Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

January 29 2024 - 12:43PM

Edgar (US Regulatory)

Schedule of Investments

November 30, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest

Rate |

|

|

Maturity

Date |

|

|

Principal

Amount

(000) |

|

|

Value |

|

|

| |

|

| Municipal Obligations–158.26%(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New York–155.96% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Albany Capital Resource Corp. (College of Siant Rose (The)); Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

07/01/2051 |

|

|

|

$ 605 |

|

|

|

$ 332,188 |

|

|

| |

|

| Allegany County Capital Resource Corp. (Houghton College); Series 2022 A, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2042 |

|

|

|

325 |

|

|

|

319,839 |

|

|

| |

|

| Amherst Development Corp. (Daemen College); Series 2018, Ref. RB |

|

|

5.00% |

|

|

|

10/01/2048 |

|

|

|

980 |

|

|

|

935,792 |

|

|

| |

|

| Brookhaven Local Development Corp. (Jefferson’s Ferry); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016, Ref. RB |

|

|

5.25% |

|

|

|

11/01/2036 |

|

|

|

1,010 |

|

|

|

1,014,810 |

|

|

| |

|

| Series 2020 B, RB |

|

|

4.00% |

|

|

|

11/01/2055 |

|

|

|

350 |

|

|

|

263,798 |

|

|

| |

|

| Brooklyn Arena Local Development Corp. (Barclays Center); Series 2009, RB(b) |

|

|

0.00% |

|

|

|

07/15/2034 |

|

|

|

8,315 |

|

|

|

5,088,860 |

|

|

| |

|

| Broome County Local Development Corp. (Good Shepherd Village at Endwell); Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

07/01/2031 |

|

|

|

250 |

|

|

|

223,428 |

|

|

| |

|

| Buffalo & Erie County Industrial Land Development Corp. (Orchard Park); Series 2015, Ref.

RB |

|

|

5.00% |

|

|

|

11/15/2037 |

|

|

|

2,465 |

|

|

|

2,460,026 |

|

|

| |

|

| Buffalo & Erie County Industrial Land Development Corp. (Tapestry Charter School); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017 A, RB |

|

|

5.00% |

|

|

|

08/01/2037 |

|

|

|

500 |

|

|

|

478,023 |

|

|

| |

|

| Series 2017 A, RB |

|

|

5.00% |

|

|

|

08/01/2047 |

|

|

|

1,500 |

|

|

|

1,355,404 |

|

|

| |

|

| Build NYC Resource Corp. (Children’s Aid Society (The)); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019, RB |

|

|

4.00% |

|

|

|

07/01/2044 |

|

|

|

45 |

|

|

|

41,915 |

|

|

| |

|

| Series 2019, RB |

|

|

4.00% |

|

|

|

07/01/2049 |

|

|

|

1,300 |

|

|

|

1,176,427 |

|

|

| |

|

| Build NYC Resource Corp. (Grand Concourse Academy Charter School); Series 2022 A, RB |

|

|

5.00% |

|

|

|

07/01/2056 |

|

|

|

100 |

|

|

|

97,204 |

|

|

| |

|

| Build NYC Resource Corp. (KIPP NYC Public School) (Social Bonds); Series 2023, RB |

|

|

5.25% |

|

|

|

07/01/2062 |

|

|

|

1,000 |

|

|

|

1,022,240 |

|

|

| |

|

| Build NYC Resource Corp. (Pratt Paper, Inc.); Series 2014, Ref. RB(c)(d) |

|

|

5.00% |

|

|

|

01/01/2035 |

|

|

|

2,700 |

|

|

|

2,702,690 |

|

|

| |

|

| Build NYC Resource Corp. (The Children’s Aid Society); Series 2015, RB |

|

|

5.00% |

|

|

|

07/01/2045 |

|

|

|

2,840 |

|

|

|

2,848,500 |

|

|

| |

|

| Build NYC Resource Corp. (Whin Music Community Charter School); Series 2022, RB(c) |

|

|

6.50% |

|

|

|

07/01/2057 |

|

|

|

1,355 |

|

|

|

1,289,484 |

|

|

| |

|

| Dutchess County Local Development Corp. (Marist College); Series 2022, RB |

|

|

4.00% |

|

|

|

07/01/2049 |

|

|

|

600 |

|

|

|

547,570 |

|

|

| |

|

| Dutchess County Local Development Corp. (Nuvance Health); Series 2019 B, Ref. RB |

|

|

4.00% |

|

|

|

07/01/2049 |

|

|

|

2,375 |

|

|

|

1,961,570 |

|

|

| |

|

| Dutchess County Local Development Corp. (Social Bonds); Series 2023, RB (CEP - FNMA) |

|

|

5.00% |

|

|

|

10/01/2040 |

|

|

|

420 |

|

|

|

449,066 |

|

|

| |

|

| Erie Tobacco Asset Securitization Corp.; Series 2005 A, RB |

|

|

5.00% |

|

|

|

06/01/2045 |

|

|

|

3,225 |

|

|

|

2,981,092 |

|

|

| |

|

| Genesee County Funding Corp. (The) (Rochester Regional Health Obligated Group); Series 2022 A, Ref.

