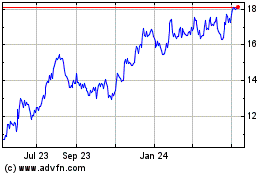

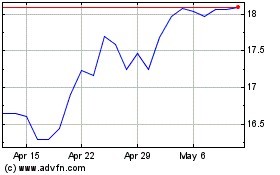

First BanCorp. (the “Corporation” or “First BanCorp.”) (NYSE:

FBP), the bank holding company for FirstBank Puerto Rico

(“FirstBank” or “the Bank”), today reported a net income of $75.8

million, or $0.46 per diluted share, for the second quarter of

2024, compared to $73.5 million, or $0.44 per diluted share, for

the first quarter of 2024, and $70.7 million, or $0.39 per diluted

share, for the second quarter of 2023.

Aurelio Alemán, President and Chief Executive Officer of

First BanCorp, commented: “We closed the first half of the year

with another quarter of solid operating performance across most

franchise metrics and remain highly encouraged by our growth

prospects throughout the rest of the year. Once again, we delivered

a strong return on assets of 1.61%, grew our net interest margin,

registered organic loan growth across all businesses, grew core

deposits and returned 100% of earnings to shareholders in the form

of buybacks and common stock dividends. We continue to generate top

quartile financial results through our proven business model,

ongoing operational efficiency, and commitment to preserve

shareholder value.

Core deposits, other than brokered and government deposits, were

up by $132 million reflecting growth in all regions. More

importantly, this growth includes a $47 million increase in

non-interest-bearing deposits, further expanding our low-cost and

well diversified funding base while reducing our exposure to

higher-cost funding sources. Even though overall asset quality

remained stable, as we have previously mentioned we have continued

to see early-delinquency and charge-off trends within the consumer

lending segment returning to historical levels.

Our balance sheet is uniquely positioned to continue serving our

clients and communities while growing the franchise and without

compromising our strong financial profile. We continue to prudently

manage our capital and expect to capitalize on value-creating

growth opportunities that best serve the long-term interest of the

franchise and its shareholders.

Q2

Q1

Q2

YTD June

2024

2024

2023

2024

2023

Financial Highlights Net interest income

$ 199,628

$ 196,520

$ 199,815

$ 396,148

$ 400,700

Provision for credit losses

11,605

12,167

22,230

23,772

37,732

Non-interest income

32,038

33,983

36,271

66,021

68,789

Non-interest expenses

118,682

120,923

112,917

239,605

228,185

Income before income taxes

101,379

97,413

100,939

198,792

203,572

Income tax expense

25,541

23,955

30,284

49,496

62,219

Net income

$ 75,838

$ 73,458

$ 70,655

$ 149,296

$ 141,353

Selected Financial Data Net interest margin

4.22%

4.16%

4.23%

4.19%

4.29%

Efficiency ratio

51.23%

52.46%

47.83%

51.84%

48.60%

Earnings per share - diluted

$ 0.46

$ 0.44

$ 0.39

$ 0.90

$ 0.78

Book value per share

$ 9.10

$ 8.88

$ 7.78

$ 9.10

$ 7.78

Tangible book value per share (1)

$ 8.81

$ 8.58

$ 7.47

$ 8.81

$ 7.47

Return on average equity

20.80%

19.56%

19.66%

20.17%

20.31%

Return on average assets

1.61%

1.56%

1.51%

1.59%

1.53%

(1) Represents a non-GAAP financial measure. Refer to

Non-GAAP Disclosures - Non-GAAP Financial Measures for the

definition of and additional information about this non-GAAP

financial measure. (In thousands, except per share

information and financial ratios)

Results for Second Quarter of

2024 compared to First Quarter of 2024

Profitability

Net income – $75.8 million, or

$0.46 per diluted share compared to $73.5 million, or $0.44 per

diluted share.

Income before income taxes –

$101.3 million compared to $97.4 million.

Adjusted pre-tax, pre-provision income

(Non-GAAP)(1) – $113.1 million, compared to $110.5

million.

Net interest income – $199.6

million compared to $196.5 million. The increase was mainly in

commercial and construction loans due to higher volume and

refinancings at higher market interest rates and higher average

balances in interest-bearing cash balances. Net interest margin

increased to 4.22%, compared to 4.16%.

Provision for credit losses – $11.6

million compared to $12.2 million. The decrease reflects a $10.1

million reduction in the provision for the residential mortgage

loan portfolio associated with updated historical loss experience,

particularly in the Puerto Rico region, and a $1.4 million

reduction in the provision for the commercial and construction loan

portfolios as a result of improvements in projections of

macroeconomic variables, primarily in the commercial mortgage loan

portfolio in the Puerto Rico region. Such decrease was partially

offset by a $10.5 million increase in provision expense for

consumer loans, in part driven by a $9.5 million recovery in the

first quarter of 2024 associated with a bulk sale of fully

charged-off consumer loans.

Non-interest income – $32.0 million

compared to $34.0 million, mainly driven by $3.2 million in

seasonal contingent commissions recorded in the first quarter of

2024.

Non-interest expenses – $118.7

million compared to $120.9 million, mainly driven by a $2.3 million

realized gain on the sale of a commercial real estate OREO property

in the Puerto Rico region in the second quarter of 2024. The

efficiency ratio was 51.23%, compared to 52.46%.

Balance Sheet

Total loans – grew by $72.4 million

to $12.4 billion, primarily attributed to growth in the commercial

and construction and consumer loan portfolios in the Puerto Rico

region. Total loan originations, other than credit card utilization

activity, of $1.1 billion, up $25.3 million.

Core deposits (other than brokered and

government deposits) –increased by $131.7 million to $12.7

billion, reflecting growth of $70.4 million in the Puerto Rico

region, $41.4 million in the Florida region, and $19.9 million in

the Virgin Islands region. This increase includes a $68.5 million

increase in time deposits and a $46.8 million increase in

non-interest-bearing deposits.

Government deposits (fully

collateralized) – decreased by $47.4 million to $3.2 billion.

Variance mainly reflects a decline of $76.6 million in the Puerto

Rico region, partially offset by an increase of $28.3 million in

the Virgin Islands region.

Asset Quality

Allowance for credit losses (“ACL”)

coverage ratio – amounted to 2.06%, compared to 2.14%.

Annualized net charge-offs to average loans ratio increased

to 0.69%, compared to 0.37%. First quarter of 2024 reflects a 31

basis points decrease due to the $9.5 million recovery associated

with a bulk sale of fully charged-off consumer loans.

Non-performing assets – decreased

by $2.7 million to $126.9 million, mainly driven by the effect

during the second quarter of 2024 of both the restoration to

accrual status of a $10.0 million commercial and industrial

(“C&I”) loan in the Florida region in the power generation

industry and a $7.2 million decrease in the OREO portfolio balance,

partially offset by the inflow of a $16.5 million commercial

relationship in the Puerto Rico region in the food retail

industry.

Liquidity and Capital

Liquidity – Cash and cash

equivalents amounted to $586.3 million, compared to $684.5 million.

When adding $1.9 billion of free high-quality liquid securities

that could be liquidated or pledged within one day, total core

liquidity amounted to $2.5 billion, or 13.37% of total assets,

compared to 14.45%. Including the $968.1 million in available

lending capacity at the Federal Home Loan Bank (“FHLB”), available

liquidity amounted to 18.50% of total assets, compared to

19.60%.

Capital – Repurchased $50.0 million

of common stock and paid $26.3 million in common stock dividends.

Capital ratios exceeded required regulatory levels. The

Corporation’s estimated total capital, common equity tier 1

(“CET1”) capital, tier 1 capital, and leverage ratios were 18.21%,

15.77%, 15.77%, and 10.63%, respectively, as of June 30, 2024. On a

non-GAAP basis, the tangible common equity ratio(1) amounted to

7.66% compared to 7.59%.

