AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON NOVEMBER 7, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

ISSUER TENDER OFFER STATEMENT

UNDER SECTION 13(e)(1) OF THE

SECURITIES EXCHANGE ACT OF 1934

INVESCO TRUST

FOR INVESTMENT GRADE NEW YORK MUNICIPALS

(Name of Subject Company)

INVESCO TRUST FOR INVESTMENT GRADE NEW YORK MUNICIPALS

(Name of Filing Person (Issuer))

COMMON SHARES, NO PAR VALUE

(Title of Class of Securities)

46131T101

(CUSIP Number

of Class of Securities)

Melanie Ringold, Esq.

Invesco Trust for Investment Grade New York Municipals

11 Greenway Plaza,

Houston, Texas 77046

(713) 626-1919

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person)

CALCULATION OF FILING FEE

|

|

|

| TRANSACTION VALUATION |

|

AMOUNT OF FILING FEE: |

| $56,972,424.60 (a) |

|

$8,722.48 (b) |

| |

| (a) |

Pursuant to Rule 0-11(b)(1) under the Securities Exchange Act of

1934, as amended, the transaction value was calculated by multiplying 4,869,438 Common Shares of Invesco Trust for Investment Grade New York Municipals by $11.70, 99% of the Net Asset Value per share as of the close of ordinary trading on the New

York Stock Exchange on November 1, 2024. |

| (b) |

Calculated as $153.10 per $1,000,000 (.0001531) of the Transaction Valuation. |

| ☐ |

Check box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

| Amount Previously Paid: |

|

Filing Party: |

| Form or Registration No.: |

|

Date Filed: |

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party tender offer subject to Rule 14d-1. |

| |

☒ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

EXPLANATORY NOTE

Copies of the Offer to Purchase, dated November 7, 2024 and the Letter of Transmittal, among other documents, have been filed by Invesco

Trust for Investment Grade New York Municipals, as Exhibits to this Schedule TO, Tender Offer Statement (the “Schedule”), pursuant to Section 13(e)(1) of the Securities Exchange Act of 1934 (the “Exchange Act”). Unless

otherwise indicated, all material incorporated herein by reference in response to items or sub-items of this Schedule is incorporated by reference from the corresponding caption in the Offer to Purchase,

including the information provided under those captions.

ITEM 1. SUMMARY TERM SHEET.

Reference is hereby made to the Summary Term Sheet of the Offer to Purchase, which is attached as Exhibit (a)(1)(i) and is incorporated herein

by reference.

ITEM 2. SUBJECT COMPANY INFORMATION.

(a) The name of the issuer is Invesco Trust for Investment Grade New York Municipals, a diversified,

closed-end management investment company organized as a Delaware statutory trust (the “Fund”). The principal executive offices of the Fund are located at 1555 Peachtree Street, N.E., Atlanta, Georgia

30309. The telephone number is (800) 341-2929.

(b) The title of the subject class of

equity securities described in the offer is Common Shares (the “Shares”), with no par value. As of October 23, 2024, there were 19,477,753 Shares issued and outstanding.

(c) The principal market in which the Shares are traded is the New York Stock Exchange. For information on the high, low and closing (as of

the close of ordinary trading on the New York Stock Exchange on the last day of each of the Fund’s fiscal quarters) net asset values and market prices of the Shares in such principal market for each quarter during the Fund’s past two

fiscal years (as well as the last two fiscal quarters), see Section 8, “Price Range of Shares” of the Offer to Purchase, which is incorporated herein by reference.

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSON.

(a) The name of the filing person is Invesco Trust for Investment Grade New York Municipals (previously defined as the “Fund”), a

diversified, closed-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and organized as a Delaware statutory trust. The principal executive offices

of the Fund are located at 1555 Peachtree Street, N.E., Atlanta, Georgia 30309. The telephone number is (800) 341-2929. The filing person is the subject company. The members of the Board of Trustees of the

Fund are as follows: Beth Ann Brown (Chair), Carol Deckbar, Cynthia Hostetler, Eli Jones, Elizabeth Krentzman, Jeffrey H. Kupor, Anthony J. LaCava, Jr., James “Jim” Liddy, Prema Mathai-Davis, Joel W. Motley, Teresa M. Ressel, Douglas

Sharp, Robert C. Troccoli and Daniel S. Vandivort.

The executive officers of the Fund are as follows: Glenn Brightman, President and

Principal Executive Officer, Melanie Ringold, Senior Vice President, Chief Legal Officer and Secretary, Tony Wong, Senior Vice President, Stephanie C. Butcher, Senior Vice President, Adrien Deberghes, Principal Financial Officer,

1

Treasurer and Senior Vice President, Crissie M. Wisdom, Anti-Money Laundering Compliance Officer, Todd F. Kuehl, Chief Compliance Officer and Senior Vice President and James Bordewick Jr., Senior

Vice President and Senior Officer.

Correspondence to the Trustees and executive officers of the Fund should be mailed to c/o Invesco

Trust for Investment Grade New York Municipals, 1555 Peachtree Street, N.E., Atlanta, Georgia 30309, Attn: Secretary.

ITEM 4. TERMS OF THE

TRANSACTION.

(a) The Fund’s Board of Trustees has determined to commence an offer to purchase up to 25% of the Fund’s issued

and outstanding Common Shares. The offer is for cash at a price equal to 99% of the Fund’s net asset value per share (“NAV”) as of the close of ordinary trading on the New York Stock Exchange on December 10, 2024, or the next

business day after which the offer is extended, upon the terms and subject to the conditions set forth in the enclosed Offer to Purchase and the related Letter of Transmittal (which together constitute the “Offer”).

A copy of the Offer to Purchase and the Letter of Transmittal is attached hereto as Exhibit (a)(1)(i) and Exhibit (a)(1)(ii), respectively,

each of which is incorporated herein by reference. For more information on the type and amount of consideration offered to shareholders, the scheduled expiration date, extending the Offer and the Fund’s intentions in the event of

oversubscription, see Section 1, “Price; Number of Shares” and Section 15, “Extension of Tender Period; Termination; Amendments” of the Offer to Purchase. For information on the dates relating to the withdrawal of

tendered Shares, the procedures for tendering Shares and withdrawing Shares tendered, and the manner in which Shares will be accepted for payment, see Section 2, “Procedures for Tendering Shares,” Section 3, “Withdrawal

Rights,” and Section 4, “Payment for Shares” in the Offer to Purchase. For information on the federal income tax consequences of the Offer, see Section 2, “Procedures for Tendering Shares,” Section 10,

“Certain Effects of the Offer,” and Section 14, “Certain Federal Income Tax Consequences,” in the Offer to Purchase.

(b) The Fund has been informed that no Trustees, officers or affiliates (as the term “affiliate” is defined in Rule 12b-2 under the Exchange Act) of the Fund intend to tender Shares pursuant to the Offer to Purchase and, therefore, the Fund does not intend to purchase Shares from any officer, Trustee or affiliate of the Fund

pursuant to the Offer to Purchase.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS.

(e) Reference is hereby made to Section 7, “Plans or Proposals of the Fund,” Section 9, “Interest of Trustees and

Executive Officers; Transactions and Arrangements Concerning the Shares,” and Section 16, “Fees and Expenses” of the Offer to Purchase, which is incorporated herein by reference. Except as set forth therein, the Fund does not

know of any agreement, arrangement or understanding, whether or not legally enforceable, between the Fund (including any of the Fund’s executive officers or Trustees, any person controlling the Fund or any officer or director of any corporation

or other person ultimately in control of the Fund) and any other person with respect to any securities of the Fund. The foregoing includes, but is not limited to: the transfer or the voting of securities, joint ventures, loan or option arrangements,

puts or calls, guarantees of loans, guarantees against loss, or the giving or withholding of proxies, consents or authorizations.

2

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS.

(a)-(c) Reference is hereby made to Section 6, “Purpose of the Offer,” Section 7, “Plans or Proposals of the

Fund,” Section 10, “Certain Effects of the Offer,” and Section 11, “Source and Amount of Funds” of the Offer to Purchase, which is incorporated herein by reference. Except as noted herein and therein, the events

listed in Item 1006(c) of Regulation M-A are not applicable to the Fund (including any of the Fund’s executive officers or Trustees, any person controlling the Fund or any officer or director of any

corporation or other person ultimately in control of the Fund).