RB |

|

|

5.25% |

|

|

|

12/01/2052 |

|

|

|

725 |

|

|

|

747,755 |

|

|

| |

|

| Hudson Yards Infrastructure Corp.; Series 2017 A, Ref. RB (INS - AGM)(e) |

|

|

4.00% |

|

|

|

02/15/2047 |

|

|

|

1,425 |

|

|

|

1,382,412 |

|

|

| |

|

| Jefferson Civic Facility Development Corp. (Samaritan Medical Center); Series 2017 A, Ref. RB |

|

|

4.00% |

|

|

|

11/01/2047 |

|

|

|

1,245 |

|

|

|

862,550 |

|

|

| |

|

| Long Island (City of), NY Power Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016 B, Ref. RB |

|

|

5.00% |

|

|

|

09/01/2036 |

|

|

|

1,345 |

|

|

|

1,389,199 |

|

|

| |

|

| Series 2017, RB |

|

|

5.00% |

|

|

|

09/01/2047 |

|

|

|

1,000 |

|

|

|

1,028,334 |

|

|

| |

|

| Series 2021 A, Ref. RB |

|

|

3.00% |

|

|

|

09/01/2040 |

|

|

|

1,150 |

|

|

|

953,593 |

|

|

| |

|

| Long Island (City of), NY Power Authority (Green Bonds); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2023 E, RB |

|

|

5.00% |

|

|

|

09/01/2048 |

|

|

|

500 |

|

|

|

540,713 |

|

|

| |

|

| Series 2023 E, RB |

|

|

5.00% |

|

|

|

09/01/2053 |

|

|

|

1,000 |

|

|

|

1,076,188 |

|

|

| |

|

| Metropolitan Transportation Authority; Series 2017 D, Ref. RB |

|

|

4.00% |

|

|

|

11/15/2042 |

|

|

|

2,950 |

|

|

|

2,775,606 |

|

|

| |

|

| Metropolitan Transportation Authority (Green Bonds); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017 A-1, RB |

|

|

5.25% |

|

|

|

11/15/2057 |

|

|

|

3,975 |

|

|

|

4,038,092 |

|

|

| |

|

| Series 2017 B-1, RB |

|

|

5.25% |

|

|

|

11/15/2057 |

|

|

|

2,065 |

|

|

|

2,143,885 |

|

|

| |

|

| Series 2017 C-2, Ref.

RB(b) |

|

|

0.00% |

|

|

|

11/15/2040 |

|

|

|

8,250 |

|

|

|

3,557,894 |

|

|

| |

|

| Monroe County Industrial Development Corp. (Rochester Regional Health); Series 2020, Ref. RB |

|

|

4.00% |

|

|

|

12/01/2046 |

|

|

|

300 |

|

|

|

254,736 |

|

|

| |

|

| Monroe County Industrial Development Corp. (St. Ann’s Community); Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

01/01/2050 |

|

|

|

850 |

|

|

|

667,748 |

|

|

| |

|

| Monroe County Industrial Development Corp. (St. John Fisher College); Series 2014 A, RB |

|

|

5.50% |

|

|

|

06/01/2034 |

|

|

|

1,000 |

|

|

|

1,009,581 |

|

|

| |

|

| MTA Hudson Rail Yards Trust Obligations; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016 A, RB |

|

|

5.00% |

|

|

|

11/15/2051 |

|

|

|

3,110 |

|

|

|

3,090,737 |

|

|

| |

|

| Series 2016 A, RB |

|

|

5.00% |

|

|

|

11/15/2056 |

|

|

|

7,985 |

|

|

|

7,897,889 |

|

|

| |

|

| Nassau (County of), NY Industrial Development Agency (Amsterdam at Harborside); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021, RB(f) |

|

|

5.00% |

|

|

|

01/01/2058 |

|

|

|

1,219 |

|

|

|

292,113 |

|

|

| |

|

| Series 2021, Ref. RB (Acquired 09/07/2021; Cost

$600,000)(c)(f)(g) |

|

|

9.00% |

|

|

|

01/01/2041 |

|

|

|

600 |

|

|

|

570,000 |

|

|

| |

|

| Nassau County Local Economic Assistance Corp. (Catholic Health Services of Long Island Obligated Group);

Series 2014, RB |

|

|

5.00% |

|

|

|

07/01/2033 |

|

|

|

1,000 |

|

|

|

1,004,205 |

|

|

| |

|

| Nassau County Tobacco Settlement Corp.; Series 2006 A-3, RB |

|

|

5.00% |

|

|

|

06/01/2035 |

|

|

|

1,250 |

|

|

|

1,150,198 |

|

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Trust for Investment Grade New York Municipals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest

Rate |

|

|

Maturity

Date |

|

|

Principal

Amount

(000) |

|

|

Value |

|

|

| |

|

| New York–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New York & New Jersey (States of) Port Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2014-186, Ref.

RB(d) |

|

|

5.00% |

|

|

|

10/15/2044 |

|

|

|

$ 2,000 |

|

|

|

$ 2,004,010 |

|

|

| |

|

| Series 2021, Ref. RB(d) |

|

|

4.00% |

|

|

|

07/15/2051 |

|

|

|

360 |

|

|

|

332,822 |

|

|

| |

|

| Series 2021, Ref. RB(d) |

|

|

5.00% |

|

|

|

07/15/2056 |

|

|

|

490 |

|

|

|

501,237 |

|

|

| |

|

| Two Hundred Thirty-First Series 2022, Ref. RB(d)

|

|

|

5.50% |

|

|

|

08/01/2047 |

|

|

|

8,000 |

|

|

|

8,590,265 |

|

|

| |

|

| Two Hundredth Series 2017, Ref. RB |

|

|

5.25% |

|

|

|

10/15/2057 |

|

|

|

6,880 |

|

|

|

7,106,622 |

|

|

| |

|

| New York (City of), NY; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2018 E-1, GO Bonds |