NET INTEREST INCOME

The following table sets forth information concerning net

interest income for the last five quarters:

Quarter Ended

(Dollars in thousands)

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Net Interest Income

Interest income

$

272,245

$

268,505

$

265,481

$

263,405

$

252,204

Interest expense

72,617

71,985

68,799

63,677

52,389

Net interest income

$

199,628

$

196,520

$

196,682

$

199,728

$

199,815

Average Balances

Loans and leases

$

12,272,816

$

12,207,840

$

12,004,881

$

11,783,456

$

11,591,516

Total securities, other short-term

investments and interest-bearing cash balances

6,698,609

6,720,395

6,835,407

7,325,226

7,333,989

Average interest-earning assets

$

18,971,425

$

18,928,235

$

18,840,288

$

19,108,682

$

18,925,505

Average interest-bearing liabilities

$

11,868,658

$

11,838,159

$

11,665,459

$

11,671,938

$

11,176,385

Average Yield/Rate

Average yield on interest-earning assets -

GAAP

5.76

%

5.69

%

5.59

%

5.47

%

5.35

%

Average rate on interest-bearing

liabilities - GAAP

2.45

%

2.44

%

2.34

%

2.16

%

1.88

%

Net interest spread - GAAP

3.31

%

3.25

%

3.25

%

3.31

%

3.47

%

Net interest margin - GAAP

4.22

%

4.16

%

4.14

%

4.15

%

4.23

%

Net interest income amounted to $199.6 million for the second

quarter of 2024, an increase of $3.1 million, compared to $196.5

million for the first quarter of 2024. The increase in net interest

income reflects the following:

- A $2.8 million increase in interest income on loans, driven

by:

- A $2.2 million increase in interest income

on commercial and construction loans, due to a $1.4 million

increase in interest income, which includes refinancings at higher

market interest rates and $0.5 million in interest income

recognized as a result of the repayment of two previously

charged-off loans in the Florida region; and a $0.8 million

increase in interest income mainly associated with a $50.2 million

increase in the average balance of this portfolio.

- A $0.4 million increase in interest income

on consumer loans and finance leases, mainly in the auto loans and

finance leases portfolios.

- A $1.8 million increase in interest income from

interest-bearing cash balances, driven by a $133.8 million increase

in the average balance of interest-bearing cash balances, primarily

consisting of cash balances deposited at the Federal Reserve Bank

(the “FED”).

Partially offset by:

- A $0.8 million net decrease in interest income from investment

securities, driven by a $0.5 million decrease in interest income on

debt securities associated with a $156.1 million decrease in the

average balance and a $0.5 million decrease related to a higher

level of premium amortization expense due to changes in anticipated

prepayments of U.S. agency mortgage-backed securities (“MBS”),

partially offset by a $0.2 million increase in interest income on

other equity securities.

- A $0.7 million net increase in interest expense on

interest-bearing deposits, consisting of:

- A $2.2 million increase in interest expense

on time deposits, excluding brokered CDs, mainly due to

approximately $1.2 million associated with higher rates paid in the

second quarter of 2024 on new issuances and renewals, and $1.0

million of additional interest expense associated with a $109.8

million increase in the average balance. The average cost of

non-brokered time deposits in the second quarter of 2024 increased

16 basis points to 3.55% when compared to the previous quarter.

Partially offset by:

- A $1.1 million decrease in interest expense

on brokered CDs, primarily related to a $73.3 million decrease in

the average balance of this portfolio.

- A $0.4 million decrease in interest expense

on interest-bearing checking and saving accounts, mainly associated

with a decrease in average rates in the second quarter of 2024 due

to a change in mix within public sector deposits. The average cost

of interest-bearing checking and saving accounts, excluding public

sector deposits, remained flat at 0.75% in the second quarter of

2024, when compared to the previous quarter.

Net interest margin for the second quarter of 2024 was 4.22%, a

6 basis points increase when compared to the first quarter of 2024,

mostly reflecting a change in asset mix from lower-yielding

interest-earning assets to higher-yielding interest-earning assets

and higher yields on commercial loans, partially offset by an

increase in the cost of interest-bearing deposits.

NON-INTEREST INCOME

The following table sets forth information concerning

non-interest income for the last five quarters:

Quarter Ended June 30, 2024 March 31, 2024

December 31, 2023 September 30, 2023 June 30,

2023 (In thousands) Service charges and fees on deposit

accounts $

9,725

$

9,662

$

9,662

$

9,552

$

9,287

Mortgage banking activities

3,419

2,882

2,094

2,821

2,860

Gain on early extinguishment of debt

-

-

-

-

1,605

Insurance commission income

2,786

5,507

2,379

2,790

2,747

Card and processing income

11,523

11,312

11,015

10,841

11,135

Other non-interest income

4,585

4,620

8,459

4,292

8,637

Non-interest income $

32,038

$

33,983

$

33,609

$

30,296

$

36,271

Non-interest income decreased by $2.0 million to $32.0 million

for the second quarter of 2024, compared to $34.0 million for the

first quarter of 2024, mainly due to:

- A $2.7 million decrease in insurance commission income mainly

driven by $3.2 million in seasonal contingent commissions recorded

in the first quarter of 2024 based on the prior year’s production

of insurance policies.

Partially offset by:

- A $0.5 million increase in revenues from mortgage banking

activities, mainly driven by an increase in the net realized gain

on sales of residential mortgage loans in the secondary market due

to a higher volume of sales and a $0.2 million net increase in the

fair value of to-be-announced forward contracts and interest rate

lock commitments. During the second and first quarters of 2024, net

realized gains of $1.5 million and $1.1 million, respectively, were

recognized as a result of Government National Mortgage Association

(“GNMA”) securitization transactions and whole loan sales to U.S.

government-sponsored enterprises amounting to $43.5 million and

$31.5 million, respectively.

NON-INTEREST EXPENSES

The following table sets forth information concerning

non-interest expenses for the last five quarters:

Quarter Ended June 30, 2024 March 31, 2024

December 31, 2023 September 30, 2023 June 30,

2023 (In thousands) Employees' compensation and benefits

$

57,456

$

59,506

$

55,584

$

56,535

$

54,314

Occupancy and equipment

21,851

21,381

21,847

21,781

21,097

Business promotion

4,359

3,842

6,725

4,759

4,167

Professional service fees:

Collections, appraisals and other credit-related fees

1,149

1,366

952

930

1,231

Outsourcing technology services

7,698

7,469

7,003

7,261

7,278

Other professional fees

3,584

3,841

3,295

2,831

3,087

Taxes, other than income taxes

5,408

5,129

5,535

5,465

5,124

FDIC deposit insurance

2,316

3,102

8,454

2,143

2,143

Other insurance and supervisory fees

2,287

2,293

2,308

2,356

2,352

Net gain on OREO operations

(3,609

)

(1,452

)

(1,005

)

(2,153

)

(1,984

)

Credit and debit card processing expenses

7,607

5,751

7,360

6,779

6,540

Communications

2,261

2,097

2,134

2,219

1,992

Other non-interest expenses

6,315

6,598

6,413

5,732

5,576

Total non-interest expenses

$

118,682

$

120,923

$

126,605

$

116,638

$

112,917

Non-interest expenses amounted to $118.7 million in the second

quarter of 2024, a decrease of $2.2 million, from $120.9 million in

the first quarter of 2024. Non-interest expenses for the second and

first quarters of 2024 include the aforementioned Federal Deposit

Insurance Corporation (“FDIC”) special assessment expense of $0.2

million and $0.9 million, respectively. Refer to Non-GAAP

Disclosures - Special Items for additional information. On a

non-GAAP basis, excluding the effect of this Special Item, adjusted

non-interest expenses decreased by $1.5 million mainly due to:

- A $2.1 million decrease in employees’ compensation and benefits

expense, mainly driven by stock-based compensation expense of

retirement-eligible employees recognized during the first quarter

of 2024 and a decrease in payroll taxes due to employees reaching

maximum taxable amounts.

