UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04058

The Korea Fund, Inc.

(Exact name of registrant as specified in charter)

60 Victoria

Embankment, London, EC4Y 0JP

(Address of principal executive offices) (Zip Code)

c/o Carmine Lekstutis

Chief Legal Officer,

JPMorgan, 4 New York Plaza, New York, NY 10004

(Name and address of agent for service)

Registrant’s telephone number, including area code: +44 207 742 3436

Date of fiscal year end: June 30

Date of reporting period: December 31, 2023

Beginning on January 1,

2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be

made available on the Fund’s website (www.thekoreafund.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect

to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Fund’s stockholder

servicing agent at (866) 706-0510.

If you prefer to receive paper copies of your shareholder reports after

January 1, 2021, direct investors may inform the Fund at any time by calling the Fund’s stockholder servicing agent at (866) 706-0510. If you invest through a financial intermediary, you should

contact your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Fund or all funds held in your

account if you invest through your financial intermediary.

Semi-Annual Report

December 31, 2023

This report contains the following two documents:

| • |

|

Chairman’s Letter to Stockholders |

| • |

|

Semi-Annual Report to Stockholders—December 31, 2023 |

The Korea Fund, Inc. Chairman’s Letter to Stockholders

Dear fellow Stockholders

We have pleasure in providing the semi-annual report for The Korea Fund, Inc. covering the first half of its financial year 2023 - 2024, that is from July 1

2023 to end-December 2023 - otherwise referred to herein as the “Period”.

After the Korean stock market reached a 14-month high point in early August, the Period witnessed a sell off through mid-October followed by a rally back to the

August high in December. For the Period the Fund gained 6.98% in US dollar terms which compares with a 7.83% gain in the Fund’s benchmark, the MSCI Korea 25/50 NR Index. Through this Period, your Funds performance ranked first quartile in our

consultant’s peer group.

Over the initial three months of the Period the

strength of the electric vehicles (“EV”) sector was more than offset by the hesitancy of the consumer whilst through the second quarter a ban on new short selling by the Financial Services Commission of South Korea raised the level of

speculation particularly in the mid and smaller cap sectors which raised the index level back up to the levels of July 2023. Of special note must be the fact that recent month-on-month exports from Korea to the US have exceeded, for the first time

for 20 years, exports to China.

The initial three-year performance tender period for

the Fund culminates as at the end of June 2024. Whilst the end of December 2023 NAV performance for this tender lagged the benchmark by 57 basis points (“BP’s”), the figure, as at February 14, 2024 NAV performance is 65 BP’s

ahead of benchmark.

Your investment adviser’s review follows in which there is

a reference to encouraging intentions of both the government and private sectors to stimulate financial markets for greater wealth accumulation as well as to better protect the interests of minority stockholders. The Bank of Korea is forecasting

2024 GDP growth at 2.1% up from 2023’s growth of 1.4% - led primarily by solid exports.

Numerous factors consume the time and attention of your Board but probably none more so than investment performance and fund expenses. Your Board constantly

strives to maintain expenses at the lowest possible levels: whilst expenses have been reduced somewhat over the recent years the decline in assets under management brought about by falling stock prices has had a greater and negative effect on

increasing the total expenses ratio (“TER”). The TER for fiscal 2023 stands at some 1.46%.

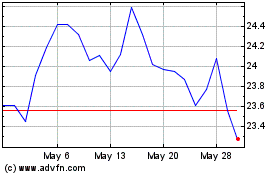

For some time, your Board has also been increasingly concerned with the lack of liquidity and free float as well as an unacceptable level of its stock discount,

relative to net asset value. In recent ‘listen only” mode discussions with stockholders we have endeavoured to best understand the desires of holders. Rest assured your Board will continue its search for a solution that will best provide

an outcome beneficial to all stockholders.

The Korea Fund, Inc. Chairman’s Letter to Stockholders (continued)

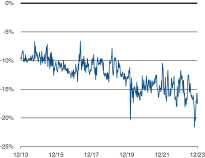

Your Board has continued the Fund’s buy back policy in an endeavour to reduce the

share discount, albeit at a rate lower than the maximum permitted. In the Period the stock price relative to NAV has traded in the discount range of 12.7 to 21.7 percent and as at February 14, 2024 stood at 16.4%.

May we thank all stockholders for your support through the Period.

Yours very sincerely,

For and On Behalf of the Korea Fund, Inc.

Julian Reid

Chair

Semi-Annual Report

December 31, 2023

The Korea Fund, Inc. Investment

Adviser’s Report

December 31, 2023 (unaudited)

Overview

In the six months to December 31, 2023, the KOSPI index rose 3.5% to finish at 2,655. In USD terms, the index rose 6.0% as the Won strengthened in the final two

months of the year to create significant differences in the performance data reported in the local and foreign currencies. Over the calendar year 2023, the KOSPI index rose 18.7% in the local currency terms and 16.4% in USD.

The third quarter saw the index and KRW weaken on continued stress from the

higher-for-longer interest rate environment amid a disappointing performance for the Chinese economy. This reversed in the fourth quarter on the back of growing optimism over the dovish pivot by the US Federal Reserve.

During the six months period, few sectors dominated performance and gains were in a

narrow section of the market. A temporary ban on new short selling from the beginning of November 2023 additionally hindered price discovery. The third quarter saw electric vehicle (EV) battery supply chain dominate with POSCO Holdings rising 61%.

The fourth quarter saw long duration stocks from healthcare and information technology (IT) and artificial intelligence (AI) outperform on falling interest rates. Domestic economy facing companies underperformed throughout the six months as they

were subject to populist and anti-market stress from politicians ahead of Korea’s legislative election due in April 2024.

Third and fourth quarter 2023 GDP rose 2.4% and 2.5% quarter on quarter, seasonally adjusted annual rate, respectively as exports contributed positively to

offset drags in domestic demand. Korea’s monthly exports turned positive year on year during the fourth quarter on the back of strong IT exports led by semiconductors. On a monthly exports value basis, December 2023 exports to the US (+21%

year on year) recorded the highest value, beating China (-3%) for the first time in 20 years—highlighting both the US economy’s continued strength and China’s struggle.

