UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May 2024

Commission

File Number: 001-41737

Lifezone

Metals Limited

Commerce

House, 1 Bowring Road

Ramsey,

Isle of Man, IM8 2LQ

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40- F ☐

On

May 24, 2024, Lifezone Metals Limited distributed the materials towards the Annual General Meeting of shareholders to be held of June

21, 2024.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

LIFEZONE METALS LIMITED |

| |

|

|

| Date: May 24, 2024 |

By: |

/s/ Chris Showalter |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Lifezone Metals Limited

2024 Notice of Annual General Meeting

and Proxy Statement

2024 NOTICE OF

ANNUAL GENERAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

LETTER FROM OUR CHAIRMAN

Commerce House

1 Bowring Road,

Ramsey

IM8 2LQ

Isle of Man

May 23, 2024

Dear Shareholder,

I am pleased to be writing to you with details of the Annual General

Meeting of Lifezone Metals Limited (the “Company”), which will be held at The Claremont, 18-22 Loch Promenade, Douglas,

Isle of Man, IM1 2LX and virtually, on June 21, 2024 at 13:00 BST / 08:00 EDT (the “AGM”).

Along with this letter, this circular contains:

| - | the formal Notice of AGM and notes to the Notice of AGM (the

“Notice”) detailing the resolutions to be proposed at the AGM; |

| - | explanatory notes to the resolutions; and |

| - | further information in respect of the Notice and the AGM. |

A copy of the Notice and our Annual Report and Accounts for the year

to December 31, 2023 are also available on the Lifezone Metals website at https://ir.lifezonemetals.com/governance/Annual-General-Meeting/.

Attendance

Shareholders may attend virtually via the electronic platform https://www.cstproxy.com/lifezonemetals/2024.

There is also the option to attend in person at The Claremont, 18 –

22 Loch Promenade, Douglas, Isle of Man, IM1 2LX.

Voting

If you would like to vote on the resolutions, please fill in the enclosed

form of proxy appointing the Chair of the Meeting as your proxy with your voting instructions and return it as indicated on the proxy

form.

Alternatively, you can register your proxy to vote electronically by

logging on to www.cstproxyvote.com as shown on your proxy form. The registrars must receive your proxy appointment by June 19, 2024, at

13:00 BST / 08:00 EDT at the latest.

Recommendation

The Directors of the Company consider that all the proposals to be

considered at the AGM are in the best interests of the Company and its members as a whole.

The Board recommends that you vote in favour of each of the resolutions

being put to the AGM in the same way as the Directors intend to do in respect of their own beneficial shareholdings (other than in respect

of those matters in which they are interested) which amount to 29,828,041 shares representing 37.3% of the existing issued ordinary shares.

Yours faithfully,

Keith Liddell

Chairman

Lifezone Metals Limited

NOTICE OF ANNUAL GENERAL MEETING

Notice is hereby given that the Annual General Meeting (the “AGM”)

of Lifezone Metals Limited (the “Company”) will be held at The Claremont, 18 – 22 Loch Promenade, Douglas, Isle of Man,

IM1 2LX with simultaneous attendance by electronic means on June 21, 2024 at 13:00 BST / 08:00 EDT to consider and, if thought fit, pass

the resolutions as set out below:

Ordinary Resolutions

| 1. | To receive the Company’s accounts for the financial

year ended December 31, 2023; |

| 2. | To ratify the appointment of the auditor; |

| 3. | To re-elect John Dowd as a Class I Director of the Company; |

| 4. | To re-elect Govind Friedland as a Class I Director of the

Company; and |

| 5. | To re-elect Ambassador Mwanaidi Maajar as a Class I Director

of the Company. |

By order of the Board

Keith Liddell

Chairman

May 23, 2024

Registered office:

Commerce House

1 Bowring Road,

Ramsey

IM8 2LQ

Isle of Man

NOTES ON NOTICE OF ANNUAL GENERAL MEETING

Record Date

The record date for determining entitlement to

receive notice of the meeting is close of trading on May 14, 2024. Only those holders of ordinary shares registered in the register of

members of the Company as at close of trading on May 14, 2024, or in the event that the AGM is adjourned, not more than 48 hours before

the time of the adjourned meeting, shall be entitled to receive notice of the meeting, or any adjourned meeting, in respect of the number

of shares registered in their names at that time.

The record date for attendance and voting at the

meeting is close of trading on June 19, 2024. Only those holders of ordinary shares registered in the register of members of the Company

as at close of trading on June 19, 2024, or in the event that the AGM is adjourned, not more than 48 hours before the time of the adjourned

meeting, shall be entitled to vote at the AGM, or any adjourned meeting, in respect of the number of shares registered in their names

at that time.

Shareholders of Record; Beneficial Owners

Most holders of the Company’s ordinary shares

hold their shares beneficially through a broker, bank or other nominee rather than of record directly in their own name. As summarized

below, there are some differences in the way to vote shares held of record and those owned beneficially.

If your shares are registered directly in your

name with the transfer agent, you are considered a shareholder of record of those shares. As a shareholder of record, you have the right

to grant a voting proxy directly to the persons named as proxy holders or to vote in person at The Claremont, 18 – 22 Loch Promenade,

Douglas, Isle of Man, IM1 2LX.

If your shares are held in a brokerage account

or by a bank or other nominee, you are considered the beneficial owner of the shares held in “street name,” and the broker

or nominee is considered the shareholder of record of those shares. As the beneficial owner, you generally have the right to direct the

broker on how to vote and are also invited to attend the AGM. However, since you are not the shareholder of record, you may not vote those

shares in person at the AGM unless you have a proxy, executed in your favour, from the holder of record of the shares. The applicable

broker or nominee will provide a voting instruction card to use in directing the broker or nominee as to how to vote the shares.

Accessing Information regarding the AGM

Information regarding the AGM, including a copy

of the Annual Report and Accounts for the year to December 31, 2023, is available from the Company’s website at https://ir.lifezonemetals.com/governance/Annual-General-Meeting/.

Attendance at AGM

If you are a member of the Company at the time

set out under the heading “Record Date,” you are entitled to attend and vote and entitled to appoint one or

more proxies to attend, speak, and vote and, on a poll, vote instead of you. A proxy need not also be a member of the Company.

