Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

August 29 2024 - 12:35PM

Edgar (US Regulatory)

The

Gabelli

Convertible

and

Income

Securities

Fund

Inc.

Schedule

of

Investments

—

June

30,

2024

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

—

79

.8

%

Aerospace

—

1

.5

%

$

1,000,000

Rocket

Lab

USA

Inc.

,

4.250

%

,

02/01/29

(a)

.............

$

1,170,625

Automotive

—

1

.4

%

1,250,000

Rivian

Automotive

Inc.

,

3.625

%

,

10/15/30

(a)

.............

1,082,449

Broadcasting

—

2

.1

%

865,000

fuboTV

Inc.

,

3.250

%

,

02/15/26

...............

520,081

1,000,000

Liberty

Media

Corp.-Liberty

Formula

One

,

2.250

%

,

08/15/27

...............

1,065,662

1,585,743

Business

Services

—

3

.8

%

1,000,000

BigBear.ai

Holdings

Inc.

,

6.000

%

,

12/15/26

(a)

.............

724,755

1,800,000

MicroStrategy

Inc.

,

2.250

%

,

06/15/32

(a)

.............

1,711,835

400,000

Zillow

Group

Inc.

,

1.375

%

,

09/01/26

...............

486,245

2,922,835

Computer

Software

and

Services

—

12

.4

%

1,375,000

Akamai

Technologies

Inc.

,

1.125

%

,

02/15/29

(a)

.............

1,306,882

150,000

Alibaba

Group

Holding

Ltd.

,

0.500

%

,

06/01/31

(a)

.............

145,163

1,350,000

CSG

Systems

International

Inc.

,

3.875

%

,

09/15/28

(a)

.............

1,257,525

Lumentum

Holdings

Inc.

1,250,000

0.500

%

,

12/15/26

...............

1,131,994

750,000

1.500

%

,

12/15/29

...............

732,213

1,050,000

PagerDuty

Inc.

,

1.500

%

,

10/15/28

(a)

.............

1,132,928

1,000,000

PAR

Technology

Corp.

,

1.500

%

,

10/15/27

...............

936,000

1,000,000

Progress

Software

Corp.

,

3.500

%

,

03/01/30

(a)

.............

1,021,583

700,000

Rapid7

Inc.

,

1.250

%

,

03/15/29

(a)

.............

663,549

1,118,000

Veritone

Inc.

,

1.750

%

,

11/15/26

...............

403,615

650,000

Vertex

Inc.

,

0.750

%

,

05/01/29

(a)

.............

777,635

9,509,087

Consumer

Products

—

0

.1

%

100,000

Spectrum

Brands

Inc.

,

3.375

%

,

06/01/29

(a)

.............

96,800

Principal

Amount

Market

Value

Consumer

Services

—

2

.1

%

$

1,000,000

Live

Nation

Entertainment

Inc.

,

3.125

%

,

01/15/29

...............

$

1,107,922

400,000

Uber

Technologies

Inc.

,

Ser.

2028

,

0.875

%

,

12/01/28

(a)

.............

476,600

1,584,522

Energy

and

Utilities

—

19

.1

%

1,308,000

Array

Technologies

Inc.

,

1.000

%

,

12/01/28

...............

1,060,081

Bloom

Energy

Corp.

1,000,000

3.000

%

,

06/01/28

...............

972,235

100,000

3.000

%

,

06/01/29

...............

88,550

1,100,000

CMS

Energy

Corp.

,

3.375

%

,

05/01/28

...............

1,081,850

400,000

Kosmos

Energy

Ltd.

,

3.125

%

,

03/15/30

(a)

.............

419,500

1,000,000

Nabors

Industries

Inc.

,

1.750

%

,

06/15/29

...............

729,000

1,925,000

NextEra

Energy

Partners

LP

,

2.500

%

,

06/15/26

(a)

.............

1,763,787

1,000,000

Northern

Oil

&

Gas

Inc.

,

3.625

%

,

04/15/29

...............

1,154,750

500,000

Ormat

Technologies

Inc.

,

2.500

%

,

07/15/27

...............

496,500

1,345,000

PG&E

Corp.

,

4.250

%

,

12/01/27

(a)

.............

1,358,114

2,250,000

PNM

Resources

Inc.

,

5.750

%

,

06/01/54

(a)

.............

2,208,375

1,400,000

PPL

Capital

Funding

Inc.

,

2.875

%

,

03/15/28

...............

1,344,350

800,000

Stem

Inc.

,

4.250

%

,

04/01/30

(a)

.............

334,720

1,910,000

Sunnova

Energy

International

Inc.

,

2.625

%

,

02/15/28

...............

