UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange

Act of 1934

(Amendment No. __)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

GENWORTH FINANCIAL, INC.

(Name of Registrant as Specified in Its Charter)

SCOTT KLARQUIST

(Name of Persons(s) Filing Proxy Statement, if Other Than the

Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the form or schedule and the date of

its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 7, 2022

PROXY STATEMENT OF SCOTT KLARQUIST

_________________________, 2022

Dear Fellow Genworth Financial, Inc. Shareholders:

The undersigned, Scott Klarquist ("Mr Klarquist", "I" or "me"),

currently owns 30,100 shares of Genworth Financial, Inc., a Delaware

corporation ("Genworth", "GNW" or the "Company"). As a shareholder of

Genworth as far back as 2016 and an author of several (in my humble

opinion) prescient analyses of our Company publicly available on the

Internet*, I have sought to engage with the Company's Board of

Directors (the "Board") to improve the corporate governance at the

Company by submitting my nomination as a director candidate for the

2022 Annual Meeting. Unfortunately, the Company declined to nominate me

without having even a single member of Genworth's Nominating and

Corporate Governance Committee contact me (let alone interview me, even

via a simple 15-minute phone call or Zoom meeting).

The Board has determined to re-nominate for election to the Board at

the Company's 2022 annual meeting of shareholders (the "Annual

Meeting") the following members of the Company's Compensation

Committee: Karen E. Dyson, Jill R. Goodman, Melina E. Higgins and

Robert P. Restrepo Jr., (collectively, the "Compensation Committee

Directors"). As further discussed in the attached Proxy Statement, I

believe that Genworth's senior executive compensation system is

seriously flawed and that the continued presence on the Board of the

Compensation Committee Directors has and will continue to harm the

Company's operating performance and stock price.

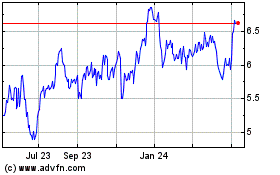

To take just one obvious data point, consider that Genworth's CEO

James McInerney has been awarded $70 million in total compensation

by our Board since he took office on January 1, 2013 (including $30

million in total cash compensation), while during that period

shareholders have suffered a total loss of 50% on their investment

in GNW stock.

All during a raging bull market, with the S&P 500 up 220% plus

dividends! This largesse to the CEO is all the more insulting to

Genworth shareholders in light of his irrational insistence on backing

no less than 17(!) extensions of the doomed China Oceanwide merger

without any ticking or termination fee

, resulting in the waste of untold millions of shareholder funds and

thousands of Genworth employee man-hours. Clearly something is amiss.

Since I am not proposing an alternate slate of directors, the election

is uncontested despite my opposition to the Compensation Committee

Directors. However, the Company has a director resignation policy in

place for uncontested elections, whereby any nominee in an uncontested

election who does not receive a majority of votes cast shall promptly

tender his or her resignation from the Board of Directors following the

certification of the stockholder vote. Under the policy, the Nominating

and Corporate Governance Committee will assess the appropriateness of

the nominee continuing to serve as a director and will recommend to the

Board of Directors whether to accept or reject the resignation, or

whether other action should be taken. The Board of Directors will act

on the Nominating Committee's recommendation and publicly disclose its

decision and the reason for the decision.

If my proxy solicitation results in any director failing to receive a

majority of the votes cast for his election, then I believe it would

clearly be inappropriate and inconsistent with contemporary corporate

governance for any such director to continue to serve on the Board. I

believe the failure of the Board to accept any such tendered

resignations that may result from the Annual Meeting would be an

egregious violation of proper corporate governance, and in direct

opposition to a clear shareholder directive.

I urge you to carefully consider the information contained in the

accompanying Proxy Statement and support my efforts by signing, dating

and returning the enclosed BLUE proxy card today to

(A) WITHHOLD your vote on the re-election of the

Compensation Committee Directors as directors at the Annual Meeting

[Proposal 1] and (B) vote AGAINST the Company's

advisory vote on executive compensation [Proposal 2]. The accompanying

Proxy Statement and the enclosed BLUE proxy card are

first being mailed to shareholders on or about [_______] [__], 2022.

If you have already voted for the Company's nominees, you have every

right to change your vote by signing, dating and returning a later

dated BLUE proxy card or by voting in person at the

Annual Meeting.

If you have any questions or require any assistance with your vote,

please reach out to me using the contact information listed below.

Thank you for your support,

/s/ Scott Klarquist

Scott Klarquist

* See Seven Corners Capital's articles from 2017 and 2018 on Seeking

Alpha re GNW.

If you have any questions, require assistance in voting your BLUE

proxy card, or need additional copies of my proxy materials, please

contact Mr Klarquist as follows:

[85 Broad Street, 18th Floor]

New York, NY 10005

(646) 592-0498

Email: info@sevencornerscapital.com

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 7, 2022

2022 ANNUAL MEETING OF SHAREHOLDERS

OF

GENWORTH FINANCIAL, INC.

_________________________

PROXY STATEMENT

OF

SCOTT KLARQUIST

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD TODAY

Scott Klarquist ("Mr Klarquist", "I" or "me") currently owns 30,100

shares of Genworth Financial, Inc., a Delaware corporation ("Genworth",

"GNW" or the "Company"), and seeks your support using the BLUE proxy card at the Company's 2022 annual meeting

of shareholders, scheduled to be held virtually on May 19, 2022, at

9:00 a.m., EST, (including any adjournments, postponements or

continuations thereof and any meeting which may be called in lieu

thereof, the "Annual Meeting"). The BLUE proxy card

will allow shareholders to vote on the following proposals under

consideration at the Annual Meeting:

· Whether to elect nine directors to our Board of Directors (the

"Board"), including the following members of the Company's Compensation

Committee: Karen E. Dyson, Jill R. Goodman, Melina E. Higgins and

Robert P. Restrepo Jr. (collectively, the "Compensation Committee

Directors");

· The advisory vote on the compensation of the Company's named

executive officers;

· The ratification of the appointment of the Company's independent

auditor for the fiscal year ending December 31, 2022; and

· Such other business that is properly brought before the Annual

Meeting.

This Proxy Statement and the enclosed BLUE proxy card

are first being mailed to shareholders on or about [_______] [__],

2022. I am asking you to (A) WITHHOLD

your vote on the re-election of the Compensation Committee Directors as

directors at the Annual Meeting [Proposal 1] and (B) vote AGAINST the Company's advisory vote on the

compensation of the Company's named executive officers [Proposal 2].

Since I am not proposing an alternate slate of directors, the election

is uncontested despite my opposition to the Compensation Committee

Directors. However, the Company has a director resignation policy in

place for uncontested elections, whereby any nominee in an uncontested

election who does not receive a majority of votes cast shall promptly

tender his or her resignation from the Board of Directors following the

certification of the stockholder vote. Under the policy, the Nominating

and Corporate Governance Committee will assess the appropriateness of

the nominee continuing to serve as a director and will recommend to the

Board of Directors whether to accept or reject the resignation, or

whether other action should be taken. The Board of Directors will act

on the Nominating Committee's recommendation and publicly disclose its

decision and the reason for the decision.

1

If this proxy solicitation results in any director failing to receive a

majority of the votes cast for his or her election, then I believe it

would clearly be inappropriate and inconsistent with contemporary

corporate governance for any such director to continue to serve on the

Board. I believe the failure of the Board to accept any such tendered

resignations that may result from the Annual Meeting would be an

egregious violation of proper corporate governance, and in direct

opposition to a clear shareholder directive.

