As filed with the Securities and Exchange Commission on July 31, 2024

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-8

REGISTRATION STATEMENT

Under The Securities Act of 1933

Garmin Ltd.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

Switzerland (State or Other Jurisdiction of Incorporation or Organization) |

|

98-0229227 (IRS Employer Identification No.) |

Mühlentalstrasse 2, 8200 Schaffhausen, Switzerland

(Address of Principal Executive Offices Including Zip Code)

Garmin Ltd. 2005 Equity Incentive Plan

(Full Title of the Plan)

Joshua H. Maxfield

1200 East 151st Street

Olathe, Kansas 66062

(Name and Address for Agent for Service)

(913) 397-8200

(Telephone Number, Including Area Code, of Agent For Service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer

Non-accelerated filer Smaller reporting company

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY NOTE

Garmin Ltd. (the “Registrant”) hereby files this Registration Statement on Form S-8 (the “Registration Statement”) to register an additional 5,000,000 of the Registrant’s Registered Shares, par value $0.10 per share (the “Registered Shares”), under the Garmin Ltd. 2005 Equity Incentive Plan (as amended or amended and restated to date, the “Plan”). Previously filed registration statements on Form S-8 are effective for the Plan. Pursuant to General Instruction E to Form S-8, this Registration Statement incorporates by reference the contents of the Registration Statement on Form S-8 (Registration No. 333-189178) filed by the Registrant on June 7, 2013, plus the Registration Statement on Form S-8 (Registration No. 333-125717) filed by the Registrant on June 10, 2005, including all attachments and exhibits thereto, except to the extent supplemented, amended or superseded by the information set forth herein.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Registrant is subject to the informational and reporting requirements of Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance therewith, files reports, proxy statements and other information with the Securities and Exchange Commission (the “Commission”). The following documents have been filed by the Registrant with the Commission (Commission File No. 001-41118) and are incorporated herein by reference:

All documents filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act subsequent to the date of this Registration Statement, and prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold, will be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents. Any statement contained in any document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or

superseded will not be deemed, except as modified or superseded, to constitute a part of this Registration Statement.

Item 6. Indemnification of Directors and Officers.

Although this area of law is unsettled in Switzerland, the Registrant believes, based on the interpretation of leading Swiss legal scholars, which is a persuasive authority in Switzerland, that, under Swiss law, the Registrant may indemnify the members of its board of directors and its officers unless the indemnification results from a breach of their duties that constitutes gross negligence or intentional breach of duty of the member of the board of directors or officer concerned. The Registrant’s articles of association make indemnification of members of the board of directors and officers and advancement of expenses to defend claims against members of the board of directors and officers mandatory on the part of the Registrant to the fullest extent allowed by Swiss law. Swiss law permits, and the Registrant’s articles of association authorize, the Registrant, or each member of the board of directors or officer individually, to purchase and maintain insurance on behalf of such members of the board of directors and officers. The Registrant has obtained such insurance from one or more third party insurers.

Item 8. Exhibits.

Exhibit Number Description

4.1 Articles of Association of the Registrant, as amended and restated on June 7, 2024 (incorporated by reference to Exhibit 10.2 of the Registrant’s Current Report on Form 8-K, filed on June 11, 2024)

4.2 Organizational Regulations of the Registrant, as amended on October 25, 2019 (incorporated by reference to Exhibit 3.2 of the Registrant’s Amendment No. 1 to Current Report on Form 8-K/A, filed on November 21, 2019)

4.3 Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Exchange Act (incorporated by reference to Exhibit 4.1 of the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 30, 2023, filed on February 21, 2024)

5.1‡ Opinion of Homburger AG, Swiss counsel to the Registrant

23.1‡ Consent of Ernst & Young LLP

23.2‡ Consent of Homburger AG (included in Exhibit 5.1)

24.1‡ Powers of Attorney (included on the signature page of this Registration Statement)

99.1 Garmin Ltd. 2005 Equity Incentive Plan, as amended and restated on June 7, 2024 (incorporated by reference to Exhibit 10.1 of the Registrant’s Current Report on Form 8-K, filed on June 11, 2024)

107‡ Calculation of Filing Fee Tables

‡ Filed herewith.

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933 (the “Securities Act”);

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Olathe, State of Kansas, on this 31st day of July, 2024.

GARMIN LTD.