|

|

5.25% |

|

|

|

03/01/2035 |

|

|

|

1,000 |

|

|

|

1,088,512 |

|

|

| |

|

| Series 2020 D-1, GO Bonds |

|

|

5.00% |

|

|

|

03/01/2038 |

|

|

|

600 |

|

|

|

653,412 |

|

|

| |

|

| Series 2020 D-1, GO Bonds |

|

|

4.00% |

|

|

|

03/01/2050 |

|

|

|

12,100 |

|

|

|

11,739,334 |

|

|

| |

|

| Series 2021 A-1, GO Bonds |

|

|

4.00% |

|

|

|

08/01/2050 |

|

|

|

500 |

|

|

|

484,970 |

|

|

| |

|

| Subseries 2019 D-1, GO Bonds |

|

|

5.00% |

|

|

|

12/01/2037 |

|

|

|

2,000 |

|

|

|

2,134,981 |

|

|

| |

|

| Subseries 2022 D-1,

RB(h) |

|

|

5.25% |

|

|

|

05/01/2043 |

|

|

|

1,700 |

|

|

|

1,885,614 |

|

|

| |

|

| New York (City of), NY Industrial Development Agency (Yankee Stadium); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2020, Ref. RB |

|

|

4.00% |

|

|

|

03/01/2045 |

|

|

|

500 |

|

|

|

460,997 |

|

|

| |

|

| Series 2020, Ref. RB (INS - AGM)(e) |

|

|

4.00% |

|

|

|

03/01/2045 |

|

|

|

200 |

|

|

|

191,813 |

|

|

| |

|

| Series 2020, Ref. RB (INS - AGM)(e) |

|

|

4.00% |

|

|

|

03/01/2045 |

|

|

|

4,240 |

|

|

|

4,072,160 |

|

|

| |

|

| New York (City of), NY Municipal Water Finance Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017 DD, RB |

|

|

5.25% |

|

|

|

06/15/2047 |

|

|

|

3,600 |

|

|

|

3,744,454 |

|

|

| |

|

| Series 2019 CC-1, RB |

|

|

4.00% |

|

|

|

06/15/2040 |

|

|

|

300 |

|

|

|

301,873 |

|

|

| |

|

| Series 2020 AA-2, RB |

|

|

4.00% |

|

|

|

06/15/2043 |

|

|

|

3,500 |

|

|

|

3,507,337 |

|

|

| |

|

| Series 2020, Ref. RB |

|

|

5.00% |

|

|

|

06/15/2050 |

|

|

|

500 |

|

|

|

530,752 |

|

|

| |

|

| Series 2021 CC-1, RB |

|

|

4.00% |

|

|

|

06/15/2051 |

|

|

|

9,000 |

|

|

|

8,771,998 |

|

|

| |

|

| New York (City of), NY Transitional Finance Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2018 C-3, RB |

|

|

4.00% |

|

|

|

05/01/2045 |

|

|

|

2,565 |

|

|

|

2,524,421 |

|

|

| |

|

| Series 2018 S-3, RB |

|

|

5.00% |

|

|

|

07/15/2043 |

|

|

|

2,115 |

|

|

|

2,210,917 |

|

|

| |

|

| Series 2018 S-3, RB |

|

|

5.25% |

|

|

|

07/15/2045 |

|

|

|

690 |

|

|

|

726,767 |

|

|

| |

|

| Series 2019 B-1, RB |

|

|

4.00% |

|

|

|

11/01/2045 |

|

|

|

1,300 |

|

|

|

1,279,347 |

|

|

| |

|

| Series 2019 C, RB(h) |

|

|

4.00% |

|

|

|

11/01/2042 |

|

|

|

8,000 |

|

|

|

7,920,034 |

|

|

| |

|

| Series 2020 C-1, RB |

|

|

4.00% |

|

|

|

05/01/2036 |

|

|

|

100 |

|

|

|

103,086 |

|

|

| |

|

| Series 2020 C-1, RB |

|

|

4.00% |

|

|

|

05/01/2040 |

|

|

|

100 |

|

|

|

99,937 |

|

|

| |

|

| Series 2020 C-1, RB |

|

|

4.00% |

|

|

|

05/01/2045 |

|

|

|

2,565 |

|

|

|

2,522,915 |

|

|

| |

|

| Series 2020 D, RB |

|

|

4.00% |

|

|

|

11/01/2040 |

|

|

|

560 |

|

|

|

559,349 |

|

|

| |

|

| Series 2020, RB |

|

|

4.00% |

|

|

|

05/01/2045 |

|

|

|

885 |

|

|

|

870,479 |

|

|

| |

|

| Series 2020, RB |

|

|

4.00% |

|

|

|

05/01/2046 |

|

|

|

2,000 |

|

|

|

1,959,105 |

|

|

| |

|

| Series 2021 B-1, RB |

|

|

4.00% |

|

|

|

08/01/2042 |

|

|

|

1,000 |

|

|

|

990,209 |

|

|

| |

|

| Series 2022 F-1, RB |

|

|

5.00% |

|

|

|

02/01/2044 |

|

|

|

1,000 |

|

|

|

1,085,952 |

|

|

| |

|

| Series 2023 A, RB |

|

|

4.00% |

|

|

|

05/01/2045 |

|

|

|

2,000 |

|

|

|

1,967,185 |

|

|

| |

|

| New York (City of), NY Trust for Cultural Resources (Carnegie Hall); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2035 |

|

|

|

450 |

|

|

|

496,292 |

|

|

| |

|

| Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2037 |

|

|

|

275 |

|

|

|

298,297 |

|

|

| |

|

| Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2038 |

|

|

|

250 |

|

|

|

269,915 |

|

|

| |

|

| Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2039 |

|

|

|

375 |

|

|

|

403,147 |

|

|

| |

|

| New York (State of) Dormitory Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2009 C, RB (INS - AGC)(e) |