692,709

1,000,000

WEC

Energy

Group

Inc.

,

4.375

%

,

06/01/29

(a)

.............

996,000

14,700,521

Financial

Services

—

5

.0

%

400,000

Bread

Financial

Holdings

Inc.

,

4.250

%

,

06/15/28

...............

536,331

700,000

Coinbase

Global

Inc.

,

0.250

%

,

04/01/30

(a)

.............

677,600

900,000

Global

Payments

Inc.

,

1.500

%

,

03/01/31

(a)

.............

828,450

750,000

HCI

Group

Inc.

,

4.750

%

,

06/01/42

...............

979,725

900,000

SoFi

Technologies

Inc.

,

1.250

%

,

03/15/29

(a)

.............

840,600

3,862,706

The

Gabelli

Convertible

and

Income

Securities

Fund

Inc.

Schedule

of

Investments

(Continued)

—

June

30,

2024

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

(Continued)

Food

and

Beverage

—

2

.5

%

$

800,000

Fomento

Economico

Mexicano

SAB

de

CV

,

2.625

%

,

02/24/26

...............

$

849,567

1,000,000

The

Chefs'

Warehouse

Inc.

,

2.375

%

,

12/15/28

...............

1,114,361

1,963,928

Health

Care

—

13

.4

%

1,000,000

Amphastar

Pharmaceuticals

Inc.

,

2.000

%

,

03/15/29

(a)

.............

958,789

750,000

Coherus

Biosciences

Inc.

,

1.500

%

,

04/15/26

...............

551,252

4,000,000

Cutera

Inc.

,

2.250

%

,

06/01/28

...............

818,002

250,000

Dexcom

Inc.

,

0.375

%

,

05/15/28

...............

245,500

1,000,000

Evolent

Health

Inc.

,

3.500

%

,

12/01/29

(a)

.............

904,750

1,000,000

Exact

Sciences

Corp.

,

2.000

%

,

03/01/30

(a)

.............

887,000

500,000

Haemonetics

Corp.

,

2.500

%

,

06/01/29

(a)

.............

492,250

1,500,000

Halozyme

Therapeutics

Inc.

,

1.000

%

,

08/15/28

...............

1,671,135

500,000

Immunocore

Holdings

plc

,

2.500

%

,

02/01/30

(a)

.............

413,200

800,000

Jazz

Investments

I

Ltd.

,

2.000

%

,

06/15/26

...............

771,400

250,000

Pacira

BioSciences

Inc.

,

2.125

%

,

05/15/29

(a)

.............

249,125

1,250,000

Sarepta

Therapeutics

Inc.

,

1.250

%

,

09/15/27

...............

1,611,250

400,000

TransMedics

Group

Inc.

,

1.500

%

,

06/01/28

...............

702,957

10,276,610

Metals

and

Mining

—

1

.2

%

1,000,000

MP

Materials

Corp.

,

3.000

%

,

03/01/30

(a)

.............

903,244

Real

Estate

Investment

Trusts

—

4

.1

%

750,000

Redwood

Trust

Inc.

,

7.750

%

,

06/15/27

...............

728,906

600,000

Rexford

Industrial

Realty

LP

,

4.125

%

,

03/15/29

(a)

.............

586,200

2,000,000

Summit

Hotel

Properties

Inc.

,

1.500

%

,

02/15/26

...............

1,810,000

3,125,106

Principal

Amount

Market

Value

Security

Software

—

1

.2

%

$

1,100,000

Cardlytics

Inc.

,

4.250

%

,

04/01/29

(a)

.............

$

894,850

Semiconductors

—

5

.1

%

200,000

Impinj

Inc.

,

1.125

%

,

05/15/27

...............

310,365

1,100,000

indie

Semiconductor

Inc.

,

4.500

%

,

11/15/27

(a)

.............

1,101,100

750,000

MKS

Instruments

Inc.

,

1.250

%

,

06/01/30

(a)

.............

802,265

600,000

ON

Semiconductor

Corp.

,

0.500

%

,

03/01/29

...............

577,050

2,100,000

Wolfspeed

Inc.

,

1.875

%

,

12/01/29

...............

1,167,600

3,958,380

Telecommunications

—

4

.0

%

1,250,000

Infinera

Corp.

,

3.750

%

,

08/01/28

...............

1,360,000

1,700,000

Liberty

Latin

America

Ltd.

,

2.000

%

,

07/15/24

...............

1,692,733

3,052,733

Transportation

—

0

.8

%

700,000

Air

Transport

Services

Group

Inc.

,

3.875

%

,

08/15/29

(a)

.............

595,675

TOTAL

CONVERTIBLE

CORPORATE

BONDS

.......................

