0000057131False00000571312025-02-182025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| Date of Report (Date of Earliest Event Reported): | February 18, 2025 |

| | | | |

LA-Z-BOY INCORPORATED |

(Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Michigan | | 1-9656 | | 38-0751137 |

| (State or other jurisdiction of | | (Commission | | (IRS Employer |

| incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | | | | | | | |

| One La-Z-Boy Drive, | Monroe, | Michigan | | 48162-5138 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (734) 242-1444

| | | | | | | | | | | |

N/A |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $1.00 par value | | LZB | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 18, 2025, La-Z-Boy Incorporated (the “Company”) issued a news release to report the Company’s financial results for the fiscal quarter ended January 25, 2025. A copy of the news release is attached to this Current Report on Form 8-K as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

The information in Items 2.02 and 7.01 of this report and the related exhibit (Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are furnished as part of this report:

| | | | | | | | |

| Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| LA-Z-BOY INCORPORATED | |

| (Registrant) | |

Date: February 18, 2025

| | | | | | | | |

| BY:/s/ Jennifer L. McCurry | |

| Jennifer L. McCurry

Vice President, Corporate Controller and Chief Accounting Officer | |

EXHIBIT 99.1

La-Z-Boy Incorporated Reports Strong Third Quarter Results;

Sales Growth Across All Segments, Company-Owned Same-Store Sales Accelerate

Fiscal 2025 Third Quarter Highlights:

•Consolidated delivered sales of $522 million

–Up 4% versus prior year

•Operating margin on a GAAP and Non-GAAP basis improved 20 basis points versus prior year

•GAAP and Non-GAAP(1) diluted EPS of $0.68

•Delivered sales and Non-GAAP(1) operating margin at high end of guidance range

•Retail segment sales increased 11%

–Fueled by same-store sales growth and independent La-Z-Boy Furniture Galleries® acquisitions, along with new stores

–Retail added three newly opened stores, and two newly acquired independent La-Z-Boy Furniture Galleries® stores, with one closure; and announced an additional two-store acquisition expected to close in the fourth quarter

MONROE, Mich., February 18, 2025 -- La-Z-Boy Incorporated (NYSE: LZB), a global leader in the retail and manufacture of residential furniture, today reported strong third quarter results for the period ended January 25, 2025. For the quarter, sales totaled $522 million, growing 4% against the prior year comparable period. Operating margin was 6.7% for the quarter on a GAAP basis and 6.8% on a Non-GAAP(1) basis. Diluted earnings per share totaled $0.68 on a GAAP and Non-GAAP(1) basis. The company returned $90 million to shareholders year-to-date, up approximately 40% versus the prior year comparable period.

Written sales trends sequentially accelerated, with third quarter total written sales for the Retail segment (company-owned La-Z-Boy Furniture Galleries®) increasing 15% versus a year ago and written same-store sales (which exclude the impact of newly opened stores and newly acquired stores) up 7% versus a year ago. Sales strength was broad based with all key markets posting positive same-store sales trends driven by strong execution and sequential improvements in traffic. Written same-store sales for the entire La-Z-Boy Furniture Galleries® network also increased 5% versus the year ago period. Performance continues to outpace the broader industry with market share gains in the quarter.

Melinda D. Whittington, Board Chair, President and Chief Executive Officer of La-Z-Boy Incorporated, said, “Our third quarter results reflect the steady progress we have made to build a more agile business, create our own momentum, and drive growth in what is still a challenged environment. We delivered sales growth across each of our segments, punctuated by strong Retail same-store sales. This was driven by solid conversion rates, average ticket, and design sales, all of which improved again year-over-year. Additionally, within our Wholesale segment, our core North America La-Z-Boy brand continues to post sales growth and margin expansion. Our vertically integrated model reinforces the unique strength of our iconic brand and positions us to disproportionately benefit when the market rebounds. We are a trusted solution for a growing number of consumers and will remain steadfast in our mission of bringing the transformational power of comfort to people, homes, and communities.

Whittington added, “As we look to the future, our brand, and it’s well-known attributes of comfort and quality, will be further supported by our expanding consumer insights. We believe this is creating a flywheel with improved innovation, strong speed to market, and improved brand reach and profitability. While underlying housing fundamentals remain challenged, we are focused on solving for the unique needs of the consumer with comfort and quality and controlling what we can control with strong execution. This is the foundation to what has led La-Z-Boy Incorporated to be successful for the past century and will continue to be the cornerstone of our philosophy for our Century Vision strategy and next 100 years.”

