SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant o

Filed

by a Party other than the Registrant x

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| o |

Soliciting Material Under Rule 14a-12 |

Knowles Corporation

(Name of Registrant as Specified In Its

Charter)

Caligan

Partners LP

Caligan

Partners CV I LP

David

Johnson

Samuel

J. Merksamer

Falcon

Edge Capital, LP

Falcon

Edge Global Master Fund, LP

Moraine

Master Fund, LP

Richard

Gerson

Jonathan

Christodoro

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

| x |

No fee required. |

| |

|

| o |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

On April 18, 2019, Caligan Partners LP issued a presentation

to stockholders of Knowles Corporation (the “Presentation”). A copy of the Presentation is attached herewith

as Exhibit 1.

WHO KNOWLES PRECISION DEVICES? APRIL 18, 2019 WWW.THEFUTUREOFKNOWLES.COM

Additional Information 2 • THIS PRESENTATION AND THE VIEWS EXPRESSED HEREIN ARE ONLY TO BE USED TO PROVIDE GENERAL INFORMATION REGARDING KNOWLES CORPORATION (“KNOWLES” OR THE “COMPANY”) . THIS PRESENTATION AND THE VIEWS EXPRESSED HEREIN DO NOT HAVE REGARD TO THE SPECIFIC INVESTMENT OBJECTIVE, FINANCIAL SITUATION, SUITABILITY, OR THE PARTICULAR NEED OF ANY SPECIFIC PERSON WHO MAY RECEIVE THIS PRESENTATION, AND SHOULD NOT BE TAKEN AS ADVICE ON THE MERITS OF ANY INVESTMENT DECISION . THE VIEWS EXPRESSED HEREIN REPRESENT THE CURRENT OPINIONS AS OF THE DATE HEREOF OF CALIGAN AND FALCON EDGE AND ARE DERIVED FROM PUBLICLY AVAILABLE INFORMATION AND THE ANALYSIS OF CALIGAN AND FALCON EDGE REGARDING THE COMPANY . CERTAIN FINANCIAL INFORMATION AND DATA USED HEREIN HAVE BEEN DERIVED OR OBTAINED FROM, WITHOUT INDEPENDENT VERIFICATION, FROM PUBLIC FILINGS, INCLUDING FILINGS MADE BY THE COMPANY WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”), AND OTHER SOURCES . • THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY DESCRIBED HEREIN IN ANY JURISDICTION TO ANY PERSON, NOR DOES IT CONSTITUTE A FINANCIAL PROMOTION, INVESTMENT ADVICE OR AN INDUCEMENT OR AN INCITEMENT TO PARTICIPATE IN ANY PRODUCT, OFFERING OR INVESTMENT . THIS PRESENTATION IS INFORMATIONAL ONLY AND SHOULD NOT BE USED AS THE BASIS FOR ANY INVESTMENT DECISION, NOR SHOULD IT BE RELIED UPON FOR LEGAL, ACCOUNTING OR TAX ADVICE OR INVESTMENT RECOMMENDATIONS OR FOR ANY OTHER PURPOSE . NO REPRESENTATION OR WARRANTY IS MADE THAT CALIGAN’S INVESTMENT PROCESSES OR INVESTMENT OBJECTIVES WILL OR ARE LIKELY TO BE ACHIEVED OR SUCCESSFUL OR THAT CALIGAN’S INVESTMENT WILL MAKE ANY PROFIT OR WILL NOT SUSTAIN LOSSES . PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS . • CALIGAN AND FALCON EDGE HAVE NOT SOUGHT OR OBTAINED CONSENT FROM ANY THIRD PARTY TO USE ANY STATEMENTS OR INFORMATION INDICATED HEREIN AS HAVING BEEN OBTAINED OR DERIVED FROM STATEMENTS MADE OR PUBLISHED BY THIRD PARTIES . ANY SUCH STATEMENTS OR INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN . NO WARRANTY IS MADE THAT DATA OR INFORMATION, WHETHER DERIVED OR OBTAINED FROM FILINGS MADE WITH THE SEC OR FROM ANY THIRD PARTY, ARE ACCURATE . • EXCEPT FOR THE HISTORICAL INFORMATION CONTAINED HEREIN, THE MATTERS ADDRESSED IN THIS PRESENTATION, INCLUDING PROJECTIONS, MARKET OUTLOOKS, ASSUMPTIONS AND ESTIMATES, ARE FORWARD - LOOKING STATEMENTS THAT ARE BASED ON CERTAIN ASSUMPTIONS, AND INVOLVE CERTAIN RISKS AND UNCERTAINTIES, INCLUDING RISKS AND CHANGES AFFECTING INDUSTRIES GENERALLY AND THE COMPANY SPECIFICALLY . YOU SHOULD BE AWARE THAT PROJECTIONS AND OTHER FORWARD - LOOKING STATEMENTS ARE INHERENTLY UNCERTAIN, AND ACTUAL RESULTS MAY DIFFER FROM THE PROJECTIONS AND OTHER FORWARD LOOKING STATEMENTS CONTAINED HEREIN DUE TO REASONS THAT MAY OR MAY NOT BE FORESEEABLE . NO REPRESENTATION, WARRANTY OR UNDERTAKING, EXPRESS OR IMPLIED, IS MADE AS TO THE ACCURACY OR REASONABLENESS OF THE ASSUMPTIONS UNDERLYING THE PROJECTIONS AND OTHER FORWARD LOOKING STATEMENTS CONTAINED HEREIN OR TO THE ACCURACY OR COMPLETENESS OF THE INFORMATION OR VIEWS CONTAINED HEREIN . • NEITHER CALIGAN NOR FALCON EDGE SHALL NOT BE RESPONSIBLE OR HAVE ANY LIABILITY FOR ANY MISINFORMATION CONTAINED IN ANY SEC FILING, ANY THIRD PARTY REPORT OR THIS PRESENTATION . ALL AMOUNTS, MARKET VALUE INFORMATION AND ESTIMATES INCLUDED IN THIS PRESENTATION HAVE BEEN OBTAINED FROM OUTSIDE SOURCES THAT CALIGAN AND FALCON EDGE BELIEVE TO BE RELIABLE OR REPRESENT THE BEST JUDGMENT OF CALIGAN AND FALCON EDGE AS OF THE DATE OF THIS PRESENTATION . • CALIGAN AND FALCON EDGE RESERVE THE RIGHT TO CHANGE OR MODIFY ANY OF ITS OPINIONS EXPRESSED HEREIN AT ANY TIME AS IT DEEMS APPROPRIATE . CALIGAN AND FALCON EDGE DISCLAIM ANY OBLIGATION TO UPDATE THE INFORMATION CONTAINED HEREIN .

