Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

March 27 2023 - 5:17PM

Edgar (US Regulatory)

Filed

pursuant to Rule 425 of the Securities Act of 1933, as amended

and

deemed filed pursuant to Regulation 14A

under

the Securities and Exchange Act of 1934, as amended

Subject

Companies:

Kayne

Anderson Energy Infrastructure Fund, Inc.

Commission

File No. 811-21593

Kayne

Anderson NextGen Energy & Infrastructure, Inc.

Commission

File No. 811-22467

TRADITIONAL MIDSTREAM (See Note 1) NATURAL GAS + LNG INFRA Compelling Long - Term Value Creation Opportunity KYN and KMF Merger: Creating Kayne Anderson’s Flagship Energy Infrastructure Fund Kayne Anderson Energy Infrastructure Fund (KYN) Kayne Anderson NextGen Energy & Infrastructure (KMF) We are pleased to announce this combination. This merger is about positioning for the future and capitalizing on long - term tailwinds in the energy infrastructure sector. KYN’s investment objective and focus remain unchanged following completion of the merger. We will continue to thoughtfully invest in the North American energy infrastructure sector, and stockholders of the combined entity will have exposure to the largest macro trends in the energy industry – energy security and the energy transition. “ “ $2.4 billion portfolio ~80% of the portfolio in the midstream sector Jim Baker President, CEO and Chairman of KYN and KMF This merger is about positioning for the future and capitalizing on significant tailwinds in the energy infrastructure sector, including energy security and the energy transition Solidifies KYN as the premier entity to provide closed - end fund investors with exposure to a portfolio of energy infrastructure investments More comprehensive way to invest in Energy Infrastructure Sector Capitalize on the favorable outlook for the North American energy sector via lower volatility energy infrastructure businesses KYN’s advisor is a diversified alternative asset manager with a long track record in energy infrastructure and energy industries KYN Portfolio Attributes • KYN will acquire substantially all KMF’s assets and assume KMF’s liabilities • KMF outstanding common stock exchanged for newly issued KYN common stock with stock - for - stock exchange at relative per share NAVs (See Note 2) Tax Considerations: • The merger is expected to qualify as a tax - free reorganization • Not expected to be taxable to KYN or KMF stockholders KMF Tender Offer: • If both KYN and KMF shareholders approve the merger, KMF to conduct a tender offer for 15 % of its outstanding shares at 95 % of NAV (See Notes 3 and 4 ) • Using KMF’s NAV and stock price as of March 24, 2023, the tender offer would represent a 19% premium to KMF’s closing price on such date (See Note 5) Stockholder Approvals: • Stockholder meetings scheduled to take place on June 20, 2023 • Record date for stockholder votes is March 27, 2023 Key Merger Terms Transaction: ~20% of the portfolio in the utilities / renewable infrastructure

Favorable Investment Attributes and Industry Tailwinds Support Value - Creation Potential Energy security a key priority given evolving geopolitical landscape Energy transition is a multi - decade megatrend in energy sector Highly contracted cash flows supported by strong underlying fundamentals “Mission critical” infrastructure assets enabling modern life Exposure to North American energy sector March 27, 2023 • Merger announcement date • Record date for stockholder votes June 20, 2023 • Stockholder meetings scheduled to take place Fiscal Q3 2023 • KMF tender offer expected to occur during Fiscal Q3 2023 (See Notes 4 and 8) Fiscal 2023 • Merger expected to close prior to the end of Fiscal 2023 Timeline to Merger Closing KYN management announced its intention to recommend another 1¢ increase to KYN’s quarterly distribution note once the merger closes 10% increase At 22¢ per share, the cumulative increase is 10% (See Note 6) KYN Distributions 5% increase On March 27, 2023, KYN increased its quarterly distribution rate by 1¢ to 21¢ per 22¢ per share Delivering Increased Distributions to Stockholders KMF Distributions 22% increase Based on KYN’s expected quarterly distribution rate once the merger closes, KMF stockholders will experience a 22% increase on a pro forma basis (See Note 7)

