EZET allows investors to gain exposure to ether

within a regulated exchange-traded product structure

Please replace the release issued July 23, 2024, at 09:30 a.m.

ET with the following corrected version due to multiple

revisions.

The updated release reads:

FRANKLIN TEMPLETON LAUNCHES FRANKLIN

ETHEREUM ETF (EZET)

EZET allows investors to gain exposure to ether

within a regulated exchange-traded product structure

Franklin Templeton today launched its second digital

asset-backed exchange-traded product (ETP), the Franklin Ethereum

ETF, under the ticker EZET. It is offered on the Cboe BZX Exchange,

Inc. and priced at 0.19%, or 19 basis points. Franklin Templeton

has agreed to fully waive fees to 0.00% until January 31, 2025, for

the first $10.0 billion in fund assets. The fund is a spot ether

(ETH) ETP available for U.S. investors and seeks to reflect the

performance of the price of ether, less the expense of fund

operations. EZET is the latest offering on the growing Franklin

Templeton Digital Assets and ETF platforms.

“After the success of our spot bitcoin ETP (EZBC) launch in

January, we are proud to add EZET to our growing lineup of digital

asset ETPs,” said Patrick O’Connor, Head of Global ETFs for

Franklin Templeton. “With EZET, we are thrilled to offer our

clients additional access to the digital asset ecosystem within a

regulated fund structure that integrates seamlessly into

traditional portfolios.”

Since 2018, Franklin Templeton Digital Assets has been building

blockchain-based technology solutions, running node validators, and

developing a wide range of investment strategies. The firm’s

dedicated digital assets research team leverages fundamental

“tokenomic” analysis, insights from an embedded data science team

and deep industry connections to help inform product development

and investment decisions.

“We have been active participants and builders in the digital

asset ecosystem since 2018 and have seen the transformative power

of blockchain technology firsthand,” said Roger Bayston, Head of

Digital Assets at Franklin Templeton. “Ethereum has been at the

forefront of Web3 innovation with things like smart contracts and

the Ethereum Virtual Machine and we're excited to bring that

technology revolution to our clients.”

Established in 2016, Franklin Templeton’s U.S. ETF and ETP

platform provides solutions for a range of market conditions and

investment objectives through active, smart beta and passively

managed products. Franklin Templeton offers over 100 ETFs and ETPs

globally with combined assets under management (AUM) of over $27

billion as of June 30, 2024.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

June 30, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

The Fund has filed a registration statement (including a

prospectus) with the Securities and Exchange Commission (“SEC”) for

the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration

statement and other documents the Fund has filed with the SEC, when

available, for more complete information about the Fund and this

offering. You may obtain these documents for free by visiting EDGAR

on the SEC website at sec.gov or by visiting

franklintempleton.com.

All investments involve risks, including possible loss of

principal. Before you invest, for more complete information

about the Fund and this offering, you should carefully read the

Fund's prospectus.

The Fund is not an investment company registered under the

Investment Company Act of 1940 (1940 Act), and therefore is not

subject to the same regulatory requirements as mutual funds or ETFs

registered under the 1940 Act. The Fund is not a commodity pool

for purposes of the Commodity Exchange Act (CEA) and accordingly is

not subject to the regulatory protections afforded by the CEA.

The Fund holds only ether and cash and is not suitable for

all investors. The Fund is not a diversified investment and,

therefore, is expected to be more volatile than other investments,

such as an investment in a more broadly diversified portfolio.

An investment in the Fund is not intended as a complete

investment plan.

An investment in the Fund is subject to market risk with respect

to the digital asset markets. The trading price of the ether held

by the Fund may go up and down, sometimes rapidly or unpredictably.

The value of the Fund’s Shares relates directly to the value of

ether, which has been in the past, and may continue to be, highly

volatile and subject to fluctuations due to a number of factors.

