UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number 001-35297

Fortuna Mining Corp.

(Translation of registrant’s name into English)

200 Burrard Street, Suite 650, Vancouver, British

Columbia, Canada V6C 3L6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fortuna Mining Corp. |

| |

(Registrant) |

| |

|

| Date: December 10, 2024 |

By: |

/s/ "Jorge Ganoza Durant" |

| |

|

Jorge Ganoza Durant |

| |

|

President and CEO |

Exhibits:

99.1 News release dated December 10, 2024

Exhibit 99.1

NEWS

RELEASE

Fortuna updates Mineral Reserves and Mineral

Resources for the Séguéla Mine, Côte d'Ivoire

Vancouver, December 10, 2024 - Fortuna Mining

Corp. (NYSE: FSM | TSX: FVI) is pleased to announce updated Mineral Reserves and Mineral Resources at its Séguéla Mine

with the discovery of over 500,000 gold ounces of new Inferred Resources.

Jorge A. Ganoza, President and CEO, commented,

“Our exploration programs in 2024 have successfully grown our Inferred Resources to 677,000 gold ounces, including the contribution

of four new mineral deposits.” Mr. Ganoza added, “These new resources come from a growing pipeline of deposits that are planned

for further expansion and definition drilling in 2025 as we look for opportunities to replace annual production related depletion and

expand reserves."

Updated Mineral

Reserve and Mineral Resources highlights

| · | Proven and Probable Mineral Reserves are reported

containing 1.0 Moz Au. |

| · | Measured and Indicated Resources exclusive of

Mineral Reserves are reported containing 396,000 oz Au. |

| · | Inferred Mineral Resources are reported containing

677,000 oz Au which includes maiden Inferred Resources containing 294,000 oz for Kingfisher and 61,000 oz for Badior, as well as an additional

141,000 oz Au of underground Inferred Resource at the Sunbird deposit. |

| · | Primary drivers for changes in Mineral Reserves

and Mineral Resources are production related depletion and the addition of new Inferred Resources as a result of the ongoing exploration

drilling activities. For the full year 2024, the Séguéla Mine is expected to produce at the upper range of 126,000 to 138,000

gold ounces. |

Paul Weedon, Senior Vice President, Exploration,

commented, "The Kingfisher deposit has emerged as an important discovery which remains open along strike and at depth, providing

excellent potential for additional growth." Mr. Weedon concluded, "There remains a host of further exploration targets ranked

for priority drill testing as we continue to explore the ultimate potential scale of our property package of 62,000 hectares."

Fortuna estimates the Kingfisher deposit contains

an Inferred Mineral Resource of 4.0 Mt at an average grade of 2.29 g/t Au containing 294,000 gold ounces, and the Badior deposit

contains an Inferred Mineral Resource of 470,000 tonnes at an average grade of 4.05 g/t Au containing 61,000 gold ounces. The updated

Inferred Mineral Resource will not materially change the existing Mineral Resource estimate at the Séguéla Mine.

