Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

May 30 2024 - 11:13AM

Edgar (US Regulatory)

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

—

98.9%

Aerospace

—

1.7%

14,000

Allient

Inc.

......................

$

499,520

1,000

L3Harris

Technologies

Inc.

...........

213,100

290,000

Rolls-Royce

Holdings

plc†

...........

1,561,822

2,274,442

Agriculture

—

0.2%

4,000

American

Vanguard

Corp.

...........

51,800

12,000

Limoneira

Co.

....................

234,720

286,520

Automotive

—

3.9%

6,300

Blue

Bird

Corp.†

..................

241,542

4,000

Daimler

Truck

Holding

AG

...........

202,651

4,100

Ferrari

NV

......................

1,787,354

153,800

Iveco

Group

NV†

.................

2,289,794

24,000

Traton

SE

.......................

863,253

5,384,594

Automotive:

Parts

and

Accessories

—

3.3%

50,013

Brembo

SpA

.....................

640,464

100,000

Dana

Inc.

.......................

1,270,000

44,002

Garrett

Motion

Inc.†

...............

437,380

1,800

Linamar

Corp.

...................

95,677

22,000

Modine

Manufacturing

Co.†

..........

2,094,180

4,537,701

Aviation:

Parts

and

Services

—

1.2%

15,500

AAR

Corp.†

.....................

927,985

1,000

Curtiss-Wright

Corp.

...............

255,940

9,000

Ducommun

Inc.†

.................

461,700

1,645,625

Broadcasting

—

3.2%

60,000

Beasley

Broadcast

Group

Inc.,

Cl. A†

....

46,800

6,000

Cogeco

Inc.

.....................

252,039

90,000

Corus

Entertainment

Inc.,

Cl. B

........

48,503

457,000

Grupo

Televisa

SAB,

ADR

............

1,462,400

250,000

ITV

plc

.........................

233,182

500

Liberty

Broadband

Corp.,

Cl. A†

.......

28,560

103

Liberty

Broadband

Corp.,

Cl. C†

.......

5,895

188

Liberty

Media

Corp.-Liberty

SiriusXM

†

..

5,586

2,000

Liberty

Media

Corp.-Liberty

SiriusXM

,

Cl. A†

........................

59,400

89,500

Sinclair

Inc.

.....................

1,205,565

50,000

Sirius

XM

Holdings

Inc.

.............

194,000

53,000

TEGNA

Inc.

.....................

791,820

4,333,750

Building

and

Construction

—

1.6%

11,741

Arcosa

Inc.

......................

1,008,082

3,500

Bouygues

SA

....................

142,845

1,000

Carrier

Global

Corp.

...............

58,130

1,500

IES

Holdings

Inc.†

................

182,460

Shares

Market

Value

6,000

Johnson

Controls

International

plc

.....

$

391,920

5,000

Knife

River

Corp.†

.................

405,400

2,188,837

Business

Services

—

6.0%

36,000

Herc

Holdings

Inc.

................

6,058,800

68,500

JCDecaux

SE†

...................

1,330,222

13,500

Loomis

AB

......................

376,850

35,000

Rentokil

Initial

plc

.................

208,375

4,000

Ströeer

SE

&

Co.

KGaA

.............

243,388

3,000

Vestis

Corp.

.....................

57,810

8,275,445

Cable

and

Satellite

—

1.4%

1,500

Cogeco

Communications

Inc.

.........

66,531

42,000

Liberty

Global

Ltd.,

Cl. A†

...........

710,640

51,000

Liberty

Global

Ltd.,

Cl. C†

...........

899,640

51,000

Megacable

Holdings

SAB

de

CV

.......

141,792

36,057

WideOpenWest

Inc.†

...............

130,527

1,949,130

Computer

Software

and

Services

—

0.3%

3,662

CareCloud

Inc.†

..................

4,248

3,000

Donnelley

Financial

Solutions

Inc.†

.....

186,030

5,000

PAR

Technology

Corp.†

.............

226,800

417,078

Consumer

Products

—

3.6%

10,000

BellRing

Brands

Inc.†

..............

590,300

15,000

Edgewell

Personal

Care

Co.

..........

579,600

29,400

Energizer

Holdings

Inc.

.............

865,536

5,500

Essity

AB,

Cl. B

...................

130,615

300

L'Oreal

SA

......................

141,971

11,500

Marine

Products

Corp.

.............

135,125

15,000

Mattel

Inc.†

.....................

297,150

45,000

Nintendo

Co.

Ltd.,

ADR

.............

