Intrepid Potash, Inc. ("Intrepid", the "Company", "we", "us", or

"our") (NYSE:IPI) today reported its results for the second quarter

of 2024.

Key Highlights for Second Quarter 2024

Financial & Operational

- Total sales of $62.1 million, which compares to $81.0 million

in the second quarter of 2023.

- Net loss of $0.8 million (or $0.06 per diluted share), which

compares to net income of $4.3 million (or $0.33 per diluted share)

in the second quarter of 2023.

- Gross margin of $7.6 million, which compares to $15.4 million

in the second quarter of 2023.

- Cash flow provided by operations of $27.7 million, which

compares to $30.5 million in the second quarter of 2023.

- Adjusted EBITDA(1) of $9.2 million, which compares to $15.8

million in the second quarter of 2023.

- Potash and Trio® sales volumes of 55 thousand and 63 thousand

tons, respectively, which compares to 79 thousand and 63 thousand

tons, respectively, in the second quarter of 2023.

- Potash and Trio® average net realized sales prices(1) of $405

and $314 per ton, respectively, which compares to $479 and $333 per

ton, respectively, in the second quarter of 2023.

Management & Board of Directors Update

- On July 10, 2024, we announced that the Board of Directors

(“the Board”) of Intrepid elected Barth Whitham, formerly Lead

Independent Director, as its Chair. On that date, the Board also

announced that it initiated a search process to identify a

successor for Intrepid’s CEO, Bob Jornayvaz, who is currently out

on an extended medical leave of absence, as it is unlikely that Mr.

Jornayvaz will return to his CEO role. During this process,

Intrepid’s CFO, Matt Preston, will continue to serve as acting

principal executive officer, working closely with the rest of the

Company’s management team and the Board.

Capital Expenditures

- Capital expenditures were $11.3 million in the second quarter

of 2024, bringing our total capital expenditures to $23.0 million

for the first six months ended June 30, 2024. We continue to expect

full-year 2024 capital expenditures of $40 million to $50

million.

Project & Operational Updates

- HB Solar Solution Mine in Carlsbad, New Mexico

- Replacement Extraction Well ("IP30B"): We successfully

completed the IP30B project in June 2024 and the new extraction

well is now serving as our primary source of brine for the current

evaporation season. We expect IP30B will be our primary extraction

well for the Eddy Cavern for future evaporation seasons.

- Phase Two of HB Injection Pipeline Project ("Phase Two"): Phase

Two is the installation of an in-line pigging system to clean the

HB injection pipeline and remove scaling to help ensure more

consistent flow rates. All pipeline is now installed and tanks have

been set, and we expect to commission the project in the third

quarter of 2024.

- Brine Recovery Mine in Wendover, Utah

- Primary Pond 7 ("PP7"): Construction of PP7 is complete and the

new pond is being filled with brine. This new primary pond is

expected to increase the brine evaporative area at Wendover and

help us meet our goals of maximizing brine availability, increasing

brine grade, and improving production. We expect to see the

production benefits of the new primary pond in the fall of

2025.

- Lithium Project: We continue to advance our lithium project in

Wendover and are in the process of reviewing proposals from

multiple partners. The lithium already present in our byproduct

magnesium brine is estimated to support approximately two thousand

tons of lithium carbonate production per year assuming the

existence of a commercially feasible extraction technology.

- Intrepid South

- Sand Project: We have all necessary permits in place to begin

construction and operation on our sand project. While our sand

project shows good potential, owing to softening conditions in the

oilfield services market, we’re pausing development and will be

dedicating our resources to other strategic priorities at this

time.

- East Underground Trio® Mine

- Operational & Cost Efficiencies: Owing to efficiencies from

the two continuous miners placed into service in 2023 and the

operation of our fine langbeinite recovery system, we've seen

significant improvement in our production rates and cost structure

compared to the prior year. For the first six months of 2024, our

cost of goods sold totaled approximately $284 per ton, which

compares to the same prior-year figure of $320 per ton. Improving

our margins in the Trio® segment through operational efficiencies

and cost savings initiatives remains a key focus for Intrepid.

Liquidity

- During the second quarter of 2024, cash flow provided by

operations was $27.7 million, while cash used in investing

activities was $9.8 million. As of July 31, 2024, Intrepid had

approximately $51.1 million in cash and cash equivalents and had no

outstanding borrowings on our $150 million revolving credit

facility.