- A $2.2 million increase in net gain on other real estate owned

(“OREO”) operations, mainly driven by the aforementioned $2.3

million realized gain on sale of a commercial real estate OREO

property in Puerto Rico.

Partially offset by:

- A $1.9 million increase in credit and debit card processing

expenses, mainly due to $1.3 million in certain credit card expense

reimbursements recognized during the first quarter of 2024.

- A $0.5 million increase in occupancy and equipment

expenses.

- A $0.5 million increase in business promotion expenses as part

of ongoing marketing efforts.

INCOME TAXES

The Corporation recorded an income tax expense of $25.5 million

for the second quarter of 2024, compared to $23.9 million for the

first quarter of 2024.

The Corporation’s estimated annual effective tax rate, excluding

entities with pre-tax losses from which a tax benefit cannot be

recognized and discrete items, was 24.1% for the second quarter of

2024. As of June 30, 2024, the Corporation had a deferred tax asset

of $142.7 million, net of a valuation allowance of $141.1 million

against the deferred tax assets.

CREDIT QUALITY

Non-Performing Assets

The following table sets forth information concerning

non-performing assets for the last five quarters:

(Dollars in thousands)

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Nonaccrual loans held for investment:

Residential mortgage

$

31,396

$

32,685

$

32,239

$

31,946

$

33,252

Construction

4,742

1,498

1,569

1,640

1,677

Commercial mortgage

11,736

11,976

12,205

21,632

21,536

C&I

27,661

25,067

15,250

18,809

9,194

Consumer and finance leases

20,638

21,739

22,444

19,137

16,362

Total nonaccrual loans held for

investment

$

96,173

$

92,965

$

83,707

$

93,164

$

82,021

OREO

21,682

28,864

32,669

28,563

31,571

Other repossessed property

7,513

6,226

8,115

7,063

5,404

Other assets (1)

1,532

1,551

1,415

1,448

2,111

Total non-performing assets (2)

$

126,900

$

129,606

$

125,906

$

130,238

$

121,107

Past due loans 90 days and still accruing

(3)

$

47,173

$

57,515

$

59,452

$

62,892

$

63,211

Nonaccrual loans held for investment to

total loans held for investment

0.78

%

0.76

%

0.69

%

0.78

%

0.70

%

Nonaccrual loans to total loans

0.78

%

0.75

%

0.69

%

0.78

%

0.70

%

Non-performing assets to total assets

0.67

%

0.69

%

0.67

%

0.70

%

0.63

%

___________________________________________________________________

(1)

Residential pass-through MBS issued by the

Puerto Rico Housing Finance Authority (“PRHFA”) held as part of the

available-for-sale debt securities portfolio.

(2)

Excludes purchased-credit deteriorated

(“PCD”) loans previously accounted for under Accounting Standards

Codification (“ASC”) Subtopic 310-30 for which the Corporation made

the accounting policy election of maintaining pools of loans as

“units of account” both at the time of adoption of current expected

credit losses (“CECL”) on January 1, 2020 and on an ongoing basis

for credit loss measurement. These loans will continue to be

excluded from nonaccrual loan statistics as long as the Corporation

can reasonably estimate the timing and amount of cash flows

expected to be collected on the loan pools. The portion of such

loans contractually past due 90 days or more amounted to $7.4

million as of June 30, 2024 (March 31, 2024- $8.6 million; December

31, 2023 - $8.3 million; September 30, 2023 - $8.9 million; June

30, 2023 - $9.5 million).

(3)

These include rebooked loans, which were

previously pooled into GNMA securities, amounting to $6.8 million

as of June 30, 2024 (March 31, 2024- $8.8 million; December 31,

2023 - $7.9 million; September 30, 2023 - $8.5 million; June 30,

2023 - $6.5 million). Under the GNMA program, the Corporation has

the option but not the obligation to repurchase loans that meet

GNMA’s specified delinquency criteria. For accounting purposes, the

loans subject to the repurchase option are required to be reflected

on the financial statements with an offsetting liability.

Variances in credit quality metrics:

- Total non-performing assets decreased by $2.7 million to $126.9

million as of June 30, 2024, compared to $129.6 million as of March

31, 2024. Total nonaccrual loans held for investment increased by

$3.2 million to $96.2 million as of June 30, 2024, compared to

$93.0 million as of March 31, 2024.

The decrease in non-performing assets was

mainly driven by:

- A $7.2 million decrease in the OREO

portfolio balance, mainly attributable to the aforementioned sale

of a $5.3 million commercial real estate OREO property in Puerto

Rico.

- A $1.3 million decrease in nonaccrual

residential mortgage loans.

- A $1.1 million decrease in nonaccrual

consumer loans, consisting mainly of auto loans and finance

leases.

Partially offset by:

- A $5.6 million increase in nonaccrual

commercial and construction loans, mainly related to the

aforementioned inflow of a $16.5 million commercial relationship in

the Puerto Rico region in the food retail industry, partially

offset by the restoration to accrual status of a $10.0 million

C&I loan in the Florida region in the power generation industry

during the second quarter of 2024.

- A $1.3 million increase in other

repossessed property, consisting of repossessed automobiles.

- Inflows to nonaccrual loans held for investment were $44.0

million in the second quarter of 2024, a decrease of $2.8 million,

compared to inflows of $46.8 million in the first quarter of 2024.

Inflows to nonaccrual consumer loans were $22.5 million in the

second quarter of 2024, a decrease of $8.7 million compared to

inflows of $31.2 million in the first quarter of 2024. Inflows to

nonaccrual residential mortgage loans were $3.4 million in the

second quarter of 2024, a decrease of $1.2 million compared to

inflows of $4.6 million in the first quarter of 2024. Inflows to

nonaccrual commercial and construction loans were $18.1 million in

the second quarter of 2024, an increase of $7.1 million compared to

inflows of $11.0 million in the first quarter of 2024. The net

increase in inflows of commercial and construction loans was mostly

related to the aforementioned $16.5 million commercial relationship

in the Puerto Rico region. See Early Delinquency below for

additional information.

- Adversely classified commercial and construction loans

increased by $10.3 million to $86.8 million as of June 30, 2024,

also driven by the aforementioned inflow of a $16.5 million

commercial relationship in the Puerto Rico region and the downgrade

of a $5.1 million commercial mortgage loan in the Puerto Rico

region, partially offset by an upgrade related to the

aforementioned restoration to accrual status of a $10.0 million

C&I loan in the Florida region.

Early Delinquency

Total loans held for investment in early delinquency (i.e.,

30-89 days past due accruing loans, as defined in regulatory

reporting instructions) amounted to $147.4 million as of June 30,

2024, an increase of $13.7 million, compared to $133.7 million as

of March 31, 2024, mainly due to a $15.2 million increase in

consumer loans, mainly in the auto loan portfolio.

