- Generated fourth quarter 2023 net income of $267.4 million and

Adjusted EBITDA1 of $228.0 million

- Reported full year 2023 net income of $386.5 million, Adjusted

EBITDA1 of $838.8 million, and Capital Expenditures2 and

investments of $531.2 million

- Issuing full year 2024 Adjusted EBITDA1 guidance of $905

million to $960 million and $125 million to $165 million of 2024

Capital Expenditures2 guidance (“2024 Guidance”)

- Completing the core shareholder dividend reinvestment

obligation with the upcoming dividend to be paid on March 7th,

2024; and going forward, all shareholders will now be eligible to

receive 100% cash dividends

- Placed Delaware Link and the Permian Highway Pipeline

(“PHP”) expansion in-service in the fourth quarter

- Completed construction and placed in-service the gathering

expansion into Lea County, New Mexico in January 2024, marking the

third and final in-service of the 2023 strategic growth

projects

Kinetik Holdings Inc. (NYSE: KNTK) (“Kinetik” or the

“Company”) today reported financial results for the quarter

and year ended December 31, 2023.

2023 Results and

Commentary

For the three and twelve months ended December 31, 2023, Kinetik

processed natural gas volumes of 1.54 Bcf/d and 1.45 Bcf/d,

respectively, and reported net income including non-controlling

interest of $267.4 million and $386.5 million, respectively.

Kinetik generated Adjusted EBITDA1 of $228.0 million and $838.8

million for the three and twelve months ended December 31, 2023,

respectively, Distributable Cash Flow1 of $149.7 million and $568.5

million for the three and twelve months ended December 31, 2023,

respectively, and Free Cash Flow1 of $76.9 million and $59.9

million for the three and twelve months ended December 31, 2023,

respectively.

“2023 was a critical year for Kinetik as we executed upon highly

strategic organic growth projects, key to our long-term vision,”

said Jamie Welch, President and Chief Executive Officer. “We

reported record volume growth each successive quarter, and

exit-to-exit processed gas volumes grew by 22%. Our initiatives

throughout 2023 have positioned us well for future growth with

existing customers and market share capture in the Northern

Delaware Basin. We have meaningfully increased our gas treating

capabilities at our processing complexes and placed into service

Delaware Link, the PHP expansion, and the gathering system

expansion into Lea County, New Mexico. Today, we stand

competitively advantaged with available processing capacity and a

fully integrated ‘wellhead to Gulf Coast market’ natural gas

transportation solution.”

“We reported full year 2023 Adjusted EBITDA1 of $838.8 million,

at the middle of the revised guidance we provided in November and

above the midpoint of the original guidance range issued in

February 2023. Capital Expenditures2 in 2023 were $531.2 million,

within our guidance range. Our operations team did a fantastic job

with operated capital spend coming in 5% below internal estimates

for full year 2023, which helped offset a portion of the

non-operated PHP expansion cost increases. With the completion of

our 2023 growth projects, our capital program and Free Cash Flow1

outlook look markedly different, representing an approximately $450

million increase in Free Cash Flow1 year-on-year.”

2024 Guidance and

Outlook

Kinetik estimates full year 2024 Adjusted EBITDA1 between $905

million and $960 million. The midpoint of the 2024 Guidance implies

Adjusted EBITDA1 growth of over 11% year-over-year.

Guidance assumptions include:

- Low-double digit growth of gas processed volumes;

- Over 90% of gross profit from fixed-fee contracts;

- 2024 average annual commodity prices of approximately $76 per

barrel for WTI, $2 per MMBtu for Houston Ship Channel natural gas,

and $0.60 per gallon for natural gas liquids; and

- Unhedged commodity-linked gross profit representing

approximately 5% of total gross profit

The Company estimates 2024 Capital Expenditures2 to be between

$125 million and $165 million. This includes approximately $35

million of maintenance capital which is elevated for this year.