- Intrepid maintains an investment account of short-and-long-term

fixed income securities that had a balance of approximately $2.5

million as of July 31, 2024.

Consolidated Results, Management Commentary, &

Outlook

In the second quarter of 2024, Intrepid generated sales of $62.1

million, a 23% decrease from second quarter 2023 sales of $81.0

million. Consolidated gross margin totaled $7.6 million, while net

loss totaled $0.8 million, or a net loss of $0.06 per diluted

share, which compares to second quarter 2023 net income of $4.3

million, or $0.33 per diluted share. The Company delivered adjusted

EBITDA(1) of $9.2 million, down from $15.8 million in the same

prior year period, with the lower profitability primarily being

driven by lower pricing for our key products. Our second quarter

2024 average net realized sales prices(1) for potash and Trio®

averaged $405 and $314 per ton, respectively, which compares to

$479 and $333 per ton, respectively, in the second quarter of

2023.

Matt Preston, Intrepid's Chief Financial Officer and acting

principal executive officer commented: "Our strategic focus

continues to be improving our potash production, and I'm happy to

share that we saw the first indications of this in our second

quarter results. Improved brine grades at HB from the Eddy Cavern

and good early-season evaporation rates, allowed us to extend our

spring production season and we still expect our 2024 potash

production to be approximately 15% higher than 2023.

As for our second quarter results, our operational and financial

performance continues to be solid. In Trio®, our sales volumes and

production are well ahead of last year's pace through the first six

months of the year as increased operating rates from our new

continuous miners and our modified operating schedule have driven

significant improvement in both our total and per ton production

costs. Trio® segment gross margin of $2.2 million in the second

quarter was an increase of approximately $3.3 million sequentially

and $1 million year-over-year. As the broader potash market looks

to be finding its midcycle pricing floor, we remain focused on

improving our unit economics by means of higher potash

production.

Lastly, we want to again extend our best wishes to Bob as he

continues his recovery. We will provide updates on our search for a

new CEO as that process unfolds in the coming months."

Segment Highlights

Potash

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(in thousands, except per ton

data)

Sales

$

30,034

$

47,264

$

67,610

$

99,761

Gross margin

$

3,312

$

12,876

$

8,886

$

27,304

Potash sales volumes (in tons)

55

79

129

167

Potash production volumes (in tons)

40

12

127

102

Average potash net realized sales price

per ton(1)

$

405

$

479

$

399

$

485

Our total sales in the potash segment decreased $17.2 million in

the second quarter of 2024, compared to the second quarter of 2023,

as potash sales decreased $17.0 million, or 41%, and potash segment

byproduct sales decreased $0.3 million. Our potash sales decreased

in the second quarter of 2024, compared to the second quarter of

2023, as our average net realized sales price per ton decreased

15%, and we sold 30% fewer tons. We sold fewer tons of potash in

the second quarter of 2024, compared to the second quarter of 2023,

as we had fewer tons of potash to sell due to lower potash

production from our HB and Wendover facilities.

Our potash segment cost of goods sold decreased by 25% in the

second quarter of 2024, compared to the second quarter of 2023, as

we sold 30% fewer tons of potash, although our production costs

remained elevated due to decreased production volumes over the past

year. A significant portion of our potash production costs are

fixed and an increase in potash tons produced reduces our potash

per ton cost.

During the second quarter of 2024, we recorded lower of cost or

net realizable value inventory adjustments of $1.4 million as our

weighted average carrying cost per ton for inventoried potash

products at our HB and Wendover facilities was higher than our

expected selling price per ton for those products.

Our potash segment gross margin decreased $9.6 million in the

second quarter of 2024, compared to the second quarter of 2023, due

to the factors discussed above.

Trio®

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(in thousands, except per ton

data)

Sales

$

26,522

$

28,748

$

63,010

$

59,022

Gross margin

$

2,182

$

1,222

$

1,043

$

2,674

Trio® sales volume (in tons)

63

63

154

128

Trio® production volume (in tons)

68

58

122

107

Average Trio® net realized sales price per

ton(1)

$

314

$

333

$

306

$

339

Trio® segment sales decreased 8% during the second quarter of

2024, compared to the second quarter of 2023. Trio® sales decreased

$0.8 million, and our Trio® segment byproduct sales decreased $1.4

million. Trio® sales volumes were flat year-over year, and similar

to potash prices discussed above, our Trio® average net realized

sales price per ton has decreased since the peak prices realized

during the second quarter of 2022, as potassium fertilizer supplies

have improved.

