- Third quarter consolidated revenues increase 32 percent to

$214.3 million with EPS of $2.28

- Irrigation revenues increase 35 percent with an increase in

operating income of 65 percent

- Infrastructure revenues increase 17 percent as road

construction activity levels improve

Lindsay Corporation (NYSE: LNN), a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology, today announced results for its third quarter of fiscal

2022, which ended on May 31, 2022.

Third Quarter Summary

Revenues for the third quarter of fiscal 2022 were $214.3

million, an increase of $52.3 million, or 32 percent, compared to

revenues of $161.9 million in the prior year third quarter. Net

earnings for the quarter were $25.1 million, or $2.28 per diluted

share, compared with net earnings of $17.8 million, or $1.60 per

diluted share, for the prior year third quarter.

“Global demand for irrigation equipment remained strong in our

third quarter, particularly in our international markets. While

inflationary pressures continue to persist, we were pleased to see

improved price realization across the business,” said Randy Wood,

President and Chief Executive Officer. “In the infrastructure

business, we are starting to see an increase in road construction

activity in the U.S., and we also began delivery of one of the Road

Zipper System projects we have been expecting in the second half of

our year.”

Third Quarter Segment Results

Irrigation segment revenues for the third quarter of fiscal 2022

were $188.7 million, an increase of $48.5 million, or 35 percent,

compared to $140.2 million in the prior year third quarter. North

America irrigation revenues of $96.2 million increased $8.8

million, or 10 percent, compared to the prior year third quarter.

The increase in North America irrigation revenues resulted

primarily from the impact of higher average selling prices, which

was partially offset by lower unit sales volume. International

irrigation revenues of $92.5 million increased $39.7 million, or 75

percent, compared to the prior year third quarter. The increase

resulted from a combination of higher average selling prices and

higher unit sales volumes in most international markets. Revenues

in Brazil more than doubled compared to the prior year third

quarter. Also contributing were favorable effects of foreign

currency translation of approximately $2.5 million compared to the

prior year third quarter.

Irrigation segment operating income for the third quarter of

fiscal 2022 was $39.6 million, an increase of $15.6 million, or 65

percent, compared to the prior year third quarter. Operating margin

was 21.0 percent of sales, compared to 17.1 percent of sales in the

prior year third quarter. The increase in operating margin resulted

from improved price realization and additional volume leverage,

which more than offset the impact of inflationary cost

increases.

Infrastructure segment revenues for the third quarter of fiscal

2022 were $25.6 million, an increase of $3.8 million, or 17

percent, compared to $21.7 million in the prior year third quarter.

The increase resulted from higher sales of road safety products and

Road Zipper System project sales, which were partially offset by

lower Road Zipper System lease revenue.

Infrastructure segment operating income for the third quarter of

fiscal 2022 was $3.8 million, which was comparable to the prior

year third quarter. Operating margin was 14.8 percent of sales,

compared to 17.3 percent of sales in the prior year third quarter.

Current year results reflect a less favorable margin mix of

revenues compared to the prior year third quarter and under

absorbed fixed overhead costs.

The backlog of unfilled orders at May 31, 2022 was $98.3 million

compared with $120.8 million at May 31, 2021. The backlog in the

prior year included an irrigation project order of $36.0 million.

Excluding the impact of this order, the irrigation backlog is

higher compared to the prior year while the infrastructure backlog

is lower.

Outlook

“Global agriculture market fundamentals remain positive;

however, grower sentiment in the U.S. is being tempered somewhat by

inflationary pressures they are experiencing with their input costs

and operational expenses. We continue to see increased activity

levels in international project markets as concerns over food

security and global grain supplies have been heightened by the

ongoing conflict between Russia and Ukraine,” said Mr. Wood. “In

the infrastructure business, we expect to complete delivery of the

Road Zipper System project that began in the third quarter, and we

also expect to begin delivery of another significant project in the

fourth quarter. We remain optimistic regarding growth opportunities

for this business based on the quality of our sales funnel and

increasing commercial activity.”

Third Quarter Conference Call

Lindsay’s fiscal 2022 third quarter investor conference call is

scheduled for 11:00 a.m. Eastern Time today. Interested investors

may participate in the call by dialing (833) 535-2202 in the U.S.,

or (412) 902-6745 internationally, and requesting the Lindsay

Corporation call. Additionally, the conference call will be

simulcast live on the Internet and can be accessed via the investor

relations section of the Company's Web site, www.lindsay.com.