Fund Performance

From July 1, 2023 to December 31, 2023, the total return of The Korea Fund, Inc. (the

“Fund”) returned 6.98%, underperforming the Fund’s benchmark, the MSCI Korea 25/50 Index (Total Return) Index by 0.85%.

Performance Attribution Review

Over the six-month review period the portfolio’s underperformance was due to stock selection.

At the sector level, underweighting the industrials sector and overweighting the IT

sector added the most value. The Biotech sector and overweight in the materials sector detracted value.

|

|

|

|

|

|

|

| 12.31.23 | |

|

The Korea Fund, Inc. Semi-Annual Report |

|

|

1 |

|

The Korea Fund, Inc. Investment

Adviser’s Report

December 31, 2023 (unaudited) (continued)

At a stock level, the underweight position in EV battery supply chain contributed positively as concerns over slowing demand resulted in significant share price

correction in the fourth quarter. Hynix contributed positively on the back of a turnaround in demand for memory related products driven by the rising memory needs of Application Service Providers (ASP) and AI fueled High Bandwidth Memory demand. KB

Financial Group contributed on shareholder return commitment despite a forced contribution to the support package for small business borrowers.

At a stock level, the overweight position in LG Chem was the largest detractor. It was hurt by concerns over slow demand for chemicals and EV battery materials.

Not owning expensive biotechs like Celltrion and HLB took a significant toll on the performance in the fourth quarter. Their performances were fueled by the short sell ban and expectation on US Federal Reserve’s dovish pivot. Poor consumption

continued to hurt performances from our retail bets in BGF Retail and Hotel Shilla.

Market

Outlook

In January 2024, the heads of top regulatory agencies in the Korean

government along with various capital market leaders, announced their plans to come up with various measures to help Korean households create wealth through investment in financial assets. The plan calls for tax incentives—including possible

removal of capital gains tax which is set to be introduced from 2025 and “Corporate Value-Up Program” which seeks to imitate the Japan’s governance improvement program. The program plans to encourage companies to examine their chronic

low valuation and come up with remedies—prodded by “naming and shaming”. In addition, the financial authorities plan to make supportive regulatory changes aimed at protecting rights of minority shareholders from bad governance

activities. While questions remain on the financial authorities’ commitment to the latest governance drive, there is no doubt on the rising demand for governance improvement from some 14 million individual investors who account for a third of

eligible voters in Korea.

The Bank of Korea expects 2024 GDP growth to improve to

2.1% from 2023’s 1.4%—thanks to solid exports—led by a tech upcycle, offsetting sluggish domestic consumption. The Bank of Korea is expected to maintain its restrictive monetary policy through the first half of 2024—with the

market expecting the first rate cut in the third quarter of 2024.

While the

near-term outlook is clouded, with a slowing global economy and geopolitical uncertainties, we are constructive on the Korean equity market due to significant valuation merit with the market trading below book value and continued global

competitiveness for Korean manufactured goods assisted by favorable foreign exchange rates.

|

|

|

|

|

| 2 |

|

The Korea Fund, Inc. Semi-Annual Report |

|

| 12.31.23 |

The Korea Fund, Inc.

Performance & Statistics

December 31, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

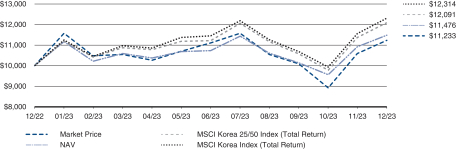

| Total Return(1) |

|

6 Months |

|

|

1 Year |

|

|

5 Year |

|

|

10 Year |

|

| Market Price |

|

|

1.12 |

% |

|

|

12.34 |

% |

|

|

0.88 |

% |

|

|

0.24 |

% |

| Net Asset Value (“NAV”) |

|

|

6.98 |

% |

|

|

14.77 |

% |

|

|

0.86 |

% |

|

|

0.23 |

% |

| MSCI Korea 25/50 Index (Total Return)(2) |

|

|

7.83 |

% |

|

|

20.91 |

% |

|

|

0.90 |

% |

|

|

0.27 |

% |

| MSCI Korea Index (Total Return)(2) |

|

|

7.63 |

% |

|

|

23.16 |

% |

|

|

1.05 |

% |

|

|

0.31 |

% |

Fund Performance Line Graph(1)

Premium (Discount) to

NAV:

December 31, 2013 to December 31, 2023

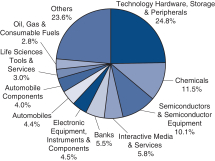

Industry Breakdown (as a % of net assets):

|

|

|

|

|

| Market Price/NAV: |

|

|

|

| Market Price |

|

|

$23.40 |

|

|

NAV(3) |

|

|

$28.36 |

|

| Discount to NAV |

|

|

17.49 |

% |

|

|

|

|

|

|

|

| Ten Largest Holdings (as a % of net assets): |

|

| 1. |

|

Samsung Electronics Co. Ltd. |

|

|

19.5 |

% |

| 2. |

|

SK Hynix, Inc. |

|

|

9.3 |

|

| 3. |

|

Samsung Electronics Co. Ltd. (Preference) |

|

|

5.6 |

|

| 4. |

|

LG Chem Ltd. |

|

|

4.8 |

|

| 5. |

|

NAVER Corp. |

|

|

4.2 |

|

| 6. |

|

Hyundai Mobis Co. Ltd. |

|

|

3.2 |

|

| 7. |

|

Hyundai Motor Co. (Preference) |

|

|

3.0 |

|

| 8. |

|

KB Financial Group, Inc. |

|

|

2.9 |

|

| 9. |

|

Samsung Electro-Mechanics Co. Ltd. |

|

|

2.5 |

|

| 10. |

|

Samsung Biologics Co. Ltd. |

|

|

2.3 |

|

|

|

|

|

|

|

|

| 12.31.23 | |

|

The Korea Fund, Inc. Semi-Annual Report |

|

|

3 |

|

The Korea Fund, Inc. Performance & Statistics

December 31, 2023 (unaudited) (continued)