Fourth Quarter Outlook:

Taylor Luebke, SVP and Chief Financial Officer of La-Z-Boy Incorporated, said, “Our strong written trends and sequential acceleration in our Retail and Wholesale businesses is a testament that our Century Vision strategy is enabling us to outperform the industry. We will continue to focus on growing our core La-Z-Boy brand by disproportionately expanding our Retail segment and driving strategic, compatible distribution in the Wholesale segment. We delivered results above a year ago and at the higher end of our sales and margin expectations for the quarter despite continued challenging macro conditions. Our expectation is for industry trends to remain under pressure, though we expect to continue to outpace the industry. Assuming no significant changes in tariffs, we expect fiscal fourth quarter sales to be in the range of $545-565 million and Non-GAAP operating margin(2) to be in the range of 8.5-9.5%.”

Key Results:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands, except per share data and percentages) | | Quarter Ended | | | | | | | | |

| 1/25/2025 | | 1/27/2024 | | Change | | | | | | | | | | |

| Sales | | $ | 521,777 | | | $ | 500,406 | | | 4% | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| GAAP operating income | | 35,168 | | | 32,561 | | | 8% | | | | | | | | | | |

| Non-GAAP operating income | | 35,422 | | | 33,022 | | | 7% | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| GAAP operating margin | | 6.7% | | 6.5% | | 20 bps | | | | | | | | | | |

| Non-GAAP operating margin | | 6.8% | | 6.6% | | 20 bps | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| GAAP net income attributable to La-Z-Boy Incorporated | | 28,429 | | | 28,640 | | | (1)% | | | | | | | | | | |

| Non-GAAP net income attributable to La-Z-Boy Incorporated | | 28,619 | | | 29,008 | | | (1)% | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Diluted weighted average common shares | | 42,103 | | | 43,195 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| GAAP diluted earnings per share | | $ | 0.68 | | | $ | 0.66 | | | 3% | | | | | | | | | | |

| Non-GAAP diluted earnings per share | | $ | 0.68 | | | $ | 0.67 | | | 1% | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Liquidity Measures:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended | | | | Nine Months Ended |

| (Unaudited, amounts in thousands) | | 1/25/2025 | | 1/27/2024 | | (Unaudited, amounts in thousands) | | 1/25/2025 | | 1/27/2024 |

| Free Cash Flow | | | | | | Cash Returns to Shareholders | | | | |

| Operating cash flow | | $ | 125,269 | | | $ | 105,354 | | | Share repurchases | | $ | 64,387 | | | $ | 40,022 | |

| Capital expenditures | | (51,538) | | | (38,034) | | | Dividends | | 25,871 | | | 24,177 | |

| Free cash flow | | $ | 73,731 | | | $ | 67,320 | | | Cash returns to shareholders | | $ | 90,258 | | | $ | 64,199 | |

| | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands) | | 1/25/2025 | | 1/27/2024 |

| Cash and cash equivalents | | $ | 314,589 | | | $ | 329,324 | |

| Restricted cash | | — | | | 3,855 | |

| Total cash, cash equivalents and restricted cash | | $ | 314,589 | | | $ | 333,179 | |

Fiscal 2025 Third Quarter Results versus Fiscal 2024 Third Quarter:

•Consolidated sales in the third quarter of Fiscal 2025 increased 4% to $522 million versus last year, primarily driven by strong same-store sales, acquisitions and new stores in our Retail business, momentum in our core North America La-Z-Boy Wholesale brand, and strong sales growth in our Joybird business

•Consolidated GAAP operating margin was 6.7% versus 6.5%

–Consolidated Non-GAAP(1) operating margin increased 20 basis points to 6.8% versus 6.6%, driven by lower input costs (reduced commodity prices and improved sourcing) partially offset by the impact of a significant customer transition in our international wholesale business

•GAAP diluted EPS increased to $0.68 from $0.66 and Non-GAAP(1) diluted EPS totaled $0.68 versus $0.67 last year in the comparable period

Retail Segment:

•Sales:

–Written sales for the Retail segment (company-owned La-Z-Boy Furniture Galleries® stores) increased 15% with broad based growth from increases in same-store sales, and new and acquired stores compared to the year ago period

▪Written same-store sales increased 7%, driven by strong execution with higher conversion rates, average ticket, and design sales

–Delivered sales increased 11% to $228 million versus last year, primarily due to higher same-store sales and growth from acquired and new stores

•Operating Margin:

–GAAP operating margin and GAAP operating income were 10.7% and $24 million, versus 10.9% and $22 million, respectively

▪Non-GAAP(1) operating margin and Non-GAAP(1) operating income were 10.7% and $24 million, down 20 basis points, and up 10%, respectively, driven by sales growth offset by an increase in selling expenses and fixed costs supporting our long-term strategy of growing our Retail business.