|

|

5.00% |

|

|

|

10/01/2024 |

|

|

|

35 |

|

|

|

35,058 |

|

|

| |

|

| Series 2011, RB |

|

|

5.00% |

|

|

|

10/01/2025 |

|

|

|

20 |

|

|

|

20,028 |

|

|

| |

|

| Series 2013 A, RB |

|

|

5.00% |

|

|

|

05/01/2028 |

|

|

|

680 |

|

|

|

680,388 |

|

|

| |

|

| Series 2014 C, RB |

|

|

5.00% |

|

|

|

03/15/2041 |

|

|

|

6,000 |

|

|

|

6,009,166 |

|

|

| |

|

| Series 2015 A, Ref. RB(h) |

|

|

5.00% |

|

|

|

07/01/2048 |

|

|

|

10,000 |

|

|

|

10,188,719 |

|

|

| |

|

| Series 2018, RB(i)(j) |

|

|

5.00% |

|

|

|

07/01/2028 |

|

|

|

645 |

|

|

|

708,529 |

|

|

| |

|

| Series 2018, RB |

|

|

5.00% |

|

|

|

07/01/2048 |

|

|

|

855 |

|

|

|

884,641 |

|

|

| |

|

| Series 2020 A, Ref. RB |

|

|

4.00% |

|

|

|

03/15/2048 |

|

|

|

3,000 |

|

|

|

2,908,957 |

|

|

| |

|

| Series 2022, RB(h) |

|

|

4.00% |

|

|

|

03/15/2049 |

|

|

|

6,500 |

|

|

|

6,282,284 |

|

|

| |

|

| New York (State of) Dormitory Authority (Catholic Health System Obligated Group); Series 2019 A, Ref.

RB |

|

|

4.00% |

|

|

|

07/01/2045 |

|

|

|

1,750 |

|

|

|

1,228,808 |

|

|

| |

|

| New York (State of) Dormitory Authority (City of New York); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2005 A, RB (INS - AMBAC)(e) |

|

|

5.50% |

|

|

|

05/15/2027 |

|

|

|

700 |

|

|

|

760,167 |

|

|

| |

|

| Series 2005 A, RB (INS - AMBAC)(e) |

|

|

5.50% |

|

|

|

05/15/2030 |

|

|

|

1,750 |

|

|

|

2,016,970 |

|

|

| |

|

| Series 2005 A, RB (INS - AMBAC)(e) |

|

|

5.50% |

|

|

|

05/15/2031 |

|

|

|

445 |

|

|

|

521,540 |

|

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Trust for Investment Grade New York Municipals |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest

Rate |

|

Maturity

Date |

|

Principal

Amount

(000) |

|

|

Value |

|

|

| |

|

| New York–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

| New York (State of) Dormitory Authority (Columbia University); Series 2018 A, RB |

|

5.00% |

|

10/01/2048 |

|

|

$ 1,000 |

|

|

|

$ 1,163,493 |

|

|

| |

|

| New York (State of) Dormitory Authority (Fashion Institute of Technology Student Housing Corp.); Series 2007,

RB (INS - NATL)(e) |

|

5.25% |

|

07/01/2028 |

|

|

2,065 |

|

|

|

2,135,513 |

|

|

| |

|

| New York (State of) Dormitory Authority (Fordham University); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2014, RB |

|

5.00% |

|

07/01/2044 |

|

|

1,000 |

|

|

|

1,004,772 |

|

|

| |

|

| Series 2021 A, Ref. RB |

|

3.00% |

|

07/01/2038 |

|

|

610 |

|

|

|

515,833 |

|

|

| |

|

| New York (State of) Dormitory Authority (Icahn School of Medicine at Mount Sinai); Series 2015, Ref.

RB |

|

5.00% |

|

07/01/2045 |

|

|

2,835 |

|

|

|

2,842,206 |

|

|

| |

|

| New York (State of) Dormitory Authority (Montefiore Obligated Group); Series 2018 A, Ref. RB |

|

5.00% |

|

08/01/2030 |

|

|

2,000 |

|

|

|

2,065,899 |

|

|

| |

|

| New York (State of) Dormitory Authority (New School (The)); Series 2022 A, Ref. RB |

|

4.00% |

|

07/01/2052 |

|

|

575 |

|

|

|

497,689 |

|

|

| |

|

| New York (State of) Dormitory Authority (New York University); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2001-1, RB (INS - BHAC)(e) |

|

5.50% |

|

07/01/2031 |

|

|

1,115 |

|

|

|

1,242,980 |

|

|

| |

|

| Series 2001-1, RB (INS - AMBAC)(e) |

|

5.50% |

|

07/01/2031 |

|

|

2,500 |

|

|

|

2,786,950 |

|

|

| |

|

| Series 2021 A, Ref. RB |

|

3.00% |

|

07/01/2041 |

|

|

1,000 |

|

|

|

806,512 |

|

|

| |

|

| New York (State of) Dormitory Authority (Orange Regional Medical Center); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2015, Ref. RB(c) |

|

5.00% |

|

12/01/2045 |

|

|

1,075 |

|

|

|

1,001,260 |

|

|

| |

|

| Series 2017, Ref. RB(c) |

|

5.00% |

|

12/01/2036 |

|

|

900 |

|

|

|

844,477 |

|

|

| |

|

| Series 2017, Ref. RB(c) |

|

5.00% |

|

12/01/2037 |

|

|

1,500 |

|

|

|

1,388,231 |

|

|

| |

|

| New York (State of) Dormitory Authority (Pace University); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2013 A, RB |

|

5.00% |

|

05/01/2025 |

|

|

1,120 |

|

|

|

1,120,645 |

|

|

| |

|

| Series 2013 A, RB |

|

5.00% |

|

05/01/2029 |

|

|

1,270 |

|

|

|

1,270,686 |

|

|

| |

|

| New York (State of) Dormitory Authority (Rochester Institute of Technology); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019 A, RB |