Mineral Reserves

| Proven and Probable |

| |

|

|

|

Contained Metal |

| Location |

Classification |

Tonnes (000) |

Au (g/t) |

Au (koz) |

| Stockpile |

Proven |

692 |

1.50 |

33 |

| Open Pit |

|

|

|

|

| Antenna |

Probable |

2,523 |

2.39 |

194 |

| Koula |

Probable |

1,114 |

6.26 |

224 |

| Ancien |

Probable |

1,604 |

4.09 |

211 |

| Agouti |

Probable |

796 |

2.56 |

65 |

| Boulder |

Probable |

578 |

1.94 |

36 |

| Sunbird |

Probable |

2,060 |

3.82 |

253 |

| Total |

Probable |

9,366 |

3.38 |

1,016 |

Mineral Resources

| Measured and Indicated |

| |

|

|

|

Contained Metal |

| Location |

Classification |

Tonnes (000) |

Au (g/t) |

Au (koz) |

| Open Pit (OP) |

|

|

|

|

| Antenna |

Indicated |

759 |

1.57 |

38 |

| Koula |

Indicated |

27 |

6.91 |

6 |

| Ancien |

Indicated |

58 |

4.86 |

9 |

| Agouti |

Indicated |

189 |

2.15 |

13 |

| Boulder |

Indicated |

294 |

1.50 |

14 |

| Sunbird |

Indicated |

176 |

2.99 |

17 |

| OP Combined |

Indicated |

1,503 |

2.02 |

98 |

| Underground (UG) |

|

|

|

|

| Koula |

Indicated |

100 |

7.89 |

25 |

| Ancien |

Indicated |

390 |

4.67 |

59 |

| Sunbird |

Indicated |

1,440 |

4.63 |

214 |

| UG Combined |

Indicated |

1,930 |

4.81 |

298 |

| Total |

Indicated |

3,433 |

3.59 |

396 |

| Inferred |

| |

|

|

|

Contained Metal |

| Location |

Classification |

Tonnes (000) |

Au (g/t) |

Au (koz) |

| Open Pit (OP) |

|

|

|

|

| Antenna |

Inferred |

780 |

2.08 |

52 |

| Koula |

Inferred |

10 |

2.23 |

1 |

| Ancien |

Inferred |

20 |

1.16 |

1 |

| Agouti |

Inferred |

40 |

1.62 |

2 |

| Sunbird |

Inferred |

10 |

0.95 |

0 |

| Badior |

Inferred |

470 |

4.05 |

61 |

| Gabbro North |

Inferred |

190 |

1.67 |

10 |

| Kestrel |

Inferred |

60 |

1.75 |

3 |

| Kingfisher |

Inferred |

4,000 |

2.29 |

294 |

| OP Combined |

Inferred |

5,580 |

2.37 |

425 |

| Underground (UG) |

|

|

|

|

| Koula |

Inferred |

310 |

5.00 |

49 |

| Ancien |

Inferred |

80 |

5.05 |

13 |

| Sunbird |

Inferred |

1,290 |

4.58 |

190 |

| UG Combined |

Inferred |

1,680 |

4.67 |

252 |

| Total |

Inferred |

7,260 |

2.90 |

677 |

Notes:

| 1. | Mineral Reserves

and Mineral Resources are as defined by the 2014 CIM Definition Standards for Mineral Resources

and Mineral Reserves. |

| 2. | Mineral Resources

are exclusive of Mineral Reserves. |

| 3. | Mineral

Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 4. | Factors

that could materially affect the reported Mineral Resources or Mineral Reserves include changes

in metal price and exchange rate assumptions; changes in local interpretations of mineralization;

changes to assumed metallurgical recoveries, mining dilution and recovery; and assumptions

as to the continued ability to access the site, retain mineral and surface rights titles,

maintain environmental and other regulatory permits, and maintain the social license to operate. |

| 5. | Mineral

Resources and Mineral Reserves are reported as of October 31, 2024. |

| 6. | Mineral Reserves

are reported on a 100 percent ownership basis at an incremental gold grade cut-off of 0.75

g/t Au for Antenna, 0.80 g/t Au for Agouti, 0.78 g/t Au for Boulder, 0.78 g/t Au for Koula,

0.84 g/t Au for Ancien, and 0.81 g/t Au for Sunbird deposits based on a gold price of $1,880/ounce,

metallurgical recovery rates of 94 percent, surface mining costs ranging between $3.76/t

to $4.28/t, processing cost of $17.87/t and G&A cost of $14.45/t, and only Proven and

Probable categories reported within the final pit designs. The Mineral Reserves pit design

for Antenna, Ancien, and Koula were based on inter-ramp angles of 30.6° to 38.3°

for oxide material, 42.9° for transitional material, and 59.6° for fresh material.

Agouti and Boulder pits were designed with the inter-ramp angles of 36.8° for oxide,

44.2° for transitional, and 60.0° for fresh material. The Sunbird pit was designed

with inter-ramp angles of 40.7° for oxide, 36.5° to 59.6° for transitional, and

52.2° to 61.2° for fresh material. The Mineral Reserves are reported with modifying

factors of mining dilution and mining recovery represented by regularizing the block models

to an appropriate selective mining unit (SMU) block size. Mineral Resources for Séguéla

are reported at a cut-off grade of 0.65 g/t Au for Antenna and Kestrel, 0.70 g/t Au

for Agouti, Boulder, Koula, Sunbird and Kingfisher, and 0.75 g/t Au for Ancien, Badior and

Gabbro North based on an assumed gold price of $2,160/oz and constrained within preliminary

pit shells. Underground Mineral Resources are reported inside MSO shapes at a gold cut-off

grade of 2.4 g/t Au based on sublevel stoping mining method. The Séguéla Mine

is subject to a 10 percent carried interest held by the State of Cote d'Ivoire. All dollar

amounts refer to United States dollars. |

| 7. | Eric Chapman,

P. Geo. (EGBC #36328), is the Qualified Person responsible for Mineral Resources; Raul Espinoza

(FAUSIMM (CP) #309581) is the Qualified Person responsible for Mineral Reserves; both being

employees of Fortuna Mining Corp. |

| 9. | Totals may not

add due to rounding. |

As of October 31, 2024, the Séguéla

Mine has Proven and Probable Mineral Reserves of 9.4 Mt containing 1.0 Moz Au, in addition to Indicated Resources of 3.4 Mt containing

396,000 oz Au and Inferred Resources of 7.3 Mt containing 677,000 oz Au.

