Q3 FY25 GAAP Operating Income of $206

million

Q3 FY25 Adjusted EBITDA of $262 million and

Adjusted EBITDA Margin of 27.5%

Average Net Sales Price Growth Across All

Regions

Reaffirms 2H and FY25 Guidance for North

America Volume and EBIT Margin, Total Adjusted Net Income

Planning for Growth and Margin Expansion

Across Regions for FY26

James Hardie Industries plc (ASX / NYSE: JHX) ("James Hardie"

or the "Company"), a leader in providing high performance, low

maintenance building products and solutions, and a company

inspiring how communities design build and grow, today announced

results for its third quarter ending December 31, 2024. Speaking to

the results, Aaron Erter, CEO said, “We delivered strong business

and financial results in the third quarter, and our year-to-date

performance shows that we have a strong handle on our business as

we continue to scale the organization and invest to grow

profitably. Our teams are focused on safely delivering the highest

quality products, solutions and services to our customers, and we

are executing on our strategy to outperform our end-markets.”

Mr. Erter continued, “We are winning by partnering with our

customers, contractors and homeowners, and this success propels our

organization forward and fuels my optimism around the future of

James Hardie. We have the strongest team in the industry and the

right strategy to go after our material conversion opportunity. In

our North American business, our results to date represent a

double-digit five-year sales CAGR leading to more than +400bps of

Adjusted EBITDA margin expansion, a clear demonstration of the

inherent strength of our unique value proposition and the

underlying momentum in our strategy.”

Rachel Wilson, CFO said, “Our strong margins underpin our cash

flow, and we are funding our capital priorities with cash generated

by our operations. In response to current market conditions, we

have demonstrated a balanced approach between cost discipline and

funding growth. This has positioned us well to accelerate our

outperformance, invest in growth and execute on our capital

allocation framework.”

Third Quarter Highlights

- Net Sales of $953 million, down (3%)

- GAAP Operating income of $206 million; GAAP Operating margin of

21.6%; GAAP Net income of $142 million; and GAAP Diluted EPS of

$0.33

- Adjusted EBITDA of $262 million, down (7%) with Adjusted EBITDA

margin of 27.5%, down (120bps)

- Adjusted Net Income of $154 million, down (15%)

- Adjusted Diluted EPS of $0.36, down (13%)

Segment Business Update and

Results

North America Fiber Cement

In North America, the Company is outperforming its end markets

through a superior total value proposition and driving leading

margins despite raw material headwinds. Supportive housing

fundamentals and significant material conversion opportunity drive

the team's focus on preparing the North America manufacturing

footprint for market recovery. The Company is investing across the

value chain and growing its contractor base to capture the repair

& remodel opportunity. Similarly, in new construction, efforts

to deepen exclusivity and increase trim attachment rates support

growth and share gain with large homebuilders including recently

signing two national, multi-year exclusive hard siding and trim

agreements with M/I Homes and David Weekley Homes, who are among

the largest homebuilders in the US. During the quarter and

comparing against record results in the prior year, net sales

decreased (1%). Volumes declined (3%) due to continued market

weakness, particularly in multi-family, partially offset by company

specific efforts to gain share in single-family new construction

and repair & remodel. Sales also benefited from a higher

average net sales price, resulting from the January 2024 price

increase. Volume of Exterior products declined low single-digits

year-over-year, but rose +5% sequentially. Volume of Interior

products declined mid single-digits on both a year-over-year and

sequential basis. EBIT margin decreased (360bps) to 29.1%, due to

higher pulp and cement costs as well as unfavorable production cost

absorption, partially offset by Hardie Operating System (HOS)

savings. Startup costs were also higher in the quarter, related to

our Prattville facility. Excluding depreciation and amortization

expense, which rose +23% to $41 million, EBITDA declined (8%) to

$251 million with EBITDA margin of 34.8%, a decrease of (250bps)

attributable to similar drivers of EBIT margin.

