in the Company's share price and volatility and risk-free rate assumptions from inception on January 30, 2023 to March 31, 2023.

•An increase in general and administrative and equity compensation reflecting full general and administrative expenses of the Company as a stand-alone entity post-Separation compared with the allocation of salaries and general and administrative expenses used for Q1 2023, which was prepared on a carve-out basis.

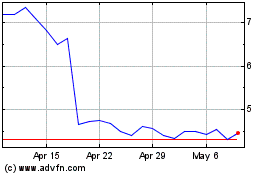

•Loss on change in fair value of investment in GT1 of $1.3 million in Q1 2024 compared with a loss of $0.8 million in Q1 2023. The loss reflects the reduction in the publicly-listed share price of GT1 at the respective period end.

The increase in net loss was partially offset by:

•A decrease in exploration expenditures due to commencement of construction of Thacker Pass and capitalization of majority of the Thacker Pass costs starting on February 1, 2023;

•Lower transaction costs in Q1 2024 of $0.9 million related to preliminary due diligence on the DOE Loan, compared with $4.0 million in Q1 2023 related to the GM Transaction.

•An increase in finance and other income of $1.9 million in Q1 2024 due to interest earned on higher cash balances after closing of the Tranche 1 Investment, compared with interest income of $nil in Q1 2023.

Expenses

Exploration and evaluation expenditures were $nil in Q1 2024 compared with $3.7 million in Q1 2023 due to the commencement of construction of Thacker Pass for accounting purposes that resulted in the capitalization of a majority of the project costs commencing on February 1, 2023.

General and administrative expenses during Q1 2024 increased to $4.3 million from $1.6 million in Q1 2023 reflecting full expenses of the Company as a stand-alone entity post-Separation compared with the allocation of salaries and general and administrative expenses used for Q1 2023.

Other Items

Transaction costs were $0.9 million during Q1 2024 reflecting costs associated with the DOE Loan application and related due diligence compared with $4.0 million in Q1 2023 reflecting transaction costs relating to the GM Transaction. The loss on change in fair value of investment in GT1 during Q1 2024 was $1.3 million compared with a loss of $0.8 million in Q1 2023. The loss on change in fair value of GM derivative liability during Q1 2024 was $0.2 million compared with a gain of

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

$9.0 million in Q1 2023. Finance and other income during Q1 2024 was $1.9 million compared with a loss of $0.4 million in Q1 2023 which is primarily due to interest earned on higher balances of cash on hand after Separation.

LIQUIDITY AND CAPITAL RESOURCES

|

|

|

|

|

|

|

|

|

Cash Flow Highlights |

|

Three Months Ended March 31, |

|

(in US$ million) |

|

2024

$ |

|

|

2023

$ |

|

Cash used in operating activities |

|

|

(1.5 |

) |

|

|

(18.4 |

) |

Cash used in investing activities |

|

|

(46.6 |

) |

|

|

(9.9 |

) |

Cash (used in)/provided by financing activities |

|

|

(0.2 |

) |

|

|

336.2 |

|

Change in cash and cash equivalents |

|

|

(48.3 |

) |

|

|

307.9 |

|

Cash and cash equivalents - beginning of the period |

|

|

195.5 |

|

|

|

0.6 |

|

Cash and cash equivalents - end of the period |

|

|

147.2 |

|

|

|

308.5 |

|

As at March 31, 2024, the Company had cash and cash equivalents of $147.2 million (March 31, 2023 - $308.5 million).

Liquidity Outlook

The Company’s working capital was $131.2 million at March 31, 2024 compared with $181.3 million at December 31, 2023. The decrease in working capital reflects the expenditure of $46.6 million on Thacker Pass construction activity in Q1 2024.

On January 30, 2023, Old LAC entered into a purchase agreement with GM pursuant to which GM agreed to make a $650 million equity investment in Old LAC, the proceeds of which are to be used for the development and construction of Thacker Pass. The Transaction is comprised of two tranches, the $320 million first tranche investment and a second tranche investment of up to $330 million. The Tranche 1 Investment closed on February 16, 2023. In conjunction with the Separation on October 3, 2023, the Tranche 2 Investment agreement between GM and Old LAC was terminated and replaced by a corresponding subscription agreement between GM and the Company.

