false

0001380936

424B5

false

0001380936

2024-05-01

2024-05-03

0001380936

2023-12-01

2024-02-29

0001380936

2023-09-01

2023-11-30

0001380936

2023-06-01

2023-08-31

0001380936

2023-03-01

2023-05-31

0001380936

2022-12-01

2023-02-28

0001380936

2022-09-01

2022-11-30

0001380936

2022-06-01

2022-08-31

0001380936

2022-03-01

2022-05-31

0001380936

2021-12-01

2022-02-28

0001380936

2021-09-01

2021-11-30

0001380936

2021-06-01

2021-08-31

0001380936

GOF:PrincipalRisksMember

2024-05-01

2024-05-03

0001380936

GOF:MarketDiscountRiskMember

2024-05-01

2024-05-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Filed

Pursuant to Rule 424(b)(5)

Securities Act File No. 333-279126

Investment Company Act File No. 811-21982

PROSPECTUS

SUPPLEMENT

(to Prospectus dated May 3, 2024)

GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND

Common Shares of Beneficial Interests

Having an Aggregate Initial Offering

Price of Up to $850,000,000

Guggenheim Strategic Opportunities

Fund (the “Fund”) is a diversified, closed-end management investment company. The Fund’s investment objective is to

maximize total return through a combination of current income and capital appreciation. The Fund pursues a relative value-based investment

philosophy, which utilizes quantitative and qualitative analysis to seek to identify securities or spreads between securities that deviate

from their perceived fair value and/or historical norms. The Fund’s sub-adviser seeks to combine a credit-managed fixed-income portfolio

with access to a diversified pool of alternative investments and equity strategies. The Fund’s investment philosophy is predicated

upon the belief that thorough research and independent thought are rewarded with performance that has the potential to outperform benchmark

indexes with both lower volatility and lower correlation of returns as compared to such benchmark indexes. The Fund cannot ensure investors

that it will achieve its investment objective.

The Fund seeks to achieve

its investment objective by investing in a wide range of fixed-income and other debt and senior equity securities (“Income Securities”)

selected from a variety of sectors and credit qualities, including, but not limited to, corporate bonds, loans and loan participations,

structured finance investments, U.S. government and agency securities, mezzanine and preferred securities and convertible securities,

and in common stocks, limited liability company interests, trust certificates and other equity investments (“Common Equity Securities”)

that the Fund’s sub-adviser believes offer attractive yield and/or capital appreciation potential, including employing a strategy

of writing (selling) covered call options and may, from time to time, buy or sell put options on individual Common Equity Securities and,

to a lesser extent, on indices of securities and sectors of securities. The Fund may also invest in asset-backed securities and mortgage-related

securities. These securities may include complex instruments, such as collateralized mortgage obligations, real estate investment trusts

(“REITs”) (including debt and preferred stock issued by REITs), and other real estate-related securities.

The Fund has entered into a

Controlled Equity OfferingSM Sales Agreement, dated July 1, 2019, as amended by First Amendment to Controlled Equity OfferingSM

Sales Agreement, dated February 1, 2021, Second Amendment to Controlled Equity OfferingSM Sales Agreement, dated September

16, 2021, Third Amendment to Controlled Equity OfferingSM Sales Agreement, dated March 27, 2023, and Fourth Amendment to Controlled

Equity OfferingSM Sales Agreement, dated May 3, 2024 (as amended the “Sales Agreement”), by and among the Fund,

the Fund’s investment adviser, Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”), and Cantor Fitzgerald

& Co. (“Cantor Fitzgerald”) relating to the Fund’s common shares of beneficial interest, par value $0.01 per share

(the “Common Shares”), offered by this Prospectus Supplement and the accompanying Prospectus. In accordance with the terms

of the Sales Agreement, the Fund may offer and sell Common Shares having an aggregate initial offering price of up to $850,000,000, from

time to time, through Cantor Fitzgerald as agent for the Fund for the offer and sale of the Common Shares.

Cantor Fitzgerald will be entitled

to compensation of up to 2.00% of the gross proceeds of the sale of any Common Shares under the Sales Agreement, with the exact amount

of such compensation to be mutually agreed upon by the Fund and Cantor Fitzgerald from time to time. In connection with the sale of the

Common Shares on behalf of the Fund, Cantor Fitzgerald may be deemed to be an “underwriter” within the meaning of the Securities

Act of 1933, as amended (the “1933 Act”), and the compensation of Cantor Fitzgerald may be deemed to be underwriting commissions

or discounts.

Sales of the Common Shares, if any,

under this Prospectus Supplement and the accompanying Prospectus may be made in negotiated transactions or by any method permitted by

law deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the 1933 Act. The Fund or the Fund and Cantor

Fitzgerald will determine whether any sales of the Common Shares will be authorized on a particular day.

The Fund’s currently outstanding

Common Shares are, and Common Shares offered by this Prospectus Supplement and the accompanying Prospectus will be, subject to notice

of issuance, listed on the New York Stock Exchange (“NYSE”) under the symbol “GOF.” At the close of business on

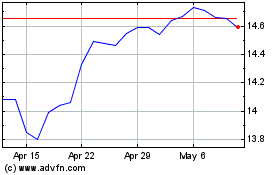

April 26, 2024, the net asset value per share of the Fund’s Common Shares was $11.88 and the last reported sale price for the Fund’s

Common Shares on the NYSE on such date was $14.55 per share,

representing a premium to net asset value of 22.47%.

To the extent that the market price per Common Share, less any distributing commission or discount, is less than the then current net

asset value per Common Share on any given day, the Fund will instruct Cantor Fitzgerald not to make any sales on such day.

This Prospectus Supplement, together

with the accompanying Prospectus, dated May 3, 2024, sets forth concisely the information that you should know before investing in the

Fund’s Common Shares. You should read this Prospectus Supplement and the accompanying Prospectus (and documents incorporated by

reference herein or therein), which contain important information about the Fund, before deciding whether to invest, and you should retain

these documents for future reference. A Statement of Additional Information, dated May 3, 2024 (the “SAI”), as supplemented

from time to time, containing additional information about the Fund, has been filed with the Securities and Exchange Commission (“SEC”)

and is incorporated by reference in its entirety into this Prospectus Supplement and the accompanying Prospectus. This Prospectus Supplement,

the accompanying Prospectus and the SAI are part of a “shelf” registration statement filed with the SEC. This Prospectus Supplement

describes the specific details regarding this offering, including the method of distribution. If information in this Prospectus Supplement

is inconsistent with the accompanying Prospectus or the SAI, you should rely on this Prospectus Supplement. You may request a free copy

of the SAI or request other information about the Fund (including the Fund’s annual and semi-annual reports) or make shareholder

inquiries by calling (800) 345-7999 or by writing the Fund, or you may obtain a copy (and other information regarding the Fund) from the

SEC’s web site (http://www.sec.gov). The information contained in, or that can be accessed through, the Fund’s website is

not part of this Prospectus Supplement or the accompanying Prospectus. Free copies of the Fund’s reports and the SAI also are available

from the Fund’s website at www.guggenheiminvestments.com/gof.

The Fund’s Common

Shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution

and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

Investors could lose money by investing in the Fund.

Capitalized terms used herein

that are not otherwise defined shall have the meanings assigned to them in the accompanying Prospectus.

Investing in the Fund’s

Common Shares involves certain risks, including the risks associated with the Fund’s use of leverage. An investment in the Fund

is subject to investment risk, including the possible loss of the entire principal amount that you invest. See “Risks” beginning

on page 32 of the accompanying Prospectus. You should consider carefully these risks together with all of the other information contained

in this Prospectus Supplement and the accompanying Prospectus before making a decision to purchase Common Shares.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus

Supplement or the accompanying Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Prospectus Supplement is

dated May 3, 2024.