ITEM 7. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

(a)-(b) Reference is hereby made to Section 11, “Source and Amount of Funds” of the Offer to Purchase, which is incorporated

herein by reference.

(d) Not applicable.

The information requested by Item 1007(a), (b) and (d) of Regulation M-A is not applicable to the

Fund’s executive officers and Trustees, any person controlling the Fund or any executive officer or director of a corporation or other person ultimately in control of the Fund.

ITEM 8. INTEREST IN SECURITIES OF THE SUBJECT COMPANY.

(a)-(b) Reference is hereby made to Section 9, “Interest of Trustees and Executive Officers; Transactions and Arrangements Concerning

the Shares” of the Offer to Purchase, which is incorporated herein by reference. There have not been any transactions in the Shares of the Fund that were effected during the past 60 days by the Fund. In addition, based upon the

Fund’s records and upon information provided to the Fund by its Trustees, executive officers and affiliates (as such term is used in Rule 12b-2 under the Exchange Act), to the best of the Fund’s

knowledge, there have not been any transactions involving the Shares of the Fund that were effected during the past 60 days by any executive officer or Trustee of the Fund, any person controlling the Fund, any executive officer or director of any

corporation or other person ultimately in control of the Fund or by any associate or subsidiary of any of the foregoing, including any executive officer or director of any such subsidiary.

ITEM 9. PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR USED.

(a) No persons have been employed, retained or are to be compensated by or on behalf of the Fund to make solicitations or recommendations in

connection with the Offer.

ITEM 10. FINANCIAL STATEMENTS.

Not applicable.

ITEM 11. ADDITIONAL

INFORMATION.

(a)(1) Reference is hereby made to Section 9, “Interest of Trustees and Executive Officers; Transactions and

Arrangements Concerning the Shares” of the Offer to Purchase, which is incorporated herein by reference.

(a)(2)-(5) Not applicable.

3

(c) Reference is hereby made to the Offer to Purchase, which is incorporated herein by reference.

ITEM 12. EXHIBITS.

|

|

|

| (a)(1)(i) |

|

Letter to Shareholders from the Senior Vice President, Chief Legal Officer and Secretary of the Fund and Offer to Purchase (filed herewith) |

|

|

| (a)(1)(ii) |

|

Letter of Transmittal (filed herewith) |

|

|

| (a)(1)(iii) |

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (filed herewith) |

|

|

| (a)(1)(iv) |

|

Letter to Clients and Client Instruction Form (filed herewith) |

|

|

| (a)(1)(v) |

|

Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9 (filed herewith) |

|

|

| (a)(2) |

|

Not applicable |

|

|

| (a)(3) |

|

Not applicable |

|

|

| (a)(4) |

|

Not applicable |

|

|

| (a)(5) |

|

Press Release dated November 1, 2024 (filed herewith) |

|

|

| (b) |

|

Not applicable |

|

|

| (d)(1) |

|

Depositary Agreement between Computershare Trust Company, N.A. and the Fund (filed herewith) |

|

|

| (d)(2) |

|

Form of Information Agent Agreement between Georgeson LLC and the Fund (filed herewith) |

|

|

| (d)(3) |

|

Master Investment Advisory Agreement, dated as of August 27, 2012, between the Registrant and Invesco Advisers, Inc. (incorporated by reference to Exhibit 77Q1 to Registrant’s report on Form N-SAR-A filed with the Securities and Exchange Commission on October 30, 2012) |

|

|

| (d)(4) |

|

Master Intergroup Sub-Advisory Contract, dated August 27, 2012, between Invesco Advisers, Inc. and each of Invesco Canada Ltd., Invesco Asset Management Deutschland GmbH, Invesco Asset

Management Limited, Invesco Asset Management (Japan) Limited, Invesco Australia Limited, Invesco Hong Kong Limited and Invesco Senior Secured Management, Inc. (incorporated by reference to Exhibit 77Q1 to Registrant’s report on Form NSAR-A filed with the Securities and Exchange Commission on October 30, 2012) |

|

|

| (d)(5) |

|

Amendment No. 1 to Master Intergroup Sub-Advisory Contract, dated December 3, 2012 (incorporated by reference to Exhibit 77Q1(e) to Registrant’s report on Form N-SAR-B/A filed with the Securities and Exchange Commission on May 26, 2017) |

|

|

| (d)(6) |

|

Termination Agreement, dated January 16, 2015, between Invesco Advisers, Inc. and Invesco Australia Limited (incorporated by reference to Exhibit 77Q1 to Registrant’s report on Form N-SAR-B filed with the Securities and Exchange Commission on April 29, 2015). |

|

|

| (d)(7) |

|

Master Custodian Contract, dated June 1, 2018, between Registrant and State Street Bank and Trust Company (incorporated by reference to Exhibit 28.g to Post-Effective Amendment No. 110 to AIM Sector Funds (Invesco

Sector Funds) registration statement on Form N-1A filed with the Securities and Exchange Commission on August 27, 2019). |

|

|

| (d)(8) |

|

Transfer Agency and Service Agreement, dated October 1, 2016, between Registrant and Computershare Trust Company, N.A. and Computershare Inc. (incorporated by reference to Exhibit 25.k to Invesco High Income 2024 Target Term

Fund registration |

4

|

|

|

|

|

statement on Form N-2 filed with the Securities and Exchange Commission on October 30, 2017). |

|

|

| (d)(9) |

|

Amendment No. 1 to Transfer Agency and Service Agreement, dated November 21, 2016 (incorporated by reference to Exhibit 25.k.1 to Invesco High Income 2024 Target Term Fund registration statement on Form N-2 filed with the Securities and Exchange Commission on October 30, 2017). |

|

|

| (d)(10) |

|

Updated Schedule to Transfer Agency and Service Agreement, dated November 27, 2017 (incorporated by reference to Exhibit 25.k.2 to Invesco High Income 2024 Target Term Fund registration statement on Form N-2 filed with the Securities and Exchange Commission on November 28, 2017). |

|

|

| (d)(11) |

|

Amendment No. 2 to Transfer Agency and Service Agreement, dated October 1, 2019, filed herewith. |

|

|

| (d)(12) |

|

Master Administrative Services Agreement, dated July 1, 2020, filed herewith. |

|

|

| (d)(13) |

|

Amendment No. 1 to Master Administrative Services Agreement, dated July 1, 2022, filed herewith. |

|

|

| (g) |

|

Not applicable |

|

|

| (h) |

|

Not applicable |

|

|

| (i) |

|

Calculation of Filing Fees |

5

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

| INVESCO TRUST FOR INVESTMENT GRADE NEW YORK MUNICIPALS |

|

| /s/ Melanie Ringold |

| Melanie Ringold |

| Senior Vice President, Chief Legal Officer and Secretary |

November 7, 2024

EXHIBIT INDEX

|

|

|

| EXHIBIT |

|

DESCRIPTION |

|

|

| (a)(1)(i) |

|

Letter to Shareholders from the Senior Vice President, Chief Legal Officer and Secretary of the Fund and Offer to Purchase |

|

|

| (a)(1)(ii) |

|

Letter of Transmittal |

|

|

| (a)(1)(iii) |

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees |

|

|

| (a)(1)(iv) |

|

Letter to Clients and Client Instruction Form |

|

|

| (a)(1)(v) |

|

Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9 |

|

|

| (a)(5) |

|

Press Release dated November 1, 2024 |

|

|

| (d)(1) |

|

Depositary Agreement between Computershare Trust Company, N.A. and the Fund |

|

|

| (d)(2) |

|

Form of Information Agent Agreement between Georgeson LLC and the Fund |

|

|

| (d)(11) |

|

Amendment No. 2 to Transfer Agency and Service Agreement, dated October 1, 2019 |

|

|

| (d)(12) |

|

Master Administrative Services Agreement, dated July 1, 2020 |

|

|

| (d)(13) |

|

Amendment No. 1 to Master Administrative Services Agreement, dated July 1, 2022 |

|

|

| (i) |

|

Calculation of Filing Fees |

Invesco Trust for Investment Grade New York Municipals

1555 Peachtree Street, N.E.

Atlanta, Georgia 30309

Dear Shareholder:

On June 10-12, 2024, the Board of Trustees of Invesco Trust for Investment Grade New York

Municipals (the “Fund”), approved a tender offer for the Fund’s Common Shares. The Fund is commencing an offer to purchase up to 25% of its issued and outstanding shares of beneficial interest upon the terms and subject to the

conditions set forth in the enclosed Offer to Purchase and the related Letter of Transmittal (which together constitute the “Offer”). If more than 25% of the Fund’s Common Shares are tendered and not withdrawn, any purchases will be

made on a pro rata basis. The offer is for cash at a price equal to 99% of the Fund’s net asset value per share (“NAV”) as of the close of ordinary trading on the New York Stock Exchange on the business day after the offer expires (as

described below). The Offer is designed to provide shareholders of the Fund with the opportunity to redeem some or all of their shares at a price very close to NAV should they wish to do so.