Replays of the conference call will remain on our Web site through

the next quarterly earnings release. The Company will have a slide

presentation available to augment management's formal presentation,

which will also be accessible via the Company's Web site.

About the Company

Lindsay Corporation (NYSE: LNN) is a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology. Established in 1955, the company has been at the

forefront of research and development of innovative solutions to

meet the food, fuel, fiber and transportation needs of the world’s

rapidly growing population. The Lindsay family of irrigation brands

includes Zimmatic® center pivot and lateral move agricultural

irrigation systems, FieldNET® remote irrigation management and

scheduling technology, and industrial IoT solutions. Also a global

leader in the transportation industry, Lindsay Transportation

Solutions manufactures equipment to improve road safety and keep

traffic moving on the world’s roads, bridges and tunnels, through

the Barrier Systems®, Road Zipper® and Snoline™ brands. For more

information about Lindsay Corporation, visit www.lindsay.com.

Concerning Forward-looking Statements

This release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management’s

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. You

can find a discussion of many of these risks and uncertainties in

the annual, quarterly and current reports that the Company files

with the Securities and Exchange Commission. Forward-looking

statements include information concerning possible or assumed

future results of operations and planned financing of the Company

and those statements preceded by, followed by or including the

words “anticipate,” “estimate,” “believe,” “intend,” "expect,"

"outlook," "could," "may," "should," “will,” or similar

expressions. For these statements, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The Company undertakes no obligation to update any forward-looking

information contained in this press release.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(Unaudited)

Three months ended

Nine months ended

(in thousands, except per share

amounts)

May 31, 2022

May 31, 2021

May 31, 2022

May 31, 2021

Operating revenues

$

214,259

$

161,936

$

580,547

$

413,998

Cost of operating revenues

152,579

117,880

438,486

297,360

Gross profit

61,680

44,056

142,061

116,638

Operating expenses:

Selling expense

8,148

7,570

24,070

22,680

General and administrative expense

14,647

12,043

40,548

39,770

Engineering and research expense

3,723

3,102

10,582

9,504

Total operating expenses

26,518

22,715

75,200

71,954

Operating income

35,162

21,341

66,861

44,684

Other income (expense):

Interest expense

(1,006

)

(1,178

)

(3,345

)

(3,584

)

Interest income

118

227

456

798

Other income, net

1,282

764

264

699

Total other income (expense)

394

(187

)

(2,625

)

(2,087

)

Earnings before income taxes

35,556

21,154

64,236

42,597

Income tax expense

10,483

3,357

16,696

5,829

Net earnings

$

25,073

$

17,797

$

47,540

$

36,768

Earnings per share:

Basic

$

2.28

$

1.63

$

4.34

$

3.38

Diluted

$

2.28

$

1.61

$

4.31

$

3.35

Shares used in computing earnings per

share:

Basic

10,978

10,907

10,960

10,879

Diluted

11,021

11,033

11,020

10,967

Cash dividends declared per share

$

0.33

$

0.33

$

0.99

$

0.97

LINDSAY CORPORATION AND

SUBSIDIARIES

SUMMARY OPERATING

RESULTS

(Unaudited)

Three months ended

Nine months ended

(in thousands)

May 31, 2022

May 31, 2021

May 31, 2022

May 31, 2021

Operating revenues:

Irrigation:

North America

$

96,153

$

87,364

$

275,601

$

220,332

International

92,540

52,811

239,759

125,772

Irrigation segment

188,693

140,175

515,360

346,104

Infrastructure segment

25,566

21,761

65,187

67,894

Total operating revenues

$

214,259

$

161,936

$

580,547

$

413,998

Operating income:

Irrigation segment

$

39,567

$

23,925

$

81,513

$

52,603

Infrastructure segment

3,779

3,767

6,869

14,364

Corporate

(8,184

)

(6,351

)

(21,521

)

(22,283

)

Total operating income

$

35,162

$

21,341

$

66,861

$

44,684

The Company manages its business activities in two reportable

segments as follows:

Irrigation - This reporting segment includes the manufacture and

marketing of center pivot, lateral move, and hose reel irrigation

systems, as well as various innovative technology solutions such as

GPS positioning and guidance, variable rate irrigation, remote

irrigation management and scheduling technology, irrigation

consulting and design and industrial IoT solutions.