How We Think About Knowles 3 • Knowles is comprised of four distinct businesses with different end - markets, competitive positioning, growth drivers, and market maturity. Segment: 1 Caligan/FE estimates for HH, MEMS, and IA based on financial disclosures in Knowles 2018 10 - K and quarterly financial supplement s. Operating Profit estimates are Non - GAAP Adjusted EBIT. Hearing Health (“HH”) • Knowles has been the technological and market leader for acoustic components used in hearing aids since 1946 MEMS Microphones (“MEMS”) • Leveraging its acoustic expertise, Knowles invented and commercialized silicon MEMS microphones used in mobile handsets, ear - worn and IoT devices Intelligent Audio (“IA”) • Audio signal processing capabilities that allow voice - wake, improve sound quality, interpret and process external audio inputs, and suppress noise Precision Devices Segment • High - reliability, harsh environment ceramic capacitors and filters serving the aerospace and defense, medical, telecommunications, industrial, and automotive markets KN Overview (FY 2018) 1 Revenue 1 % Total Operating Profit (Adj) Margin % Total $225MM 27% $70MM 31% 60% $445MM 54% $111MM 25% 95% $12MM 1% $(55)MM N/M - 47% $682MM 83% $126MM 19% 108% $145MM 17% $34MM 23% 29% $(43)MM N/M - 37% $827MM $117MM 14% Audio Segment (Total) Unallocated Corporate Expense Total Knowles Corp.