In order to participate, the materials described in the Offer must be delivered to Computershare Trust Company, N.A. by 11:59 p.m. New York

City time, December 9, 2024 or such later date to which the Offer is extended (the “Expiration Date”). The pricing time and date for the Offer is currently scheduled to be the close of ordinary trading on the New York Stock Exchange

on December 10, 2024. Should the Offer be extended beyond December 9, 2024, the pricing date will be the later of December 10, 2024 or the next business day following the newly designated Expiration Date. The amount to be paid per

share will be 99% of the Fund’s NAV as of the close of ordinary trading on the New York Stock Exchange on the pricing date. Shareholders who choose to participate in the Offer can expect payments for shares tendered and accepted to be mailed

within seven business days after the Expiration Date.

If, after carefully evaluating all of the information set forth in the Offer to

Purchase, you wish to tender shares pursuant to the Offer, please follow the instructions contained in the Offer to Purchase and Letter of Transmittal or, if your shares are held of record in the name of a broker, dealer, commercial bank, trust

company or other nominee, contact that firm to effect the tender for you. Shareholders are urged to consult their own investment and tax advisers and make their own decisions whether to tender any shares and, if so, how many shares to tender.

As of the close of ordinary trading on the New York Stock Exchange on October 23, 2024, the Fund’s NAV was $11.69 per share and

19,477,753 shares were issued and outstanding. The Fund’s NAV during the pendency of this Offer may be obtained by contacting Georgeson LLC, the Fund’s Information Agent, toll free at: (866)

410-5795.

(i)

NEITHER THE FUND NOR ITS BOARD OF TRUSTEES IS MAKING ANY RECOMMENDATION TO ANY SHAREHOLDER

WHETHER TO TENDER OR REFRAIN FROM TENDERING SHARES IN THE OFFER. THE FUND AND BOARD URGE EACH SHAREHOLDER TO READ AND EVALUATE THE OFFER AND RELATED MATERIALS CAREFULLY AND MAKE HIS OR HER OWN DECISION. QUESTIONS, REQUESTS FOR ASSISTANCE AND

REQUESTS FOR ADDITIONAL COPIES OF THE OFFER SHOULD BE DIRECTED TO GEORGESON LLC AT (866) 410-5795.

|

| Sincerely, |

|

| /s/ Melanie Ringold |

| Melanie Ringold |

| Senior Vice President, Chief Legal Officer and Secretary |

November 7, 2024

(ii)

OFFER TO PURCHASE

INVESCO TRUST FOR INVESTMENT GRADE NEW YORK MUNICIPALS

OFFER TO PURCHASE FOR CASH 4,869,438

OUTSTANDING COMMON SHARES

SUMMARY TERM SHEET

THIS SUMMARY

HIGHLIGHTS CERTAIN INFORMATION IN THIS OFFER TO PURCHASE. TO UNDERSTAND THE OFFER FULLY AND FOR A MORE COMPLETE DESCRIPTION OF THE TERMS OF THE OFFER, YOU SHOULD READ CAREFULLY THIS ENTIRE OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL. WE

HAVE INCLUDED SECTION REFERENCES PARENTHETICALLY TO DIRECT YOU TO A MORE COMPLETE DESCRIPTION IN THE OFFER TO PURCHASE OF THE TOPICS IN THIS SUMMARY.

What and how many securities is Invesco Trust for Investment Grade New York Municipals (the “Fund”) offering to purchase? (See Section 1,

“Price; Number of Shares”)

| |

• |

|

The Fund is offering to purchase up to 25% or 4,869,438 shares (the “Offer Amount”) of its Common

Shares (“Shares”). If the number of Shares properly tendered and not withdrawn prior to the date and time the offer expires is less than or equal to the Offer Amount, the Fund will, upon the terms and subject to the conditions of the

offer, purchase all Shares tendered. If more Shares than the Offer Amount are properly tendered and not withdrawn prior to the date the offer expires, the Fund will purchase the Offer Amount on a pro rata basis. Shareholders cannot be assured that

all of their tendered Shares will be repurchased. |

How much and in what form will the Fund pay me for my Shares? (See

Section 1, “Price; Number of Shares” and Section 4, “Payment for Shares”)

| |

• |

|

The Fund will pay cash for Shares purchased pursuant to the offer. The purchase price will equal 99% of the net

asset value per share (“NAV”), as of the close of ordinary trading on the New York Stock Exchange (the “NYSE”) on December 10, 2024, unless the offer is extended. As of October 23, 2024, the Fund’s NAV was $11.69

per Share. Note that the NAV can change every business day. You can obtain current NAV quotations from Georgeson LLC, the information agent for the offer (“Information Agent”) at (866) 410-5795.

|

When does the offer expire? Can the Fund extend the offer, and if so, when will the Fund announce the extension? (See

Section 1, “Price; Number of Shares” and Section 15, “Extension of Tender Period; Termination; Amendments”)

| |

• |

|

The offer expires on Monday, December 9, 2024, at 11:59 p.m., New York City time, unless the Fund extends

the offer. |

(iii)

| |

• |

|

The Fund may extend the offer period at any time. If it does, the Fund will determine the purchase price on the

later of December 10, 2024 or the first business day after the new expiration date. |

| |

• |

|

If the offer period is extended, the Fund will make a public announcement of the extension no later than 9:30

a.m. New York City time on the next business day following the previously scheduled expiration date. |

Will I have to pay any fees

or commissions on Shares I tender? (See Section 1, “Price; Number of Shares,” Section 4, “Payment for Shares” and Section 16, “Fees and Expenses”)

| |

• |

|

Shares will be purchased at 99% of the Fund’s NAV to help defray certain costs of the tender, including the

processing of tender forms, effecting payment, postage and handling. Excess costs associated with the tender will be charged against the Fund’s capital. Excess fees collected, if any, will be returned to the Fund. No separate service fee will

be charged in conjunction with the offer. |

Does the Fund have the financial resources to pay me for my Shares? (See

Section 11, “Source and Amount of Funds”)

| |

• |

|

Yes. If the Fund purchased 4,869,438 Shares at 99% of the October 23, 2024 NAV of $11.69 per Share, the cost

of reimbursing the tendering shareholders would be approximately $56,354,493. The Fund intends to first use cash on hand to pay for Shares tendered, and then intends to sell portfolio securities or borrow under its current credit arrangement to

raise any additional cash needed for the purchase of Shares. |

How do I tender my Shares? (See Section 2, “Procedures for

Tendering Shares”)

| |

• |

|

If your Shares are registered in the name of a nominee holder, such as a broker, dealer, commercial bank, trust

company or other nominee (“Nominee Holder”), you should contact that firm if you wish to tender your Shares. |

| |

• |

|

All other shareholders wishing to participate in the offer must, prior to the date and time the offer expires:

|

| |

• |

|

Complete and execute a Letter of Transmittal (or facsimile thereof), together with any required signature

guarantees, and any other documents required by the Letter of Transmittal. You must send these materials to Computershare Trust Company, N.A. (the “Depositary”) at its address set forth on page (vi) of this offer. If you hold

certificates for Shares, you must send the certificates to the Depositary at its address set forth on page (vi) of this offer. If your Shares are held in book-entry form, you must comply with the book-entry delivery procedure set forth in

Section 2.C of this offer. In all these cases, the Depositary must receive these materials prior to the date and time the offer expires. |

| |

• |

|

The Fund’s transfer agent holds Shares in uncertificated form. When a shareholder tenders share

certificates, the Depositary will accept any of the shareholder’s uncertificated Shares for |

(iv)

| |

tender first and accept the balance of tendered Shares from the shareholder’s certificated Shares. |

Until what time can I withdraw tendered Shares? (See Section 3, “Withdrawal Rights”)

| |

• |

|

You may withdraw your tendered Shares at any time prior to the date and time the offer expires. In addition,

after the offer expires, you may withdraw your tendered Shares if the Fund has not yet accepted tendered Shares for payment by January 7, 2025. |