611,550

7,000

Salvatore

Ferragamo

SpA

............

85,110

32,000

Scandinavian

Tobacco

Group

A/S

......

572,995

6,000

Shiseido

Co.

Ltd.

.................

163,694

7,000

Spectrum

Brands

Holdings

Inc.

.......

623,070

2,000

Vista

Outdoor

Inc.†

................

65,560

4,862,276

Consumer

Services

—

1.4%

2,500

Allegion

plc

.....................

336,775

11,500

Ashtead

Group

plc

................

818,630

500

Boyd

Group

Services

Inc.

............

105,718

350

Cie

de

L'Odet

SE

..................

592,073

1,853,196

Diversified

Industrial

—

7.3%

105,000

Ampco

-Pittsburgh

Corp.†

...........

227,850

34,700

Ardagh

Group

SA†

................

154,589

3,500

AZZ

Inc.

........................

270,585

12,900

Enpro

Inc.

......................

2,177,133

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Diversified

Industrial

(Continued)

33,000

Greif

Inc.,

Cl. A

...................

$

2,278,650

9,500

Griffon

Corp.

....................

696,730

8,500

Jardine

Matheson

Holdings

Ltd.

.......

317,050

2,400

Moog

Inc.,

Cl. A

..................

383,160

25,500

Myers

Industries

Inc.

..............

590,835

5,000

Smiths

Group

plc

.................

103,591

22,000

Steel

Partners

Holdings

LP†

..........

872,300

8,500

Sulzer

AG

.......................

1,033,930

40,000

Toray

Industries

Inc.

...............

191,729

40,000

Tredegar

Corp.

...................

260,800

12,000

Trinity

Industries

Inc.

...............

334,200

10,000

Velan

Inc.

.......................

43,188

7,000

Wartsila

OYJ

Abp

.................

106,407

10,042,727

Educational

Services

—

0.2%

13,900

Universal

Technical

Institute

Inc.†

......

221,566

Electronics

—

2.8%

4,000

Flex

Ltd.†

.......................

114,440

25,000

Mirion

Technologies

Inc.†

...........

284,250

10,000

Resideo

Technologies

Inc.†

..........

224,200

37,000

Sony

Group

Corp.,

ADR

.............

3,172,380

3,795,270

Energy

and

Utilities:

Alternative

Energy

—

0.1%

5,500

NextEra

Energy

Partners

LP

..........

165,440

Energy

and

Utilities:

Electric

—

0.7%

31,200

Algonquin

Power

&

Utilities

Corp.

......

197,167

7,500

Fortis

Inc.

......................

296,334

12,000

PNM

Resources

Inc.

...............

451,680

945,181

Energy

and

Utilities:

Integrated

—

1.0%

21,000

Avista

Corp.

.....................

735,420

3,700

Emera

Inc.

......................

130,212

15,000

Hawaiian

Electric

Industries

Inc.

.......

169,050

100,000

Hera

SpA

.......................

352,353

1,387,035

Energy

and

Utilities:

Natural

Gas

—

1.1%

25,000

National

Fuel

Gas

Co.

..............

1,343,000

10,000

PrairieSky

Royalty

Ltd.

.............

195,858

1,538,858

Energy

and

Utilities:

Services

—

0.8%

42,000

Dril

-Quip

Inc.†

...................

946,260

3,000

Pineapple

Energy

Inc.†

.............

204

1,500

Weatherford

International

plc†

........

173,130

1,119,594

Shares

Market

Value

Energy

and

Utilities:

Water

—

2.6%

70,000

Beijing

Enterprises

Water

Group

Ltd.

....

$

15,562

1,500

Consolidated

Water

Co.

Ltd.

..........

43,965

17,000

Mueller

Water

Products

Inc.,

Cl. A

.....

273,530

90,000

Primo

Water

Corp.

................

1,638,900

50,000

Severn

Trent

plc

..................

1,558,755

3,530,712

Entertainment

—

6.8%

30,000

Atlanta

Braves

Holdings

Inc.,

Cl. A†

....

1,257,000

27,011

Atlanta

Braves

Holdings

Inc.,

Cl. C†

....

1,055,050

231,500

Entain

plc

.......................

2,329,905

3,000

GAN

Ltd.†

......................

3,810

14,000

Golden

Entertainment

Inc.

...........

515,620

500

Liberty

Media

Corp.-Liberty

Live,

Cl. A†

..

21,175

47

Liberty

Media

Corp.-Liberty

Live,

Cl. C†

..