Wholesale Segment:

•Sales:

–Sales increased 2% to $363 million, driven by our core North America La-Z-Boy brand through favorable shift in product/channel mix with higher sales to our La-Z-Boy Furniture Galleries®, partially offset by the impact of a significant customer transition in our international wholesale business

•Operating Margin:

–GAAP operating margin increased to 6.5% versus 6.4%

▪Non-GAAP(1) operating margin was 6.5%, increasing 10 basis points from the year ago period driven by gross margin expansion (lower input costs and favorable foreign exchange), partially offset by significant deleverage in our international wholesale business

Corporate & Other:

•Joybird written sales increased 10% and delivered sales increased 9% to $37 million driven by improved retail traffic and strong execution

•Joybird operating margin performance saw year-over-year improvement from higher gross margins driven by favorable product mix and SG&A leverage on higher sales leading to breakeven operating profit

Balance Sheet and Cash Flow, Fiscal 2025 Third Quarter:

•Ended the quarter with $315 million in cash(3) and no external debt

•Generated $57 million in cash from operations versus $48 million in the third quarter of last fiscal year. Year to date, cash flow from operations was $125 million, up 19% from last year's comparable period

•Invested $19 million in capital expenditures, primarily related to La-Z-Boy Furniture Galleries® (new stores and remodels)

•Returned approximately $20 million to shareholders, including $11 million in share repurchases and $9 million in dividends. Year to date, $90 million has been returned to shareholders, approximately 40% more than the respective period last year

Dividend:

On February 18, 2025, the Board of Directors declared a quarterly cash dividend of $0.22 per share on the common stock of the company. The dividend will be paid on March 14, 2025, to shareholders of record on March 4, 2025.

Conference Call:

La-Z-Boy will hold a conference call with the investment community on Wednesday, February 19, 2025, at 8:30 a.m. ET. The toll-free dial-in number is (888) 506-0062; international callers may use (973) 528-0011. Enter Participant Access Code: 837177.

The call will be webcast live, with corresponding slides, and archived on the internet. It will be available at https://lazboy.gcs-web.com/. A telephone replay will be available for a week following the call. This replay will be accessible to callers from the U.S. and Canada at (877) 481-4010 and to international callers at (919) 882-2331. Enter Replay Passcode: 51987. The webcast replay will be available for one year.

Investor Relations Contact:

Mark Becks, CFA, (734) 457-9538

mark.becks@la-z-boy.com

Media Contact:

Cara Klaer, (734) 598-0652

cara.klaer@la-z-boy.com

About La-Z-Boy:

La-Z-Boy Incorporated brings the transformational power of comfort to people, homes, and communities around the world - a mission that began when its founders invented the iconic recliner in 1927. Today, the company operates as a vertically integrated furniture retailer and manufacturer, committed to uncompromising quality and compassion for its consumers.

The Retail segment consists of nearly 200 company-owned La-Z-Boy Furniture Galleries® stores and is part of a broader network of over 360 La-Z-Boy Furniture Galleries® that, with La-Z-Boy.com, serve

customers nationwide. Joybird®, an e-commerce retailer and manufacturer of modern upholstered furniture, has 12 stores in the U.S. In the Wholesale segment, La-Z-Boy manufactures comfortable, custom furniture for its Furniture Galleries® and a variety of retail channels, England Furniture Co. offers custom upholstered furniture, and casegoods brands Kincaid®, American Drew®, and Hammary® provide pieces that make every room feel like home. To learn more, please visit: https://www.la-z-boy.com/.

Notes:

(1)Non-GAAP amounts for the third quarter of fiscal 2025 exclude:

•purchase accounting charges related to acquisitions completed in prior periods totaling $0.3 million pre-tax, or less than $0.01 per diluted share, all included in operating income

Non-GAAP amounts for the third quarter of fiscal 2024 exclude:

•a $0.2 million pre-tax, or less than $0.01 per diluted share, related to our supply chain optimization actions

•purchase accounting charges related to acquisitions completed in prior periods totaling $0.3 million pre-tax, or $0.01 per diluted share, all included in operating income

(2)This reference to Non-GAAP operating margin for a future period is a Non-GAAP financial measure. We have not provided a reconciliation of Non-GAAP operating margin for future periods in this press release because such reconciliation cannot be provided without unreasonable efforts.

