Nissan Sees Profits on New Launches - Analyst Blog

May 11 2012 - 11:55AM

Zacks

Nissan Motor Co. (NSANY) posted a 7% increase

in profits to ¥341.43 billion ($4.32 billion) or ¥81.67 ($1.03) per

share in fiscal 2011 ended March 31, 2012 compared with ¥319.22

billion or ¥76.44 in the prior fiscal year. However, the EPS was

lower than the Zacks Consensus Estimate of $1.88.

Sales in the quarter appreciated 7% to ¥9.41 trillion ($118.95

billion) in the year. Operating profit inched up 2% to ¥545.84

billion ($6.90 billion) from ¥537.47 billion in fiscal 2010.

The improvement in revenues and profits was attributable to

strong demand for the company’s vehicles, frequent product launches

during the year and market expansion programs. The company believes

investments in manufacturing capacity expansion, particularly in

China, North America, Brazil and Russia, will enhance sales volume

of the company.

The company released five new models during the year including

Tiida in China, Lafesta Highway Star in Japan, front-drive and

rear-drive versions of the NV400 commercial van in Europe and the

Infiniti JX in the U.S.

Due to these factors, the automaker recovered earlier from the

disruptions caused by the twin disasters in Japan and severe

flooding in Thailand last year compared with its domestic rivals,

Toyota Motor Corp. (TM) and Honda Motor

Co. (HMC).

In the fiscal year, Nissan’s global sales totaled 4.85 million

units, up 16% from 4.18 million units last year. With this, the

company has outperformed the growth in total industry volumes of

4.2% to 75.7 million units from 72.6 million units in fiscal 2010.

Globally, it acquired a market share of 6.4% during the year, up

0.6 percentage points from the prior year.

Nissan’s sales in its largest market, China, improved 22% to

1.25 million units. Meanwhile, its sales rose 12% to 1.08 million

units in the U.S., 17.5% to 713,000 units across Europe (including

Russia), 9% to 655,000 units in Japan and 16% to 826,000 units in

Other markets.

For fiscal 2012 ending March 31, 2013, Nissan expects revenues

of ¥10.3 trillion ($125.61 billion) based on a 10.4% increase in

unit sales to 5.35 million. The company plans to launch 10 products

globally including Altima, Pathfinder, Sylphy/Sentra, NV350 Caravan

and a long wheelbase version of the Infiniti M hybrid sedan. It has

aimed for product launches averaging every six weeks and expand its

Infiniti and light commercial vehicle businesses.

The company also anticipates operating profit of ¥700 billion

($8.54 billion) and net income of ¥400 billion ($4.88 billion) for

the year. The company has succeeded in cutting purchasing costs by

5% annually and aims to reduce total costs by 5% each year.

Nissan Motor, founded in 1933 and headquartered in Yokohama-shi,

Japan, together with its subsidiaries, engages in the manufacture

and sale of automotive products, industrial machinery and marine

equipment primarily in Japan, North America, and Europe. The

company offers passenger cars, trucks, buses, forklifts, light

commercial vehicles, power trains and parts, as well as sales

financing activities.

Due to better than expected recovery, promising results and

clear-cut outlook, the company currently retains a Zacks #2 Rank on

its stock, which translates to a short-term (1 to 3 months) rating

of Buy.

HONDA MOTOR (HMC): Free Stock Analysis Report

NISSAN ADR (NSANY): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

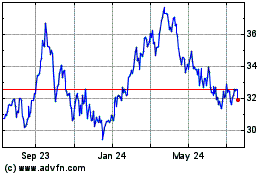

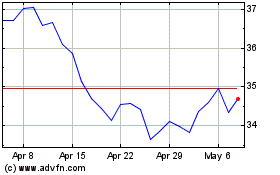

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024