Notes to Performance & Statistics:

| (1) |

|

Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all

dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return does not reflect the deduction of taxes that a

shareholder may pay on the receipt of distributions made by the Fund or on the proceeds of any sales of the Fund’s shares made by a shareholder. Total return for a period of more than one year represents the average annual total return.

|

| |

|

Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors

such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends. |

| |

|

An investment in the Fund involves risk, including the loss of principal. Total return, market price and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is

not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is

equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily. |

| (2) |

|

Morgan Stanley Capital International (“MSCI”) Korea Index is a market capitalization-weighted index of equity securities of companies domiciled in Korea. The index is designed to represent the performance of

the Korean stock market and excludes certain market segments unavailable to U.S. based investors. The MSCI Korea Index (Total Return) returns assume reinvestment of dividends (net of foreign withholding taxes) and, unlike Fund returns, do not

reflect any fees or expenses. Effective July 1, 2017, the Board approved The MSCI Korea 25/50 Index (Total Return) as the primary benchmark for the Fund. The MSCI Korea 25/50 Index (Total Return) is designed to measure the performance of the large

and mid cap segments of the Korean market. It applies certain investment limits that are imposed on regulated investment companies, or RICs, under the current US Internal Revenue Code. One requirement of a RIC is that at the end of each quarter of

its tax year no more than 25% of the value of the RIC’s total assets may be invested in a single issuer and the sum of the weights of all issuers representing more than 5% of the fund should not exceed 50% of the fund’s total assets. The

index covers approximately 85% of the free float-adjusted market capitalization in Korea. The returns assume reinvestment of dividends (net of foreign withholding taxes) but do not reflect any fees or expenses. It is not possible to invest directly

in an index. Total Return for a period of more than one year represents the average annual return. |

| (3) |

|

The NAV disclosed in the Fund’s financial statements may differ from this NAV due to accounting principles generally accepted in the United States of America. |

|

|

|

|

|

| 4 |

|

The Korea Fund, Inc. Semi-Annual Report |

|

| 12.31.23 |

The Korea Fund, Inc. Schedule of

Portfolio Investments

As of December 31, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Investments |

|

Value ($) |

|

| |

COMMON STOCKS–98.8% |

|

|

|

|

|

Automobile Components–4.0% |

|

|

|

|

| |

33,300 |

|

|

Hankook Tire & Technology Co. Ltd.* |

|

|

$ 1,170,390 |

|

| |

23,850 |

|

|

Hyundai Mobis Co. Ltd. |

|

|

4,369,631 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,540,021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobiles–4.4% |

|

|

|

|

| |

46,000 |

|

|

Hyundai Motor Co. (Preference) |

|

|

4,072,958 |

|

| |

25,400 |

|

|

Kia Corp.* |

|

|

1,964,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,037,224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banks–5.5% |

|

|

|

|

| |

87,500 |

|

|

Hana Financial Group, Inc. |

|

|

2,935,151 |

|

| |

30,500 |

|

|

KakaoBank Corp.* |

|

|

671,602 |

|

| |

96,600 |

|

|

KB Financial Group, Inc. |

|

|

4,030,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,637,079 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Biotechnology–1.6% |

|

|

|

|

| |

37,260 |

|

|

APRILBIO Co. Ltd.* |

|

|

485,964 |

|

| |

14,500 |

|

|

Hugel, Inc.* |

|

|

1,677,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,163,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Markets–2.3% |

|

|

|

|

| |

23,300 |

|

|

KIWOOM Securities Co. Ltd.* |

|

|

1,792,846 |

|

| |

30,300 |

|

|

Korea Investment Holdings Co. Ltd.* |

|

|

1,435,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,227,961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chemicals–11.5% |

|

|

|

|

| |

34,800 |

|

|

DL Holdings Co. Ltd.* |

|

|

1,382,599 |

|

| |

76,100 |

|

|

Dongsung Finetec Co. Ltd.* |

|

|

720,045 |

|

| |

7,986 |

|

|

Hansol Chemical Co. Ltd.* |

|

|

1,399,733 |

|

| |

12,700 |

|

|

Kumho Petrochemical Co. Ltd.* |

|

|

1,304,188 |

|

| |

16,950 |

|

|

LG Chem Ltd.* |

|

|

6,519,368 |

|

| |

7,700 |

|

|

Lotte Chemical Corp.* |

|

|

912,314 |

|

| |

27,000 |

|

|

SK IE Technology Co. Ltd.*(a) |

|

|

1,642,816 |

|

| |

18,400 |

|

|

SKC Co. Ltd.* |

|

|

1,286,645 |

|

| |

2,900 |

|

|

Soulbrain Co. Ltd.* |

|

|

681,451 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,849,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Staples Distribution & Retail–1.2% |

|

|

|

|

| |

15,704 |

|

|

BGF retail Co. Ltd.* |

|

|

1,594,941 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Equipment, Instruments & Components–4.5% |

|

|

|

|

| |

28,500 |

|

|

Samsung Electro-Mechanics Co. Ltd.* |

|

|

3,376,586 |

|

| |

7,200 |

|

|

Samsung SDI Co. Ltd.* |

|

|

2,621,454 |

|

| |

8,680 |

|

|

SOLUM Co. Ltd.* |

|

|

183,643 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,181,683 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entertainment–2.7% |

|

|

|

|

| |

8,750 |

|

|

NCSoft Corp.* |

|

|

1,627,426 |

|

| |

44,252 |

|

|

Nexon Games Co. Ltd.* |

|

|

513,590 |

|

| |

16,300 |

|

|

SM Entertainment Co. Ltd.* |

|

|

1,162,759 |

|

| |

12,000 |

|

|

YG Entertainment, Inc.* |

|

|

473,489 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,777,264 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12.31.23 | |

|

The Korea Fund, Inc. Semi-Annual Report |

|

|

5 |

|

The Korea Fund, Inc. Schedule of Portfolio Investments

As of December 31, 2023 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Investments |

