As filed with the Securities and Exchange Commission on August 6, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HYSTER-YALE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | | 31-1637659 |

(State or other jurisdiction

of incorporation or organization) | | (IRS Employer

Identification No.) |

5875 Landerbrook Drive

Cleveland, Ohio 44124

(440) 449-9600

(Address of Principal Executive Offices Including Zip Code)

Hyster-Yale, Inc. (f/k/a Hyster-Yale Materials Handling, Inc.) 2020 Long-Term Equity Incentive Plan

(Amended and Restated Effective May 8, 2024)

(Full title of the plan)

Suzanne Schulze Taylor

Senior Vice President, General Counsel and Secretary

5875 Landerbrook Drive

Cleveland, Ohio 44124

(Name and address of agent for service)

(440) 449-9600

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 (“Registration Statement”) has been prepared and filed pursuant to and in accordance with the requirements of General Instruction E to Form S-8 for the purpose of effecting the registration under the Securities Act of 1933 (the “Securities Act”) of an additional 800,000 shares of Class A common stock, par value $0.01 per share (the “Class A Common Stock”), of Hyster-Yale, Inc., a Delaware corporation (the “Registrant”), issuable pursuant to the Hyster-Yale, Inc. (f/k/a Hyster-Yale Materials Handling, Inc.) 2020 Long-Term Equity Incentive Plan (Amended and Restated Effective May 8, 2024) (the “Plan”). Except to the extent supplemented, amended or superseded by the information set forth herein, the contents of the Registrant’s Registration Statement on Form S-8 (filed on February 1, 2022), including all exhibits attached thereto, filed as Registration No. 333-262448 is incorporated herein by reference.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which are on file with the Securities and Exchange Commission (the “Commission”), are incorporated in this Registration Statement by reference:

•The Registrant’s Annual Report on Form 10-K for the year ended December 31, 2023 (Commission File No. 000-54799) filed with the Commission on February 27, 2024;

•The Registrant’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 (Commission File No. 000-54799) filed with the Commission on May 7, 2024 and June 30, 2024 (Commission File No. 000-54799) filed with the Commission on August 6, 2024;

•The Registrant’s Current Reports on Form 8-K (Commission File No. 000-54799) filed with the Commission on March 5, 2024, May 13, 2024 and June 5, 2024; and

•The description of the shares of Class A Common Stock contained in Exhibit 4.3 to the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2019 (Commission File No. 000-54799) filed with the Commission on February 25, 2020, which updated the description thereof contained in our Registration Statement on Form 8-A (Commission No. 001-35646) filed with the Commission on September 7, 2012, including any subsequently filed amendments and reports updating such description.

All documents filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934 subsequent to the effective date of this Registration Statement and prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold, will be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents. Any statement contained in any document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except as modified or superseded, to constitute a part of this Registration Statement.

Item 6. Indemnification of Directors and Officers.

The Registrant’s Third Amended and Restated Certificate of Incorporation provides in Article IX that the Registrant will indemnify its directors, officers and employees and each person who is or was serving at the request of the Registrant as a director, officer or employee of another corporation, partnership, joint venture, trust or other enterprise, to the full extent permitted by statute.

Subsection (a) of Section 145 of the General Corporation Law of the State of Delaware (“DGCL”) empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or in the right of the corporation) by reason of the fact that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation or enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if such person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s conduct was unlawful.

Subsection (b) of Section 145 of the DGCL empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor, by reason of the fact that such person acted in any of the capacities set forth above, against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit if such person acted under standards similar to those set forth in the paragraph above, except that no indemnification may be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation, unless and only to the extent that the Court of Chancery of the State of Delaware or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to be indemnified for such expenses which the court shall deem proper.

Section 145 further provides that, to the extent that a director or officer of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in subsections (a) and (b) of Section 145, or in defense of any claim, issue or matter therein, such person will be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith; that any indemnification under subsections (a) and (b) of Section 145 (unless ordered by a court) will be made by a corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances because such person has met the applicable standard of conduct set forth in subsections (a) and (b) of Section 145; that expenses (including attorney’s fees) incurred by an officer or director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the corporation; that indemnification provided for by Section 145 will not be deemed exclusive of any other rights to which the indemnified party may be entitled; and that a corporation is empowered to purchase and maintain insurance on behalf of a director or officer of the corporation against any liability asserted against such director or officer and incurred by such director or officer in such capacity, or arising out of his or status as such, whether or not the corporation would have the power to indemnify him or her against such liability under Section 145.