Voting Procedures

If you are a shareholder of record, you may vote

in person at the AGM or submit your proxy form over the internet or by mail by following the instructions provided herein. A form of proxy

is enclosed in this Notice of Annual General Meeting for use in connection with the business set out above. To be valid, forms of proxy

and any power of attorney or other authority under which they are signed, or a copy of such authority certified by a notary or in some

other way approved by the Board, must be received no later than 48 hours before the meeting. As an alternative to completing and returning

the printed form of proxy, you may submit your proxy electronically by accessing www.cstproxyvote.com. You may appoint more than one proxy

provided that each proxy is appointed to exercise the rights attached to a different share or shares that you hold. When two or more valid

but differing appointments of proxy are delivered in respect of the same share for use at the same meeting and in respect of the same

matter, the one which is last validly delivered shall be treated as replacing and revoking the other or others as regards that share.

If the Company is unable to determine which appointment was last validly delivered, none of them shall be treated as valid in respect

of that share. The appointment of a proxy will not prevent you from attending, speaking and/or voting in person. In the event that and

to the extent that you personally vote your shares, your proxy shall not be entitled to vote and any vote cast by a proxy in such circumstances

shall be ignored.

If you hold your shares beneficially in “street

name” through a broker or other nominee, you must follow the instructions provided by your broker or nominee to vote your shares.

Joint Holders

In the case of joint holders of record the vote

of the senior holder who tenders a vote, whether in person or by proxy, shall be accepted to the exclusion of the votes of the other joint

holders. For this purpose, seniority shall be determined by the order in which the names of the holders stand in the Company’s register

of members.

In the case of joint holders who hold in “street

name”, in order to vote, all the joint holders must sign and return a proxy or voting instructions pursuant to their brokers’ instructions.

Corporate Holders

A corporation which is a member may by resolution

of its directors or other governing body authorise one or more persons to act as its representative who may exercise, on its behalf, all

its powers as a member, provided that they do not do so in relation to the same shares.

Shares Eligible to Vote; Quorum

As at close of trading on May 14, 2024 (being

the latest practicable date prior to the publication of this Notice of Annual General Meeting), the Company’s issued share capital

comprised of 80,000,354 ordinary shares. Each ordinary share carries the right to one vote at a general meeting of the Company and, therefore

the total number of voting rights in the Company as at close of trading on May 14, 2024 is 80,000,354. The website referred to under the

heading “Accessing Information regarding the AGM” will include information on the number of shares and voting

rights.

For purposes of the meeting, one or more shareholders

entitled to attend and to vote on the business to be transacted at the meeting and holding more than 50% of our ordinary shares will constitute

a quorum,

As soon as practicable following the AGM the results

of voting at the AGM and the numbers of proxy votes cast for, against or withheld in respect of each resolution will be announced via

Form 6-K furnished to the U.S. Securities and Exchange Commission (the “SEC”) and also placed on the Company’s website

referred to under the heading “Accessing Information regarding the AGM”.

Except as provided above, shareholders who have

general questions about the AGM should email info@lifezonemetals.com (no other methods of communication will be accepted). You may not

use any electronic address provided either:

| - | In this Notice of Annual General Meeting; or |

| - | Any related documents (including the Chairman’s letter

and proxy form), to communicate with the Company for any purpose other than those expressly stated. |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD PRACTICES

Corporate Governance Principles

Foreign private issuers, such as Lifezone Metals,

must briefly highlight any significant ways in which their corporate governance practices differ from those followed by U.S. domestic

companies subject to the listing standards of the New York Stock Exchange (the “NYSE”). We intend to follow the rules generally

applicable to U.S. domestic companies listed on the NYSE, subject to certain exceptions. In particular, a majority of our board of directors

is considered “independent” as defined under NYSE listing rules.

Lifezone Metals is considered a “foreign

private issuer” under the securities laws of the U.S. and the rules of the NYSE. Under the applicable securities laws of the U.S.,

“foreign private issuers” are subject to different disclosure requirements than U.S. domiciled issuers. As a foreign private

issuer, Lifezone Metals is not subject to the SEC’s proxy rules. NYSE listing rules include certain accommodations in the corporate

governance requirements that allow foreign private issuers, such as us, to follow “home country” corporate governance practices

in lieu of the otherwise applicable corporate governance standards of NYSE. Accordingly, Lifezone Metals’ shareholders may not receive

the same protections afforded to shareholders of companies that are subject to all of the NYSE’s corporate governance requirements.

Certain corporate governance practices in the

Isle of Man, Lifezone Metals’ home country, may differ significantly from NYSE corporate governance listing standards. For instance,

Lifezone Metals may choose to follow home country practice in lieu of NYSE corporate governance listing standards such as:

| ● | having a majority of the board

be independent (although all of the members of the audit committee must be independent under the U.S. Securities Exchange Act of 1934

as amended (the “Exchange Act”)); |

| ● | having a compensation committee

and a nominating or corporate governance committee consisting entirely of independent directors; |

| ● | having annual meetings and

director elections; and |

| ● | obtaining shareholder approval

prior to certain issuances (or potential issuances of securities). |

Lifezone Metals intends to follow home country

practice and be exempt from requirements to obtain shareholder approval for the issuance of 20% or more of its outstanding shares under

NYSE listing rule 312.03(c).

Lifezone Metals has formed board committees beyond

those required under Isle of Man law. In addition to maintaining an audit committee consisting of at least three independent directors

under NYSE listing rules, we established the following board committees: (1) a compensation committee; (2) a nominating and corporate

governance committee; (3) an investment committee; (4) a disclosure committee; and (5) a sustainability committee. For more information,

see “Board Practices - Board Committees.”

Lifezone Metals intends to take all actions necessary

for it to maintain compliance as a foreign private issuer under the applicable corporate governance requirements of the Sarbanes-Oxley

Act of 2002, the rules adopted by the SEC and the NYSE corporate governance rules and listing standards.

Because Lifezone Metals is a foreign private issuer,

its directors and senior management are not subject to short-swing profit and insider trading reporting obligations under Section 16 of

the Exchange Act. They will, however, be subject to the obligation to report changes in share ownership under Section 13 of the Exchange

Act and related SEC rules.

In addition, we have policies and systems in place

to promote ethical conduct and mitigate against a variety of risks, including ethics, conduct, modern slavery, anti-bribery and corruption,

human rights, environmental, health and safety, insider trading and disclosure, trade compliance and sanctions, data protection and whistle-blowing.

Board Practices

Board Composition

The Lifezone Metals board is composed of eight

directors and is divided into three classes. At each annual general meeting, each of the Directors of the relevant class, the term of

which shall then expire, shall be eligible for re-election to the board for a period of three years.

