0001819438False00018194382024-11-012024-11-010001819438wk:CommonStock0.0001ParValuePerShareMember2024-11-012024-11-010001819438wk:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member2024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2024

ESS TECH, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39525 | | 98-1550150 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

26440 SW Parkway Ave., Bldg. 83 Wilsonville, Oregon | | 97070 |

| (Address of principal executive offices) | | (Zip code) |

(855) 423-9920

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | GWH | | The New York Stock Exchange |

| Warrants, each fifteen warrants exercisable for one share of common stock at an exercise price of $172.50 | | GWH.W | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 1, 2024, ESS Tech, Inc. (the “Company”) entered into a Credit Agreement (the “Credit Agreement”) by and between the Company, as borrower, and Export-Import Bank of the United States, as lender (“EXIM”), and related agreements related to the financing of two production lines under the first tranche of the previously announced up to $50 million financing package.

The Credit Agreement provides for a secured loan facility in an aggregate principal amount of up to $22,709,850, of which $20,000,000 is available to be borrowed for equipment financing and the balance will be used to finance an exposure fee and transaction expenses. The loan facility has a maturity date of June 30, 2031. Half of the proceeds of the loan facility may be used on a retroactive basis for the financing of the Company’s existing automated battery assembly line and the remainder may be used for the financing or refinancing of an additional line upon the closing of an equity raise milestone.

Interest will accrue on borrowings at the Commercial Interest Reference Rate published by EXIM and be payable quarterly in arrears beginning on December 30, 2024, subject to the imposition of a 0.05% penalty interest surcharge if the Company fails to meet certain export quotas for three or more fiscal years. The Company is required to pay to EXIM (i) a loan commitment fee of 0.50% per annum on the uncancelled and undisbursed balance of the total commitment, payable on a quarterly basis commencing on March 30, 2025, and (ii) an exposure fee equal to 12.4250% of the total borrowings, not to exceed $2,485,000 in the aggregate. The Company is required to repay borrowings in nineteen quarterly installments, commencing on December 30, 2026, with any outstanding obligations being due on June 30, 2031.

The Credit Agreement contains customary affirmative and negative covenants, including covenants limiting the ability of the Company to, among other things, grant liens, undergo certain fundamental changes, use financed goods for an unapproved purpose, make certain restricted payments, dispose of assets, and modify the project site lease, in each case, subject to limitations and exceptions set forth in the Credit Agreement. The Company is also required to meet or exceed specified trailing four quarter revenue targets, which financial covenant will be tested quarterly beginning with the fiscal quarter ending March 31, 2025.

The Company’s obligations under the Credit Agreement are secured pursuant to a security agreement granting EXIM a first priority security interest in the financed equipment and a securities account containing collateral consisting of cash and cash equivalents in an amount equal to a certain portion of the disbursements under the Credit Agreement that decreases upon the equity raise milestone and will be reported as restricted cash.

The Credit Agreement contains customary events of default including, among others, certain payment defaults, indebtedness cross defaults, covenant defaults, a change of control default, a material adverse change default, bankruptcy and insolvency defaults and judgment defaults. If an event of default exists, EXIM may require immediate payment of all obligations under the Credit Agreement and may exercise certain other rights and remedies provided for under the Credit Agreement, the other credit documents and applicable law. In the event of a payment default, a default interest rate will apply equal to 1.00% above the higher of the Commercial Interest Reference Rate published by EXIM or the applicable rate of interest specified in the Federal Reserve Statistical Release H.15 (519) as the average monthly rate for the month immediately preceding the date of the relevant payment default for a maturity closest to the duration of the payment default.

The foregoing description of the Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full and complete terms of the Credit Agreement, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 hereof is incorporated by reference into this Item 2.03.

Forward-Looking Statements

The Company cautions you that statements included in this report that are not a description of historical facts are forward-looking statements. These forward-looking statements include statements regarding the disbursement of funds under the Credit Agreement and repayment thereof. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause outcomes to be materially different from any outcomes expressed or implied by the forward-looking statements, including but not limited to the Company’s inability to comply with its obligations under the Credit Agreement, and other factors, risks and uncertainties included in the Company’s other filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the Company undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof. All forward-looking statements are

qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: November 5, 2024

| | | | | |

| ESS TECH, INC. |

| |

| By: | /s/ Anthony Rabb |

| Name: | Anthony Rabb |

| Title: | Chief Financial Officer |

Cover

|

Nov. 01, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2024

|

| Entity Registrant Name |

ESS TECH, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39525

|

| Entity Tax Identification Number |

98-1550150

|

| Entity Address, Address Line One |

26440 SW Parkway Ave.

|

| Entity Address, Address Line Two |

Bldg. 83

|

| Entity Address, City or Town |

Wilsonville

|

| Entity Address, State or Province |

OR

|

| Entity Address, Postal Zip Code |

97070

|

| City Area Code |

(855)

|

| Local Phone Number |

423-9920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819438

|

| Amendment Flag |

false

|

| Common Stock 0.0001 Par Value Per Share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GWH

|

| Security Exchange Name |

NYSE

|

| Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each fifteen warrants exercisable for one share of common stock at an exercise price of $172.50

|

| Trading Symbol |

GWH.W

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

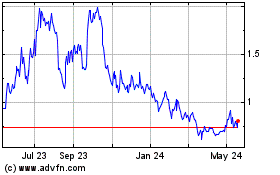

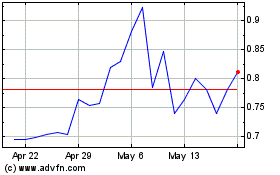

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Nov 2024 to Dec 2024

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Dec 2023 to Dec 2024