UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number 001-35297

Fortuna Silver Mines Inc.

(Translation of registrant’s name into English)

200 Burrard Street, Suite 650, Vancouver,

British Columbia, Canada V6C 3L6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

FORM 20-F

¨ FORM 40-F x

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Fortuna Silver Mines Inc. |

| |

(Registrant) |

| |

|

| Date: June 10, 2024 |

By: |

/s/ "Jorge Ganoza Durant" |

| |

|

Jorge Ganoza Durant |

| |

|

President and CEO |

Exhibits:

99.1 News release dated June 10, 2024

Exhibit 99.1

|

|

NEWS

RELEASE |

Fortuna Completes Offering

of Convertible Senior Notes

Vancouver, June 10, 2024 – Fortuna

Silver Mines Inc. (TSX: FVI) (NYSE: FSM) (“Fortuna” or the “Company”) has closed its previously announced

offering of 3.75% convertible senior notes due 2029 (the “Notes”) in an aggregate principal amount of US$172.5 million (the

“Offering”), which includes exercise of the full amount of the option to purchase an additional US$22.5 million aggregate

principal amount of Notes. The initial conversion rate for the Notes is 151.7220 common shares of Fortuna (“Shares”) per

US$1,000 principal amount of Notes, equivalent to an initial conversion price of approximately US$6.59 per Share.

The Company intends to use the net proceeds from

the Offering to repay bank indebtedness, to fund working capital requirements, for general corporate purposes and to fund the repayment

of its existing 4.65% senior subordinated unsecured convertible debentures (the “Debentures”), to the extent that such Debentures

are not converted into shares prior to the redemption date.

As previously announced, the Company has issued

a notice of redemption in respect of the Debentures, which are expected to be redeemed on July 10, 2024. Holders of the Debentures

may choose to convert their Debentures prior to the redemption date or receive a cash payment from the debenture trustee.

The Notes and the Shares issuable upon the conversion

thereof have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”),

or qualified by a prospectus in Canada. The Notes and the Shares may not be offered or sold in the United States absent registration

under the Securities Act or an applicable exemption from registration under the Securities Act.

This news release is neither an offer to sell

nor the solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer to sell or solicitation of

an offer to buy, or a sale of, the Notes or any other securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

About Fortuna Silver Mines

Inc.

Fortuna Silver Mines Inc. is a Canadian precious

metals mining company with five operating mines in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, and Peru. Sustainability

is integral to all our operations and relationships. We produce gold and silver and generate shared value over the long-term for our

stakeholders through efficient production, environmental protection, and social responsibility.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Silver Mines Inc.

Investor Relations:

Carlos Baca | info@fortunasilver.com

Forward-looking Statements

This news release contains forward-looking

statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation

and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements

of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could

cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements

in this news release include, without limitation, the redemption of the existing debentures and the anticipated use of proceeds. These

Forward-looking Statements are based on certain assumptions that Fortuna has made in respect thereof as at the date of this news release.

Often, but not always, these Forward-looking Statements can be identified by the use of words such as “estimated”, “potential”,

“open”, “future”, “assumed”, “projected”, “used”, “detailed”,

“has been”, “gain”, “planned”, “reflecting”, “will”, “anticipated”,

“estimated” “containing”, “remaining”, “to be”, or statements that events, “could”

or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Fortuna to be materially

different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and

factors include, without limitation, those factors discussed under “Risk Factors” in Fortuna’s Annual Information Form for

the fiscal year ended December 31, 2023, a copy of which can be found on the Company’s profile on the SEDAR+ website at www.sedarplus.ca

and on EDGAR at www.sec.gov/edgar. Although Fortuna has attempted to identify important factors that could cause actual actions, events

or results to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events

or results to differ from those anticipated, estimated or intended.

Forward-looking Statements contained herein

are based on the assumptions, beliefs, expectations and opinions of management and such other assumptions as set out herein. Forward-looking

Statements are made as of the date hereof and Fortuna disclaims any obligation to update any Forward-looking Statements, whether as a

result of new information, future events or results or otherwise, except as required by law. There can be no assurance that these Forward-looking

Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

Accordingly, investors should not place undue reliance on Forward-looking Statements.

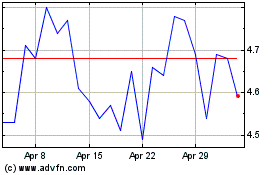

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Feb 2025 to Mar 2025

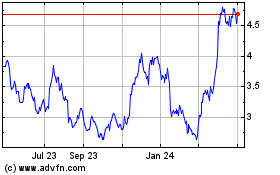

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Mar 2024 to Mar 2025