Allowance for Credit Losses

The following table summarizes the activity of the ACL for

on-balance sheet and off-balance sheet exposures during the second

and first quarters of 2024:

Quarter Ended June 30,

2024

Loans and Finance

Leases

Debt Securities

Residential Mortgage

Loans

Commercial and Construction

Loans

Consumer Loans and Finance

Leases

Total Loans and Finance

Leases

Unfunded Loans

Commitments

Held-to-Maturity

Available-for-Sale

Total ACL

Allowance for Credit Losses

(Dollars in thousands)

Allowance for credit losses, beginning

balance

$

56,689

$

73,337

$

133,566

$

263,592

$

4,919

$

1,235

$

442

$

270,188

Provision for credit losses - (benefit)

expense

(10,593

)

(4,198

)

26,721

11,930

(417

)

32

60

11,605

Net (charge-offs) recoveries

(45

)

1,033

(21,978

)

(20,990

)

-

-

47

(20,943

)

Allowance for credit losses, end of

period

$

46,051

$

70,172

$

138,309

$

254,532

$

4,502

$

1,267

$

549

$

260,850

Amortized cost of loans and finance

leases

$

2,809,666

$

5,863,843

$

3,711,999

$

12,385,508

Allowance for credit losses on loans to

amortized cost

1.64

%

1.20

%

3.73

%

2.06

%

Quarter Ended March 31,

2024

Loans and Finance

Leases

Debt Securities

Residential Mortgage

Loans

Commercial and Construction

Loans

Consumer Loans and Finance

Leases

Total Loans and Finance

Leases

Unfunded Loans

Commitments

Held-to-Maturity

Available-for-Sale

Total ACL

Allowance for Credit Losses

(Dollars in thousands)

Allowance for credit losses, beginning

balance

$

57,397

$

71,426

$

133,020

$

261,843

$

4,638

$

2,197

$

511

$

269,189

Provision for credit losses - (benefit)

expense

(464

)

(2,799

)

16,180

12,917

281

(962

)

(69

)

12,167

Net (charge-offs) recoveries

(244

)

4,710

(15,634

)

(11,168

)

-

-

-

(11,168

)

Allowance for credit losses, end of

period

$

56,689

$

73,337

$

133,566

$

263,592

$

4,919

$

1,235

$

442

$

270,188

Amortized cost of loans and finance

leases

$

2,801,587

$

5,830,014

$

3,679,847

$

12,311,448

Allowance for credit losses on loans to

amortized cost

2.02

%

1.26

%

3.63

%

2.14

%

The main variances of the total ACL by main categories are

discussed below:

Allowance for Credit Losses for Loans and Finance Leases

As of June 30, 2024, the ACL for loans and finance leases was

$254.5 million, a decrease of $9.1 million, from $263.6 million as

of March 31, 2024. The ratio of the ACL for loans and finance

leases to total loans held for investment was 2.06% as of June 30,

2024, compared to 2.14% as of March 31, 2024. The ratio of the

total ACL for loans and finance leases to nonaccrual loans held for

investment was 264.66% as of June 30, 2024, compared to 283.54% as

of March 31, 2024.

The ACL for residential mortgage loans decreased by $10.6

million, mainly driven by updated historical loss experience used

for determining the ACL estimate resulting in a downward revision

of estimated loss severities and lower required reserve levels.

The ACL for commercial and construction loans decreased by $3.1

million, mainly due to an improvement on the economic outlook of

certain macroeconomic variables, particularly in variables

associated with commercial real estate property performance.

Meanwhile, the ACL for consumer loans increased by $4.6 million,

mainly driven by updated historical loss experience used for

determining the ACL estimate resulting in an upward revision of

estimated loss severities and higher required reserve levels in the

auto loans and finance leases portfolios, increases in portfolio

volumes, and increases in historical charge-off levels.

The provision for credit losses on loans and finance leases was

$11.9 million for the second quarter of 2024, compared to $12.9

million in the first quarter of 2024.

- Provision for credit losses for the residential mortgage loan

portfolio was a net benefit of $10.6 million for the second quarter

of 2024, compared to a net benefit of $0.5 million for the first

quarter of 2024. The increase in net benefit during the second

quarter of 2024 was mainly the result of the aforementioned updated

historical loss experience.

- Provision for credit losses for the commercial and construction

loan portfolios was a net benefit of $4.2 million for the second

quarter of 2024, compared to a net benefit of $2.8 million for the

first quarter of 2024. The increase in net benefit during the

second quarter of 2024 was mainly driven by an improvement on the

economic outlook of certain macroeconomic variables, particularly

in variables associated with commercial real estate property

performance, and $1.2 million in recoveries of two commercial loans

in the Florida region during the second quarter of 2024, compared

to a $5.0 million recovery of a C&I loan in the Puerto Rico

region during the first quarter of 2024.

- Provision for credit losses for the consumer loan and finance

lease portfolios was an expense of $26.7 million for the second

quarter of 2024, compared to an expense of $16.2 million for the

first quarter of 2024. The increase in provision expense was mainly

driven by the $9.5 million recovery associated with the

aforementioned bulk sale of fully charged-off consumer loans during

the first quarter of 2024, the upward historical loss experience

resulting in higher required reserve levels in the auto loans and

finance leases portfolios, increases in portfolio volumes, and

increases in historical charge-off levels.

Net Charge-Offs

The following table presents ratios of annualized net

charge-offs (recoveries) to average loans held-in-portfolio for the

last five quarters:

Quarter Ended June 30, 2024 March 31, 2024

December 31, 2023 September 30, 2023 June 30,

2023 Residential mortgage

0.01

%

0.03

%

-0.04

%

-0.01

%

0.06

%

Construction

-0.02

%

-0.02

%

0.01

%

-3.18

%

-0.99

%

Commercial mortgage

-0.07

%

-0.01

%

0.09

%

-0.01

%

0.01

%

Commercial and Industrial

-0.08

%

-0.59

%

0.00

%

-0.02

%

0.87

%

Consumer loans and finance leases

2.38

%

1.70

%

(1)

2.26

%

1.79

%

1.51

%

Total loans

0.69

%

0.37

%

(1)

0.69

%

0.48

%

0.67

%

(1)

The $9.5 million recovery associated with the bulk sale of fully

charged-off consumer loans during the first quarter of 2024 reduced

the consumer loans and finance leases and total net charge-offs to

related average loans ratio for the quarter ended March 31, 2024 by

104 basis points and 31 basis points, respectively.

The ratios above are based on annualized net charge-offs and are

not necessarily indicative of the results expected in subsequent

periods.

Net charge-offs were $21.0 million for the second quarter of

2024, or an annualized 0.69% of average loans, compared to $11.2

million, or an annualized 0.37% of average loans, in the first

quarter of 2024. The $9.8 million increase in net charge-offs was

mainly driven by the effect during the first quarter of 2024 of

both the $9.5 million recovery associated with the aforementioned

bulk sale of fully charged-off consumer loans and the

aforementioned $5.0 million recovery associated with a C&I loan

in the Puerto Rico region, partially offset by a decrease in

charge-offs in the auto loans and finance leases portfolios and

$1.2 million in recoveries of two commercial loans in the Florida

region during the second quarter of 2024.

Allowance for Credit Losses for Unfunded Loan Commitments

As of June 30, 2024, the ACL for off-balance sheet credit

exposures decreased to $4.5 million, compared to $4.9 million as of

March 31, 2024, mainly driven by an improvement on the economic

outlook of certain macroeconomic variables, particularly in

variables associated with commercial real estate property

performance.

Allowance for Credit Losses for Debt Securities

As of June 30, 2024, the ACL for debt securities was $1.8

million, of which $1.3 million related to Puerto Rico municipal

bonds classified as held-to-maturity, compared to $1.6 million and

$1.2 million, respectively, as of March 31, 2024.

LIQUIDITY

Cash and cash equivalents decreased by $98.2 million to $586.3

million as of June 30, 2024. When adding $1.9 billion of free

high-quality liquid securities that could be liquidated or pledged

within one day, total core liquidity amounted to $2.5 billion as of

June 30, 2024, or 13.37% of total assets, compared to $2.7 billion,

or 14.45% of total assets as of March 31, 2024. In addition, as of

June 30, 2024, the Corporation had $968.1 million available for

credit with the FHLB based on the value of collateral pledged with

the FHLB. As such, the basic liquidity ratio (which includes cash,

free high-quality liquid assets such as U.S. government and

government-sponsored enterprises’ obligations that could be

liquidated or pledged within one day, and available secured lines

of credit with the FHLB to total assets) was approximately 18.50%

as of June 30, 2024, compared to 19.60% as of March 31, 2024.