By: /s/ Clifton A. Pemble

Name: Clifton A. Pemble

Title: President and Chief Executive Officer

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each of the undersigned officers and directors of the Registrant hereby constitutes and appoints Clifton A. Pemble, Douglas G. Boessen, Andrew R. Etkind, and Joshua H. Maxfield, or any of them, each acting alone, as the true and lawful attorney-in-fact or agent, or attorneys-in-fact or agents, for each of the undersigned, with full power of substitution and resubstitution, and in the name, place and stead of each of the undersigned, to execute and file any and all amendments, including post-effective amendments, supplements and exhibits to the Registration Statement and any and all applications or other documents to be filed with the Commission or any state securities commission or other regulatory authority or exchange with respect to the securities covered by the Registration Statement, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing necessary, appropriate or desirable to be done in and about the premises in order to effectuate the same as fully to all intents and purposes as he or she might or could do if personally present, hereby ratifying and confirming all that said attorneys-in-fact and agents, and each of them, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

|

Date: July 31, 2024 |

/s/ Clifton A. Pemble

Clifton A. Pemble

Director, President and Chief Executive Officer (Principal Executive Officer) |

Date: July 31, 2024 |

/s/ Douglas G. Boessen

Douglas G. Boessen

Chief Financial Officer and Treasurer (Principal Financial Officer and Principal Accounting Officer) |

|

|

|

|

Date: July 31, 2024 |

/s/ Min H. Kao

Dr. Min H. Kao

Executive Chairman |

Date: July 31, 2024 |

/s/ Susan M. Ball

Susan M. Ball

Director |

Date: July 31, 2024 |

/s/ Jonathan C. Burrell

Jonathan C. Burrell

Director |

Date: July 31, 2024 |

/s/ Joseph J. Hartnett

Joseph J. Hartnett

Director |

Date: July 31, 2024 |

/s/ Catherine A. Lewis

Catherine A. Lewis

Director |

|

|

|

Confidential To: Garmin Ltd. Mühlentalstrasse 2 8200 Schaffhausen Switzerland |

Homburger AG Prime Tower Hardstrasse 201 CH–8005 Zurich T +41 43 222 10 00 F +41 43 222 15 00 lawyers@homburger.ch |

Zurich, July 31, 2024 |

|

Garmin Ltd. |

Registration Statement on Form S-8 |

We have acted and are acting as Swiss counsel to Garmin Ltd., a stock corporation incorporated under the laws of Switzerland (the Company), in connection with the Registration Statement on Form S-8 (the Registration Statement) to be filed with the United States Securities and Exchange Commission (the SEC) on the date hereof under the Securities Act of 1933, as amended (the Act), with respect to the registration of an additional 5,000,000 registered shares of the Company, each with a nominal value of USD 0.10, that may be delivered pursuant to the Garmin Ltd. 2005 Equity Incentive Plan, as amended and restated on June 7, 2024 (the Plan).

As such counsel, we have been requested to give our opinion as to certain legal matters under Swiss law.

Capitalized terms used herein shall have the meaning attributed to them in the Documents (as defined below) unless otherwise defined herein. The Company's registered shares, each with a nominal value of USD 0.10, are referred to herein as Registered Shares.

This opinion is confined to and given on the basis of the laws of Switzerland in force at the date hereof as currently applied by the Swiss courts. In the absence of explicit statutory law, we base our opinion solely on our independent professional judgment. This opinion is also confined to the matters stated herein and is not to be read as extending, by implication or otherwise, to any document referred to in the Documents (other than listed below) or any other matter.

For purposes of this opinion, we have not conducted any due diligence or similar investigation as to factual circumstances which are or may be referred to in the Documents, and we express no opinion as to the accuracy of representations and warranties of facts set out in the Documents or the factual background assumed therein.

For the purpose of giving this opinion, we have only reviewed originals or copies of the following documents (collectively the Documents):

(a)An electronic copy of the resolutions passed by the shareholders of the Company (the Shareholder Resolution) at the Company's annual general meeting held on June 7, 2024 (the 2024 AGM), as reflected in the minutes of such meeting, regarding the approval of an amendment and restatement of the Plan that, among other things, increased the number of Registered Shares available for issuance under the Plan from 13,000,000 to 18,000,000 Registered Shares (the Plan so amended and restated the Amended and Restated Plan);

(b)an electronic copy of unanimous written resolutions of the Company's board of directors (the Board) dated June 7, 2024 (the Board Resolutions), regarding, among other things, the filing of the Registration Statements with the SEC;

(c)an electronic copy of a Secretary's Certificate dated July 12, 2024, regarding the resolutions Board adopted at its meeting held on February 16, 2024, regarding the approval of the Amended and Restated Plan by the Company's shareholders at the 2024 AGM;

(d)an electronic copy of the Amended and Restated Plan;

(e)an electronic of the Articles of Association (Statuten) of the Company, dated June 7, 2024, in the form as approved by the shareholders at the 2024 AGM and as authenticated by a notary public based on the ascertainment resolutions of the Board adopted at a Board meeting on June 7, 2024 (the Articles of Association);

(f)a copy of the Organizational Regulations (Organisationsreglement) of the Company, dated as of October 25, 2019 (the Organizational Regulations); and

(g)a copy of an online excerpt from the Commercial Register of the Canton of Schaffhausen, Switzerland, for the Company, dated as of July 30, 2024 (the Excerpt).