Shareholders are advised that the Company's nine nominees, including

the Compensation Committee Directors, are not my nominees, have not

consented to be named in these proxy materials, and are the nominees of

Genworth. Because the Compensation Committee Directors are not my

nominees and have not consented to be named in this proxy statement,

they are not participants in this solicitation. The names, backgrounds

and qualifications of the Company's nominees, and other information

about them, can be found in the Company's proxy statement. I can

provide no assurance that any of the Company's nominees will serve as

directors if elected or that the Compensation Committee Directors will

submit their resignations if they are elected by a plurality of the

votes cast, but fail to receive a majority.

I intend to vote my shares as follows: WITHHOLD with respect to the

election of the Compensation Committee Directors; FOR all other Company

nominees (other than the Compensation Committee Directors); AGAINST the

approval of the advisory vote on the compensation of the Company's

named executive officers; and FOR the ratification of the Company's

independent auditors for the fiscal year ending December 31, 2022.

Please note, however, that all shares of Common Stock represented by

the enclosed BLUE proxy card will be voted at the Annual Meeting as

marked and, in the absence of specific instructions, will be voted in

accordance with my recommendations and voting instructions specified

herein and in accordance with the discretion of the persons named on

the BLUE proxy card with respect to any other matters that may be voted

upon at the Annual Meeting. Please see the "Voting and Proxy

Procedures" section of this Proxy Statement and the BLUE proxy card for

additional detail.

The Company has set the close of business on March 21, 2022 as the

record date for determining shareholders entitled to notice of and to

vote at the Annual Meeting (the "Record Date"). The mailing address of

the principal executive offices of the Company is 6620 West Broad

Street, Richmond, Virginia 23230. Shareholders of record at the close

of business on the Record Date will be entitled to vote at the Annual

Meeting. As of the Record Date, there were 510,096,390 shares of Common

Stock outstanding.

THIS SOLICITATION IS BEING MADE BY MR KLARQUIST AND NOT ON BEHALF OF

THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. I AM NOT AWARE OF

ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS

SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH I AM NOT

AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE

THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE

PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

2

I URGE YOU TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD TO (A) WITHHOLD YOUR VOTE ON THE RE-ELECTION OF THE

COMPENSATION COMMITTEE DIRECTORS AS DIRECTORS AT THE ANNUAL MEETING

[PROPOSAL 1] AND (B) VOTE AGAINST THE COMPANY'S

ADVISORY VOTE ON THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE

OFFICERS [PROPOSAL 2].

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY THE COMPANY, YOU MAY

REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS

PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY

ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME

PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF

REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING

AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting-This Proxy Statement and my BLUE proxy card are

available at www.sevencornerscapital.com

3

IMPORTANT

Your vote is important, no matter how few shares of Common Stock

you own. I urge you to sign, date, and return the enclosed BLUE

proxy card today to (A) WITHHOLD your vote on the re-election of

the Compensation Committee Directors as directors at the Annual

Meeting [Proposal 1], (B) vote AGAINST the Company's advisory vote

on the compensation of the Company's named executive officers

[Proposal 2], and (C) in accordance with my recommendations on the

other proposal(s) on the agenda for the Annual Meeting.

· If your shares of Common Stock are registered in your own name,

please sign and date the enclosed BLUE proxy card and return it to me

in the enclosed postage-paid envelope today.

· If your shares of Common Stock are held in a brokerage account

or bank, you are considered the beneficial owner of the shares of

Common Stock, and these proxy materials, together with a BLUE voting

form, are being forwarded to you by your broker or bank. As a

beneficial owner, if you wish to vote, you must instruct your broker,

trustee or other representative how to vote. Your broker cannot vote

your shares of Common Stock on your behalf without your instructions.

As a beneficial owner, you may vote the shares at the Annual Meeting

only if you obtain a legal proxy from the broker or bank giving you the

rights to vote the shares.

· Depending upon your broker or custodian, you may be able to vote

either by toll-free telephone or by the Internet. Please refer to the

enclosed voting form for instructions on how to vote electronically.

You may also vote by signing, dating and returning the enclosed voting

form.

Since only your latest dated proxy card will count, I urge you not to

return any proxy card you receive from the Company. Even if you return

the Company proxy card marked "withhold" as a protest against the

incumbent directors, it will revoke any proxy card you may have

previously sent to us. So please make certain that the latest dated

proxy card you return is the BLUE proxy card.

If you have any questions, require assistance in voting your BLUE

proxy card, or need additional copies of my proxy materials, please

contact Mr Klarquist as follows:

[85 Broad Street, 18th Floor]

New York, NY 10005

(646) 592-0498

Email: info@sevencornerscapital.com

4

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events leading up to this

proxy solicitation:

· In late March 2021, Mr Klarquist acquired 100 shares of the

Company's common stock and subsequently transferred these shares into

record ownership.

· On February 2, 2022, Mr. Klarquist delivered a notice of his

intent to nominate himself as a candidate for election to the Board at

the 2022 Annual Meeting (the "Nomination Notice"), stating in the

notice that "while I do not currently intend to solicit proxies for the

2022 annual meeting, I reserve the right to change this decision at a

later date."

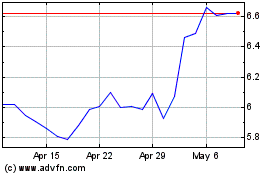

· Two days later, on February 4, 2022, Compensation Committee

Director Restrepo purchased 50,000 shares of GNW stock on the open

market, his first such open market purchase of the Company's stock

since joining the Board in 2016.

· On February 11, 2022, the company delivered notice to Mr.

Klarquist that his Nomination Notice did not comply with the

requirements for notices of director nominations contained in the

company's bylaws. The company also provided the company's standard

directors' and officers' questionnaire, as requested by Mr. Klarquist

in his February 2 letter. The next day, on February 12, 2022, Mr

Klarquist responded to the Company's corporate secretary as follows:

"[M]ost (if not all) of the items you claim are "missing" are actually

points about which you are either confused or incorrect. Nevertheless,

while maintaining that there's nothing "missing" in the nomination

letter, I will attempt to re-submit by your deadline in order to make

things more clear for you."

· On February 14, 2022, Mr. Klarquist provided the company with

supplemental information regarding his Nomination Notice.

· On February 15, 2022, the company informed Mr. Klarquist that

his Nomination Notice, as supplemented, continued to not comply with

the requirements for notices of director nominations contained in the

company's bylaws.

· On February 16, 2022, Mr. Klarquist provided the company with

supplemental information regarding his Nomination Notice and a

completed directors' and officers' questionnaire. Mr Klarquist also

made the following request to the Company's corporate secretary:

"Please let me know ASAP when I can speak to any of the so-called

"independent" members of GNW's Governance & Nominating Committee

about my candidacy (since I'm certain they are all in favor of

best-in-class corporate governance, no doubt they will be eager to

interview me given my expertise in identifying companies [like

Genworth] with sub-optimal governance practices). I am available

anytime this week or next to do a Zoom call with them." The Company

never responded to Mr Klarquist's request and offer to meet.

· On March 2, 2022, the company informed Mr. Klarquist that the

Nominating and Corporate Governance Committee had determined not to

recommend his name for election to the Board and that the company

intended to disclose the Nomination Notice in this Proxy Statement.

· On March 11, 2022, Mr. Klarquist informed the company that he

intended to solicit proxies from certain of the company's stockholders.

