Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

May 15 2024 - 6:00AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

May 15, 2024

Commission File Number 001-36761

1 Temasek Avenue #37-02B

Millenia Tower

Singapore 039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or

Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM

S-8 (FILE NO. 333-201716) OF KENON HOLDINGS LTD. AND IN THE PROSPECTUSES RELATING TO SUCH REGISTRATION STATEMENT.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

KENON HOLDINGS LTD.

|

|

|

|

|

|

|

|

Date: May 15, 2024

|

By:

|

/s/ Robert L. Rosen

|

|

|

|

|

Name: Robert L. Rosen

|

|

|

|

|

Title: Chief Executive Officer

|

|

Exhibit 99.1

Kenon Holdings Ltd. Provides Updates on Arbitration Proceeding against the Republic of

Peru

Singapore, May 15, 2024. Kenon Holdings Ltd. (NYSE: KEN, TASE: KEN) (“Kenon”) announces an update on its arbitration proceeding under the Free Trade

Agreement between Singapore and the Republic of Peru (“Peru”) in respect of the parties’ requests for rectification of and/or supplementation to the previously announced award relating to interest and other

matters. The claims, proceedings and the award in favor of Kenon and its wholly-owned subsidiary IC Power Ltd. (“IC Power”) in the amount of $110.7 million in damages together with $5.1 million in fees and

costs plus pre- and post-award interest (the “Award”) are described in more detail in Kenon’s annual report on Form 20-F for the year ending December 31, 2023 (the “Form

20-F”).

Kenon today announces that the arbitration tribunal has issued its Decision on the Requests for

Rectification and Clarification (the “Decision”). Pursuant to the Decision, pre- and post-award interest on the Award shall be payable at a rate of 6.91% per annum, compounding annually. As of April 30, 2024,

pre- and post-award interest on the Award is approximately $60 million. Interest will continue to accrue until the Award is paid.

As described in more detail in the Form 20-F, Kenon and IC Power have entered into an agreement with a

capital provider to provide capital for expenses in relation to the pursuit of their arbitration claims against Peru and other costs, and in the event Kenon or IC Power receives proceeds in connection with the Award or settlement thereof, the capital

provider will be entitled to be repaid the amount committed by the capital provider and to receive a portion of the claim proceeds, including interest. As of April 30, 2024, Kenon estimates that its share of the Award, including interest and net of

arbitration costs, would be approximately $75 million, subject to tax.

Pursuant to the International Centre for Settlement of Investment Dispute (“ICSID”)

Convention, Peru has 120 days from the date of the Decision to file an application to annul the Award on the limited grounds established by the ICSID Convention.

Caution Concerning Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements include statements with respect to the Award, pre- and post-Award interest on the Award, the agreement with a capital provider and Kenon’s estimated share of the Award and other

non-historical statements. These forward-looking statements are based on current expectations or beliefs, and are subject to uncertainty and changes in circumstances. These forward-looking statements are subject to a number of risks and

uncertainties, which could cause the actual results to differ materially from those indicated in these forward-looking statements. Such risks include the risks related to the Award including a potential application to annul the Award, the ability to

enforce the Award, amounts payable to the capital provider and retained by Kenon upon payment or successful enforcement of the Award and other risks including those set forth under the heading “Risk Factors” in Kenon’s most recent Annual Report on

Form 20-F filed with the U.S. Securities and Exchange Commission. Except as required by law. Kenon undertakes no obligation to update these forward-looking statements, whether as a result of new information, future events, or otherwise.

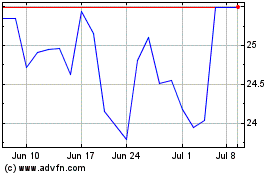

Kenon (NYSE:KEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kenon (NYSE:KEN)

Historical Stock Chart

From Nov 2023 to Nov 2024