Following a robust due diligence and term sheet negotiation process since receiving the Letter of Substantial Completion in February 2023, on March 12, 2024, the DOE provided the Company with Conditional Commitment of a DOE Loan for $2.26 billion with a 24-year maturity and interest rates fixed from the date of each monthly advance for the term of the loan at then applicable U.S. Treasury rates. The Conditional Commitment represents a significant milestone and demonstrates the DOE’s intent to finance Thacker Pass. Certain technical, legal and financial conditions, including negotiation of definitive financing documents, must be satisfied before funding of the DOE Loan.

Subsequent to March 31, 2024, on April 22, 2024, the Company completed the Offering for aggregate gross proceeds to the Company of $275 million or net proceeds of approximately $263 million after deducting underwriters' fees of $12 million.

The DOE Loan is to finance the construction of the processing facilities at Thacker Pass Phase 1 and will include interest accrued during construction, which is estimated to be $290 million over the three-year construction period. The expected funding from the DOE Loan, GM’s strategic investment, the proceeds from the Offering and cash on hand are expected to substantially fund the construction of Thacker Pass Phase 1.

The Company continues to develop Thacker Pass and does not generate revenues from operations. The Company’s capital resources are driven by the status of its projects, and its ability to compete for investor support of its projects.

Over the long-term, the Company expects to meet its obligations and fund the development of Thacker Pass through its financing plans described above; however, due to the conditions associated with such financings, there can be no assurance that the Company will successfully complete all of its contemplated financing plans. The Company has the flexibility to manage its expenditure levels in accordance with the anticipated timing of receipt of funds from expected sources of financing. Except as disclosed, the Company does not know of any trends, demands, commitments, events or uncertainties that will result in, or that are reasonably likely to result in, its liquidity and capital resources either materially increasing or decreasing at present or in the foreseeable future. The Company does not engage in currency hedging to offset any risk of currency fluctuations.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

Operating Activities

Cash used in operating activities during the three months ended March 31, 2024 was $1.5 million compared with cash used by operating activities during the three months ended March 31, 2023 of $18.4 million. The significant components of operating activities are discussed in the Results of Operations section above.

Investing Activities

Cash used in investing activities for the three months ended March 31, 2024, was $46.6 million compared with $9.9 million for the three months ended March 31, 2023. which reflects an increased level of construction activity at Thacker Pass in Q1 2024 relative to Q1 2023.

Financing Activities

Funding from the Former Parent and Proceeds from GM Transaction

In Q1 2023, prior to the Separation, the Company was funded with $320.1 million in proceeds from the Tranche 1 Investment that were advanced via a loan from Old LAC (recorded within liabilities) or capital contributions (recorded within Net former parent investment in equity). The Net former parent investment represents Old LAC’s interest in the recorded net assets and the cumulative net equity investment in LAC North America during the period prior to Separation on October 3, 2023. Subsequent to October 3, 2023, the impact of funding by parent of LAC North America eliminates on consolidation. As a result, the Net former parent investment during the three months ended March 31, 2024 was $nil (2023 – $16.4 million).

CURRENT SHARE INFORMATION

Issued and outstanding securities of the Company as at the date of this MD&A were as follows:

|

|

|

|

|

Common Shares issued and outstanding |

|

|

217,170,053 |

|

Restricted Share Units (RSUs) |

|

|

3,253,020 |

|

Deferred Share Units (DSUs) |

|

|

136,883 |

|

Performance Share Units (PSUs) |

|

|

981,098 |

|

Common shares, fully diluted |

|

|

221,541,054 |

|

All equity incentive units can be settled as common shares on a one-for-one basis, except for PSUs. The number of common shares issuable upon vesting of PSUs granted after the Separation depends on the performance of the Company’s shares over a predetermined performance periods as compared to a prescribed peer group of companies and can vary from zero to up to two times the number of PSUs granted.