· On March 14, 2022, Mr. Klarquist submitted a books and records

demand pursuant to Section 220 of the Delaware General Corporation Law,

requesting certain information regarding the record and beneficial

owners of GNW stock in order to communicate with them regarding the

2022 Annual Meeting (the "Books and Records Demand"), and further

notified the company that he had acquired 10,000 shares of the

company's Class A Common Stock.

· On March 18, 2022, Mr. Klarquist informed the company that he

intended to solicit stockholders to vote against the company's director

nominees, rather than in favor of his own candidacy.

· On March 21, 2022, the company responded to the Books and

Records Demand, demanding the payment from Mr Klarquist in advance of

an unspecified amount of money to the Company in order for him to

receive any of the requested books and records.

· On March 23, 2022, Mr. Klarquist informed the company that he

would agree not to solicit any proxies for the 2022 Annual Meeting if

the company agreed to provide him with a subset of the requested books

and records at no cost to him.

· On March 24, 2022, the Company's counsel responded to Mr

Klarquist, again demanding an advance payment (total amount still

unspecified, but approximately $500 for the list of GNW shareholders of

record) for any books and records.

· Later on March 24, 2022, Mr. Klarquist responded to the

company's counsel as follows: "I guess we've reached a deadlock on all

of this & I don't want to waste any more time with fruitless

back-and-forth emails (GNW clearly is not willing to be reasonable), so

I don't see any need to communicate any further on the above points."

· On March 28, 2022, the Company filed its preliminary proxy

statement with respect to the 2022 Annual Meeting.

· On April 5, 2022, the Company filed a revised version of its

preliminary proxy statement with respect to the 2022 Annual Meeting.

Also on April 5, 2022, Mr Klarquist acquired an additional 20,000

shares of the company's Class A Common Stock.

· On April 6, 2022, the Company filed a its definitive

proxy statement with respect to the 2022 Annual Meeting.

Also on April 6, 2022, Mr Klarquist filed an open letter to GNW

shareholders on Form DFAN14A. On April 7, 2022, Mr Klarquist filed his preliminary

proxy statement with respect to the 2022 Annual Meeting.

7

REASONS FOR THE SOLICITATION

Genworth's Compensation Committee Directors Have Failed

Shareholders and Need to be Removed

Incentives determine outcomes. As Charlie Munger has said, "Never,

ever, think about something else when you should be thinking about the

power of incentives." By far the most important incentives for any

corporate executive are the terms of such executive's short and

long-term compensation. Unfortunately, I believe Genworth's senior

executive compensation makes little sense, due to the decisions made by

Genworth's Compensation Committee, as further

explained herein. Therefore I am soliciting shareholders to vote WITHHOLD with respect to the election of each of

Karen E. Dyson, Jill R. Goodman, Melina E. Higgins and Robert P.

Restrepo Jr.

to the Board at the Annual Meeting, because I believe it will send a

strong message to the Board that shareholders are

dissatisfied with Genworth's executive compensation policies and will

cause it to take action to protect the shareholders' investment in our

Company.

Genworth's executive compensation system regarding its senior officers,

such as Genworth's CEO Thomas E. McInerney, appears to be deeply

flawed.

To take just one obvious data point, consider that Genworth's CEO

James McInerney has been awarded $70 million in total compensation

by our Board since he took office on January 1, 2013 through

December 31, 2021 (including $30 million in total cash

compensation), while during that period shareholders have suffered

a total loss of 50% on their investment in Genworth stock

(including receiving zero dividends).

All during a raging bull market, with the S&P 500 up 220% plus

dividends!

|

CEO McInerney

|

Base Salary

|

Cash Incentive Bonus

|

Stock Awards

|

Option Awards

|

Other Comp

|

TOTAL

|

TOTAL CASH COMP

|

|

2013

|

973,799

|

3,000,000

|

790,000

|

7,056,600

|

165,665

|

11,986,064

|

3,973,799

|

|

2014

|

996,803

|

0

|

1,142,250

|

0

|

557,312

|

2,696,365

|

996,803

|

|

2015

|

1,035,141

|

1,200,000

|

775,000

|

0

|

175,372

|

3,185,513

|

2,235,141

|

|

2016

|

996,804

|

3,000,000

|

4,215,000

|

0

|

328,453

|

8,540,257

|

3,996,804

|

|

2017

|

996,804

|

3,000,000

|

4,443,080

|

0

|

525,327

|

8,965,211

|

3,996,804

|

|

2018

|

996,804

|

2,500,000

|

5,291,240

|

0

|

523,900

|

9,311,944

|

3,496,804

|

|

2019

|

1,000,000

|

2,500,000

|

5,139,528

|

0

|

463,106

|

9,102,634

|

3,500,000

|

|

2020

|

1,000,000

|

2,540,000

|

3,350,874

|

0

|

466,714

|

7,357,588

|

3,540,000

|

|

2021

|

1,000,000

|

3,000,000

|

4,063,966

|

0

|

435,413

|

8,499,379

|

4,000,000

|

|

Totals

|

8,996,155

|

20,740,000

|

29,210,938

|

7,056,600

|

3,641,262

|

69,644,955

|

29,736,155

|

Source: GNW Proxy Statements 2014-2022. Amounts in $.

This largesse to the CEO is all the more insulting to Genworth

shareholders in light of his irrational insistence on backing

no less than 17(!) extensions of the doomed China Oceanwide merger

without any ticking or termination fee (note that Directors Higgins

and Restrepo were both on our Board throughout the entirety of this

fiasco)

, resulting in the waste of untold millions of shareholder funds and

thousands of Genworth employee man-hours. While CEO McInerney likely

enjoys receiving millions in cash compensation per year courtesy of the

shareholders regardless of whether the shareholders win or lose (what

CEO wouldn't?), he apparently is not willing to bet on himself via our

stock, as he has been dumping GNW shares in recent months at a

staggering pace. Per his SEC Form 4 filings, he sold 150,000 shares on

the open market on February 22nd, as well as an additional

1,005,609 shares on March 1st, in each case at a small

fraction of Genworth's reported book value. Clearly something is amiss.

The Company has a director resignation policy in place for uncontested

elections, whereby any nominee for director in a non-contested election

of directors who receives a greater number of votes "withheld" from his

or her election than votes "for" such election shall submit to the

Board a letter of resignation for consideration by the Nominating and

Corporate Governance Committee. The Nominating and Corporate Governance

Committee (excluding any nominee in question if a member thereof) shall

evaluate such offer of resignation in light of the best interests of

the Company and its shareholders and shall recommend to the Board the

action to be taken with respect thereto. The Board shall then act

promptly with respect to the letter of resignation and the Company

shall publicly disclose the decision of the Board.