What Makes Up Knowles’ Precision Devices 4 • Knowles’ Precision Devices (“PD”) segment, produces high - reliability, harsh environment ceramic capacitors and electro magnetic interference (“EMI”) filters for use in mission - critical applications in military, medical, electric vehicle, and telecommunications market segments • Radar, pacemakers, MRI equipment, satellites, airplanes, electric vehicles and mobile phone base stations contain PD capacitors and filters • Knowles’ PD segment is made up of six different acquisitions including : • Dielectric Laboratories, acquired by Dover in 1985 • Novacap (focused on aerospace and defense end markets), acquired by Dover in 1987 • Syfer , acquired by Dover in 2000 , which had just created a now ubiquitous technology to avoid cracking a multi - layer ceramic capacitor (“MLCC”) • Voltronics , acquired by Dover in 2004 , which provided precision trimmer capacitor capabilities • StackiCap , acquired by Dover in 2012 • Subsequent to Knowles’ spin from Dover, Knowles’ Precision Devices has purchased Johanson Manufacturing and Compex for $ 20 . 5 MM in aggregate adding ~ $ 14 MM in revenues 1 Caligan/FE estimates based on disclosures in Knowles’ 2014 Analyst Day presentation of end - market revenue. 2 Knowles quarterly financial supplements from 2016 – 2018 for Precision Devices and Knowles’ 10 - Ks. All financials on a non - GAA P basis. Precision Devices Financial Summary 2 ($MM) 2016 2017 2018 Revenues 93.8 106.8 144.7 Growth 13.9% 35.5% Gross Profit 32.5 40.9 60.9 Margin 34.6% 38.3% 42.1% R&D 2.5 4.2 5.8 % of Revenues 2.7% 3.9% 4.0% SG&A 16.9 16.1 22.3 % of Revenues 18.0% 15.1% 15.4% EBITDA 20.4 25.4 39.9 Margin 21.7% 23.8% 27.6% PD Focuses On Mission - Critical Applications

Precision Devices Is Not A Commodity Passive Component Supplier 5 • PD does not make commodity capacitors and filters that are found in a majority of consumer electronic devices but instead makes ceramic capacitors with substantial engineering content per device where customers value quality, reliability, and performance for mission - critical applications • PD’s differentiation versus commodity capacitors can be seen in its gross margin and EBIT margin profile ; PD has gross margins that are 1 , 450 basis points and EBIT margins that are ~ 1 , 400 basis points greater than commodity capacitor manufacturers • In certain defense and medical applications, PD enters multi - year contracts with fixed pricing where PD is a sole sourced provider • Due to PD’s reputation for quality, reliability, and speed, PD is often the first call for many customers having already qualified its products for demanding technical specifications and possessing US manufacturing facilities for defense end - markets • Rather than sharing part numbers and being commingled in the same bin with capacitors made by other manufacturers, PD capacitors and filters are designed to meet customer specifications for individual applications 1 S&P Capital IQ and Knowles’ 4Q2018 financial supplements. Competitor set includes publicly traded companies that produce capacitors. 2 S&P Capital IQ and Knowles’ 4Q2018 financial supplements . Competitor set includes publicly traded companies that produce capacitors. Ceramic Capacitor Producers LTM EBIT Margins 2 Ceramic Capacitor Producers LTM Gross Margins 1 42.1% 15% 20% 25% 30% 35% 40% 45% Non - KN Average: 27.6% 23.4% 0% 5% 10% 15% 20% 25% Non - KN Average: 9.7%