* * *

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING

STATEMENTS

This Prospectus Supplement, the

accompanying Prospectus and the Fund’s SAI, including documents incorporated by reference herein and therein, contain “forward-looking

statements.” These statements describe the Fund’s plans, strategies, goals, beliefs and assumptions concerning future economic

and other conditions and the outlook for the Fund, based on currently available information. Forward-looking statements can be identified

by words such as “may,” “will,” “intend,” “expect,” “estimate,” “continue,”

“plan,” “anticipate,” and similar terms and the negative of such terms. By their nature, all forward- looking

statements involve risks and uncertainties and may be expressed differently, and actual results could differ materially from those contemplated

by the forward-looking statements. Several factors that could materially affect the Fund’s actual results are the performance of

the portfolio of securities and other investments held by the Fund, the conditions in the U.S. and international economies and financial

and other markets, the price at which the Fund’s Common Shares will trade in the public markets and other factors discussed in the

Fund’s periodic filings with the SEC.

Although the Fund believes that

the expectations expressed in any forward-looking statements are reasonable, actual results could differ materially from those expressed

or implied in any forward-looking statements. The Fund’s future financial condition and results of operations, as well as any forward-looking

statements, are subject to change and are subject to inherent risks and uncertainties, such as those disclosed in the “Risks”

section of the accompanying Prospectus. You are cautioned not to place undue

ii

reliance on these forward- looking statements. All

forward-looking statements contained or incorporated by reference in this Prospectus Supplement or the accompanying Prospectus are made

as of the date of this Prospectus Supplement or the accompanying Prospectus, as the case may be. Except for the Fund’s ongoing obligations

under the federal securities laws, the Fund does not intend, and the Fund undertakes no obligation, to update any forward- looking statement.

The forward-looking statements contained in this Prospectus Supplement, the accompanying Prospectus and the Fund’s SAI are excluded

from the safe harbor protection provided by Section 27A of the 1933 Act.

Currently known risk factors that

could cause actual results to differ materially from the Fund’s expectations include, but are not limited to, the factors described

in the “Risks” section of the accompanying Prospectus. The Fund urges you to review carefully those sections for a more detailed

discussion of the risks of an investment in the Fund’s Common Shares.

You should rely only on the information

contained or incorporated by reference in this Prospectus Supplement and the accompanying Prospectus in making your investment decisions.

This Prospectus Supplement, which describes the specific terms of this offering, also adds to information contained in the accompanying

Prospectus and the documents incorporated by reference in the Prospectus. The Fund has not and Cantor Fitzgerald has not authorized any

other person to provide you with different or inconsistent information. If anyone provides you with different or inconsistent information,

you should not rely on it. The Fund and Cantor Fitzgerald take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. This Prospectus Supplement and the accompanying Prospectus do not constitute an offer

to sell or solicitation of an offer to buy any securities in any jurisdiction where the offer or sale is not permitted. You should assume

the information appearing in this Prospectus Supplement and in the accompanying Prospectus is accurate only as of the respective dates

on their front covers. The Fund’s business, financial condition and prospects may have changed since such dates. The Fund will advise

investors of any material changes to the extent required by applicable law.

iii

PROSPECTUS SUPPLEMENT SUMMARY

This is only a summary of information contained

elsewhere in this Prospectus Supplement and the accompanying Prospectus. This summary does not contain all of the information that you

should consider before investing in the Fund’s Common Shares. The following summary is qualified in its entirety by reference to

the more detailed information included elsewhere in this Prospectus Supplement and in the accompanying Prospectus and in the Fund’s

Statement of Additional Information, dated May 3, 2024 (the “SAI”). You should carefully read the more detailed information

contained in this Prospectus Supplement and the accompanying Prospectus, dated May 3, 2024, especially the information set forth under

the headings “Investment Objective and Policies” and “Risks” prior to making an investment in the Fund. You may

also wish to request a copy of the SAI, which contains additional information about the Fund and is incorporated by reference in its entirety

into this Prospectus Supplement and the accompanying Prospectus. Capitalized terms used herein that are not otherwise defined shall have

the meanings assigned to them in the accompanying Prospectus.

| The Fund | | Guggenheim Strategic Opportunities Fund (the “Fund”) is a diversified,

closed-end management investment company that commenced operations on July 26, 2007. The Fund’s objective is to maximize total

return through a combination of current income and capital appreciation. The Fund pursues a relative value-based investment philosophy,

which utilizes quantitative and qualitative analysis to seek to identify securities or spreads between securities that deviate from their

perceived fair value and/or historical norms. |

The Fund’s common shares of beneficial

interest, par value $0.01 per share, are called “Common Shares” and the holders of the Common Shares are called “Common

Shareholders” throughout this Prospectus Supplement and the accompanying Prospectus.

| Management of the Fund | | Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”)

acts as the Fund’s investment adviser and is responsible for the management of the Fund. Guggenheim Partners Investment Management,

LLC (the “Sub-Adviser”) is responsible for the management of the Fund’s portfolio of securities. Each of the Investment

Adviser and the Sub-Adviser are wholly-owned subsidiaries of Guggenheim Partners, LLC (“Guggenheim Partners”). Guggenheim

Partners is a diversified financial services firm with wealth management, capital markets, investment management and proprietary investing

businesses, whose clients are a mix of individuals, family offices, endowments, investment funds, foundations, insurance companies and

other institutions that have entrusted Guggenheim Partners with the supervision of more than $310 billion of assets as of December 31,

2023. Guggenheim Partners is headquartered in Chicago and New York with a global network of offices throughout the United States, Europe,

and Asia. |

| Listing and Symbol | | The Fund’s currently outstanding Common Shares are, and Common

Shares offered by this Prospectus Supplement and the accompanying Prospectus will be, subject to notice of issuance, listed on the New

York Stock Exchange (the “NYSE”) under the symbol “GOF.” As of the close of business on April 26, 2024, the net

asset value per share of the Fund’s Common Shares was $11.88 and the last reported sale price for the Fund’s Common Shares

on the NYSE on such date was $14.55 per share, representing a premium to net asset value of 22.47%. |

| Distributions | | The Fund has paid distributions to Common Shareholders monthly since inception. Payment of

future distributions is subject to approval by the Fund’s Board of Trustees, as well as meeting the covenants of any outstanding

borrowings and the asset coverage requirements of the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s

distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to

change. The Fund expects that distributions paid on Common Shares will generally consist of (i) investment

company taxable income taxed as ordinary income, which includes, among other things, dividend and interest income accrued on portfolio

assets, short-term capital gain and income from certain hedging and interest rate transactions, (ii) qualified dividend income, (iii)

long-term capital gain and (iv) return of capital. There is no guarantee of any future distribution or that the current distribution

rates will be maintained. |

| The Offering | | The Fund has entered into a Controlled Equity OfferingSM Sales

Agreement, dated July 1, 2019, as amended by First Amendment to Controlled Equity OfferingSM Sales Agreement, dated February

1, 2021, Second Amendment to Controlled Equity OfferingSM Sales Agreement, dated September 16, 2021, Third Amendment to Controlled

Equity OfferingSM Sales Agreement, dated March 27, 2023, and Fouth Amendment to Controlled Equity OfferingSM Sales

Agreement, dated May 3, 2024 (as amended, the “Sales Agreement”), by and among the Fund, the Investment Adviser,

and Cantor Fitzgerald & Co. (“Cantor Fitzgerald”) relating to the Fund’s Common Shares offered by this Prospectus

Supplement and the accompanying Prospectus. In accordance with the terms of the Sales Agreement, the Fund may offer and sell Common Shares

having an aggregate initial offering price of up to $850,000,000, from time to time, through Cantor Fitzgerald as agent for the Fund

for the offer and sale of the Common Shares. |

1

Sales of the Common Shares, if any, under this

Prospectus Supplement and the accompanying Prospectus may be made in negotiated transactions or by any method permitted by law deemed

to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended (the “1933

Act”). See “Plan of Distribution” in this Prospectus Supplement.