Please refer to the accompanying “Reconciliation of GAAP to Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures: Segment Information” for detailed information on calculating the Non-GAAP financial measures used in this press release and a reconciliation to the most directly comparable GAAP measure.

(3)Cash includes cash, cash equivalents and restricted cash.

Cautionary Note Regarding Forward-Looking Statements:

This news release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Generally, forward-looking statements include information concerning expectations, projections or trends relating to our results of operations, financial results, financial condition, strategic initiatives and plans, expenses, dividends, share repurchases, liquidity, use of cash and cash requirements, borrowing capacity, investments, future economic performance, and our business and industry.

The forward-looking statements in this press release are based on certain assumptions and currently available information and are subject to various risks and uncertainties, many of which are unforeseeable and beyond our control. Additional risks and uncertainties that we do not presently know about or that we currently consider to be immaterial may also affect our business operations and financial results. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed in our Fiscal 2024 Annual Report on Form 10-K and other factors identified in our reports filed with the Securities and Exchange Commission (the “SEC”), available on the SEC’s website at www.sec.gov. Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or for any other reason.

Non-GAAP Financial Measures:

In addition to the financial measures prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), this press release also includes Non-GAAP financial measures. Management uses these Non-GAAP financial measures when assessing our ongoing performance. This press release contains references to Non-GAAP operating income (on a consolidated basis and by segment), Non-GAAP operating margin (on a consolidated basis and by segment), and Non-GAAP net income attributable to La-Z-Boy Incorporated per diluted share, Non-GAAP diluted earnings per share (and components thereof, including Non-GAAP income before income taxes and Non-GAAP net income attributable to La-Z-Boy Incorporated), each of which may exclude, as applicable, supply chain optimization charges and purchase accounting charges. The supply chain optimization charges include asset impairment costs, accelerated depreciation expense, lease termination gains, severance costs, and employee relocation costs related to shifting upholstery production from our Ramos, Mexico operations to other upholstery plants and relocating our cut and sew operations back to Ramos, Mexico, resulting in the permanent closure of our leased cut and sew facility in Parras, Mexico. The purchase accounting charges include the amortization of intangible assets, incremental expense upon the sale of inventory acquired at fair value, and fair value adjustments of future cash payments recorded as interest expense. These Non-GAAP financial measures are not meant to be considered superior to or a substitute for La-Z-Boy Incorporated’s results of operations prepared in accordance with GAAP and may not be comparable to similarly titled measures reported by other companies. Reconciliations of such Non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the accompanying tables.

Management believes that presenting certain Non-GAAP financial measures will help investors understand the long-term profitability trends of our business and compare our profitability to prior and future periods and to our peers. Management excludes purchase accounting charges because the amount and timing of such charges are significantly impacted by the timing, size, number and nature of the acquisitions consummated and the success with which we operate the businesses acquired. While the company has a history of acquisition activity, it does not acquire businesses on a predictable cycle, and the impact of purchase accounting charges is unique to each acquisition and can vary significantly from acquisition to acquisition. Similarly, supply chain optimization charges are dependent on the timing, size, number and nature of the operations being closed, consolidated or centralized, and the charges may not be incurred on a predictable cycle. Management believes that exclusion of these items facilitates more consistent comparisons of the company’s operating results over time. Where applicable, the accompanying “Reconciliation of GAAP to Non-GAAP Financial Measures” tables present the excluded items net of tax calculated using the effective tax rate from operations for the period in which the adjustment is presented.

# # #

LA-Z-BOY INCORPORATED

CONSOLIDATED STATEMENT OF INCOME

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Nine Months Ended |

| (Unaudited, amounts in thousands, except per share data) | | 1/25/2025 | | 1/27/2024 | | 1/25/2025 | | 1/27/2024 |

| Sales | | $ | 521,777 | | | $ | 500,406 | | | $ | 1,538,336 | | | $ | 1,493,492 | |

| Cost of sales | | 290,412 | | | 287,152 | | | 862,980 | | | 851,905 | |

| Gross profit | | 231,365 | | | 213,254 | | | 675,356 | | | 641,587 | |

| Selling, general and administrative expense | | 196,197 | | | 180,693 | | | 569,046 | | | 540,888 | |