Subsequent to March 31, 2024, on April 22, 2024, the Company completed the Offering of 55 million common shares. The Company has granted the underwriters an option to purchase up to 8,250,000 common shares at the Issue Price, exercisable in whole or in part, for up to 30 days after the closing of the Offering.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

RELATED PARTY TRANSACTIONS

Transition Service Agreement

Upon closing of the Arrangement, the Company entered into a Transition Services Agreement with Lithium Argentina whereby each company provides various accounting, payroll and other technical services to each other for a defined period of time.

Compensation of Directors and Key Management

The Company’s key management includes the executive management team who supervise day-to-day operations and independent directors on the Company’s Board of Directors who oversee management. Their compensation is as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

(in US$ thousands) |

|

2024 |

|

|

2023 |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

Salaries, bonuses, benefits and directors' fees included in the Consolidated Statement of Comprehensive loss |

|

|

942 |

|

|

|

568 |

|

Equity compensation |

|

|

894 |

|

|

|

294 |

|

|

|

|

1,836 |

|

|

|

862 |

|

The above numbers represent (a) an allocation of the remuneration of those directors and key management personnel for services allocated by Old LAC to LAC North America for the three months ended March 31, 2023; and (b) the actual costs incurred by the Company for directors and key management personnel of the Company for compensation earned at and incurred by the Company for the three months ended March 31, 2024.

Amounts due to directors and key management personnel as at March 31, 2024 are as follows:

|

|

|

|

|

|

|

|

|

(in US$ thousands) |

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

|

$ |

|

|

$ |

|

Total due to directors and key management |

|

|

236 |

|

|

|

2,376 |

|

CONTRACTUAL OBLIGATIONS

As at March 31, 2024, the Company had the following contractual obligations (undiscounted):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years ending December 31, |

|

(in US$ million) |

|

2024 |

|

|

2025 |

|

|

2026 |

|

|

2027 and

later |

|

|

Total |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

Accounts payable and accrued liabilities |

|

|

20,793 |

|

|

– |

|

|

– |

|

|

– |

|

|

|

20,793 |

|

Obligations under office leases¹ |

|

|

647 |

|

|

|

565 |

|

|

|

712 |

|

|

– |

|

|

|

1,924 |

|

Obligations under land leases¹ |

|

|

51 |

|

|

|

70 |

|

|

|

73 |

|

|

|

4,940 |

|

|

|

5,134 |

|

Other obligations¹ |

|

|

40 |

|

|

|

3,551 |

|

|

|

23 |

|

|

– |

|

|

|

3,614 |

|

Total |

|

|

21,531 |

|

|

|

4,186 |

|

|

|

808 |

|

|

|

4,940 |

|

|

|

31,465 |

|

¹Includes principal and interest/finance charges.

The Company’s commitments including royalties and option payments, most of which will be incurred in the future if the Company starts production from Thacker Pass, are disclosed in Notes 8, 11 and 21 of Q1 2024 financial statements.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

FINANCIAL INSTRUMENTS

Financial assets and liabilities are recognized when the Company becomes a party to the contractual provisions of the instrument. Financial assets are derecognized when the rights to receive cash flows from the assets have expired or have been transferred and the Company has transferred substantially all risks and rewards of ownership.

All of the Company’s financial instruments are classified into financial assets and liabilities measured at amortized cost, other than the shares acquired as part of the investment in GT1 and Ascend Elements, and the GM Tranche 2 derivative liability, which are carried at fair value. All financial instruments are initially measured at fair value plus, in the case of items measured at amortized cost, transaction costs that are directly attributable to the acquisition or issue of the financial asset or financial liability.

Financial assets are measured at amortized cost if they are held for the collection of contractual cash flows where those cash flows solely represent payments of principal and interest. The Company’s intent is to hold these financial assets in order to collect contractual cash flows. The contractual terms give rise to cash flows on specified dates that are solely payments of principal and interest on the principal amount outstanding.

The Company assesses on a forward-looking basis the expected credit losses associated with its financial assets carried at amortized cost. The impairment methodology applied depends on whether there has been a significant increase in credit risk.