8

Genworth's Shareholders Will Be Negatively Impacted by the

Ongoing Tenure of the Compensation Committee Directors

Genworth's executive compensation system is only as good as the

decisions collectively made by the Compensation Committee Directors. In

other words, "garbage in, garbage out." Since almost every public

company (including ours) benchmarks its compensation practices against

those of a self-selected peer group, it is instructive to analyze

Genworth's peer group, which includes the following 14 companies (see

page [47] of Genworth's 2022 proxy statement): Aflac, Inc.; American

Financial Group, Inc.; Assurant, Inc.; CNA Financial Corporation; CNO

Financial Group, Inc.; Fidelity National Financial; First American

Financial Corporation; Hanover Insurance Group; Lincoln National

Corporation; MGIC Investment Corporation; Principal Financial Group,

Inc.; Radian Group; Reinsurance Group of America, Inc.; and Unum Group

(collectively, the "Genworth Peer Group"). Unfortunately, the Genworth

Peer Group bears no resemblance to our company as regards market

capitalization, which is usually (in my experience reviewing proxy

statements) a key determinant in identifying peer groups (in addition

to type of business):

ð Current Genworth market cap: $1.9B, versus current Genworth Peer

Group Average Market Cap: $11.3B (smallest, Radian: $3.8B; largest,

Aflac: $41B)

The average market cap of the Genworth Peer Group is over 5X that

of our company (indeed, the smallest market cap in the Genworth

Peer Group is over double that of Genworth)!

In determining executive compensation, Genworth has no business

comparing itself to competitors with market caps that are 2X to 20X

higher; rather, Genworth should compare itself to similar companies in

the $1 billion to $3 billion market cap range, such as mortgage insurer

NMI Holdings Inc, or "NMIH" (current market cap: $1.7B), whose C-suite

executives make about half of the compensation of Genworth's:

|

GNW C-suite Top 5

|

Total GNW 2021 Compensation

|

NMIH C-suite Top 5

|

Total NMIH 2021 Compensation

|

|

McInerney

|

8,499,379

|

Merkle

|

4,970,949

|

|

Sheehan

|

5,579,800

|

Shuster

|

2,824,871

|

|

Gupta

|

11,006,561

|

Pollitzer

|

2,822,604

|

|

Haendiges

|

2,682,654

|

Leatherberry

|

2,436,972

|

|

Bobitz

|

2,229,729

|

Mathis

|

2,338,198

|

|

Total

|

29,998,123

|

Total

|

15,393,594

|

Source:

2022 GNW and NMIH Proxy Statements. Amounts in $.

Perhaps unsurprisingly for a company that appears to prioritize its

shareholders by properly reining in corporate expenses, in 2021 the

ratio of the total compensation of NMIH's CEO to its average

employee was a respectable 28:1, whereas the same ratio for

Genworth's CEO was an outrageous 81:1 (no, not a typo), or 3X that

of NMIH.

(See page 78 of Genworth's 2022 Proxy Statement.) Double or triple

(depending on the metric used) the compensation for a vastly inferior

long-term total shareholder return (during the past five years, NMIH's

stock has outperformed Genworth's by approximately 7,000 basis points)

is not something to write home about-and the buck stops with the

enablers of this nonsense, Genworth's Compensation Committee Directors.

Strangely, per page [35] of Genworth's 2022 Proxy Statement, our

Compensation Committee has retained a compensation consultant (Steven

Hall & Partners, LLC) that has just two employees (per its website)

and appears, based on a full-text search on EDGAR, to have represented

just a handful other public companies over the past year, one of which

(Kohl's) is currently embroiled in a proxy war. The challenger in the

Kohl's contest (Macellum Advisors) said this in its March 18, 2022

proxy statement: "We believe that [Kohl's] Board has approved a poorly

designed executive compensation program that insufficiently ties

rewards to performance". Why haven't the Compensation Committee

Directors hired a more reputable firm for compensation advice, such as

Semler Brossy or F.W. Cook? Is it because a tiny firm such as Steven

Hall & Partners, lacking the scale to offset overhead costs enjoyed

by larger compensation consultancies, might just be a bit more

desperate for fee income and therefore more willing to rubber-stamp

whatever compensation scheme our Board comes up with (no matter how

illogical)?

9

The Specifics of Genworth's Executive Compensation System Raise

Troubling Questions

Upon closer examination of the discussion of executive compensation

contained in Genworth's 2022 proxy statement dated April 6, 2022 (the "Company Proxy")

(which runs a mind-boggling 40 pages), a myriad of troubling questions

are raised regarding the specific metrics and criteria used to

determine the compensation for our Company's NEOs, such as the

following:

· The Company Proxy (Page [41]), Note 1, states: "Mr. Bobitz

resigned from his position as Executive Vice President and General

Counsel effective December 31, 2021, but will remain employed with the

company in an advisory role through June 30, 2022." Why is Mr Bobitz

being paid for 6 months after his resignation? What is he "advising"

on, how much is the Company paying him and how many hours per week is

he required to work?

· The Company Proxy (Page [42]), states: "Genworth also reduced

annual operating expenses by approximately $75million on a run-rate

basis." How is this calculated? The line item for consolidated

"acquisition and operating expenses" for both Q4 2021 and full year

2021 was higher year over year, according to the Company's own

financial statements in its 2021 Form 10-K filing.

· The Company Proxy (Page [43]), states: "U.S. Life business

exceeded expectations in its expense management efforts." What are

these expense management targets and where are they disclosed? Also on

Page [43], we are told: "Investments strategic asset production &

environmental, social & governance investment initiatives exceeded

target goals." Similarly, what are these target goals and where are

they disclosed? Lastly on this page we find a sentence beginning with

the following preamble: "In consideration of the favorable feedback

received on our compensation design over the past three years..." Does

the Company really believe that garnering 84%, 90% & 91%

(respectively) over the past 3 years (and, moreover, with these

percentages trending in the wrong direction) on its executive

compensation advisory votes is "favorable"? This is far below what

Genworth's self-defined "peers" seem to receive (see, e.g., AFLAC,

which had results of 96%, 98% and 97% for the same years).

· The Company Proxy (Page [49]) lists multiple "Key Financial

Objectives" for which Genworth's actual 2021 results either almost

reached or barely exceeded the "maximum" level needed for the highest

possible bonus payment. For example, 2021 LTC In-Force Rate Actions

Gross Incremental Premium Approvals came in at $403 million, less than

1% above the $400 million "maximum" bonus threshold for this test.

Similarly, Enact's 2021 Adjusted Operating Income was $520 million, or

99.4% of the $523 million "maximum" bonus threshold for this metric.

And 2021 Net Investment Income was $3,370 million, or 99.8% of the

"maximum" bonus threshold of $3,377 million.

How likely is it that actual 2021 financial results for so many

different uncorrelated financial metrics could so closely mirror

the precise numbers required in order for Genworth's C-suite

executives to cash in "maximum" short-term bonuses?

On what date in 2021 were these "Key Financial Objectives" established

by our Compensation Committee Directors? Were any of these subsequently

amended? Where are Genworth's 2022 key financial objectives disclosed?

If they aren't, why not?

· The Company Proxy (Page [50]), Note 4, refers to "adjusted

levered operating income" and "average ending Genworth's levered equity

attributable to Enact." How is each of these defined/calculated? Where

is the numerical calculation of the "Operating ROE for Enact" metric

for 2021 in the Company Proxy? Why is it determined over trailing 5

quarters, instead of 4? In addition, why did Genworth's 2020 Proxy

Statement refer to "adjusted unlevered operating income" and "unlevered

equity" (i.e., why did it change for 2021)?

-

The Company Proxy (Page [52]) claims that the 2021 short-term

incentive compensation for CEO McInerney was determined "based

on the achievement of the financial and strategic measures

indicated below", yet no such financial or strategic measures,

nor any percentage weightings for such measures for bonus

purposes, are listed below.