How do I withdraw tendered Shares? (See Section 3, “Withdrawal Rights”)

| |

• |

|

If you desire to withdraw tendered Shares, you should either: |

| |

• |

|

Give proper written notice to the Depositary; or |

| |

• |

|

If your Shares are held of record in the name of a Nominee Holder, contact that firm to withdraw your tendered

Shares. |

Will there be any tax consequences to tendering my Shares? (See Section 2, “Procedures for Tendering

Shares,” Section 10, “Certain Effects of the Offer” and Section 14, “Certain Federal Income Tax Consequences”)

| |

• |

|

Yes. If your tendered Shares are purchased, it will be a taxable transaction either in the form of a “sale

or exchange” or, under certain circumstances, a “dividend.” See Section 2.E with respect to the application of Federal income tax withholding on payments made to shareholders. Please consult your tax advisor as to the tax

consequences of tendering your Shares in this offer. |

What is the purpose of the offer? (See Section 6, “Purpose of the

Offer”)

| |

• |

|

The purpose of the offer is to fulfill an agreement made by the Board of Trustees of the Fund with Saba Capital

Management, L.P. to conduct a tender offer for Shares of the Fund. |

| |

• |

|

Please bear in mind that neither the Fund nor its Board has made any recommendation as to whether or not you

should tender your Shares. Shareholders are urged to consult their own investment and tax advisors and make their own decisions whether to tender any Shares and, if so, how many Shares to tender. |

What are the most significant conditions of the offer? (See Section 5, “Certain Conditions of the Offer”)

| |

• |

|

The Fund will not accept tenders or effect repurchases if: |

| |

• |

|

such transactions, if consummated, would: (A) result in the delisting of the Fund’s shares from the

NYSE or (B) impair the Fund’s status as a regulated investment company |

(v)

| |

under the Code (which would make the Fund a taxable entity, causing the Fund’s income to be taxed at the fund level in addition to the taxation of shareholders who receive distributions from

the Fund); or |

| |

• |

|

there is any (A) legal or regulatory action or proceeding instituted or threatened challenging such

transaction, (B) suspension of or limitation on prices for trading securities generally on the NYSE or other national securities exchange(s), including the Nasdaq Stock Market and the NYSE MKT LLC or (C) declaration of a banking moratorium

by federal or state authorities or any suspension of payment by banks in the United States or New York State. |

The

preceding is not a complete list. For a complete list of the conditions of the offer, please see Section 5, “Certain Conditions of the Offer.”

If I decide not to tender, how will the offer affect my Shares? (See Section 10, “Certain Effects of the Offer” and Section 16,

“Fees and Expenses”)

| |

• |

|

If you do not tender your Shares (or if you own Shares following completion of the offer) you will be subject to

any increased risks associated with the reduction in the Fund’s total assets due to the payment for the tendered Shares. These risks may include greater volatility due to a decreased asset base and proportionately higher expenses. The reduced

assets of the Fund as a result of the offer may result in less investment flexibility for the Fund, depending on the number of Shares repurchased, could limit the Fund’s ability to use leverage, and may have an adverse effect on the Fund’s

investment performance. |

Does the Fund have other plans or proposals? (See Section 7, “Plans or Proposals of the

Fund”)

| |

• |

|

In an effort to manage leverage levels in connection with the offer, the Fund has filed a notice of intention to

redeem up to 440 shares in the aggregate of one or more series of its outstanding Variable Rate Muni Term Preferred Shares (“preferred shares”) with the SEC. The preferred share redemption price will be the $100,000 liquidation preference

per share, plus an additional amount representing the final accumulated dividend amounts owed. The Fund expects to finance the preferred share redemption with cash on hand and portfolio sales. The Fund expects to determine the actual amount of

preferred shares to be redeemed based on the results of the tender offer, among other considerations. |

Whom do I contact if I have

questions about the tender offer?

| |

• |

|

For additional information or assistance, you may call the Information Agent toll-free at (866) 410-5795. |

(vi)

INVESCO TRUST FOR INVESTMENT GRADE NEW YORK MUNICIPALS

OFFER TO PURCHASE FOR CASH 4,869,438

OF ITS ISSUED AND OUTSTANDING COMMON

SHARES AT 99% OF NET ASSET VALUE PER SHARE

THE OFFER

PERIOD AND WITHDRAWAL RIGHTS

WILL EXPIRE AT 11:59 P.M. NEW YORK CITY TIME

ON DECEMBER 9, 2024, UNLESS THE OFFER IS EXTENDED.

To the holders of Common Shares of Invesco Trust for Investment Grade New York Municipals:

Invesco Trust for Investment Grade New York Municipals, a diversified, closed-end management investment

company organized as a Delaware statutory trust (the “Fund”), is offering to purchase up to 25% of its Common Shares (“Offer Amount”), without par value (“Shares”), for cash at a price (the “Purchase Price”)

equal to 99% of their net asset value per share (“NAV”) as of the close of ordinary trading on the New York Stock Exchange (the “NYSE”) on December 10, 2024 or, if the offer is extended, on the later of December 10,

2024 or the next business day after the offer expires. The offer period and withdrawal rights will expire at 11:59 p.m. New York City time on December 9, 2024 (the “Initial Expiration Date”), unless extended (the Initial Expiration

Date or the latest date to which the Offer is extended, the “Expiration Date”), upon the terms and subject to the conditions set forth in this Offer to Purchase and the related Letter of Transmittal (which together constitute the

“Offer”). The Shares are currently traded on the NYSE under the ticker symbol “VTN.” The NAV on October 23, 2024 was $11.69 per Share. You can obtain current NAV quotations from Georgeson LLC, the information agent for the

Offer (“Information Agent”) at (866) 410-5795. For information on Share price history, see Section 8, “Price Range of Shares.”

The Offer is not conditioned upon the tender of any minimum number of Shares. If the number of Shares properly tendered and not withdrawn

prior to the Expiration Date is less than or equal to the Offer Amount, the Fund will, upon the terms and subject to the conditions of the Offer, purchase all Shares tendered. If more Shares than the Offer Amount are properly tendered and not

withdrawn prior to the Expiration Date, the Fund will, upon the terms and subject to the conditions of the Offer, purchase the Offer Amount on a pro rata basis. See Section 1, “Price; Number of Shares.”

If, after carefully evaluating all of the information set forth in the Offer, you wish to tender Shares pursuant to the Offer, please either

follow the instructions contained in the Offer and Letter of Transmittal or, if your Shares are held of record in the name of a Nominee Holder, contact such firm to effect the tender for you. If you do not wish to tender your Shares, you need not

take any action.

(vii)

THIS OFFER IS BEING MADE TO ALL SHAREHOLDERS

OF THE FUND AND IS NOT CONDITIONED UPON ANY

MINIMUM NUMBER OF SHARES BEING TENDERED.

THIS OFFER IS SUBJECT TO CERTAIN CONDITIONS.

SEE SECTION 5, “CERTAIN CONDITIONS OF THE OFFER.”

IMPORTANT

Neither the Fund nor its

Board of Trustees makes any recommendation to any shareholder as to whether to tender any or all of such shareholder’s Shares. Shareholders are urged to evaluate carefully all information in the Offer, consult their own investment and tax

advisors, and make their own decisions whether to tender Shares and, if so, how many Shares to tender.

No person has been authorized to make any

recommendation on behalf of the Fund as to whether shareholders should tender Shares pursuant to the Offer. No person has been authorized to give any information or to make any representations in connection with the Offer other than those contained

herein or in the Letter of Transmittal. If given or made, such recommendation and such information and representations must not be relied upon as having been authorized by the Fund. The Fund has been advised that no Trustee or executive officer of

the Fund intends to tender any Shares pursuant to the Offer.

Questions and requests for assistance and requests for additional copies

of this Offer to Purchase and Letter of Transmittal should be directed to the Information Agent at the telephone number set forth below.