In addition to the aforementioned available credit from the

FHLB, the Corporation also maintains borrowing capacity at the FED

Discount Window Program. The Corporation does not consider

borrowing capacity from the FED Discount Window as a primary source

of liquidity but had approximately $2.5 billion available for

funding under the FED’s Borrower-In-Custody Program as of June 30,

2024. Combined, as of June 30, 2024, the Corporation had $6.0

billion, or 132% of estimated uninsured deposits (excluding fully

collateralized government deposits), available to meet liquidity

needs. Also, the Corporation has access to financing with other

counterparties through repurchase agreements.

The Corporation’s total deposits, excluding brokered CDs,

amounted to $15.9 billion as of June 30, 2024, compared to $15.8

billion as of March 31, 2024, which includes $3.2 billion in

government deposits that are fully collateralized as of each of

June 30, 2024 and March 31, 2024. Excluding fully collateralized

government deposits and FDIC-insured deposits, as of June 30, 2024,

the estimated amount of uninsured deposits was $4.5 billion, which

represents 28.46% of total deposits, compared to $4.4 billion, or

27.93% of total deposits, as of March 31, 2024. Refer to Table 11

in the accompanying tables (Exhibit A) for additional information

about the deposits composition.

STATEMENT OF FINANCIAL CONDITION

Total assets were approximately $18.9 billion as of June 30,

2024, down $9.6 million from March 31, 2024.

The following variances within the main components of total

assets are noted:

- A $98.2 million decrease in cash and cash equivalents, related

to loan growth, the repurchases of common stock, the payment of

common stock dividends, and repayment of matured brokered CDs,

partially offset by cash inflows from the investment securities

portfolio.

- A $95.1 million decrease in investment securities, mainly

driven by principal repayments of $132.9 million, which include

scheduled repayments of $97.9 million and maturities of $35.0

million, partially offset by $28.0 million in purchases of

Community Reinvestment Act qualified debt securities during the

second quarter of 2024 and a $10.6 million increase in the fair

value of available-for-sale debt securities attributable to changes

in market interest rates.

- A $72.4 million increase in total loans. The variance consisted

of increases of $47.6 million in the Puerto Rico region, $17.7

million in the Florida region, and $7.1 million in the Virgin

Islands region. On a portfolio basis, the variance consisted of

increases of $33.8 million in commercial and construction loans,

$32.2 million in consumer loans, primarily auto loans and finance

leases in the Puerto Rico region, and $6.4 million in residential

mortgage loans. The growth in commercial and construction loans was

mainly in the Puerto Rico region, driven by a $43.1 million

increase in the floor plan lines of credit portfolio and a $9.6

million disbursement of a construction loan, partially offset by

$27.4 million in payoffs associated with two C&I loans. Total

loan originations, including refinancings, renewals, and draws from

existing commitments (excluding credit card utilization activity),

amounted to $1.1 billion in the second quarter of 2024, an increase

of $25.3 million compared to the first quarter of 2024. The

variances by geography and portfolio basis follow: Total loan

originations in the Puerto Rico region amounted to $840.5 million

in the second quarter of 2024, an increase of $33.0 million,

compared to $807.5 million in the first quarter of 2024. The $33.0

million increase in total loan originations consisted of increases

of $24.9 million in residential mortgage loans, $7.2 million in

consumer loans, and $0.9 million in commercial and construction

loans. Total loan originations in the Virgin Islands region

amounted to $20.8 million in the second quarter of 2024, compared

to $19.1 million in the first quarter of 2024. The $1.7 million

increase in total loan originations consisted of increases of $1.5

million in commercial and construction loans and $0.9 million in

consumer loans, partially offset by a $0.7 million decrease in

residential mortgage loans. Total loan originations in the Florida

region amounted to $251.0 million in the second quarter of 2024,

compared to $260.4 million in the first quarter of 2024. The $9.4

million decline in total loan originations was mainly due to a

$21.7 million decrease in commercial and construction loans,

principally in commercial mortgage loans. This variance was

partially offset by increases of $9.8 million in residential

mortgage loans and $2.5 million in consumer loans.

Total liabilities were approximately $17.4 billion as of June

30, 2024, a decrease of $21.3 million from March 31, 2024.

- Total deposits decreased $16.6 million consisting of:

- A $100.9 million decrease in brokered CDs. The decline reflects

maturing short-term brokered CDs amounting to $174.6 million with

an all-in cost of 5.51% that were paid off during the second

quarter of 2024, partially offset by $73.7 million of new issuances

with original average maturities of approximately 1 year and an

all-in cost of 5.18%.

- A $47.4 million decrease in government deposits, which includes

a decline of $76.6 million in the Puerto Rico region, partially

offset by increases of $28.3 million in the Virgin Islands region

and $0.9 million in the Florida region.

- A $131.7 million increase in deposits, excluding brokered CDs

and government deposits, reflecting growth of $70.4 million in the

Puerto Rico region, $41.4 million in the Florida region, and $19.9

million in the Virgin Islands region. The increase in such deposits

includes a $68.5 million increase in time deposits and a $46.8

million increase in non-interest-bearing deposits.

Total stockholders’ equity amounted to $1.5 billion as of June

30, 2024, an increase of $11.7 million from March 31, 2024, mainly

driven by net income generated in the second quarter of 2024 and a

$10.6 million increase in the fair value of available-for-sale debt

securities due to changes in market interest rates recognized as

part of accumulated other comprehensive loss, partially offset by

$50.0 million in stock repurchases under the 2023 capital plan

authorization of $225 million and $26.6 million in common stock

dividends declared in the second quarter of 2024.

As of June 30, 2024, capital ratios exceeded the required

regulatory levels for bank holding companies and well-capitalized

banks. The Corporation’s estimated CET1 capital, tier 1 capital,

total capital and leverage ratios under the Basel III rules were

15.77%, 15.77%, 18.21%, and 10.63%, respectively, as of June 30,

2024, compared to CET1 capital, tier 1 capital, total capital, and

leverage ratios of 15.90%, 15.90%, 18.36%, and 10.65%,

respectively, as of March 31, 2024.

Meanwhile, estimated CET1 capital, tier 1 capital, total capital

and leverage ratios of our banking subsidiary, FirstBank, were

15.97%, 16.73%, 17.98%, and 11.29%, respectively, as of June 30,

2024, compared to CET1 capital, tier 1 capital, total capital and

leverage ratios of 16.12%, 16.89%, 18.15%, and 11.31%,

respectively, as of March 31, 2024.

Tangible Common Equity (Non-GAAP)

On a non-GAAP basis, the Corporation’s tangible common equity

ratio increased to 7.66% as of June 30, 2024, compared to 7.59% as

of March 31, 2024, mainly driven by the $10.6 million increase in

the fair value of available-for-sale debt securities due to changes

in market interest rates. Refer to Non-GAAP Disclosures- Non-GAAP

Financial Measures for the definition of and additional information

about this non-GAAP financial measure.

