Kosmos Energy Ltd. (“Kosmos” or the “Company”) (NYSE: KOS) notes

today’s announcement by Tullow Oil plc (“Tullow”) (LSE: TLW)

regarding a potential transaction involving Tullow and Kosmos and

confirms that it is in very preliminary discussions with Tullow

regarding a possible all-share offer by Kosmos for Tullow.

There can be no certainty that any offer will be made, nor as to

the terms on which any offer might be made. Pursuant to Rule 2.5 of

the Code, Kosmos reserves the right to vary the form and/or mix of

the offer consideration and vary the transaction structure. A

further announcement will be made as and when appropriate.

As stated in today’s announcement by Tullow, in accordance with

Rule 2.6(a) of the Code, Kosmos is required, by not later than 5.00

p.m. on 9 January 2025, to either announce a firm intention

to make an offer for Tullow in accordance with Rule 2.7 of the Code

or announce that it does not intend to make an offer, in which case

the announcement will be treated as a statement to which Rule 2.8

of the Code applies. This deadline can be extended with the consent

of the Takeover Panel in accordance with Rule 2.6(c) of the

Code.

ABOUT KOSMOS

Kosmos is a full-cycle deepwater, independent oil and gas

exploration and production company focused along the offshore

Atlantic Margins. Our key assets include production offshore Ghana,

Equatorial Guinea and the U.S. Gulf of Mexico, as well as a

world-class gas development offshore Mauritania and Senegal. We

also pursue a proven basin exploration program in Equatorial

Guinea, Ghana and the U.S. Gulf of Mexico. Kosmos is listed on the

New York Stock Exchange and London Stock Exchange and is traded

under the ticker symbol KOS. As an ethical and transparent company,

Kosmos is committed to doing things the right way. The Company’s

Business Principles articulate our commitment to transparency,

ethics, human rights, safety and the environment. Read more about

this commitment in our Corporate Responsibility Report. For

additional information, visit www.kosmosenergy.com.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION.

THIS IS NOT AN ANNOUNCEMENT OF A FIRM INTENTION TO MAKE AN

OFFER UNDER RULE 2.7 OF THE CITY CODE ON TAKEOVERS AND MERGERS (THE

"CODE") AND THERE CAN BE NO CERTAINTY THAT AN OFFER WILL BE MADE,

NOR AS TO THE TERMS ON WHICH ANY OFFER MIGHT BE MADE.

PUBLICATION ON A WEBSITE

In accordance with Rule 26.1 of the Code, a copy of this

announcement will be made available on www.kosmosenergy.com no

later than 12 noon (London time) on the business day following the

date of this announcement. The content of the website referred to

above is not incorporated into and does not form part of this

announcement.

The person responsible for arranging for the release of this

announcement on behalf of Kosmos is Josh Marion.

RULE 2.4 INFORMATION

In accordance with Rule 2.4(c)(iii) of the Code, Kosmos confirms

that it is not aware of any dealings in Tullow shares that would

require a minimum level, or particular form, of consideration that

it would be obliged to offer under Rule 6 or Rule 11 of the Code

(as appropriate). However, it has not been practicable for Kosmos

to make enquiries of all persons presumed to be acting in concert

with it prior to this announcement in order to confirm whether any

details are required to be disclosed under Rule 2.4(c)(iii). To the

extent that any such details are identified following such

enquiries, Kosmos will make an announcement disclosing such details

as soon as practicable, and in any event by no later than the time

it is required to make its Opening Position Disclosure under Rule

8.1 of the Code.

RULE 2.9 INFORMATION

In accordance with Rule 2.9 of the Code, Kosmos confirms that,

as at close of business on 12 December 2024 (being the business day

prior to the date of this announcement), its issued share capital

consisted of 471,816,671 ordinary shares with a par value of $0.01

each in the capital of Kosmos which carry voting rights of one vote

per share and admitted to trading on the New York Stock Exchange

and London Stock Exchange with International Securities

Identification Number (“ISIN”) US5006881065.

IMPORTANT NOTICES

Evercore Partners International LLP ("Evercore"), which is

authorised and regulated by the Financial Conduct Authority in the

UK, is acting exclusively as financial adviser to Kosmos and no one

else in connection with the matters described in this announcement

and will not be responsible to anyone other than Kosmos for

providing the protections afforded to clients of Evercore nor for

providing advice in connection with the matters referred to herein.

Neither Evercore nor any of its subsidiaries, branches or

affiliates owes or accepts any duty, liability, or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Evercore in connection with this announcement, any statement

contained herein, any offer or otherwise. Apart from the

responsibilities and liabilities, if any, which may be imposed on

Evercore by the Financial Services and Markets Act 2000 and

successor legislation, or the regulatory regime established

thereunder, or under the regulatory regime of any jurisdiction

where exclusion of liability under the relevant regulatory regime

would be illegal, void or unenforceable, neither Evercore nor any

of its affiliates accepts any responsibility or liability

whatsoever for the contents of this announcement, and no

representation, express or implied, is made by it, or purported to

be made on its behalf, in relation to the contents of this

announcement, including its accuracy, completeness or verification

of any other statement made or purported to be made by it, or on

its behalf, in connection with Kosmos or the matters described in

this announcement. To the fullest extent permitted by applicable

law, Evercore and its affiliates accordingly disclaim all and any

responsibility or liability whether arising in tort, contract or

otherwise (save as referred to above) which they might otherwise

have in respect of this announcement, or any statement contained

herein.

DISCLOSURE REQUIREMENTS OF THE CODE

Under Rule 8.3(a) of the Code, any person who is interested in 1

per cent. or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified.

An Opening Position Disclosure must contain details of the

person's interests and short positions in, and rights to subscribe

for, any relevant securities of each of (i) the offeree company and

(ii) any securities exchange offeror(s). An Opening Position

Disclosure by a person to whom Rule 8.3(a) applies must be made by

not later than 3.30 pm (London time) on the 10th business day

following the commencement of the offer period and, if appropriate,

by not later than 3.30 pm (London time) on the 10th business day

following the announcement in which any securities exchange offeror

is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a securities exchange

offeror prior to the deadline for making an Opening Position

Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by not later than 3.30 pm

(London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and 8.4 of

the Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212449846/en/

ENQUIRIES

Kosmos Jamie Buckland, Investor Relations, +44 (0) 203

954 2831 Thomas Golembeski, Media Relations, +1-214-445-9674

Evercore (Financial Adviser to Kosmos) Tel: +44 (0) 20

7653 6000 David Waring Ed Banks Hugo Baker Julien Baril

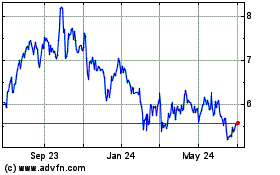

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

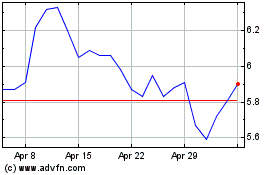

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Dec 2023 to Dec 2024