Current Report Filing (8-k)

June 18 2020 - 8:31AM

Edgar (US Regulatory)

false 0001326380 0001326380 2020-06-18 2020-06-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant To Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 18, 2020

GameStop Corp.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-32637

|

|

20-2733559

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

625 Westport Parkway, Grapevine, TX 76051

(817) 424-2000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Class A Common Stock

|

|

GME

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On June 18, 2020, GameStop Corp. (the “Company”) announced that it has extended the date by which tenders must be delivered (the “Early Tender Date”) in order to receive the Early Exchange Consideration (as defined in the Offering Memorandum referred to below) in its previously announced offer to exchange (the “Exchange Offer”) any and all of its outstanding $414.6 million aggregate principal amount of 6.75% Senior Notes due 2021 (the “Existing Notes”) for newly issued 10.00% Senior Secured Notes due 2023 (the “New Notes”) and related solicitation of consents (the “Consent Solicitation”) to certain Proposed Amendments (as defined in the Offering Memorandum) to the indenture governing the Existing Notes. The Early Tender Date was previously 5:00 p.m., New York City time, on June 17, 2020 and will now be extended to 11:59 p.m., New York City time, on July 1, 2020 (the “Expiration Date”), unless extended or the Exchange Offer is otherwise terminated by the Company. Accordingly, eligible holders that tender their Existing Notes prior to the Expiration Date will be eligible to receive the Early Exchange Consideration.

In addition, the Company announced the early tender results of the Exchange Offer and Consent Solicitation. Based on the principal amount of the Existing Notes validly tendered and not validly withdrawn as of 5:00 p.m., New York City time, on June 17, 2020, the requisite number of consents have been received to adopt the Proposed Amendments. The Proposed Amendments will become operative on the settlement date of the Exchange Offer. Pursuant to the terms of the Exchange Offer and Consent Solicitation, the withdrawal deadline has passed.

The Exchange Offer and Consent Solicitation are being made pursuant to the terms and subject to the conditions set forth in the offering memorandum and consent solicitation statement, dated June 4, 2020 (the “Offering Memorandum”), all of which remain unchanged except as provided in the press release issued by the Company attached as Exhibit 99.1 hereto. The Exchange Offer and Consent Solicitation will expire on the Expiration Date, unless extended or earlier terminated by the Company, and are subject to customary conditions. The Expiration Date may be extended at the sole discretion of the Company.

This Current Report on Form 8-K, including the information incorporated by reference herein, is neither an offer to sell nor a solicitation of an offer to buy any of the Existing Notes or the New Notes, nor is the Exchange Offer being made in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities, blue sky or other laws of any such jurisdiction. Additionally, neither the Existing Notes nor the New Notes have been registered under the Securities Act of 1933, as amended, or any state securities laws.

A copy of the press release issued by the Company is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

GAMESTOP CORP.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: June 18, 2020

|

|

|

|

By:

|

|

/s/ James A. Bell

|

|

|

|

|

|

Name:

|

|

James A. Bell

|

|

|

|

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

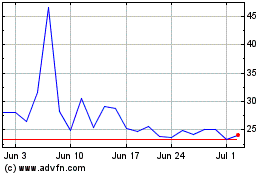

GameStop (NYSE:GME)

Historical Stock Chart

From Jun 2024 to Jul 2024

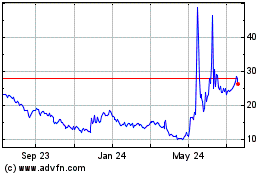

GameStop (NYSE:GME)

Historical Stock Chart

From Jul 2023 to Jul 2024