Welch added, “2024 will be an important year along the journey

to achieve our financial targets. We have strengthened the

composition of our cash flows with increased contributions from our

Pipeline Transportation segment and MVC fee-based revenue. The

Pipeline Transportation segment is expected to contribute 40% of

total 2024 Adjusted EBITDA1, a nearly 15% increase in two years.

Our 2024 Capital Expenditures2 guidance is below our previously

communicated expectations as we focus on a reduced capital program

given the completion of last year’s growth projects. We expect a

significant increase in Free Cash Flow1 this year, despite the

dividend being paid in cash to all shareholders.”

Financial

- Achieved quarterly net income of $267.4 million and Adjusted

EBITDA1 of $228.0 million.

- Achieved 2023 annual net income of $386.5 million and Adjusted

EBITDA1 of $838.8 million.

- Reported full year 2023 Capital Expenditures2 of $531.2

million, within the Company’s guidance range provided in February,

and for the fourth quarter 2023 reported Capital Expenditures2 of

$95.0 million.

- Declared a dividend of $0.75 per share for the quarter ended

December 31, 2023, or $3.00 per share on an annualized basis. 98.9

million shares have elected to reinvest fourth quarter dividends

into newly issued shares of Class A common stock. As a result,

$39.2 million of fourth quarter dividends will be paid in

cash.3

- Following the payment on March 7, 2024, all shareholders will

be eligible to receive 100% cash dividend payments.

- Exited the fourth quarter with a Leverage Ratio1,4 per the

Company’s Revolving Credit Agreement of 4.0x and a Net Debt to

Adjusted EBITDA Ratio1,5 of 4.3x.

- Realized over $50 million of Adjusted EBITDA1 synergies in

2023, exceeding the original merger target.

- Issued $800 million of 6.625% sustainability-linked senior

notes. The net proceeds repaid a portion of the outstanding

borrowings under Kinetik’s existing Term Loan Credit Facility and

extended the maturity of that facility to June 2026.

- Closed upsized secondary offering of 7.5 million shares by APA

Corporation, increasing public float by 47%.

Selected Key 2023

Metrics:

Three Months Ended

Twelve Months Ended December

31,

2023

2023

(In thousands, except

ratios)

Net income including non-controlling

interest6

$

267,354

$

386,452

Adjusted EBITDA1

$

228,005

$

838,830

Distributed Cash Flow1

$

149,713

$

568,507

Dividend Coverage Ratio1,7

1.3x

1.3x

Free Cash Flow1

$

76,917

$

59,931

Leverage Ratio1,4

4.0x

Net Debt to Adjusted EBITDA Ratio1,5

4.3x

Common stock issued and outstanding8

151,185,576

December 31, 2023

September 30, 2023

June 30, 2023

March 31, 2023

(In thousands)

Net Debt1,9

$ 3,589,490

$ 3,629,932

$ 3,647,763

$ 3,535,016

Growth Projects

- Completed and placed in service Kinetik’s gathering system

expansion into Lea County, New Mexico on January 18, 2024, ahead of

schedule by over two months and under budget.

- Placed in service the PHP expansion on December 1, 2023,

expanding PHP’s capacity by 550 MMcf/d and increasing natural gas

deliveries from the Permian to the U.S. Gulf Coast. Kinetik’s PHP

ownership is now over 55%.

- Placed in service on October 1, 2023, Delaware Link, Kinetik’s

wholly owned and operated 30 inch intrabasin residue gas pipeline

to Waha with an initial throughput capacity of 1 Bcf/d.

- Installation of front-end amine treating at Pecos Bend should

be placed in-service by April 2024, completing Kinetik’s system

wide treating project.

Governance and

Sustainability

- Michael Kumar was appointed to the Board of Directors,

replacing Ron Schweizer. Mr. Kumar currently serves as a Senior

Policy Advisor for I Squared Capital.

- The Company’s 2023 compensation program tied 20% of all

salaried employees’ at-risk pay, including executives, to specific

sustainability and safety related goals. The Company plans for a

similar approach in 2024.