Knowles Has Repeatedly Stated It Is Transitioning To An Audio Company And That Precision Devices Is Not - Strategic To Knowles 6 Transition to Audio Solutions Provider Date Public Statement 3Q 2018 Earnings Call “ Our transition from an acoustic component supplier to an audio solutions provider is well underway . ” - Jeff Niew , October 24 , 2018 2Q 2018 Earnings Call “ As we transition from an acoustic component supplier to an audio solutions provider , we're expanding our available market and enabling macro audio trends . ” - Jeff Niew , July 24 , 2018 2018 JPM TMT “So in all, we're very excited about the products we made on our multi - year transition from being acoustic components supplier into an audio solutions provider” - Jeff Niew , May 17 , 2018 2017 JPM TMT “About 2 years ago -- just short of 2 years ago, Knowles acquired the company, Audience, with the idea that we were looking to make a transformative acquisition relative to not just being an acoustic component supplier but becoming more of a company that provides solution to audio input problems . ” - Jeff Niew , May 23 , 2017 Non - Strategic Precision Devices Date Public Statement 4Q 2017 Earnings Call “As I mentioned, we are pleased to complete the divestiture of our timing business during the quarter . The sale of this non - strategic business has sharpened our focus on growth platforms where we have strong market positions and attractive margin profiles” - Jeff Niew , February 7 , 2018 2017 Roth Conference “And just to mention here, Precision Devices, we do have a crystal oscillator business that makes high - end crystal oscillators for primarily mil - space and the base station market, and we also have a capacitor business that makes high - end capacitors . Both of these businesses are cash flow positive, generate cash for us, don't require a tremendous amount of investment back in the business . I would say they're not very strategic to the Audio portion of our business, but they are nice businesses for us . And I won't say too much more about that today . I'd rather move on and talk more about the Audio portion, which is 77 % . ” - Jeff Niew , March 14 , 2017 Source: S&P Capital IQ transcripts.

• Since the Spin, Knowles has invested more than $ 700 MM in the businesses that represent its current Audio Segment and less than $ 70 MM in its current Precision Devices segment 1 • Shareholders should expect Knowles to deploy its capital in its highest return opportunity projects, but instead, Knowles spent 10 X the capital in the segment where it earned 1 , 000 bps lower ROIC (excluding Sound Solutions) Capital Invested Since Spin Demonstrates Knowles’ Priorities On Audio 7 1 All information sourced from Knowles 10 - Ks . Includes estimates of $ 15 MM of research and development (“R&D”) and $ 5 MM of capital expenditures in 2014 for Hearing Health and $ 4 MM of R&D and $ 4 MM of capital expenditures for capacitors/filters in 2014 . Capital Invested includes R&D, capital expenditures, and acquisitions . 2 All information sourced from Knowles 10 - Ks . ROIC defined as the result of dividing (a) (i) GAAP EBIT multiplied by (ii) 1 minus Knowles’ effective tax rate (“ETR”) of 15 % by (b) year - end segment total assets . 2014 - 2018 Segment Capital Invested ($MM) 1 - 100 200 300 400 500 600 700 800 Audio Precision Devices 2016 - 2018 Segment Average ROIC 2 0% 2% 4% 6% 8% 10% 12% 14% 16% Audio Precision Devices

Synergies in Passive Component & Semiconductor Transactions Acquirer Target Publicly Announced Cost Synergies LTM EBITDA EV/EBITDA (Pre-Synergy) EV/EBITDA (Post- Synergy) Synergies / EBITDA Tessera (Xperi) DTS 15.0 71.0 13.3x 11.0x 21% Infineon Int'l Rectifier 67.7 175.4 13.8x 9.9x 39% Microchip Microsemi 300.0 555.3 18.1x 11.8x 54% Littelfuse IXYS 30.0 44.6 15.7x 9.4x 67% TTM Anaren 15.0 55.0 14.1x 11.1x 27% Microsemi Knowles Timing 19.0 9.0 14.8x 4.8x 211% Cobham Aeroflex 85.0 122.7 11.9x 7.0x 69% Weighted Average 16.4x 10.9x 70% Synergies In Strategic Combinations Are Enormous 8 • Strategic buyers that either (i) currently manufacture ceramic based technologies or (ii) overlap in end - market applications will have material synergies with similar customers, products, and manufacturing facilities • These synergies are obviously not available to Knowles’ shareholders as long as the business is held by Knowles • We believe that the net present value of capturing part of those synergies outweigh any benefit garnered from trying to time a sale • On a non - deal roadshow in late 2018 , Knowles’ management indicated they have received reverse inquiry into the Precision Devices segment Source: All comparable data from S&P Capital IQ and publicly announced cost synergies. Knowles Timing Device synergy estimat es detailed on slide 9 from public transcripts of Microsemi. Acquisitions of private companies or divisions of public companies.