For additional details about the Company’s financial instruments please refer to the Note 21 of the Q1 2024 financial statements.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

DECOMMISSIONING PROVISION AND RECLAMATION BOND

The carrying value of the liability for decommissioning that arose to date as a result of exploration activities at Thacker Pass as at March 31, 2024 is $1.5 million. The Company has a $1.7 million reclamation bond payable to the BLM guaranteed by a third-party insurance company. In 2021, BLM approved a reclamation cost estimate for the Thacker Pass plan of operations of $47.6 million. Financial assurance of $13.7 million for the initial work plan was placed with the agency in February 2023 prior to initiating construction with the remaining amount to be placed as construction activities progress.

ESTIMATION UNCERTAINTY AND ACCOUNTING POLICY JUDGMENTS

Please refer to the Company’s annual consolidated financial statements for the year ended December 31, 2023, for Critical Accounting Estimates and Judgments disclosure and Accounting Policies disclosure. The nature and amount of significant estimates and judgments made by management in applying the Company’s accounting policies and the key sources of estimation uncertainty as well as accounting policies applied during the three months ended March 31, 2024, were substantially the same as those that management applied in the annual financial statements as at and for the year ended December 31, 2023.

Accounting for the Agreements with General Motors

The Company’s accounting for the agreements with GM, involved judgment, specifically in the Company’s assumption that in the Company’s determination the Offtake Agreement represents an agreement with market selling prices; and that the Offtake Agreement is separate from the equity financing provided by GM.

Following termination of the warrants on July 31, 2023, the fair value of the Tranche 2 Investment subscription agreement with GM involved estimation which was determined using Monte Carlo simulation. The simulation of the fair value required significant assumptions, including expected volatility of the Company’s share price and a risk- free rate.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

Commencement of Construction of Thacker Pass

The Company determined that the technical feasibility and commercial viability of Thacker Pass had been demonstrated following the release of the Thacker Pass Feasibility Study on January 31, 2023, the receipt of the favorable ruling from the Federal Court for the issuance of the ROD, and the receipt of notice to proceed from BLM on February 7, 2023. The Company entered into an EPCM agreement and other construction-related contracts. Construction of Thacker Pass, including site preparation, geotechnical drilling, water pipeline development and associated infrastructure has commenced. Accordingly, the Company transferred the capitalized costs of Thacker Pass from exploration and evaluation assets to property, plant and equipment and began to capitalize development costs starting February 1, 2023.

Concurrent with the transfer of the Thacker Pass assets from exploration and evaluation to property, plant and equipment, management completed an impairment test of Thacker Pass which compared the carrying value to the recoverable amount. The recoverable amount is the greater of the value in use and the fair value less disposal costs. The fair value less disposal costs was calculated using a discounted cash flow model with feasibility study economics. The significant assumptions that impacted the fair value included future lithium prices, capital cost estimates, operating cost estimates, estimated mineral reserves and resources, and the discount rate. Based on the result of the impairment test, management concluded that there was no impairment.

NEW IFRS PRONOUNCEMENTS

Amendments to IAS 1 – Presentation of Financial Statements

In October 2022, the International Accounting Standards Board ("IASB") issued amendments to International Accounting Standard ("IAS") 1, Presentation of Financial Statements titled Non-current Liabilities with Covenants. These amendments sought to improve the information that an entity provides when its right to defer settlement of a liability is subject to compliance with covenants within 12 months after the reporting period. These amendments to IAS 1 override but incorporate the previous amendments, Classification of Liabilities as Current or Non-current, issued in January 2020, which clarified that liabilities are classified as either current or non-current, depending on the rights that exist at the end of the reporting period. Liabilities should be classified as non-current if a company has a substantive right to defer settlement for at least 12 months at the end of the reporting period. The amendments are effective January 1, 2024, with early adoption permitted. Retrospective application is required on adoption. These amendments did not impact Q1 2024 financial statements.

RISKS AND UNCERTAINTIES

For risks and uncertainties faced by the Company, please refer to the following disclosure documents filed on the Company’s profile on SEDAR+ at www.sedarplus.ca and EDGAR profile at www.sec.gov: annual MD&A for the year ended December 31, 2023 in the section entitled “Risks and Uncertainties;” and the Annual Information Form for the year ended December 31, 2023 in the section entitled “Risk Factors.”