- Kinetik expects to publish its 2023 Sustainability Report

mid-year, providing further details on its sustainability strategy,

targets, and results.

- Granted 2023 performance bonuses in Kinetik Class A Common

Stock rather than cash which reinforces alignment with our

shareholders.

Upcoming Tour Dates

Kinetik plans to participate at the following upcoming

conferences and events:

- Morgan Stanley Energy & Power Conference in New York City

on March 7th

- Barclays Midstream Corporate Access Day Luncheon in New York

City on March 7th

- Goldman Sachs Non-Deal Roadshow in Boston on March 12th

- Wolfe Houston Bus Tour on March 19th

- Bank of America Spring Energy Summit in Houston on March

26th

Investor Presentation

An updated investor presentation will be available under Events

and Presentations in the Investors section of the Company’s website

at www.kinetik.com.

Conference Call and

Webcast

Kinetik will host its fourth quarter 2023 results conference

call on Thursday, February 29, 2024 at 8:00 am Central Standard

Time (9:00 am Eastern Standard Time) to discuss fourth quarter

results. To access a live webcast of the conference call, please

visit the Investor Relations section of Kinetik’s website at

www.ir.kinetik.com. A replay of the conference call also will be

available on the website following the call.

About Kinetik Holdings

Inc.

Kinetik is a fully integrated, pure-play, Permian-to-Gulf Coast

midstream C-corporation operating in the Delaware Basin. Kinetik is

headquartered in Midland, Texas and has a significant presence in

Houston, Texas. Kinetik provides comprehensive gathering,

transportation, compression, processing and treating services for

companies that produce natural gas, natural gas liquids, crude oil

and water. Kinetik posts announcements, operational updates,

investor information and press releases on its website,

www.kinetik.com.

Forward-looking

statements

This news release includes certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws. Forward-looking statements include, but are not

limited to, statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “seeks,” “possible,” “potential,”

“predict,” “project,” “prospects,” “guidance,” “outlook,” “should,”

“would,” “will,” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. These statements

include, but are not limited to, statements about the Company’s

future business strategy and other plans, expectations, and

objectives for the Company’s operations, including statements about

strategy, synergies, sustainability goals and initiatives,

portfolio monetization opportunities, expansion projects and future

operations, and financial guidance; the Company’s share repurchase

program and the projected timing, purchase price and number of

shares purchased under such program, if at all; projected dividend

amounts and the timing thereof and the Company’s leverage and

financial profile. While forward-looking statements are based on

assumptions and analyses made by us that we believe to be

reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties which could cause our actual

results, performance, and financial condition to differ materially

from our expectations. See Part I, Item 1A. Risk Factors in our

Annual Report on Form 10-K for the year ended December 31, 2023 to

be filed with the SEC. Any forward-looking statement made by us in

this news release speaks only as of the date on which it is made.

Factors or events that could cause our actual results to differ may

emerge from time to time, and it is not possible for us to predict

all of them. We undertake no obligation to publicly update any

forward-looking statement whether as a result of new information,

future development, or otherwise, except as may be required by

law.

Additional information

Additional information follows, including a reconciliation of

Adjusted EBITDA, Distributable Cash Flow, Free Cash Flow, and Net

Debt (non-GAAP financial measures) to the GAAP measures.