The Company has examined its governance obligations

as a public company, as well as the rules and regulations of the SEC and NYSE. The Company has also considered carefully the standards

that apply to it as a foreign private issuer and the fact that it is a relatively young company. In addition to this, we consulted with

our shareholders in 2023, and following these discussions we consider that amending the Company’s Amended and Restated Memorandum

and Articles of Association to vote on annual election of directors is not a priority item for the Company at this time. The board of

directors intends to keep this item under review and also if the Company is notified of any specific shareholder feedback.

Robert Edwards (Lead Independent Director) was

previously Executive Chairman of Bluejay Mining plc, a London listed junior mining company, as well as holding two other independent director

roles. In order to negate any perception of overboarding, Robert Edwards stepped down from his position as Executive Chairman of Bluejay

Ming plc in December 2023.

Lifezone Metals’ directors are divided among

the three classes as follows:

| ● | the Class I directors

include John Dowd, Govind Friedland and Mwanaidi Maajar and their terms will expire at this AGM; |

| ● | the Class II

directors include Robert Edwards, Jennifer Houghton and Beatriz Orrantia and their terms will expire at the 2025 AGM; and |

| ● | the Class III

directors include Keith Liddell and Chris Showalter and their terms will expire at the 2026 AGM. |

Director Independence

The Lifezone Metals board has determined that

each member of the Lifezone Metals board qualifies as independent, as defined under the listing rules of NYSE, other than Mr. Liddell

and Mr. Showalter. In addition, Robert Edwards was appointed as Lead Independent Director in February 2024.

Board Oversight of Risk

One of the key functions of the Lifezone Metals

board is informed oversight of the Company’s risk management process. The Lifezone Metals board has appointed the audit committee

to assist in the oversight of Lifezone’s financial risk exposures and risk management and the compliance by the Company with applicable

legal and regulatory requirements. The audit committee, among other things, also reviews and approves all related party transactions,

oversees the risk management framework and satisfy itself that the framework is sound. It establishes and communicates the Company’s

risk appetite, endorses the risk policy and standards of Lifezone and is regularly briefed on and considers cyber security threats.

The CEO of Lifezone is accountable for assigning

appropriate responsibilities for implementing and embedding risk management into the decision-making process across the Company, while

the COO of Lifezone is overall responsible for the roll-out of this risk management policy and processes. Both attend audit committee

meetings and the COO is tasked to ensure that adequate processes and procedures are in place to enable Lifezone Metals to operate with

an appropriate balance of risks and controls. The COO has oversight that the Company maintains up to date risk registers and provides

a report at least quarterly to the audit committee. The CFO is responsible for the oversight of all internal controls and risk related

to financial processes and financial reporting.

In addition, the Lifezone Metals board as a whole,

as well as through the various standing committees of the Lifezone Metals board, addresses risks inherent in their respective areas of

oversight. For example, the audit committee is responsible for overseeing the management of risks associated with the Company’s

financial reporting, accounting and auditing matters, and the Company’s compensation committee oversees the management of risks

associated with Lifezone Metals’ compensation policies and programs.

Board Committees

The Lifezone Metals board has established an audit

committee, a compensation committee, a nominating and corporate governance committee, a disclosure committee, an investment committee,

and a sustainability committee.

The Lifezone Metals board may establish other

committees to facilitate the management of the Company’s business.

The Lifezone Metals board and its committees hold

scheduled meetings throughout the year and can also hold special meetings and act by written consent from time to time, as appropriate.

The Lifezone Metals board has delegated various responsibilities and authority to its committees as generally described below. The committees

will regularly report on their activities and actions to the full Lifezone Metals board.

Each committee of the Lifezone Metals board has

a written charter approved by the Lifezone Metals board. Copies of each charter are posted on the Company’s website at www.lifezonemetals.com.

The inclusion of the Company’s website address in this proxy statement does not include or incorporate by reference the information

on Lifezone Metals’ website into this proxy statement, and you should not consider information contained on the Company’s

website to be part of this proxy statement. Members will serve on these committees until their resignation or until otherwise determined

by the Lifezone Metals board.

Audit Committee: Chair, Jennifer Houghton

The members of Lifezone Metals’ audit committee

are Jennifer Houghton, Robert Edwards, and Mwanaidi Maajar, each of whom is financially literate.

Ms. Houghton qualifies as an audit committee financial

expert within the meaning of SEC regulations and meets the accounting or related financial management expertise requirements of the NYSE.

Each of Mr. Edwards, Ms. Houghton and Ms. Maajar are independent under the rules and regulations of the SEC and the listing rules of the

NYSE applicable to audit committee members.

Lifezone Metals’ audit committee assists

the Lifezone Metals board with its oversight of, among other things, the following: the financial statements of Lifezone Metals, including

such financial statements’ integrity; Lifezone Metals’ compliance with legal and regulatory requirements; the qualifications,

independence, appointment and performance of Lifezone Metals’ independent registered public accounting firm; and the design and

implementation of Lifezone Metals’ internal audit function and risk assessment and risk management, including oversight of cyber

security threats. The audit committee also discusses with Lifezone Metals’ management and independent registered public accounting

firm the annual audit plan and scope of audit activities, scope and timing of the annual audit of Lifezone Metals’ financial statements,

and the results of the audit, quarterly reviews of Lifezone Metals’ financial statements and, as appropriate, initiates inquiries

into certain aspects of Lifezone Metals’ financial affairs.

Lifezone Metals’ audit committee is responsible

for establishing, maintaining and overseeing the processes and procedures for the receipt, retention and treatment of any complaints regarding

accounting, internal accounting controls or auditing matters, as well as for the confidential and anonymous submissions by Lifezone Metals’

employees of concerns regarding questionable accounting or auditing matters. In addition, Lifezone Metals’ audit committee has direct

responsibility for the appointment, compensation, retention and oversight of the work of Lifezone Metals’ independent registered

public accounting firm. Lifezone Metals’ audit committee has sole authority to approve the hiring and discharging of Lifezone Metals’

independent registered public accounting firm, all audit engagement terms and fees and all permissible non-audit engagements with the

independent auditor. Lifezone Metals’ audit committee reviews and oversees all related person transactions in accordance with Lifezone

Metals’ policies and procedures.

Compensation Committee: Chair, John Dowd

The members of Lifezone Metals’ compensation

committee are John Dowd, Robert Edwards and Keith Liddell.

Lifezone Metals’ compensation committee

assists the Lifezone Metals board in discharging certain of Lifezone Metals’ responsibilities with respect to compensating its directors

and executive officers, and the administration and review of its incentive and equity-based compensation plans, including its equity incentive

plans, and certain other matters related to Lifezone Metals’ compensation programs.