|

Value ($) |

|

|

|

|

|

Food Products–2.5% |

|

|

|

|

| |

7,550 |

|

|

CJ CheilJedang Corp. |

|

|

$ 1,894,938 |

|

| |

18,000 |

|

|

Orion Corp.* |

|

|

1,615,322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,510,260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Equipment & Supplies–0.4% |

|

|

|

|

| |

24,000 |

|

|

Suheung Co. Ltd.* |

|

|

534,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Durables–0.8% |

|

|

|

|

| |

25,500 |

|

|

Coway Co. Ltd.* |

|

|

1,127,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Conglomerates–1.6% |

|

|

|

|

| |

16,500 |

|

|

SK, Inc. |

|

|

2,271,210 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance–2.4% |

|

|

|

|

| |

76,900 |

|

|

Hyundai Marine & Fire Insurance Co. Ltd.* |

|

|

1,845,054 |

|

| |

27,600 |

|

|

Samsung Life Insurance Co. Ltd.* |

|

|

1,476,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,321,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interactive Media & Services–5.8% |

|

|

|

|

| |

10,335 |

|

|

AfreecaTV Co. Ltd.* |

|

|

683,686 |

|

| |

37,100 |

|

|

Kakao Corp.* |

|

|

1,556,334 |

|

| |

33,500 |

|

|

NAVER Corp.* |

|

|

5,796,183 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,036,203 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Life Sciences Tools & Services–3.0% |

|

|

|

|

| |

5,450 |

|

|

Samsung Biologics Co. Ltd.*(a) |

|

|

3,206,126 |

|

| |

18,900 |

|

|

ST Pharm Co. Ltd.* |

|

|

991,726 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,197,852 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery–1.3% |

|

|

|

|

| |

130,000 |

|

|

HSD Engine Co. Ltd.* |

|

|

985,663 |

|

| |

36,500 |

|

|

Hy-Lok Corp.* |

|

|

753,269 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,738,932 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metals & Mining–1.4% |

|

|

|

|

| |

5,200 |

|

|

POSCO Holdings, Inc. |

|

|

1,999,352 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels–2.8% |

|

|

|

|

| |

16,300 |

|

|

SK Innovation Co. Ltd.* |

|

|

1,763,949 |

|

| |

39,700 |

|

|

S-Oil Corp. |

|

|

2,137,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,901,710 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Passenger Airlines–1.4% |

|

|

|

|

| |

105,000 |

|

|

Korean Air Lines Co. Ltd.* |

|

|

1,939,883 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pharmaceuticals–1.0% |

|

|

|

|

| |

30,900 |

|

|

HK inno N Corp.* |

|

|

1,065,006 |

|

| |

7,200 |

|

|

Yuhan Corp.* |

|

|

383,882 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,448,888 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Professional Services–0.4% |

|

|

|

|

| |

71,554 |

|

|

NICE Information Service Co. Ltd.* |

|

|

525,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment–10.1% |

|

|

|

|

| |

27,000 |

|

|

HAESUNG DS Co. Ltd.* |

|

|

1,152,784 |

|

| |

117,000 |

|

|

SK Hynix, Inc. |

|

|

12,769,142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,921,926 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6 |

|

The Korea Fund, Inc. Semi-Annual Report |

|

| 12.31.23 |

The Korea Fund, Inc. Schedule of

Portfolio Investments

As of December 31, 2023 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Investments |

|

Value ($) |

|

|

|

|

|

Specialty Retail–1.4% |

|

|

|

|

| |

19,800 |

|

|

Hotel Shilla Co. Ltd.* |

|

|

$ 1,001,893 |

|

| |

103,984 |

|

|

K Car Co. Ltd. |

|

|

943,269 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,945,162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals–24.8% |

|

|

|

|

| |

440,500 |

|

|

Samsung Electronics Co. Ltd. |

|

|

26,736,959 |

|

| |

158,000 |

|

|

Samsung Electronics Co. Ltd. (Preference) |

|

|

7,613,468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,350,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks (Cost $102,962,073) |

|

|

136,780,421 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments–98.8% (Cost $102,962,073) |

|

|

136,780,421 |

|

|

|

|

|

Other Assets Less Liabilities–1.2% |

|

|

1,591,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets–100.0% |

|

|

$138,372,199 |

|

|

|

|

|

|

|

|

|

|

Percentages indicated

are based on net assets.

Abbreviations

|

|

|

| Preference |

|

A special type of equity investment that shares in the earnings of the company, has limited voting rights, and may have a dividend preference. Preference shares may also have liquidation preference. |

|

|

| (a) |

|

Security exempt from registration pursuant to Regulation S under the Securities Act of 1933, as amended. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling

efforts in the United States and as such may have restrictions on resale. |

|

|

| * |

|

Non-income producing security. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 1

Quoted prices |

|

|

Level 2

Other significant

observable

inputs |

|

|

Level 3

Significant

unobservable

inputs |

|

|

Total |

|

|

|

|

|

|

| Total Investments in Securities (a) |

|

$ |

— |

|

|

$ |

136,780,421 |

|

|

|

— |

|

|

|

136,780,421 |

|

| (a) |

|

Please refer to the schedule of portfolio investments for specifics of portfolio holdings. |

|

|

|

|

|

|

|

|

|

|

| See Notes to Financial Statements |

|

| 12.31.23 | |

|

The Korea Fund, Inc. Semi-Annual Report |

|

|

7 |

|

The Korea Fund, Inc. Statement of Assets

and Liabilities

As of December 31, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

| |

|

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

| Investments, at value |

|

|

|

|

|

|

$136,780,421 |

|

|

|

|

| Cash |

|

|

|

|

|

|

176,446 |

|

|

|

|

| Foreign currency, at value |

|

|

|

|

|

|

542,609 |

|

|

|

|

| Prepaid expenses and other assets |

|

|

|

|

|

|

45,345 |

|

|

|

|

| Receivables: |

|

|

|

|

|

|

|

|

|

|

|

| Investment securities sold |

|

|

|

|

|

|

851,916 |

|

|

|

|

| Dividends (net of withholding taxes) |

|

|

|

|

|

|

932,139 |

|

|

|

|

| Total Assets |

|

|

|

|

|

|

139,328,876 |

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Payables: |

|

|

|

|

|

|

|

|

|

|

|

| Investment securities purchased |

|

|

|

|

|

|

737,452 |

|

|

|

|

| Fund shares repurchased |

|

|

|

|

|

|

28,529 |

|

|

|

|

| Accrued liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Investment Management fees |

