KRONOS WORLDWIDE, INC. PRICES PRIVATE OFFERING OF AN ADDITIONAL €75 MILLION OF 9.50% SENIOR SECURED NOTES DUE 2029

July 23 2024 - 4:23PM

Kronos Worldwide, Inc. (NYSE: KRO) (the “Company”) announced today

that its wholly-owned subsidiary, Kronos International, Inc.

(“KII”), has agreed to sell €75 million aggregate principal amount

of additional 9.50% Senior Secured Notes due 2029 (the “Notes”)

through an institutional private placement. The Notes will be

issued as additional notes to the existing €276,174,000 aggregate

principal amount of 9.50% Senior Secured Notes due 2029 that KII

issued on February 12, 2024 (the “Existing Notes”). Other than with

respect to the date of issuance and issue price, the Notes will

have the same terms as the Existing Notes. The Notes will be

maintained under the same ISIN and Common Code numbers as the

Existing Notes, except that the Notes issued pursuant to

Regulation S under the U.S. Securities Act of 1933, as amended

(the “Securities Act”), will trade separately under different ISIN

and Common Code numbers until 40 days after the issue date of the

Notes, but thereafter, the Notes issued pursuant to

Regulation S will be maintained under the same ISIN and Common

Code numbers as the Existing Notes issued pursuant to Regulation

S.

The Notes will be fully and unconditionally

guaranteed, jointly and severally, on a senior basis by the Company

and each of its direct and indirect domestic, wholly-owned

subsidiaries (other than the Issuer, the “Guarantors”), subject to

certain exceptions and secured by first-priority security interests

in certain assets of the Company and the Guarantors.

The Notes were oversubscribed and priced at a

premium of 107.50%. The proceeds to the Company are expected to be

approximately €80,625,000 (or approximately $87,500,000 at current

exchange rates) before fees and expenses. The Company intends to

use the proceeds of the offering, after payment of fees and

expenses, to repay a portion of its global revolving credit

facility with Wells Fargo, on which it drew in connection with its

recently announced acquisition of the remaining equity interest

that it did not already own of Louisiana Pigment Company. L.P., a

chloride-process TiO2 production facility located in Lake Charles,

LA which the Company had previously operated as a 50% owned joint

venture with Venator Materials. Subject to customary closing

conditions, the closing of this offering is expected to occur on or

about July 30, 2024.

This press release shall not constitute an offer

to sell, or the solicitation of an offer to buy any of the Notes

nor shall there be any sales of the Notes in any jurisdiction in

which such offer, solicitation or sale would be unlawful without

registration or qualification under the securities laws of any such

jurisdiction. This notice is being issued pursuant to and in

accordance with Rule 135(c) under the Securities Act.

The Notes and related guarantees subject to the

private placement have not been and will not be registered under

the Securities Act, or any state securities laws, and will be sold

only to persons reasonably believed to be qualified institutional

buyers in reliance on Rule 144A under the Securities Act and in

offshore transactions to non-U.S. persons (within the meaning of

Regulation S) outside the U.S. that are not “retail investors”

residing in a member state of the EEA or the UK. The Notes and

related guarantees may not be offered or sold in the United States

or to U.S. persons except pursuant to registration under or an

exemption from the registration requirements of the Securities Act

and applicable state securities laws.

About the Company

Kronos Worldwide, Inc., incorporated in Delaware

in 1989, is a leading global producer and marketer of value-added

titanium dioxide pigments, or TiO2, a base industrial product used

in a wide range of applications. The Company, along with its

distributors and agents, sells and provides technical services for

its products to approximately 3,000 customers in 100 countries with

the majority of its sales in Europe, North America and the Asia

Pacific region. The Company believes it has developed considerable

expertise and efficiency in the manufacture, sale, shipment and

service of its products in domestic and international markets.

Forward-Looking Statements

The statements in this press release relating to

matters that are not historical facts are forward-looking

statements that represent management’s beliefs and assumptions

based on currently available information. These forward-looking

statements include, among others, statements about the potential

outcome or effect of the notes offering or the use of proceeds

therefrom. Although Kronos believes the expectations reflected in

such forward-looking statements are reasonable, it cannot give any

assurances that these expectations will prove to be correct. Such

statements by their nature involve substantial risks and

uncertainties that could significantly impact expected results, and

actual future results could differ materially from those described

in such forward-looking statements. The factors that could cause

actual future results to differ materially include, but are not

limited to, those identified in the Company’s most recent annual

and quarterly reports filed with the Securities and Exchange

Commission.

* * * * *

This news release is for informational purposes only and is not

an offer to sell, or the solicitation of an offer to buy,

securities.

Investor Relations Contact

Bryan A. HanleySenior Vice President and TreasurerTel.

972-233-1700

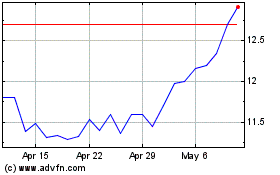

Kronos Worldwide (NYSE:KRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

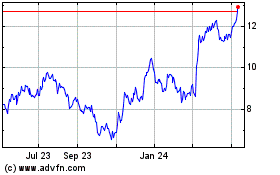

Kronos Worldwide (NYSE:KRO)

Historical Stock Chart

From Nov 2023 to Nov 2024