Common Shares may not be sold through agents,

underwriters or dealers without delivery or deemed delivery of the Prospectus and this Prospectus Supplement describing the method and

terms of the offering of the Common Shares.

Under the 1940 Act, the Fund may not sell Common

Shares at a price below the then current net asset value per Common Share, exclusive of any distributing commission or discount.

| Risks | | See “Risks” beginning on page 32 of the accompanying Prospectus for a discussion

of factors you should consider carefully before deciding to invest in the Fund’s Common Shares. |

| Use of Proceeds | | The Fund intends to invest the net proceeds of the offering in accordance

with its investment objective and policies as stated in the accompanying Prospectus or otherwise invest the net proceeds as follows.

It is currently anticipated that the Fund will be able to invest most of the net proceeds of the offering in accordance with its investment

objective and policies within three months after receipt of such proceeds. Pending such investment, it is anticipated that the proceeds

will be invested in U.S. government securities or high quality, short-term money-market securities. The Fund may also use the proceeds

for working capital purposes, including the payment of distributions, interest and operating expenses. A portion of the cash held by

the Fund, including net proceeds of the offering, is usually used to pay distributions in accordance with the Fund’s distribution

policy and may be a return of capital, which is in effect a partial return of the amount a Common Shareholder invested in the Fund. Common

Shareholders who receive the payment of a distribution consisting of a return of capital may be under the impression that they are receiving

net investment income or profit when they are not. The Fund’s distributions may be greater than the Fund’s net investment

income or profit. If the Fund does not offer or sell Common Shares, the Fund may not be able to maintain distributions at historical

levels. |

SUMMARY OF FUND EXPENSES

The following table contains information about the costs

and expenses that the Common Shareholders will bear directly or indirectly. The table reflects the use of leverage in an amount equal

to approximately 23% of the Fund’s total managed assets, which reflects approximately the percentage of the Fund’s total managed

assets attributable to leverage as of November 30, 2023 (unaudited), and shows Fund expenses as a percentage of net assets attributable

to Common Shares. The table and example below are based on the Fund’s capital structure as of November 30, 2023 (unaudited) after

giving effect to the anticipated net proceeds of the Common Shares offered pursuant to this Prospectus Supplement and assuming the Fund

incurs the estimated offering expenses described below. The extent of the Fund’s assets attributable to leverage following an offering,

and the Fund’s associated expenses, are likely to vary (perhaps significantly) from these assumptions. The purpose of the table

and the example below is to help you understand the fees and expenses that you, as a Common Shareholder, would bear directly or indirectly.

The following table should not be considered a representation of the Fund’s future expenses. Actual expenses may be greater or less

than shown. The following table shows estimated Fund expenses as a percentage of average net assets attributable to Common Shares, and

not as a percentage of managed assets. See “Management of the Fund” in the accompanying Prospectus.

Shareholder Transaction Expenses

| Sales load (as a percentage of offering price) |

2.00%(1) |

| Offering expenses borne by the Fund (as a percentage of offering price) |

0.60%(1),

(2) |

| Dividend Reinvestment Plan fees(3) |

None |

|

Annual Expenses |

As a Percentage of Net Assets

Attributable to

Common Shares (reflecting

leverage)(4) |

| Management fee(5) |

1.25% |

| Acquired fund fees and expenses(6) |

0.02% |

| Interest expense(7) |

1.41% |

| Other expenses(8) |

0.08% |

| Total annual expenses(9) |

2.76% |

2

As required by relevant SEC regulations, the following

Example illustrates the expenses that you would pay on a $1,000 investment in Common Shares, assuming (1) “Total annual expenses”

of 2.76% of net assets attributable to Common Shares, (2) the sales load of $20 and estimated offering expenses of $6, and (3) a 5% annual

return*:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Total Expenses Incurred: |

$53 |

$109 |

$168 |

$327 |

| * | The Example should not be considered a representation of future expenses or returns. Actual expenses

may be higher or lower than those assumed. Moreover, the Fund’s actual rate of return may be higher or lower than the hypothetical

5% return shown in the Example. The Example assumes that all dividends and distributions are reinvested at net asset value. See “Distributions”

and “Dividend Reinvestment Plan” in the accompanying Prospectus. |

The above table and Example and

the assumption in the Example of the 5% annual return are required by the regulations of the SEC. The assumed 5% annual return is not

a prediction of, and does not represent, the projected or actual performance of the Fund’s Common Shares. For more complete descriptions

of certain of the Fund’s costs and expenses, see “Management of the Fund” in the accompanying Prospectus. The Example

assumes that the estimated “Other expenses” set forth in the table are accurate.

3

CAPITALIZATION

In accordance with the terms of

the Sales Agreement, the Fund may offer and sell Common Shares having an aggregate initial offering price of up to $850,000,000, from

time to time, through Cantor Fitzgerald as the Fund’s agent for the offer and sale of the Common Shares. The price per share of

any of the Common Shares sold hereunder may be greater or less than the price of $14.55 per share (the last reported sale price for the

Fund’s Common Shares on the NYSE as of April 26, 2024) assumed herein, depending on the market price of the Common Shares at the

time of such sale. Furthermore, there is no guarantee that the Fund will sell all of the Common Shares available for sale hereunder or

that there will be any sales of the Common Shares hereunder. To the extent that the market price per Common Share, less any distributing

commission or discount, is less than the then current net asset value per Common Share on any given day, the Fund will instruct Cantor

Fitzgerald not to make any sales on such day.

The following table sets forth the Fund’s capitalization:

| (i) | on a historical basis as of May 31, 2023 (audited); |

| (ii) | on a historical basis as of November 30, 2023 (unaudited); |

| (iii) | on an as adjusted basis, as of April 26, 2024 (unaudited), to reflect the issuance of an aggregate of

906,506 Common Shares pursuant to the Fund’s Automatic Dividend Reinvestment Plan, and the application of the net proceeds from

such issuances of the Common Shares; and the issuance and sale of 9,457,506 Common Shares issued and sold after November 30, 2023, but

prior to the date of this Prospectus Supplement (less the commission paid and offering expenses payable by the Fund in connection with

the issuance and sale of such Common Shares); and an increase in Borrowings of $7,000,000 and a decrease in reverse repurchase agreements

of $527,193; and |

| (iv) | on an as further adjusted basis (unaudited) to reflect the assumed sale of 58,419,244 Common Shares

at a price of $14.55 per share (the last reported sale price for the Fund’s Common Shares on the NYSE as of April 26, 2024), in

an offering under this Prospectus Supplement and the accompanying Prospectus less the assumed commission of $17,000,000 (representing

an estimated commission paid to Cantor Fitzgerald of 2.00% of the gross proceeds of the sale of the Common Shares effected by Cantor Fitzgerald

in this offering) and estimated offering expenses payable by the Fund of $5,100,000. |

| |

Actual as of

May 31, 2023 |

Actual as of

November 30, 2023 |

As Adjusted as of

April 26, 2024 |

As Further Adjusted |

| |

(audited) |

(unaudited) |

(unaudited) |

(unaudited) |

| Short-Term Debt: |

|

|

|

|

| Borrowings and Reverse Repurchase Agreements |

$343,499,795 |

$457,656,543 |

$464,129,350 |

$464,129,350 |

| Common Shareholder’s Equity: |

|

|

|

|

| Common shares of beneficial interest, par value $0.01 per share; unlimited shares authorized, 119,342,322 shares issued and outstanding (actual as of May 31, 2023), 129,852,127 shares issued and outstanding (actual as of November 30, 2023), 140,216,139 shares issued and outstanding (as adjusted), and 198,635,383 shares issued and outstanding (as further adjusted) |