The Information Agent for the Offer is:

Georgeson LLC

1290 Avenue of the

Americas, 9th Floor

New York, NY 10104

All Holders Call Toll Free: (866) 410-5795

The Depositary for the Offer is:

Computershare Trust Company, N.A.

|

|

|

|

By Mail: |

|

By Express Mail, Courier or Other Expedited Service: |

| |

|

| Computershare Trust Company,

N.A. |

|

Computershare Trust Company, N.A. |

| Voluntary Corporate Actions COY

VTN |

|

Voluntary Corporate Actions COY VTN |

| P.O. Box 43011 |

|

150 Royall Street, Suite V |

|

Providence, RI 02940-3011 |

|

Canton, MA 02021 |

November 7, 2024

(viii)

TABLE OF CONTENTS

|

|

|

|

|

|

|

| SECTION |

|

PAGE |

|

| SUMMARY TERM SHEET |

|

|

1 |

|

| 1. |

|

PRICE; NUMBER OF SHARES |

|

|

1 |

|

| 2. |

|

PROCEDURES FOR TENDERING SHARES |

|

|

1 |

|

| 3. |

|

WITHDRAWAL RIGHTS |

|

|

5 |

|

| 4. |

|

PAYMENT FOR SHARES |

|

|

6 |

|

| 5. |

|

CERTAIN CONDITIONS OF THE OFFER |

|

|

7 |

|

| 6. |

|

PURPOSE OF THE OFFER |

|

|

7 |

|

| 7. |

|

PLANS OR PROPOSALS OF THE FUND |

|

|

7 |

|

| 8. |

|

PRICE RANGE OF SHARES |

|

|

8 |

|

| 9. |

|

INTEREST OF TRUSTEES AND EXECUTIVE OFFICERS; TRANSACTIONS AND ARRANGEMENTS CONCERNING THE SHARES |

|

|

8 |

|

| 10. |

|

CERTAIN EFFECTS OF THE OFFER |

|

|

10 |

|

| 11. |

|

SOURCE AND AMOUNT OF FUNDS |

|

|

11 |

|

| 12. |

|

CERTAIN INFORMATION ABOUT THE FUND |

|

|

12 |

|

| 13. |

|

ADDITIONAL INFORMATION |

|

|

12 |

|

| 14. |

|

CERTAIN FEDERAL INCOME TAX CONSEQUENCES |

|

|

12 |

|

| 15. |

|

EXTENSION OF TENDER PERIOD; TERMINATION; AMENDMENTS |

|

|

17 |

|

| 16. |

|

FEES AND EXPENSES |

|

|

17 |

|

| 17. |

|

MISCELLANEOUS |

|

|

17 |

|

| 1. |

PRICE; NUMBER OF SHARES. |

The Fund will, upon the terms and subject to the conditions of the Offer, accept for payment (and thereby purchase) up to the Offer Amount of

its issued and outstanding Shares or such lesser number as are properly tendered (and not withdrawn in accordance with Section 3, “Withdrawal Rights”). The Fund reserves the right to extend the Offer to a later Expiration Date. See

Section 15, “Extension of Tender Period; Termination; Amendments.” The later of the Initial Expiration Date or the latest time and date to which the Offer is extended is hereinafter called the “Expiration Date.” The purchase

price of the Shares will be 99% of their NAV computed as of the close of ordinary trading on the NYSE on December 10, 2024 or, if the Offer period is extended, the later of December 10, 2024 or the next business day following the newly

designated Expiration Date. The NAV on October 23, 2024 was $11.69 per Share. You can obtain current NAV quotations from the Information Agent by calling (866) 410-5795. Shareholders tendering Shares

shall be entitled to receive all dividends with an “ex date” on or before the Expiration Date provided that they own Shares as of the record date.

The Offer is being made to all shareholders of the Fund and is not conditioned upon any minimum number of Shares being tendered. If the number

of Shares properly tendered and not withdrawn prior to the Expiration Date is less than or equal to the Offer Amount, the Fund will, upon the terms and subject to the conditions of the Offer, purchase all Shares so tendered. If more Shares than the

Offer Amount are properly tendered and not withdrawn prior to the Expiration Date, the Fund will purchase the Offer Amount on a pro rata basis. Shares acquired by the Fund pursuant to the Offer will thereafter constitute authorized but unissued

shares.

Shares will be purchased at 99% of the Fund’s NAV to help defray certain costs of the tender, including the processing of

tender forms, effecting payment, postage and handling. Excess costs associated with the tender will be charged against the Fund’s capital. Excess fees collected, if any, will be returned to the Fund. No separate service fee will be assessed in

conjunction with the Offer. Tendering shareholders will not be obligated to pay transfer taxes on the purchase of Shares by the Fund, except in the circumstances set forth in Section 4, “Payment for Shares.”

On October 23, 2024, there were 19,477,753 Shares issued and outstanding and there were approximately 225 holders of record of Shares.

The Fund has been advised that no Trustees or officers of the Fund or their associates (as such term is used in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (“Exchange Act”)),

intend to tender any Shares pursuant to the Offer.

The Fund reserves the right, in its sole discretion, at any time or from time to time,

to extend the period of time during which the Offer is open by giving notice of such extension to the Depositary and making a public announcement thereof. See Section 15, “Extension of Tender Period; Termination; Amendments.” The Fund

currently has no intention of extending the Offer. If the Fund decides, in its sole discretion, to decrease the number of Shares being sought and, at the time that notice of such decrease is first published, sent or given to holders of Shares in the

manner specified below, the Expiration Date is less than ten business days away, the Expiration Date will be extended at least ten business days from the date of the notice. During any extension, all Shares previously tendered and not withdrawn will

remain subject to the Offer, subject to the right of a tendering shareholder to withdraw his or her Shares.

| 2. |

PROCEDURES FOR TENDERING SHARES. |

| |

A. |

Proper Tender of Shares. |

Holders of Shares that are registered in the name of a nominee holder, such as a broker, dealer, commercial bank, trust company or other

nominee (“Nominee Holder”) should contact such firm if they desire to tender their Shares.

1

For Shares to be properly tendered pursuant to the Offer, the following must occur prior to 11:59

p.m. New York City time on the Expiration Date:

| |

(a) |

A properly completed and duly executed Letter of Transmittal (or facsimile thereof), together with any required

signature guarantees, (or an Agent’s Message in the case of a book-entry transfer, as described in Section 2.C), and any other documents required by the Letter of Transmittal must be received by the Depositary at its address set forth on

page (vi) of this Offer; and |

| |

(b) |

Either the certificates for the Shares must be received by the Depositary at its address set forth on page

(vi) of this Offer, or the tendering shareholder must comply with the book-entry delivery procedure set forth in Section 2.C. |

If the Letter of Transmittal or any certificates or stock powers are signed by trustees, executors, administrators, guardians, agents, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing and must submit proper

evidence satisfactory to the Fund of their authority to so act.

Letters of Transmittal and certificates representing Shares should be

sent to the Depositary; they should not be sent or delivered to the Fund.

The Fund’s transfer agent holds Shares in uncertificated

form. When a shareholder tenders certificated Shares, the Depositary will accept any of the shareholder’s uncertificated Shares for tender first and accept the balance of tendered Shares from the shareholder’s certificated Shares, and,

upon request, will issue a new certificate for the remaining Shares.

Section 14(e) of the Exchange Act and Rule 14e-4 promulgated thereunder make it unlawful for any person, acting alone or in concert with others, to tender shares in a partial tender offer for such person’s own account unless at the time of tender, and

at the time the shares are accepted for payment, the person tendering has a net long position equal to or greater than the amount tendered in (i) shares, and will deliver or cause to be delivered such shares for the purpose of tender to the

person making the offer within the period specified in the offer, or (ii) an equivalent security and, upon acceptance of his or her tender, will acquire shares by conversion, exchange, or exercise of such equivalent security to the extent

required by the terms of the offer, and will deliver or cause to be delivered the shares so acquired for the purpose of tender to the fund prior to or on the expiration date. Section 14(e) and Rule 14e-4

provide a similar restriction applicable to the tender or guarantee of a tender on behalf of another person.

The acceptance of Shares by

the Fund for payment will constitute a binding agreement between the tendering shareholder and the Fund upon the terms and subject to the conditions of the Offer, including the tendering shareholder’s representation that (i) such

shareholder has a net long position in the Shares being tendered within the meaning of Rule 14e-4 promulgated under the Exchange Act and (ii) the tender of such Shares complies with Rule 14e-4.