|

4.00% |

|

07/01/2044 |

|

|

1,985 |

|

|

|

1,925,569 |

|

|

| |

|

| Series 2019 A, RB |

|

5.00% |

|

07/01/2049 |

|

|

1,410 |

|

|

|

1,464,546 |

|

|

| |

|

| New York (State of) Dormitory Authority (Wagner College); Series 2022, Ref. RB |

|

5.00% |

|

07/01/2057 |

|

|

2,280 |

|

|

|

2,201,454 |

|

|

| |

|

| New York (State of) Dormitory Authority (Yeshiva University); Series 2022 A, Ref. RB |

|

5.00% |

|

07/15/2050 |

|

|

1,000 |

|

|

|

982,901 |

|

|

| |

|

| New York (State of) Mortgage Agency (Social Bonds); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2023 252, RB |

|

4.45% |

|

10/01/2043 |

|

|

75 |

|

|

|

76,617 |

|

|

| |

|

| Series 2023 252, RB |

|

4.55% |

|

10/01/2048 |

|

|

125 |

|

|

|

123,076 |

|

|

| |

|

| Series 2023 252, RB |

|

4.65% |

|

10/01/2053 |

|

|

150 |

|

|

|

150,484 |

|

|

| |

|

| New York (State of) Power Authority (Green Bonds); Series 2020 A, Ref. RB |

|

4.00% |

|

11/15/2060 |

|

|

3,300 |

|

|

|

3,141,981 |

|

|

| |

|

| New York (State of) Power Authority (Green Transmission) (Green Bonds); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2022, RB (INS - AGM)(e) |

|

4.00% |

|

11/15/2061 |

|

|

5,000 |

|

|

|

4,660,159 |

|

|

| |

|

| Series 2023, RB (INS - AGM)(e) |

|

5.13% |

|

11/15/2063 |

|

|

1,380 |

|

|

|

1,477,292 |

|

|

| |

|

| New York (State of) Thruway Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2014 J, RB |

|

5.00% |

|

01/01/2034 |

|

|

4,085 |

|

|

|

4,088,122 |

|

|

| |

|

| Series 2019 B, RB (INS - AGM)(e) |

|

4.00% |

|

01/01/2040 |

|

|

2,340 |

|

|

|

2,343,647 |

|

|

| |

|

| Series 2019 B, RB |

|

4.00% |

|

01/01/2050 |

|

|

2,000 |

|

|

|

1,843,078 |

|

|

| |

|

| Series 2020 N, RB |

|

5.00% |

|

01/01/2040 |

|

|

2,000 |

|

|

|

2,145,327 |

|

|

| |

|

| New York (State of) Utility Debt Securitization Authority (Green Bonds); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2022, Ref. RB |

|

5.00% |

|

12/15/2049 |

|

|

550 |

|

|

|

595,953 |

|

|

| |

|

| Series 2022, Ref. RB |

|

5.00% |

|

09/15/2052 |

|

|

250 |

|

|

|

270,054 |

|

|

| |

|

| New York City Housing Development Corp. (Sustainable Development Bonds); Series 2023, RB |

|

4.80% |

|

02/01/2053 |

|

|

1,620 |

|

|

|

1,655,536 |

|

|

| |

|

| New York Convention Center Development Corp. (Hotel Unit Fee Secured); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2015, Ref. RB |

|

5.00% |

|

11/15/2040 |

|

|

1,965 |

|

|

|

1,975,620 |

|

|

| |

|

| Series 2016 B, RB(b) |

|

0.00% |

|

11/15/2044 |

|

|

1,730 |

|

|

|

584,753 |

|

|

| |

|

| Series 2016, RB(b) |

|

0.00% |

|

11/15/2056 |

|

|

5,000 |

|

|

|

839,938 |

|

|

| |

|

| New York Counties Tobacco Trust IV; Series 2010 A, RB(c)

|

|

6.25% |

|

06/01/2041 |

|

|

870 |

|

|

|

870,037 |

|

|

| |

|

| New York Counties Tobacco Trust V; |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2005 S-1, RB(b)

|

|

0.00% |

|

06/01/2038 |

|

|

8,430 |

|

|

|

3,456,237 |

|

|

| |

|

| Series 2005 S-2, RB(b)

|

|

0.00% |

|

06/01/2050 |

|

|

14,850 |

|

|

|

2,080,427 |

|

|

| |

|

| New York Liberty Development Corp. (3 World Trade Center); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2014, Class 1, Ref. RB(c) |

|

5.00% |

|

11/15/2044 |

|

|

4,895 |

|

|

|

4,770,817 |

|

|

| |

|

| Series 2014, Class 3, Ref. RB(c) |

|

7.25% |

|

11/15/2044 |

|

|

1,085 |

|

|

|

1,091,808 |

|

|

| |

|

| New York Liberty Development Corp. (Bank of America Tower at One Bryant Park); Series 2019, Ref. RB |

|

2.80% |

|

09/15/2069 |

|

|

2,785 |

|

|

|

2,467,882 |

|

|

| |

|

| New York Liberty Development Corp. (Goldman Sachs Headquarters); Series 2007, RB |

|

5.50% |

|

10/01/2037 |

|

|

2,845 |

|

|

|

3,216,996 |

|

|

| |

|

| New York Liberty Development Corp. (Green Bonds); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021 A, Ref. RB |

|

2.75% |

|

11/15/2041 |

|

|

925 |

|

|

|

721,259 |

|

|

| |

|

| Series 2021 A, Ref. RB |

|

2.88% |

|

11/15/2046 |

|

|

1,175 |

|

|

|

871,267 |

|

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Trust for Investment Grade New York Municipals |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest

Rate |

|

Maturity

Date |

|

Principal

Amount

(000) |

|

|

Value |

|

|

| |

|

| New York–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

| New York State Environmental Facilities Corp. (New York City Municipal Water Finance Authority Projects - 2nd

Resolution Bonds); Series 2017 E, RB |

|

5.00% |

|

06/15/2042 |

|

|

$ 575 |

|

|

|

$ 601,812 |

|

|

| |

|

| New York State Urban Development Corp.; |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019 A, Ref. RB |

|

4.00% |

|

03/15/2042 |

|

|

4,950 |

|

|

|

4,887,251 |

|

|

| |

|

| Series 2020 C, Ref. RB |

|

5.00% |

|

03/15/2050 |

|

|

1,410 |

|

|

|

1,482,841 |

|

|

| |

|

| New York State Urban Development Corp. (Bidding Group 3); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021, Ref. RB |

|

4.00% |

|

03/15/2046 |

|

|

1,320 |

|

|

|

1,283,352 |

|

|

| |

|

| Series 2021, Ref. RB(h) |

|

4.00% |

|

03/15/2046 |

|

|

9,000 |

|

|

|

8,750,129 |

|

|

| |

|

| New York State Urban Development Corp. (Bidding Group 4); Series 2020 E, Ref. RB |

|

4.00% |

|

03/15/2046 |

|

|

2,500 |

|

|

|

2,448,334 |

|

|

| |

|

| New York Transportation Development Corp. (American Airlines, Inc. John F. Kennedy International Airport);

Series 2023, RB(d) |

|

5.38% |

|

06/30/2060 |

|

|

1,500 |

|

|

|

1,501,323 |

|

|

| |

|

| New York Transportation Development Corp. (American Airlines, Inc.); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016, Ref. RB(d) |

|

5.00% |

|

08/01/2026 |

|

|

1,485 |

|

|

|

1,485,057 |

|

|

| |

|

| Series 2016, Ref. RB(d) |

|

5.00% |

|

08/01/2031 |

|

|

800 |

|

|

|

799,946 |

|

|

| |

|

| New York Transportation Development Corp. (Delta Air Lines, Inc. LaGuardia Airport Terminals C&D

Redevelopment); Series 2018, RB(d) |

|

5.00% |

|

01/01/2036 |

|

|

5,455 |

|

|

|

5,493,172 |

|

|

| |

|

| New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment); Series 2016 A, RB(d)(h)(k) |

|

5.00% |

|

07/01/2046 |

|

|

7,000 |

|

|

|

6,939,411 |

|

|

| |

|

| New York Transportation Development Corp. (Terminal 4 JFK International Airport); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2020 A, Ref. RB(d) |

|

5.00% |

|

12/01/2031 |

|

|

200 |

|

|

|

212,698 |

|

|

| |

|

| Series 2020 C, Ref. RB |

|

5.00% |

|

12/01/2036 |

|

|

640 |

|

|

|

676,790 |

|

|

| |

|

| Series 2022, RB(d) |

|

5.00% |

|

12/01/2041 |

|

|

2,000 |

|

|

|

2,062,674 |

|

|

| |

|

| Niagara Area Development Corp. (Catholic Health System, Inc.); Series 2022, RB |

|

5.00% |

|

07/01/2052 |

|

|

450 |

|

|

|

344,807 |

|

|

| |

|

| Niagara Area Development Corp. (Covanta); Series 2018 A, Ref.

RB(c)(d) |

|

4.75% |

|

11/01/2042 |

|

|

1,820 |

|

|

|

1,464,228 |

|

|

| |

|

| Niagara Frontier Transportation Authority (Buffalo Niagara International Airport); Series 2014 A, Ref. RB(d) |

|

5.00% |

|

04/01/2028 |

|

|

1,000 |

|

|

|

1,001,670 |

|

|

| |

|

| Niagara Tobacco Asset Securitization Corp.; Series 2014, Ref. RB |

|

5.25% |

|

05/15/2040 |

|

|

725 |

|

|

|

725,049 |

|

|

| |

|

| Oneida County Local Development Corp. (Mohawk Valley Health System); Series 2019, Ref. RB (INS - AGM)(e) |

|

4.00% |

|

12/01/2049 |

|

|

2,000 |

|

|

|

1,773,715 |

|

|

| |

|

| Onondaga (County of), NY Trust for Cultural Resources (Syracuse University); Series 2019, Ref. RB |

|

4.00% |

|

12/01/2049 |

|

|

4,260 |

|

|

|

4,163,200 |

|

|

| |

|

| Rockland Tobacco Asset Securitization Corp.; |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2001, RB |

|

5.75% |

|

08/15/2043 |

|

|

1,375 |

|

|

|

1,396,044 |

|

|

| |

|

| Series 2005 A, RB(b)(c) |

|

0.00% |

|

08/15/2045 |

|

|

8,065 |

|

|

|

2,293,621 |

|

|

| |

|

| Series 2005 C, RB(b)(c) |

|

0.00% |

|

08/15/2060 |

|

|

96,000 |

|

|

|

6,159,917 |

|

|

| |

|

| Suffolk County Economic Development Corp. (Catholic Health Services); Series 2014 C, RB |

|

5.00% |

|

07/01/2032 |

|

|

1,085 |

|

|

|

1,089,784 |

|

|

| |

|

| Tompkins County Development Corp. (Tompkins Cortland Community College Foundation, Inc.); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2013 A, RB(f) |