Our Trio® cost of goods sold decreased 18% in the second quarter

of 2024 despite sales volumes matching the prior year quarter, as

improved production rates and decreased total production costs led

to an improvement in our per unit costs. In the second quarter of

2024, we produced 68 thousand tons of Trio® which compares to 58

thousand tons in the same prior-year period. A significant portion

of our production costs are fixed and an increase in tons produced

decreases our per ton production costs.

Our Trio® segment generated gross margin of $2.2 million in the

second quarter of 2024, compared to gross margin of $1.2 million in

the second quarter of 2023, due to the factors discussed above.

Oilfield Solutions

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(in thousands)

Sales

$

5,539

$

5,111

$

10,862

$

9,361

Gross margin

$

2,130

$

1,284

$

4,129

$

1,756

Our oilfield solutions segment sales increased $0.4 million in

the second quarter of 2024, compared to the second quarter of 2023,

primarily due to a $0.2 million increase in brine water sales and a

$0.3 million increase in other oilfield solution products and

services. Our water sales increased compared to the prior year

period due to increased sales of water on our South ranch. Our

brine water sales and sales of other oilfield solutions segments

products and services increased due to continued strong demand from

oil and gas operators in the Permian Basin near Intrepid South.

Our cost of goods sold decreased $0.4 million, or 11%, in the

second quarter of 2024, compared to the second quarter of 2023, due

to using less contract labor. In the second quarter of 2023, we

used contract labor to complete various projects at Intrepid

South.

Gross margin for the second quarter of 2024 increased $0.8

million compared to the second quarter of 2023, due to the factors

discussed above.

Notes

1 Adjusted net (loss) income, adjusted net (loss) income per

diluted share, adjusted earnings before interest, taxes,

depreciation, and amortization (or adjusted EBITDA) and average net

realized sales price per ton are non-GAAP financial measures. See

the non-GAAP reconciliations set forth later in this press release

for additional information.

Unless expressly stated otherwise or the context otherwise

requires, references to tons in this press release refer to short

tons. One short ton equals 2,000 pounds. One metric tonne, which

many international competitors use, equals 1,000 kilograms or

2,204.62 pounds.

Conference Call Information

Intrepid will host a conference call on Tuesday, August 6, 2024,

at 12:00 p.m. Eastern Time to discuss the results and other

operating and financial matters and answer investor questions.

Management invites you to listen to the conference call by using

the toll-free dial-in number 1 (800) 715-9871 or International

dial-in number 1 (646) 307-1963; please use conference ID 1179359.

The call will also be streamed on the Intrepid website,

intrepidpotash.com. A recording of the conference call will be

available approximately two hours after the completion of the call

by dialing 1 (800) 770-2030 for toll-free, 1 (609) 800-9909 for

International, or at intrepidpotash.com. The replay of the call

will require the input of the replay access code 1179359. The

recording will be available through August 13, 2024.

About Intrepid

Intrepid is a diversified mineral company that delivers

potassium, magnesium, sulfur, salt, and water products essential

for customer success in agriculture, animal feed, and the oil and

gas industry. Intrepid is the only U.S. producer of muriate of

potash, which is applied as an essential nutrient for healthy crop

development, utilized in several industrial applications, and used

as an ingredient in animal feed. In addition, Intrepid produces a

specialty fertilizer, Trio®, which delivers three key nutrients,

potassium, magnesium, and sulfate, in a single particle. Intrepid

also provides water, magnesium chloride, brine, and various

oilfield products and services. Intrepid serves diverse customers

in markets where a logistical advantage exists and is a leader in

the use of solar evaporation for potash production, resulting in

lower cost and more environmentally friendly production. Intrepid's

mineral production comes from three solar solution potash

facilities and one conventional underground Trio® mine.

Intrepid routinely posts important information, including

information about upcoming investor presentations and press

releases, on its website under the Investor Relations tab.

Investors and other interested parties are encouraged to enroll at

intrepidpotash.com, to receive automatic email alerts for new

postings.

Forward-looking Statements

This document contains forward-looking statements - that is,

statements about future, not past, events. The forward-looking

statements in this document relate to, among other things,

statements about Intrepid's future financial performance, cash flow

from operations expectations, water sales, production costs,

acquisition expectations and operating plans, its market outlook,

and statements regarding management matters. These statements are

based on assumptions that Intrepid believes are reasonable.