From December 31, 2023 to October 31, 2024, Mineral

Reserve tonnes decreased by 20 percent, while gold grade increased by 11 percent to 3.38 g/t Au and contained gold ounces decreased by

12 percent. Changes are due to mining related depletion of 123,000 oz Au, pit optimization and increases to the reporting cut-off grade

due to higher processing and service costs resulting in a decrease of 53,000 oz Au, adjustments related to the identification of historical

artisanal activities at the Ancien deposit resulting in a decrease of 17,000 oz Au, offset by an increase of 55,000 oz Au in relation

to grade control drilling conducted at the Antenna, Koula, and Ancien deposits, as well as exploration drilling at Sunbird.

Measured and Indicated Resource gold ounces, exclusive

of Mineral Reserves, increased 4 percent, or 15,000 oz Au in relation to minor adjustments in the geologic interpretation and reporting

cut-off grades.

Inferred Resources tonnes increased by 137 percent

to 7.3 Mt, while gold grade increased by 16 percent to 2.90 g/t Au, and contained gold ounces increased by 176 percent to 677,000

oz Au. The change is due to the maiden estimates of the Kingfisher, Badior, Gabbro North, and Kestrel deposits adding 368,000 oz Au, an

extension of the underground resources at the Sunbird deposit adding 141,000 oz Au, and adjustments to pit shells and an increase in reporting

cut-off grades, resulting in a decrease of 71,000 oz Au.

Deposit geology and drilling

The Kingfisher deposit is located approximately

1 kilometer to the east of the previously reported Sunbird deposit, with the Kestrel deposit located just 250 meters to the south of the

currently mined Antenna pit. Badior is located approximately 7 kilometers to the north of the processing plant and the Gabbro North deposit

is located 2.5 kilometers to the southeast of Badior, approximately 6 kilometers from the plant (refer to Figure 1). Kingfisher is hosted

in a set of quartz veins along a moderately sheared contact between a series of basalt-dolerite units, which also hosts the Boulder and

Agouti deposits located 1 and 3 kilometers, respectively, to the north, with a steep easterly dip consistent with the majority of the

other deposits at Séguéla. Kestral is hosted in a series of steep easterly dipping quartz veins within an intercalated basalt-dolerite

sequence associated within the locally named Koula-Ancien basalt package. Badior appears to be hosted in steeply dipping quartz veins

close to the contact of a series of volcanoclastics to the west and the Koula-Ancien basalt package to the east. Gabbro North is hosted

in the East Domain, a thick sequence of pillow basalts and minor mafic volcanoclastics, within steeply dipping quartz veins. Structural

deformation is variable across all of the units with the mineralization and quartz veining usually associated with the development of

mylonitic zones.

The maiden Inferred Mineral Resource estimates

were prepared using diamond and reserve circulation (RC) drillholes comprising 168 holes totaling 23,628 meters for Kingfisher, 68 holes

totaling 8,285 meters for Badior, 78 holes totaling 9,320 meters for Gabbro North, and 42 holes totaling 4,879 meters for Kestrel, all

drilled by Fortuna since 2021. Kingfisher mineralization has been drilled over a strike length of 2 kilometers to a depth of 250 meters

along 50-meter centers. Badior, Gabbro North and Kestrel mineralization has been defined over strike lengths of 300, 500, and 150 meters,

respectively, and to depths of 150 meters along 25-meter centers.

All RC drilling used a 5.25-inch face sampling

pneumatic hammer with samples collected into 60-liter plastic bags. Samples were kept dry by maintaining enough air pressure to exclude

groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails.

Once collected, RC samples were riffle split through a three-tier splitter to yield a 12.5 percent representative sample for submission

to the analytical laboratory. The residual 87.5 percent samples were stored at the drill site until assay results were received and validated.

Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the Fortuna-controlled

core yard.

All diamond drill holes were drilled with HQ sized

diamond drill bits. The core was logged, marked up for sampling using standard lengths of one meter or to a geological boundary. Samples

were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location

at the Company's core yard at the project site. The other half was sampled, catalogued and placed into sealed bags and securely stored

at the site until shipment.

All RC and diamond core samples were shipped to

ALS Laboratories preparation laboratory in Yamoussoukro for preparation and then, via commercial courier, to ALS's facility in Ouagadougou,

Burkina Faso for finishing. Routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed

for all Séguéla samples. Quality control procedures included the systematic insertion of blanks, duplicates, and standards

into the sample stream. In addition, the ALS laboratory inserted its own quality control samples.