Asia Pacific Fiber Cement

In Australia & New Zealand, the Company is increasing share

through new customer acquisitions and project conversion enabled by

customer integration. The Company is influencing how homeowners

build, and driving growth through Co-Creation and leveraging the

James Hardie brand. The teams are innovating to accelerate material

conversion with a key focus on new construction, specifically the

conversion of brick & masonry. Overall, while market demand

remains challenged, the Asia Pacific team is focused on finding

further efficiencies and driving HOS savings to underpin the

segment's consistent profitability. During the quarter, net sales

decreased (13%) in Australian dollars, due to lower volumes of

(28%) partially offset by a higher average net sales price of +20%.

The decline in volumes and the increase in average net sales price

was primarily attributable to our decision to cease manufacturing

and wind down commercial operations in the Philippines. Australia

& New Zealand together saw a low single-digit decrease in

volume and a slight increase in average net sales price, leading to

relatively flat net sales. EBIT margin rose +180bps to 29.3%,

primarily attributable to the Philippines decision. Margins also

rose modestly in Australia & New Zealand, due primarily to

slightly positive average net sales price and HOS savings.

Excluding depreciation and amortization expense, which increased

+17% to $5 million, EBITDA declined (3%) to $40 million with EBITDA

margin of 33.5%, an increase of +290bps attributable to the

Philippines decision.

Europe Building Products

Markets across Europe remain challenged, particularly in Germany

where improvement is anticipated to be more gradual, while in the

UK, the Company is well-positioned to capture potential improvement

in residential construction. Growth in high-value products remains

a strategic priority, as leveraging a broader and deeper product

portfolio should accelerate share gains and customer wins.

Highlighting the strength of our offering, earlier this fiscal year

Hardie® Architectural Panel received the prestigious iF Design

Award, recognizing our unwavering commitment to creating products

that seamlessly blend form and function. During the quarter, net

sales declined (1%) in Euros, including a (4%) impact related to a

favorable customer rebate true-up in the prior year, partially

offset by a higher average net sales price of +4%, driven by a

price increase earlier this fiscal year. EBIT margin decreased

(340bps) to 3.1%, although profitability improved, when excluding

the unfavorable comparison created by the prior year customer

rebate true-up. Excluding depreciation and amortization expense,

which rose +9% to $8 million, EBITDA declined (22%) to $12 million

with EBITDA margin of 10.3%, a (260bps) decrease similarly

explained by the customer rebate true-up impact.

Market Outlook and Guidance, Planning

Assumptions and Long-Term Aspirations

Full Year FY25 Market Outlook and Guidance

Speaking to the Company's market outlook, Mr. Erter said, “With

our fiscal year drawing to a close, I reflect with pride on the

resilience our teams have shown throughout FY25. The opportunity in

the years to come is substantial, and the investments we have made

throughout the year are foundational enablers of scale and critical

accelerators of our future growth. But this year is not over, and

our business leaders remain focused on finishing strong to cement a

strong foundation for the coming years. Our market demand

expectations have not changed, but importantly, neither has our

commitment to outperforming our end markets and managing the

business decisively to sustain our peer-leading profitability.”

Ms. Wilson added with respect to financial guidance, “Despite

challenging end markets and raw material headwinds, we remain

well-positioned to deliver volumes within our original guidance

range. Our Hardie Operating System initiatives, together with

efforts to rationalize and prioritize expenses have helped mitigate

uncontrollable headwinds to margins. We delivered a solid third

quarter, which gives us increased confidence in reiterating both

our second half and full fiscal year guidance across each of our

operating metrics.”

- North America Volumes: At least 2.95 billion standard

feet (unchanged)

- North America EBIT Margin: At least 29.3%

(unchanged)

- Adjusted Net Income: At least $635 million

(unchanged)

- Capital Expenditures: ~$420 million (prev. $420 million

to $440 million)

Full Year FY26 Planning Assumptions

Ms. Wilson added with respect to FY26 planning assumptions, “We

are committed to driving profitable growth in our operating

businesses, and it is imperative that we are aligned as an

organization around making decisions that drive cash generation,

which funds our growth investments and capital return priorities.