Forward-looking statements by their nature address matters that are

uncertain. The particular uncertainties that could cause Intrepid's

actual results to be materially different from its forward-looking

statements include the following:

- changes in the price, demand, or supply of our products and

services;

- challenges and legal proceedings related to our water

rights;

- our ability to successfully identify and implement any

opportunities to grow our business whether through expanded sales

of water, Trio®, byproducts, and other non-potassium related

products or other revenue diversification activities;

- the costs of, and our ability to successfully execute, any

strategic projects;

- declines or changes in agricultural production or fertilizer

application rates;

- declines in the use of potassium-related products or water by

oil and gas companies in their drilling operations;

- our ability to prevail in outstanding legal proceedings against

us;

- our ability to comply with the terms of our revolving credit

facility, including the underlying covenants;

- further write-downs of the carrying value of assets, including

inventories;

- circumstances that disrupt or limit production, including

operational difficulties or variances, geological or geotechnical

variances, equipment failures, environmental hazards, and other

unexpected events or problems;

- changes in reserve estimates;

- currency fluctuations;

- adverse changes in economic conditions or credit markets;

- the impact of governmental regulations, including environmental

and mining regulations, the enforcement of those regulations, and

governmental policy changes;

- adverse weather events, including events affecting

precipitation and evaporation rates at our solar solution

mines;

- increased labor costs or difficulties in hiring and retaining

qualified employees and contractors, including workers with mining,

mineral processing, or construction expertise;

- changes in management and the board of directors, and our

reliance on key personnel, including our ability to identify,

recruit, and retain key personnel;

- changes in the prices of raw materials, including chemicals,

natural gas, and power;

- our ability to obtain and maintain any necessary governmental

permits or leases relating to current or future operations;

- interruptions in rail or truck transportation services, or

fluctuations in the costs of these services;

- our inability to fund necessary capital investments;

- global inflationary pressures and supply chain challenges;

- the impact of global health issues, and other global

disruptions on our business, operations, liquidity, financial

condition and results of operations; and

- the other risks, uncertainties, and assumptions described in

Item 1A. Risk Factors of our Annual Report on Form 10-K for the

year ended December 31, 2023, and our other reports we file with

the Securities and Exchange Commission.

In addition, new risks emerge from time to time. It is not

possible for Intrepid to predict all risks that may cause actual

results to differ materially from those contained in any

forward-looking statements Intrepid may make. All information in

this document speaks as of the date of this release. New

information or events after that date may cause our forward-looking

statements in this document to change. We undertake no obligation

to update or revise publicly any forward-looking statements to

conform the statements to actual results or to reflect new

information or future events.

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023

(In thousands, except per

share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Sales

$

62,055

$

81,035

$

141,342

$

167,955

Less:

Freight costs

9,423

10,516

22,253

22,106

Warehousing and handling costs

2,586

2,801

5,675

5,534

Cost of goods sold

41,070

52,336

97,501

108,581

Lower of cost or net realizable value

inventory adjustments

1,352

—

1,855

—

Gross Margin

7,624

15,382

14,058

31,734

Selling and administrative

7,937

7,948

16,294

16,806

Accretion of asset retirement

obligation

622

535

1,244

1,070

Impairment of long-lived assets

831

—

2,208

—

Loss (gain) on sale of assets

241

(7

)

492

193

Other operating income

(1,266

)

(439

)

(2,659

)

(730

)

Other operating expense

887

77

2,413

1,753

Operating (Loss) Income

(1,628

)

7,268

(5,934

)

12,642

Other Income

Equity in (loss) earnings of

unconsolidated entities

(116

)

(1,059

)

33

(238

)

Interest income

547

76

791

161

Other income

60

43

68

56

(Loss) Income Before Income

Taxes

(1,137

)

6,328

(5,042

)

12,621

Income Tax Benefit (Expense)

304

(2,023

)

1,079

(3,810

)

Net (Loss) Income

$

(833

)

$

4,305

$

(3,963

)

$

8,811

Weighted Average Shares Outstanding:

Basic

12,886

12,766

12,852

12,730

Diluted

12,886

12,855

12,852

12,865

(Loss) Earnings Per Share:

Basic

$

(0.06

)