Nominating and Corporate Governance Committee:

Chair, Jennifer Houghton

The members of Lifezone Metals’ nominating

and corporate governance committee are Jennifer Houghton, Beatriz Orrantia, and Govind Friedland.

Lifezone Metals’ nominating and corporate

governance committee assists the Lifezone Metals board with its oversight of, among other things, the size, composition and structure

of the Lifezone Metals board, identification, recommendation, recruitment and retention of high-quality board members, and annual self-evaluation

of the board and management.

The nominating and corporate governance committee

also develops and makes recommendations to the Lifezone Metals board regarding a set of corporate governance guidelines.

Investment Committee: Chair, Keith Liddell

The members of Lifezone Metals’ investment

and finance committee are Keith Liddell, John Dowd, and Robert Edwards.

Lifezone Metals’ investment committee assists

the Lifezone Metals board in oversight of, among other things, long term stewardship of the investments and assets of Lifezone Metals

in order to best further the aims of Lifezone Metals, and the implementation, returns and review of Lifezone Metals’ investment

strategy to deliver and maintain the returns and value of Lifezone Metals’ investment portfolio over the long term; as well as how

best to generate a consistent and sustainable return to fund Lifezone Metals’ annual expenditure, and the best means to deliver

the investment objectives within an acceptable level of risk.

The investment committee works with and, if necessary,

advises the other committees of the Lifezone Metals board on those specific areas that primarily come within the mandate of the other

committees but also are part of Lifezone Metals’ policies, goals, initiatives, programs and strategies overseen by the investment

and finance committee.

Sustainability Committee: Chair, Beatriz

Orrantia

The members of Lifezone Metals’ sustainability

committee are Beatriz Orrantia, Govind Friedland, and Mwanaidi Maajar.

Lifezone Metals’ sustainability committee

assists the Lifezone Metals board in oversight of, among other things, the development, implementation and monitoring of the Lifezone

Metals policies, goals, initiatives and programs related to environment, social, health, safety, and sustainability matters; the systems

and processes designed to manage and mitigate social, environmental, health, safety, and sustainability-related risks, opportunities,

commitments and compliance; the policies, goals, initiatives and programs relating to community relationships and impacts with respect

to social, environmental, health, safety and sustainability matters; public policy and advocacy strategies with respect to social, environmental,

health, safety and sustainability matters; strategies relating to the protection or enhancement of the Lifezone Metals’ reputation

with respect to corporate social responsibility and social, environmental, health, safety and sustainability matters; and the consideration

of any potential environmental benefits of projects or initiatives.

The sustainability committee works with and, if

necessary, advises the other committees of Lifezone Metals board on those specific areas that primarily come within the mandate of the

other committees but also are part of the Lifezone Metals’ policies, goals, initiatives, programs, risks, opportunities and strategies

overseen by the sustainability committee.

Disclosure Committee: Chair, Chris Showalter

The members of Lifezone Metals’ disclosure

committee are Chris Showalter, Ingo Hofmaier and Spencer Davis.

Lifezone Metals’ disclosure committee assists

the Lifezone Metals board in discharging certain of Lifezone Metals’ responsibilities with respect to disclosures made to shareholders,

the general public and/or the investment community, including the accuracy, completeness and timeliness of disclosure statements and meeting

applicable legal, regulatory and NYSE listing standards.

Conflicts of Interest

Under Isle of Man law, the directors owe fiduciary

duties at both common law and under statute, including a duty to act honestly, and in good faith with a view to the best interests of

Lifezone Metals. In exercising the powers of a director, the directors must exercise their powers for a proper purpose and shall not act

or agree to the company acting in a manner that contravenes the Amended and Restated Memorandum and Articles of Association of Lifezone

Metals of the Companies Act 2006 of the Isle of Man (“IOM Companies Act”).

In addition to the above, directors also owe a

duty of care which is not fiduciary in nature. This duty has been defined as a requirement to act as a reasonably diligent person having

both the general knowledge, skill and experience that may reasonably be expected of a person carrying out the same functions as are carried

out by that director in relation to the company and the general knowledge skill and experience which that director has.

Isle of Man law does not regulate transactions

between a company and its significant members; however it does provide that such transactions must be entered into in good faith in the

best interests of the company and not with the effect of constituting a fraud on the minority members.

Directors have a duty not to put themselves in

a position of conflict and this includes a duty not to engage in self-dealing, or to otherwise benefit as a result of their position.

This duty is subject to the IOM Companies Act and the Amended and Restated Memorandum and Articles of Association of Lifezone Metals which

provide, in summary, that subject to a director having duly declared his or her interests to the board that director may be party to a

transaction with the Company and may vote and count in quorum at a board meeting in respect of a matter in which such director is interested.

Accordingly, as a result of multiple business

affiliations, the directors of Lifezone Metals may have similar legal obligations relating to presenting business opportunities to multiple

entities. In addition, conflicts of interest may arise when the board of Lifezone Metals evaluates a particular business opportunity.

Lifezone Metals cannot assure you that any of

the above-mentioned conflicts will be resolved in its favor. Furthermore, each of the directors of Lifezone Metals may have pre-existing

fiduciary obligations to other businesses of which they are officers or directors.

Limitation on Liability and Indemnification of Officers and Directors

The IOM Companies Act provides that, subject to

contrary provision in its articles, a company may indemnify against all expenses, including legal fees, and against all judgments, fines

and amounts paid in settlement and reasonably incurred in connection with legal, administrative or investigative proceedings any person

who: (a) is or was a party or is threatened to be made a party to any threatened, pending or completed proceedings, whether civil, criminal,

administrative or investigative, by reason of the fact that the person is or was a director of the company; or (b) is or was, at the request

of the company, serving as a director of, or in any other capacity is or was acting for, another body corporate or a partnership, joint

venture, trust or other enterprise. The IOM Companies Act provides that this does not apply to a person referred to above unless such

person acted honestly and in good faith and in what such person believed to be in the best interests of the company and, in the case of

criminal proceedings, had no reasonable cause to believe that the conduct of such person was unlawful.

RESOLUTIONS TO BE VOTED ON

Resolution 1 - To receive the Company’s

accounts for the financial year ended December 31, 2023

The Chair will present to the AGM the accounts

for the financial year ended December 31, 2023.

Resolution 2 - Ratification of the appointment

of the auditor

Resolution 2 proposes the ratification of the

re-appointment by the board of directors of Grant Thornton as the Company’s auditor.