The following table presents a reconciliation of the

Corporation’s tangible common equity and tangible assets to the

most comparable GAAP items as of the indicated dates:

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

(In thousands, except ratios and per share

information)

Tangible Equity:

Total common equity - GAAP

$

1,491,460

$

1,479,717

$

1,497,609

$

1,303,068

$

1,397,999

Goodwill

(38,611

)

(38,611

)

(38,611

)

(38,611

)

(38,611

)

Other intangible assets

(9,700

)

(11,542

)

(13,383

)

(15,229

)

(17,092

)

Tangible common equity -

non-GAAP

$

1,443,149

$

1,429,564

$

1,445,615

$

1,249,228

$

1,342,296

Tangible Assets:

Total assets - GAAP

$

18,881,374

$

18,890,961

$

18,909,549

$

18,594,608

$

19,152,455

Goodwill

(38,611

)

(38,611

)

(38,611

)

(38,611

)

(38,611

)

Other intangible assets

(9,700

)

(11,542

)

(13,383

)

(15,229

)

(17,092

)

Tangible assets - non-GAAP

$

18,833,063

$

18,840,808

$

18,857,555

$

18,540,768

$

19,096,752

Common shares outstanding

163,865

166,707

169,303

174,386

179,757

Tangible common equity ratio -

non-GAAP

7.66

%

7.59

%

7.67

%

6.74

%

7.03

%

Tangible book value per common share -

non-GAAP

$

8.81

$

8.58

$

8.54

$

7.16

$

7.47

Exposure to Puerto Rico Government

As of June 30, 2024, the Corporation had $316.7 million of

direct exposure to the Puerto Rico government, its municipalities,

and public corporations, an increase of $3.0 million when compared

to $313.7 million as of March 31, 2024. As of June 30, 2024,

approximately $203.1 million of the exposure consisted of loans and

obligations of municipalities in Puerto Rico that are supported by

assigned property tax revenues and for which, in most cases, the

good faith, credit, and unlimited taxing power of the applicable

municipality have been pledged to their repayment, and $59.4

million consisted of loans and obligations which are supported by

one or more specific sources of municipal revenues. The

Corporation’s total direct exposure to the Puerto Rico government

also included $8.8 million in a loan extended to an affiliate of

the Puerto Rico Electric Power Authority and $42.3 million in loans

to agencies of Puerto Rico public corporations. In addition, the

total direct exposure included an obligation of the Puerto Rico

government, specifically a residential pass-through MBS issued by

the PRHFA, at an amortized cost of $3.1 million (fair value of $1.5

million as of June 30, 2024), included as part of the Corporation’s

available-for-sale debt securities portfolio. This residential

pass-through MBS issued by the PRHFA is collateralized by certain

second mortgages and had an unrealized loss of $1.6 million as of

June 30, 2024, of which $0.4 million is due to credit

deterioration.

The aforementioned exposure to municipalities in Puerto Rico

included $107.5 million of financing arrangements with Puerto Rico

municipalities that were issued in bond form but underwritten as

loans with features that are typically found in commercial loans.

These bonds are accounted for as held-to-maturity debt

securities.

As of June 30, 2024, the Corporation had $2.7 billion of public

sector deposits in Puerto Rico, compared to $2.8 billion as of

March 31, 2024. Approximately 23% of the public sector deposits as

of June 30, 2024 were from municipalities and municipal agencies in

Puerto Rico, and 77% were from public corporations, the Puerto Rico

central government and agencies, and U.S. federal government

agencies in Puerto Rico.

NON-GAAP DISCLOSURES

This press release contains GAAP financial measures and non-GAAP

financial measures. Non-GAAP financial measures are used when

management believes that the presentation of these non-GAAP

financial measures enhances the ability of analysts and investors

to analyze trends in the Corporation’s business and understand the

performance of the Corporation. The Corporation may utilize these

non-GAAP financial measures as guides in its budgeting and

long-term planning process. Where non-GAAP financial measures are

used, the most comparable GAAP financial measure, as well as the

reconciliation of the non-GAAP financial measure to the most

comparable GAAP financial measure, can be found in the text or in

the tables in or attached to this press release. Any analysis of

these non-GAAP financial measures should be used only in

conjunction with results presented in accordance with GAAP.

Certain non-GAAP financial measures, such as adjusted net income

and adjusted earnings per share, adjusted pre-tax, pre-provision

income, and adjusted non-interest expenses exclude the effect of

items that management believes are not reflective of core operating

performance (the “Special Items”). Other non-GAAP financial

measures include adjusted net interest income and adjusted net

interest income margin, tangible common equity, tangible book value

per common share, and certain capital ratios. These measures should

be read in conjunction with the accompanying tables (Exhibit A),

which are an integral part of this press release, and the

Corporation’s other financial information that is presented in

accordance with GAAP.

Special Items

The financial results for the second and first quarters of 2024

and second quarter of 2023 included the following Special

Items:

Quarters Ended June 30, 2024 and March 31,

2024

FDIC Special Assessment Expense

Charges of $0.2 million ($0.1 million after-tax, calculated

based on the statutory tax rate of 37.5%) and $0.9 million ($0.6

million after-tax) were recorded in the second and first quarter of

2024, respectively, to increase the initial estimated FDIC special

assessment resulting from the FDIC’s updates related to the loss

estimate in connection with losses to the Deposit Insurance Fund

associated with protecting uninsured deposits following the

failures of certain financial institutions during the first half of

2023. The aforementioned charges increased the estimated FDIC

special assessment to a total of $7.4 million, which was the

revised estimated loss reflected in the FDIC invoice for the first

quarterly collection period with a payment date of June 28, 2024.

The FDIC deposit special assessment is reflected in the condensed

consolidated statements of income as part of “FDIC deposit

insurance” expenses.

Quarter Ended June 30, 2023

Gain Recognized from Legal Settlement

During the second quarter of 2023, the Corporation recognized a

$3.6 million ($2.3 million after-tax, calculated based on the

statutory tax rate of 37.5%) gain from a legal settlement reflected

in the condensed consolidated statements of income as part of other

non-interest income.

Gain on Early Extinguishment of Debt

During the second quarter of 2023, the Corporation recognized a

$1.6 million gain on the repurchase of $21.4 million in junior

subordinated debentures reflected in the condensed consolidated

statements of income as “Gain on early extinguishment of debt.” The

junior subordinated debentures are reflected in the condensed

consolidated statements of financial condition as “Other

borrowings.” The purchase price equated to 92.5% of the $21.4

million par value. The 7.5% discount resulted in the gain of $1.6

million. The gain, realized at the holding company level, had no

effect on the income tax expense in the second quarter of 2023.

Non-GAAP Financial Measures

Adjusted Pre-Tax, Pre-Provision Income

Adjusted pre-tax, pre-provision income is a non-GAAP performance

metric that management uses and believes that investors may find

useful in analyzing underlying performance trends, particularly in

times of economic stress, including as a result of natural

catastrophes or health epidemics. Adjusted pre-tax, pre-provision

income, as defined by management, represents income before income

taxes adjusted to exclude the provisions for credit losses on

loans, unfunded loan commitments and debt securities. In addition,

from time to time, earnings are also adjusted for certain items

that management believes are not reflective of core operating

performance, which are regarded as Special Items.

Tangible Common Equity Ratio and Tangible Book Value per Common

Share

The tangible common equity ratio and tangible book value per

common share are non-GAAP financial measures that management

believes are generally used by the financial community to evaluate

capital adequacy. Tangible common equity is total common equity

less goodwill and other intangible assets. Tangible assets are

total assets less goodwill and other intangible assets. Tangible

common equity ratio is tangible common equity divided by tangible

assets. Tangible book value per common share is tangible assets

divided by common shares outstanding. Refer to Statement of

Financial Condition - Tangible Common Equity (Non-GAAP) for a

reconciliation of the Corporation’s total stockholders’ equity and

total assets in accordance with GAAP to the non-GAAP financial

measures of tangible common equity and tangible assets,

respectively. Management uses and believes that many stock analysts

use the tangible common equity ratio and tangible book value per

common share in conjunction with other more traditional bank

capital ratios to compare the capital adequacy of banking

organizations with significant amounts of goodwill or other

intangible assets, typically stemming from the use of the purchase

method of accounting for mergers and acquisitions. Accordingly, the

Corporation believes that disclosure of these financial measures

may be useful to investors. Neither tangible common equity nor

tangible assets, or the related measures, should be considered in

isolation or as a substitute for stockholders’ equity, total

assets, or any other measure calculated in accordance with GAAP.