|

|

|

|

|

|

78,470 |

|

|

|

|

| Custodian, administrator and accounting agent fees |

|

|

|

|

|

|

36,800 |

|

|

|

|

| Other |

|

|

|

|

|

|

75,426 |

|

|

|

|

| Total Liabilities |

|

|

|

|

|

|

956,677 |

|

|

|

|

| Net Assets |

|

|

|

|

|

|

$138,372,199 |

|

|

|

|

| Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

| Common Stock: |

|

|

|

|

|

|

|

|

|

|

|

| Par value ($0.01 per share, applicable to $4,878,173 shares issued

and outstanding) |

|

|

|

|

|

|

$48,782 |

|

|

|

|

|

Paid-in-capital in excess of par |

|

|

|

|

|

|

123,761,295 |

|

|

|

|

| Total distributable earnings (loss) |

|

|

|

|

|

|

14,562,122 |

|

|

|

|

| Net Assets |

|

|

|

|

|

|

$138,372,199 |

|

|

|

|

| Net Asset Value Per Share |

|

|

|

|

|

|

$28.37 |

|

|

|

|

| Cost of investments |

|

|

|

|

|

|

$102,962,073 |

|

|

|

|

| Cost of foreign currency |

|

|

|

|

|

|

535,018 |

|

|

|

|

|

|

|

|

| 8 |

|

The Korea Fund, Inc. Semi-Annual Report |

|

| 12.31.23 | |

|

See Notes to Financial Statements |

The Korea Fund, Inc. Statement of

Operations

For the Six Months Ended December 31, 2023 (unaudited)

|

|

|

|

|

|

|

|

|

| |

|

|

| Investment Income: |

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

|

$1,545 |

|

|

|

|

| Dividend income |

|

|

|

|

|

|

1,412,598 |

|

|

|

|

| Foreign taxes withheld (net) |

|

|

|

|

|

|

(236,726) |

|

|

|

|

| Total investment income |

|

|

|

|

|

|

1,177,417 |

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Investment Management (See Note 3) |

|

|

|

|

|

|

454,055 |

|

|

|

|

| Interest expense |

|

|

|

|

|

|

1 |

|

|

|

|

| Legal |

|

|

|

|

|

|

96,772 |

|

|

|

|

| Directors |

|

|

|

|

|

|

124,852 |

|

|

|

|

| Custodian, administrator and accounting agent fees |

|

|

|

|

|

|

107,211 |

|

|

|

|

| Insurance |

|

|

|

|

|

|

55,002 |

|

|

|

|

| Audit and tax services |

|

|

|

|

|

|

42,912 |

|

|

|

|

| Stockholder communications |

|

|

|

|

|

|

28,456 |

|

|

|

|

| Transfer agent |

|

|

|

|

|

|

16,598 |

|

|

|

|

| New York Stock Exchange listing |

|

|

|

|

|

|

31,250 |

|

|

|

|

| Other |

|

|

|

|

|

|

1,535 |

|

|

|

|

| Total expenses |

|

|

|

|

|

|

958,644 |

|

|

|

|

| Net Investment Income (loss) |

|

|

|

|

|

|

218,773 |

|

|

|

|

| Realized/Unrealized Gains (Losses): |

|

|

|

|

|

|

|

|

|

|

|

| Net realized gain (loss) on transactions from: |

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

(3,499,467) |

|

|

|

|

| Foreign currency transactions |

|

|

|

|

|

|

75 |

|

|

|

|

| Net realized gain (loss) |

|

|

|

|

|

|

(3,499,392) |

|

|

|

|

| Change in net unrealized appreciation/depreciation on: |

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

12,028,035 |

|

|

|

|

| Foreign currency translations |

|

|

|

|

|

|

11,720 |

|

|

|

|

| Change in net unrealized appreciation/depreciation |

|

|

|

|

|

|

12,039,755 |

|

|

|

|

| Net realized/unrealized gains (losses) |

|

|

|

|

|

|

8,540,363 |

|

|

|

|

| Change in Net Assets Resulting from Operations |

|

|

|

|

|

|

$8,759,136 |

|

|

|

|

|

|

|

|

|

|

| See Notes to Financial Statements |

|

| 12.31.23 | |

|

The Korea Fund, Inc. Semi-Annual Report |

|

|

9 |

|

The Korea Fund, Inc. Statements of

Changes in Net Assets

For the Periods Indicated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Six Months Ended

December 31, 2023

(Unaudited) |

|

|

|

|

|

Year Ended

June 30, 2023 |

|

|

|

|

|

|

| Change in Net Assets Resulting from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

|

|

|

|

$218,773 |

|

|

|

|

|

|

|

$925,212 |

|

|

|

|

|

|

| Net realized (loss) |

|

|

|

|

|

|

(3,499,392) |

|

|

|

|

|

|

|

(12,490,770) |

|

|

|

|

|

|

| Change in net unrealized appreciation/depreciation |

|

|

|

|

|

|

12,039,755 |

|

|

|

|

|

|

|

17,721,120 |

|

|

|

|

|

|

| Change in net assets resulting from operations |

|

|

|

|

|

|

8,759,136 |

|

|

|

|

|

|

|

6,155,562 |

|

|

|

|

|

|

| Distributions to Stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributable earnings |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(16,400,673) |

|

|

|

|

|

|

| Return of capital |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(109,644) |

|

|

|

|

|

|

| Total distributions to stockholders |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(16,510,317) |

|

|

|

|

|

|

| Common Stock Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of shares repurchased |

