The Zacks Analyst Blog Highlights: AutoNation, Ford Motor, General Motors, Toyota Motor and Honda Motor - Press Releases

May 10 2012 - 4:30AM

Zacks

For Immediate

Release

Chicago, IL – May 10, 2012 –

Zacks.com announces the list of stocks featured in the Analyst

Blog. Every day the Zacks Equity Research analysts discuss the

latest news and events impacting stocks and the financial markets.

Stocks recently featured in the blog include

AutoNation Inc. (AN),

Ford Motor Co. (F), General Motors

Company (GM), Toyota Motor Corp. (TM) and

Honda Motor Co. (HMC).

Get the most recent insight from

Zacks Equity Research with the free Profit from the Pros

newsletter: http://at.zacks.com/?id=5513

Here are highlights from

Wednesday’s Analyst Blog:

AutoNation Sales Rise

12%

AutoNation Inc.

(AN) announced a 12% rise in new vehicles sales to 20,534 units in

April 2012. The improvement in sales was attributable to higher

sales in all its segments compared to the comparable month of the

prior year.

Sales in the Domestic segment went

up 9% to 6,306 units. The segment comprises of retail automotive

franchises that sell vehicles manufactured by Ford Motor

Co. (F), General Motors Company (GM) and

Chrysler. During the month, the automotive retailer’s sales of Ford

vehicles went up 4%.

Sales in the Import segment hiked

16% to 10,358 units. The segment comprises of retail automotive

franchises that sell vehicles produced by Toyota Motor

Corp. (TM), Honda Motor Co. (HMC) and

others. The retailer’s sales of Toyota-made

vehicles escalated 29% in the reported month.

Light vehicle sales in the U.S

depicted a sluggish growth of 2.3% to 1.18 million units from 1.16

million units in April last year. Meanwhile, it went up 9.5% to

seasonally adjusted annual rate (SAAR) of 14.42 million units from

13.17 million units in the year-ago month.

The sluggish growth was

attributable to lower sales performance of the two biggest players

in the industry – General Motors and Ford, and

fewer selling days (due to more Sundays in the month compared with

April 2011). However, auto sales were favorably affected by

fuel-efficient lineups and pent-up demand.

Headquartered in Fort Lauderdale,

Florida, AutoNation is the largest automotive retailer in the U.S.

The company owns and operates 260 new vehicle franchises that sell

32 brands located in the major metropolitan markets in 15 states.

The company offers a range of automotive products and services,

including new vehicle, used vehicles, vehicle maintenance and

repair services, vehicle parts, vehicle protection products and

other aftermarket products.

AutoNation posted its first-quarter

2012 profits of 56 cents per share, up 22% from 46 cents in the

year-ago quarter, surpassing the Zacks Consensus Estimate by 3

cents per share.

Revenues in the quarter rose 10.4%

to $3.7 billion from $3.3 billion in the same quarter last year. It

was higher than the Zacks Consensus Estimate of $3.6 billion. The

higher revenues were attributable to improvement in retail new

vehicle sales.

The company’s effort to expand its

dealer network by investing in existing stores and service centers

will help it to outgrow peers. With this, the company retains a

Zacks #1 Rank, which implies a short-term Strong Buy rating.

Want more from Zacks Equity

Research? Subscribe to the free Profit from the Pros newsletter:

http://at.zacks.com/?id=5515.

About Zacks Equity

Research

Zacks Equity Research provides the

best of quantitative and qualitative analysis to help investors

know what stocks to buy and which to sell for the long-term.

Continuous coverage is provided for

a universe of 1,150 publicly traded stocks. Our analysts are

organized by industry which gives them keen insights to

developments that affect company profits and stock performance.

Recommendations and target prices are six-month time horizons.

Zacks "Profit from the Pros" e-mail

newsletter provides highlights of the latest analysis from Zacks

Equity Research. Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks

Investment Research, Inc., which was formed in 1978 by Leon Zacks.

As a PhD from MIT Len knew he could find patterns in stock market

data that would lead to superior investment results. Amongst his

many accomplishments was the formation of his proprietary stock

picking system; the Zacks Rank, which continues to outperform the

market by nearly a 3 to 1 margin. The best way to unlock the

profitable stock recommendations and market insights of Zacks

Investment Research is through our free daily email newsletter;

Profit from the Pros. In short, it's your steady flow of Profitable

ideas GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=5518.

Visit

http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter:

http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does

not guarantee future results. Investors should always research

companies and securities before making any investments. Nothing

herein should be construed as an offer or solicitation to buy or

sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

AUTONATION INC (AN): Free Stock Analysis Report

FORD MOTOR CO (F): Free Stock Analysis Report

GENERAL MOTORS (GM): Free Stock Analysis Report

HONDA MOTOR (HMC): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

To read this article on Zacks.com click here.

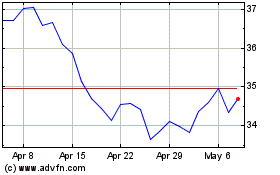

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

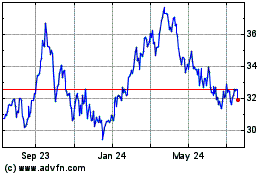

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024