- Capitalizes on Strength of EXPR as a Fully Integrated

Omnichannel Platform and WHP Expertise in Acquiring and Growing

Global Consumer Brands to Drive Growth

- WHP to Invest $25 Million to Acquire 5.4 Million Newly Issued

Shares of EXPR at $4.60 Per Share, Representing an Approximate 7.4%

Pro Forma Ownership

- EXPR and WHP Form Intellectual Property Joint Venture Valued at

Approximately $400 Million with WHP to Invest $235 Million for 60%

Ownership, EXPR to Own 40%

- EXPR Will Continue to Advance EXPRESSway Forward Strategy;

Partnership with WHP Will Scale Express Brand Through Category and

Global Licensing Expansion

Fashion apparel retailer Express, Inc. (NYSE: EXPR) ("EXPR") and

WHP Global ("WHP"), a leading global brand management firm, today

announced that they have entered into a mutually transformative

strategic partnership to advance an omnichannel platform which is

expected to drive accelerated, long-term growth through the

acquisition and operation of a portfolio of brands. EXPR and WHP

will also form an intellectual property joint venture intended to

scale the Express brand through new domestic category licensing and

international expansion opportunities.

"Our EXPRESSway Forward strategy has reinvigorated our brand and

rebuilt the foundation of our company, paving the way for this bold

next chapter in our transformation," said Tim Baxter, Chief

Executive Officer at EXPR. "Our partnership with WHP will drive

greater scale and profitability of the Express brand through their

category licensing and international expertise and strengthen our

balance sheet. We expect to accelerate our growth by acquiring

multiple brands in partnership with WHP and operating them on our

platform. Both of these are expected to drive shareholder

value."

This transaction is expected to provide the following

significant financial and operational benefits:

- Capitalizes on strength of EXPR as a fully integrated

omnichannel platform. EXPR will be ideally positioned to

participate in anticipated retail industry consolidation and pursue

acquisitions with WHP and is expected to expand its brand portfolio

to accelerate growth and profitability. Through synergistic

M&A, EXPR will leverage its platform to drive cost savings and

margin expansion.

- Scales existing multi-billion-dollar Express brand through

intellectual property joint venture. We expect this partnership

to accelerate growth for the Express brand through licensing in

non-core categories and international expansion by leveraging WHP’s

expertise.

- Strengthens EXPR balance sheet by providing capital to

acquire brands and reduce debt. EXPR will maintain its

disciplined approach to capital deployment and is working with WHP

to identify compelling, accretive brand acquisition

opportunities.

- Accelerates WHP growth. The strategic partnership is

expected to provide WHP with a best-in-class operating platform to

broaden its M&A pipeline.

"The global growth potential of the Express brand and the EXPR

omnichannel platform will give our company a distinct competitive

edge as we look to acquire more consumer brands," said Yehuda

Shmidman, WHP Global Chairman and Chief Executive Officer. "We are

excited to partner with Tim and his management team and view this

partnership as a huge win for both of our companies."

Baxter continued, "By scaling the Express brand and identifying

opportunities to expand our portfolio, we will leverage our

platform to accelerate growth, generate operating margin expansion

and drive profitability. We have found the right partner in WHP and

look forward to welcoming Yehuda to our Board of Directors."

Transaction Details

The partnership will be effectuated through a multifaceted

transaction. EXPR will form an intellectual property joint venture

with WHP, which will acquire certain intellectual property of EXPR.

Concurrently, EXPR will transform into an omnichannel platform

company, managed and run by its current leadership upon closing of

the transaction. All other aspects of the existing EXPR business

remain unchanged.

Under the terms of the transaction, WHP will also make a common

equity PIPE investment to acquire 5.4 million newly issued shares

of EXPR at $4.60 per share, representing an approximate pro forma

ownership of 7.4%.