TECHNICAL INFORMATION AND QUALIFIED PERSON

Detailed scientific and technical information on Thacker Pass can be found in (i) the November 2022 Feasibility Study and (ii) the Thacker Pass 1300 Report. The November 2022 Feasibility Study has an effective date of November 2, 2022 and was prepared by Daniel Roth, P.E., Laurie Tahija, QP-MMSA, Eugenio Iasillo, P.E., Kevina Martina, PE., Benson Chow, RM-SME, Walter Mutler, P.E., Kevin Bahe, P.E., Paul Kaplan, P.E., Tyler Cluff, RMSME and Bruce Shannon, P.E., each of whom is a “Qualified Person” for the purposes of NI 43-101 for the sections of the report that they are responsible for preparing and are independent of the Company. The Thacker Pass 1300 Report was prepared by M3 Engineering & Technology Corporation, EXP U.S. Services Inc., Process Engineering LLC, NewFields Mining Design & Technical Services, Wood Canada Limited, Piteau Associates, Sawtooth, a subsidiary of The North American Coal Corporation (NAC), which is a wholly-owned subsidiary of NACCO Industries, Inc. and Industrial TurnAround Corporation, each of which are independent companies and not associates or affiliates of the Company or any associated company of the Company and are “qualified persons” within the meaning of Subpart 1300 of Regulation S-K.

Copies of the Reports are available on the Company’s website at www.lithiumamericas.com and, as applicable, on the Company’s SEDAR+ profile at www.sedarplus.ca and EDGAR profile at www.sec.gov.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

The scientific and technical information in this MD&A has been reviewed and approved by Dr. Rene LeBlanc, a “Qualified Person” for purposes of NI 43-101 and Subpart 1300 of Regulation S-K by virtue of his experience, education, and professional association. Dr. LeBlanc is the Company’s Vice-President of Growth and Product Strategy.

Further information about Thacker Pass, including a description of key assumptions, parameters, description of sampling methods, data verification and QA/QC programs, and methods relating to the results of the feasibility study, the resources and reserves, and factors that may affect those estimates is available in the above-mentioned Reports.

USE OF NON-GAAP FINANCIAL MEASURES AND RATIOS

The Company’s Q1 2024 financial statements have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IFRS”) applicable to the preparation of interim financial statements, including International Accounting Standards ("IAS”) 34, Interim Financial Reporting. The Q1 2024 financial statements should be read in conjunction with the 2023 Annual Financials which have been prepared in accordance with IFRS. This MD&A refers to non-GAAP financial measures “working capital” and expected average annual “EBITDA” with respect to the results of the feasibility study for Thacker Pass, which are not measures recognized under IFRS and do not have standardized meanings prescribed by IFRS or by Generally Accepted Accounting Principles (“GAAP”) in the United States.

These non-GAAP financial measures may not be comparable to similar measures used by other issuers.

“Working capital” is the difference between current assets and current liabilities. It is a financial measure that has been derived from the Company’s financial statements and applied on a consistent basis as appropriate. The Company discloses this financial measure because it believes it assists readers in understanding the results of the Company’s operations and financial position and provides further information about the Company’s financial results to investors.

“EBITDA” is an abbreviation for earnings before interest, taxes, depreciation and amortization. The Company believes this measure provides investors with an improved ability to evaluate the prospects of the Company and, in particular, Thacker Pass. As Thacker Pass is not in production, this prospective non‐GAAP financial measure may not be reconciled to the nearest comparable measure under IFRS and the equivalent historical non-GAAP financial measure for the prospective non‐GAAP measure or ratio discussed herein is $nil.

These measures should not be considered in isolation or used in substitution for other measures of performance prepared in accordance with IFRS.