Figure

1: Séguéla Mine deposit locations

Mineral Resource estimation

The maiden Mineral Resource estimates for Badior,

Gabbro North, and Kestrel were prepared using data with an effective cut-off date of June 30, 2024, with the Kingfisher deposit prepared

using data with an effective date of October 20, 2024. Three-dimensional wireframes were generated from the host lithologies, including

the weathering profile and alluvial cover, as well as mineralized envelopes based on a nominal cut-off grade from 0.2 to 0.3 g/t Au.

Collar locations at Badior, Gabbro North and Kestrel

were surveyed using hand-held GPS with elevations draped on to the topographic surface wireframe. The uncertainty in the accuracy of collar

locations meant these deposits were classified as Inferred Resources despite data density being sufficient for a higher classification.

All collars are in the process of being resurveyed to improve confidence in their location. Collars at the Kingfisher deposit were surveyed

by differential GPS using Total Station methodology.

Wireframes for each mineralized envelope were

used to select and flag drillhole samples. Samples were preferentially sampled at 1-meter intervals regardless of drilling technique.

Consequently, all input data was composited to 1 meter.

Composites for each mineralized domain were reviewed

separately and in conjunction with log probability plots, histograms and box and whisker plots, with no clear evidence for multiple discrete

grade populations. All data was collectively treated as a single statistical domain for the purposes of geostatistical analysis.

Input composite data for each individual domain

were assessed for the existence of outliers. Top cut grade capping was applied on a semi-quantitative basis per-domain, based on the histograms,

log probability and mean/variance plots for each domain.

Experimental semi-variogram were generated for

the collective input data from all domains at each deposit and where sufficient data was available semi-variograms were modeled to establish

grade continuity and assist in guiding estimation and search parameters used in the estimation of gold grades.

A block model was built to encompass the mineralization

in its entirety for each deposit. The block model was aligned with the national grid utilizing the same UTM coordinate system as the input

data with consideration of the likely selective mining unit used to define block size.

The wireframes defining mineralized domains were

used as hard boundaries in the grade interpolation. Only grades inside each mineralized wireframe were used to interpolate the blocks

inside the same wireframe. Ordinary kriging (OK) or inverse power of distance (IPD) was selected for grade interpolation in the mineralized

domains depending on data density. It is considered by the Qualified Person to be appropriate for this style of deposit.

All estimates were performed on a parent block

basis. Search parameters for estimation were determined based on Kriging Neighborhood Analysis (KNA). Single block KNA within a well-informed

portion of the deposit was utilized. An oriented ellipsoid search was used to select data for interpolation. Search ellipsoid orientations

were based on orientations derived from variogram analysis. A two-pass expanding search was used to complete the estimation for gold within

the individual mineralization objects, based on the variogram ranges.

Fixed bulk density values were assigned to individual

lithologies based on more than 1,000 water immersion measurements of drill core taken from across the Séguéla property.

Validation of the block models was undertaken

using a variety of methods, including checks for un-estimated mineralization blocks, incorrect or absent assignation of density values,

and mineralized blocks or blocks with density values above topography.

Following these checks, swath plots were generated

along the three principal axes to assess the representativity of estimated grade profiles in comparison to the input composite grades.

Swath plots were generated on a per-mineralization solid basis. Swath plots and log-probability plots indicate a suitable level of adherence

of the estimated grades to the expected values observed within the input composite data.

Ongoing exploration program

Drill activities remain ongoing across the Séguéla

property. This work is targeting extensions down dip and along strike at the Kingfisher and Sunbird deposits from the currently modeled

Inferred Mineral Resource and infilling areas of lower density of drilling within the currently modeled Inferred Mineral Resource.

Following on from the receipt of all data associated

with the drilling campaign, the Kingfisher and Sunbird Inferred Mineral Resource estimate will be updated, with a view to potentially

upgrading portions of the Inferred Mineral Resource to higher confidence classifications, and better define the extents of the mineralization,

which currently remains open at depth and along strike.

Qualified Person

Eric Chapman, Senior Vice President, Technical

Services, is a Professional Geoscientist of the Association of Professional Engineers and Geoscientists of the Province of British Columbia

(Registration Number 36328) and a Qualified Person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects.

Mr. Chapman has reviewed and approved the scientific and technical information contained in this news release and has verified the underlying

data.

About Fortuna Mining Corp.

Fortuna Mining Corp. is a Canadian precious metals

mining company with five operating mines in Argentina, Burkina Faso, Côte d'Ivoire, Mexico, and Peru, as well as the advanced exploration

pre-development stage Diamba Sud Gold Project located in Senegal. Sustainability is integral to all our operations and relationships.