|

|

|

|

|

|

(1,105,125) |

|

|

|

|

|

|

|

(1,726,806) |

|

|

|

|

|

|

| Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in net assets |

|

|

|

|

|

|

7,654,011 |

|

|

|

|

|

|

|

(12,081,561) |

|

|

|

|

|

|

| Beginning of period |

|

|

|

|

|

|

130,718,188 |

|

|

|

|

|

|

|

142,799,749 |

|

|

|

|

|

|

| End of period |

|

|

|

|

|

|

$138,372,199 |

|

|

|

|

|

|

|

$130,718,188 |

|

|

|

|

|

|

| Shares Activity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares outstanding, beginning of year |

|

|

|

|

|

|

4,929,184 |

|

|

|

|

|

|

|

5,003,506 |

|

|

|

|

|

|

| Shares repurchased |

|

|

|

|

|

|

(51,011) |

|

|

|

|

|

|

|

(74,322) |

|

|

|

|

|

|

| Shares outstanding, end of year |

|

|

|

|

|

|

4,878,173 |

|

|

|

|

|

|

|

4,929,184 |

|

|

|

|

|

|

|

|

| 10 |

|

The Korea Fund, Inc. Semi-Annual Report |

|

| 12.31.23 | |

|

See Notes to Financial Statements |

The Korea Fund, Inc. Financial

Highlights

For a share of stock outstanding throughout each period^:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

Six Months

Ended

December 31,

2023

(Unaudited) |

|

|

|

|

Year ended June 30, |

|

| |

|

|

|

2023 |

|

|

|

|

|

2022 |

|

|

|

|

|

2021 |

|

|

|

|

|

2020 |

|

|

|

|

|

2019 |

|

| Net asset value, beginning of period |

|

|

|

|

$26.52 |

|

|

|

|

|

$28.54 |

|

|

|

|

|

|

|

$54.37 |

|

|

|

|

|

|

|

$31.09 |

|

|

|

|

|

|

|

$32.78 |

|

|

|

|

|

|

|

$42.39 |

|

| Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (1) |

|

|

|

|

0.04 |

|

|

|

|

|

0.19 |

|

|

|

|

|

|

|

0.32 |

|

|

|

|

|

|

|

0.21 |

|

|

|

|

|

|

|

0.16 |

|

|

|

|

|

|

|

0.22 |

|

| Net realized and change in unrealized gain (loss) |

|

|

|

|

1.76 |

|

|

|

|

|

1.06 |

|

|

|

|

|

|

|

(17.05 |

) |

|

|

|

|

|

|

23.58 |

|

|

|

|

|

|

|

(1.85 |

) |

|

|

|

|

|

|

(4.76 |

) |

| Total from investment operations |

|

|

|

|

1.80 |

|

|

|

|

|

1.25 |

|

|

|

|

|

|

|

(16.73 |

) |

|

|

|

|

|

|

23.79 |

|

|

|

|

|

|

|

(1.69 |

) |

|

|

|

|

|

|

(4.54 |

) |

| Dividends and Distributions to Stockholders from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

|

|

— |

|

|

|

|

|

(0.03 |

) |

|

|

|

|

|

|

(2.05 |

) |

|

|

|

|

|

|

(0.53 |

) |

|

|

|

|

|

|

(0.07 |

) |

|

|

|

|

|

|

(0.61 |

) |

| Net realized gains |

|

|

|

|

— |

|

|

|

|

|

(3.27 |

) |

|

|

|

|

|

|

(7.06 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(4.62 |

) |

| Return of capital |

|

|

|

|

— |

|

|

|

|

|

(0.02 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

| Total dividends and distributions to stockholders |

|

|

|

|

— |

|

|

|

|

|

(3.32 |

) |

|

|

|

|

|

|

(9.11 |

) |

|

|

|

|

|

|

(0.53 |

) |

|

|

|

|

|

|

(0.07 |

) |

|

|

|

|

|

|

(5.23 |

) |

| Common Stock Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accretion to net asset value resulting from share repurchases and

tender offer |

|

|

|

|

0.05 |

|

|

|

|

|

0.05 |

|

|

|

|

|

|

|

0.01 |

|

|

|

|

|

|

|

0.02 |

|

|

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

0.16 |

|

| Net asset value, end of period |

|

|

|

|

$28.37 |

|

|

|

|

|

$26.52 |

|

|

|

|

|

|

|

$28.54 |

|

|

|

|

|

|

|

$54.37 |

|

|

|

|

|

|

|

$31.09 |

|

|

|

|

|

|

|

$32.78 |

|

| Market price, end of period |

|

|

|

|

$23.40 |

|

|

|

|

|

$23.14 |

|

|

|

|

|

|

|

$24.35 |

|

|

|

|

|

|

|

$46.16 |

|

|

|

|

|

|

|

$25.85 |

|

|

|

|

|

|

|

$28.84 |

|

| Total return: (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value |

|

|

|

|

6.98 |

% |

|

|

|

|

5.34 |

% |

|

|

|

|

|

|

(35.39 |

)% |

|

|

|

|

|

|

76.93 |

% |

|

|

|

|

|

|

(4.96 |

)% |

|

|

|

|

|

|

(9.92 |

)% |

| Market price |

|

|

|

|

1.12 |

% |

|

|

|

|

8.60 |

% |

|

|

|

|

|

|

(33.55 |

)% |

|

|

|

|

|

|

80.66 |

% |

|

|

|

|

|

|

(10.15 |

)% |

|

|

|

|

|

|

(10.97 |

)% |

| RATIOS/SUPPLEMENTAL DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets, end of period (000s) |