• Knowles sold its high reliability Timing device business to Microsemi in November 2017 for ~ 15 x LTM EBITDA . At multiple investor conferences shortly after the acquisition closed, Microsemi management stated that they believed they were going to triple the operating margin through cost synergies including manufacturing consolidation and operating expense reduction • “We did a small acquisition -- which closed last quarter . We -- a company by the name of Vectron is a carve out from Knowles Corporation … . Historically, for the last few years, the company has done about $ 100 million in revenue, and it's done so at a low 30 s gross margin . So we're significantly below our 16 % - plus margins today and it's done so at about a 10 % EBITDA margin, give or take . That's a business where we think we can turn that EBITDA margin into something like the gross margin . Meaning, we think we can triple that operating margin . There are some redundant fab facilities, which we need to shutter . There's very good overlap for us in the space, which means we can take out a lot of synergy on the operating expense lines . ” - Robert Adams, Former SVP of Corporate Development, Microsemi, Corp . , January 18 , 2018 • “ But I'll tell you the way we think about it . It was an undermanaged asset that's acquired . Gross margins were in the low 30 s, and the op margin was below 10 % of revenues . That's a business over the 2 - year time frame when we consolidate those facilities, we're going to trim some of the nonpalatable, nonstrategic product offerings . Gross margin's going to go up . We're not saying it's going to go up to a corporate gross margin kind of number . There's not that much headroom there . But on the op line, it's an op line we think we can bring into the 30 % zone . It's a 2 - year program, but it's an op margin we can triple . ” - Robert Adams, Former SVP of Corporate Development, Microsemi, Corp . , February 14 , 2018 Case Study: Knowles’ Timing Devices 9 Source: All transcripts from S&P Capital IQ.

Path To $2+ Of EPS In 2020 10 1 S&P Capital IQ and Caligan/FE calculations . 2 Revised Net Income equal to 2019 consensus net income of $ 100 . 6 MM less $ 30 . 8 MM of net income from Precision Devices plus $ 10 . 1 MM of increased net income from a forced conversion of Knowles’ Convertible Notes . 3 Assumes Knowles’ fully diluted shares outstanding of 93 . 2 mm plus shares from exercise of convertible note less the note hedge ( 8 . 1 million shares, net) and Knowles closing price of $ 18 . 95 on April 15 , 2019 . 4 Assumes $ ( 55 )MM of Non - GAAP EBIT becomes $ 0 MM of Non - GAAP EBIT either through revenue growth or expense reduction . 5 Assumes $ 13 MM to $ 28 MM of unallocated corporate expenses can be reduced through moving from a divisional to a functional corporate structure . • High reliability components suppliers with significant defense and medical end - market exposure have transacted at mid - teens EBITDA multiples, including Knowles’ Timing Device Business • We believe that Knowles can sell its PD segment at an attractive price, without any tax - leakage, in a quick and robust process • Proceeds would provide Knowles with flexibility to tender for its convertible debt and return capital directly to shareholders • Combined with either revenue growth or expense reduction in Intelligent Audio that brings the business unit to breakeven, Knowles could be on pace to generate $ 2 . 00 + in EPS in 2020 • We believe that a divestiture of PD would have material benefits that are difficult to quantify from public information including forcing a rationalization of the divisional structure at Knowles into a functional structure to materially reduce unallocated corporate expense Precision Devices Divestiture Generates Meaningful EPS Accretion 2019 Consensus PD EBITDA 1 44 EV/EBITDA Multiple 12.0x 14.0x 16.0x Total EV ($mm) 528 616 704 Step 1: Repurchase Shares Tender Premium to Current Price 0% 5% 10% Modified Dutch Tender Price 18.95 19.90 20.85 Shares Repurchased 27.9 31.0 33.8 Revised 2019 Net Income 2 79.9 79.9 79.9 Revised S/O 3 73.6 70.5 67.6 Revised 2019 EPS 1.09 1.13 1.18 Step 2: Remove IA Drag on Profitability Accretion From Removing IA Drag 4 0.64 0.66 0.69 % 58.9% 61.5% 64.1% Step 3: Rationalize Unallocated Corporate Expense Expense Reduction 5 0.12 0.19 0.25 % 11.3% 17.4% 23.6% New EPS 1.84 1.99 2.13 Multiple 14.0x 14.0x 14.0x New Share Price 25.81 27.80 29.77 Upside 36.2% 46.7% 57.1%