We produce gold and silver and generate shared value over the long-term for our stakeholders through efficient production, environmental

protection, and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Mining Corp.

Investor Relations:

Carlos Baca | info@fmcmail.com

| fortunamining.com | X | LinkedIn

| YouTube

Forward-looking Statements

This news release contains forward-looking

statements which constitute "forward-looking information" within the meaning of applicable Canadian securities legislation and

"forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995 (collectively, "Forward-looking Statements"). All statements included herein, other than statements of historical

fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual

events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this

news release include, without limitation, Mineral Resource and Reserve estimates; the Company's plans regarding the mill at the Séguéla

Mine; the Company’s expectation regarding gold production at the Séguéla Mine for

the full year 2024; statements regarding the potential for additional growth at the Kingfisher deposit; the Company’s plans to conduct

further exploration programs at Séguéla; statements regarding updating the Inferred Mineral Resource

estimates at the Kingfisher and Sunbird deposits with a view to potentially upgrading portions of the Inferred Mineral Resource to higher

classifications the Company's business strategy, plans and outlook; the merit of the Company's mines and mineral properties; mineral

resource and reserve estimates, metal recovery rates, concentrate grade and quality; changes in tax rates and tax laws, requirements for

permits, anticipated approvals and other matters. Often, but not always, these Forward-looking Statements can be identified by the use

of words such as "estimated", "expected", "anticipated", "potential", "open", "future",

"assumed", "projected", "used", "detailed", "has been", "gain", "planned",

"reflecting", "will", "containing", "remaining", "to be", or statements that events,

"could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially

different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and

factors include, among others, changes in general economic conditions and financial markets; uncertainty relating

to new mining operations such as the Séguéla Mine, including the possibility that actual capital and operating costs and

economic returns will differ significantly from those estimated for such projects prior to production; risks associated with war

or other geo-political hostilities, such as the Ukrainian – Russian and the Israel – Hamas conflicts, any of which could continue

to cause a disruption in global economic activity; fluctuation in currencies and foreign exchange rates; increases in the rate of inflation;

the imposition or any extension of capital controls in countries in which the Company operates; any changes in tax laws in Argentina and

the other countries in which we operate; changes in the prices of key supplies; technological and operational hazards in Fortuna's mining

and mine development activities; risks related to water and power availability; risks inherent in mineral exploration; uncertainties inherent

in the estimation of mineral reserves, mineral resources, and metal recoveries; changes to current estimates of mineral reserves and resources;

changes to production and cost estimates; changes in the position of regulatory authorities with respect to the granting of approvals

or permits; governmental and other approvals; changes in government, political unrest or instability in countries where Fortuna is active;

labor relations issues; as well as those factors discussed under "Risk Factors" in the Company's Annual Information Form. Although

the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those

described in Forward-looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated,

estimated or intended.

Forward-looking Statements contained herein

are based on the assumptions, beliefs, expectations and opinions of management, including, but not limited to, the accuracy of the Company's

current mineral resource and reserve estimates; that the Company's activities will be conducted in accordance with the Company's public

statements and stated goals; that there will be no material adverse change affecting the Company, its properties or changes to production

estimates (which assume accuracy of projected ore grade, mining rates, recovery timing, and recovery rate estimates and may be impacted

by unscheduled maintenance, labor and contractor availability and other operating or technical difficulties); geo-political uncertainties

that may affect the Company's production, workforce, business, operations and financial condition; the expected trends in mineral prices

and currency exchange rates; that all required approvals and permits will be obtained for the Company's business and operations on acceptable

terms; that there will be no significant disruptions affecting the Company's operations, the ability to meet current and future obligations

and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any

obligation to update any Forward-looking Statements, whether as a result of new information, future events or results or otherwise, except

as required by law. There can be no assurance that these Forward-looking Statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking

Statements.

Cautionary Note to United States Investors

Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in

this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves.

NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian

company of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral

resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of

Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves. Canadian standards, including NI 43-101, differ

significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in

this news release may not be comparable to similar information disclosed by U.S. companies.

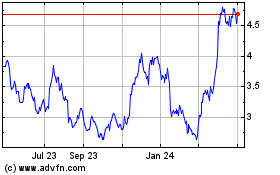

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Jan 2025 to Feb 2025

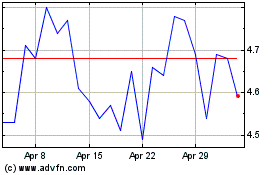

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Feb 2024 to Feb 2025