The intellectual property joint venture implies a total value of

the Express brand’s intellectual property at approximately $400

million and will be 60% owned by WHP and 40% owned by the EXPR

platform company. WHP will invest $235 million for its stake in the

intellectual property joint venture and EXPR will contribute

certain of its intellectual property assets in exchange for cash

consideration. EXPR will enter into an exclusive long-term license

agreement with multiple renewal options with the intellectual

property joint venture to use the contributed intellectual property

for EXPR’s existing business and will pay a royalty fee to the

intellectual property joint venture. Cash earnings in the

intellectual property joint venture will be distributed quarterly

to both parties on a pro rata basis.

The transaction is expected to close in EXPR’s fourth fiscal

quarter of 2022, subject to lender consent, regulatory approvals

and customary closing conditions.

Management and Board of Directors

The existing Express, Inc. management team and Board of

Directors will continue to lead the company with Mr. Baxter serving

as a director and CEO and Mylle Mangum serving as Chairman of the

Express, Inc. Board of Directors. Upon completion of the

transaction, the Express, Inc. Board of Directors will be expanded

to include Mr. Shmidman.

Advisors

Moelis & Company LLC is serving as financial advisor and

Kirkland & Ellis LLP is serving as legal advisor to EXPR on

this transaction. Goodwin Procter LLP is serving as legal advisor

to WHP.

Express’ Third Quarter Financial Results

In a separate press release issued today, EXPR announced its

third quarter 2022 financial results. The press release is

available at www.express.com/investor.

Conference Call Information

A conference call to discuss the transaction and EXPR’s third

quarter 2022 results is scheduled for December 8, 2022 at 8:00 a.m.

Eastern Time (ET). Investors and analysts interested in

participating in the earnings call are invited to dial (888)

550-5723 approximately ten minutes prior to the start of the call.

The conference call will also be webcast live at

www.express.com/investor. A telephone replay of this call will be

available beginning at 12:00 p.m. ET on December 8, 2022 until

11:59 p.m. ET on December 15, 2022 and can be accessed by dialing

(800) 770-2030 and entering the replay pin number 1790468. In

addition, an investor presentation and infographic of the

transaction, and an investor presentation of EXPR’s third quarter

2022 results will be available at www.express.com/investor

beginning at approximately 7:00 a.m. ET on December 8, 2022.

About Express, Inc.

Express is a modern, multichannel apparel and accessories brand

grounded in versatility, guided by its purpose - We Create

Confidence. We Inspire Self-Expression. - and powered by a styling

community. Launched in 1980 with the idea that style, quality and

value should all be found in one place, Express has been a part of

some of the most important and culture-defining fashion trends. The

Express Edit design philosophy ensures that the brand is always ‘of

the now’ so people can get dressed for every day and any occasion

knowing that Express can help them look the way they want to look

and feel the way they want to feel.

The Company operates over 550 retail and outlet stores in the

United States and Puerto Rico, the express.com online store and the

Express mobile app. Express, Inc. is comprised of the brands

Express and UpWest, and is traded on the NYSE under the symbol

EXPR. For more information, please visit www.express.com or

www.upwest.com.

About WHP Global

WHP Global is a leading New York based firm that acquires global

consumer brands and invests in high-growth distribution channels

including digital commerce platforms and global expansion. WHP owns

ANNE KLEIN®, JOSEPH ABBOUD®, JOE'S JEANS®, WILLIAM RAST®, ISAAC

MIZRAHI®, LOTTO®, TOYS"R"US®, and BABIES"R"US®. Collectively the

brands generate over USD$4.5 billion in global retail sales. The

company also owns WHP+, a turnkey direct to consumer digital

e-commerce platform and WHP SOLUTIONS, a sourcing agency based in

Asia. For more information, please visit www.whp-global.com.

