Kinetik Prices $500 Million Sustainability-Linked Senior Notes Offering Due 2028

December 04 2023 - 4:49PM

Business Wire

Kinetik Holdings Inc. (NYSE: KNTK) (“Kinetik”) today

announced that its subsidiary, Kinetik Holdings LP (the

“Issuer”), has priced its previously announced offering of

$500 million sustainability-linked senior notes due 2028 (the

“Senior Notes”). The Senior Notes were priced at par. The

Senior Notes mature on December 15, 2028, pay interest at the rate

of 6.625% per year and are payable on June 15 and December 15 of

each year. The first interest payment will be made on June 15,

2024. The Senior Notes will be fully and unconditionally guaranteed

by Kinetik.

The Issuer intends to use the net proceeds from the Offering,

together with cash on hand and borrowings under its revolving

credit facility, to repay a portion of the outstanding borrowings

under its existing Term Loan Credit Facility (“Term Loan”).

The Offering is expected to close on December 6, 2023, subject to

customary closing conditions. The Issuer has received approvals

from the lenders party to the Term Loan to enter into a First

Amendment to the Term Loan concurrently with the closing of the

Offering, which will amend certain provisions, including, among

other things, extending the maturity to June 8, 2026, effective

upon prepayment of loans thereunder in an aggregate principal

amount of no less than $500 million.

The interest rate on the Senior Notes will be linked to

Kinetik’s performance against sustainability performance targets

related to greenhouse gas (“GHG”) and methane emissions

reduction targets and the representation of women in corporate

officer positions. Kinetik published a Sustainability-Linked

Financing Framework (the “Framework”) on May 16, 2022 and

obtained a second party opinion (“SPO”) on the Framework

from ISS ESG. The Framework and the SPO are available on Kinetik’s

website.

The Senior Notes have not been and will not be registered under

the Securities Act of 1933, as amended (the “Securities

Act”), or the securities laws of any state and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements under the

Securities Act and applicable state securities laws.

The Senior Notes were offered only to persons reasonably

believed to be qualified institutional buyers under Rule 144A and

to non-U.S. persons outside the United States under Regulation S

under the Securities Act.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor shall there be

any sale of any securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Kinetik Holdings Inc.

Kinetik is a fully integrated, pure-play, Permian-to-Gulf Coast

midstream C-corporation operating in the Delaware Basin. Kinetik is

headquartered in Midland, Texas and has a significant presence in

Houston, Texas. Kinetik provides comprehensive gathering,

transportation, compression, processing and treating services for

companies that produce natural gas, natural gas liquids, crude oil

and water.

Forward-looking statements

This news release includes certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws. Forward-looking statements include, but are not

limited to, statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “seeks,” “possible,” “potential,”

“predict,” “project,” “prospects,” “guidance,” “outlook,” “should,”

“would,” “will,” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. These statements

include, but are not limited to, statements about Kinetik’s future

plans, expectations, and objectives for Kinetik’s operations,

including statements about strategy, synergies, and future

operations, sustainability initiatives, the Offering, the use of

proceeds therefrom and the amendment of the Term Loan. While

forward-looking statements are based on assumptions and analyses

made by us that we believe to be reasonable under the

circumstances, whether actual results and developments will meet

our expectations and predictions depend on a number of risks and

uncertainties which could cause our actual results, performance,

and financial condition to differ materially from our expectations.

See Part I, Item 1A. Risk Factors in our Annual Report on Form 10-K

for the year ended December 31, 2022. Any forward-looking statement

made by us in this news release speaks only as of the date on which

it is made. Factors or events that could cause our actual results

to differ may emerge from time to time, and it is not possible for

us to predict all of them. We undertake no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future development, or otherwise, except as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231204808646/en/

Kinetik Investors: (713) 487-4832 Maddie Wagner (713) 574-4743

Alex Durkee

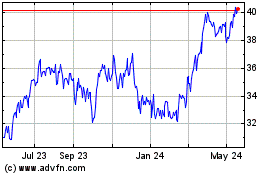

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Jan 2025 to Feb 2025

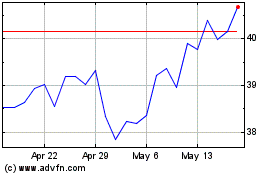

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Feb 2024 to Feb 2025