Resolutions 3 to 5 - Re-election of Directors

of the Company

For additional information regarding election

of directors and committees, see Corporate Governance Principles and Board Practices.

The articles of association of the Company provide

that the Board shall be divided into three classes, designated Class I Directors, Class II Directors and Class III Directors. Class I

Directors shall initially hold office until the Company’s first annual general meeting, (i.e., this meeting). At each annual general

meeting, each of the Directors of the relevant class the term of which shall then expire shall be eligible for re-election to the Board

for a period of three years.

The Board considers that the performance of each

Board member continues to be effective, that each member of the Board demonstrates the commitment required to continue in their present

roles, and accordingly supports each Class I Director’s re-election.

Information about directors standing for re-election:

- Class I Directors

John Dowd – Independent Non–Executive

Director

| | Mr. Dowd was the Chief Executive

Officer and Chairman of the board of directors of GoGreen from April 2021 until July 5, 2023, and he has decades of experience generating

attractive risk-adjusted returns as a manager of capital. He currently serves on the board of directors at the Commonwealth School in

Boston. Mr. Dowd previously spent more than three decades researching and investing in the global energy industry. From 2006 to 2019,

he served as portfolio manager at Fidelity Research & Management Co., LLC, managing Fidelity’s energy and natural resources

oriented sector funds. Mr. Dowd previously served as a Senior Research Analyst of Sanford C. Bernstein & Co., LLC from 2000 to 2006

and from 1995 to 1997, where he covered the oil service and equipment, and refining and integrated oil segments. Mr. Dowd also previously

served as a partner of Lawhill Capital Partners, an energy focused investment management firm, from 1997 to 2000. He holds a Bachelor’s

degree in Mechanical Engineering from Carnegie Mellon University. |

Govind Friedland – Independent Non–Executive

Director

| | Govind Friedland has served

as a Director of Lifezone Metals since July 2023. He is the Founder and Executive Chairman of GoviEx Uranium Inc., and has more than

20 years of experience working internationally to finance, explore and develop strategic energy minerals critical for combating global

air pollution. His career experience has focused primarily on nickel, copper and uranium. Mr. Friedland has served as the Executive Chairman

of GoviEx since October 2012 and previously served as its Chief Executive Officer from June 2006 to October 2012. Mr. Friedland was on

the board of directors at Cordoba Minerals Corp., which is developing the San Matias copper/gold complex north of Medellin, Colombia,

and Sama Resources Inc. which is focused on the Samapleau nickel/copper project in Ivory Coast, West Africa. He holds a Bachelor’s

degree in Geology and Geological Engineering from Colorado School of Mines. Mr. Friedland possesses a unique multicultural background,

having lived much of his life in Asia immersed in the mineral exploration industry. Mr. Friedland is also a founding shareholder of I-Pulse

Inc., a private U.S. company that uses proprietary super capacitors and related technologies to address inefficiencies across a wide

range of industries including mineral exploration, mineral processing, hydrocarbon EOR and geothermal drilling technology, water discovery,

and large utility-scale batteries as well as advanced manufacturing. Mr. Friedland has extensive experience working internationally to

finance, explore and develop strategic minerals projects. |

Ambassador Mwanaidi Maajar – Independent Non–Executive

Director

| | Ms. Maajar is an advocate and

senior partner at REX Advocates, a law firm in Tanzania. Ms. Maajar has experience in corporate commercial law practice, corporate secretarial

practice, and corporate governance. She has chaired and sat on the boards of private and listed companies as well as public corporations.

As part of her corporate governance practice, she trains boards of directors of companies and board committees in corporate governance

practice. She also has relevant experience in natural resources law (Mining, Oil & Gas) in Tanzania. Ms. Maajar also has experience

in banking and finance, competition law, property, and energy law. Ms. Maajar served as the Tanzanian Ambassador to the United States

of America after having served for four years as the Tanzanian High Commissioner to the United Kingdom between 2006 and 2013. Ms. Maajar

is currently Chair of the governing council of the University of Dar Es Salaam, having been a member of the Council since 2018. Ms Maajar

is also since 2021 a member of the board of directors of the Jakaya Kikwete Cardiac Institute. |

EXECUTIVE OFFICERS AND DIRECTORS

The following table lists the names, ages, as

of the date of our Annual Report for 2023 and positions of the individuals who currently serve as directors and executive officers of

Lifezone Metals:

| Name |

|

Age

(as at

December 31,

2023) |

|

Position(s) |

| Keith Liddell |

|

65 |

|

Chair of the Board, Director |

| Chris Showalter |

|

48 |

|

Chief Executive Officer, Director |

| Ingo Hofmaier |

|

48 |

|

Chief Financial Officer |

| Gerick Mouton |

|

47 |

|

Chief Operating Officer |

| Dr. Mike Adams |

|

63 |

|

Chief Technology Officer |

| Spencer Davis |

|

46 |

|

Group General Counsel |

| Anthony von Christierson |

|

35 |

|

Senior Vice President: Commercial and Business Development |

| Evan Young |

|

39 |

|

Senior Vice President: Investor Relations and Capital Markets |

| Govind Friedland |

|

49 |

|

Director |

| John Dowd |

|

55 |

|

Director |

| Robert Edwards |

|

57 |

|

Lead Independent Director |

| Beatriz Orrantia |

|

52 |

|

Director |

| Jennifer Houghton |

|

62 |

|

Director |

| Mwanaidi Maajar |

|

70 |

|

Director |

Natasha

Liddell departed from her role as Chief Sustainability Officer, effective February 16, 2024.

Executive Officers

Chris Showalter, Chief Executive Officer.

| | With over 17 years of experience,

Mr. Showalter brings a corporate finance and merchant banking background to the Lifezone team. Mr. Showalter also has extensive experience

across Africa. In addition to capital markets and fundraising, Mr. Showalter brings strong expertise originating, sourcing and developing

relationships across Africa, having held previous roles as CEO at KellTech and the role as Director and Partner at merchant bank Hannam

& Partners in Zimbabwe, where he focused on the African mining sector. Mr. Showalter is an integral part of the negotiations and

development of relations with the GoT. In addition to capital markets and fundraising, Mr. Showalter brings strong expertise originating,

sourcing and developing relationships across Africa. Having spent over 6 years in Zimbabwe, he has developed specific expertise in the

platinum sector and advised on a number of platinum mining companies on their current operations and future expansion potential, after

relocating to the country as co-Chief Executive Officer of Renaissance Capital. Prior to this, he spent 9 years at Goldman Sachs as a

Vice President in the New York office where he held various sales roles in equity and capital markets while also exploring opportunities

for Goldman Sachs across southern Africa. Mr. Showalter has been Chief Executive Officer of KNL since 2019 when KNL was incorporated.