(In last year's proxy statement, such measures appeared, but only

34% of the CEO's annual incentive pay that year was tied to

specific financial metrics, while two-thirds was based on undefined

and unmeasured objectives like "Right Size Organization" and "Close

China Oceanwide Transaction OR Implement Strategic Alternatives"

(truly a Pass/Fail test if one ever existed!)) Our Compensation

Committee Directors also lauded him for "developing and executing a

new strategy after the China Oceanwide transaction" and decided to

grant him a bonus for 2021 equal to 150% of his targeted amount

(why 150%?), when he in fact should have been reprimanded (not

rewarded) by the Board for allowing the China Oceanwide debacle to

drag on so long in the first place.

· The Company Proxy on Pages [52-54] discloses that each of the

five Company NEOs achieved between 135% and 150% of their targeted

bonus for 2021, despite Genworth's stock price appreciating a

pedestrian 7% during the year (well below the S&P 500's total

return).

Apparently, at Genworth nobody in the C-suite ever gets a grade of

"B", they all get either "As" or "A-minuses"!

Talk about grade inflation.

· Any discussion of Genworth's long-term incentive compensation

(on Pages [55-60] of the Company Proxy) is moot, given that the Company

should not be handing out any such compensation to its underperforming

executives (especially in light of how much these executives receive in

aggregate short-term pay). However, it is worth noting that the metrics

seem to change with every three-year cycle (likely conveniently for

C-suite insiders), with the 2019-2021 LTI goal consisting solely of

3-year Consolidated Genworth Adjusted Operating Income (itself a

fatally flawed measure, do to its "self-grading" definition [see

below]), which then changed for the 2020-2022 cycle to (A) Enact &

Genworth Mortgage Insurance Australia Adjusted Operating Income (2/3)

and (B) Net Present Value of Approved Rate Actions (1/3), only to

change once again for 2021-2023 to (x) Consolidated Genworth Adjusted

Operating Income (80%) and (y) Total Shareholder Return (20%).

There is no rhyme or reason to these constantly changing metrics,

nor do they appear to result in any increase in Genworth's

long-term share price, which has been stuck around the $4/share

level for the past 5 years.

· Shareholders should note that the definition of "Genworth

Consolidated Adjusted Operating Income" on Page [57] of the Company

Proxy specifically excludes a laundry list of items for compensation

purposes (virtually all of which might negatively affect the

measurement of such income, rendering the metric practically useless in

gauging true operating performance). These exclusions include "impacts

from in-force reserve changes from future period assumption changes

(e.g. mortality, interest rate, expense, lapse, morbidity), methodology

changes (e.g. changes that would arise from a system conversion),

changes in foreign exchange rates, tax changes based on updated

regulations, guidance, assessments, or refinements related to technical

areas of the Tax Cuts and Jobs Act, legal fees and settlement costs

related to merger & acquisition litigation, any strategic

deal-related expenses (e.g. 3rd party legal, actuarial or reinsurance

support for negotiating or implementing a transaction), and

professional fees related to the implementation of the Long Duration

Targeted Improvements ("LDTI") accounting standard".

The Company even excludes the effect of "strategic transactions in

2021, 2022 or 2023 that are not included in forecast assumptions"

in determining its 3-year LTI operating performance.

· In demonstrating the

Compensation Committee Directors' uncanny ability to needlessly

squander shareholder funds

, the Company Proxy on Pages [65-66] discloses that Genworth (meaning

us, the shareholders) not only paid a so-called "Cash Retention Bonus"

of $3,000,000 to Enact's CEO Gupta in 2021 (aren't his Base Salary plus

various cash and stock bonuses retention payments enough?), but it also

paid a so-called "Cash Separation Payment" of $1,875,000 to Genworth's

former COO Schneider, who quit in January 2021 (in return for quitting,

Mr Schneider also received a pro-rated annual incentive payment of

$468,750, payments related to health benefits of $51,374 and

accelerated RSU vesting with an aggregate value of $753,719).

10

Are the Compensation Committee Directors Just Here for the

Networking and Easy Money?

In light of the foregoing, rational Genworth shareholders should ask

themselves: Who are the Compensation Committee Directors serving on

behalf of, the shareholders (the true owners of the Company) or the

members of Genworth's C-suite? We might conceivably take solace that

the answer is the former if any of the Compensation Committee Directors

had demonstrated a firm commitment to align their financial interests

with those of the shareholders in the past, but in my view this sadly

has not been the case.

None of Compensation Committee Directors Higgins, Dyson or Goodman

has ever purchased a single share of Genworth stock on the open

market, and, while Director Restrepo deserves some credit in

recently buying 50,000 shares, his purchase came two days after I

submitted my director nomination and a proxy contest was suddenly

in prospect. A coincidence? Or was Director Restrepo's purchase

defensive and reactionary?

Prior to the submission of my director nomination, Mr Restrepo had

never bothered to purchase open market shares of Genworth stock since

joining our Board in late 2016.

In addition, each of the Compensation Committee Directors serves on the

boards of various other public and non-public companies, calling into

question their willingness to challenge entrenched management.

Compensation Committee Director Restrepo, for example, also serves on

the boards of RLI Corp (where he made $175,000 in director fees for

2021) and Enact Holdings (thereby earning double director fees courtesy of Genworth

shareholders, since we own 82% of Enact!). Compensation Committee

Director Dyson (the committee chair), on the other hand, serves on the

boards of USAA Federal Savings Bank (since October 2017); CALIBRE

Systems, Inc. (since October 2018); and the Army Emergency Relief

Organization (since 2020). Why rock the boat as a director, if one can

instead rubber-stamp the CEO's lucrative compensation package and

empire-building plans and thereby collect director fees well into the

six figures, while working just a few weeks a year?

Each of Genworth's Compensation Committee Directors, for example,

stands to make a *minimum* of $270,000 in director fees for serving

on our Board (versus $242,000 in 2020), plus additional fees for

serving as a committee chair or board chair-that is, so long as

they don't get ejected from the director suite for being

obstreperous

(the Nomination Committee can simply decline to renominate any such

director at the next annual meeting, perhaps following a not-so-subtle

hint from the CEO).

Lastly, in a strange side note, one of the Compensation Committee

Directors has her age listed incorrectly in Genworth's preliminary

proxy statement. It seems Director Dyson should currently be either 63

or 64 years old (rather than 62), based on her college graduation date

of 1980 (per an article about her on Missouri State's website). One

wonders, what other professional credentials listed in Genworth's

preliminary proxy statement for our Directors will prove to be

inaccurate upon closer examination?

11

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board currently has nine members up for election at the Annual

Meeting, including the Compensation Committee Directors. I am seeking

your support to WITHHOLD your vote on the re-election

of the Compensation Committee Directors as directors

at the Annual Meeting. The names, backgrounds and qualifications of the

Company's nominees, and other information about them, can be found in

the Company's proxy statement.

Since I am not proposing an alternate slate of directors, the election

is considered to be uncontested despite my opposition to the

Compensation Committee Directors. However, the Company has a director

resignation policy in place for uncontested elections, whereby any

director who receives a greater number of votes "withheld" from his or

her election than votes "for" such election must submit to the Board a

letter of resignation for consideration by the Nominating and Corporate

Governance Committee. Under the policy, the Nominating and Corporate

Governance Committee (excluding any nominee in question if a member

thereof) will then evaluate such offer of resignation in light of the

best interests of the Company and its shareholders and recommend to the

Board the action to be taken with respect thereto. Promptly following

receipt of the recommendation of the Nominating and Corporate

Governance Committee, the Board (excluding any nominee in question)

would act with respect to such letter of resignation and shall notify

the nominee of its decision.