|

|

|

|

$138,372 |

|

|

|

|

|

$130,718 |

|

|

|

|

|

|

|

$142,800 |

|

|

|

|

|

|

|

$272,946 |

|

|

|

|

|

|

|

$156,745 |

|

|

|

|

|

|

|

$168,093 |

|

| Ratio of expenses to average net assets |

|

|

|

|

1.48 |

%(3) |

|

|

|

|

1.46 |

% |

|

|

|

|

|

|

1.21 |

% |

|

|

|

|

|

|

1.12 |

% |

|

|

|

|

|

|

1.22 |

% |

|

|

|

|

|

|

1.25 |

% |

| Ratio of net investment income to average net assets |

|

|

|

|

0.34 |

%(3) |

|

|

|

|

0.70 |

% |

|

|

|

|

|

|

0.77 |

% |

|

|

|

|

|

|

0.46 |

% |

|

|

|

|

|

|

0.52 |

% |

|

|

|

|

|

|

0.62 |

% |

| Portfolio turnover rate |

|

|

|

|

19 |

% |

|

|

|

|

37 |

% |

|

|

|

|

|

|

35 |

% |

|

|

|

|

|

|

81 |

% |

|

|

|

|

|

|

42 |

% |

|

|

|

|

|

|

27 |

% |

| ^ |

|

A “—” may reflect actual amounts rounding to less than $0.01 or 0.01%. |

|

| (1) |

|

Calculated on average common shares outstanding during the period. |

|

| (2) |

|

Total return is calculated by subtracting the value of an investment in the Fund at the beginning of the specified period from the value at the end of the period and dividing the remainder by the value of the investment

at the beginning of the period and expressing the result as a percentage. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection

with the purchase or sale of Fund shares. Total return does not reflect the deduction of taxes that a shareholder may pay on the receipt of distributions made by the Fund or on proceeds of any sales of the Fund’s shares made by a shareholder.

Total return on net asset value may reflect adjustments to conform to U.S. GAAP. Total investment return for a period of less than one year is not annualized. Performance at market price will differ from results at NAV. Although market price returns

typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in

the Fund’s dividends. |

|

|

|

|

|

|

|

|

|

|

| See Notes to Financial Statements |

|

| 12.31.23 | |

|

The Korea Fund, Inc. Semi-Annual Report |

|

|

11 |

|

The Korea Fund, Inc. Notes to Financial

Statements

December 31, 2023 (unaudited)

1. Organization and Significant Accounting Policies

The Korea Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940

and the rules and regulations thereunder, as amended, as a closed-end, non-diversified management investment company organized as a Maryland corporation, and

accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services—Investment Companies. JPMorgan

Asset Management (Asia Pacific) Limited (the “Investment Adviser”) serves as the Fund’s investment manager. The Fund has authorized 200 million shares of common stock with $0.01 par value. The Korea Fund has filed a notice under

the Commodity Exchange Act under Regulation 4.5 that The Korea Fund is operated by JPMorgan Asset Management (Asia Pacific) Limited, a registered investment adviser that has claimed an exclusion from the definition of the term “commodity

pool operator” under the Commodity Exchange Act and, therefore, is not subject to registration or regulation as a commodity pool operator under the Commodity Exchange Act.

The Fund’s investment objective is to seek long-term capital appreciation through investment

in securities, primarily equity securities, of Korean companies. There can be no assurance that the Fund will meet its stated objective.

The preparation of the Fund’s financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S.

GAAP”) requires the Fund’s management to make estimates and assumptions that affect the reported amounts and disclosures in the Fund’s financial statements. Actual results could differ from those estimates.

Like many other companies, the Fund’s organizational documents provide that its officers

(“Officers”) and the Board of Directors of the Fund (the “Board” or the “Directors”) are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of

its principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Directors’ maximum exposure under these

arrangements is unknown as this could involve future claims against the Fund.

The following

is a summary of significant accounting policies consistently followed by the Fund:

(a)

Valuation of Investments

Portfolio securities and other financial instruments for which market quotations are readily available are valued at market value.

Market values for various types of securities and other instruments are determined on the basis of closing prices or last sales prices on an exchange or other market, or based on quotes or other market information obtained from quotation reporting

systems, established market makers or independent pricing services. For foreign equity securities (with certain exceptions, if any), the Fund fair values its securities daily using modeling tools provided by a statistical research service. This

service utilizes statistics and programs based on historical performance of markets and other economic data (which may include changes in the value of U.S. securities or security indices). Investments in mutual funds are valued at the net asset

value (“NAV”) as reported on each business day.

Portfolio securities and other

financial instruments for which market quotations are not readily available (including in cases where available market quotations are deemed to be unreliable), are fair valued, in good faith, under Rule 2a-5,

1940 Act, the Manager has been designated as “valuation designee”, pursuant to procedures established by the Board, or persons acting at their discretion (“Valuation Committee”) pursuant to procedures established by the Board.

The Fund’s investments are valued daily and the Fund’s NAV is calculated as of the close of regular trading (normally 4:00 p.m. Eastern Time) on the New York Stock Exchange (“NYSE”) on each day the NYSE is open for business

using prices supplied by an independent pricing service or broker/dealer quotations, or by using the last sale or settlement price on the exchange that is the primary market for such securities, or the mean between the last bid and ask quotations.

In unusual circumstances, the Board or the Valuation Committee may in good faith determine the NAV as of 4:00 p.m., Eastern Time, notwithstanding an earlier, unscheduled close or halt of trading on the NYSE.

Short-term investments having a remaining maturity of 60 days or less are valued at amortized cost

unless the Board or its Valuation Committee determines that particular circumstances dictate otherwise.

Investments initially valued in currencies other than the U.S. dollar are converted to the U.S. dollar using exchange rates obtained from pricing services. As a result,

the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside the United States or denominated in currencies other than the U.S. dollar may

be affected significantly on a day that the NYSE is closed.

The prices used by the Fund to

value securities may differ from the value that would be realized if the securities were sold and these differences could be material to the Fund’s financial statements.

|

|

|

|

|

| 12 |

|

The Korea Fund, Inc. Semi-Annual Report |

|

| 12.31.23 |

The Korea Fund, Inc. Notes to Financial Statements

December 31, 2023 (unaudited) (continued)

1. Organization and Significant Accounting Policies (continued)

(b) Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly

transaction between market participants. The three levels of the fair value hierarchy are described below:

| |

• |

|

Level 1—unadjusted quoted prices in active markets for identical investments that the Fund has the ability to access |

| |

• |

|

Level 2—valuations based on other significant observable inputs, which may include, but are not limited to, quoted prices for similar assets or liabilities, interest rates, yield curves, volatilities,

prepayment speeds, loss severities, credit risks and default rates or other market corroborated inputs |

| |

• |

|

Level 3—valuations based on significant unobservable inputs (including the Investment Adviser’s or Valuation Committee’s own assumptions and securities whose price was determined by using a single

broker’s quote) |

The valuation techniques used by the Fund to measure fair

value during the year ended December 31, 2023 were intended to maximize the use of observable inputs and to minimize the use of unobservable inputs.