| | | | | | | | |

| Operating income | | 35,168 | | | 32,561 | | | 106,310 | | | 100,699 | |

| Interest expense | | (102) | | | (106) | | | (411) | | | (329) | |

| Interest income | | 3,465 | | | 4,124 | | | 11,619 | | | 11,222 | |

| | | | | | | | |

| Other income (expense), net | | 97 | | | (639) | | | (2,400) | | | 21 | |

| Income before income taxes | | 38,628 | | | 35,940 | | | 115,118 | | | 111,613 | |

| Income tax expense | | 9,683 | | | 7,256 | | | 29,516 | | | 27,309 | |

| Net income | | 28,945 | | | 28,684 | | | 85,602 | | | 84,304 | |

| Net (income) attributable to noncontrolling interests | | (516) | | | (44) | | | (977) | | | (986) | |

| Net income attributable to La-Z-Boy Incorporated | | $ | 28,429 | | | $ | 28,640 | | | $ | 84,625 | | | $ | 83,318 | |

| | | | | | | | |

| Basic weighted average common shares | | 41,437 | | | 42,767 | | | 41,733 | | | 43,005 | |

| Basic net income attributable to La-Z-Boy Incorporated per share | | $ | 0.69 | | | $ | 0.67 | | | $ | 2.03 | | | $ | 1.94 | |

| | | | | | | | |

| Diluted weighted average common shares | | 42,103 | | | 43,195 | | | 42,380 | | | 43,344 | |

| Diluted net income attributable to La-Z-Boy Incorporated per share | | $ | 0.68 | | | $ | 0.66 | | | $ | 2.00 | | | $ | 1.92 | |

LA-Z-BOY INCORPORATED

CONSOLIDATED BALANCE SHEET

| | | | | | | | | | | | | | | |

| (Unaudited, amounts in thousands, except par value) | | 1/25/2025 | | 4/27/2024 | |

| Current assets | | | | | |

| Cash and equivalents | | $ | 314,589 | | | $ | 341,098 | | |

| | | | | |

Receivables, net of allowance of $5,686 at 1/25/2025 and $5,076 at 4/27/2024 | | 127,612 | | | 139,213 | | |

| Inventories, net | | 288,720 | | | 263,237 | | |

| Other current assets | | 109,991 | | | 93,260 | | |

| Total current assets | | 840,912 | | | 836,808 | | |

| Property, plant and equipment, net | | 325,031 | | | 298,224 | | |

| Goodwill | | 221,693 | | | 214,453 | | |

| Other intangible assets, net | | 50,664 | | | 47,251 | | |

| Deferred income taxes – long-term | | 9,343 | | | 10,283 | | |

| Right of use lease assets | | 450,062 | | | 446,466 | | |

| Other long-term assets, net | | 61,179 | | | 59,957 | | |

| Total assets | | $ | 1,958,884 | | | $ | 1,913,442 | | |

| | | | | |

| Current liabilities | | | | | |

| | | | | |

| Accounts payable | | $ | 106,594 | | | $ | 96,486 | | |

| | | | | |

| Lease liabilities, short-term | | 79,224 | | | 77,027 | | |

| Accrued expenses and other current liabilities | | 269,691 | | | 263,768 | | |

| Total current liabilities | | 455,509 | | | 437,281 | | |

| | | | | |

| Lease liabilities, long-term | | 408,972 | | | 404,724 | | |

| Other long-term liabilities | | 62,224 | | | 58,077 | | |

| Shareholders' equity | | | | | |

Preferred shares – 5,000 authorized; none issued | | — | | | — | | |

Common shares, $1.00 par value – 150,000 authorized; 41,411 outstanding at 1/25/2025 and 42,440 outstanding at 4/27/2024 | | 41,411 | | | 42,440 | | |

| Capital in excess of par value | | 381,759 | | | 368,485 | | |

| Retained earnings | | 603,569 | | | 598,009 | | |

| Accumulated other comprehensive loss | | (5,467) | | | (5,870) | | |

| Total La-Z-Boy Incorporated shareholders' equity | | 1,021,272 | | | 1,003,064 | | |

| Noncontrolling interests | | 10,907 | | | 10,296 | | |

| Total equity | | 1,032,179 | | | 1,013,360 | | |

| Total liabilities and equity | | $ | 1,958,884 | | | $ | 1,913,442 | | |

LA-Z-BOY INCORPORATED

CONSOLIDATED STATEMENT OF CASH FLOWS

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| (Unaudited, amounts in thousands) | | 1/25/2025 | | 1/27/2024 |

| Cash flows from operating activities | | | | |

| Net income | | $ | 85,602 | | | $ | 84,304 | |

| Adjustments to reconcile net income to cash provided by operating activities | | | | |