By submitting the Letter of Transmittal, a tendering shareholder shall, subject to and effective

upon acceptance for payment of the Shares tendered, be deemed in consideration of such acceptance to sell, assign and transfer to, or upon the order of, the Fund all right, title and interest in and to all the Shares that are being tendered (and any

and all dividends, distributions, other Shares or other securities or rights declared or issuable in respect of such Shares after the Expiration Date) and irrevocably constitute and appoint the Depositary the true and lawful agent and attorney-in-fact of the tendering shareholder with respect to such Shares (and any such dividends, distributions, other Shares or securities or rights), with full power of

substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest) to (a) deliver certificates for such Shares (and any such other dividends, distributions, other Shares or securities or rights) or transfer

ownership of such Shares (and any such other dividends, distributions, other Shares or securities or rights), together, in either such case, with all accompanying evidences of transfer and authenticity to or

2

upon the order of the Fund, upon receipt by the Depositary of the purchase price, (b) present such Shares

(and any such other dividends, distributions, other Shares or securities or rights) for transfer on the books of the Fund, and (c) receive all benefits and otherwise exercise all rights of beneficial ownership of such Shares (and any such other

dividends, distributions, other Shares or securities or rights), all in accordance with the terms of the Offer. Upon such acceptance for payment, all prior powers of attorney given by the tendering shareholder with respect to such Shares (and any

such dividends, distributions, other shares or securities or rights) will, without further action, be revoked and no subsequent powers of attorney may be given by the tendering shareholder with respect to the tendered Shares (and, if given, will be

null and void).

By submitting a Letter of Transmittal, and in accordance with the terms and conditions of the Offer, a tendering

shareholder shall be deemed to represent and warrant that: (a) the tendering shareholder has full power and authority to tender, sell, assign and transfer the tendered Shares (and any and all dividends, distributions, other Shares or other

securities or rights declared or issuable in respect of such Shares after the Expiration Date); (b) when and to the extent the Fund accepts the Shares for purchase, the Fund will acquire good, marketable and unencumbered title thereto, free and

clear of all liens, restrictions, charges, proxies, encumbrances or other obligations relating to their sale or transfer, and not subject to any adverse claim; (c) on request, the tendering shareholder will execute and deliver any additional

documents deemed by the Depositary or the Fund to be necessary or desirable to complete the sale, assignment and transfer of the tendered Shares (and any and all dividends, distributions, other Shares or securities or rights declared or issuable in

respect of such Shares after the Expiration Date); and (d) the tendering shareholder has read and agreed to all of the terms of the Offer, including this Offer to Purchase and the Letter of Transmittal.

| |

B. |

Signature Guarantees and Method of Delivery. |

Signatures on the Letter of Transmittal are required to be guaranteed if the tendered stock certificates are registered in a name other than

that of the tendering shareholder or if a check for cash is to be issued in a name other than that of the registered owner of such Shares. In those instances, all signatures on the Letter of Transmittal must be guaranteed by an eligible guarantor

acceptable to the Depositary (an “Eligible Guarantor”). An Eligible Guarantor includes a bank, broker, dealer, credit union, savings association or other entity that is a member in good standing of the Securities Transfer Agents Medallion

Program (“STAMP”), or a bank, broker, dealer, credit union, savings association or other entity that is an “Eligible Guarantor Institution” as such term is defined in Rule 17Ad-15 under the

Exchange Act. Shareholders should contact the Depositary for a determination as to whether a particular institution is such an Eligible Guarantor. If Shares are tendered for the account of an institution that qualifies as an Eligible Guarantor,

signatures on the Letter of Transmittal are not required to be guaranteed. If the Letter of Transmittal is signed by a person or persons authorized to sign on behalf of the registered owner(s), then the Letter of Transmittal must be accompanied by

documents evidencing such authority to sign to the satisfaction of the Fund.

THE METHOD OF DELIVERY OF ANY DOCUMENTS, INCLUDING

CERTIFICATES FOR SHARES, IS AT THE ELECTION AND RISK OF THE PARTY TENDERING SHARES. IF DOCUMENTS ARE SENT BY MAIL, IT IS RECOMMENDED THAT THEY BE SENT BY REGISTERED MAIL, PROPERLY INSURED, WITH RETURN RECEIPT REQUESTED.

| |

C. |

Book-Entry Delivery Procedure. |

The Depositary will establish accounts with respect to the Shares at the Depository Trust Company (“DTC”) for purposes of the Offer

by November 12, 2024. Any financial institution that is a participant in any of DTC’s systems may make delivery of tendered Shares by (i) causing DTC to transfer such Shares into the Depositary’s account in accordance with

DTC’s procedure for such transfer; and (ii) causing a confirmation of receipt of such delivery to be received by the Depositary. DTC may charge the account of such financial institution for tendering Shares on behalf of shareholders.

Notwithstanding that delivery of Shares may be properly effected in accordance with this book-entry delivery procedure, the Letter of Transmittal (or manually signed facsimile thereof), with signature guarantee, if required, or, in lieu of the

Letter of Transmittal, an Agent’s Message (as defined below) in connection with a book-entry transfer, must

3

be transmitted to and received by the Depositary at the appropriate address set forth on page (vi) of this

Offer to Purchase before 11:59 p.m. New York City time on the Expiration Date.

The term “Agent’s Message” means a message

from DTC transmitted to, and received by, the Depositary forming a part of a timely confirmation of a book-entry transfer (a “Book-Entry Confirmation”), which states that DTC has received an express acknowledgment from the DTC participant

(“DTC Participant”) tendering the Shares that are the subject of the Book-Entry Confirmation that (i) the DTC Participant has received and agrees to be bound by the terms of the Letter of Transmittal; and (ii) the Fund may

enforce such agreement against the DTC Participant.

DELIVERY OF DOCUMENTS TO DTC IN ACCORDANCE WITH DTC’S PROCEDURES DOES NOT

CONSTITUTE DELIVERY TO THE DEPOSITARY FOR PURPOSES OF THIS OFFER.

| |

D. |

Determination of Validity. |

All questions as to the validity, form, eligibility (including time of receipt) and acceptance of tenders will be determined by the Fund, in

its sole discretion, whose determination shall be final and binding. The Fund reserves the absolute right to reject any or all tenders determined by it not to be in appropriate form or good order, or the acceptance of or payment for which may, in

the opinion of the Fund’s counsel, be unlawful. The Fund also reserves the absolute right to waive any of the conditions of the Offer or any defect in any tender with respect to any particular Shares or any particular shareholder, and the

Fund’s interpretations of the terms and conditions of the Offer will be final and binding. Unless waived, any defects or irregularities in connection with tenders must be cured within such times as the Fund shall determine. Tendered Shares will

not be accepted for payment unless any defects or irregularities have been cured or waived within such time. Neither the Fund, the Depositary nor any other person shall be obligated to give notice of any defects or irregularities in tenders, nor

shall any of them incur any liability for failure to give such notice.

| |

E. |

Federal Income Tax Withholding. |

Backup Withholding. To prevent backup federal income tax withholding equal to 24% of the gross payments made pursuant to the

Offer, each shareholder must notify the Depositary of such shareholder’s correct taxpayer identification number (or certify that such taxpayer is awaiting a taxpayer identification number and provide it within the required 60 day period) and

provide certain other information by completing the Substitute Internal Revenue Service (“IRS”) Form W-9 included in the Letter of Transmittal. Non-U.S.

Shareholders (as that term is defined in the next paragraph) who have not previously submitted an IRS Form W-8 (W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, or W-8IMY, as applicable, or their substitute forms) to the

Depositary must do so in order to avoid backup withholding. Such form (and additional IRS forms) may be obtained from the Information Agent or the IRS at irs.gov. Additionally, if you submitted an IRS Form W-8

without a taxpayer identification number more than three years ago or any information on the IRS Form W-8 that you submitted has changed, you must submit a new IRS Form

W-8 to avoid backup withholding.

U.S. Withholding at the Source. Since the Fund cannot

determine whether a payment made pursuant to the Offer should be characterized as an “exchange” or a “dividend” for tax purposes at the time of the payment, any payment to a tendering shareholder who is a nonresident alien

individual, a foreign trust or estate or a foreign corporation, as such terms are defined in the Internal Revenue Code of 1986, as amended (the “Code”) (a “Non-U.S. Shareholder”), that does

not hold its Shares in connection with a trade or business conducted in the United States, generally will be treated as a dividend for U.S. federal income tax purposes and generally will be subject to U.S. withholding tax at the rate of 30%. This

30% U.S. withholding tax will apply even if a Non-U.S. Shareholder has provided the required certification to avoid backup withholding (unless a reduced rate under an applicable tax treaty or exemption

applies). A tendering Non-U.S. Shareholder who realizes a capital gain on a tender of Shares will not be subject to U.S. federal income tax on such gain, unless the Shareholder is an individual who is

physically present in the United States for 183 days or more during the tax year and certain other conditions are satisfied. A tendering Non-U.S. Shareholder who realizes a capital gain may be eligible to

claim a refund of the withheld tax by filing a U.S. tax return if

4

the shareholder can demonstrate that the proceeds were not dividends. Special rules may also apply in the case of

Non-U.S. Shareholders that are: (i) former citizens or residents of the United States; or (ii) subject to special rules such as “controlled foreign corporations.” Non-U.S. Shareholders are advised to consult their own tax advisors.