An investment asset’s or liability’s level within the fair value hierarchy is based on the lowest level input, individually or in aggregate, that is significant

to the fair value measurement. The objective of fair value measurement remains the same even when there is a significant decrease in the volume and level of activity for an asset or liability and regardless of the valuation techniques used.

The inputs or methodology used for valuing securities are not necessarily an indication of the

risk associated with investing in those securities. The following are certain inputs and techniques that the Fund generally uses to evaluate how to classify each major category of assets and liabilities within Level 2 and Level 3, in

accordance with U.S. GAAP.

An asset or liability for which market values cannot be measured

using the methodologies described above is valued by methods deemed reasonable in good faith by the Valuation Committee, following the procedures established by the Board, to represent fair value. Under these procedures, the Fund generally uses a

market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant information. Fair value determinations involve the consideration of a number of subjective

factors, an analysis of applicable facts and circumstances and the exercise of judgment. As a result, it is possible that the fair value for a security determined in good faith in accordance with the Fund’s valuation procedures may differ from

valuations for the same security determined by other funds using their own valuation procedures. Although the Fund’s valuation procedures are designed to value a security at the price the Fund may reasonably expect to receive upon the

security’s sale in an orderly transaction, there can be no assurance that any fair value determination thereunder would, in fact, approximate the amount that the Fund would actually realize upon the sale of the security or the price at which

the security would trade if a reliable market price were readily available.

Equity

Securities (Common and Preferred Stock)—Equity securities traded in inactive markets and certain foreign equity securities are valued using inputs which include broker-dealer quotes, recently executed transactions adjusted for changes in

the benchmark index, or evaluated price quotes received from independent pricing services that take into account the integrity of the market sector and issuer, the individual characteristics of the security, and information received from

broker-dealers and other market sources pertaining to the issuer or security. To the extent that these inputs are observable, the values of equity securities are categorized as Level 2. To the extent that these inputs are unobservable, the

values are categorized as Level 3.

(c) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on an identified cost basis. Interest income

on uninvested cash is recorded upon receipt. Dividend income is recorded on the ex-dividend date. Korean-based corporations have generally adopted calendar year-ends, and their interim and final corporate

actions are normally approved, finalized and announced by their boards of directors and stockholders in the first and third quarters of each calendar year. Generally, estimates of their dividends are accrued on the

ex-dividend date principally in the prior December and/or June period ends. These dividend announcements are recorded by the Fund on such ex-dividend dates. Any

subsequent adjustments thereto by Korean corporations are recorded when announced. Presently, dividend income from Korean equity investments is earned primarily in the last calendar quarter of each year, and will be received primarily in the first

calendar quarter of the following year. Certain other dividends and related withholding taxes, if applicable, from Korean securities may be recorded subsequent to the ex-dividend date as soon as the Fund is

informed of such dividends and taxes. Dividend and interest income on the Statement of Operations are shown net of any foreign taxes withheld on income from foreign securities.

|

|

|

|

|

|

|

| 12.31.23 | |

|

The Korea Fund, Inc. Semi-Annual Report |

|

|

13 |

|

The Korea Fund, Inc. Notes to Financial Statements

December 31, 2023 (unaudited) (continued)

1. Organization and Significant Accounting Policies (continued)

(d) Federal Income Taxes

The Fund intends to distribute all of its taxable income and to comply with the other requirements of Subchapter M of the U.S. Internal Revenue Code of 1986, as amended,

applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. The Fund may be subject to excise tax based on distributions to stockholders.

Accounting for uncertainty in income taxes establishes for all entities, including pass-through

entities such as the Fund, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax

disclosures. In accordance with provisions set forth under U.S. GAAP, the Investment Adviser has reviewed the Fund’s tax positions for all open tax years.

As of December 31, 2023, the Fund has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions they have taken. The

Fund’s U.S. federal income tax returns for the prior three years, as applicable, remain subject to examination by the Internal Revenue Service.

(e) Foreign Investment and Exchange Controls in Korea

The Foreign Exchange

Transaction Act, the Presidential Decree relating to such Act and the regulations of the Minister of Strategy and Finance (formerly known as Minister of Finance and Economy) issued thereunder impose certain limitations and controls which generally

affect foreign investors in Korea. Through August 18, 2005, the Fund had a license from the Ministry of Finance and Economy to invest in Korean securities and to repatriate income received from dividends and interest earned on, and net realized

capital gains from, its investments in Korean securities or to repatriate from investment principal up to 10% of the NAV (taken at current value) of the Fund (except upon termination of the Fund, or for expenses in excess of Fund income, in which

case the foregoing restriction shall not apply). Under the Foreign Exchange Transaction Act, the Minister of Strategy and Finance has the power, with prior (posterior in case of urgency) public notice of scope and duration, to suspend all or a part

of foreign exchange transactions when emergency measures are deemed necessary in case of radical change in the international or domestic economic situation. The Fund could be adversely affected by delays in, or the refusal to grant, any required

governmental approval for such transactions.

The Fund relinquished its license from the

Korean Ministry of Finance and Economy effective August 19, 2005. The Fund had engaged in negotiations with the Korean Ministry of Finance and Economy concerning the feasibility of the Fund’s license being amended to allow the Fund to

repatriate more than 10% of Fund capital. However, the Ministry of Finance and Economy advised the Fund that the license cannot be amended as a result of a change in the Korean regulations. As a result of the relinquishment of the license, the Fund

is subject to the Korean securities transaction tax equal to 0.20%of the fair market value of any portfolio securities transferred by the Fund on the Korea Exchange and 0.35% of the fair market value of any portfolio securities transferred outside