No documents have been reviewed by us in connection with this opinion other than those listed above. Accordingly, we shall limit our opinion to the Documents and their legal implications under Swiss law.

In this opinion, Swiss legal concepts are expressed in English terms and not in their original language. These concepts may not be identical to the concepts described by the same English terms as they exist under the laws of other jurisdictions.

In rendering the opinion below, we have assumed the following:

(h)all copies, fax copies or electronic versions of the documents produced to us conform to the respective original documents and the originals of such documents were executed in the manner and by the individuals appearing on the respective copies;

(i)all signatures appearing on all original documents or copies thereof which we have examined are genuine;

(j)all factual information contained in, or material statements given in connection with, the Documents are true and accurate;

(k)the filing of the Registration Statement with the SEC has been authorized by all necessary actions under all applicable laws;

(l)the Registration Statement has been filed by the Company with the SEC;

(m)any Registered Shares issued out of the Conditional Share Capital (as defined below) will be listed on the New York Stock Exchange in accordance with applicable laws and regulations;

(n)all authorizations, approvals, consents, licenses, exemptions and other requirements for the filing of the Registration Statement or for any other activities carried on in view of, or in connection with, the performance of the obligations expressed to be undertaken by the Company in the Registration Statement have been duly obtained and are and will remain in full force and effect, and any related conditions to which the parties thereto are subject have been satisfied;

(o)the exercise notice with respect to Registered Shares issued out of Conditional Share Capital will be duly delivered in accordance with Swiss law and the Amended and Restated Plan;

(p)to the extent the Company issues Registered Shares out of Conditional Share Capital, the performance of the contributions in money shall be made at a banking institution subject to the Federal Law of November 8, 1934, Relating to Banks and Savings Banks, as amended, or, in case of performance of the contributions by way of set-off, in accordance with the applicable provisions of the Swiss Code of Obligations;

(q)no Registered Shares have been issued out of the Conditional Share Capital (as defined below) since the date of the Articles of Association;

(r)the Excerpt, the Articles of Association and the Organizational Regulations are correct, complete and up-to-date, and the Amended and Restated Plan is in full force and effect and has not been amended; and

(s)the Shareholder Resolution and the Board Resolutions have been duly resolved in the manner set forth therein, and have not been rescinded or amended and are in full force and effect.

Based on the foregoing and subject to the qualifications set out below, we are of the opinion that:

1.The Company is a corporation (Aktiengesellschaft) duly incorporated and validly existing under the laws of Switzerland, with all requisite corporate power and authority to enter into, perform and conduct its business as described in the Articles of Association.

2.The Company's share capital registered in the Commercial Register of the Canton of Schaffhausen amounts to USD 19,490,096.50, divided into 194,900,965 Registered Shares with a par value of USD 0.10 each. Such Registered Shares have been validly issued, fully paid and are non-assessable.

3.Pursuant to the Company's conditional share capital as included in the Articles of Association (the Conditional Share Capital), the Company's share capital may be increased in an amount not to exceed USD 9,903,870.90 through the issuance of up to 99,038,709 fully paid-up Registered Shares through the exercise of option rights which are granted to employees and/or members of the board of directors of the Company or group companies.

4.The Registered Shares that may be issued from the Conditional Share Capital, if and when such Registered Shares are issued pursuant to the Amended and Restated Plan, and after the nominal amount for such Registered Shares has been paid-in in cash or by way of set-off, will be validly issued, fully paid and non-assessable.

The above opinions are subject to the following qualifications:

(t)The lawyers of our firm are members of the Zurich bar and do not hold themselves out to be experts in any laws other than the laws of Switzerland. Accordingly, we are opining herein as to Swiss law only and we express no opinion with respect to the applicability thereto, or the effect thereon, of the laws of any other jurisdiction.

(u)We note that, under Swiss law, shares issued out of Conditional Share Capital cannot be paid-in by way of contribution in kind.

(v)The exercise of voting rights and rights related thereto with respect to any Registered Shares is only permissible after registration in the Company's share register as a shareholder with voting rights in accordance with the provisions of, and subject to the limitations provided in, the Articles of Association.

(w)We express no opinion as to any commercial, accounting, tax, auditing or other non-legal matters.

(x)We have not investigated or verified the truth or accuracy of the information contained in the Registration Statements, nor have we been responsible for ensuring that no material information has been omitted from the Registration Statement.

(y)Any issuance of the Registered Shares out of Conditional Share Capital must be confirmed by the auditor of the Company, and amended Articles of Association of the Company reflecting the issuance of Registered Shares from Conditional Share Capital, together with said confirmation by the Company's auditor, must be filed with the competent commercial register no later than three months after the end of the Company's fiscal year.