$1,193,423 |

$1,298,521 |

$1,402,161 |

$1,986,354 |

| Additional paid-in capital |

$1,701,870,143 |

$1,853,025,655 |

$1,992,981,847 |

$2,820,297,654 |

| Total distributable earnings (loss) |

$(229,369,746) |

$(293,476,357) |

$(293,476,357) |

$(293,476,357) |

| Net assets |

$1,473,693,820 |

$1,560,847,819 |

$1,700,907,651 |

$2,528,807,651 |

| |

|

|

|

|

|

USE OF PROCEEDS

Sales of the Common

Shares, if any, under this Prospectus Supplement and the accompanying Prospectus may be made in negotiated transactions or by any method

permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the 1933 Act. Assuming the sale

of $850,000,000 of the Common Shares under this Prospectus Supplement and the accompanying Prospectus, the net proceeds to the Fund from

this offering will be approximately $827,900,000, after deducting the estimated commission and estimated offering expenses. There is no

guarantee that there will be any sales of the Common Shares pursuant to the Prospectus Supplement. The price per share of any Common Share

sold hereunder may be greater or less than the price assumed herein, depending on the market price of the Common Shares at the time of

such sale.

Furthermore, there is no

guarantee that the Fund will sell all of the Common Shares available for sale hereunder or that there will be any sales of the Common

Shares hereunder. To the extent that the market price per Common Share, less any distributing commission or discount, is less than the

then current net asset value per Common Share on any given day, the Fund will instruct Cantor Fitzgerald not to make any sales on such

day. As a result, the proceeds received by the Fund may be less than

4

the amount of net proceeds estimated in this Prospectus

Supplement.

The Fund intends to invest the net

proceeds of the offering in accordance with its investment objective and policies as stated in the accompanying Prospectus or otherwise

invest the net proceeds as follows. It is currently anticipated that the Fund will be able to invest most of the net proceeds of the offering

in accordance with its investment objective and policies within three months after the receipt of such proceeds. Pending such investment,

it is anticipated that the proceeds will be invested in U.S. government securities or high quality, short-term money-market securities.

The Fund may also use the proceeds for working capital purposes, including the payment of distributions, interest and operating expenses.

A portion of the cash held by the Fund, including net proceeds of the offering, is usually used to pay distributions in accordance with

the Fund’s distribution policy and may be a return of capital, which is in effect a partial return of the amount a Common Shareholder

invested in the Fund. Common Shareholders who receive the payment of a distribution consisting of a return of capital may be under the

impression that they are receiving net investment income or profit when they are not. The Fund’s distributions may be greater than

the Fund’s net investment income or profit. If the Fund does not offer or sell Common Shares, the Fund may not be able to maintain

distributions at historical levels.

PLAN OF DISTRIBUTION

Under the Sales Agreement,

upon written instructions from the Fund, Cantor Fitzgerald will use its commercially reasonable efforts consistent with its sales and

trading practices, to solicit offers to purchase Common Shares under the terms and subject to the conditions set forth in the Sales Agreement.

Cantor Fitzgerald’s solicitation will continue until the Fund instructs Cantor Fitzgerald to suspend the solicitations and offers.

The Fund will instruct Cantor Fitzgerald as to the amount of the Common Shares to be sold by Cantor Fitzgerald. The Fund may instruct

Cantor Fitzgerald not to sell Common Shares if the sales cannot be effected at or above the price designated by the Fund in any instruction.

The Fund or Cantor Fitzgerald may suspend the offering of the Common Shares upon proper notice and subject to other conditions.

Cantor Fitzgerald will provide

written confirmation to the Fund not later than the opening of the trading day on the NYSE following any trading day on which Common Shares

are sold under the Sales Agreement. Each confirmation will include the number of the Common Shares sold on the preceding day, the net

proceeds to the Fund and the compensation payable by the Fund to Cantor Fitzgerald in connection with the sales.

The Fund will pay Cantor

Fitzgerald commissions for its services in acting as agent for the sale of the Common Shares. Cantor Fitzgerald will be entitled to compensation

of up to 2.00% of the gross proceeds of the sale of any Common Shares under the Sales Agreement, with the exact amount of such compensation

to be mutually agreed upon by the Fund and Cantor Fitzgerald from time to time. There is no guarantee that there will be any sales of

the Common Shares pursuant to this Prospectus Supplement.

Settlement for sales of the

Common Shares will occur on the second trading day (and on and after May 28, 2024, the first trading day) following the date on

which such sales are made, or on some other date that is agreed upon by the Fund and Cantor Fitzgerald in connection with a

particular transaction, in return for payment of the net proceeds to the Fund. There is no arrangement for funds to be deposited in

escrow, trust or similar arrangement.

In connection with the sale of

the Common Shares on behalf of the Fund, Cantor Fitzgerald may be deemed to be an “underwriter” within the meaning of the

1933 Act, and the compensation paid to Cantor Fitzgerald may be deemed to be underwriting commissions or discounts. The Fund and the Investment

Adviser have agreed to provide indemnification and contribution to Cantor Fitzgerald against certain civil liabilities, including liabilities

under the 1933 Act. The Fund and the Investment Adviser have also agreed to reimburse Cantor Fitzgerald for other specified expenses.

The offering of the Common Shares

pursuant to the Sales Agreement will terminate upon the earlier of (1) the sale of all Common Shares subject to the Sales Agreement or

(2) the termination of the Sales Agreement. The Sales Agreement may be terminated by the Fund in its sole discretion at any time by giving

10 days’ notice to Cantor Fitzgerald. The Sales Agreement may be terminated by the Investment Adviser in its sole discretion in

the event the Investment Adviser ceases to act as investment adviser to the Fund. In addition, Cantor Fitzgerald may terminate the Sales

Agreement under the circumstances specified in the Sales Agreement and in its sole discretion at any time following a period of 30 days

from the date of the Sales Agreement by giving 10 days’ notice to the Fund.

Under the 1940 Act, the Fund

may not sell Common Shares at a price below the then current net asset value per Common Share, exclusive of any distributing commission

or discount. To the extent that the market price per Common Share, less any distributing commission or discount, is less than the then

current net asset value per Common Share on any given day, the Fund will instruct Cantor Fitzgerald not to make any sales on such day.

In accordance with the terms

of the Sales Agreement, the Fund may offer and sell Common Shares having an aggregate initial offering price of up to $850,000,000, from

time to time, through Cantor Fitzgerald as agent for the Fund for the offer and sale of the Common Shares.

The principal business address of Cantor Fitzgerald is

499 Park Avenue, New York, New York 10022.

5

LEGAL MATTERS

Certain legal matters will be passed

on by Dechert LLP, Washington, D.C., as counsel to the Fund in connection with the offering of the Common Shares. Certain legal matters

will be passed on by Hunton Andrews Kurth LLP, Houston, Texas, as special counsel to Cantor Fitzgerald in connection with the offering

of the Common Shares.

INCORPORATION BY REFERENCE

This Prospectus Supplement

is part of a registration statement filed with the SEC. The Fund is permitted to “incorporate by reference” the information

filed with the SEC, which means that the Fund can disclose important information to you by referring you to those documents. The information

incorporated by reference is considered to be part of this Prospectus Supplement, and later information that the Fund files with the SEC

will automatically update and supersede this information.

