Honda Gets A Boost From Its Motorcycles -- WSJ

August 01 2018 - 3:02AM

Dow Jones News

By Sean McLain

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 1, 2018).

TOKYO -- Like other auto makers, Honda Motor Co. is getting hit

by higher costs resulting from U.S. metals tariffs. But helping

ease the pain for the Japanese company are its two-wheelers.

Sales of Honda's motorcycle models, which are doing well in

Asia, rose 14% and drove up earnings in the latest quarter, the

company said Tuesday. Honda also raised profit projections for the

full fiscal year ending in early 2019.

The bulk of its motorcycles are sold in poorer nations, often

for less than $1,000. But they are profitable. Honda's operating

margin for its motorcycle business was 16.6% for the June-ended

fiscal first quarter, compared to 5.3% for its car business.

In India, Honda's biggest motorcycle market, sales grew by 28%

in June. It sold more than 800,000 Activa scooters there during the

quarter. The bike starts at around $800. Another popular model, the

Dream Yuga, is targeted at younger Indians and comes in colors with

names like lemon-ice yellow.

Honda became famous in the 1950s for its motorcycles and entered

the car market only later -- an unusual heritage for car makers.

Today, revenue from cars far outweighs motorcycles, but profit from

the inexpensive bikes is bailing out Honda's car business, some of

which is literally underwater.

Honda said Tuesday that its auto plant in Celaya, Mexico, was

damaged by floodwaters and wouldn't resume production until

mid-November. The factory produces the Fit subcompact and the HR-V

small sport-utility vehicle.

The company said the plant shutdown will reduce operating profit

by Yen50 billion ($450 million) this fiscal year and reduce sales

volume in North America by 75,000 units.

An even bigger hit -- an estimated Yen75 billion -- will come

from rising raw-material costs, Honda said. Prices for steel and

aluminum have risen sharply, particularly in the U.S. as a result

of tariffs imposed by President Donald Trump's administration. That

makes foreign steel more expensive and allows domestic producers to

raise prices, boosting costs at Honda's production facilities in

the U.S.

Honda also produces more than 200,000 vehicles in Mexico,

including some of its best-selling models. Seiji Kuraishi, Honda's

chief operating officer, said the "biggest impact" from trade

conflicts would come if there were changes to the North American

Free Trade Agreement, which allows Honda to export freely to the

U.S. from Mexico.

Overall for its latest quarter, Honda posted profit of Yen244.3

billion, up 18% from a year earlier, while revenue climbed 8.4% to

Yen4 trillion.

Write to Sean McLain at sean.mclain@wsj.com

(END) Dow Jones Newswires

August 01, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

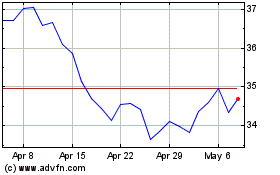

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

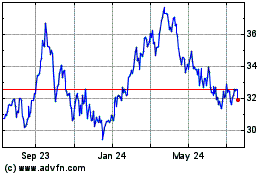

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024