Non-GAAP financial

measures

Kinetik’s financial information includes information prepared in

conformity with generally accepted accounting principles (GAAP) as

well as non-GAAP financial information. It is management’s intent

to provide non-GAAP financial information to enhance understanding

of our consolidated financial information as prepared in accordance

with GAAP. Adjusted EBITDA, Distributable Cash Flow, Free Cash

Flow, Dividend Coverage Ratio, Net Debt and Leverage Ratio are

non-GAAP measures. This non-GAAP information should be considered

by the reader in addition to, but not instead of, the financial

statements prepared in accordance with GAAP and reconciliations

from these results should be carefully evaluated. See

“Reconciliation of GAAP to Non-GAAP Measures” elsewhere in this

news release. This news release also includes certain

forward-looking non-GAAP financial information. Reconciliations of

these forward-looking non-GAAP measures to their most directly

comparable GAAP measure are not available without unreasonable

efforts. This is due to the inherent difficulty of forecasting the

timing or amount of various reconciling items that would impact the

most directly comparable forward-looking GAAP financial measure,

that have not yet occurred, are out of Kinetik’s control and/or

cannot be reasonably predicted. Accordingly, such reconciliation is

excluded from this new release. Forward-looking non-GAAP financial

measures provided without the most directly comparable GAAP

financial measures may vary materially from the corresponding GAAP

financial measures.

- A non-GAAP financial measure. See “Non-GAAP Financial Measures”

and “Reconciliation of GAAP to Non-GAAP Measures” for further

details.

- Net of contributions in aid of construction and returns of

invested capital from unconsolidated affiliates.

- Leverage Ratio is total debt less cash and cash equivalents

divided by last twelve months Adjusted EBITDA, calculated in the

Company’s credit agreement. The calculation includes Qualified

Project and Acquisition EBITDA Adjustments that pertain to the

funding of the Permian Highway Pipeline expansion project, Delaware

Link project, first quarter 2023 midstream infrastructure asset

acquisition, and other qualified projects at the Midstream

Logistics segment.

- Net Debt to Adjusted EBITDA Ratio is defined as Net Debt

divided by last twelve months Adjusted EBITDA.

- Dividends reinvested and dividends paid in cash as of February

27th, 2024. Final numbers are subject to change.

- Net income including noncontrolling interest for the three and

twelve months ended December 31, 2022 was $48.5 million and $250.7

million, respectively.

- Dividend Coverage Ratio is Distributable Cash Flow divided by

total declared dividends.

- Issued and outstanding shares of 151,185,576 is the sum of

57,096,538 shares of Class A common stock and 94,089,038 shares of

Class C common stock.

- Net Debt is defined as total long-term debt, excluding deferred

financing costs, premiums and discounts, less cash and cash

equivalents.

Notes Regarding Presentation of Financial

Information

The following addresses the results of our operations for the

three and twelve months ended December 31, 2023, as compared to our

results of operations for the same periods in 2022. As the business

combination between BCP Raptor Holdco, LP, Kinetik’s predecessor

for accounting purposes (“BCP”) and Altus Midstream LP

(“Altus”) (the “Transaction”) was determined to be a

reverse merger, BCP was considered the accounting acquirer and

Altus was considered the legal acquirer. Therefore, BCP’s net

assets, carrying at historical value, were presented as the

predecessor to the Company’s historical financial statements and

the comparable period presented herein reflects the results of

operations of BCP for the three and twelve months ended December

31, 2022 and Altus’ results of operations from February 22, 2022,

the closing date of the Transaction, through December 31, 2022.

Kinetik’s financial results on and after February 22, 2022 reflect

the results of the combined company.

Unless otherwise noted or the context requires otherwise,

references herein to Kinetik Holdings Inc. or “the Company” with

respect to time periods prior to February 22, 2022 include BCP and

its consolidated subsidiaries and do not include Altus and its

consolidated subsidiaries, while references herein to Kinetik

Holdings Inc. with respect to time periods from and after February

22, 2022 include Altus and its consolidated subsidiaries.

The Company completed a two-for-one Stock Split on June 8, 2022.

All corresponding per-share and share amounts for periods prior to

June 8, 2022 have been retroactively restated to reflect the

two-for-one Stock Split.