$

0.34

$

(0.31

)

$

0.69

Diluted

$

(0.06

)

$

0.33

$

(0.31

)

$

0.68

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

AS OF JUNE 30, 2024 AND

DECEMBER 31, 2023

(In thousands, except share

and per share amounts)

June 30,

December 31,

2024

2023

ASSETS

Cash and cash equivalents

$

51,663

$

4,071

Short-term investments

2,464

2,970

Accounts receivable:

Trade, net

21,617

22,077

Other receivables, net

1,679

1,470

Inventory, net

101,932

114,252

Prepaid expenses and other current

assets

3,832

7,200

Total current assets

183,187

152,040

Property, plant, equipment, and mineral

properties, net

354,294

358,249

Water rights

19,184

19,184

Long-term parts inventory, net

30,899

30,231

Long-term investments

5,090

6,627

Other assets, net

9,000

8,016

Non-current deferred tax asset, net

195,337

194,223

Total Assets

$

796,991

$

768,570

LIABILITIES AND STOCKHOLDERS'

EQUITY

Accounts payable

$

7,173

$

12,848

Accrued liabilities

11,310

14,061

Accrued employee compensation and

benefits

6,856

7,254

Other current liabilities

8,100

12,401

Total current liabilities

33,439

46,564

Advances on credit facility

—

4,000

Asset retirement obligation, net of

current portion

31,321

30,077

Operating lease liabilities

345

741

Finance lease liabilities

1,428

1,451

Deferred other income, long-term

46,617

—

Other non-current liabilities

1,593

1,309

Total Liabilities

114,743

84,142

Commitments and Contingencies

Common stock, $0.001 par value; 40,000,000

shares authorized;

12,908,078 and 12,807,316 shares

outstanding

at June 30, 2024, and December 31, 2023,

respectively

14

13

Additional paid-in capital

667,419

665,637

Retained earnings

36,827

40,790

Less treasury stock, at cost

(22,012

)

(22,012

)

Total Stockholders' Equity

682,248

684,428

Total Liabilities and Stockholders'

Equity

$

796,991

$

768,570

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023

(In thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cash Flows from Operating

Activities:

Net (loss) income

$

(833

)

$

4,305

$

(3,963

)

$

8,811

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Depreciation, depletion and

amortization

8,594

8,892

17,898

18,183

Accretion of asset retirement

obligation

622

535

1,244

1,070

Amortization of deferred financing

costs

76

75

151

151

Amortization of intangible assets

84

80

164

161

Stock-based compensation

1,235

1,803

2,557

3,549

Lower of cost or net realizable value

inventory adjustments

1,352

—

1,855

—

Impairment of long-lived assets

831

—

2,208

—

Loss (gain) on disposal of assets

241

(7

)

492

193

Allowance for parts inventory

obsolescence

419

—

472

—

Equity in loss (earnings) of

unconsolidated entities

116

1,059

(33

)

238

Distribution of earnings from

unconsolidated entities

—

132

—

452

Changes in operating assets and

liabilities:

Trade accounts receivable, net

20,208

15,391

459

2,917

Other receivables, net

(497

)

(867

)

(250

)

(959

)

Inventory, net

(1,509

)

3,117

9,326

10,763

Prepaid expenses and other current

assets

1,353

656

2,275

906

Deferred tax assets, net

(325

)

2,016

(1,114

)

3,676

Accounts payable, accrued liabilities, and

accrued employee compensation and benefits

(3,271

)

(2,827

)

(6,892

)

(8,132

)

Operating lease liabilities

(356

)

(408

)

(740

)

(809

)

Deferred other income

(562

)

—

43,872

—

Other liabilities

(32

)

(3,455

)

(703

)

(2,222

)

Net cash provided by operating

activities

27,746

30,497

69,278

38,948

Cash Flows from Investing

Activities:

Additions to property, plant, equipment,

mineral properties and other assets

(11,301

)

(20,895

)

(22,974

)

(41,934

)

Purchase of investments

—

(459

)

—

(1,415

)

Proceeds from sale of assets

55

24

4,651

89

Proceeds from redemptions/maturities of

investments

1,000

2,500

1,500

4,000

Other investing, net

416

508

416

508

Net cash used in investing activities

(9,830

)

(18,322

)

(16,407

)

(38,752

)

Cash Flows from Financing

Activities:

Payments of financing lease

(176

)

(167

)

(500

)