__________

We have issued this opinion as of the date hereof and we assume no obligation to advise you of any changes that are made or brought to our attention hereafter.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

This opinion is governed by and shall be construed in accordance with the laws of Switzerland.

Sincerely yours,

HOMBURGER AG

/s/ David Oser

David Oser

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the Garmin Ltd. 2005 Equity Incentive Plan, as amended and restated on June 7, 2024, of our reports dated February 21, 2024, with respect to the consolidated financial statements and schedule of Garmin Ltd. and Subsidiaries and the effectiveness of internal control over financial reporting of Garmin Ltd. and Subsidiaries, included in its Annual Report (Form 10-K) for the year ended December 30, 2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Kansas City, Missouri

July 31, 2024

0001121788N/AEX-FILING FEES00011217882024-07-312024-07-31000112178812024-07-312024-07-31xbrli:pureiso4217:USD

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Garmin Ltd.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

Security Type |

Security Class Title |

Fee Calculation Rule |

Amount Registered |

Proposed Maximum Offering Price Per Unit |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee |

Equity |

Registered Shares, par value $0.10 per share |

Other |

5,000,000 |

$173.495 |

$867,475,000 |

$147.60 per $1 million |

$128,100 |

Total Offering Amounts |

|

$867,475,000 |

|

$128,100 |

Total Fee Offsets |

|

|

|

$0 |

Net Fee Due |

|

|

|

$128,100 |

The amount registered reflected in Table 1 above represents the maximum number of additional Registered Shares, par value $0.10 per share (the “Registered Shares”), of Garmin Ltd. (the “Registrant”) issuable pursuant to the Garmin Ltd. 2005 Equity Incentive Plan (as amended or amended and restated to date, the “Plan”), being registered on the Registration Statement on Form S-8 (the “Registration Statement”) to which this exhibit relates. Pursuant to Rule 416 of the Securities Act of 1933 (the “Securities Act”), the Registration Statement also covers such additional Registered Shares as may become issuable pursuant to the anti-dilution provisions of the Plan. The proposed maximum offering price per unit and the maximum aggregate offering prices in Table 1 above are estimated solely for the purposes of determining the amount of the registration fee, pursuant to paragraphs (c) and (h) of Rule 457 under the Securities Act, on the basis of the average of the high and low sale prices of the Registered Shares on the New York Stock Exchange on July 25, 2024, which is a date within five business days prior to filing.

Table 2: Fee Offset Claims and Sources

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant or Filer Name |

Form or Filing Type |

File Number |

Initial Filing Date |

Filing Date |

Fee Offset Claimed |

Security Type Associ-ated with Fee Offset Claimed |

Security Title Associ-ated with Fee Offset Claimed |

Unsold Securities Associ-ated with Fee Offset Claimed |

Unsold Aggregate Offering Amount Associated with Fee Offset Claimed |

Fee Paid with Fee Offset Source |

Rule 457(p) |

Fee Offset Claims |

|

|

|

|

|

|

|

|

|

|

|

Fee Offset Sources |

|

|

|

|

|

|

|

|

|

|

|

The Registrant is not relying on Rule 457(p) under the Securities Act to offset any of the filing fee due with respect to the Registration Statement to which this exhibit relates, so no information is provided under this Table 2.

v3.24.2

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_Securities424iNa |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:naItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2

Offerings - Offering: 1

|

Jul. 31, 2024

USD ($)

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Registered Shares, par value $0.10 per share

|

| Amount Registered |

5,000,000

|

| Proposed Maximum Offering Price per Unit |

173.495

|

| Maximum Aggregate Offering Price |

$ 867,475,000

|

| Fee Rate |

0.01476%

|

| Amount of Registration Fee |

$ 128,100

|

| Offering Note |

The proposed maximum offering price per unit and the maximum aggregate offering prices in Table 1 above are estimated solely for the purposes of determining the amount of the registration fee, pursuant to paragraphs (c) and (h) of Rule 457 under the Securities Act, on the basis of the average of the high and low sale prices of the Registered Shares on the New York Stock Exchange on July 25, 2024, which is a date within five business days prior to filing.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

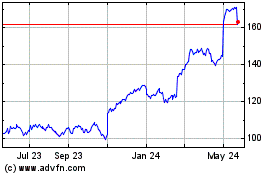

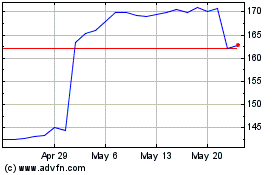

Garmin (NYSE:GRMN)

Historical Stock Chart

From Jul 2024 to Jul 2024

Garmin (NYSE:GRMN)

Historical Stock Chart

From Jul 2023 to Jul 2024