2,059

600

Madison

Square

Garden

Entertainment

Corp.†

.......................

23,526

4,600

Madison

Square

Garden

Sports

Corp.†

..

848,792

7,379

Manchester

United

plc,

Cl. A†

.........

103,011

113,750

Ollamani

SAB†

...................

205,475

40,000

Paramount

Global,

Cl. A

.............

873,200

6,000

Sphere

Entertainment

Co.†

..........

294,480

15,000

Ubisoft

Entertainment

SA†

...........

315,644

15,000

Universal

Music

Group

NV

...........

451,175

75,000

Vivendi

SE

......................

817,229

28,000

Warner

Bros

Discovery

Inc.†

.........

244,440

9,361,591

Environmental

Services

—

1.1%

18,000

Renewi

plc†

.....................

130,405

6,000

Stericycle

Inc.†

...................

316,500

20,000

TOMRA

Systems

ASA

..............

312,348

4,000

Waste

Connections

Inc.

.............

688,040

1,447,293

Equipment

and

Supplies

—

5.7%

24,500

Commercial

Vehicle

Group

Inc.†

.......

157,535

31,500

Flowserve

Corp.

..................

1,438,920

11,000

Graco

Inc.

......................

1,028,060

17,000

Interpump

Group

SpA

..............

828,805

58,000

Mueller

Industries

Inc.

..............

3,127,940

800

Snap-on

Inc.

....................

236,976

4,500

Watts

Water

Technologies

Inc.,

Cl. A

....

956,475

7,774,711

Financial

Services

—

4.0%

750

Credit

Acceptance

Corp.†

............

413,663

6,200

EXOR

NV

.......................

689,288

51,000

FinecoBank

Banca

Fineco

SpA

........

763,972

100

First

Citizens

BancShares

Inc.,

Cl. A

....

163,500

38,000

Flushing

Financial

Corp.

.............

479,180

10,000

FTAI

Aviation

Ltd.

.................

673,000

225,000

GAM

Holding

AG†

.................

65,241

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Financial

Services

(Continued)

1,000

Groupe

Bruxelles

Lambert

NV

........

$

75,584

5,000

I3

Verticals

Inc.,

Cl. A†

.............

114,450

7,500

Janus

Henderson

Group

plc

..........

246,675

12,000

Kinnevik

AB,

Cl. A†

................

135,202

23,000

Kinnevik

AB,

Cl. B†

................

257,740

1,800

PROG

Holdings

Inc.

...............

61,992

70,000

Resona

Holdings

Inc.

..............

430,968

22,500

Synovus

Financial

Corp.

............

901,350

5,471,805

Food

and

Beverage

—

12.2%

7,000

Britvic

plc

......................

72,624

280

Chocoladefabriken

Lindt

&

Spruengli

AG

.

3,350,003

70,000

ChromaDex

Corp.†

................

243,600

3,000

Corby

Spirit

and

Wine

Ltd.,

Cl. A

.......

28,548

140,000

Davide

Campari-Milano

NV

..........

1,406,777

10,000

Fevertree

Drinks

plc

...............

151,584

9,000

Fomento

Economico

Mexicano

SAB

de

CV,

ADR

.........................

1,172,430

1,000

Heineken

Holding

NV

...............

80,698

39,000

ITO

EN

Ltd.

.....................

952,715

14,000

Kameda

Seika

Co.

Ltd.

..............

392,588

10,500

Kerry

Group

plc,

Cl. A

..............

912,464

195,000

Kikkoman

Corp.

..................

2,493,857

6,500

Luckin

Coffee

Inc.,

ADR†

............

158,860

93,000

Maple

Leaf

Foods

Inc.

..............

1,524,883

250,000

Nissin

Foods

Co.

Ltd.

..............

158,109

20,000

Nomad

Foods

Ltd.

................

391,200

4,000

Post

Holdings

Inc.†

................

425,120

190,000

Premier

Foods

plc

.................

358,274

10,500

Remy

Cointreau

SA

................

1,058,481

900

Symrise

AG

.....................

107,729

8,000

The

Hain

Celestial

Group

Inc.†

........

62,880

9,000

Treasury

Wine

Estates

Ltd.

...........

73,017

40,000

Tsingtao

Brewery

Co.

Ltd.,

Cl. H

.......

274,949

215,000

Vitasoy

International

Holdings

Ltd.

.....

184,320

35,000

Yakult

Honsha

Co.

Ltd.

.............

714,890

16,750,600

Health

Care

—

6.1%

18,237

Avantor

Inc.†

....................