Argument That Knowles Will De - Rate From Divestiture Is Debunked By Its Own Trading History 11 1 All trading multiples from S&P Capital IQ. Forward P/E Pre/Post Sound Solutions 1 Forward EV/EBITDA Pre/Post Sound Solutions 1 Sound Solutions Divestiture Announced 8x 9x 10x 11x 12x Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Rolling 90 Day Average Forward EV/EBITDA Average Sound Solutions Divestiture Announced • One of the reasons Knowles has given to argue against a strategic review of Precision Devices is that they may “de - rate” due to an increase in mobile handset exposure • This argument is disproven by Knowles’ own trading history after it divested Sound Solutions in 2016 . Mobile handsets represented 50 % of Knowles’ revenue in 2015 , pre - divestiture and 34 % in 2016 post - divestiture • In the 3 months pre - announcement of divestiture, Knowles’ rolling 90 day average multiples were : • 20 . 5 x Forward P/E • 10 . 75 x Forward EV/EBITDA • For the 3 months post - announcement of divestiture, Knowles’ rolling 90 day average multiples were : • 15 x Forward P/E • 9 x Forward EV/EBITDA • For full year 2015 , Knowles traded at an average 9 . 8 x Forward EV/EBITDA multiple and traded at an average of 9 . 5 x Forward EV/EBITDA in 2016 . Similarly, Knowles traded at an average of 19 . 6 x Forward EPS in 2015 and 15 . 0 x Forward EPS in 2016 12x 14x 16x 18x 20x 22x 24x 26x Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Rolling 90 Day Average Forward P/E Average

13x 14x 15x 16x 17x Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Rolling 90 Day Average Forward P/E Average Knowles’ Divestiture Of Timing Devices Had Negligible Impact On Trading Multiples 12 1 All trading multiples from S&P Capital IQ. 2 Knowles’ 2018 proxy statement. Forward P/E Pre/Post Timing Devices 1 Forward EV/EBITDA Pre/Post Timing Devices 1 Timing Device Divestiture Announced Timing Device Divestiture Announced • Similarly, the effect of the divestiture of Knowles’ crystal oscillator division (“Timing Devices”) in 2017 , which the compensation committee cited as being “not core to our overall strategy,” 2 had a negligible impact on trading multiples • In the 3 months pre - announcement of divestiture, Knowles’ rolling 90 day average multiples were : • 14 . 9 x Forward P/E • 9 . 2 x Forward EV/EBITDA • For the 3 months post - announcement of divestiture, Knowles’ rolling 90 day average multiples were : • 14 . 1 x Forward P/E • 9 . 1 x Forward EV/EBITDA 8x 9x 10x Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Rolling 90 Day Average Forward EV/EBITDA Average

Cited Examples Of Handset Concentration Conflate Negative Effect Of Customer Concentration On Trading Multiples 13 Apple Concentration vs. Forward P/E 1 Apple Concentration vs. Forward EV/EBITDA 1 y = - 4.5901x + 15.696 10x 11x 12x 13x 14x 15x 16x 17x 18x 19x 20x 15% 25% 35% 45% 55% 65% 75% 85% Forward P/E Apple Concentration y = - 3.7191x + 10.177 6x 7x 8x 9x 10x 11x 12x 15% 25% 35% 45% 55% 65% 75% 85% EV/Forward EBITDA Apple Concentration • Part of the Company’s misguided analysis regarding “de - rating” is based on customers they cited with material mobile handset exposure (CRUS, SWKS, and QRVO) • This analysis conflates the negative effect of customer concentration on trading multiples with mobile handset exposure • From 2015 - 2018 , the average revenue from Apple for the competitors cited has been : • CRUS : 75 % • SWKS : 43 % • QRVO : 35 % • KN 20 % • Divesting Precision Devices would move Knowles’ 2018 Apple concentration from 19 % to 23 % , a negligible increase • A simple regression on average Apple revenue concentration for the competitors cited versus average forward EBITDA and earnings multiples from 2015 – 2018 demonstrates that a Precision Device divestiture may remove 0 . 15 x from Knowles’ Forward EBITDA multiple and 0 . 2 x from Knowles’ Forward Earnings multiple 1 Caligan/FE calculations from SEC filings for Qorvo, Skyworks, and Cirrus Logic and average trading multiples from S&P Capital I Q.