We have built our near-, medium- and long-term plans around this

organizational imperative, and to maintain alignment between how we

communicate externally and how we run our business, we plan to

provide guidance for sales and EBITDA beginning with FY26, in lieu

of volume, EBIT and net income. To assist in this transition and to

reinforce our commitment to also growing EBIT and net income, we

are sharing additional non-cash and non-operating modeling

assumptions."

- Total Depreciation & Amortization Expense: ~$225mm

vs. ~$210mm in FY25

- Interest Expense: ~$60mm vs. ~$62mm in FY25

- Capitalized Interest: ~($20mm) vs. ~($20mm) in FY25

- Adjusted Effective Tax Rate: Relatively Flat vs. 23.0 to

24.0% in FY25

Note: Assumptions are subject to change, but reflect current

in-service fixed assets, debt balances and market interest

rates.

Mr. Erter concluded by saying, “Thanks to the hard work of our

teams, and our decision to boldly continue investing through the

softer environment, we are set up to sustain our leading position

in the industry and accelerate our outperformance as markets

recover. We continue to plan for recovery and growth in both repair

& remodel and new construction. Our teams continuously evolve

our plans to deliver sustained market outperformance and capture

the value that our products demand in the marketplace. While it is

still too early to quantify our expected results for FY26, we are

planning for sales growth and Adjusted EBITDA margin expansion

across each of our segments, and for the company as a whole.”

Cash Flow, Capital Investment &

Allocation

Operating cash flow totaled $657 million during the nine months

of FY25, driven by $734 million of net income, adjusted for

non-cash items, and lower working capital of $50 million, partially

offset by $88 million of asbestos claims paid. Capital expenditures

were $333 million.

During the nine months of FY25, the Company invested $134

million related to capacity expansion, with key milestones

including commencement of production at the Company's Westfield,

Massachusetts ColorPlus® facility in April, as well as the

Company's Prattville Alabama facility, specifically on Sheet

Machine 3 in September. Throughout the remainder of FY25, the

Company plans to continue construction of Sheet Machine 4 and

ColorPlus® finishing capacity, both at Prattville, Alabama,

continue the ongoing brownfield expansion in Orejo, Spain, and

further its planning for previously announced brownfield and

greenfield capacity in North America.

During the nine months of FY25, the Company repurchased 4.5

million shares for a total of $150 million, completing the

previously-announced repurchase program. In November, the Company's

Board of Directors approved a new repurchase program, under which

the Company is authorized to purchase up to $300 million of shares

through October of 2025.

Key Financial

Information

Q3 FY25

Q3 FY24

Change

Q3 FY25

Q3 FY24

Change

Group

(US$ millions)

Net Sales

953.3

978.3

(3%)

EBIT

206.1

226.1

(9%)

Adjusted EBIT

207.0

234.1

(12%)

EBIT Margin (%)

21.6

23.1

(1.5 pts)

Adjusted EBIT Margin (%)

21.7

23.9

(2.2 pts)

Adjusted EBITDA

262.1

280.4

(7%)

Adjusted EBITDA Margin (%)

27.5

28.7

(1.2 pts)

Net Income

141.7

145.1

(2%)

Adjusted Net Income

153.6

179.9

(15%)

Diluted EPS - US$ per share

0.33

0.33

—%

Adjusted Diluted EPS - US$ per share

0.36

0.41

(13%)

North America Fiber Cement

(US$ millions)

Net Sales

719.3

727.0

(1%)

EBIT

209.3

237.8

(12%)

EBIT Margin (%)

29.1

32.7

(3.6 pts)

EBITDA

250.5

271.3

(8%)

EBITDA Margin (%)

34.8

37.3

(2.5 pts)

Asia Pacific Fiber Cement

(US$ millions)

(A$ millions)

Net Sales

118.1

133.8

(12%)

180.1

206.3

(13%)

EBIT

34.8

36.7

(5%)

52.8

56.7

(7%)

Adjusted EBIT

34.8

36.7

(5%)

52.8

56.7

(7%)

EBIT Margin (%)

29.3

27.5

1.8 pts

29.3

27.5

1.8 pts

Adjusted EBIT Margin (%)

29.3

27.5

1.8 pts

29.3

27.5

1.8 pts

Adjusted EBITDA

39.7

40.9

(3%)