Forward-Looking Statements

Certain statements are "forward-looking statements" made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

any statement that does not directly relate to any historical or

current fact and include, but are not limited to (1) guidance and

expectations, including statements regarding expected operating

margins, comparable sales, effective tax rates, interest income,

net income, diluted earnings per share, cash tax refunds,

liquidity, EBITDA, free cash flow, eCommerce demand, and capital

expenditures, (2) statements regarding expected store openings,

store closures, store conversions, and gross square footage, and

(3) statements regarding Express, Inc.’s (the "Company", "we",

"our" or "us") strategy, plans, and initiatives, including, but not

limited to, results expected from such strategy, plans, and

initiatives. You can identify these forward-looking statements by

the use of words in the future tense and statements accompanied by

words such as "outlook," "indicator," "believes," "expects,"

"potential," "continues," "may," "will," "should," "seeks,"

"approximately," "predicts," "intends," "plans," "scheduled,"

"estimates," "anticipates," "opportunity," "leads" or the negative

version of these words or other comparable words. Forward-looking

statements are based on our current expectations and assumptions,

which may not prove to be accurate. These statements are not

guarantees and are subject to risks, uncertainties, and changes in

circumstances that are difficult to predict, and significant

contingencies, many of which are beyond the Company's control. Many

factors could cause actual results to differ materially and

adversely from these forward-looking statements. Among these

factors are (1) changes in consumer spending and general economic

conditions; (2) the COVID-19 pandemic and its continued impact on

our business operations, store traffic, employee availability,

financial condition, liquidity and cash flow; (3) geopolitical

risks, including impacts from the ongoing conflict between Russia

and Ukraine and increased tensions between China and Taiwan; (4)

our ability to operate our business efficiently, manage capital

expenditures and costs, and obtain financing when required; (5) our

ability to identify and respond to new and changing fashion trends,

customer preferences, and other related factors; (6) fluctuations

in our sales, results of operations, and cash levels on a seasonal

basis and due to a variety of other factors, including our product

offerings relative to customer demand, the mix of merchandise we

sell, promotions, and inventory levels; (7) customer traffic at

malls, shopping centers, and at our stores; (8) competition from

other retailers; (9) our dependence on a strong brand image; (10)

our ability to adapt to changing consumer behavior and develop and

maintain a relevant and reliable omnichannel experience for our

customers; (11) the failure or breach of information systems upon

which we rely; (12) our ability to protect customer data from fraud

and theft; (13) our dependence upon third parties to manufacture

all of our merchandise; (14) changes in the cost of raw materials,

labor, and freight; (15) supply chain or other business disruption,

including as a result of the coronavirus; (16) our dependence upon

key executive management; (17) our ability to execute our growth

strategy, EXPRESSway Forward, including engaging our customers and

acquiring new ones, executing with precision to accelerate sales

and profitability, creating great product and reinvigorating our

brand; (18) our substantial lease obligations; (19) our reliance on

third parties to provide us with certain key services for our

business; (20) impairment charges on long-lived assets; (21) claims

made against us resulting in litigation or changes in laws and

regulations applicable to our business; (22) our inability to

protect our trademarks or other intellectual property rights which

may preclude the use of our trademarks or other intellectual

property around the world; (23) restrictions imposed on us under

the terms of our asset-based loan facility, including restrictions

on the ability to effect share repurchases; (24) changes in tax

requirements, results of tax audits, and other factors that may

cause fluctuations in our effective tax rate; (25) changes in

tariff rates; and (26) natural disasters, extreme weather, public

health issues, including pandemics, fire, acts of terrorism or war

and other events that cause business interruption. These factors

should not be construed as exhaustive and should be read in

conjunction with the additional information concerning these and

other factors in the Company’s filings with the Securities and

Exchange Commission. We undertake no obligation to publicly update

or revise any forward-looking statement as a result of new

information, future events, or otherwise, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221207005985/en/

Express Contacts

Investors Greg Johnson gjohnson@express.com 614-474-4890

Media Jamie Moser / Caroline Lipe Joele Frank, Wilkinson

Brimmer Katcher 212-355-4449

WHP Global Contacts

Media Jaime Cassavechia EJ Media Group 212-518-4771 x108

jaime@ejmediagroup.com

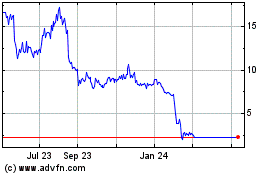

Express (NYSE:EXPR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Express (NYSE:EXPR)

Historical Stock Chart

From Mar 2024 to Mar 2025