| (Gain)/loss on disposal and impairment of assets | | 73 | | | (15) | |

| Gain on sale of investments | | (199) | | | (1,169) | |

| Provision for doubtful accounts | | 518 | | | (267) | |

| Depreciation and amortization | | 35,020 | | | 36,493 | |

| Amortization of right-of-use lease assets | | 61,521 | | | 56,660 | |

| Lease impairment/(settlement) | | — | | | (1,175) | |

| Equity-based compensation expense | | 13,428 | | | 11,048 | |

| | | | |

| | | | |

| | | | |

| Change in deferred taxes | | 2,134 | | | 1,911 | |

| Change in receivables | | 10,465 | | | 4,277 | |

| Change in inventories | | (21,726) | | | 5,968 | |

| Change in other assets | | (10,217) | | | (6,314) | |

| Change in payables | | 11,897 | | | (15,420) | |

| Change in lease liabilities | | (62,607) | | | (57,385) | |

| Change in other liabilities | | (640) | | | (13,562) | |

| Net cash provided by operating activities | | 125,269 | | | 105,354 | |

| | | | |

| Cash flows from investing activities | | | | |

| Proceeds from disposals of assets | | 188 | | | 4,836 | |

| | | | |

| Capital expenditures | | (51,538) | | | (38,034) | |

| Purchases of investments | | (6,783) | | | (17,869) | |

| Proceeds from sales of investments | | 11,715 | | | 23,337 | |

| Acquisitions | | (24,772) | | | (26,299) | |

| Net cash used for investing activities | | (71,190) | | | (54,029) | |

| | | | |

| Cash flows from financing activities | | | | |

| | | | |

| Payments on finance lease liabilities | | (442) | | | (346) | |

| Holdback payments for acquisitions | | — | | | (5,000) | |

| Stock issued for stock and employee benefit plans, net of shares withheld for taxes | | 10,906 | | | 6,241 | |

| Repurchases of common stock | | (64,387) | | | (40,022) | |

| Dividends paid to shareholders | | (25,871) | | | (24,177) | |

| Dividends paid to minority interest joint venture partners (1) | | (1,414) | | | (1,172) | |

| Net cash used for financing activities | | (81,208) | | | (64,476) | |

| | | | |

| Effect of exchange rate changes on cash and equivalents | | 620 | | | (348) | |

| Change in cash, cash equivalents and restricted cash | | (26,509) | | | (13,499) | |

| Cash, cash equivalents and restricted cash at beginning of period | | 341,098 | | | 346,678 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 314,589 | | | $ | 333,179 | |

| | | | |

| Supplemental disclosure of non-cash investing activities | | | | |

| Capital expenditures included in payables | | $ | 4,010 | | | $ | 3,008 | |

(1)Includes dividends paid to joint venture minority partners resulting from the repatriation of dividends from our foreign earnings that we no longer consider permanently reinvested.

LA-Z-BOY INCORPORATED

SEGMENT INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Nine Months Ended |

| (Unaudited, amounts in thousands) | | 1/25/2025 | | 1/27/2024 | | 1/25/2025 | | 1/27/2024 |

| Sales | | | | | | | | |

| Wholesale segment: | | | | | | | | |

| Sales to external customers | | $ | 255,028 | | | $ | 260,542 | | | $ | 770,031 | | | $ | 760,531 | |

| Intersegment sales | | 107,970 | | | 95,833 | | | 307,764 | | | 294,286 | |

| Wholesale segment sales | | 362,998 | | | 356,375 | | | 1,077,795 | | | 1,054,817 | |

| | | | | | | | |

| Retail segment sales | | 227,667 | | | 204,696 | | | 651,601 | | | 627,248 | |

| | | | | | | | |

| Corporate and Other: | | | | | | | | |

| Sales to external customers | | 39,082 | | | 35,168 | | | 116,704 | | | 105,713 | |

| Intersegment sales | | 1,580 | | | 2,964 | | | 4,753 | | | 8,712 | |

| Corporate and Other sales | | 40,662 | | | 38,132 | | | 121,457 | | | 114,425 | |

| | | | | | | | |

| Eliminations | | (109,550) | | | (98,797) | | | (312,517) | | | (302,998) | |

| Consolidated sales | | $ | 521,777 | | | $ | 500,406 | | | $ | 1,538,336 | | | $ | 1,493,492 | |

| | | | | | | | |

| Operating Income (Loss) | | | | | | | | |

| Wholesale segment | | $ | 23,565 | | | $ | 22,711 | | | $ | 72,093 | | | $ | 67,664 | |

| Retail segment | | 24,457 | | | 22,313 | | | 73,003 | | | 79,512 | |

| Corporate and Other | | (12,854) | | | (12,463) | | | (38,786) | | | (46,477) | |

| Consolidated operating income | | $ | 35,168 | | | $ | 32,561 | | | $ | 106,310 | | | $ | 100,699 | |