Mr. Showalter received his Bachelor of Arts with Honors in environmental studies from Dartmouth College and his Master of Business Administration

from Fordham University. |

Ingo Hofmaier, Chief Financial Officer.

| | Mr. Hofmaier is a market-facing

finance executive with over 25 years of experience in financial reporting, tax, commercial contracts, project and corporate finance,

mergers and acquisitions and investment banking. Mr. Hofmaier was previously the Chief Executive Officer at Omico Mining Corp., a Namibian

copper exploration company, and he has also served as the Chief Financial Officer of SolGold plc, an LSE and TSX-listed copper and gold

developer. He brings corporate finance, financial and risk management experience in global commodity markets across a diverse range of

commodities and geographies, including Africa, Asia and the Americas. Mr. Hofmaier’s experience includes 7 years as a partner at

merchant bank Hannam & Partners in London, where he was responsible for metals & mining corporate finance, as well as at Rio

Tinto, Capgemini and Wienerberger AG, a building material and industrial minerals group, where he spent 8 years as group financial controller

for the U.S. business and commercial director during the successful project execution and market entry in India, among other roles. At

the time of this report, Mr. Hofmaier is an independent board member of First Tin plc, an LSE main market-listed tin development company,

where he chairs both the audit & risk and nominations & remuneration committees. Mr. Hofmaier is based in London, while travelling

frequently to North America and Tanzania. |

Gerick Mouton, Chief Operating Officer.

| | Mr. Mouton, a mechanical engineer,

is a global metals and mining professional. His experience in holding senior, executive and Board of Director positions within established

international listed mining companies and engineering consultancies has afforded him the rare opportunity to build a wide range of skills

over a 25-year period. His knowledge spans the entire project life cycle, across various commodities, including but not limited to: early

stage strategic project development scenarios; project economics and financial evaluations, challenging project development expectations;

partnership negotiations; organizational establishment, project marketing; and dynamic stakeholder relationships. These projects and

operations have exposed Mr. Mouton to a multitude of cultures within several countries on multiple continents, for example: Botswana,

Ghana, Democratic Republic of Congo (DRC), Zambia, Madagascar, Tanzania, South Africa and Indonesia. He has worked extensively with interested

and affected parties and other stakeholders to ensure uninterrupted development of large-scale mining projects in challenging social

locations. His interaction with multicultural stakeholders over his career has enhanced his mitigation knowledge with regards to environmental,

social and governance (ESG) challenges facing the development of new mining projects. |

Dr. Mike Adams, Chief Technology Officer.

| | Dr. Adams has been working

as process consultant with Lifezone Limited and for over 10 years has been focused on the implementation and commercialization of the

Hydromet Technology for the environmentally and economically effective recovery of PGM, gold, base and rare metals. His work for over

40 years has included process and resource development for metals recovery. He has project managed the bankable piloting of several nickel

sulfide and nickel laterite projects worldwide. He has also consulted independently for over 10 years and was previously Director of

Rockwell Minerals Ltd (now ASX-listed Elementos Ltd), Metallurgical Manager with SGS Lakefield Oretest and Head of Process and Environmental

Chemistry at Mintek. Dr. Adams completed a Bachelor of Science (BSc) honors and Master of Science (MSc) degrees in applied chemistry

at Witwatersrand University, a PhD on the chemistry of the carbon-in-pulp process and a Doctor of Science (DSc) in engineering on advances

in the processing of gold ores. He was Associate Editor for Hydrometallurgy Journal for eight years and has edited three books, including

Gold Ore Processing, second edition, published in 2016 by Elsevier. Dr. Adams has made a significant contribution to the chemistry and

optimization of the carbon-in-pulp process for gold recovery, for which he received the Raikes Gold Medal from the South African Chemical

Institute and two silver medals from the Southern African Institute of Mining and Metallurgy. |

Spencer Davis, Group General Counsel.

| | Mr. Davis is an experienced

general counsel, having advised multiple global businesses and teams across multiple jurisdictions (UK; US; EU; Africa, Middle East and

Asia-Pacific). He has held general counsel and Chief Legal Officer roles at various global companies, having started his career in private

practice in 2000. Previously, Mr. Davis has been responsible for providing expert, pragmatic and strategic legal advice internationally

to leadership teams and boards. He has experience advising boards, executives and senior management on all legal matters, risks and laws,

balancing legal compliance and risk, with pragmatism and commercial solutions. Mr. Davis is also a qualified company secretary (ACIS,

Chartered Institute of Governance 2016), with experience in corporate governance issues, legal compliance, oversight of boards and group

committees, corporate secretarial duties, ethics, regulatory and business conduct, preserving corporate records and managing statutory

filings and forms. Mr. Davis has significant experience in complex commercial transactions, M&A, funding and investments, hyper-growth

business, joint venture arrangements, technology, IP, data and privacy and has experience setting priority areas for companies preparing

for U.S. IPOs. Mr. Davis also has previous experience serving as the Chair of a risk and compliance committee and experience maintaining

internal processes, codes of conduct and procedures in anti-trust, data protection and privacy, anti-bribery and money laundering. Mr.

Davis holds a Masters in Law and is licensed to practice in England, New York and Ireland; he also has an MBA from London Business School. |

Anthony von Christierson, Senior Vice President: Commercial and Business Development.

| | Mr. von Christierson is responsible for investment appraisal,

business development and commercial activities at Lifezone and plays an important role in the commercialization of its hydrometallurgical

technology. He started his career at Goldman Sachs in London in the European and Emerging Markets leveraged finance team within the investment

banking division. Before transitioning into resources, Mr. von Christierson co-founded a mobile application business that was subsequently

acquired. Mr. von Christierson is also a director of the Southern Prospecting Group, a private equity family office with focus on the

resources and technology spaces. Mr. von Christierson attended Durham University and holds a Bachelor of Science with Honors in Natural

Sciences. |

Evan Young, Senior Vice President: Investor

Relations and Capital Markets.