60.3

63.2

(5%)

Adjusted EBITDA Margin (%)

33.5

30.6

2.9 pts

33.5

30.6

2.9 pts

Europe Building Products

(US$ millions)

(€ millions)

Net Sales

115.9

117.5

(1%)

108.6

109.3

(1%)

EBIT

3.6

7.6

(53%)

3.4

7.1

(52%)

EBIT Margin (%)

3.1

6.5

(3.4 pts)

3.1

6.5

(3.4 pts)

EBITDA

11.9

15.2

(22%)

11.2

14.1

(21%)

EBITDA Margin (%)

10.3

12.9

(2.6 pts)

10.3

12.9

(2.6 pts)

9 Months

FY25

9 Months

FY24

Change

9 Months

FY25

9 Months

FY24

Change

Group

(US$ millions)

Net Sales

2,906.0

2,931.4

(1%)

EBIT

593.8

683.4

(13%)

Adjusted EBIT

654.0

708.3

(8%)

EBIT Margin (%)

20.4

23.3

(2.9 pts)

Adjusted EBIT Margin (%)

22.5

24.2

(1.7 pts)

Adjusted EBITDA

810.8

845.0

(4%)

Adjusted EBITDA Margin (%)

27.9

28.8

(0.9 pts)

Net Income

380.4

454.6

(16%)

Adjusted Net Income

488.2

533.3

(8%)

Diluted EPS - US$ per share

0.88

1.03

(15%)

Adjusted Diluted EPS - US$ per share

1.13

1.21

(7%)

Operating Cash Flow

657.4

749.5

(12%)

North America Fiber Cement

(US$ millions)

Net Sales

2,144.4

2,156.2

(1%)

EBIT

638.5

688.1

(7%)

EBIT Margin (%)

29.8

31.9

(2.1 pts)

EBITDA

754.0

787.7

(4%)

EBITDA Margin (%)

35.2

36.5

(1.3 pts)

Asia Pacific Fiber Cement

(US$ millions)

(A$ millions)

Net Sales

401.8

421.3

(5%)

606.9

641.1

(5%)

EBIT

68.0

127.6

(47%)

104.3

194.1

(46%)

Adjusted EBIT

125.3

127.6

(2%)

189.0

194.1

(3%)

EBIT Margin (%)

17.2

30.3

(13.1 pts)

17.2

30.3

(13.1 pts)

Adjusted EBIT Margin (%)

31.1

30.3

0.8 pts

31.1

30.3

0.8 pts

Adjusted EBITDA

139.7

140.1

—%

210.8

213.1

(1%)

Adjusted EBITDA Margin (%)

34.7

33.2

1.5 pts

34.7

33.2

1.5 pts

Europe Building Products

(US$ millions)

(€ millions)

Net Sales

359.8

353.9

2%

332.9

326.5

2%

EBIT

24.7

31.9

(23%)

22.8

29.4

(22%)

EBIT Margin (%)

6.8

9.0

(2.2 pts)

6.8

9.0

(2.2 pts)

EBITDA

48.6

53.4

(9%)

44.9

49.2

(9%)

EBITDA Margin (%)

13.5

15.1

(1.6 pts)

13.5

15.1

(1.6 pts)

Further Information

Readers are referred to the Company’s Condensed Consolidated

Financial Statements and Management’s Analysis of Results for the

third quarter ended December 31, 2024 for additional information

regarding the Company’s results.

All comparisons made are vs. the comparable period in the prior

fiscal year and amounts presented are in US dollars, unless

otherwise noted.

Conference Call Details

James Hardie will hold a conference call to discuss results and

outlook Wednesday, February 19, 2025 at 9:00am AEDT (Tuesday,

February 18, 2025 at 5:00pm EST). Participants may register for a

live webcast and access a replay following the event of the event

on the Investor Relations section of the Company’s website

(ir.jameshardie.com).

