Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

May 15 2024 - 7:00AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

May 15, 2024

Commission File Number 001-36761

1 Temasek Avenue #37-02B

Millenia Tower

Singapore 039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-201716) OF

KENON HOLDINGS LTD. AND IN THE PROSPECTUSES RELATING TO SUCH REGISTRATION STATEMENT.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

|

|

KENON HOLDINGS LTD.

|

|

|

|

|

|

|

|

Date: May 15, 2024

|

By:

|

/s/ Robert L. Rosen

|

|

|

|

|

Name: Robert L. Rosen

|

|

|

|

|

Title: Chief Executive Officer

|

|

Exhibit 99.1

Kenon’s Subsidiary OPC Energy Ltd. Announces Entry into a Tax Equity Investment

Agreement for Stagecoach Project

Singapore, May 15, 2024. Kenon Holdings Ltd.’s (NYSE: KEN, TASE: KEN) subsidiary OPC Energy Ltd. (“OPC”) has announced

that a subsidiary of OPC’s subsidiary CPV Group (“CPV”) (in which OPC has a 70% interest) entered into a tax equity investment agreement (the “Investment Agreement”) with

a tax equity partner for an investment of $52 million in the Stagecoach Project, a solar-powered electricity generation plant with capacity of 102 MWdc, located in Georgia, United States (the “Project”). The

closing date of the investment occurred on the date the Investment Agreement was signed, which was after the Project reached its commercial operation date in the second quarter of 2024. The Project is owned indirectly by CPV.

Pursuant to the Investment Agreement, $43 million of the tax equity partner’s investment in the Project was provided on the closing date, and the remaining $9 million will be provided over time

depending on the Project’s production in accordance with the terms of the Investment Agreement.

In return for its investment in the Project, the tax equity partner is expected to benefit from most of the tax benefits in the Project, including in the form of production tax credits (PTC), which

provide a tax benefit for every KW/h generated by renewable energy during a ten-year period, as well as a certain participation in the distributable cash flow from the Project. In addition, the tax equity partner is entitled to participate in most of

the Project’s taxable income/losses for tax purposes, subject to certain conditions. At the end of a 9.5-year period from the closing date, the tax equity partner’s portion in the taxable income and tax benefits will decrease significantly and CPV

will have the option to purchase the tax equity partner's share in the Project pursuant to, and in accordance with, the terms of the Investment Agreement.

The Investment Agreement includes provisions for indemnification of the tax equity partner for certain matters, and veto rights, among other things, in respect of the creation of liens on the

Project’s assets or the entry into additional material agreements relating to the Project.

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about the Investment Agreement

entered into with the tax equity partner, including the terms and conditions of the investment, potential benefits of the investment, features of the Project and other non-historical statements. These forward-looking statements are based on current

expectations or beliefs, and are subject to uncertainty and changes in circumstances. These forward-looking statements are subject to a number of risks and uncertainties, which could cause the actual results to differ materially from those indicated

in Kenon’s forward-looking statements. Such risks include the risk that the investment is not consummated on the terms described herein or at all, the risk that the conditions to completion of the investment are not fulfilled and other risks,

including those set forth under the heading “Risk Factors” in Kenon’s most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. Except as required by law, Kenon undertakes no obligation to update these

forward-looking statements, whether as a result of new information, future events, or otherwise.

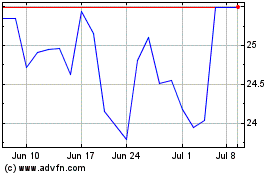

Kenon (NYSE:KEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kenon (NYSE:KEN)

Historical Stock Chart

From Nov 2023 to Nov 2024