Disclaimer and Risk Considerations All investments involve risk, including possible loss of principal. The value of an investment in the funds could be volatile, and you could suffer losses of some or a substantial portion of the amount invested. The funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. For this and other important information, please refer to each fund’s most recent prospectus available at www.sec.gov and www.kaynefunds.com. Closed - end funds, unlike open - end funds, are not continuously offered. As with any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Shares of closed - end funds frequently trade at a market price that is below their net asset value. Performance data quoted represent past performance; past performance does not guarantee future results. Current performance of the funds may be higher or lower than the performance quoted. NAV returns reflect the deduction of management fees and expenses but do not reflect transaction fees or broker commissions. CAUTIONARY NOTE REGARDING FORWARD - LOOKING STATEMENTS: This communication contains statements reflecting assumptions, expectations, projections, intentions, or beliefs about future events. These and other statements not relating strictly to historical or current facts constitute forward - looking statements as defined under the U.S. federal securities laws. Forward - looking statements involve a variety of risks and uncertainties. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; energy industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in detail in the Company’s filings with the SEC, available at www.kaynefunds.com or www.sec.gov. Actual events could differ materially from these statements or from our present expectations or projections. You should not place undue reliance on these forward - looking statements, which speak only as of the date they are made. Kayne Anderson undertakes no obligation to publicly update or revise any forward - looking statements made herein. There is no assurance that the Company’s investment objectives will be attained. This communication shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of any securities in any jurisdiction in which such offer or sale is not permitted. Nothing contained in this communication is intended to recommend any investment policy or investment strategy or consider any investor’s specific objectives or circumstances. Before investing, please consult with your investment, tax, or legal adviser regarding your individual circumstances. This communication is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any shares of KYN or KMF. The tender offer would be made solely by a formal tender offer document when available. KMF stockholders should read that document when it is available. This press release contains forward - looking statements related to the proposed tender offer, including the timing and the process for the proposed tender offer. Such statements are based on management’s current expectations and are subject to a number of uncertainties and risks, which could cause actual terms to differ from those described in the forward - looking statements. KAYNE ANDERSON: Leading the Way in Alternative Niche Investing Since 1984 KA Fund Advisors, LLC (“KAFA”) is the adviser to KYN and KMF. Kayne Anderson Capital Advisors, L.P. (collectively “Kayne Anderson”), founded in 1984, is leading alternative investment management firm focused on infrastructure, real estate, credit, and private equity. Kayne’s investment philosophy is to pursue niches, with an emphasis on cash flow, where our knowledge and sourcing advantages enable us to seek to deliver above average, risk - adjusted investment returns. As responsible stewards of capital, Kayne’s philosophy extends to promoting responsible investment practices and sustainable business practices to create long - term value for our investors. Kayne manages over $32 billion in assets (as of 1/31/23) for institutional investors, family offices, high net worth and retail clients and employs over 350 professionals in five offices across the U.S. For additional information, please contact investor relations at 877.657.3863 or email cef@kaynecapital.com. Kayne Anderson Energy Infrastructure Fund, Inc. (NYSE: KYN) is a non - diversified, closed - end management investment company registered under the Investment Company Act of 1940, as amended, whose common stock is traded on the NYSE. The Company’s investment objective is to provide a high after - tax total return with an emphasis on making cash distributions to stockholders. KYN intends to achieve this objective by investing at least 80% of its total assets in securities of Energy Infrastructure Companies. See Glossary of Key Terms in the Company’s most recent annual report for a description of these investment categories and the meaning of capitalized terms. Kayne Anderson NextGen Energy & Infrastructure, Inc. (NYSE: KMF) is a non - diversified, closed - end management investment company registered under the Investment Company Act of 1940, as amended, whose common stock is traded on the NYSE. The Fund’s investment objective is to provide a high level of total return with an emphasis on making cash distributions to its stockholders. The Fund seeks to achieve its investment objective by investing at least 80% of its total assets in securities of Energy Companies and Infrastructure Companies. The Fund anticipates that the majority of its investments will consist of investments in ”NextGen” companies, which we define as Energy Companies and Infrastructure Companies that are meaningfully participating in, or benefitting from, the Energy Transition. See Glossary of Key Terms in the Fund’s most recent annual report for a description of these investment categories and the meaning of capitalized terms. Footnotes 1. Includes diversified, liquids - oriented and G&P midstream companies. 2. The exchange ratio will be determined immediately prior to the merger’s closing date. As of March 24, 2023, KYN’s NAV per share was $9.51 and KMF’s was $8.41. For illustrative purposes, if these were the NAVs on the day prior to closing of the merger, then KMF stockholders would be issued approximately 0.884 shares of KYN for each share of KMF. 3. KMF management, its Board of Directors and Kayne Anderson have agreed to not participate in the tender offer. 4. Tender offer will occur prior to the merger’s closing date. 5. Example for illustrative purposes. 6. This increase is relative to the distribution paid to stockholders during the first quarter of Fiscal 2023 (20 cents per share). 7. This increase is (i) based on an implied distribution rate of 19.5 cents per KMF share pro forma for the merger and (ii) is relative to KMF’s distribution paid to stockholders during the first quarter of Fiscal 2023 (16 cents per share). 8. Tender offer subject to both KYN and KMF shareholders approving the merger.

Kayne Anderson NextGen E... (NYSE:KMF)

Historical Stock Chart

From Jun 2024 to Jul 2024

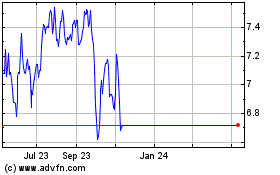

Kayne Anderson NextGen E... (NYSE:KMF)

Historical Stock Chart

From Jul 2023 to Jul 2024