AutoNation Beats, EPS Up 22% - Analyst Blog

April 25 2012 - 10:33AM

Zacks

AutoNation Inc. (AN) recorded a profit of $73.5

million or 56 cents per share in the first quarter of 2012 compared

with $70.3 million or 46 cents in the corresponding quarter of last

year, reflecting a 22% increase on per-share basis. The profit

surpassed the Zacks Consensus Estimate by 3 cents per share.

Revenues in the quarter rose 10.4% to $3.7 billion from $3.3

billion in the same quarter last year. The boost in sales was

driven by improvement in retail new vehicle sales. Revenues were

higher than the Zacks Consensus Estimate of $3.6 billion.

New vehicle revenues escalated 11.7% to $1.9 billion. Revenue

per vehicle hiked to $32,419 from $32,043 in the first quarter of

2011. The retailer’s new vehicle sales went up 10.4% to 61,516

units and 8.3% to 60,327 units on same store basis. The rise in

unit sales was higher than the industry sales increase of 7% (CNW

Research data).

Used vehicle (retail and wholesale) revenues increased 10.5% to

$918.8 million from $831.4 million in the first quarter of 2011.

The retailer’s used vehicle sales rose 9.6% to 46,116 vehicles,

while revenue per vehicle grew marginally to $17,371 from $17,282

in the same quarter last year. On a same-store basis, used vehicle

sales increased 8.1% to 45,495 units.

Parts and service business saw a 5.2% rise in revenues to $599.9

million in the quarter. Meanwhile, Finance and Insurance business

recorded a 17.6% increase in revenues to $130.2 million.

Gross profit increased 6.5% to $603.0 million from $566.2

million in the year ago quarter. The improvement was driven by

higher gross profit earned from the Finance and Insurance segment

as well as increase in retail new vehicle gross profit.

Gross profit per new vehicle retailed decreased 3.2% to $2,178

while gross profit per used vehicle retailed fell 2.9% to $1,702.

However, Finance and Insurance gross profit per vehicle retailed

increased 6.9% to $1,210.

Operating income increased 6.2% to $148.7 million from $140.0

million a year ago. However, operating margin declined marginally

to 4.1% versus 4.2% a year ago.

Segment Details

Revenues in the Domestic segment – comprising

stores that sell vehicles manufactured by General

Motors (GM), Ford Motor

(F) and Chrysler increased 12.1% to $1.22 billion. Unit sales rose

15.7% to 20,513 vehicles. Segment operating income improved 5.9% to

$49.7 million from $42.9 million in the first quarter of 2011.

Revenues in the Import segment – comprising

stores that sell vehicles manufactured primarily by Toyota

Motor (TM), Honda Motor (HMC) and

Nissan Motor (NSANY) – hiked 8.7% to $1.36

billion. Unit sales increased 6.2% to 31,038 automobiles. Segment

operating income increased 12.5% to $61.9 million from $55.0

million in the comparable quarter last year.

Revenues in the Premium Luxury segment –

comprising stores that sell vehicles manufactured primarily by

Daimler AG’s (DDAIF) Mercedes, BMW and Lexus –

went up 11.3% to $1.02 billion. Unit sales rose 14% to 9,965

vehicles. Segment operating income rose 1.9% to $58.8 million from

$57.7 million in the comparable quarter of 2011.

Share Repurchases

During the quarter, AutoNation repurchased 11.7 million shares

for $405.4 million. Meanwhile between April 1, 2012 and April 24,

2012, the company repurchased 2.1 million shares for $70.8 million.

The company has 122 million shares outstanding as of April 24,

2012.

Financial Details

AutoNation’s cash and cash equivalents declined to $76.3 million

as of March 31, 2012 from $84.3 million as of March 31, 2011. The

company’s inventory was valued at $2.0 billion as of March 31, 2012

versus $1.7 billion as of March 31, 2011. Meanwhile, capital

expenditures increased to $29.1 million in 2012 from $24.7 million

in the prior year.

Our Take

AutoNation is the largest automotive retailer in the U.S. with

headquartered in Fort Lauderdale, Florida. As of March 31, 2012,

the company owned and operated 260 new vehicle franchises that sell

32 brands located in the major metropolitan markets in 15 states.

Currently, the company retains a Zacks #2 Rank, which implies a

“Buy” rating for the short-term.

AUTONATION INC (AN): Free Stock Analysis Report

DAIMLER AG (DDAIF): Free Stock Analysis Report

FORD MOTOR CO (F): Free Stock Analysis Report

GENERAL MOTORS (GM): Free Stock Analysis Report

HONDA MOTOR (HMC): Free Stock Analysis Report

NISSAN ADR (NSANY): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

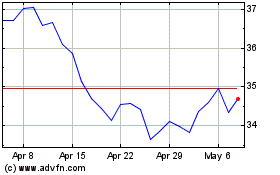

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

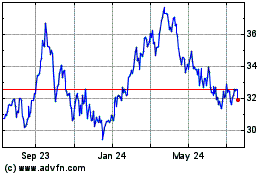

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024