Foreign Account Tax Compliance

Act (“FATCA”) Withholding. Since the Fund cannot determine whether a payment made pursuant to the Offer should be characterized as an “exchange” or a “dividend” for tax purposes at the time of the payment,

the Fund will be required to withhold a 30% tax on any payment to a tendering shareholder that is a foreign financial institution (“FFI”) or non-financial foreign entity (“NFFE”) that fails

to comply (or be deemed compliant) with extensive reporting and withholding requirements designed to inform the U.S. Department of the Treasury of U.S.-owned foreign investment accounts. The Fund may disclose the information that it receives from

its shareholders to the IRS, non-U.S. taxing authorities or other parties as necessary to comply with FATCA or similar laws. Withholding also may be required if a foreign entity that is a shareholder of a Fund

fails to provide the Fund with appropriate certifications or other documentation concerning its status under FATCA.

Additional

Information. For an additional discussion of federal income tax withholding as well as a discussion of certain other federal income tax consequences to tendering shareholders, see Section 14, “Certain Federal Income Tax

Consequences.”

Except as otherwise provided in this Section 3, tenders of Shares made pursuant to the Offer will be irrevocable. If you desire to

withdraw Shares tendered on your behalf by a Nominee Holder, you may withdraw by contacting that firm and instructing them to withdraw such Shares. You have the right to withdraw tendered Shares at any time prior to 11:59 p.m. New York City time on

December 9, 2024. Upon terms and subject to the conditions of the Offer, the Fund expects to accept for payment properly tendered Shares promptly after the Expiration Date. After 11:59 p.m. New York City time, on January 7, 2025, if the

Fund has not yet accepted tendered Shares for payment, you may withdraw your tendered Shares.

To be effective, a written or facsimile

transmission notice of withdrawal must be timely received by the Depositary at the address set forth on page (vi) of this Offer. Any notice of withdrawal must specify the name of the person who tendered the Shares to be withdrawn, the number of

Shares to be withdrawn, and the names in which the Shares to be withdrawn are registered, if different from the name of the person who tendered the Shares.

If certificates have been delivered to the Depositary, the name of the registered holder and the serial numbers of the particular certificates

evidencing the Shares withdrawn must also be furnished to the Depositary and the signature on the notice of withdrawal must be guaranteed by an Eligible Guarantor. If Shares have been delivered pursuant to the book-entry delivery procedure (set

forth in Section 2, “Procedures for Tendering Shares”), any notice of withdrawal must specify the name and number of the account at the book-entry transfer facility to be credited with the withdrawn Shares (which must be the same

name, number, and book-entry transfer facility from which the Shares were tendered), and must comply with the procedures of DTC.

All

questions as to the form and validity (including time of receipt) of notices of withdrawal will be determined by the Fund in its sole discretion, whose determination shall be final and binding. Neither the Fund, the Depositary nor any other person

is or will be obligated to give any notice of any defects or irregularities in any notice of withdrawal, and none of them will incur any liability for failure to give any such notice. Shares properly withdrawn shall not thereafter be deemed to be

tendered for purposes of the Offer. However, withdrawn Shares may be retendered by following the procedures described in Section 2, “Procedures for Tendering Shares,” prior to 11:59 p.m. New York City time on the Expiration Date.

5

For purposes of the Offer, the Fund will be deemed to have accepted for payment (and thereby purchased) Shares that are tendered and not

withdrawn when, as and if, it gives oral or written notice to the Depositary of its acceptance of such Shares for payment pursuant to the Offer. Upon the terms and subject to the conditions of the Offer, the Fund will, promptly after the Expiration

Date, accept for payment (and thereby purchase) Shares properly tendered prior to 11:59 p.m. New York City time on the Expiration Date.

Payment for Shares accepted for payment pursuant to the Offer will be made by the Depositary out of funds made available to it by the Fund.

The Depositary will act as agent for the Fund for the purpose of effecting payment to the tendering shareholders. In all cases, payment for Shares tendered and accepted for payment pursuant to the Offer will be made only after timely receipt by the

Depositary of (i) Share certificates evidencing such Shares or a Book-Entry Confirmation of the delivery of such Shares, (ii) a properly completed and duly executed Letter of Transmittal (or a facsimile thereof) or, in the case of a

book-entry transfer, an Agent’s Message in lieu of the Letter of Transmittal, and (iii) any other documents required by the Letter of Transmittal. Accordingly, payment may not be made to all tendering shareholders at the same time and will

depend upon when Share certificates are received by the Depositary or Book-Entry Confirmations of tendered Shares are received in the Depositary’s account at DTC.

If any tendered Shares are not accepted for payment or are not paid because of an invalid tender, if certificates are submitted for more

Shares than are tendered, or if a shareholder withdraws tendered Shares, (i) certificates for such unpurchased Shares will be promptly returned, at the Fund’s expense, to the tendering shareholder, as soon as practicable following the

expiration, termination or withdrawal of the Offer, (ii) Shares delivered pursuant to the book-entry delivery procedures will be credited to the account from which they were delivered, and (iii) uncertificated Shares held by the

Fund’s transfer agent will be returned to the transfer agent.

The Fund will pay all transfer taxes, if any, payable on the transfer

to it of Shares purchased pursuant to the Offer. If, however, payment of the purchase price is to be made to, or if unpurchased Shares were registered in the name of, any person other than the tendering holder, or if any tendered certificates are

registered or the Shares tendered are held in the name of any person other than the person signing the Letter of Transmittal, the amount of any transfer taxes (whether imposed on the registered holder or such other person) payable on account of such

transfer will be deducted from the purchase price unless satisfactory evidence of the payment of such taxes, or exemption therefrom, is submitted. In addition, if certain events occur, the Fund may not be obligated to purchase Shares pursuant to the

Offer. See Section 5, “Certain Conditions of the Offer.”

Any tendering shareholder or other payee who fails to complete

fully and sign the Substitute IRS Form W-9 in the Letter of Transmittal may be subject to federal income tax withholding of 24% of the gross proceeds paid to such shareholder or other payee pursuant to the

Offer. Non-U.S. shareholders should provide the Depositary with a completed IRS Form W-8BEN (or other IRS Form W-8, where applicable, or their substitute forms) in order

to avoid 24% backup withholding. A copy of IRS Form W-8 will be provided upon request from the Information Agent or may be obtained from the IRS at irs.gov. See Section 2, “Procedures for Tendering

Shares” and Section 14, “Certain Federal Income Tax Consequences.”

6

| 5. |

CERTAIN CONDITIONS OF THE OFFER. |

Notwithstanding any other provision of the Offer, the Fund will not accept tenders or effect repurchases if: (i) such transactions, if

consummated, would: (A) result in the delisting of the Fund’s shares from the NYSE or (B) impair the Fund’s status as a regulated investment company under the Code (which would make the Fund a taxable entity, causing the

Fund’s income to be taxed at the fund level in addition to the taxation of shareholders who receive distributions from the Fund); or (ii) there is any (A) legal or regulatory action or proceeding instituted or threatened challenging

such transaction, (B) suspension of or limitation on prices for trading securities generally on the NYSE or other national securities exchange(s), including the Nasdaq Stock Market and the NYSE MKT LLC or (C) declaration of a banking

moratorium by federal or state authorities or any suspension of payment by banks in the United States or New York State.

The Fund

reserves the right, at any time during the pendency of the Offer, to terminate, extend or amend the Offer in any respect. If the Fund determines to terminate or amend the Offer or to postpone the acceptance for payment of or payment for Shares

tendered, it will, to the extent necessary, extend the period of time during which the Offer is open as provided in Section 15, “Extension of Tender Period; Termination; Amendments.” In the event any of the foregoing conditions are

modified or waived in whole or in part at any time, the Fund will promptly make a public announcement of such waiver and may, depending on the materiality of the modification or waiver, extend the Offer period as provided in Section 15,

“Extension of Tender Period; Termination; Amendments.”