(210

)

Proceeds from short-term borrowings on

credit facility

—

—

—

5,000

Repayments of short-term borrowings on

credit facility

—

(5,000

)

(4,000

)

(5,000

)

Employee tax withholding paid for

restricted stock upon vesting

(142

)

(298

)

(775

)

(1,337

)

Net cash used in financing activities

(318

)

(5,465

)

(5,275

)

(1,547

)

Net Change in Cash, Cash Equivalents

and Restricted Cash

17,598

6,710

47,596

(1,351

)

Cash, Cash Equivalents and Restricted

Cash, beginning of period

34,649

11,023

4,651

19,084

Cash, Cash Equivalents and Restricted

Cash, end of period

$

52,247

$

17,733

$

52,247

$

17,733

INTREPID POTASH, INC. UNAUDITED

NON-GAAP RECONCILIATIONS FOR THE THREE AND SIX MONTHS ENDED

JUNE 30, 2024 AND 2023 (In thousands)

To supplement Intrepid's consolidated financial statements,

which are prepared and presented in accordance with GAAP, Intrepid

uses several non-GAAP financial measures to monitor and evaluate

its performance. These non-GAAP financial measures include adjusted

net (loss) income, adjusted net (loss) income per diluted share,

adjusted EBITDA, and average net realized sales price per ton.

These non-GAAP financial measures should not be considered in

isolation, or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP. In

addition, because the presentation of these non-GAAP financial

measures varies among companies, these non-GAAP financial measures

may not be comparable to similarly titled measures used by other

companies.

Intrepid believes these non-GAAP financial measures provide

useful information to investors for analysis of its business.

Intrepid uses these non-GAAP financial measures as one of its tools

in comparing period-over-period performance on a consistent basis

and when planning, forecasting, and analyzing future periods.

Intrepid believes these non-GAAP financial measures are used by

professional research analysts and others in the valuation,

comparison, and investment recommendations of companies in the

potash mining industry. Many investors use the published research

reports of these professional research analysts and others in

making investment decisions.

Adjusted Net (Loss) Income and Adjusted Net (Loss) Income Per

Diluted Share

Adjusted net (loss) income and adjusted net (loss) income per

diluted share are calculated as net (loss) income or net (loss)

income per diluted share adjusted for certain items that impact the

comparability of results from period to period, as set forth in the

reconciliation below. Intrepid considers these non-GAAP financial

measures to be useful because they allow for period-to-period

comparisons of its operating results excluding items that Intrepid

believes are not indicative of its fundamental ongoing

operations.

Reconciliation of Net (Loss) Income to Adjusted Net (Loss)

Income:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(in thousands)

Net (Loss) Income

$

(833

)

$

4,305

$

(3,963

)

$

8,811

Adjustments

Impairment of long-lived assets

831

—

2,208

—

Loss (gain) on sale of assets

241

(7

)

492

193

Calculated income tax effect(1)

(279

)

2

(702

)

(50

)

Total adjustments

793

(5

)

1,998

143

Adjusted Net (Loss) Income

$

(40

)

$

4,300

$

(1,965

)

$

8,954

Reconciliation of Net (Loss) Income per Share to Adjusted Net

(Loss) Income per Share:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net (Loss) Income Per Diluted Share

$

(0.06

)

$

0.33

$

(0.31

)

$

0.68

Adjustments

Impairment of long-lived assets

0.06

—

0.17

—

Loss on sale of assets

0.02

—

0.04

0.02

Calculated income tax effect(1)

(0.02

)

—

(0.05

)

—

Total adjustments

0.06

—

0.16

0.02

Adjusted Net (Loss) Income Per Diluted

Share

$

—

$

0.33

$

(0.15

)

$

0.70

(1) Assumes an annual effective tax rate of 26% for 2024

and 2023.

Adjusted EBITDA

Adjusted earnings before interest, taxes, depreciation, and

amortization (or adjusted EBITDA) is calculated as net (loss)

income adjusted for certain items that impact the comparability of

results from period to period, as set forth in the reconciliation

below. Intrepid considers adjusted EBITDA to be useful, and believe

it to be useful for investors, because the measure reflects

Intrepid's operating performance before the effects of certain

non-cash items and other items that Intrepid believes are not

indicative of its core operations. Intrepid uses adjusted EBITDA to

assess operating performance.