Item 8. Exhibits.

| | | | | |

Exhibit

Number | Description |

| 4.1 | |

| 4.2 | |

| 4.3 | |

| 4.4 | |

| 4.5 | First Amendment to Stockholders’ Agreement, dated as of December 31, 2012, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 10.5 to the Registrant’s Annual Report on Form 10-K, filed by the Registrant on February 19, 2013, Commission File Number 000-54799. |

| 4.6 | Second Amendment to Stockholders’ Agreement, dated as of January 18, 2013, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 10.6 to the Registrant’s Annual Report on Form 10-K, filed by the Registrant on February 19, 2013, Commission File Number 000-54799. |

| 4.7 | Third Amendment to Stockholders’ Agreement, dated as of March 27, 2015, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 10.1 to the Registrant’s Quarterly Report on Form 10-Q, filed by the Registrant on April 29, 2015, Commission File Number 000-54799. |

| |

| | | | | |

Exhibit

Number | Description |

| 4.8 | Fourth Amendment to Stockholders’ Agreement, dated as of December 29, 2015, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 10 filed with Amendment No. 4 to the Statement on Schedule 13D, filed by the reporting persons named therein on February 16, 2016, Commission File Number 005-87003. |

| 4.9 | Fifth Amendment to Stockholders’ Agreement, dated as of December 2, 2016, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit No. 11 filed with Amendment No. 5 to the Statement on Schedule 13D, filed by the reporting persons named therein on February 14, 2017, Commission File Number 005-87003. |

| 4.10 | Sixth Amendment to Stockholders’ Agreement, dated as of December 22, 2016, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit No. 12 filed with Amendment No. 5 to the Statement on Schedule 13D, filed by the reporting persons named therein on February 14, 2017, Commission File Number 005-87003. |

| 4.11 | Seventh Amendment to Stockholders’ Agreement, dated as of February 6, 2017, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 10.1 to the Registrant’s Quarterly Report on Form 10-Q, filed by the Registrant on May 2, 2017, Commission File Number 000-54799. |

| 4.12 | Eighth Amendment to Stockholders’ Agreement, dated as of October 30, 2018, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 10.10 to the Registrant’s Annual Report on Form 10-K, filed by the Registrant on February 26, 2019, Commission File Number 000-54799. |

| 4.13 | Ninth Amendment to Stockholders’ Agreement, dated as of December 5, 2019, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 28 filed with Amendment No. 8 to the Statement on Schedule 13D, filed by the reporting persons named therein on February 13, 2020, Commission File Number 005-87003. |

| 4.14 | Tenth Amendment to Stockholders’ Agreement, dated as of December 31, 2020, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholders identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 30 filed with Amendment No. 9 to the Statement on Schedule 13D, filed by the reporting persons named therein on February 12, 2021, Commission File Number 005-87003. |

| 4.15 | Eleventh Amendment to Stockholders’ Agreement, dated as of December 7, 2021, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholders identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 4.15 to the Registration Statement on Form S-8, filed by the Registrant on February 1, 2022, Commission File Number 333-262448. |

| 4.16 | Twelfth Amendment to Stockholders’ Agreement, dated as of December 12, 2022, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 41 filed with Amendment No. 11 to the Statement on Schedule 13D, filed by the reporting persons named therein on February 14, 2023, Commission File Number 005-87003. |

| 4.17 | Thirteenth Amendment to Stockholders’ Agreement, dated as of February 12, 2024, by and among the Depository, Hyster-Yale Materials Handling, Inc., the new Participating Stockholder identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 28, 2012, as amended, by and among the Depository, the Hyster-Yale Materials Handling, Inc. and the Participating Stockholders is incorporated by reference to Exhibit 43 filed with Amendment No. 12 to the Statement on Schedule 13D, filed by the reporting persons named therein on February 13, 2024, Commission File Number 005-87003. |

| 4.18 | |

| 5.1 | |

| | | | | |

Exhibit

Number | Description |

| 23.1 | |

| 23.2 | |

| 24.1 | |

| 107 | |

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Cleveland, Ohio, on this sixth day of August, 2024.

HYSTER-YALE, INC.

By: /s/ Suzanne Schulze Taylor

Name: Suzanne Schulze Taylor

Title: Senior Vice President, General Counsel and Secretary

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| * | | President and Chief Executive Officer (principal executive officer), Director | | August 6, 2024 |

| Rajiv K. Prasad | | | | |

| | | | | |

| * | | Senior Vice President, Chief Financial Officer and Treasurer (principal financial officer) | | August 6, 2024 |

| Scott A. Minder | | | | |

| | | | |

| * | | Vice President, Controller and Chief Accounting Officer (principal accounting officer) | | August 6, 2024 |

| Dena R. McKee | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| Colleen R. Batcheler | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| James B. Bemowski | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| J.C. Butler, Jr. | | | | |

| | | | | |

| * | | Director | | August 6, 2024 |

| Gary L. Collar | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| Carolyn Corvi | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| Edward T. Eliopoulos | | | | |