What Is The Right Comp Set For Knowles? 14 Rolling 90 - Day Average Forward P/E (“Peers”) 1 Rolling 90 - Day Average KN Forward P/E 1 • Caligan and Falcon Edge ask investors – which peer set does Knowles most closely resemble? 1 S&P Capital IQ. KN excluding 2015 due to Sound Solutions losses and acquisition of Audience. All %s based on GAAP expenses a nd revenues. 10x 15x 20x 25x Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 SWKS/QRVO/CRUS LFUS/ROG/IIVI 5 - Year Average: 20x 5 - Year Average: 13x 12x 13x 14x 15x 16x 17x 18x 19x Jun-14 Aug-14 Oct-14 Dec-14 Feb-16 Apr-16 May-16 Jul-16 Sep-16 Nov-16 Dec-16 Feb-17 Apr-17 Jun-17 Aug-17 Oct-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Aug-18 Oct-18 Dec-18 Rolling 90-Day Average 5-Year Average Electronic Components LTM Gross Margin LTM EBITDA Margin LTM R&D (% of Revenue) LTM ROIC Disclosed Customer Concentration Littelfuse 40.1% 21.2% 5.1% 8.9% 10.7% (Arrow) Rogers 35.4% 18.7% 3.8% 7.7% None II - VI 39.4% 19.6% 10.3% 7.8% None Average 38.3% 19.8% 6.4% 8.1% N/A Semiconductors LTM Gross Margin LTM EBITDA Margin LTM R&D (% of Revenue) LTM ROIC Disclosed Apple Exposure Cirrus Logic 50.1% 15.6% 30.7% 7.1% 81% Skyworks 50.1% 41.2% 11.0% 22.5% 47% Qorvo 49.5% 29.6% 14.6% 2.9% 36% Average 49.9% 28.8% 18.7% 10.8% 55% Knowles LTM Gross Margin LTM EBITDA Margin LTM R&D (% of Revenue) LTM ROIC Disclosed Apple Exposure KN (ex - PD) 39.3% 24.6% 6.7% 5.6% 23% KN (ex - PD,IA) 39.5% 33.3% 7.2% 9.2% 23%

0% 1% 2% 3% 4% 5% 6% 7% NOVT CREE CMTL COHR MEI KN Divesting Precision Devices Should Force A Rationalization Of Knowles’ Unallocated Corporate Expense 15 • Knowles divested its speaker and receiver business in 2016 and its oscillator business in 2017 , reducing its total revenues by ~ $ 400 mm since 2013 . However, Knowles’ unallocated corporate overhead and stock - based compensation (“SBC”) has increased, as a percentage of total revenues, from 3 . 3 % in 2013 to 6 . 4 % in 2018 • Knowles has not reduced its corporate overhead in proportion to its divestitures and fall in its MEMS revenues . If Knowles reduced its corporate overhead to the same percentage of revenue that it was in 2013 , Knowles would increase EBITDA by $ 25 . 6 mm or EPS by $ 0 . 23 • Compared to its proxy peers, and other companies in electronic components and communications space with aggregate revenues of less than $ 1 billion, Knowles has the highest unallocated corporate expense, as a percentage of revenue (and notionally) • Knowles’ unallocated corporate expenses spiked in 2015 to $ 56 mm, prior to the divestitures of the speaker/receiver business or the crystal oscillator business . So the argument that these are “stranded” costs is impossible to make – either these are more Intelligent Audio costs that should be classified as such or the Company has become $ 13 mm more inefficient since its spin • In connection with a sale of PD, we would expect Knowles to undertake a holistic review of its operating model KN Unallocated Corporate Overhead Growth 1 Operating Expenses includes segment level SG&A and R&D. Source: Knowles SEC Filings. Proxy Peer Unallocated Corporate Expense (% Revenues) Average 2.6% 0% 1% 2% 3% 4% 5% 6% 7% 8% - 10 20 30 40 50 60 2013 2014 2015 2016 2017 2018 % of Total Revenue Total Corporate Expense & Unallocated SBC ($MM) Non-GAAP Corporate Expense Unallocated SBC % of Revenue