Reconciliation of Net (Loss) Income to Adjusted EBITDA:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(in thousands)

Net (Loss) Income

$

(833

)

$

4,305

$

(3,963

)

$

8,811

Impairment of long-lived assets

831

—

2,208

—

Loss (gain) on sale of assets

241

(7

)

492

193

Interest expense

—

—

—

—

Income tax (benefit) expense

(304

)

2,023

(1,079

)

3,810

Depreciation, depletion, and

amortization

8,594

8,892

17,898

18,183

Amortization of intangible assets

84

80

164

161

Accretion of asset retirement

obligation

622

535

1,244

1,070

Total adjustments

10,068

11,523

20,927

23,417

Adjusted EBITDA

$

9,235

$

15,828

$

16,964

$

32,228

Average Potash and Trio® Net Realized Sales Price per

Ton

Average net realized sales price per ton for potash is

calculated as potash segment sales less potash segment byproduct

sales and potash freight costs and then dividing that difference by

the number of tons of potash sold in the period. Likewise, average

net realized sales price per ton for Trio® is calculated as Trio®

segment sales less Trio® segment byproduct sales and Trio® freight

costs and then dividing that difference by Trio® tons sold.

Intrepid considers average net realized sales price per ton to be

useful, and believe it to be useful for investors, because it shows

Intrepid's potash and Trio® average per ton pricing without the

effect of certain transportation and delivery costs. When Intrepid

arranges transportation and delivery for a customer, it includes in

revenue and in freight costs the costs associated with

transportation and delivery. However, some of Intrepid's customers

arrange for and pay their own transportation and delivery costs, in

which case these costs are not included in Intrepid's revenue and

freight costs. Intrepid uses average net realized sales price per

ton as a key performance indicator to analyze potash and Trio®

sales and price trends.

Reconciliation of Sales to Average Net Realized Sales Price per

Ton:

Three Months Ended June

30,

2024

2023

(in thousands, except per ton amounts)

Potash

Trio®

Potash

Trio®

Total Segment Sales

$

30,034

$

26,522

$

47,264

$

28,748

Less: Segment byproduct sales

5,896

109

6,158

1,520

Freight costs

1,871

6,660

3,272

6,266

Subtotal

$

22,267

$

19,753

$

37,834

$

20,962

Divided by:

Tons sold

55

63

79

63

Average net realized sales price per

ton

$

405

$

314

$

479

$

333

Six Months Ended June

30,

2024

2023

(in thousands, except per ton amounts)

Potash

Trio®

Potash

Trio®

Total Segment Sales

$

67,610

$

63,010

$

99,761

$

59,022

Less: Segment byproduct sales

11,060

313

11,500

2,740

Freight costs

5,017

15,634

7,264

12,952

Subtotal

$

51,533

$

47,063

$

80,997

$

43,330

Divided by:

Tons sold

129

154

167

128

Average net realized sales price per

ton

$

399

$

306

$

485

$

339

Three Months Ended June 30,

2024

Product

Potash Segment

Trio® Segment

Oilfield Solutions

Segment

Intersegment

Eliminations

Total

Potash

$

24,138

$

—

$

—

$

(40

)

$

24,098

Trio®

—

26,413

—

—

26,413

Water

—

—

2,572

—

2,572

Salt

3,335

109

—

—

3,444

Magnesium Chloride

932

—

—

—

932

Brine Water

1,584

—

1,166

—

2,750

Other

45

—

1,801

—

1,846

Total Revenue

$

30,034

$

26,522

$

5,539

$

(40

)

$

62,055

Six Months Ended June 30,

2024

Product

Potash Segment

Trio® Segment

Oilfield Solutions

Segment

Intersegment

Eliminations

Total

Potash

$

56,550

$

—

$

—

$

(140

)

$

56,410

Trio®

—

62,697

—

—

62,697

Water

—

—

4,741

—

4,741

Salt

6,479

313

—

—

6,792

Magnesium Chloride

1,351

—

—

—

1,351

Brine Water

3,167

—

2,293

—

5,460

Other

63

—

3,828

—

3,891

Total Revenue

$

67,610

$

63,010

$

10,862

$

(140

)

$

141,342

Three Months Ended June 30,

2023

Product

Potash Segment

Trio® Segment

Oilfield Solutions

Segment

Intersegment

Eliminations

Total

Potash

$

41,106

$

—

$

—

$

(88

)