| | | | | |

| * | | Director | | August 6, 2024 |

| John P. Jumper | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| Dennis W. LaBarre | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| H. Vincent Poor | | | | |

| | | | | |

| * | | Director | | August 6, 2024 |

| Alfred M. Rankin, Jr. | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| Claiborne R. Rankin | | | | |

| | | | | |

| * | | Director | | August 6, 2024 |

| Britton T. Taplin | | | | |

| | | | |

| * | | Director | | August 6, 2024 |

| David B. H. Williams | | | | |

| | | | | |

* The undersigned, pursuant to a power of attorney, executed by each of the officers and directors above and filed with the Commission herewith, by signing her name hereto, does hereby sign and deliver this Registration Statement on behalf of each of the persons noted above in the capacities indicated.

By: /s/ Suzanne Schulze Taylor

Name: Suzanne Schulze Taylor

Title: Senior Vice President, General Counsel and Secretary

Calculation of Filing Fee Tables

Form S-8

(Form Type)

HYSTER-YALE, INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered | Proposed Maximum Offering Price Per Unit | Maximum Aggregate

Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Class A Common Stock, $0.01 par value per share | Other | 800,000 | $82.52 | $66,016,000 | $147.60 per $1 million | $9,744 |

| Total Offering Amount | — | — | — | $66,016,000 | — | $9,744 |

| Total Fee Offsets | — | — | — | — | — | — |

| Net Fee Due | — | — | — | — | — | $9,744 |

The amount registered reflected in Table 1 above represents the maximum number of shares of Class A common stock, par value $0.01 per share (the “Common Stock”), of Hyster-Yale, Inc. (the “Registrant”) issuable pursuant to the Hyster-Yale, Inc. (f/k/a Hyster-Yale Materials Handling, Inc.) 2020 Long-Term Equity Incentive Plan (Amended and Restated Effective May 8, 2024) (the “Plan”) being registered on the Registration Statement on Form S-8 (the “Registration Statement”) to which this exhibit relates. Pursuant to Rule 416 of the Securities Act of 1933 (the “Securities Act”), the Registration Statement also covers such additional shares of Common Stock as may become issuable pursuant to the anti-dilution provisions of the Plan. The proposed maximum offering price per unit and the maximum aggregate offering price in Table 1 above are estimated solely for the purposes of determining the amount of the registration fee, pursuant to paragraphs (c) and (h) of Rule 457 under the Securities Act, on the basis of the average of the high and low sale prices of Common Stock on the New York Stock Exchange on July 31, 2024, which is a date within five business day prior to filing.

Table 2: Fee Offset Claims and Sources

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Registrant

or Filer

Name | Form or Filing

Type | File

Number | Initial Filing

Date | Filing

Date | Fee Offset

Claimed | Security

Type Associated with Fee Offset

Claimed | Security Title Associated with Fee Offset

Claimed | Unsold Securities Associated with Fee Offset

Claimed | Aggregate Offering Amount Associated with Fee Offset

Claimed | Fee Paid with Fee Offset

Source |

| Rule 457 |

| Fee Offset Claims | | | |

| | | | | | | |

| Fee Offset Sources | | | |

| | | | | | | |

The Registrant is not relying on Rule 457(p) under the Securities Act to offset any of the filing fee due with respect to the Registration Statement to which this exhibit relates, so no information is provided under this Table 2.

August 6, 2024

Hyster-Yale, Inc.

5875 Landerbrook Drive

Suite 300

Cleveland, Ohio 44124

Re: Registration Statement on Form S-8 filed by Hyster-Yale, Inc.

Ladies and Gentlemen:

I am the Senior Vice President, General Counsel and Secretary of Hyster-Yale, Inc., a Delaware corporation (the “Company”). This opinion is delivered in connection with the Hyster-Yale, Inc. (f/k/a Hyster-Yale Materials Handling, Inc.) 2020 Long-Term Equity Incentive Plan (Amended and Restated Effective May 8, 2024) (the “Plan”). In connection with the opinion expressed herein, I have examined such documents, records and matters of law as I have deemed relevant or necessary for purposes of this opinion. Based on the foregoing, and subject to the further limitations, qualifications and assumptions set forth herein, I am of the opinion that the 800,000 shares (the “Shares”) of the Company’s Class A Common Stock, par value $0.01 per share, that may be issued or delivered and sold pursuant to the Plan and the authorized award agreements thereunder (the “Award Agreements”) will be, when issued or delivered and sold in accordance with such Plan and the Award Agreements, validly issued, fully paid and nonassessable, provided that the consideration for the Shares is at least equal to the stated par value thereof.

