Demand for Automobiles Growing in the U.S.

May 11 2012 - 8:20AM

Marketwired

U.S. auto sales have seen an impressive rise in 2012 as an

improving economy and high gas prices have boosted demand for newer

and more fuel efficient vehicles. The boost in the economy has

allowed consumers to replace aging vehicles, which many had delayed

during the recent economic downturn. Currently, the average vehicle

on the road is a record 10.8 years old. Five Star Equities examines

the outlook for companies in the Auto Manufacturers Industry and

provides equity research on General Motors Company (NYSE: GM) and

Honda Motor Co. Ltd (NYSE: HMC)

Access to the full company reports can be found at:

www.FiveStarEquities.com/GM

www.FiveStarEquities.com/HMC

The industry continues to gain momentum despite high fuel prices

and concerns of global economic issues. Sales for new vehicles in

April rose 2.3 percent to 1.18 million according to researcher

Autodata. The seasonally adjusted annual rate (SAAR) of 14.4

million beat the estimate of 14.3 million of 15 analysts surveyed

by Bloomberg. "Demand for automobiles is helping propel

production," Jack Ablin, chief investment officer of Harris Private

Bank in Chicago, wrote in an e-mail. "We expect this trend to

continue even in the face of moderating economic winds abroad."

Five Star Equities releases regular market updates on the Auto

Manufacturers Industry so investors can stay ahead of the crowd and

make the best investment decisions to maximize their returns. Take

a few minutes to register with us free at www.FiveStarEquities.com

and get exclusive access to our numerous stock reports and industry

newsletters.

General Motors recently announced first quarter net income

attributable to common stockholders of $1.0 billion, or $0.60 per

fully diluted share. These results include a net loss from special

items related to goodwill impairment that reduced net income by

$0.6 billion, or $0.33 per fully diluted share. Net revenue in the

first quarter of 2012 was $37.8 billion, an increase of $1.6

billion compared with the first quarter of 2011.

Honda Motor recently announced its consolidated financial

results for the fiscal fourth quarter and the fiscal year ended

March 31, 2012. Despite the unfavorable currency effects due to the

appreciation of the Japanese yen and increase in R&D expenses,

consolidated operating income for the fiscal fourth quarter

(January 1, 2012 through March 31, 2012) amounted to 111.9 billion

yen, approximately 2.4 times greater than the same period of last

year.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

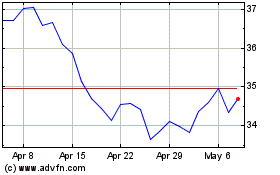

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

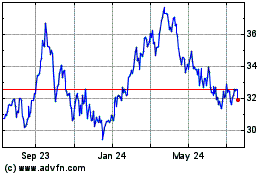

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024