$

41,018

Trio®

—

27,228

—

—

27,228

Water

100

1,474

2,568

—

4,142

Salt

3,278

46

—

—

3,324

Magnesium Chloride

1,667

—

—

—

1,667

Brine Water

1,113

—

1,001

—

2,114

Other

—

—

1,542

—

1,542

Total Revenue

$

47,264

$

28,748

$

5,111

$

(88

)

$

81,035

Six Months Ended June 30,

2023

Product

Potash Segment

Trio® Segment

Oilfield Solutions

Segment

Intersegment

Eliminations

Total

Potash

$

88,261

$

—

$

—

$

(189

)

$

88,072

Trio®

—

56,282

—

—

56,282

Water

180

2,522

4,187

—

6,889

Salt

6,321

218

—

—

6,539

Magnesium Chloride

2,804

—

—

—

2,804

Brine Water

2,195

—

1,823

—

4,018

Other

—

—

3,351

—

3,351

Total Revenue

$

99,761

$

59,022

$

9,361

$

(189

)

$

167,955

Three Months Ended

June 30, 2024

Potash

Trio®

Oilfield Solutions

Other

Consolidated

Sales

$

30,034

$

26,522

$

5,539

$

(40

)

$

62,055

Less: Freight costs

2,803

6,660

—

(40

)

9,423

Warehousing and handling

costs

1,343

1,243

—

—

2,586

Cost of goods sold

21,224

16,437

3,409

—

41,070

Lower of cost or net

realizable value inventory

adjustments

1,352

—

—

—

1,352

Gross Margin

$

3,312

$

2,182

$

2,130

$

—

$

7,624

Depreciation, depletion, and amortization

incurred1

$

6,178

$

851

$

1,195

$

454

$

8,678

Six Months Ended June 30, 2024

Potash

Trio®

Oilfield Solution

Other

Consolidated

Sales

$

67,610

$

63,010

$

10,862

$

(140

)

$

141,342

Less: Freight costs

6,759

15,634

—

(140

)

22,253

Warehousing and handling

costs

3,070

2,605

—

—

5,675

Cost of goods sold

47,040

43,728

6,733

—

97,501

Lower of cost or net

realizable value inventory

adjustments

1,855

—

—

—

1,855

Gross Margin

$

8,886

$

1,043

$

4,129

$

—

$

14,058

Depreciation, depletion, and amortization

incurred1

$

13,149

$

1,735

$

2,266

$

912

$

18,062

Three Months Ended

June 30, 2023

Potash

Trio®

Oilfield Solution

Other

Consolidated

Sales

$

47,264

$

28,748

$

5,111

$

(88

)

$

81,035

Less: Freight costs

4,338

6,266

—

(88

)

10,516

Warehousing and handling

costs

1,609

1,192

—

—

2,801

Cost of goods sold

28,441

20,068

3,827

—

52,336

Gross Margin

$

12,876

$

1,222

$

1,284

$

—

$

15,382

Depreciation, depletion, and amortization

incurred1

$

6,429

$

1,405

$

915

$

223

$

8,972

Six Months Ended June 30, 2023

Potash

Trio®

Oilfield Solution

Other

Consolidated

Sales

$

99,761

$

59,022

$

9,361

$

(189

)

$

167,955

Less: Freight costs

9,343

12,952

—

(189

)

22,106

Warehousing and handling

costs

3,089

2,445

—

—

5,534

Cost of goods sold

60,025

40,951

7,605

—

108,581

Gross Margin

$

27,304

$

2,674

$

1,756

$

—

$

31,734

Depreciation, depletion and amortization

incurred1

$

13,482

$

2,611

$

1,822

$

429

$

18,344

(1) Depreciation, depletion, and amortization incurred for

potash and Trio® excludes depreciation, depletion, and amortization

amounts absorbed in or relieved from inventory.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240805586709/en/

Evan Mapes, CFA, Investor Relations Manager Phone: 303-996-3042

Email: evan.mapes@intrepidpotash.com

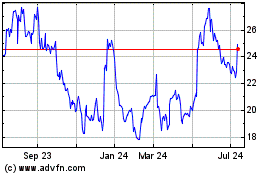

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

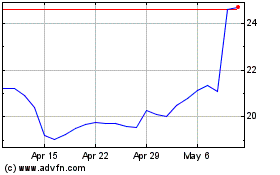

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Jan 2024 to Jan 2025