|

5.00% |

|

07/01/2027 |

|

|

1,000 |

|

|

|

350,000 |

|

|

| |

|

| Series 2013 A, RB(f) |

|

5.00% |

|

07/01/2032 |

|

|

750 |

|

|

|

262,500 |

|

|

| |

|

| Series 2013 A, RB(f) |

|

5.00% |

|

07/01/2038 |

|

|

2,000 |

|

|

|

700,000 |

|

|

| |

|

| Triborough Bridge & Tunnel Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2013 A, Ref. RB(b) |

|

0.00% |

|

11/15/2032 |

|

|

2,000 |

|

|

|

1,426,216 |

|

|

| |

|

| Series 2021 A-1, Ref. RB |

|

4.00% |

|

05/15/2046 |

|

|

815 |

|

|

|

801,013 |

|

|

| |

|

| Subseries 2021 B-1, Ref. RB |

|

4.00% |

|

05/15/2056 |

|

|

1,000 |

|

|

|

963,304 |

|

|

| |

|

| Triborough Bridge & Tunnel Authority (Green Bonds); Series 2022

D-2, RB |

|

5.25% |

|

05/15/2047 |

|

|

5,545 |

|

|

|

6,131,136 |

|

|

| |

|

| Triborough Bridge & Tunnel Authority (MTA Brdiges & Tunnels) (Green Bonds); Subseries 2022 D-2, RB |

|

5.50% |

|

05/15/2052 |

|

|

350 |

|

|

|

387,883 |

|

|

| |

|

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2020 A, RB |

|

5.00% |

|

11/15/2054 |

|

|

3,120 |

|

|

|

3,292,390 |

|

|

| |

|

| Series 2021 A, RB |

|

5.00% |

|

11/15/2056 |

|

|

1,120 |

|

|

|

1,184,231 |

|

|

| |

|

| Series 2022, RB(h) |

|

5.25% |

|

05/15/2062 |

|

|

8,000 |

|

|

|

8,634,397 |

|

|

| |

|

| Triborough Bridge & Tunnel Authority( MTA Brdiges & Tunnels); Series 2023 A, RB(h) |

|

4.25% |

|

05/15/2058 |

|

|

10,000 |

|

|

|

9,755,339 |

|

|

| |

|

| TSASC, Inc.; |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016 B, Ref. RB |

|

5.00% |

|

06/01/2045 |

|

|

2,070 |

|

|

|

1,837,811 |

|

|

| |

|

| Series 2017 A, Ref. RB |

|

5.00% |

|

06/01/2036 |

|

|

2,885 |

|

|

|

2,947,075 |

|

|

| |

|

| Westchester (County of), NY Industrial Development Agency (Million Air Two LLC General Aviation Facilities);

Series 2017 A, RB(c)(d) |

|

7.00% |

|

06/01/2046 |

|

|

1,030 |

|

|

|

900,720 |

|

|

| |

|

| Westchester County Local Development Corp. (Betheal Methodist); |

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2020 A, Ref. RB |

|

5.00% |

|

07/01/2040 |

|

|

150 |

|

|

|

121,468 |

|

|

| |

|

| Series 2020 A, Ref. RB |

|

5.13% |

|

07/01/2055 |

|

|

520 |

|

|

|

387,186 |

|

|

| |

|

| Westchester County Local Development Corp. (Kendal on Hudson); Series 2022, Ref. RB |

|

4.25% |

|

01/01/2045 |

|

|

420 |

|

|

|

346,724 |

|

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Trust for Investment Grade New York Municipals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest

Rate |

|

|

Maturity

Date |

|

|

Principal

Amount

(000) |

|

|

Value |

|

|

| |

|

| New York–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Westchester County Local Development Corp. (Purchase Senior Learning Community Inc.); Series 2021, Ref. RB(c) |

|

|

4.50 |

% |

|

|

07/01/2056 |

|

|

$ |

600 |

|

|

$ |

421,193 |

|

|

| |

|

| Westchester County Local Development Corp. (Westchester Medical Center Obligated Group); Series 2023, RB (INS

- AGM)(e) |

|

|

5.75 |

% |

|

|

11/01/2053 |

|

|

|

1,250 |

|

|

|

1,376,030 |

|

|

| |

|

| Westchester Tobacco Asset Securitization Corp.; Series 2016 C, Ref. RB |

|

|

5.13 |

% |

|

|

06/01/2051 |

|

|

|

2,705 |

|

|

|

2,724,303 |

|

|

| |

|

| Western Regional Off-Track Betting Corp.; Series 2021, Ref. RB(c) |

|

|

4.13 |

% |

|

|

12/01/2041 |

|

|

|

275 |

|

|

|

203,700 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

357,630,553 |

|

|

| |

|

|

|

|

|

|

| Puerto Rico–2.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Children’s Trust Fund; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2002, RB |

|

|

5.50 |

% |

|

|

05/15/2039 |

|

|

|

705 |

|

|

|

706,782 |

|

|

| |

|

| Series 2002, RB |

|

|

5.63 |

% |

|

|

05/15/2043 |

|

|

|

145 |

|

|

|

146,646 |

|

|

| |

|

| Series 2005 A, RB(b) |

|

|

0.00 |

% |

|

|

05/15/2050 |

|

|

|

2,000 |

|

|

|

368,330 |

|

|

| |

|

| Puerto Rico (Commonwealth of) Electric Power Authority; Series 2007 VV, Ref. RB (INS - NATL)(e) |

|

|

5.25 |

% |

|

|

07/01/2030 |

|

|

|

500 |

|

|

|

495,811 |

|

|

| |

|

| Puerto Rico Sales Tax Financing Corp.; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2018 A-1, RB(b)