The documents listed below, and any

reports and other documents subsequently filed with the SEC pursuant to Section 30(b)(2) of the 1940 Act and Sections 13(a), 13(c), 14

or 15(d) of the Securities Exchange Act of 1934, prior to the termination of this offering will be incorporated by reference into this

Prospectus Supplement and deemed to be part of this Prospectus Supplement from the date of the filing of such reports and documents:

| • | the Fund’s Statement of Additional Information, dated May 3, 2024, filed with

the SEC with the accompanying Prospectus on May 3, 2024; |

| • | the Fund’s Annual Report on Form N-CSR for the fiscal year ended May 31, 2023, filed with

the SEC on August 2, 2023; |

| • | the Fund’s Semi-Annual Report on Form N-CSR for the six months ended November 30, 2023,

filed with the SEC on February 2, 2024; and |

You may request a free copy of the information

incorporated by reference into this Prospectus Supplement by calling (800) 345-7999 or by writing to the Investment Adviser at Guggenheim

Funds Investment Advisors, LLC, 227 West Monroe Street, Chicago, Illinois 60606, or you may obtain a copy (and other information regarding

the Fund) from the SEC’s web site (http://www.sec.gov). Free copies of the Fund’s reports will also be available from the

Fund’s web site at www.guggenheiminvestments.com/gof. The information contained in, or that can be accessed through, the Fund’s

website is not part of this Prospectus Supplement, the Prospectus or the SAI.

ADDITIONAL INFORMATION

This Prospectus Supplement and the

accompanying Prospectus constitute part of a Registration Statement filed by the Fund with the SEC under the 1933 Act and the 1940 Act.

This Prospectus Supplement and the accompanying Prospectus omit certain of the information contained in the Registration Statement, and

reference is hereby made to the Registration Statement and related exhibits for further information with respect to the Fund and Common

Shares offered hereby. Any statements contained herein concerning the provisions of any document are not necessarily complete, and, in

each instance, reference is made to the copy of such document filed as an exhibit to the Registration Statement or otherwise filed with

the SEC. Each such statement is qualified in its entirety by such reference. The complete Registration Statement, other documents incorporated

by reference, and other information the Fund has filed electronically with the SEC, may be obtained from the SEC upon payment of the fee

prescribed by its rules and regulations or free of charge through the SEC’s web site (http://www.sec.gov),

by calling (800) 345-7999, by writing to the Investment Adviser at Guggenheim Investment Advisors, LLC, 227 West Monroe Street, Chicago,

Illinois 60606, or by visiting our website at www.guggenheiminvestments.com.

6

PROSPECTUS

Guggenheim Strategic Opportunities Fund

$850,000,000

Common Shares

________________

Investment

Objective and Philosophy. Guggenheim Strategic Opportunities Fund (the “Fund”) is a diversified, closed-end management

investment company. The Fund’s investment objective is to maximize total return through a combination of current income and capital

appreciation. The Fund pursues a relative value-based investment philosophy, which utilizes quantitative and qualitative analysis to seek

to identify securities or spreads between securities that deviate from their perceived fair value and/or historical norms. The Fund’s

sub-adviser seeks to combine a credit-managed fixed-income portfolio with access to a diversified pool of alternative investments and

equity strategies. The Fund’s investment philosophy is predicated upon the belief that thorough research and independent thought

are rewarded with performance that has the potential to outperform benchmark indexes with both lower volatility and lower correlation

of returns as compared to such benchmark indexes. The Fund cannot ensure investors that it will achieve its investment objective.

Investment

Portfolio. The Fund seeks to achieve its investment objective by investing in a wide range of fixed-income and other debt and

senior equity securities (“Income Securities”) selected from a variety of sectors and credit qualities, including, but not

limited to, corporate bonds, loans and loan participations, structured finance investments, U.S. government and agency securities, mezzanine

and preferred securities and convertible securities, and in common stocks, limited liability company interests, trust certificates and

other equity investments (“Common Equity Securities”) that the Fund’s sub-adviser believes offer attractive yield and/or

capital appreciation potential, including employing a strategy of writing (selling) covered call options and may, from time to time, buy

or sell put options on individual Common Equity Securities and, to a lesser extent, on indices of securities and sectors of securities.

The Fund may also invest in asset-backed securities (“ABS”) and mortgage-related securities. These securities may include

complex instruments, such as collateralized mortgage obligations, real estate investment trusts (“REITs”) (including debt

and preferred stock issued by REITs), and other real estate-related securities.

Offering. The

Fund may offer, from time to time, up to $850,000,000 aggregate initial offering price of common shares of beneficial interest, par value

$0.01 per share (“Common Shares”), in one or more offerings in amounts, at prices and on terms set forth in one or more supplements

to this Prospectus (each, a “Prospectus Supplement”). You should read this Prospectus and any related Prospectus Supplement

carefully before you decide to invest in the Common Shares.

The

Fund may offer Common Shares (1) directly to one or more purchasers, (2) through agents that the Fund may designate from time to time

or (3) to or through underwriters or dealers. The Prospectus Supplement relating to a particular offering of Common Shares will identify

any agents or underwriters involved in the sale of Common Shares, and will set forth any applicable purchase price, fee, commission or

discount arrangement between the Fund and agents or underwriters or among underwriters or the basis upon which such amount may be calculated.

The Fund may not sell Common Shares through agents, underwriters or dealers without delivery of this Prospectus and the Prospectus Supplement.

See “Plan of Distribution.”

________________

Investing

in the Fund’s Common Shares involves certain risks, including the risks associated with the Fund’s use of leverage. An investment

in the Fund is subject to investment risk, including the possible loss of the entire principal amount that you invest. See “Risks”

on page 32 of this Prospectus and the section of the Fund’s most recent annual report on Form N-CSR entitled “Principal Risks

of the Fund,” which is incorporated by reference herein. You should carefully consider these risks together with all of the other

information contained in this Prospectus before making a decision to purchase the Fund’s Common Shares.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

i

________________

Prospectus dated May 3, 2024

Investment

Adviser and Sub-Adviser. Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”) acts as the Fund’s

investment adviser and is responsible for the management of the Fund. Guggenheim Partners Investment Management, LLC (the “Sub-Adviser”)

is responsible for the management of the Fund’s portfolio of securities. Each of the Investment Adviser and the Sub-Adviser is a

wholly-owned subsidiary of Guggenheim Partners, LLC (“Guggenheim Partners”). Guggenheim Partners is a diversified financial

services firm with wealth management, capital markets, investment management and proprietary investing businesses, whose clients are a

mix of individuals, family offices, endowments, investment funds, foundations, insurance companies and other institutions that have entrusted

Guggenheim Partners with the supervision of approximately $310 billion of assets as of December 31, 2023. Guggenheim Partners is headquartered

in Chicago and New York with a global network of offices throughout the United States, Europe, and Asia. The Investment Adviser and the

Sub-Adviser are referred to herein collectively as the “Adviser.”

Investment

Parameters. The Fund may allocate its assets among a wide variety of Income Securities and Common Equity Securities. The Fund

may invest without limitation in below-investment grade securities (e.g., securities rated below Baa3 by Moody’s Investors Service,

Inc., below BBB- by Standard & Poor’s Ratings Group or Fitch Ratings or comparably rated by another nationally recognized statistical

rating organization or, if unrated, determined by the Sub-Adviser to be of comparable quality). Below investment grade securities are

commonly referred to as “high-yield” or “junk” bonds and are considered speculative with respect to the issuer’s

capacity to pay interest and repay principal. The Fund’s investments in any of the sectors and types of Income Securities in which

the Fund may invest may include, without limitation, below-investment grade securities. Under normal market conditions, the Fund will

not invest more than: 50% of its total assets in Common Equity Securities consisting of common stock; 30% of its total assets in other

investment companies, including registered investment companies, private investment funds and/or other pooled investment vehicles; 20%

of its total assets in non-U.S. dollar-denominated Income Securities of corporate and governmental issuers located outside the United

States; and 10% of its total assets in Income Securities of issuers in emerging markets.