61,285,814

Shares

MANDATORY

CONVERTIBLE

SECURITIES

(b)

—

7

.6

%

Diversified

Industrial

—

1

.8

%

25,000

Chart

Industries

Inc.

,

Ser.

B

,

6.750

%

,

12/15/25

...............

1,421,000

Energy

and

Utilities

—

2

.2

%

40,000

NextEra

Energy

Inc.

,

6.926

%

,

09/01/25

...............

1,659,600

Health

Care

—

2

.1

%

34,000

BrightSpring

Health

Services

Inc.

,

6.750

%

,

02/01/27

...............

1,600,380

Specialty

Chemicals

—

1

.5

%

25,000

Albemarle

Corp.

,

7.250

%

,

03/01/27

...............

1,166,500

TOTAL

MANDATORY

CONVERTIBLE

SECURITIES

...................

5,847,480

The

Gabelli

Convertible

and

Income

Securities

Fund

Inc.

Schedule

of

Investments

(Continued)

—

June

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

—

5

.7

%

Aerospace

—

0

.1

%

400

The

Boeing

Co.

†

..................

$

72,804

Automotive:

Parts

and

Accessories

—

0.0

%

2,000

Dana

Inc.

.......................

24,240

Broadcasting

—

0

.1

%

35,000

Grupo

Televisa

SAB

,

ADR

............

96,950

Computer

Hardware

—

0

.1

%

400

International

Business

Machines

Corp.

..

69,180

Diversified

Industrial

—

0

.7

%

1,000

General

Electric

Co.

................

158,970

800

ITT

Inc.

........................

103,344

3,300

Textron

Inc.

.....................

283,338

545,652

Energy

and

Energy

Services

—

0

.1

%

1,200

Halliburton

Co.

...................

40,536

Entertainment

—

0.0

%

7,500

Ollamani

SAB

†

...................

17,091

1,000

Paramount

Global

,

Cl. B

.............

10,390

27,481

Financial

Services

—

2

.2

%

1,200

American

Express

Co.

..............

277,860

1,000

Citigroup

Inc.

....................

63,460

400

JPMorgan

Chase

&

Co.

,

CDI

..........

80,904

600

Julius

Baer

Group

Ltd.

..............

33,524

300

Morgan

Stanley

..................

29,157

6,200

State

Street

Corp.

.................

458,800

12,000

The

Bank

of

New

York

Mellon

Corp.

....

718,680

300

The

PNC

Financial

Services

Group

Inc.

..

46,644

1,709,029

Food

and

Beverage

—

0

.2

%

600

Pernod

Ricard

SA

.................

81,413

400

Remy

Cointreau

SA

................

33,371

114,784

Health

Care

—

0

.9

%

400

Johnson

&

Johnson

...............

58,464

1,300

Merck

&

Co.

Inc.

..................

160,940

1,700

Perrigo

Co.

plc

...................

43,656

6,000

Pfizer

Inc.

......................

167,880

8,000

Roche

Holding

AG

,

ADR

............

277,360

708,300

Real

Estate

Investment

Trusts

—

0

.9

%

7,205

Crown

Castle

Inc.

.................

703,929

Shares

Market

Value

Retail

—

0

.2

%

200

Costco

Wholesale

Corp.

.............

$

169,998

Telecommunications

—

0

.2

%

200

Swisscom

AG

....................

112,527

TOTAL

COMMON

STOCKS

...........

4,395,410

Principal

Amount

U.S.

GOVERNMENT

OBLIGATIONS

—

6

.9

%

$

5,305,000

U.S.

Treasury

Bills,

5.288

%

to

5.320

%

††

,

08/08/24

to

09/05/24

......................

5,263,896

TOTAL

INVESTMENTS

—

100

.0

%

.....

(Cost

$

81,154,163

)

..............

$

76,792,600

(a)

Securities

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

(b)

Mandatory

convertible

securities

are

required

to

be

converted

on

the

dates

listed;

they

generally

may

be

converted

prior

to

these

dates

at

the

option

of

the

holder.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

CDI

CHESS

(Australia)

Depository

Interest

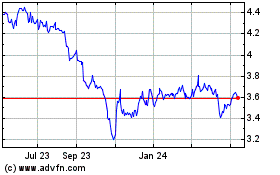

Gabelli Converitble and ... (NYSE:GCV)

Historical Stock Chart

From Jan 2025 to Feb 2025

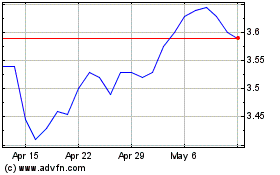

Gabelli Converitble and ... (NYSE:GCV)

Historical Stock Chart

From Feb 2024 to Feb 2025