LA-Z-BOY INCORPORATED

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Nine Months Ended |

| (Amounts in thousands, except per share data) | | 1/25/2025 | | 1/27/2024 | | 1/25/2025 | | 1/27/2024 |

| GAAP gross profit | | $ | 231,365 | | | $ | 213,254 | | | $ | 675,356 | | | $ | 641,587 | |

| Purchase accounting charges (1) | | — | | | — | | | 140 | | | — | |

| | | | | | | | |

| Supply chain optimization charges (2) | | — | | | 205 | | | — | | | 3,966 | |

| | | | | | | | |

| Non-GAAP gross profit | | $ | 231,365 | | | $ | 213,459 | | | $ | 675,496 | | | $ | 645,553 | |

| | | | | | | | |

| GAAP SG&A | | $ | 196,197 | | | $ | 180,693 | | | $ | 569,046 | | | $ | 540,888 | |

| Purchase accounting charges (3) | | (254) | | | (254) | | | (765) | | | (762) | |

| | | | | | | | |

| Supply chain optimization charges (4) | | — | | | (2) | | | — | | | (1,857) | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP SG&A | | $ | 195,943 | | | $ | 180,437 | | | $ | 568,281 | | | $ | 538,269 | |

| | | | | | | | |

| GAAP operating income | | $ | 35,168 | | | $ | 32,561 | | | $ | 106,310 | | | $ | 100,699 | |

| Purchase accounting charges | | 254 | | | 254 | | | 905 | | | 762 | |

| | | | | | | | |

| Supply chain optimization charges | | — | | | 207 | | | — | | | 5,823 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP operating income | | $ | 35,422 | | | $ | 33,022 | | | $ | 107,215 | | | $ | 107,284 | |

| | | | | | | | |

| GAAP income before income taxes | | $ | 38,628 | | | $ | 35,940 | | | $ | 115,118 | | | $ | 111,613 | |

| Purchase accounting charges recorded as part of gross profit, SG&A, and interest expense | | 254 | | | 254 | | | 905 | | | 810 | |

| | | | | | | | |

| Supply chain optimization charges | | — | | | 207 | | | — | | | 5,823 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP income before income taxes | | $ | 38,882 | | | $ | 36,401 | | | $ | 116,023 | | | $ | 118,246 | |

| | | | | | | | |

| GAAP net income attributable to La-Z-Boy Incorporated | | $ | 28,429 | | | $ | 28,640 | | | $ | 84,625 | | | $ | 83,318 | |

| Purchase accounting charges recorded as part of gross profit, SG&A, and interest expense | | 254 | | | 254 | | | 905 | | | 810 | |

| Tax effect of purchase accounting | | (64) | | | (51) | | | (232) | | | (198) | |

| | | | | | | | |

| | | | | | | | |

| Supply chain optimization charges | | — | | | 207 | | | — | | | 5,823 | |

| Tax effect of supply chain optimization | | — | | | (42) | | | — | | | (1,427) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP net income attributable to La-Z-Boy Incorporated | | $ | 28,619 | | | $ | 29,008 | | | $ | 85,298 | | | $ | 88,326 | |

| | | | | | | | |

| GAAP net income attributable to La-Z-Boy Incorporated per diluted share ("Diluted EPS") | | $ | 0.68 | | | $ | 0.66 | | | $ | 2.00 | | | $ | 1.92 | |

| Purchase accounting charges, net of tax, per share | | — | | | 0.01 | | | 0.01 | | | 0.02 | |

| | | | | | | | |

| Supply chain optimization charges, net of tax, per share | | — | | | — | | | — | | | 0.10 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP net income attributable to La-Z-Boy Incorporated per diluted share ("Diluted EPS") | | $ | 0.68 | | | $ | 0.67 | | | $ | 2.01 | | | $ | 2.04 | |

(1)Includes incremental expense upon the sale of inventory acquired at fair value.

(2)Fiscal 2024 includes severance charges related to shifting upholstery production from our Ramos, Mexico operations to other upholstery plants and relocating our cut and sew operations back to Ramos, Mexico, resulting in the permanent closure of our leased cut and sew facility in Parras, Mexico.