KINETIK HOLDINGS INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

2023

2022(1)

(In thousands, except per

share data)

Operating revenues:

Service revenue

$

107,426

$

103,832

$

417,751

$

393,954

Product revenue

235,876

187,971

822,410

806,353

Other revenue

5,566

3,690

16,251

13,183

Total operating revenues

348,868

295,493

1,256,412

1,213,490

Operating costs and expenses:

Costs of sales (exclusive of depreciation

and amortization shown separately below)(2)

141,621

123,321

515,721

541,518

Operating expenses

42,716

36,293

161,520

137,289

Ad valorem taxes

6,668

1,034

21,622

16,970

General and administrative expenses

24,775

22,088

97,906

94,268

Depreciation and amortization

72,715

67,736

280,986

260,345

Loss on disposal of assets

4,236

9

19,402

12,611

Total operating costs and expenses

292,731

250,481

1,097,157

1,063,001

Operating income

56,137

45,012

159,255

150,489

Other income (expense):

Interest and other income

379

239

2,004

489

Gain on redemption of mandatorily

redeemable Preferred Units

—

—

—

9,580

Loss on debt extinguishment

(1,876

)

—

(1,876

)

(27,975

)

Gain on embedded derivative

—

—

—

89,050

Interest expense

(75,411

)

(56,667

)

(205,854

)

(149,252

)

Equity in earnings of unconsolidated

affiliates

53,187

60,250

200,015

180,956

Total other (expense) income, net

(23,721

)

3,822

(5,711

)

102,848

Income before income taxes

32,416

48,834

153,544

253,337

Income tax (benefit) expense

(234,938

)

372

(232,908

)

2,616

Net income including non-controlling

interest

267,354

48,462

386,452

250,721

Net income attributable to Preferred Unit

limited partners

—

—

—

115,203

Net Income attributable to common

shareholders

267,354

48,462

386,452

135,518

Net income attributable to Common Unit

limited partners

168,046

32,966

245,114

94,783

Net income attributable to Class A Common

Shareholders

$

99,308

$

15,496

$

141,338

$

40,735

Net income attributable to Class A Common

Shareholders, per share

Basic

$

1.70

$

0.26

$

2.39

$

1.48

Diluted

$

1.70

$

0.25

$

2.38

$

1.48

Weighted average shares(3)

Basic

55,738

44,403

51,791

41,326

Diluted

55,883

44,448

52,060

41,361

(1) The results of the legacy Altus

business are not included in the Company’s consolidated financials

prior to February 22, 2022. Refer to Note 1 – Description of

Business and Basis of Presentation in the Notes to the Consolidated

Financial Statements of the Company’s Form 10-K to be filed

subsequent to this earnings release for further information. (2)

Cost of sales (exclusive of depreciation and amortization) is net

of gas service revenues totaling $148.3 million and $70.4 million

for the years ended December 31, 2023 and 2022, respectively, for

certain volumes where we act as principal. (3) Share amounts have

been retrospectively restated to reflect the Company’s two-for-one

stock split, which was effected on June 8, 2022. Refer to Note 11 –

Equity and Warrants in the Notes to the Consolidated Financial

Statements of the Company’s Form 10-K to be filed subsequent to

this earnings release for further information.

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2022

2023

2022(1)

Net Income Including Non-controlling

Interests to Adjusted EBITDA

(In thousands)

Net income including non-controlling

interests (GAAP)

$

267,354

$

48,462

$

386,452

$

250,721

Add back:

Interest expense

75,411

56,667

205,854

149,252

Income tax (benefit) expense

(234,938

)

372

(232,908

)

2,616

Depreciation and amortization

72,715

67,736

280,986

260,345

Amortization of contract costs

1,655

463

6,620

1,807

Proportionate EBITDA from unconsolidated

affiliates

81,139

78,388

306,072

268,826

Share-based compensation

12,642

11,814

55,983

42,780

Loss on disposal of assets

4,236

9

19,402

12,611

Loss on debt extinguishment

1,876

—

1,876

27,975

Integration costs

30

2,197

1,015

12,208

Acquisition transaction costs

—

—

648

6,412

Other one-time cost or amortization

4,356

5,385

11,901

16,355

Deduct:

