Kimco Realty® (NYSE: KIM), a real estate investment trust (REIT)

and leading owner and operator of high-quality, open-air,

grocery-anchored shopping centers and mixed-used properties in the

United States, today announced that S&P Global Ratings

(“S&P”) revised its rating outlook for KIM to ‘Positive’ from

‘Stable’ and affirmed the Company’s ratings, including the ‘BBB+’

Issuer Credit Rating.

In its public announcement, S&P noted “The

positive outlook reflects our expectation for Kimco to achieve

solid operating performance over the next two years. This stems

from favorable retail fundamentals, historically high leased

occupancy, positive leasing and releasing spreads, and upside

potential at recently acquired RPT properties.”

About Kimco

Realty®Kimco Realty® (NYSE: KIM) is a

real estate investment trust (REIT) and leading owner and operator

of high-quality, open-air, grocery-anchored shopping centers and

mixed-use properties in the United States. The company’s

portfolio is strategically concentrated in the first-ring suburbs

of the top major metropolitan markets, including

high-barrier-to-entry coastal markets and rapidly expanding Sun

Belt cities. Its tenant mix is focused on essential,

necessity-based goods and services that drive multiple shopping

trips per week. Publicly traded on the NYSE since 1991 and included

in the S&P 500 Index, the company has specialized in shopping

center ownership, management, acquisitions, and value-enhancing

redevelopment activities for more than 60 years. With a proven

commitment to corporate responsibility, Kimco Realty is a

recognized industry leader in this area. As of June 30, 2024, the

company owned interests in 567 U.S. shopping centers and mixed-use

assets comprising 101 million square feet of gross leasable

space.

The company announces material information to

its investors using the company’s investor relations website

(investors.kimcorealty.com), SEC filings, press releases, public

conference calls, and webcasts. The company also uses social media

to communicate with its investors and the public, and the

information the company posts on social media may be deemed

material information. Therefore, the company encourages investors,

the media, and others interested in the company to review the

information that it posts on the social media channels, including

Facebook (www.facebook.com/kimcorealty), Twitter

(www.twitter.com/kimcorealty) and LinkedIn

(www.linkedin.com/company/kimco-realty-corporation). The list of

social media channels that the company uses may be updated on its

investor relations website from time to time.

Safe Harbor StatementThis

communication contains certain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). The Company

intends such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with the safe harbor

provisions. Forward-looking statements, which are based on certain

assumptions and describe the Company’s future plans, strategies and

expectations, are generally identifiable by use of the words

“believe,” “expect,” “intend,” “commit,” “anticipate,” “estimate,”

“project,” “will,” “target,” “plan,” “forecast” or similar

expressions. You should not rely on forward-looking statements

since they involve known and unknown risks, uncertainties and other

factors which, in some cases, are beyond the Company’s control and

could materially affect actual results, performances or

achievements. Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to, (i) general adverse economic and local real estate conditions,

(ii) the impact of competition, including the availability of

acquisition or development opportunities and the costs associated

with purchasing and maintaining assets; (iii) the inability of

major tenants to continue paying their rent obligations due to

bankruptcy, insolvency or a general downturn in their business,

(iv) the reduction in the Company’s income in the event of multiple

lease terminations by tenants or a failure of multiple tenants to

occupy their premises in a shopping center, (v) the potential

impact of e-commerce and other changes in consumer buying

practices, and changing trends in the retail industry and

perceptions by retailers or shoppers, including safety and

convenience, (vi) the availability of suitable acquisition,

disposition, development and redevelopment opportunities, and the

costs associated with purchasing and maintaining assets and risks

related to acquisitions not performing in accordance with our

expectations, (vii) the Company’s ability to raise capital by

selling its assets, (viii) disruptions and increases in operating

costs due to inflation and supply chain disruptions, (ix) risks

associated with the development of mixed-use commercial properties,

including risks associated with the development, and ownership of

non-retail real estate, (x) changes in governmental laws and

regulations, including, but not limited to, changes in data

privacy, environmental (including climate change), safety and

health laws, and management’s ability to estimate the impact of

such changes, (xi) the Company’s failure to realize the expected

benefits of the merger with RPT Realty (the “RPT Merger”), (xii)

significant transaction costs and/or unknown or inestimable

liabilities related to the RPT Merger, (xiii) the risk of

litigation, including shareholder litigation, in connection with

the RPT Merger, including any resulting expense, (xiv) the ability

to successfully integrate the operations of the Company and RPT and

the risk that such integration may be more difficult,

time-consuming or costly than expected, (xv) risks related to

future opportunities and plans for the combined company, including

the uncertainty of expected future financial performance and

results of the combined company, (xvi) effects relating to the RPT

Merger on relationships with tenants, employees, joint venture

partners and third parties, (xvii) the possibility that, if the

Company does not achieve the perceived benefits of the RPT Merger

as rapidly or to the extent anticipated by financial analysts or

investors, the market price of the Company’s common stock could

decline, (xviii) valuation and risks related to the Company’s joint

venture and preferred equity investments and other investments,

(xix) collectability of mortgage and other financing receivables,

(xx) impairment charges, (xxi) criminal cybersecurity attacks,

disruption, data loss or other security incidents and breaches,

(xxii) risks related to artificial intelligence, (xxiii) impact of

natural disasters and weather and climate-related events, (xxiv)

pandemics or other health crises, such as the coronavirus disease

2019 (“COVID-19”), (xxv) our ability to attract, retain and

motivate key personnel, (xxvi) financing risks, such as the

inability to obtain equity, debt or other sources of financing or

refinancing on favorable terms to the Company, (xxvii) the level

and volatility of interest rates and management’s ability to

estimate the impact thereof, (xxviii) changes in the dividend

policy for the Company’s common and preferred stock and the

Company’s ability to pay dividends at current levels, (xxix)

unanticipated changes in the Company’s intention or ability to

prepay certain debt prior to maturity and/or hold certain

securities until maturity, (xxx) the Company’s ability to continue

to maintain its status as a REIT for U.S. federal income tax

purposes and potential risks and uncertainties in connection with

its UPREIT structure, and (xxxi) other risks and uncertainties

identified under Item 1A, “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2023. Accordingly, there

is no assurance that the Company’s expectations will be realized.

The Company disclaims any intention or obligation to update the

forward-looking statements, whether as a result of new information,

future events or otherwise. You are advised to refer to any further

disclosures the Company makes in other filings with the Securities

and Exchange Commission (“SEC”).

CONTACT:David F. BujnickiSenior Vice President, Investor

Relations and StrategyKimco Realty

Corporation1-833-800-4343 dbujnicki@kimcorealty.com

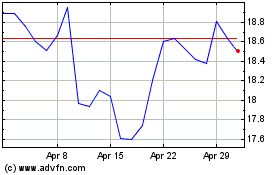

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

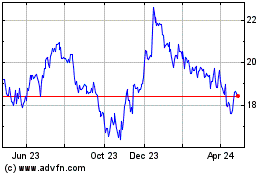

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Nov 2023 to Nov 2024