Moreover, the manner in which the Corporation calculates its

tangible common equity, tangible assets, and any other related

measures may differ from that of other companies reporting measures

with similar names.

Net Interest Income Excluding Valuations, and on a

Tax-Equivalent Basis

Net interest income, interest rate spread, and net interest

margin are reported excluding the changes in the fair value of

derivative instruments and on a tax-equivalent basis in order to

provide to investors additional information about the Corporation’s

net interest income that management uses and believes should

facilitate comparability and analysis of the periods presented. The

changes in the fair value of derivative instruments have no effect

on interest due or interest earned on interest-bearing liabilities

or interest-earning assets, respectively. The tax-equivalent

adjustment to net interest income recognizes the income tax savings

when comparing taxable and tax-exempt assets and assumes a marginal

income tax rate. Income from tax-exempt earning assets is increased

by an amount equivalent to the taxes that would have been paid if

this income had been taxable at statutory rates. Refer to Table 4

in the accompanying tables (Exhibit A) for a reconciliation of the

Corporation’s net interest income to adjusted net interest income

excluding valuations, and on a tax-equivalent basis. Management

believes that it is a standard practice in the banking industry to

present net interest income, interest rate spread, and net interest

margin on a fully tax-equivalent basis. This adjustment puts all

earning assets, most notably tax-exempt securities and tax-exempt

loans, on a common basis that management believes facilitates

comparison of results to the results of peers.

NET INCOME AND RECONCILIATION TO ADJUSTED NET INCOME

(NON-GAAP)

The following table reconciles, for the second and first

quarters of 2024, second quarter of 2023, and six-month periods

ended June 30, 2024 and 2023, net income to adjusted net income and

adjusted earnings per diluted share, which are non-GAAP financial

measures that exclude the significant Special Items discussed in

the Non-GAAP Disclosures - Special Items section.

Quarter Ended Six-Month Period Ended June 30,

2024 March 31, 2024 June 30, 2023 June 30,

2024 June 30, 2023 (In thousands, except per share

information) Net income, as reported (GAAP) $

75,838

$

73,458

$

70,655

$

149,296

$

141,353

Adjustments: FDIC special assessment expense

152

947

-

1,099

-

Gain recognized from legal settlement

-

-

(3,600

)

-

(3,600

)

Gain on early extinguishment of debt

-

-

(1,605

)

-

(1,605

)

Income tax impact of adjustments (1)

(57

)

(355

)

1,350

(412

)

1,350

Adjusted net income attributable to common stockholders (non-GAAP)

$

75,933

$

74,050

$

66,800

$

149,983

$

137,498

Weighted-average diluted shares outstanding

165,543

167,798

179,277

166,670

180,253

Earnings Per Share - diluted (GAAP) $

0.46

$

0.44

$

0.39

$

0.90

$

0.78

Adjusted Earnings Per Share - diluted (non-GAAP) $

0.46

$

0.44

$

0.37

$

0.90

$

0.76

(1)

See Non-GAAP Disclosures - Special Items above for discussion of

the individual tax impact related to the above adjustments.

INCOME BEFORE INCOME TAXES AND RECONCILIATION TO ADJUSTED

PRE-TAX, PRE-PROVISION INCOME (NON-GAAP)

The following table reconciles income before income taxes to

adjusted pre-tax, pre-provision income for the last five quarters

and for the six-month periods ended June 30, 2024 and 2023:

Quarter Ended Six-Month Period Ended June 30,

2024 March 31, 2024 December 31, 2023

September 30, 2023 June 30, 2023 June 30, 2024

June 30, 2023 (Dollars in thousands) Income before income

taxes $

101,379

$

97,413

$

84,874

$

108,990

$

100,939

$

198,792

$

203,572

Add: Provision for credit losses expense

11,605

12,167

18,812

4,396

22,230

23,772

37,732

Add: FDIC special assessment expense

152

947

6,311

-

-

1,099

-

Less: Gain recognized from legal settlement

-

-

-

-

(3,600

)

-

(3,600

)

Less: Gain on early extinguishment of debt

-

-

-

-

(1,605

)

-

(1,605

)

Adjusted pre-tax, pre-provision income (1) $

113,136

$

110,527

$

109,997

$

113,386

$

117,964

$

223,663

$

236,099

Change from most recent prior period (amount) $

2,609

$

530

$

(3,389

)

$

(4,578

)

$

(171

)

$

(12,436

)

$

5,475

Change from most recent prior period (percentage)

2.4

%

0.5

%

-3.0

%

-3.9

%

-0.1

%

-5.3

%

2.4

%

____________________________________________

(1)

Non-GAAP financial measure. See Non-GAAP Disclosures above for the

definition and additional information about this non-GAAP financial

measure.

Conference Call / Webcast Information

First BanCorp.’s senior management will host an earnings

conference call and live webcast on Tuesday, July 23, 2024, at

10:00 a.m. (Eastern Time). The call may be accessed via a live

Internet webcast through the Corporation’s investor relations

website, fbpinvestor.com, or through a dial-in telephone number at

(833) 470-1428 or (404) 975-4839 for international callers. The

participant access code is 715720. The Corporation recommends that

listeners go to the web site at least 15 minutes prior to the call

to download and install any necessary software. Following the

webcast presentation, a question and answer session will be made

available to research analysts and institutional investors. A

replay of the webcast will be archived in the Corporation’s

investor relations website, fbpinvestor.com, until July 23, 2025. A

telephone replay will be available one hour after the end of the

conference call through August 22, 2024, at (866) 813-9403. The

replay access code is 306594.

Safe Harbor

This press release may contain “forward-looking statements”

concerning the Corporation’s future economic, operational, and

financial performance. The words or phrases “expect,” “anticipate,”

“intend,” “should,” “would,” “will,” “plans,” “forecast,”

“believe,” and similar expressions are meant to identify

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and are subject to the

safe harbor created by such sections. The Corporation cautions

readers not to place undue reliance on any such forward-looking

statements, which speak only as of the date hereof, and advises

readers that any such forward-looking statements are not guarantees

of future performance and involve certain risks, uncertainties,

estimates, and assumptions by us that are difficult to predict.

Various factors, some of which are beyond our control, including,

but not limited to, the uncertainties more fully discussed in Part

I, Item 1A, “Risk Factors” of the Corporation’s Annual Report on

Form 10-K for the year ended December 31, 2023, and the following,

could cause actual results to differ materially from those

expressed in, or implied by, such forward-looking statements: the

effect of the current interest rate environment and inflation

levels or changes in interest rates on the level, composition and

performance of the Corporation’s assets and liabilities, and

corresponding effects on the Corporation’s net interest income, net

interest margin, loan originations, deposit attrition, overall

results of operations, and liquidity position; the effects of

changes in the interest rate environment, including any adverse

change in the Corporation’s ability to attract and retain clients

and gain acceptance from current and prospective customers for new

products and services, including those related to the offering of

digital banking and financial services; volatility in the financial

services industry, including failures or rumored failures of other

depository institutions, and actions taken by governmental agencies

to stabilize the financial system, which could result in, among

other things, bank deposit runoffs, liquidity constraints, and

increased regulatory requirements and costs; the effect of

continued changes in the fiscal and monetary policies and

regulations of the U.S. federal government, the Puerto Rico

government and other governments, including those determined by the

Federal Reserve Board, the Federal Reserve Bank of New York, the

FDIC, government-sponsored housing agencies and regulators in

Puerto Rico, the U.S., and the U.S. and British Virgin Islands,

that may affect the future results of the Corporation; uncertainty

as to the ability of FirstBank to retain its core deposits and

generate sufficient cash flow through its wholesale funding

sources, such as securities sold under agreements to repurchase,

FHLB advances, and brokered CDs, which may require us to sell

investment securities at a loss; adverse changes in general

economic conditions in Puerto Rico, the U.S., and the U.S. and

British Virgin Islands, including in the interest rate environment,

unemployment rates, market liquidity, housing absorption rates,

real estate markets, and U.S. capital markets, which may affect

funding sources, loan portfolio performance and credit quality,

market prices of investment securities, and demand for the

Corporation’s products and services, and which may reduce the

Corporation’s revenues and earnings and the value of the

Corporation’s assets; the impact of government financial assistance

for hurricane recovery and other disaster relief on economic

activity in Puerto Rico, and the timing and pace of disbursements

of funds earmarked for disaster relief; the ability of the

Corporation, FirstBank, and third-party service providers to

identify and prevent cyber-security incidents, such as data

security breaches, ransomware, malware, “denial of service”