Interest and other income

363

—

677

—

Warrant valuation adjustment

14

133

88

133

Gain on redemption of mandatorily

redeemable Preferred Units

—

—

—

9,580

Unrealized gain on derivatives

4,907

—

4,291

—

Gain on embedded derivative

—

—

—

89,050

Equity income from unconsolidated

affiliates

53,187

60,250

200,015

180,956

Adjusted EBITDA(2) (non-GAAP)

$

228,005

$

211,110

$

838,830

$

772,189

Distributable Cash Flow (3)

Adjusted EBITDA (non-GAAP)

$

228,005

$

211,110

$

838,830

$

772,189

Proportionate EBITDA from unconsolidated

affiliates

(81,139

)

(78,388

)

(306,072

)

(268,826

)

Returns on invested capital from

unconsolidated affiliates

66,599

70,978

272,490

256,764

Interest expense

(75,411

)

(56,667

)

(205,854

)

(149,252

)

Unrealized (gain) loss on interest rate

derivatives

22,862

—

(4,619

)

—

Maintenance capital expenditures

(11,203

)

(4,806

)

(26,268

)

(12,298

)

Distributions paid to preferred unit

limited partners

—

—

—

(8,787

)

Distributable cash flow

(non-GAAP)

$

149,713

$

142,227

$

568,507

$

589,790

Free Cash Flow (4)

Distributable cash flow (non-GAAP)

$

149,713

$

142,227

$

568,507

$

589,790

Cash interest adjustment

10,726

12,989

2,773

28,982

Realized gain on interest rate

derivatives

4,736

—

11,818

—

Growth capital expenditures

(56,231

)

(42,409

)

(296,872

)

(207,927

)

Capitalized interest

(4,495

)

(1,485

)

(18,270

)

(2,755

)

Investments in unconsolidated

affiliates

(32,822

)

(21,041

)

(226,947

)

(76,770

)

Returns of invested capital from

unconsolidated affiliates

886

—

6,679

—

Contributions in aid of construction

4,404

1,455

12,243

15,799

Free cash flow (non-GAAP)

$

76,917

$

91,736

$

59,931

$

347,119

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (Continued)

Twelve Months Ended

December 31,

2023

2022(1)

(In thousands)

Reconciliation of net cash provided by

operating activities to Adjusted EBITDA

Net cash provided by operating

activities

$

584,480

$

613,006

Net changes in operating assets and

liabilities

4,057

(24,682

)

Interest expense

205,854

149,252

Amortization of deferred financing

costs

(6,194

)

(9,569

)

Contingent liabilities remeasurement

—

839

Current income tax expense

492

522

Returns on invested capital from

unconsolidated affiliates

(272,490

)

(256,764

)

Proportionate EBITDA from unconsolidated

affiliates

306,072

268,826

Derivative fair value adjustment and

settlement

7,963

(4,216

)

Interest income

(677

)

—

Unrealized gain on derivatives

(4,291

)

—

Integration costs

1,015

12,208

Transaction costs

648

6,412

Other one-time cost or amortization

11,901

16,355

Adjusted EBITDA(2) (non-GAAP)

$

838,830

$

772,189

Distributable Cash Flow(3)

Adjusted EBITDA (non-GAAP)

$

838,830

$

772,189

Proportionate EBITDA from unconsolidated

affiliates

(306,072

)

(268,826

)

Returns on invested capital from

unconsolidated affiliates

272,490

256,764

Interest expense

(205,854

)

(149,252

)

Unrealized gain on interest rate

derivatives

(4,619

)

—

Maintenance capital expenditures

(26,268

)

(12,298

)

Distributions paid to preferred unit

limited partners

—

(8,787

)

Distributable cash flow

(non-GAAP)

$

568,507

$

589,790

Free Cash Flow(4)

Distributable cash flow (non-GAAP)

$

568,507

$

589,790

Cash interest adjustment

2,773

28,982

Realized gain on interest rate

derivatives

11,818

—

Growth capital expenditures

(296,872

)

(207,927

)

Capitalized interest

(18,270

)

(2,755

)