DISCLOSURE CONTROLS AND PROCEDURES

Disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed by the Company in its annual filings, interim filings or other reports filed under securities legislation is recorded, processed, summarized and reported within the time periods specified by securities regulators and include controls and procedures designed to ensure that information required to be disclosed by the Company in its annual filings, interim filings or other reports filed under securities legislation is accumulated and communicated to the issuer’s management, including its certifying officers, as appropriate to allow timely decisions regarding required disclosure. The Company’s management designed the disclosure controls and procedures to provide reasonable assurance that material information relating to the Company, including its consolidated subsidiaries, is made known to them on a timely basis. The Company’s management believes that any disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the disclosure controls and procedures are met.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The Company’s management, including the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), is responsible for establishing and maintaining adequate internal control over financial reporting. Any system of internal control over financial reporting, no matter how well-designed, has inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. There have been no significant changes in our internal controls over financial reporting during the three months ended March 31, 2024, that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

FORWARD-LOOKING STATEMENTS

This MD&A contains certain “forward-looking information” within the meaning of applicable Canadian securities legislation, and “forward-looking statements” within the meaning of applicable United States securities legislation (collectively referred to as “forward-looking information” ("FLI")). All statements, other than statements of historical fact, are FLI and can be identified by the use of statements that include, but are not limited to, words, such as "anticipate,” "plan,” "continues,” "estimate,” "expect,” "may,” "will,” "projects,” "predict,” "proposes,” "potential,” "target,” "implement,” "scheduled,” “forecast,” "intend,” “would,” "could,” "might,” "should,” "believe" and similar terminology, or statements that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved. FLI in this MD&A includes, but is not limited to: the anticipated use of net proceeds of the $275 million Offering; expectation that the Tranche 2 Investment and the Offering, together with the DOE Loan will fully fund the Thacker Pass Phase 1; the expected operations, financial results and condition of the Company; the Company’s future objectives and strategies to achieve those objectives, including the future prospects of the Company; the estimated cash flow, capitalization and adequacy thereof for the Company; the estimated costs of the development of Thacker Pass, including timing, progress, approach, continuity or change in plans, construction, commissioning, milestones, anticipated production and results thereof and expansion plans; expectations regarding accessing funding from the ATVM Loan and the Tranche 2 Investment; anticipated timing to resolve, and the expected outcome of, any complaints or claims made or that could be made concerning the permitting process in the United States for Thacker Pass; capital expenditures and programs; estimates, and any change in estimates, of the mineral resources and mineral reserves at Thacker Pass; development of mineral resources and mineral reserves; the expected benefits of the Arrangement to, and resulting treatment of, shareholders and the Company; the anticipated effects of the Arrangement; information concerning the tax treatment of the Arrangement; government regulation of mining operations and treatment under governmental and taxation regimes; the future price of commodities, including lithium; the creation of a battery supply chain in the United States to support the electric vehicle market; the realization of mineral resources and mineral reserves estimates, including whether certain mineral resources will ever be developed into mineral reserves, and information and underlying assumptions related thereto; the timing and amount of future production; currency exchange and interest rates; the Company’s ability to raise capital; expected expenditures to be made by the Company on Thacker Pass; ability to produce high purity battery grade lithium products; settlement of agreements related to the operation and sale of mineral production as well as contracts in respect of operations and inputs required in the course of production; the timing, cost, quantity, capacity and product quality of production at Thacker Pass; successful development of Thacker Pass, including successful results from the Company’s testing facility and third-party tests related thereto; capital costs, operating costs, sustaining capital requirements, after tax net present value and internal rate of return, payback period, sensitivity analyses, and net cash flows of Thacker Pass; the expected capital expenditures for the construction of Thacker Pass; anticipated job creation and workforce hub at Thacker Pass; the expectation that the PLA will minimize construction risk, ensure availability of skilled labor, address the challenges associated with Thacker Pass’ remote location and be effective in prioritizing employment of local and regional skilled craft workers, including members of underrepresented communities; the Company’s commitment to sustainable development, minimizing the environmental impact at Thacker Pass and plans for phased reclamation during the life of mine; ability to achieve capital cost efficiencies; the Tranche 2 Investment and the potential for additional financing scenarios for Thacker Pass; the expected timetable for completing the Tranche 2 Investment; the ability of the Company to complete the Tranche 2 Investment on the terms and timeline anticipated, or at all; the receipt of required stock exchange and regulatory approvals and authorizations, and the securing of sufficient available funding to complete the development of Phase 1 of Thacker Pass as required for the Tranche 2 Investment; the expected benefits of the Tranche 2 Investment; as well as other statements with respect to management’s beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2024

(Expressed in US dollars, unless stated otherwise)