|

|

|

0.00 |

% |

|

|

07/01/2029 |

|

|

|

565 |

|

|

|

446,891 |

|

|

| |

|

| Series 2018 A-1, RB(b)

|

|

|

0.00 |

% |

|

|

07/01/2031 |

|

|

|

650 |

|

|

|

468,939 |

|

|

| |

|

| Series 2018 A-1, RB |

|

|

5.00 |

% |

|

|

07/01/2058 |

|

|

|

2,000 |

|

|

|

1,944,159 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,577,558 |

|

|

| |

|

|

|

|

|

|

| Virgin Islands–0.30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Virgin Islands (Government of) Port Authority; Series 2014 B, Ref. RB |

|

|

5.00 |

% |

|

|

09/01/2044 |

|

|

|

785 |

|

|

|

687,164 |

|

|

| |

|

| TOTAL INVESTMENTS IN SECURITIES(l)–158.26% (Cost

$372,261,675) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

362,895,275 |

|

|

| |

|

| FLOATING RATE NOTE OBLIGATIONS–(18.31)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes with interest and fee rates ranging from 3.85% to 3.87% at 11/30/2023 and contractual maturities of

collateral ranging from 11/01/2042 to 05/15/2062(m) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(41,975,000 |

) |

|

| |

|

| VARIABLE RATE TERM PREFERRED SHARES–(39.42)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(90,384,939 |

) |

|

| |

|

| OTHER ASSETS LESS LIABILITIES–(0.53)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,235,101 |

) |

|

| |

|

| NET ASSETS APPLICABLE TO COMMON SHARES–100.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

229,300,235 |

|

|

| |

|

Investment Abbreviations:

|

|

|

| AGC |

|

– Assured Guaranty Corp. |

| AGM |

|

– Assured Guaranty Municipal Corp. |

| AMBAC |

|

– American Municipal Bond Assurance Corp. |

| BHAC |

|

– Berkshire Hathaway Assurance Corp. |

| CEP |

|

– Credit Enhancement Provider |

| FNMA |

|

– Federal National Mortgage Association |

| GO |

|

– General Obligation |

| INS |

|

– Insurer |

| NATL |

|

– National Public Finance Guarantee Corp. |

| RB |

|

– Revenue Bonds |

| Ref. |

|

– Refunding |

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Trust for Investment Grade New York Municipals |

Notes to Schedule of Investments:

| (a) |

Calculated as a percentage of net assets. Amounts in excess of 100% are due to the Trust’s use of leverage.

|

| (b) |

Zero coupon bond issued at a discount. |

| (c) |

Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the

“1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at November 30, 2023 was $25,972,183, which

represented 11.33% of the Trust’s Net Assets. |

| (d) |

Security subject to the alternative minimum tax. |

| (e) |

Principal and/or interest payments are secured by the bond insurance company listed. |

| (f) |

Defaulted security. Currently, the issuer is in default with respect to principal and/or interest payments. The aggregate

value of these securities at November 30, 2023 was $2,174,613, which represented less than 1% of the Trust’s Net Assets. |

| (g) |

Restricted security. The value of this security at November 30, 2023 represented less than 1% of the Trust’s Net

Assets. |

| (h) |

Underlying security related to TOB Trusts entered into by the Trust. |

| (i) |

Advance refunded; secured by an escrow fund of U.S. Government obligations or other highly rated collateral.

|

| (j) |

Security has an irrevocable call by the issuer or mandatory put by the holder. Maturity date reflects such call or put.

|

| (k) |

Security is subject to a reimbursement agreement which may require the Trust to pay amounts to a counterparty in the event

of a significant decline in the market value of the security underlying the TOB Trusts. In case of a shortfall, the maximum potential amount of payments the Trust could ultimately be required to make under the agreement is $4,670,000. However, such

shortfall payment would be reduced by the proceeds from the sale of the security underlying the TOB Trusts. |

| (l) |

Entities may either issue, guarantee, back or otherwise enhance the credit quality of a security. The entities are not

primarily responsible for the issuer’s obligations but may be called upon to satisfy the issuer’s obligations. No concentration of any single entity was greater than 5% each. |

| (m) |

Floating rate note obligations related to securities held. The interest and fee rates shown reflect the rates in effect at

November 30, 2023. At November 30, 2023, the Trust’s investments with a value of $60,355,927 are held by TOB Trusts and serve as collateral for the $41,975,000 in the floating rate note obligations outstanding at that date.

|

The valuation policy and a listing of other significant accounting policies are available in the most recent shareholder report.

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Trust for Investment Grade New York Municipals |

Notes to Quarterly Schedule of Portfolio Holdings

November 30, 2023

(Unaudited)

NOTE 1–Additional Valuation Information

Generally Accepted Accounting

Principles (“GAAP”) defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions.

GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant

unobservable inputs (Level 3), generally when market prices are not readily available. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or

out of an investment’s assigned level:

|

|

|

| Level 1 |

|

– Prices are determined using quoted prices in an active market for identical

assets. |

| Level 2 |

|

– Prices are determined using other significant observable inputs. Observable inputs are

inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities

and others. |

| Level 3 |

|

– Prices are determined using significant unobservable inputs. In situations where quoted

prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect Invesco Advisers, Inc.’s assumptions

about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

As of November 30, 2023, all of the securities in this Trust were valued based on Level 2 inputs (see the

Schedule of Investments for security categories). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation,

the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

|

|

|

|

|

Invesco Trust for Investment Grade New York Municipals |

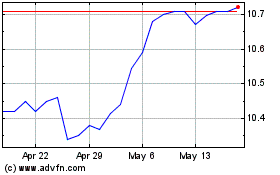

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Dec 2023 to Dec 2024