Common

Shares. The Fund’s currently outstanding Common Shares are, and the Common Shares offered in this Prospectus will be, subject

to notice of issuance, listed on the New York Stock Exchange (the “NYSE”) under the symbol “GOF.” The net asset

value of the Common Shares at the close of business on April 26, 2024 was $11.88 per share and the last sale price of the Common Shares

on the NYSE on such date was $14.55, representing a premium to net asset value of 22.47%. See “Market and Net Asset Value Information.”

Financial

Leverage. The Fund may seek to enhance total returns as well as the level of its current distributions by utilizing financial

leverage through, among other things: (i) the issuance of preferred shares (“Preferred Shares”), (ii) borrowing, the issuance

of commercial paper or other forms of debt (“Borrowings”), (iii) reverse repurchase agreements, dollar rolls or similar transactions

or (iv) a combination of the foregoing (collectively, “Financial Leverage”). The Fund may utilize Financial Leverage up to

the limits imposed by the Investment Company Act of 1940, as amended (the “1940 Act”); however, the aggregate amount of Financial

Leverage is not currently expected to exceed 33 1/3% of the Fund’s Managed Assets (as defined herein) after such issuance and/or

borrowing.

The

Fund maintains a committed facility agreement with BNP Paribas Prime Brokerage International, Ltd. (“BNP Paribas”), pursuant

to which the Fund may borrow up to $400 million, with the right to request an increase to $800 million. As of November 30, 2023 (unaudited),

outstanding Borrowings under the Fund’s committed facility agreement were approximately $49 million, representing approximately

3% of the Fund’s Managed Assets as of such date, and there was approximately $409 million in reverse repurchase agreements outstanding,

representing approximately 20% of the Fund’s Managed Assets as of such date. As of November 30, 2023 (unaudited), the Fund’s

total Financial Leverage represented approximately 23% of the Fund’s Managed Assets.

The

Fund’s use of leverage through reverse repurchase agreements, dollar rolls and economically similar transactions will be included

when calculating the Fund’s Financial Leverage and therefore will be limited by the Fund’s maximum overall Financial Leverage

levels to the extent permitted by the 1940 Act, and may be further limited by the applicable requirements of the SEC discussed herein.

ii

In

addition, the Fund may engage in certain derivatives transactions that have economic characteristics similar to leverage. Subject to Rule

18f-4, the Fund’s obligations under such transactions will not be considered indebtedness for purposes of the 1940 Act, and will

not be included in calculating the aggregate amount of the Fund’s Financial Leverage, but the Fund’s use of such transactions

may be limited by the applicable requirements of the SEC.

The

Fund’s total Financial Leverage may vary significantly over time based on, among other factors, the Sub-Adviser’s assessment

of market and economic conditions, available investment opportunities and cost of Financial Leverage. The Fund has at times used greater

levels of Financial Leverage than on November 30, 2023. The Fund may in the future increase Financial Leverage up to the parameters set

forth herein. On November 30, 2023, the Fund had $49 million in outstanding Borrowings under the Fund’s committed facility agreement.

Although the use of Financial Leverage by the Fund may create an opportunity for increased total return for the Common Shares, it also

results in additional risks and can magnify the effect of any losses. Financial Leverage involves risks and special considerations for

shareholders, including the likelihood of greater volatility of net asset value and market price of and dividends on the Common Shares.

To the extent the Fund increases its amount of Financial Leverage outstanding, it will be more exposed to these risks. The cost of Financial

Leverage, including the portion of the investment advisory fee attributable to the assets purchased with the proceeds of Financial Leverage,

is borne by Common Shareholders. To the extent the Fund increases its amount of Financial Leverage outstanding, the Fund’s annual

expenses as a percentage of net assets attributable to Common Shares will increase. There can be no assurance that a leveraging strategy

will be utilized or, if utilized, will be successful. See “Use of Leverage” and the section of the Fund’s most recent annual report on Form N-CSR entitled “Principal

Risks of the Fund—Financial Leverage and Leveraged Transactions Risk,” which is incorporated by reference herein, for a discussion

of associated risks.

You

should read this Prospectus (and documents incorporated by reference herein), which contains important information about the Fund, together

with any Prospectus Supplement, before deciding whether to invest in the Common Shares of the Fund, and retain these documents for future

reference. A Statement of Additional Information (File No. 811-21982), dated May 3, 2024 (the “SAI”), as supplemented from

time to time, containing additional information about the Fund, has been filed with the SEC and is incorporated by reference in its entirety

into this Prospectus. The SEC maintains an internet site that contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC (http://www.sec.gov). You may request a free copy of the SAI or request other

information about the Fund (including the Fund’s annual and semi-annual reports) or make shareholder inquiries by calling (800)

345-7999 or by writing to the Investment Adviser at Guggenheim Investment Advisors, LLC, 227 West Monroe Street, Chicago, Illinois 60606,

or you may obtain a copy (and other information regarding the Fund) from the SEC’s website (www.sec.gov). Free copies of the Fund’s

reports and the SAI will also be available from the Fund’s website at www.guggenheiminvestments.com/gof. The information contained

in, or that can be accessed through, the Fund’s website is not part of this Prospectus.

The

Fund’s Common Shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured

depository institution and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other

government agency. Investors could lose money by investing in the Fund.

* * *

iii

You should rely only on the information

contained or incorporated by reference in this Prospectus and any accompanying Prospectus Supplement in making your investment decisions.

The Fund has not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. The Fund is not making an offer to sell these securities in any jurisdiction where the offer or

sale is not permitted. You should assume that the information appearing in this Prospectus is accurate only as of the date of this Prospectus.

The Fund’s business, financial conditions and prospects may have changed since such date. The Fund will advise investors of any

material changes to the extent required by applicable law.

________________

FORWARD-LOOKING STATEMENTS

This

Prospectus, including documents incorporated by reference herein, contains or incorporates by reference forward-looking statements,

within the meaning of the federal securities laws, that involve risks and uncertainties. These statements describe the Fund’s

plans, strategies, and goals and the Fund’s beliefs and assumptions concerning future economic and other conditions and the

outlook for the Fund, based on currently available information. In this Prospectus, words such as “anticipates,”

“believes,” “expects,” “objectives,” “goals,” “future,”

“intends,” “seeks,” “will,” “may,” “could,” “should,” and

similar expressions are used in an effort to identify forward-looking statements, although some forward-looking statements may be

expressed differently. The Fund is not entitled to the safe harbor for forward-looking statements pursuant to Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”).

iv

PROSPECTUS SUMMARY

This

is only a summary of information contained elsewhere in this Prospectus. This summary does not contain all of the information that you

should consider before investing in the Fund’s common shares of beneficial interest, par value $0.01 per share (“Common Shares”).

You should carefully read the more detailed information contained elsewhere in this Prospectus and any related Prospectus Supplement(s)

prior to making an investment in the Fund, especially the information set forth under the headings “Investment Objective and Policies”

and “Risks.” You may also wish to request a copy of the Fund’s Statement of Additional Information dated May 3, 2024

(the “SAI”), as supplemented from time to time, which contains additional information about the Fund.

| |

|

| The Fund |

Guggenheim Strategic Opportunities Fund (the “Fund”)

is a diversified, closed-end management investment company that commenced operations on July 26, 2007. The Fund’s objective is to

maximize total return through a combination of current income and capital appreciation. The Fund pursues a relative value-based investment

philosophy, which utilizes quantitative and qualitative analysis to seek to identify securities or spreads between securities that deviate

from their perceived fair value and/or historical norms.

