Toyota Profits Down 30.5% in FY12 - Analyst Blog

May 09 2012 - 10:43AM

Zacks

Toyota Motor Corp. (TM) posted a 30.5% decline

in profits to ¥283.56 billion ($3.7 billion) or ¥90.20 ($1.17) per

share in its fiscal year ended March 31, 2012 compared with ¥408.18

billion or ¥130.16 in the prior fiscal year. With this, the company

has missed the Zacks Consensus Estimate of $2.52 per share for the

year.

Consolidated revenues in the year dipped marginally by 2% to

¥18.58 trillion ($241.59 billion). Total unit sales increased 0.6%

to 7.35 million units during the fiscal year. Higher unit sales in

Japan (8%), Europe (0.3%) and Asia (6%) were more than offset by

lower sales in North America (8%) and Other reporting regions

(2%).

The decrease in revenues and profits was attributable to

challenges faced by the company owing to the earthquake in Japan

and severe flooding in Thailand in 2011 as well as unprecedented

strength of the yen.

Operating income fell 24% to ¥355.63 billion from ¥468.28

billion fiscal 2011. Marketing efforts and cost reduction efforts

each had a positive impact of ¥150.0 billion on the operating

income. However, they were offset by unfavorable changes in

exchange rates of ¥250.0 billion, an increase in expense of ¥100.0

billion and other factors of ¥62.6 billion.

Segment Results

In the Automotive segment, revenues slid 2% to ¥16.99 trillion

in the year while operating income fell 75% to ¥21.68 billion. The

decrease in operating income was mainly attributable to unfavorable

changes in exchange rates, despite cost reduction efforts.

In the Financial Services segment, revenues ebbed 8% to ¥1.10

trillion while operating income dipped 14.5% to ¥306.44 billion.

The fall in operating income was caused by valuation losses on

interest rate swaps at fair value and effects related to credit

losses including provision and reversal in sales finance

subsidiaries. In All Other businesses, revenues grew 8% to ¥1.05

billion while operating income rose 19% to ¥42.06 billion.

Financial Position

Toyota had cash and cash equivalents of ¥1.68 trillion as of

March 31, 2012, a decrease from ¥2.08 trillion as of March 31,

2011. Total debt amounted to ¥12.0 trillion as of March 31, 2012,

reflecting a debt-to-capitalization ratio of 53%, compared with

¥12.40 trillion or 54.5% as of March 31, 2011.

In fiscal 2012, Toyota’s operating net cash flow sagged 28% to

¥1.45 trillion from ¥2.02 trillion in the prior fiscal year,

primarily driven by lower profits and significant decline in

deferred income taxes. Meanwhile, capital expenditures (net)

increased to ¥686.90 billion from ¥577.98 billion a year ago.

Fiscal 2013 Guidance

For fiscal 2013 ending March 31, 2013, Toyota projected

consolidated vehicles sales to increase 1.35 million units to 8.70

million units. Consequently, the company expects higher

consolidated revenues of ¥22.00 trillion, operating income of ¥1.00

trillion yen and profits of ¥760.0 billion for the fiscal year

compared with fiscal 2012.

Our Take

Toyota is the leading automaker in the world. Its product

portfolio consists of a full range of models from passenger cars,

minivans and trucks as well as related parts and accessories. Its

domestic competitor includes Honda Motor Co. (HMC)

and Nissan Motor Co. (NSANY). Despite the

disappointing but expected results, a promising outlook led the

company to retain a Zacks #2 Rank on its shares, which translates

to a short-term (1 to 3 months) rating of Buy.

(Exchange rate: $1 = ¥76.92)

HONDA MOTOR (HMC): Free Stock Analysis Report

NISSAN ADR (NSANY): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

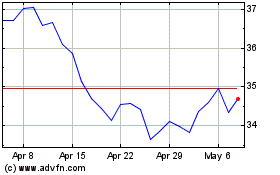

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

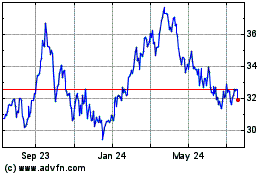

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024