Extreme volatility in the future, including substantial, sustained

or rapid declines in the trading prices of ether, could have a

material adverse effect on the value of the Shares and the Shares

could lose all or substantially all of their value.

Competitive pressures may negatively affect the ability

of the Fund to garner substantial assets and achieve commercial

success.

Digital assets represent a new and rapidly evolving

industry, and the value of the Fund’s Shares depends on the

acceptance of ether. Due to the relative unregulated nature and

lack of transparency surrounding the operations of digital asset

exchanges, which may experience fraud, manipulation, security

failures or operational problems, as well as the wider ether

market, the value of ether and, consequently, the value of the

Shares may be adversely affected, causing losses to

Shareholders.

Digital asset markets in the U.S. exist in a state of

regulatory uncertainty, and adverse legislative or regulatory

developments could significantly harm the value of ether or the

Shares, such as by banning, restricting or imposing onerous

conditions or prohibitions on the use of ether, validation

activity, digital wallets, the provision of services related to

trading and custodying ether, the operation of the Ethereum

network, or the digital asset markets generally.

The Index price used to calculate the value of the Fund’s

ether has a limited performance history and may be volatile,

adversely affecting the value of the Shares. Moreover, the Index

Administrator could experience system failures or errors. Errors in

the Index data, computations and/or construction may occur from

time to time and may not be identified and/or corrected for a

period of time or at all, which may have an adverse impact on the

Fund and the Shareholders.

A temporary or permanent “fork” in the Ethereum blockchain could

adversely affect the value of the Shares. The Fund does not have

the ability or intention to hold any asset (including any crypto

asset) other than ether and cash. Shareholders may not receive the

benefits of any forks or “airdrops.” Forks or airdrops may result

in extraordinary expenses borne by the Fund.

The Fund is a passive investment vehicle and is not actively

managed, meaning it does not manage its portfolio to sell ether

at times when its price is high, or acquire ether at low prices in

the expectation of future price increases. Also, the Fund does not

use any hedging techniques to attempt to reduce the risks of losses

resulting from ether price decreases. The Fund is not a leveraged

product and does not utilize leverage, derivatives or similar

instruments or transactions. The Fund's Shares are not interests or

obligations of the Fund's Sponsor or its affiliates, and are not

insured by the Federal Deposit Insurance Corporation or any other

governmental agency.

The amount of ether represented by each Share will decrease

over the life of the Fund due to the sales of ether necessary

to pay the Sponsor’s Fee and other Fund expenses. Without increases

in the price of ether sufficient to compensate for that decrease,

the price of the Shares will also decline and you will lose money

on your investment in Shares.

Security threats to the Fund’s account at the Ether

Custodian or Prime Broker could result in the halting of Fund

operations and a loss of Fund assets or damage to the reputation of

the Fund, each of which could result in a reduction in the value of

the Shares.

The Fund will not stake the ether it holds, so an investment

in the Fund’s shares will not realize the economic benefits of

staking.

If the process of creation and redemption of Creation Units

encounters any unanticipated difficulties, the possibility for

arbitrage transactions by Authorized Participants intended to keep

the price of the Shares closely linked to the price of ether may

not exist and, as a result, the price of the Shares may fall or

otherwise diverge from NAV.

Franklin Distributors, LLC. Member FINRA, SIPC. Marketing agent

for the Franklin Ethereum ETF.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE.

Copyright © 2024. Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723311571/en/

Franklin Templeton Corporate Communications: Travis Fishstein,

(917) 822-1857, travis.fishstein@franklintempleton.com

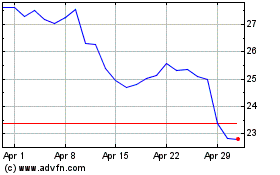

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

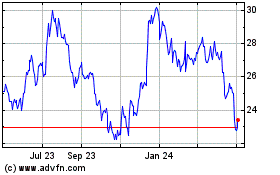

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Nov 2023 to Nov 2024