If I am successful in soliciting your support to WITHHOLD your vote

from the election of the Compensation Committee Directors such that

each of the Compensation Committee Directors receive more votes

"withheld" from his election than votes "for" his election at the

Annual Meeting, each of the Compensation Committee Directors must

tender his resignation to the Board for consideration by the Nominating

and Corporate Governance Committee. I believe the failure of the Board

to insist on the resignations of the Compensation Committee Directors

in the event they fail to receive a majority of the votes cast for

their election would be in direct opposition to a clear shareholder

directive and inconsistent with the Company's Governance Guidelines.

Shareholders are advised that the Company's nine nominees, including

the Compensation Committee Directors, are not the nominees of Mr

Klarquist, have not consented to be named in these proxy materials, and

are the nominees of Genworth. Because the Compensation Committee

Directors are not my nominees and have not consented to be named in

this proxy statement, they are not participants in this solicitation.

The names, backgrounds and qualifications of the Company's nominees,

and other information about them, can be found in the Company's proxy

statement. This Proxy Statement does not include authority to vote for

the Compensation Committee Directors. Should you choose to vote in

favor of either of the Compensation Committee Directors you must use

the Company's proxy card. I can provide no assurance that any of the

Company's nominees will serve as directors if elected or that the

Compensation Committee Directors will submit their resignations if they

are elected by a plurality of the votes cast, but fail to receive a

majority.

I STRONGLY URGE YOU TO "WITHHOLD" YOUR VOTE FROM THE ELECTION OF

KAREN E. DYSON, JILL R. GOODMAN, MELINA E. HIGGINS AND ROBERT P.

RESTREPO JR.

ON THE ENCLOSED BLUE PROXY CARD.

I MAKE NO RECOMMENDATION WITH RESPECT TO THE ELECTION OF THE OTHER

COMPANY NOMINEES AND INTEND TO VOTE MY SHARES "FOR" THEIR ELECTION.

12

PROPOSAL NO. 2

ADVISORY VOTE TO APPROVE THE COMPENSATION OF THE COMPANY'S NAMED

EXECUTIVE OFFICERS

As discussed in further detail in the Company's proxy statement and

pursuant to Section 14A of the Securities Exchange Act of 1934, as

amended, the Company is asking shareholders to approve, on an advisory

basis, the Company's compensation of its named executive officers.

Accordingly, the Company is asking shareholders to vote FOR the

approval, on an advisory basis, of the compensation of the Company's

named executive officers.

This vote is an advisory vote only and will not be binding on the

Company, the Board of Directors or the Compensation Committee, and will

not be construed as overruling a decision by, or creating or implying

any additional fiduciary duty for, the Board of Directors or the

Compensation Committee. The Compensation Committee will consider the

outcome of the vote when making future compensation decisions for the

Named Executive Officers.

I have serious concerns with the compensation to the Company's named

executive officers and therefore believe shareholders should vote AGAINST this proposal. [SEE DISCUSSION BEGINNING ON

PAGE 8 ABOVE].

I RECOMMEND A VOTE "AGAINST" THE APPROVAL OF THE ADVISORY

RESOLUTION APPROVING THE COMPENSATION OF THE COMPANY'S NAMED

EXECUTIVE OFFICERS AND INTEND TO VOTE MY SHARES "AGAINST" THIS

PROPOSAL.

13

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF

THE INDEPENDENT AUDITOR

As discussed in further detail in the Company's proxy statement, the

Audit Committee of the Board (the "Audit Committee") has selected KPMG

LLP ("KPMG") to act as the Company's independent auditor for the fiscal

year ending December 31, 2022.

According to the Company, none of the Company's certificate of

incorporation, Bylaws or anything else require that the Company's

shareholders approve the appointment of KPMG as the Company's

independent auditor. The Company has stated that the Audit Committee

will consider the results of the shareholder vote for this proposal

and, in the event of a negative vote, will reconsider its selection of

KPMG. Even if the appointment is ratified, the Audit Committee, in its

discretion, may change the appointment at any time during the year if

it determines that a change would be in the best interests of the

Company and its shareholders.

The favorable vote of the holders of a majority of the shares of Common

Stock represented in person or by proxy and entitled to vote on the

proposal at the Annual Meeting is required to ratify the selection of

KPMG.

I MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE

SELECTION OF KPMG AS THE COMPANY'S INDEPENDENT AUDITOR FOR THE

FISCAL YEAR ENDING DECEMBER 31, 2022, AND INTEND TO VOTE MY SHARES

"FOR" THIS PROPOSAL.

14

VOTING AND PROXY PROCEDURES

Shareholders are entitled to one vote for each share of Genworth's

Class A Common Stock (the "Common Stock") held of record on the Record

Date with respect to each matter to be acted on at the Annual Meeting.

Only shareholders of record on the Record Date will be entitled to

notice of and to vote at the Annual Meeting. Shareholders who sell

their shares of Common Stock before the Record Date (or acquire them

without voting rights after the Record Date) may not vote such shares.

Shareholders of record on the Record Date will retain their voting

rights in connection with the Annual Meeting even if they sell such

shares after the Record Date. Based on publicly available information,

Mr Klarquist believes that the only outstanding class of securities of

the Company entitled to vote at the Annual Meeting is the shares of

Common Stock.

Shares of Common Stock represented by properly executed BLUE proxy

cards will be voted at the Annual Meeting as marked and, in the absence

of specific instructions, will be voted WITHHOLD with

respect to the election of the Compensation Committee Directors, FOR all other Company nominees (other than the

Compensation Committee Directors), AGAINST the

advisory resolution approving the compensation of the named executive

officers, and FOR the ratification of the appointment

of KPMG LLP as the independent auditor of the Company for the fiscal

year ending December 31, 2022.

Shareholders are advised that the Company's nine nominees, including

the Compensation Committee Directors, are not the nominees of Mr

Klarquist, have not consented to be named in these proxy materials, and

are the nominees of Genworth. Because the Compensation Committee

Directors are not my nominees and have not consented to be named in

this proxy statement, they are not participants in this solicitation.

The names, backgrounds and qualifications of the Company's nominees,

and other information about them, can be found in the Company's proxy

statement. This Proxy Statement does not include authority to vote for

the Compensation Committee Directors. Should you choose to vote in

favor of either of the Compensation Committee Directors you must use

the Company's proxy card. I can provide no assurance that any of the

Company's nominees will serve as directors if elected or that the

Compensation Committee Directors will submit their resignations if they

are elected by a plurality of the votes cast, but fail to receive a

majority.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be

represented at a duly called meeting in person or by proxy in order to

legally conduct business at the meeting. The presence, in person or by

proxy, of the holders of at least a majority of the shares entitled to

vote at the Annual Meeting will be considered a quorum for the

transaction of business.

Abstentions are counted as present and entitled to vote for purposes of

determining a quorum. If you vote to abstain on one or more proposals,

your shares of Common Stock will be counted as present for purposes of

determining a quorum unless you vote to abstain on all proposals.

According to the Company's proxy statement, abstentions and broker

non-votes (if any) are counted as present for purposes of establishing

a quorum at the Annual Meeting. However, if you hold your shares in

street name and do not provide voting instructions to your broker, your

shares will not be voted on any proposal on which your broker does not

have discretionary authority to vote (a "broker non-vote"). Under

applicable rules, your broker will not have discretionary authority to

vote your shares at the Annual Meeting on any of the proposals.

If you are a shareholder of record, you must deliver your vote by mail,

attend the Annual Meeting in person and vote, vote by Internet or vote

by telephone to be counted in the determination of a quorum.