Outstanding Questions For Shareholders 16 Despite public pronouncements that Precision Devices is not strategically linked to Knowles’ audio business, the Board has seemingly concluded that it is not in the Board’s interest to explore a sale at this time . We disagree and believe that it is incumbent on the Board to address several specific issues : • The Board reduced Jeff Niew’s long - term incentive target for 2018 , driven by divestitures that had decreased the revenue of the Company and changed Knowles’ peer group composition . Does Knowles’ compensation structure create a perverse incentive to avoid future divestitures regardless of whether a divestiture would create value for shareholders? • A major factor of consideration regarding asset sales and use of proceeds will be driven by “conviction” in the Audio segment’s mid to long - term financial prospects . What is the potential accretion if Knowles divests Precision Devices and reinvests in its core business through share repurchases? • Artificial targets such as keeping handset revenue at below 50 % of total revenue are, in our view, also inappropriate in consideration of such strategic discussions . Will a divestiture with appropriate and well - considered reinvestment of proceeds lead to better risk - adjusted returns for shareholders? • How much cost could be removed by focusing Knowles exclusively on acoustics? What is the potential effect of moving from a divisional structure to a functional structure on Knowles’ allocated and unallocated corporate expense?

Contacts & Additional Information 17 Investors Edward McCarthy / Geoffrey Weinberg / Peter Aymar D . F . King & Co . , Inc . ( 212 ) 269 - 5550 KN@dfking . com Press Robert Laman Mark Cho Caligan Partners, LP Falcon Edge Capital, LP + 1 ( 646 ) 859 - 8205 + 1 ( 212 ) 230 - 2295 rl@caliganpartners . com MCho@falconedgecap . com F or Additional Information IR@caliganpartners . com www . thefutureofknowles . com IMPORTANT INFORMATION ABOUT PROXY PARTICIPANTS Caligan, Caligan CV I LP, Samuel Merksamer, David Johnson, Falcon Edge, Falcon Edge Global Master Fund, LP, Moraine Master Fund, LP, Richard Gerson and Jonathan Christodoro (collectively, the “Participants”) intend to file with the SEC a definitive proxy statement and accompanying form of proxy to be used in connection with the solicitation of proxies from the stockholders of the Company . All stockholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants when they become available, as they will contain important information, including additional information related to the Participants . The definitive proxy statement and an accompanying proxy card will be furnished to some or all of the Company’s stockholders and will be, along with other relevant documents, available at no charge on the SEC website at http : //www . sec . gov/ and from the Participants' proxy solicitor, D . F . King & Co . , Inc, by requesting a copy via email to KN@dfking . com . Information about the Participants and a description of its direct or indirect interests by security holdings is contained in the preliminary proxy statement filed by Caligan with the SEC on April 8 , 2019 . This document is available free of charge from the sources indicated above .

This regulatory filing also includes additional resources:

p19-1015exhibit_1.pdf

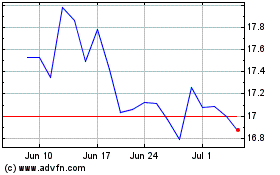

Knowles (NYSE:KN)

Historical Stock Chart

From Jun 2024 to Jul 2024

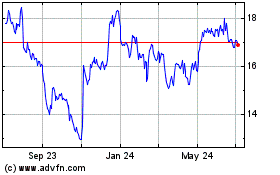

Knowles (NYSE:KN)

Historical Stock Chart

From Jul 2023 to Jul 2024