About James Hardie

James Hardie Industries plc is the world’s #1 producer and

marketer of high-performance fiber cement and fiber gypsum building

solutions. We market our fiber cement products and systems under

the Hardie™ brand, such as Hardie® Plank, Hardie® Panel, Hardie®

Trim, Hardie® Backer, Hardie® Artisan Siding, Hardie™ Architectural

Collection, and other brand names such as Cemboard®, Prevail®,

Scyon®, Linea® and Hardie™ Oblique™ cladding. We are also a market

leader in the European premium timber frame and dry lining

business, especially in Germany, Switzerland and Denmark. We market

our fiber gypsum and cement-bonded boards under the fermacell®

brand and our fire-protection boards under the AESTUVER® brand.

James Hardie Industries plc is a limited liability company

incorporated in Ireland with its registered office at 1st Floor,

Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79,

Ireland.

Cautionary Note and Use of Non-GAAP

Measures

This Earnings Release includes financial measures that are not

considered a measure of financial performance under generally

accepted accounting principles in the United States (GAAP), such as

Adjusted Net Income, Adjusted EBIT, Adjusted EBITDA and Adjusted

Diluted EPS. These non-GAAP financial measures should not be

considered to be more meaningful than the equivalent GAAP measure.

Management has included such measures to provide investors with an

alternative method for assessing its operating results in a manner

that is focused on the performance of its ongoing operations and

excludes the impact of certain legacy items, such as asbestos

adjustments. Additionally, management uses such non-GAAP financial

measures for the same purposes. However, these non-GAAP financial

measures are not prepared in accordance with GAAP, may not be

reported by all of the Company’s competitors and may not be

directly comparable to similarly titled measures of the Company’s

competitors due to potential differences in the exact method of

calculation. The Company is unable to forecast the comparable US

GAAP financial measure for future periods due to, amongst other

factors, uncertainty regarding the impact of actuarial estimates on

asbestos-related assets and liabilities in future periods. For

additional information regarding the non-GAAP financial measures

presented in this Earnings Release, including a reconciliation of

each non-GAAP financial measure to the equivalent GAAP measure, see

the section titled “Non-GAAP Financial Measures” included in the

Company’s Earnings Presentation for the third quarter ended

December 31, 2024.

In addition, this Earnings Release includes financial measures

and descriptions that are considered to not be in accordance with

GAAP, but which are consistent with financial measures reported by

Australian companies, such as EBIT and EBIT margin. The Company

prepares its condensed consolidated financial statements under

GAAP. The equivalent GAAP financial statement line item description

for EBIT used in its condensed consolidated financial statements is

Operating income (loss). The Company provides investors with

definitions and a cross- reference from the non-GAAP financial

measure used in this Earnings Release to the equivalent GAAP

financial measure used in the Company's condensed consolidated

financial statements. See the section titled “Non-GAAP Financial

Measures” included in the Company’s Earnings Presentation for the

third quarter ended December 31, 2024.

This Earnings Release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of James Hardie to be materially

different from those expressed or implied in this release,

including, among others, the risks and uncertainties set forth in

Section 3 “Risk Factors” in James Hardie’s Annual Report on Form

20-F for the fiscal year ended March 31, 2024; changes in general

economic, political, governmental and business conditions globally

and in the countries in which James Hardie does business; changes

in interest rates; changes in inflation rates; changes in exchange

rates; the level of construction generally; changes in cement

demand and prices; changes in raw material and energy prices;

changes in business strategy and various other factors. Should one

or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those described herein. James Hardie assumes no

obligation to update or correct the information contained in this

Earnings Release except as required by law.

This earnings release has been authorized by the James Hardie

Board of Directors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218956006/en/

Investor and Media

Contact

Joe Ahlersmeyer, CFA Vice President, Investor Relations

+1 773-970-1213 investors@jameshardie.com

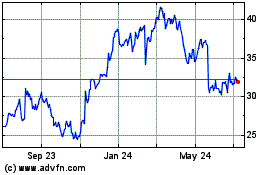

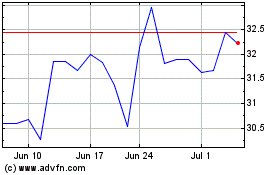

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Jan 2025 to Feb 2025

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Feb 2024 to Feb 2025