Investments in unconsolidated

affiliates

(226,947

)

(76,770

)

Returns of invested capital from

unconsolidated affiliates

6,679

—

Contributions in aid of construction

12,243

15,799

Free cash flow (non-GAAP)

$

59,931

$

347,119

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (Continued)

December 31, 2023

September 30, 2023

June 30, 2023

March 31, 2023

Net Debt(5)

(In thousands)

Long-term debt, net

$

3,562,809

$

3,606,962

$

3,625,799

$

3,511,648

Plus: Deferred financing costs

31,510

23,038

24,201

25,352

Less: Unamortized premiums and discounts,

net

319

—

—

—

Total long-term debt

3,594,000

3,630,000

3,650,000

3,537,000

Less: Cash and cash equivalents

4,510

68

2,237

1,984

Net debt (non-GAAP)

$

3,589,490

$

3,629,932

$

3,647,763

$

3,535,016

(1) The results of the legacy Altus

business are not included in the Company’s consolidated financials

prior to February 22, 2022. (2) Adjusted EBITDA is defined as net

income including non-controlling interests adjusted for interest,

taxes, depreciation and amortization, impairment charges, asset

write-offs, the proportionate EBITDA from unconsolidated

affiliates, equity in earnings from unconsolidated affiliates,

share-based compensation expense, non-cash increases and decreases

related to trading and hedging agreements, extraordinary losses and

unusual or non-recurring charges. Adjusted EBITDA provides a basis

for comparison of our business operations between current, past and

future periods by excluding items that we do not believe are

indicative of our core operating performance. Adjusted EBITDA

should not be considered as an alternative to the GAAP measure of

net income including non-controlling interests or any other measure

of financial performance presented in accordance with GAAP. (3)

Distributable Cash Flow is defined as Adjusted EBITDA, adjusted for

the proportionate EBITDA from unconsolidated affiliates, returns on

invested capital from unconsolidated affiliates, interest expense,

net of amounts capitalized, unrealized gains or losses on interest

rate derivatives, distributions to preferred unitholders and

maintenance capital expenditures. Distributable Cash Flow should

not be considered as an alternative to the GAAP measure of net

income including non-controlling interests or any other measure of

financial performance presented in accordance with GAAP. We believe

that Distributable Cash Flow is a useful measure to compare cash

generation performance from period to period and to compare the

cash generation performance for specific periods to the amount of

cash dividends we make. (4) Free Cash Flow is defined as

Distributable Cash Flow adjusted for growth capital expenditures,

investments in unconsolidated affiliates, returns of invested

capital from unconsolidated affiliates, cash interest, capitalized

interest, realized gains or losses on interest rate derivatives and

contributions in aid of construction. Free Cash flow should not be

considered as an alternative to the GAAP measure of net income

including non-controlling interests or any other measure of

financial performance presented in accordance with GAAP. We believe

that Free Cash Flow is a useful performance measure to compare cash

generation performance from period to period and to compare the

cash generation performance for specific periods to the amount of

cash dividends that we make. (5) Net Debt is defined as total

long-term debt, excluding deferred financing costs, premiums and

discounts, less cash and cash equivalents. Net Debt illustrates our

total debt position less cash on hand that could be utilized to pay

down debt at the balance sheet date. Net Debt should not be

considered as an alternative to the GAAP measure of total long-term

debt, or any other measure of financial performance presented in

accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240228510256/en/

Kinetik Investors: (713) 487-4832 Maddie Wagner (713) 574-4743

Alex Durkee Website: www.kinetik.com

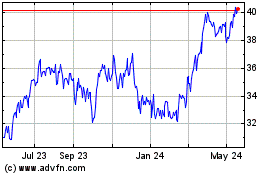

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Oct 2024 to Nov 2024

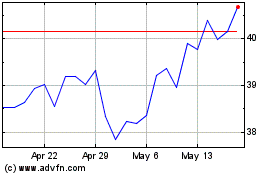

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Nov 2023 to Nov 2024