466,320

13,000

Bausch

+

Lomb

Corp.†

.............

224,900

37,000

Bausch

Health

Cos.

Inc.†

............

392,570

600

Bio-Rad

Laboratories

Inc.,

Cl. A†

......

207,522

150

Bio-Rad

Laboratories

Inc.,

Cl. B†

......

51,850

6,500

Catalent

Inc.†

....................

366,925

500

Charles

River

Laboratories

International

Inc.†

........................

135,475

400

Chemed

Corp.

...................

256,772

8,800

Cutera

Inc.†

.....................

12,936

1,000

DaVita

Inc.†

.....................

138,050

Shares

Market

Value

12,000

DENTSPLY

SIRONA

Inc.

............

$

398,280

4,000

Endo

International

plc†

.............

1

13,000

Evolent

Health

Inc.,

Cl. A†

...........

426,270

5,000

Halozyme

Therapeutics

Inc.†

.........

203,400

4,200

Henry

Schein

Inc.†

................

317,184

1,750

ICU

Medical

Inc.†

.................

187,810

5,000

Idorsia

Ltd.†

.....................

15,679

20,000

InfuSystem

Holdings

Inc.†

...........

171,400

4,800

Integer

Holdings

Corp.†

.............

560,064

2,000

Lantheus

Holdings

Inc.†

............

124,480

10,000

Option

Care

Health

Inc.†

............

335,400

10,000

Owens

&

Minor

Inc.†

..............

277,100

28,000

Patterson

Cos.

Inc.

................

774,200

35,000

Perrigo

Co.

plc

...................

1,126,650

4,000

Silk

Road

Medical

Inc.†

.............

73,280

700

STERIS

plc

......................

157,374

5,700

SurModics

Inc.†

..................

167,238

400

Teladoc

Health

Inc.†

...............

6,040

4,500

Tenet

Healthcare

Corp.†

.............

472,995

1,600

The

Cooper

Companies

Inc.

..........

162,336

10,000

Treace

Medical

Concepts

Inc.†

........

130,500

8,341,001

Hotels

and

Gaming

—

2.6%

3,000

Caesars

Entertainment

Inc.†

..........

131,220

901

Flutter

Entertainment

plc†

...........

179,563

26,000

Full

House

Resorts

Inc.†

............

144,820

40,000

International

Game

Technology

plc

.....

903,600

656,250

Mandarin

Oriental

International

Ltd.

....

1,020,469

9,000

MGM

Resorts

International†

.........

424,890

250,000

The

Hongkong

&

Shanghai

Hotels

Ltd.†

.

190,050

5,500

Wynn

Resorts

Ltd.

................

562,265

3,556,877

Machinery

—

5.2%

21,000

Astec

Industries

Inc.

...............

917,910

379,000

CNH

Industrial

NV,

New

York

.........

4,911,840

2,400

Tennant

Co.

.....................

291,864

13,000

Twin

Disc

Inc.

....................

214,890

5,700

Xylem

Inc.

......................

736,668

7,073,172

Manufactured

Housing

and

Recreational

Vehicles

—

0.6%

1,900

Cavco

Industries

Inc.†

..............

758,214

Metals

and

Mining

—

1.1%

1,500

ATI

Inc.†

.......................

76,755

26,250

Cameco

Corp.

....................

1,137,150

4,000

Metallus

Inc.†

....................

89,000

35,000

Sierra

Metals

Inc.†

................

19,950

3,000

Wheaton

Precious

Metals

Corp.

.......

141,390

1,464,245

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Publishing

—

0.8%

1,400

Graham

Holdings

Co.,

Cl. B

..........

$

1,074,752

10,000

The

E.W.

Scripps

Co.,

Cl. A†

..........

39,300

1,114,052

Real

Estate

—

0.3%

20,000

Starwood

Property

Trust

Inc.,

REIT

.....

406,600

32,000

Trinity

Place

Holdings

Inc.†

..........

4,800

411,400

Retail

—

2.4%

5,000

AutoNation

Inc.†

..................

827,900

7,000

BBB

Foods

Inc.,

Cl. A†

..............

166,460

600

Biglari

Holdings

Inc.,

Cl. A†

..........

567,579

8,000

Camping

World

Holdings

Inc.,

Cl. A

....

222,800

20,000

Hertz

Global

Holdings

Inc.,

New

York†

..

156,600

7,000

MarineMax

Inc.†

..................

232,820

6,000

Movado

Group

Inc.

................