Infrastructure – This reporting segment includes the manufacture

and marketing of moveable barriers, specialty barriers, crash

cushions and end terminals, and road marking and road safety

equipment.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

May 31, 2022

May 31, 2021

August 31, 2021

ASSETS

Current assets:

Cash and cash equivalents

$

81,757

$

120,801

$

127,107

Marketable securities

13,930

19,663

19,604

Receivables, net

155,518

107,713

93,609

Inventories, net

195,566

136,601

145,244

Other current assets, net

28,663

32,947

30,539

Total current assets

475,434

417,725

416,103

Property, plant, and equipment, net

94,441

92,517

91,997

Intangibles, net

18,769

21,893

20,367

Goodwill

67,476

68,134

67,968

Operating lease right-of-use assets

20,263

19,360

18,281

Deferred income tax assets

7,857

10,247

8,113

Other noncurrent assets, net

27,676

12,341

14,356

Total assets

$

711,916

$

642,217

$

637,185

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

72,350

$

49,351

$

45,209

Current portion of long-term debt

221

216

217

Other current liabilities

101,243

94,589

92,814

Total current liabilities

173,814

144,156

138,240

Pension benefits liabilities

5,474

6,086

5,754

Long-term debt

115,384

115,557

115,514

Operating lease liabilities

20,688

19,369

18,301

Deferred income tax liabilities

730

881

832

Other noncurrent liabilities

15,056

19,995

20,099

Total liabilities

331,146

306,044

298,740

Shareholders' equity:

Preferred stock

—

—

—

Common stock

19,063

18,991

18,991

Capital in excess of stated value

92,516

85,257

86,495

Retained earnings

564,805

525,926

528,130

Less treasury stock - at cost

(277,238

)

(277,238

)

(277,238

)

Accumulated other comprehensive loss,

net

(18,376

)

(16,763

)

(17,933

)

Total shareholders' equity

380,770

336,173

338,445

Total liabilities and shareholders'

equity

$

711,916

$

642,217

$

637,185

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Nine months ended

(in thousands)

May 31, 2022

May 31, 2021

CASH FLOWS FROM OPERATING ACTIVITIES:

Net earnings

$

47,540

$

36,768

Adjustments to reconcile net earnings to

net cash (used in) provided by operating activities:

Depreciation and amortization

14,930

14,688

Provision for uncollectible accounts

receivable

734

304

Deferred income taxes

514

205

Share-based compensation expense

4,061

5,021

Unrealized foreign currency transaction

gain

(754

)

(1,934

)

Other, net

645

(2,123

)

Changes in assets and liabilities:

Receivables

(63,365

)

(22,934

)

Inventories

(49,209

)

(28,612

)

Other current assets

1,669

(14,025

)

Accounts payable

26,319

20,828

Other current liabilities

822

20,149

Other noncurrent assets and

liabilities

(8,840

)

2,325

Net cash (used in) provided by operating

activities

(24,934

)

30,660

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property, plant, and

equipment

(12,222

)

(22,532

)

Purchases of marketable securities

(18,468

)

(13,067

)

Proceeds from maturities of marketable

securities

23,592

12,592

Other investing activities, net

(2,952

)

(1,960

)

Net cash used in investing activities

(10,050

)

(24,967

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from exercise of stock

options

2,894

3,892

Common stock withheld for payroll tax

obligations

(1,181

)

(1,269

)

Proceeds from employee stock purchase

plan

319

—

Principal payments on long-term debt

(163

)

(141

)

Dividends paid

(10,865

)

(10,566

)

Net cash used in financing activities

(8,996

)

(8,084

)

Effect of exchange rate changes on cash

and cash equivalents

(1,370

)

1,789

Net change in cash and cash

equivalents

(45,350

)

(602

)

Cash and cash equivalents, beginning of

period

127,107

121,403

Cash and cash equivalents, end of

period

$

81,757

$

120,801

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220630005269/en/

LINDSAY CORPORATION: Brian Ketcham Senior Vice President

& Chief Financial Officer 402-827-6579

THREE PART ADVISORS: Jeff Elliott 972-423-7070 Gary

Guyton 214-442-0016

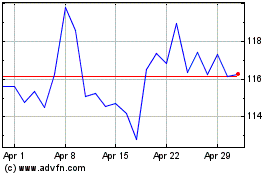

Lindsay (NYSE:LNN)

Historical Stock Chart

From Jun 2024 to Jul 2024

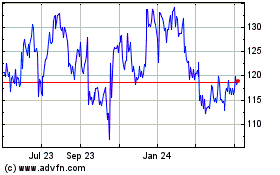

Lindsay (NYSE:LNN)

Historical Stock Chart

From Jul 2023 to Jul 2024