| | Mr. Young brings significant

capital markets experience in the metals and mining industry, and played an integral role in bringing public Ivanhoe Electric Inc., a

minerals exploration and technology company, in 2022. His skills are critical in telling and enhancing the Lifezone Metals equity story

to the financial community. Prior to joining Lifezone Metals in 2023, Evan was with the Ivanhoe group of companies since 2017, where

he had an evolving role in investor relations and corporate development for both public and private minerals exploration and technology

companies. Prior to his tenure at the Ivanhoe companies, Evan served as Director, Investor Relations for Primero Mining Corp., a NYSE

and TSX dual-listed company with gold mining operations in Mexico and Canada. He also worked in equity research at the boutique Canadian

brokerage Haywood Securities Inc. and as an investment banking analyst at BMO Capital Markets in the Metals and Mining group. He has

a Master of Science with Distinction in Metals and Energy Finance from Imperial College London and a Bachelor of Science in Mining Engineering

from Queen’s University. |

Directors

Keith Liddell, Chair of the Board.

| | Mr. Liddell is an experienced

metallurgical engineer, resource company director and investor in the natural resource space. Mr. Liddell has an Honors Bachelor of Science

(Minerals Engineering) from the University of Birmingham and a Master of Science in Engineering from the University of the Witwatersrand.

Working since 1981 exclusively in the mineral and metals industry, he has experience in management and ownership of a number of public

and private businesses and joint ventures with a variety of participants. In various roles he has taken a number of resource projects,

including nickel and PGMs, through exploration, development and production. At Lifezone Limited, Mr. Liddell is primarily focused on

further developing Lifezone Limited’s Hydromet Technology - providing strategic guidance and contributing to the Kabanga DFS. Having

been involved in technical and corporate roles, company management, capital raising and managing stakeholder relationships, Mr. Liddell

has a unique blend of attributes that allow concurrent appreciation of the various social, environmental, commercial and technical components

that constitute successful modern resource companies. Mr. Liddell has been Chair of KNL since 2019 when KNL was incorporated. |

Chris Showalter. For an overview of Mr.

Showalter’s business experience, please see the section entitled “Executive Officers and Directors - Executive Officers.”

Robert Edwards- Lead Independent Director.

| | Appointed as Lead Independent

Director in February 2024, Mr. Edwards brings 30 years of experience in the natural resource sector primarily from production mining,

new business development, equity research, investment banking, and board level experience predominately across numerous markets. He started

his career in South Africa working in production mining and new business roles before joining HSBC as a precious metals equities analyst

within the HSBC Global Mining team. Thereafter he moved to Russia and was instrumental in transforming Renaissance Capital from a niche

single country investment bank into a successful boutique resource focused investment bank operating across the CIS, Africa and Asia.

When he left Renaissance Capital (Renaissance) after a decade, he was serving as its Chairman of Mining and Metals managing all investment

banking and principal investment activity in the mining, metals sector and fertilizer sectors. After leaving Renaissance he has worked

as a Senior Advisor to the Royal Bank of Canada (Europe) Investment Banking Division working on mergers and acquisitions and senior client

coverage. Mr. Edwards also served as the Independent Non-Executive Chairman of Sierra Rutile until its sale to Iluka Resources as well

as an Independent Non-Executive Director of GB Minerals until its sale to Itafos, a major phosphate and specialty fertilizer company.

He served as an Independent Non-Executive Director of MMC Norilsk Nickel (NorNickel), the world’s biggest producer of nickel and

palladium as well as major producer of copper and platinum, for over eight years until March, 2022. Mr. Edwards served on the Audit,

Corporate Governance and ESG Committees of NorNickel. Mr. Edwards also serves as an Independent Non-Executive Director of Chaarat Gold

Limited which is listed in London and of Sandfire Resources Limited, an ASX listed copper and zinc producer with assets in Spain and

Botswana. Mr. Edwards graduated from the Camborne School of Mines with an Honours Degree in Mining Engineering and holds both a Mine

Managers and a Mine Overseers certificate of competency (South Africa). He is also a Member of the Institute of Materials, Minerals and

Mining. |

Jennifer Houghton.

| | Ms. Houghton has board level

experience as an Independent Non-Executive Director for Santander International where she has chaired the board audit committee and has

been a member of the board risk committee and board nomination committee since 2020. Ms. Houghton has also been chair of the Institute

of Directors Isle of Man since 2017. In addition, she has been a director of IoD Isle of Man Limited since 2020. Ms. Houghton has also

chaired the Diana Princess of Wales Hospice Care at Home Trust since 2019. Ms. Houghton has also held various other roles, including

working as a senior manager within the audit department of Deloitte in California, Luxembourg, Sweden and the Isle of Man, as a finance

manager of AXA for two years from 2006-2008, and as the finance director of an Isle of Man regulated business from 2008-2016. Ms. Houghton

has been a Chartered Director since 2021, a Fellow of the Institute of Directors since 2019, a qualified accountant since 1989 and has

worked within regulated and unregulated sectors as a director since 2008. |

Beatriz Orrantia.

| | Ms. Orrantia has sustainability

expertise as a consultant in ESG, decarbonization and Just Transition. Ms. Orrantia also has legal experience, having worked as a mergers

and acquisitions, securities and mining lawyer from 2005 to 2015 at large Canadian law firms (Gowlings LLP, McCarthy Tetrault LLP and

Heenan Blaikie LLP). In addition to legal mining expertise, Ms. Orrantia has operational mining experience cultivated during her time

with Barrick as VP Special Projects, focusing on mining operations and capital projects across assets in Latin America and certain global

projects, including Kabanga, from February 2015 until November 2017. Ms. Orrantia also obtained directorship certification by the National

Association of Corporate Directors, the leading certification in the United States for board members. Ms. Orrantia has a degree in civil

law from the Universidad del Rosario in Colombia and a degree in common law from Osgoode Hall Law School in Canada. She also holds a

certificate in sustainability and innovation from Harvard University (Extension School) and is pursuing a master’s degree in sustainability

from Harvard University (Extension School). Ms. Orrantia is currently a member of the board of directors of Star Royalties Ltd., having

been a director since 2020, and a member of the boards of directors of Fission Uranium Corporation and Sierra Metals Inc., having been

a director since 2023. |

For information about the Class 1 Directors, see

“Resolutions To Be Voted on”.

Family Relationships

Keith Liddell is the father of Simon Liddell,

VP Mining and the stepfather of Charles Liddell, who is the owner / partner in the Australian firm Integrated Finance Limited. For the

twelve months ended December 31, 2023, Integrated Finance Limited were paid or payable $34,650 (December 31, 2022: $34,650) for the provision

of information technology services to KNL, a wholly owned subsidiary of Lifezone. The total amount outstanding as of December 31, 2023,

is $0 (December 31, 2022: $0). There are no other family relationships between the other directors, director nominees, or executive officers.