The purpose of the offer is to fulfill an agreement made by the Board of Trustees of the Fund with Saba Capital Management, L.P. to conduct a

tender offer for Shares of the Fund. The Fund makes no assurance that it will make another tender offer in the future.

NEITHER THE

FUND NOR ITS BOARD OF TRUSTEES MAKES ANY RECOMMENDATION TO ANY SHAREHOLDER AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING ANY OR ALL OF SUCH SHAREHOLDER’S SHARES AND HAS NOT AUTHORIZED ANY PERSON TO MAKE ANY SUCH RECOMMENDATION. SHAREHOLDERS

ARE URGED TO EVALUATE CAREFULLY ALL INFORMATION IN THE OFFER, CONSULT THEIR OWN INVESTMENT AND TAX ADVISORS, AND MAKE THEIR OWN DECISIONS WHETHER TO TENDER SHARES AND, IF SO, HOW MANY SHARES TO TENDER.

| 7. |

PLANS OR PROPOSALS OF THE FUND. |

Except to the extent described herein or in connection with the operation of the Fund’s automatic dividend reinvestment plan, the Fund

does not have any other present plans or proposals and is not engaged in any negotiations that relate to or would result in:

| |

(a) |

any extraordinary transactions, such as a merger, reorganization or liquidation, involving the Fund or any of

its subsidiaries; |

| |

(b) |

other than in connection with transactions in the ordinary course of the Fund’s operations and for

purposes of funding the Offer, any purchase, sale or transfer of a material amount of assets of the Fund or any of its subsidiaries; |

| |

(c) |

any material change in the Fund’s present dividend policy, or indebtedness or capitalization of the Fund;

|

| |

(d) |

changes to the present Board or management of the Fund, including changes to the number or the term of members

of the Board, the filling of any existing vacancies on the Board or changes to any material term of the employment contract of any executive officer; |

7

| |

(e) |

any other material change in the Fund’s corporate structure or business, including any plans or proposals

to make any changes in the Fund’s investment policy for which a vote would be required by Section 13 of the 1940 Act; |

| |

(f) |

any class of equity securities of the Fund being delisted from a national securities exchange or ceasing to be

authorized to be quoted in an automated quotations system operated by a national securities association; |

| |

(g) |

any class of equity securities of the Fund becoming eligible for termination of registration pursuant to

Section 12(g)(4) of the Exchange Act; or |

| |

(h) |

the suspension of the Fund’s obligation to file reports pursuant to Section 15(d) of the Exchange

Act. |

The Fund anticipates redeeming some or all of its outstanding VMTP shares as part of the effort to raise cash for

the tender offer and/or to take advantage of interest rate changes.

| 8. |

PRICE RANGE OF SHARES. |

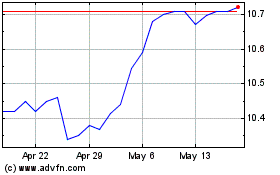

The Shares are traded on the NYSE. During each completed fiscal quarter of the Fund during the past two fiscal years and during the current

fiscal year, the highest and lowest NAV, Market Price per Share, and period-end NAV and Market Price per Share (as of the close of ordinary trading on the NYSE on the last day of such periods) were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NAV ($) |

|

|

Market Price ($) |

|

| Fiscal Quarter Ended |

|

High |

|

|

Low |

|

|

Close |

|

|

High |

|

|

Low |

|

|

Close |

|

| May 31, 2022 |

|

$ |

13.71 |

|

|

$ |

13.28 |

|

|

$ |

12.54 |

|

|

$ |

11.69 |

|

|

$ |

10.12 |

|

|

$ |

11.25 |

|

| August 31, 2022 |

|

|

12.55 |

|

|

|

11.34 |

|

|

|

11.86 |

|

|

|

11.61 |

|

|

|

10.33 |

|

|

|

10.65 |

|

| November 30, 2022 |

|

|

11.76 |

|

|

|

10.63 |

|

|

|

11.71 |

|

|

|

10.54 |

|

|

|

9.19 |

|

|

|

10.63 |

|

| February 28, 2023 |

|

|

12.26 |

|

|

|

10.87 |

|

|

|

11.66 |

|

|

|

11.57 |

|

|

|

9.96 |

|

|

|

10.09 |

|

| May 31, 2023 |

|

|

12.23 |

|

|

|

10.49 |

|

|

|

11.84 |

|

|

|

11.57 |

|

|

|

9.77 |

|

|

|

9.99 |

|

| August 31, 2023 |

|

|

12.08 |

|

|

|

10.31 |

|

|

|

11.59 |

|

|

|

11.43 |

|

|

|

9.72 |

|

|

|

9.82 |

|

| November 30, 2023 |

|

|

11.77 |

|

|

|

10.04 |

|

|

|

11.77 |

|

|

|

10.34 |

|

|

|

8.51 |

|

|

|

9.97 |

|

| February 29, 2024 |

|

|

12.25 |

|

|

|

10.66 |

|

|

|

12.10 |

|

|

|

11.81 |

|

|

|

10.12 |

|

|

|

10.53 |

|

| May 31, 2024 |

|

|

12.20 |

|

|

|

12.19 |

|

|

|

11.70 |

|

|

|

11.67 |

|

|

|

10.34 |

|

|

|

10.84 |

|

| August 31, 2024 |

|

|

12.27 |

|

|

|

11.42 |

|

|

|

12.04 |

|

|

|

11.70 |

|

|

|

10.84 |

|

|

|

11.41 |

|

Shareholders tendering Shares shall be entitled to receive all dividends with an “ex date” on or

before the Expiration Date, but not yet paid, on Shares tendered pursuant to the Offer. At this time, it is anticipated that a cash dividend will be declared by the Board of Trustees with a record date before the Expiration Date and that,

accordingly, holders of Shares purchased pursuant to the Offer will receive such dividend with respect to such Shares. The amount and frequency of dividends in the future will depend on circumstances existing at that time.

| 9. |

INTEREST OF TRUSTEES AND EXECUTIVE OFFICERS; TRANSACTIONS AND ARRANGEMENTS CONCERNING THE SHARES.

|

The members of the Board of Trustees of the Fund are as follows: Beth Ann Brown (Chair), Carol Deckbar, Cynthia

Hostetler, Eli Jones, Elizabeth Krentzman, Jeffrey H. Kupor, Anthony J. LaCava, Jr., James “Jim” Liddy, Prema Mathai-Davis, Joel W. Motley, Teresa M. Ressel, Douglas Sharp, Robert C. Troccoli and Daniel S. Vandivort.

The executive officers of the Fund are as follows: Glenn Brightman, President and Principal Executive Officer, Melanie Ringold, Senior Vice

President, Chief Legal Officer and Secretary,

8

Tony Wong, Senior Vice President, Stephanie C. Butcher, Senior Vice President, Adrien Deberghes, Principal

Financial Officer, Treasurer and Senior Vice President, Crissie M. Wisdom, Anti-Money Laundering Compliance Officer, Todd F. Kuehl, Chief Compliance Officer and Senior Vice President and James Bordewick Jr., Senior Vice President and Senior Officer.

Correspondence to the Trustees and executive officers of the Fund should be mailed to c/o Invesco Trust for Investment Grade New York

Municipals, 1555 Peachtree Street, N.E., Atlanta, Georgia 30309, Attn: Secretary.

Based upon the Fund’s records and upon information

provided to the Fund by its Trustees, executive officers and affiliates (as such term is used in Rule 12b-2 under the Exchange Act), as of October 25, 2024, the Trustees and executive officers of the Fund

and their associates (as that term is defined in Rule 12b-2 under the Exchange Act), as a group beneficially owned no Shares. The Fund has been informed that no Trustee or executive officer of the Fund intends

to tender any Shares pursuant to the Offer.

Based upon the Fund’s records and upon information provided to the Fund by its Trustees,

executive officers and affiliates (as such term is used in Rule 12b-2 under the Exchange Act), neither the Fund nor, to the best of the Fund’s knowledge, any of the Trustees or executive officers of the

Fund, nor any associates (as such term is used in Rule 12b-2 under the Exchange Act) of any of the foregoing, has effected any transactions in Shares during the sixty business day period prior to the date

hereof.