The Fund’s common shares of beneficial interest, par value

$0.01 per share, are called “Common Shares” and the holders of Common Shares are called “Common Shareholders”

throughout this Prospectus and any accompanying Prospectus Supplement(s). |

| The Offering |

The Fund may offer, from time to time, up to $850,000,000 aggregate

initial offering price of Common Shares, in one or more offerings in amounts, at prices and on terms to be set forth in one or more supplements

to this Prospectus (each, a “Prospectus Supplement”).

The Fund may offer Common Shares (1) directly to one or more purchasers,

(2) through agents that the Fund may designate from time to time, or (3) to or through underwriters or dealers. The Prospectus Supplement

relating to a particular offering will identify any agents or underwriters involved in the sale of Common Shares, and will set forth any

applicable purchase price, fee, commission or discount arrangement between the Fund and agents or underwriters or among underwriters or

the basis upon which such amount may be calculated. The Fund may not sell Common Shares through agents, underwriters or dealers without

delivery of this Prospectus and a Prospectus Supplement describing the method and terms of the offering of Common Shares. See “Plan

of Distribution.” |

| Use of Proceeds |

The Fund intends to invest the net proceeds of the offering of Common Shares in accordance with its investment objective and policies as stated in the accompanying Prospectus Supplement or otherwise invest the net proceeds as follows. It is currently anticipated that the Fund will be able to invest most of the net proceeds of an offering of Common Shares in accordance with its investment objective and policies within three months after the receipt of such proceeds. Pending such investment, it is anticipated that the proceeds will be invested in U.S. government securities or high quality, short-term money-market securities. The Fund may also use the proceeds for working capital purposes, including the payment of distributions, interest and operating expenses. A portion of the cash held by the Fund, including net proceeds of the offering, is usually used to pay distributions in accordance with the Fund’s distribution policy and may be a return of capital, which is in effect a partial return of the amount a Common Shareholder invested in the Fund. Common Shareholders who receive the payment of a distribution consisting of a return of capital may be under the impression that they are receiving net investment income or profit when they are not. The Fund’s distributions may be greater than the Fund’s net investment income or profit. If the Fund does not offer or sell Common Shares, the Fund may not be able to maintain distributions at historical levels. |

1

| Investment Objective |

The Fund’s investment objective is to maximize

total return through a combination of current income and capital appreciation. The Fund cannot ensure investors that it will achieve

its investment objective. The Fund’s investment objective is considered fundamental and may not be changed without the approval

of Common Shareholders. |

| Principal Investment Strategies |

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Principal Investment Strategies,” which is incorporated by reference

herein, for a discussion of the Fund’s principal investment strategies. |

| Investment Portfolio |

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Portfolio Composition,” which is incorporated by reference herein,

for a discussion of the types of securities and other instruments in which the Fund will or may ordinarily invest. |

| Financial Leverage and Leveraged Transactions |

The Fund may seek to enhance total returns as well as the level

of its current distributions by utilizing financial leverage through, among other things: (i) the issuance of preferred shares (“Preferred

Shares”), (ii) borrowing or the issuance of commercial paper or other forms of debt (“Borrowings”), (iii) reverse

repurchase agreements, dollar rolls or similar transactions or (iv) a combination of the foregoing (“leveraged transactions”

and collectively, “Financial Leverage”). The Fund may utilize Financial Leverage up to the limits imposed by the Investment

Company Act of 1940, as amended (the “1940 Act”); however, the aggregate amount of Financial Leverage is not currently

expected to exceed 33 1/3% of the Fund’s Managed Assets (as defined herein) after such issuance and/or borrowing.

The Fund maintains a committed facility

agreement with BNP Paribas Prime Brokerage International, Ltd., pursuant to which the Fund may borrow up to $400 million (with the

right to request an increase to $800 million). As of November 30, 2023 (unaudited), outstanding Borrowings under the Fund’s

committed facility agreement were approximately $49 million, which represented approximately 3% of the Fund’s Managed Assets

as of such date, and there was approximately $409 million in reverse repurchase agreements outstanding, which represented approximately

20% of the Fund’s Managed Assets as of such date. As of November 30, 2023 (unaudited), the Fund’s total Financial Leverage

represented approximately 23% of the Fund’s Managed Assets.

The Fund’s

use of leverage through reverse repurchase agreements, dollar rolls and economically similar transactions will be included when calculating

the Fund’s Financial Leverage and therefore will be limited by the Fund’s maximum overall Financial Leverage levels to

the extent permitted by the 1940 Act, and may be further limited by the applicable requirements of the SEC discussed herein.

In addition, the

Fund may engage in certain derivatives transactions that have economic characteristics similar to leverage. The Fund’s obligations

under such transactions will not be considered indebtedness for purposes of the 1940 Act and will not be included in calculating

the aggregate amount of the Fund’s Financial Leverage, but the Fund’s use of such transactions may be limited by the

applicable requirements of the SEC.

The Fund’s total Financial

Leverage may vary significantly over time based on, among other factors, the Sub-Adviser’s assessment of market and economic

conditions, available investment opportunities and cost of Financial Leverage. The Fund has at times used greater levels of Financial

Leverage than on November 30, 2023. The Fund may in the future increase Financial Leverage up to the parameters set forth herein.

Although the use of Financial Leverage and leveraged transactions by the Fund may create an opportunity for increased total return

for Common Shares, it also results in additional risks and can magnify the effect of any losses. Financial Leverage and the use of

leveraged transactions involve risks and special considerations for |

|

2

| |

|

| |

shareholders, including the likelihood of greater volatility of net asset value and market price of and dividends on the Common Shares. To the extent the Fund increases its amount of Financial Leverage and leveraged transactions outstanding, it will be more exposed to these risks. The cost of Financial Leverage and leveraged transactions, including the portion of the investment advisory fee attributable to the assets purchased with the proceeds of Financial Leverage and leveraged transactions, is borne by Common Shareholders. To the extent the Fund increases its amount of Financial Leverage outstanding, the Fund’s annual expenses as a percentage of net assets attributable to Common Shares will increase. There can be no assurance that a leveraging strategy will be utilized or, if utilized, will be successful. See “Use of Leverage” and the section of the Fund’s most recent annual report on Form N-CSR entitled “Principal Risks of the Fund—Financial Leverage and Leveraged Transactions Risk,” which is incorporated by reference herein for a discussion of associated risks. |

| Temporary Investments |

At any time when a temporary posture is believed by the Sub-Adviser to be warranted (a “temporary period”), the Fund may, without limitation, hold cash or invest its assets in money market instruments and repurchase agreements in respect of those instruments. The Fund may not achieve its investment objective during a temporary period or be able to sustain its historical distribution levels. See “The Fund’s Investments—Temporary Investments.” |

| Management of the Fund |

Guggenheim Funds Investment Advisors, LLC acts as the Fund’s

Investment Adviser pursuant to an advisory agreement with the Fund (the “Advisory Agreement”). Pursuant to the Advisory Agreement,

the Investment Adviser is responsible for the management of the Fund and administers the affairs of the Fund to the extent requested by

the board of trustees of the Fund (the “Board of Trustees” or the “Board”). As compensation for its services,

the Fund pays the Investment Adviser a fee, payable monthly in arrears at an annual rate equal to 1.00% of the Fund’s average daily

Managed Assets. “Managed Assets” for purposes of calculating the fees payable under the Advisory and Sub- Advisory Agreements

(as defined herein) means the total assets of the Fund (other than assets attributable to any investments by the Fund in Affiliated Investment

Funds), including the assets attributable to the proceeds from any borrowings or other forms of Financial Leverage, minus liabilities,

other than liabilities related to any Financial Leverage. “Affiliated Investment Funds” means investment companies, including

registered investment companies, private investment funds and/or other pooled investment vehicles, advised or managed by the Fund’s

investment Sub-Adviser or any of its affiliates. “Managed Assets” for all other purposes means the total assets of the Fund,

including the assets attributable to the proceeds from any borrowings or other forms of Financial Leverage, minus liabilities, other than

liabilities related to any Financial Leverage. Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Principal Risks of the Fund,” which is incorporated by reference herein, for a discussion of associated

risks.