PRINCIPAL SHAREHOLDERS, CERTAIN RELATIONSHIPS AND RELATED PARTY

TRANSACTIONS

Principal Shareholders

The following table and accompanying footnotes

set forth information regarding the beneficial ownership of the Lifezone Metals Ordinary Shares as of February 29, 2024:

| ● | each person known by Lifezone

Metals to be the beneficial owner of more than 5% of its outstanding ordinary shares; |

| ● | each of Lifezone Metals’

current executive officers and directors; and |

| ● | all of Lifezone Metals’

executive officers and directors as a group. |

The beneficial ownership of Lifezone Metals Ordinary

Shares is based on 80,000,354 shares outstanding as of February 29, 2024.

Except as otherwise indicated, the address for

each shareholder listed below is Commerce House, 1 Bowring Road, Ramsey, IM8 2LQ, Isle of Man.

Beneficial ownership is determined in accordance

with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such

rules, beneficial ownership includes any shares over which the individual has sole or shared voting power or investment power as well

as any shares that the individual has the right to acquire within 60 days of February 29, 2024, through the exercise of any option, warrant

or other right. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have

sole voting and investment power with respect to all shares held by that person.

| Beneficial Owner | |

Lifezone

Metals

Ordinary

Shares | | |

%

of Lifezone

Metals

Ordinary

Shares | |

| Keith Liddell(1) | |

| 23,701,437 | | |

| 29.6 | % |

| Peter Smedvig | |

| 13,820,941 | | |

| 17.3 | % |

| Varna Holdings Ltd | |

| 5,770,889 | | |

| 7.2 | % |

| Kamberg INV Ltd | |

| 4,062,180 | | |

| 5.1 | % |

| Directors and Executive Officers of the Company: | |

| | | |

| | |

| Chris Showalter | |

| 3,438,942 | | |

| 4.3 | % |

| Ingo Hofmaier | |

| - | | |

| - | |

| Gerick Mouton | |

| - | | |

| - | |

| Dr. Mike Adams(2) | |

| 242,960 | | |

| * | |

| Spencer Davis | |

| - | | |

| - | |

| Anthony von Christierson | |

| 506,128 | | |

| * | |

| Govind Friedland | |

| 663,657 | | |

| * | |

| John Dowd | |

| 1,269,512 | | |

| 1.6 | % |

| Robert Edwards | |

| - | | |

| - | |

| Jennifer Houghton | |

| - | | |

| - | |

| Mwanaidi Maajar | |

| - | | |

| - | |

| Beatriz Orrantia | |

| - | | |

| - | |

| Evan Young | |

| 5,405 | | |

| * | |

| All Directors and Executive Officers of Lifezone Metals as a Group (14 Individuals) | |

| 29,828,041 | | |

| 37.3 | % |

| (1) | Consists of 5,172,747 shares

beneficially owned solely by Keith Liddell, 18,045,777 shares beneficially owned jointly between Keith Liddell and Jane Shelagh Liddell

and 482,913 shares beneficially owned solely by Jane Shelagh Liddell. By virtue of his relationship with Jane Shelagh Liddell, Keith

Liddell may be deemed to have beneficial ownership of the shares owned solely by Jane Shelagh Liddell. Keith Liddell disclaims any beneficial

ownership of the shares owned solely by Jane Shelagh Liddell other than to the extent of any pecuniary interest he may have therein,

directly or indirectly. |

| (2) | Consists of (i) 3,833,882 Lifezone

Metals Ordinary Shares and (ii) 1,533,553 Earnout share rights. The Company has been informed that (a) Hermetica Limited is wholly owned

by The Hermetica Trust, (b) the trustee of The Hermetica Trust is LJ Skye Trustees Limited, (c) the board of directors of LJ Skye Trustees

Limited makes voting and investment decisions on a joint decision making basis, and no single individual has sole decision making power,

and (d) that the beneficiaries of The Hermetica Trust include children of Dr. Mike Adams. |

To our knowledge, other than as provided in the

table above, our other filings with the SEC, public disclosure and our Annual Report, there has been no significant change in the percentage

ownership held by any other major shareholder since December 31, 2023.

To our knowledge, 9.3 million ordinary shares,

representing 11.8% of our total outstanding ordinary shares, were held by record shareholders with registered addresses in the United

States.

Related Party Transactions

For details, see Note 22 of our audited consolidated

financial statements for the year ended December 31, 2023 in our Annual Report for the year 2023.

PRINCIPAL AUDITOR FEES AND SERVICES

Audit Committee Financial Expert

Our board of directors has determined that Jennifer

Houghton, a member of our audit committee, is a “financial expert,” as defined in Item 16A of Form 20-F. Ms. Houghton is “independent,”

as defined in Rule 10A-3 under the Exchange Act. For a description of Ms. Houghton’s experience, see “Executive Officers

and Directors”.

Principal Accountant Fees And Services

The following table sets forth the aggregate fees

by categories specified below in connection with certain professional services rendered and billed by Grant Thornton, our independent

registered public accounting firm since 2021, for the periods indicated.

| | |

For the years ended, | |

| | |

December 31 | |

| | |

2023 | | |

2022 | | |

2021 | |

| Audit fees | |

| 731,589 | | |

| 318,541 | | |

| 172,477 | |

| All other fees | |

| - | | |

| - | | |

| - | |

| | |

| 731,589 | | |

| 318,541 | | |

| 172,477 | |

Audit fees include the aggregate fees billed for

each of the fiscal years for professional services rendered by our independent registered public accounting firm for the audit of our

annual financial statements or for the audits of our financial statements and review of the interim financial statements in connection

with our listing on July 6, 2023.

All other fees include the aggregate fees billed

in each of the fiscal years for products and services provided by our independent registered public accounting firm, other than the services

reported under audit fees, audit-related fees, and tax fees.

19

Exhibit 99.2

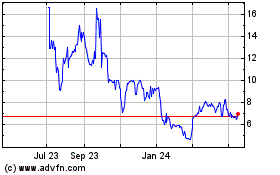

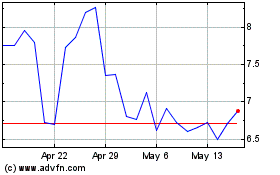

Lifezone Metals (NYSE:LZM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lifezone Metals (NYSE:LZM)

Historical Stock Chart

From Nov 2023 to Nov 2024