15

VOTES REQUIRED FOR APPROVAL

Election of Directors

─ The Company has adopted a plurality vote standard for director

elections. However, under the Company's director resignation

policy set forth in its Governance Guidelines, any nominee for director

in a non-contested election of directors who receives a greater number

of votes "withheld" from his or her election than votes "for" such

election must submit to the Board a letter of resignation for

consideration by the Nominating and Corporate Governance Committee. The

Nominating and Corporate Governance Committee (excluding any nominee in

question if a member thereof) will evaluate such offer of resignation

in light of the best interests of the Company and its shareholders and

will recommend to the Board the action to be taken with respect

thereto. The Board will then act promptly with respect to the letter of

resignation and the Company will publicly disclose the decision of the

Board.

Since I am not proposing an alternate slate of directors, the election

is considered to be uncontested despite my opposition to the

Compensation Committee Directors.

Advisory Vote on Executive Compensation

─ According to the Company's proxy statement, the affirmative

vote of a majority of the shares of Common Stock, represented

in person or by proxy at the Annual Meeting and entitled to vote on the

matter, is required to approve of the Company's executive compensation.

The Company's proxy statement notes, however, that this vote is

advisory only and will not be binding. The results of the vote on this

proposal will be taken into consideration by the Company, the Board or

the appropriate committee of the Board, as applicable, when making

future decisions regarding these matters.

Ratification of the Selection of Accounting Firm

─ According to the Company's proxy statement, the affirmative

vote of a majority of the shares of Common Stock, represented

in person or by proxy at the Annual Meeting and entitled to vote on the

matter, is required to ratify the selection of KPMG. The Company's

proxy statement notes, however, that this vote is advisory only and

will not be binding. The results of the vote on this proposal will be

taken into consideration by the Company, the Board or the appropriate

committee of the Board, as applicable, when making future decisions

regarding these matters.

If you sign and submit your BLUE proxy card without specifying how you

would like your shares voted, your shares will be voted in accordance

with my recommendations specified herein and in accordance with the

discretion of the persons named on the BLUE proxy card with respect to

any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Shareholders of the Company may revoke their proxies at any time prior

to exercise by attending the Annual Meeting and voting (although

attendance at the Annual Meeting will not in and of itself constitute

revocation of a proxy) or by delivering a written notice of revocation.

The delivery of a subsequently dated proxy which is properly completed

will constitute a revocation of any earlier proxy. The revocation may

be delivered either to me at the address set forth on the back cover of

this Proxy Statement or to the Company at 6620 West Broad Street,

Richmond, Virginia 23230 or any other address provided by the Company.

Although a revocation is effective if delivered to the Company, I

request that either the original or photostatic copies of all

revocations be mailed to Mr Klarquist at the address set forth on the

back cover of this Proxy Statement so that I will be aware of all

revocations and can more accurately determine if and when proxies have

been received from the holders of record on the Record Date of a

majority of the shares entitled to be voted at the Annual Meeting.

Additionally, I may use this information to contact shareholders who

have revoked their proxies to solicit later dated proxies for a vote to

withhold on the Compensation Committee Directors.

IF YOU WISH TO VOTE WITHHOLD ON THE ELECTION OF THE COMPENSATION

COMMITTEE DIRECTORS TO THE BOARD, PLEASE SIGN, DATE AND RETURN

PROMPTLY THE ENCLOSED BLUE PROXY CARD IN THE POSTAGE-PAID

ENVELOPE PROVIDED.

16

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being

made by Mr Klarquist. Proxies may be solicited by mail, facsimile,

telephone, electronic mail, in person and by advertisements.

The entire expense of soliciting proxies is being borne by Mr

Klarquist. Costs of this solicitation of proxies are currently

estimated to be approximately (A) in cash, up to $12,000 (including,

but not limited to, costs incidental to the solicitation) and (B) in

kind, up to [$150,000 in value of legal & other solicitation

services being performed by Mr Klarquist in his individual capacity, as

opposed to being performed by third-party service providers such as law

firms and proxy solicitors (as is typical in proxy contests)]. Mr

Klarquist estimates that through the date hereof his expenses in

furtherance of, or in connection with, (i) in cash, negligible and (ii)

in kind, [$__,000]. To the extent legally permissible, if I am

successful in its proxy solicitation, I intend to seek reimbursement

from the Company for the expenses I incur in connection with this

solicitation. I do not intend to submit the question of such

reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

[Not applicable]

17

Mr Klarquist beneficially owns 30,100 shares of GNW Class A common

stock (100 shares of record and 30,000 beneficially but not of record).

He disclaims beneficial ownership of shares of Common Stock that he

does not directly own. The shares of Common Stock purchased by Mr

Klarquist were purchased with working capital. Positions in the shares

of Common Stock held in margin accounts may be pledged as collateral

security for the repayment of debit balances in such accounts. Since

other securities are held in such margin accounts in addition to the

Common Stock, it may not possible to determine the amounts, if any, of

margin used to purchase the shares of Common Stock held by Mr Klarquist

any one time.

Except as set forth in this Proxy Statement, (i) during the past ten

(10) years, no Participant has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors); (ii) no

Participant directly or indirectly beneficially owns any securities of

the Company; (iii) no Participant owns any securities of the Company

which are owned of record but not beneficially; (iv) no Participant has

purchased or sold any securities of the Company during the past two

years; (v) no part of the purchase price or market value of the

securities of the Company owned by any Participant is represented by

funds borrowed or otherwise obtained for the purpose of acquiring or

holding such securities; (vi) no Participant is, or within the past

year was, a party to any contract, arrangements or understandings with

any person with respect to any securities of the Company, including,

but not limited to, joint ventures, loan or option arrangements, puts

or calls, guarantees against loss or guarantees of profit, division of

losses or profits, or the giving or withholding of proxies; (vii) no

associate of any Participant owns beneficially, directly or indirectly,

any securities of the Company; (viii) no Participant owns beneficially,

directly or indirectly, any securities of any parent or subsidiary of

the Company; (ix) no Participant or any of his, her or its associates

was a party to any transaction, or series of similar transactions,

since the beginning of the Company's last fiscal year, or is a party to

any currently proposed transaction, or series of similar transactions,

to which the Company or any of its subsidiaries was or is to be a

party, in which the amount involved exceeds $120,000; (x) no

Participant or any of his, her or its associates has any arrangement or

understanding with any person with respect to any future employment by

the Company or its affiliates, or with respect to any future

transactions to which the Company or any of its affiliates will or may

be a party; (xi) no Participant has a substantial interest, direct or

indirect, by securities holdings or otherwise, in any matter to be

acted on at the Annual Meeting; (xii) no Participant holds any

positions or offices with the Company; (xiii) no Participant has a

family relationship with any director, executive officer, or person

nominated or chosen by the Company to become a director or executive

officer; and (xiv) no companies or organizations, with which any of the

Participants has been employed in the past five years, is a parent,

subsidiary or other affiliate of the Company. There are no material

proceedings to which any Participant or any of his, her or its

associates is a party adverse to the Company or any of its subsidiaries

or has a material interest adverse to the Company or any of its

subsidiaries.

18

OTHER MATTERS AND ADDITIONAL INFORMATION

I am unaware of any other matters to be considered at the Annual

Meeting. However, should other matters, which I am not aware of at a

reasonable time before this solicitation, be brought before the Annual

Meeting, the persons named as proxies on the enclosed BLUE proxy card will vote on such matters in their

discretion.