Guggenheim Partners Investment Management, LLC acts as the Fund’s

Sub-Adviser pursuant to a sub-advisory agreement with the Fund and the Investment Adviser (the “Sub-Advisory Agreement”).

Pursuant to the Sub-Advisory Agreement, the Sub-Adviser is responsible for the management of the Fund’s portfolio of securities.

As compensation for its services, the Investment Adviser pays the Sub-Adviser a fee, payable monthly in arrears at an annual rate equal

to 0.50% of the Fund’s average daily Managed Assets, less 0.50% of the Fund’s average daily assets attributable to any investments

by the Fund in Affiliated Investment Funds. |

3

| |

Each of the Investment Adviser and the Sub-Adviser are wholly-owned

subsidiaries of Guggenheim Partners, LLC (“Guggenheim Partners”). Guggenheim Partners is a diversified financial services

firm with wealth management, capital markets, investment management and proprietary investing businesses, whose clients are a mix of individuals,

family offices, endowments, investment funds, foundations, insurance companies and other institutions that have entrusted Guggenheim Partners

with the supervision of approximately $310 billion of assets as of December 31, 2023. Guggenheim Partners is headquartered in Chicago

and New York with a global network of offices throughout the United States, Europe, and Asia.

References to the “Adviser” may include the Investment

Adviser or the Sub-Adviser, as applicable.

See “Management of the Fund.” |

| Distributions |

The Fund intends to pay substantially all of its net investment

income to Common Shareholders through monthly distributions. In addition, the Fund intends to distribute any net long-term capital gains

to Common Shareholders as long-term capital gain dividends at least annually. The Fund expects that distributions paid on the Common Shares

will generally consist of (i) investment company taxable income taxed as ordinary income, which includes, among other things, dividend

and interest income accrued on portfolio assets, short-term capital gain and income from certain hedging and interest rate transactions,

(ii) qualified dividend income, (iii) long-term capital gain and (iv) return of capital. Distributions may be paid by the Fund from any

permitted source and, from time to time, all or a portion of a distribution may be a return of capital. To the extent the Fund receives

dividends with respect to its investments in Common Equity Securities that consist of qualified dividend income (income from domestic

and certain foreign corporations), a portion of the Fund’s distributions to its Common Shareholders may consist of qualified dividend

income. The Fund cannot assure you, however, as to what percentage of the dividends paid on Common Shares, if any, will consist of qualified

dividend income or long-term capital gains, which are taxed at lower rates for individuals than ordinary income. In certain circumstances,

the Fund may elect to retain income or capital gain and pay income or excise tax on such undistributed amount. Alternatively, the distributions

paid by the Fund for any particular month may be more than the amount of net investment income from that monthly period. As a result,

all or a portion of a distribution may be a return of capital, which is in effect a partial return of the amount a Common Shareholder

invested in the Fund. For U.S. federal income tax purposes, a return of capital distribution is generally not taxable up to the amount

of the Common Shareholder’s tax basis in their Common Shares and would reduce such tax basis, and any amounts exceeding such basis

will be treated as a gain from the sale of their Common Shares. Although a return of capital may not be taxable, it will generally increase

the Common Shareholder’s potential gain, or reduce the Common Shareholder’s potential loss, on any subsequent sale or other

disposition of Common Shares. Common Shareholders who receive the payment of a distribution consisting of a return of capital may be under

the impression that they are receiving net investment income or profits when they are not. Common Shareholders should not assume that

the source of a distribution from the Fund is net investment income or profit. See “Distributions” and “U.S. Federal

Income Tax Considerations.”

The Fund’s distribution rate is not constant and the amount

of distributions, when declared by the Fund’s Board of Trustees, is subject to change. There is no guarantee of any future distribution

or that the current returns and distribution rate will be maintained.

If you hold your Common Shares in your own name or if you hold

your Common Shares with a brokerage firm that participates in the Fund’s Dividend Reinvestment Plan (the “Plan”), unless

you elect to receive cash, all dividends and distributions that are declared by the Fund will be automatically reinvested in additional

Common Shares of the Fund |

4

| |

pursuant to the Plan. If you hold your Common Shares with a brokerage firm that does not participate in the

Plan, you will not be able to participate in the Plan and any dividend reinvestment may be effected on different terms than those described

above. Consult your financial adviser for more information. See “Dividend Reinvestment Plan.” |

| Listing and Symbol |

The Fund’s currently outstanding Common Shares are, and the Common Shares offered by this Prospectus will be, subject to notice of issuance, listed on the New York Stock Exchange (the “NYSE”) under the symbol “GOF.” The net asset value of the Common Shares at the close of business on April 26, 2024 was $11.88 per share and the last reported sale price of the Common Shares on the NYSE on such date was $14.55, representing a premium to net asset value of 22.47%. |

| Special Risk Considerations |

An investment in Common Shares of the Fund involves special risk considerations. Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Principal Risks of the Fund,” which is incorporated by reference herein, for a discussion of the risks associated with an investment in the Fund. You should carefully consider these risks together with all of the other information contained in this Prospectus, including the section of this Prospectus entitled “Risks” beginning on page 32, before making a decision to purchase the Fund’s Common Shares. |

| Anti-Takeover Provisions in the Fund’s Governing Documents |

The Fund’s Amended and Restated Agreement and Declaration of Trust (the “Declaration of Trust”) and the Fund’s Bylaws, each as may be amended and/or restated from time to time (collectively, the “Governing Documents”), include provisions that could limit the ability of other entities or persons to acquire control of the Fund or convert the Fund to an open-end fund. These provisions could have the effect of depriving the Common Shareholders of opportunities to sell their Common Shares at a premium over the then-current market price of the Common Shares. See “Anti-Takeover and Other Provisions in the Fund’s Governing Documents” and “Risks—Anti- Takeover Provisions.” |

| Administrator, Custodian, Transfer Agent and Dividend Disbursing Agent |

The Bank of New York Mellon acts as the custodian of the Fund’s assets pursuant to a custody agreement. Under the custody agreement, the custodian holds the Fund’s assets in compliance with the 1940 Act. For its services, the custodian receives a monthly fee based upon, among other things, the average value of the total assets of the Fund, plus certain charges for securities transactions. |

| |

Computershare Inc. acts as the Fund’s dividend disbursing agent, transfer agent and registrar with respect to the Common Shares of the Fund, and Computershare Trust Company, N.A. acts as agent under the Fund’s Dividend Reinvestment Plan (the “Plan Agent”). |

| |

MUFG Investor Services (US) LLC (“MUFG”) acts as the Fund’s administrator and fund accounting agent. Pursuant to an administration agreement, MUFG provides certain administrative services to the Fund. Pursuant to an accounting and administration agreement, MUFG is responsible for maintaining the books and records of the Fund’s securities and cash. For its services, MUFG receives a monthly fee based upon the average daily Managed Assets of the Fund. |

5

SUMMARY OF FUND EXPENSES

The

following table contains information about the costs and expenses that Common Shareholders will bear directly or indirectly. The table

is based on the capital structure of the Fund as of November 30, 2023 (unaudited) (except as noted below). The purpose of the table and

the example below is to help you understand the fees and expenses that you, as a Common Shareholder, would bear directly or indirectly.

The following table should not be considered a representation of the Fund’s future expenses. Actual expenses may be greater or less