167,580

1,500

Penske

Automotive

Group

Inc.

........

242,985

10,000

PetIQ

Inc.†

......................

182,800

15,000

Pets

at

Home

Group

plc

.............

50,814

9,000

Rush

Enterprises

Inc.,

Cl. B

..........

479,610

120,000

Sun

Art

Retail

Group

Ltd.

............

23,918

3,321,866

Specialty

Chemicals

—

1.8%

4,500

Ashland

Inc.

.....................

438,165

52,500

Element

Solutions

Inc.

..............

1,311,450

13,547

Huntsman

Corp.

..................

352,628

2,500

Novonesis

(

Novozymes

)

B

...........

146,518

14,000

SGL

Carbon

SE†

..................

105,048

6,000

T.

Hasegawa

Co.

Ltd.

...............

120,293

2,000

Takasago

International

Corp.

.........

45,316

700

Treatt

plc

.......................

3,764

2,523,182

Telecommunications

—

1.2%

8,250

Eurotelesites

AG†

.................

32,887

5,000

Gogo

Inc.†

......................

43,900

6,000

Hellenic

Telecommunications

Organization

SA,

ADR

......................

43,080

100,000

Pharol

SGPS

SA†

.................

5,265

33,000

Telekom

Austria

AG

................

275,916

17,500

Telephone

and

Data

Systems

Inc.

......

280,350

11,000

Telesat

Corp.†

...................

94,600

100,000

Vodafone

Group

plc,

ADR

...........

890,000

1,665,998

Transportation

—

1.6%

64,000

Bollore

SE

......................

427,397

17,000

FTAI

Infrastructure

Inc.

.............

106,760

12,000

GATX

Corp.

.....................

1,608,360

2,142,517

Shares

Market

Value

Wireless

Communications

—

1.0%

40,000

Millicom

International

Cellular

SA,

SDR†

.

$

815,396

15,000

United

States

Cellular

Corp.†

.........

547,500

1,362,896

TOTAL

COMMON

STOCKS

.........

135,296,397

PREFERRED

STOCKS

—

0.2%

Health

Care

—

0.2%

10,000

XOMA

Corp.,

Ser.

A,

8.625%

.........

251,900

Retail

—

0.0%

450

Qurate

Retail

Inc.,

8.000%,

03/15/31

....

22,374

TOTAL

PREFERRED

STOCKS

........

274,274

RIGHTS

—

0.0%

Energy

and

Utilities:

Services

—

0.0%

13,750

Pineapple

Energy

Inc.,

CVR†

.........

14,509

Health

Care

—

0.0%

45,000

Achillion

Pharmaceuticals

Inc.,

CVR†

...

22,500

1,500

Tobira

Therapeutics

Inc.,

CVR†(a)

......

0

22,500

TOTAL

RIGHTS

................

37,009

WARRANTS

—

0.0%

Diversified

Industrial

—

0.0%

64,000

Ampco

-Pittsburgh

Corp.,

expire

08/01/25†

6,400

Principal

Amount

U.S.

GOVERNMENT

OBLIGATIONS

—

0.9%

$

1,240,000

U.S.

Treasury

Bills,

5.269%

to

5.311%††,

04/16/24

to

06/27/24

......................

1,228,336

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$101,334,184)

.............

$

136,842,416

(a)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

CVR

Contingent

Value

Right

REIT

Real

Estate

Investment

Trust

SDR

Swedish

Depositary

Receipt

The

Gabelli

Global

Small

and

Mid

Cap

Value

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Geographic

Diversification

%

of

Total

Investments

Market

Value

United

States

........................

53.7

%

$

73,510,901

Europe

..............................

31.2

42,749,451

Japan

...............................

6.8

9,289,981

Canada

..............................

4.2

5,683,260

Latin

America

.......................

2.3

3,192,521

Asia/Pacific

.........................

1.8

2,416,302

Total

Investments

...................

100.0%

$

136,842,416

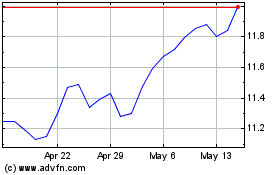

Gabelli Global Small and... (NYSE:GGZ)

Historical Stock Chart

From May 2024 to Jun 2024

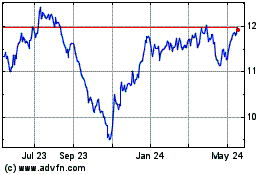

Gabelli Global Small and... (NYSE:GGZ)

Historical Stock Chart

From Jun 2023 to Jun 2024