UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commision File Number 005-81586

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE

C.V.

(Exact name of Registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name into English)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

This report on Form 6-K shall be deemed to be incorporated by reference

into the Offer to Purchase, dated October 31, 2023, relating to the previously announced cash tender offer by Fomento Económico

Mexicano, S.A.B. de C.V. (FEMSA).

CONTENTS

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the

registrant has duly caused this report to be signed

on its behalf of the

undersigned, thereunto duly authorized.

| |

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE C.V. |

| |

|

| |

By: /s/ Eugenio Garza y Garza |

| |

Eugenio Garza y Garza |

| |

Director of Finance and Corporate Development |

Date: November 9, 2023

Exhibit 99.1

FEMSA ANNOUNCES FINAL RESULTS OF

ITS PREVIOUSLY ANNOUNCED TENDER OFFER

FOR ITS OUTSTANDING NOTES DUE 2043

November 9, 2023

MONTERREY, MEXICO - FOMENTO ECONÓMICO MEXICANO, S.A.B. DE

C.V. (“FEMSA”) (NYSE: FMX; BMV: FEMSAUBD, FEMSAUB) today announced the final results of its previously announced

offer (the “Tender Offer”) to purchase for cash any and all of its outstanding US$552,830,000 principal amount of 4.375%

Senior Notes due 2043 (CUSIP/ISIN: 344419 AB2 / US344419AB20) (the “Securities”) on the terms and subject to the conditions

set forth in the offer to purchase, dated October 31, 2023 (the “Offer to Purchase”) and the related notice of guaranteed

delivery (the “Notice of Guaranteed Delivery” and, together with the Offer to Purchase, the “Offer Documents”).

The Tender Offer expired on November 6, 2023, at 5:00 p.m. (New York

City time) (the “Expiration Date”) and settled on November 9, 2023 (the “Settlement Date”). No Notice

of Guaranteed Delivery was received by FEMSA prior to the Expiration Date.

All conditions described in the Offer to Purchase that were to be satisfied

or waived were satisfied on or prior to the Settlement Date and FEMSA accepted for purchase all Securities tendered (and not validly withdrawn)

on or prior to the Expiration Date.

The table below sets forth the aggregate principal amount of the Securities

validly tendered, and not validly withdrawn, in the Tender Offer, and the aggregate consideration paid for the Securities accepted for

purchase in the Tender Offer.

| Notes | |

| CUSIP/ISIN | | |

| Principal Amount

Outstanding(1) | | |

| Offer

Consideration(2) | | |

| Principal Amount Tendered and

Accepted for Purchase | |

| 4.375% Senior Notes due 2043 | |

| 344419 AB2 / US344419AB20 | | |

US$ | 552,830,000 | | |

US$ | 900.21 | | |

US$ | 126,799,000 | |

| (1) | Immediately prior to the commencement of

the Tender Offer. |

| (2) | Per US$1,000 principal amount of the Securities.

Holders whose Securities were accepted for purchase also received the accrued and unpaid

interest on such Securities (the “Accrued Interest”) from, and including,

the last interest payment date for the Securities to, but not including, the Settlement Date,

and additional amounts in respect of withholding taxes applicable to the Accrued Interest

(including gains derived from the sale of the Securities in the Tender Offer that are treated

as interest) (the “Additional Amounts”), if any. |

The aggregate amount paid by FEMSA to Holders whose Securities were

accepted for purchase, including Accrued Interest and Additional Amounts, was approximately US$117 million.

FEMSA retained BofA Securities, Inc. to act as dealer manager in connection

with the Tender Offer (the “Dealer Manager”). Global Bondholder Services Corporation acted as the tender agent and

information agent for the Tender Offer.

Any questions or requests for assistance regarding the Tender Offer

may be directed to the Dealer Manager at (888) 292-0070 (toll-free) or (646) 855-8988 (collect). Requests for additional copies of the

Offer Documents may be directed to Global Bondholder Services Corporation at +1 (855) 654-2014 (toll-free) or +1 (212) 430-3774 (collect).

The Offer Documents can be accessed at the following link: https://www.gbsc-usa.com/femsa/.

* * *

This press release is for informational purposes only. This press release

shall not constitute an offer to purchase or the solicitation of an offer to sell any securities, nor shall there be any offer, solicitation

or sale of any securities in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful.

The Tender Offer was made solely pursuant to the Offer Documents. The

Offer Documents have not been filed with, and have not been approved or reviewed by any federal or state securities commission or regulatory

authority of any country. No authority has passed upon the accuracy or adequacy of the Offer Documents or any other documents related

to the Tender Offer, and it is unlawful and may be a criminal offense to make any representation to the contrary. The Tender Offer was

not made to holders of Securities in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. In any jurisdiction in which the securities laws or blue sky laws require the Tender Offer

to be made by a licensed broker or dealer, the Tender Offer was deemed to have been made on behalf of FEMSA by the Dealer Manager or one

or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

FEMSA Forward Announcement

The Tender Offer described above forms an integral part of the series

of strategic initiatives announced by FEMSA on February 15, 2023, as a result of a thorough strategic review of its business platform,

including the bottom-up definition of long-range plans for each business unit, as well as the top-down analysis of FEMSA’s corporate

and capital structure. That announcement is available at: https://www.globenewswire.com/news release/2023/02/15/2609255/0/en/FEMSA-Forward-Announcing-results-of-strategic-review.html.

That announcement does not form part of this communication.

About FEMSA

FEMSA is a company that creates economic and social value through companies

and institutions and strives to be the best employer and neighbor to the communities in which it operates. It participates in the retail

industry through a Proximity Americas Division operating, among others, OXXO, a small-format store chain, and other related retail formats,

and Proximity Europe which includes Valora, its European retail unit which operates convenience and foodvenience formats. In the retail

industry, it also participates through a Health Division, which includes drugstores and related activities and Digital@FEMSA, which includes

Spin by OXXO and Spin Premia, among other digital financial services initiatives. In the beverage industry, it participates through Coca-Cola

FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume. FEMSA also participates in the logistics and distribution

industry through its Strategic Business Unit, which additionally provides point-of-sale refrigeration and plastic solutions to its business

units and third-party clients. Across its business units, FEMSA has more than 350,000 employees in 18 countries. FEMSA is a member of

the Dow Jones Sustainability MILA Pacific Alliance, the FTSE4Good Emerging Index and the Mexican Stock Exchange Sustainability Index:

S&P/BMV Total México ESG, among other indexes that evaluate its sustainability performance.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking

statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties. No

assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

FEMSA undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or

future events or for any other reason.

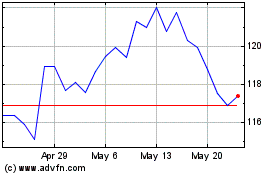

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Jun 2024 to Jul 2024

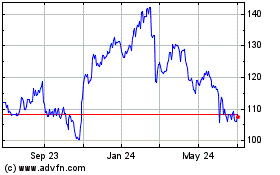

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Jul 2023 to Jul 2024