attacks, “hacking,” identity theft, and state-sponsored

cyberthreats, and the occurrence of and response to any incidents

that occur, which may result in misuse or misappropriation of

confidential or proprietary information, disruption, or damage to

our systems or those of third-party service providers on which we

rely, increased costs and losses and/or adverse effects to our

reputation; general competitive factors and other market risks as

well as the implementation of existent or planned strategic growth

opportunities, including risks, uncertainties, and other factors or

events related to any business acquisitions, dispositions,

strategic partnerships, strategic operational investments,

including systems conversions, and any anticipated efficiencies or

other expected results related thereto; uncertainty as to the

implementation of the debt restructuring plan of Puerto Rico and

the fiscal plan for Puerto Rico as certified on June 5, 2024, by

the oversight board established by the Puerto Rico Oversight,

Management, and Economic Stability Act, or any revisions to it, on

our clients and loan portfolios, and any potential impact from

future economic or political developments and tax regulations in

Puerto Rico; the impact of changes in accounting standards, or

assumptions in applying those standards, and of forecasts of

economic variables considered for the determination of the ACL; the

ability of FirstBank to realize the benefits of its net deferred

tax assets; the ability of FirstBank to generate sufficient cash

flow to pay dividends to the Corporation; environmental, social,

and governance matters, including our climate-related initiatives

and commitments; the impacts of natural or man-made disasters, the

emergence or continuation of widespread health emergencies,

geopolitical conflicts (including sanctions, war or armed conflict,

such as the ongoing conflict in Ukraine, the conflict between

Israel and Hamas, and the possible expansion of such conflicts in

surrounding areas and potential geopolitical consequences),

terrorist attacks, or other catastrophic external events, including

impacts of such events on general economic conditions and on the

Corporation’s assumptions regarding forecasts of economic

variables; the risk that additional portions of the unrealized

losses in the Corporation’s debt securities portfolio are

determined to be credit-related, resulting in additional charges to

the provision for credit losses on the Corporation’s debt

securities portfolio, and the potential for additional credit

losses that could emerge from the downgrade of the U.S.’s Long-Term

Foreign-Currency Issuer Default Rating to ‘AA+’ from ‘AAA’ in

August 2023 and subsequent negative ratings outlooks; the impacts

of applicable legislative, tax, or regulatory changes, as well as

of the 2024 U.S. and Puerto Rico general election, on the

Corporation’s financial condition or performance; the risk of

possible failure or circumvention of the Corporation’s internal

controls and procedures and the risk that the Corporation’s risk

management policies may not be adequate; the risk that the FDIC may

further increase the deposit insurance premium and/or require

further special assessments, causing an additional increase in the

Corporation’s non-interest expenses; any need to recognize

impairments on the Corporation’s financial instruments, goodwill,

and other intangible assets; the risk that the impact of the

occurrence of any of these uncertainties on the Corporation’s

capital would preclude further growth of FirstBank and preclude the

Corporation’s Board of Directors from declaring dividends; and

uncertainty as to whether FirstBank will be able to continue to

satisfy its regulators regarding, among other things, its asset

quality, liquidity plans, maintenance of capital levels, and

compliance with applicable laws, regulations and related

requirements. The Corporation does not undertake to, and

specifically disclaims any obligation to update any

“forward-looking statements” to reflect occurrences or

unanticipated events or circumstances after the date of such

statements, except as required by the federal securities laws.

About First BanCorp.

First BanCorp. is the parent corporation of FirstBank Puerto

Rico, a state-chartered commercial bank with operations in Puerto

Rico, the U.S., and the British Virgin Islands and Florida, and of

FirstBank Insurance Agency. First BanCorp.’s shares of common stock

trade on the New York Stock Exchange under the symbol FBP.

Additional information about First BanCorp. may be found at

www.1firstbank.com.

EXHIBIT A

Table 1 – Condensed Consolidated Statements of Financial

Condition

As of June 30, 2024 March 31, 2024 December

31, 2023 (In thousands, except for share information)

ASSETS Cash and due from banks

$

581,843

$

680,734

$

661,925

Money market investments:

Time deposits with other financial institutions

500

300

300

Other short-term investments

3,939

3,485

939

Total money market investments

4,439

3,785

1,239

Debt securities available for sale, at fair value (ACL of $549 as

of June 30, 2024; $442 as of March 31, 2024; and $511 as of

December 31, 2023)

4,957,311

5,047,179

5,229,984

Debt securities held to maturity, at amortized cost, net of ACL of

$1,267 as of June 30, 2024; $1,235 as of March 30, 2024; and $2,197

as of December 31, 2023 (fair value of $333,690 as of June 30,

2024; $338,120 as of March 31, 2024; and $346,132 as of December

31, 2023)

343,168

348,095

351,981

Total debt securities

5,300,479

5,395,274

5,581,965

Equity securities

51,037

51,390

49,675

Total investment securities

5,351,516

5,446,664

5,631,640

Loans, net of ACL of $254,532 as of June 30, 2024; $263,592 as of

March 31, 2024; and $261,843 as of December 31, 2023

12,130,976

12,047,856

11,923,640

Loans held for sale, at lower of cost or market

10,392

12,080

7,368

Total loans, net

12,141,368

12,059,936

11,931,008

Accrued interest receivable on loans and investments

77,895

73,154

77,716

Premises and equipment, net

138,554

141,471

142,016

OREO

21,682

28,864

32,669

Deferred tax asset, net

142,725

147,743

150,127

Goodwill

38,611

38,611

38,611

Other intangible assets

9,700

11,542

13,383

Other assets

373,041

258,457

229,215

Total assets

$

18,881,374

$

18,890,961

$

18,909,549

LIABILITIES

Deposits:

Non-interest-bearing deposits

$

5,406,054

$

5,346,326

$

5,404,121

Interest-bearing deposits

11,122,902

11,199,185

11,151,864

Total deposits

16,528,956

16,545,511

16,555,985

Advances from the FHLB

500,000

500,000

500,000

Other borrowings

161,700

161,700

161,700

Accounts payable and other liabilities

199,258

204,033

194,255

Total liabilities

17,389,914

17,411,244

17,411,940

STOCKHOLDERSʼ EQUITY

Common stock, $0.10 par value, 223,663,116 shares issued (June 30,

2024 - 163,865,453 shares outstanding; March 31, 2024 - 166,707,047

shares outstanding; and December 31, 2023 - 169,302,812 shares

outstanding)

22,366

22,366

22,366

Additional paid-in capital

961,254

959,319

965,707

Retained earnings

1,941,980

1,892,714

1,846,112

Treasury stock, at cost (June 30, 2024 - 59,797,663 shares; March

31, 2024 - 56,956,069 shares; and December 31, 2023 - 54,360,304

shares)

(790,465

)

(740,447

)

(697,406