The opinion expressed herein is limited to the General Corporation Law of the State of Delaware, as currently in effect, and I express no opinion as to the effect of the laws of any other jurisdiction on the opinion expressed herein. In addition, I have assumed that the resolutions authorizing the Company to issue or deliver and sell the Shares pursuant to the Plan and the Award Agreements will be in full force and effect at all times at which the Shares are issued or delivered and sold by the Company, and that the Company will take no action inconsistent with such resolutions. In rendering the opinion above, I have assumed that each award under the Plan will be approved by the Board of Directors of the Company or an authorized committee of the Board of Directors.

I hereby consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement on Form S-8 filed by the Company to effect the registration of the Shares to be issued and sold pursuant to the Plan under the Securities Act of 1933 (the “Act”). In giving such consent, I do not thereby admit that I am included in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

Very truly yours,

/s/ Suzanne Schulze Taylor

Suzanne Schulze Taylor

5875 Landerbrook Drive Suite 300 Cleveland, Ohio 44124-4069 Telephone 440-449-9600

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the Hyster-Yale, Inc. (f/k/a Hyster-Yale Materials Handling, Inc.) 2020 Long-Term Equity Incentive Plan (Amended and Restated Effective May 8, 2024) of our reports dated February 27, 2024, with respect to the consolidated financial statements of Hyster-Yale Materials Handling, Inc. and subsidiaries, and the effectiveness of internal control over financial reporting of Hyster-Yale Materials Handling, Inc. and subsidiaries (now named Hyster-Yale, Inc. effective May 31, 2024), included in its Annual Report (Form 10-K) for the year ended December 31, 2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Cleveland, Ohio

August 6, 2024

POWER OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each of the undersigned officers and directors of Hyster-Yale, Inc., a Delaware corporation (the “Registrant”), hereby constitutes and appoints Alfred M. Rankin, Jr., Suzanne Schulze Taylor, Dennis W. LaBarre, Scott A. Minder and Dena R. McKee, or any of them, each acting alone, as his or her true and lawful attorney-in-fact or agent, or attorneys-in-fact or agents, with the full power of substitution and resubstitution, for the undersigned and in the name, place and stead of the undersigned, to execute and file with the Securities and Exchange Commission under the Securities Act of 1933 one or more Registration Statements on Form S-8 with respect to the registration of Class A common stock, par value $0.01 per share of the Registrant pursuant to the Hyster-Yale, Inc. (f/k/a Hyster-Yale Materials Handling, Inc.) 2020 Long-Term Equity Incentive Plan (Amended and Restated Effective May 8, 2024), together with any and all amendments, supplements and exhibits thereto, including any and all pre-effective and post-effective amendments, and any and all applications or other documents to be filed with the Securities and Exchange Commission or any state securities commission or other regulatory authority or exchange with respect to the securities covered by the Registration Statement(s) on Form S-8, with full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact or agents, or his or her substitutes, may lawfully do or cause to be done by virtue hereof.

This Power of Attorney may be executed in multiple counterparts, each of which shall be deemed an original with respect to the person executing it.

Executed as of the first day of August, 2024. | | | | | | | | |

| | |

| /s/ Rajiv K. Prasad | | /s/ Scott A. Minder |

Rajiv K. Prasad

President and Chief Executive Officer (principal executive officer), Director | | Scott A. Minder

Senior Vice President and Chief Financial Officer (principal financial officer) |

| | |

| /s/ Dena R. McKee | | /s/ Colleen R. Batcheler |

Dena R. McKee

Vice President, Controller and Chief Accounting Officer (principal accounting officer) | | Colleen R. Batcheler

Director |

| | |

| /s/ James B. Bemowski | | /s/ J.C. Butler, Jr. |

James B. Bemowski

Director | | J.C. Butler, Jr.

Director |

| | |

| /s/ Gary L. Collar | | /s/ Carolyn Corvi |

Gary L. Collar

Director | | Carolyn Corvi

Director |

| | |

| /s/ Edward T. Eliopoulos | | /s/ John P. Jumper |

Edward T. Eliopoulos

Director | | John P. Jumper

Director |

| | |

| /s/ Dennis W. LaBarre | | /s/ H. Vincent Poor |

Dennis W. LaBarre

Director | | H. Vincent Poor

Director |

| | |

| /s/ Alfred M. Rankin, Jr. | | /s/ Claiborne R. Rankin |

Alfred M. Rankin, Jr.

Director | | Claiborne R. Rankin

Director |

| | |

| /s/ Britton T. Taplin | | /s/ David B.H. Williams |

Britton T. Taplin

Director | | David B.H. Williams

Director |

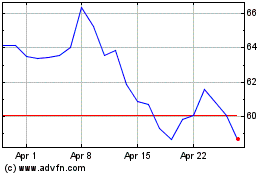

Hyster Yale (NYSE:HY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hyster Yale (NYSE:HY)

Historical Stock Chart

From Jan 2024 to Jan 2025