(3)Includes amortization of intangible assets.

(4)The first nine months of fiscal 2024 includes $3.0 million of accelerated depreciation of fixed assets related to shifting upholstery production from our Ramos, Mexico operations to other upholstery plants and relocating our cut and sew operations back to Ramos, Mexico, resulting in the permanent closure of our leased cut and sew facility in Parras, Mexico. The first nine months of fiscal 2024 also includes a $1.2 million gain related to the settlement of the Torreón, Mexico lease obligation on previously impaired assets.

LA-Z-BOY INCORPORATED

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

SEGMENT INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Nine Months Ended |

| (Amounts in thousands) | | 1/25/2025 | | % of sales | | 1/27/2024 | | % of sales | | 1/25/2025 | | % of sales | | 1/27/2024 | | % of sales |

| GAAP operating income (loss) | | | | | | | | | | | | | | | | |

| Wholesale segment | | $ | 23,565 | | | 6.5% | | $ | 22,711 | | | 6.4% | | $ | 72,093 | | | 6.7% | | $ | 67,664 | | | 6.4% |

| Retail segment | | 24,457 | | | 10.7% | | 22,313 | | | 10.9% | | 73,003 | | | 11.2% | | 79,512 | | | 12.7% |

| Corporate and Other | | (12,854) | | | N/M | | (12,463) | | | N/M | | (38,786) | | | N/M | | (46,477) | | | N/M |

| Consolidated GAAP operating income | | $ | 35,168 | | | 6.7% | | $ | 32,561 | | | 6.5% | | $ | 106,310 | | | 6.9% | | $ | 100,699 | | | 6.7% |

| | | | | | | | | | | | | | | | |

| Non-GAAP items affecting operating income | | | | | | | | | | | | | | | | |

| Wholesale segment | | $ | 55 | | | | | $ | 262 | | | | | $ | 166 | | | | | $ | 5,987 | | | |

| Retail segment | | — | | | | | — | | | | | 140 | | | | | — | | | |

| Corporate and Other | | 199 | | | | | 199 | | | | | 599 | | | | | 598 | | | |

| Consolidated Non-GAAP items affecting operating income | | $ | 254 | | | | | $ | 461 | | | | | $ | 905 | | | | | $ | 6,585 | | | |

| | | | | | | | | | | | | | | | |

| Non-GAAP operating income (loss) | | | | | | | | | | | | | | | | |

| Wholesale segment | | $ | 23,620 | | | 6.5% | | $ | 22,973 | | | 6.4% | | $ | 72,259 | | | 6.7% | | $ | 73,651 | | | 7.0% |

| Retail segment | | 24,457 | | | 10.7% | | 22,313 | | | 10.9% | | 73,143 | | | 11.2% | | 79,512 | | | 12.7% |

| Corporate and Other | | (12,655) | | | N/M | | (12,264) | | | N/M | | (38,187) | | | N/M | | (45,879) | | | N/M |

| Consolidated Non-GAAP operating income | | $ | 35,422 | | | 6.8% | | $ | 33,022 | | | 6.6% | | $ | 107,215 | | | 7.0% | | $ | 107,284 | | | 7.2% |

| | | | | | | | | | | | | | | | |

| N/M - Not Meaningful | | | | | | | | | | | | | | | | |

Document and Entity Information

|

Feb. 18, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 18, 2025

|

| Entity Registrant Name |

LA-Z-BOY INCORPORATED

|

| Entity Incorporation, State or Country Code |

MI

|

| Entity File Number |

1-9656

|

| Entity Tax Identification Number |

38-0751137

|

| Entity Address, Address Line One |

One La-Z-Boy Drive,

|

| Entity Address, City or Town |

Monroe,

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48162-5138

|

| City Area Code |

734

|

| Local Phone Number |

242-1444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

LZB

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000057131

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

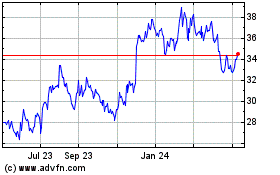

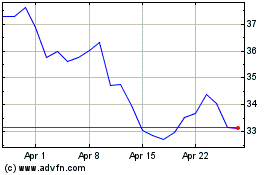

La Z Boy (NYSE:LZB)

Historical Stock Chart

From Feb 2025 to Mar 2025

La Z Boy (NYSE:LZB)

Historical Stock Chart

From Mar 2024 to Mar 2025