Some banks, brokers and other nominee record holders may be

participating in the practice of "householding" proxy statements and

annual reports. This means that only one copy of this Proxy Statement

may have been sent to multiple shareholders in your household. I will

promptly deliver a separate copy of the document to you if you write to

me using the contact information on the back cover of this proxy

statement. If you want to receive separate copies of my proxy materials

in the future, or if you are receiving multiple copies and would like

to receive only one copy for your household, you should contact your

bank, broker or other nominee record holder, or you may contact me at

the above address and phone number.

The information concerning the Company and the proposals in the

Company's proxy statement contained in this Proxy Statement has been

taken from, or is based upon, publicly available documents on file with

the SEC and other publicly available information. Although I have no

knowledge that would indicate that statements relating to the Company

contained in this Proxy Statement, in reliance upon publicly available

information, are inaccurate or incomplete, to date I have not had

access to the books and records of the Company, was not involved in the

preparation of such information and statements and am not able to

verify such information and statements. All information relating to any

person other than the Participants is given only to my knowledge.

You should not assume that the information contained in this Proxy

Statement is accurate as of any date other than the date of this proxy

statement, and the mailing of this Proxy Statement to shareholders

shall not create any implication to the contrary.

SHAREHOLDER PROPOSALS

According to the Company's proxy statement, for a shareholder proposal

to be considered for inclusion in the Company's proxy statement for the

annual meeting next year, the written proposal must be received by the

Corporate Secretary of the Company at their principal executive offices

no later than [December __, 2022]. If the date of next year's annual

meeting is moved more than 30 days before or after the anniversary date

of the Annual Meeting, the deadline for inclusion of proposals in the

Company's proxy statement is instead a reasonable time before the

Company begins to print and mail its proxy materials.

According to the Company's proxy statement, for a shareholder proposal

that is not intended to be included in the Company's proxy statement

under Rule 14a-8 or for a shareholder to nominate a director for

election to the Board for the annual meeting next year, the shareholder

must give timely notice to the Corporate Secretary of the Company in

accordance with the Company's Bylaws, which, in general, require that

the notice be received by the Corporate Secretary of the Company:

-

Not earlier than [January 19, 2023], and

-

Not later than the close of business on [February 18, 2023].

19

According to the Company's proxy statement, if the date of next year's

annual meeting is moved more than 30 days before or after the

anniversary date of the Annual Meeting, then notice of a shareholder

proposal that is not intended to be included in the Company's proxy

statement under Rule 14a-8 or notice of a director nomination must be

received no later than the close of business on the tenth day following

the day on which notice of the date of such annual meeting is mailed to

the shareholders or the date on which public disclosure of the date of

such annual meeting is made, whichever is first.

CERTAIN ADDITIONAL INFORMATION

I HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY

APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY'S PROXY

STATEMENT RELATING TO THE UPCOMING ANNUAL MEETING BASED ON MY RELIANCE

ON RULE 14A-5(C) UNDER THE EXCHANGE ACT. THIS DISCLOSURE IS EXPECTED TO

INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE

COMPANY'S DIRECTORS AND EXECUTIVE OFFICERS, INFORMATION CONCERNING

EXECUTIVE AND DIRECTOR COMPENSATION, INFORMATION CONCERNING THE

COMMITTEES OF THE BOARD AND OTHER INFORMATION CONCERNING THE BOARD,

INFORMATION CONCERNING CERTAIN RELATIONSHIPS AND RELATED PARTY

TRANSACTIONS, INFORMATION ABOUT THE COMPANY'S INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE I

FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF

THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND

MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy

Statement and the Schedule attached hereto has been taken from, or is

based upon, publicly available information.

________________

Your vote is important. No matter how many or how few shares you

own, please vote WITHHOLD with respect to the election of the

Compensation Committee Directors by marking, signing, dating and

mailing the enclosed BLUE proxy card promptly.

Thank you,

Scott Klarquist

April [__], 2022

20

SCHEDULE I

Below is information regarding persons who beneficially own more than

5% of the Common Shares and the ownership of Common Shares by the

Company's directors and officers.

|

|

|

Beneficial Ownership

|

|

|

|

Name of Beneficial Owner

|

|

Number of

Shares

|

|

Percentage

|

|

Other Non-Management

Director Stock-Based Holdings(1)

|

|

BlackRock, Inc.(2)

|

|

72,937,368

|

|

14.4%

|

|

|

|

The Vanguard Group, Inc.(3)

|

|

55,360,357

|

|

10.9%

|

|

|

|

Thomas J. McInerney

|

|

4,039,625

|

|

*

|

|

|

|

Daniel J. Sheehan IV(4)

|

|

1,522,651

|

|

*

|

|

|

|

Rohit Gupta(4)

|

|

443,166

|

|

*

|

|

|

|

Brian Haendiges(4)

|

|

63,450

|

|

*

|

|

|

|

Ward E. Bobitz(4)

|

|

496,563

|

|

*

|

|

|

|

Kevin D. Schneider(5)

|

|

268,097

|

|

*

|

|

|

|

G. Kent Conrad

|

|

-

|

|

-

|

|

222,832

|

|

Karen E. Dyson

|

|

-

|

|

-

|

|

31,961

|

|

Jill R. Goodman

|

|

-

|

|

-

|

|

29,311

|

|

Melina E. Higgins

|

|

-

|

|

-

|

|

236,913

|

|

Howard D. Mills

|

|

-

|

|

-

|

|

29,311

|

|

Debra J. Perry

|

|

-

|

|

-

|

|

151,403

|

|

Robert P. Restrepo Jr.

|

|

50,000

|

|

*

|

|

151,403

|

|

Elaine A. Sarsynski(6)

|

|

-

|

|

-

|

|

-

|

|

Ramsey D. Smith

|

|

-

|

|

-

|

|

29,311

|

|

All directors and executive officers as a group (15

persons)(7)

|

|

6,208,293

|

|

1.2%

|

|

|

|

|

|

|

*

|

Less than 1%.

|

|

|

|

|

|

|

|

|

|

I-1

IMPORTANT

Tell the Board what you think! Your vote is important. No matter how

many shares of Common Stock you own, please give Mr Klarquist your

proxy to vote WITHHOLD with respect to the election of the Compensation Committee Directors and in accordance

with Mr Klarquist's recommendations on the other proposal(s) on the

agenda for the Annual Meeting by taking three steps:

· SIGNING the enclosed BLUE proxy card;

· DATING the enclosed BLUE proxy card; and

· MAILING the enclosed BLUE proxy card TODAY in the envelope

provided (no postage is required if mailed in the United States).

If any of your shares of Common Stock are held in the name of a

brokerage firm, bank, bank nominee or other institution, only it

can vote such shares of Common Stock and only upon receipt of your

specific instructions.

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet.

Please refer to the enclosed voting form for instructions on how to

vote electronically. You may also vote by signing, dating and returning

the enclosed BLUE voting form.

If you have any questions or require any additional information

concerning this Proxy Statement, please contact Mr Klarquist at the

address set forth

below.

If you have any questions, require assistance in voting your BLUE

proxy card, or need additional copies of my proxy materials, please

contact Mr Klarquist as follows:

[85 Broad Street, 18th Floor]

New York, NY 10005

(646) 592-0498

Email: info@sevencornerscapital.com

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 5, 2022

GENWORTH FINANCIAL, INC.