Equus Total Return, Inc. (NYSE: EQS) ("Equus") today announces that

Morgan E&P, LLC, ("Morgan"), a wholly-owned subsidiary of

Equus, continues to acquire mineral rights in the Bakken/Three

Forks formation in the Williston Basin of North Dakota. Morgan has

increased its acreage in this area from 4,747.52 net acres to

5,976.84 net acres, an increase of 1,229.32 net acres, or

approximately 25.9%.

Morgan engaged the petroleum engineering firm of Cawley,

Gillespie & Associates, Inc. (“CG&A”) to review and provide

an updated reserve analysis of the asset using the November 30th,

2023 NYMEX strip pricing.

Using a discount rate of 10% (PV 10 Valuation) the values of

proved undeveloped, probable, and possible reserves associated with

the project have increased to $13,575,442, $30,841,802, and

$71,751,024, respectively.

CG&A continues to confirm forty-eight (48) gross drilling

locations, although they have increased Morgan’s net drilling

locations from fifteen (15) to eighteen (18). As additional net

acreage and working interests are acquired, the resulting number of

net drilling locations is expected to increase accordingly. Neither

CG&A nor Morgan can guarantee any amounts that may be

recoverable from these properties. Based on a historical analysis

of the geologic strata that are the subject of Morgan’s development

rights CG&A has noted the estimated ultimate recovery (“EUR”)

from a single well is expected to be approximately 814,000 barrels

of oil equivalent.

About Morgan E&P, LLCMorgan E&P, LLC

(www.morganep.com) is an upstream exploration and production

company focused on the development of oil and gas assets throughout

North America. Morgan is a wholly-owned subsidiary of Equus.

About EquusEquus Total Return, Inc. is a

business development company that trades as a closed-end fund on

the New York Stock Exchange under the symbol "EQS". Additional

information on the Company may be obtained from the Company's

website at www.equuscap.com.

The SEC permits oil and gas companies, in their filings with the

SEC, to disclose only proved, probable and possible reserves that a

company anticipates as of a given date to be economically and

legally producible and deliverable by application of development

projects to known accumulations. We use certain terms in this press

release, such as EUR (estimated ultimate recovery) and total

resource potential, that the SEC's rules strictly prohibit us from

including in filings with the SEC. These measures are by their

nature more speculative than estimates of reserves prepared in

accordance with SEC definitions and guidelines and accordingly are

less certain. We also note that the SEC strictly prohibits us from

aggregating proved, probable and possible reserves in filings with

the SEC due to the different levels of certainty associated with

each reserve category. In addition, PV-10 is a non-GAAP financial

measure, which differs from the GAAP financial measure of

"Standardized Measure" because PV-10 does not include the effects

of income taxes on future income. The income taxes related to the

acquired properties are unknown at this time and are subject to

many variables. As such, the Company has not provided the

Standardized Measure of the acquired properties or a reconciliation

of PV-10 to Standardized Measure.

While the Company believes its assumptions concerning future

events are reasonable, a number of factors could cause actual

results to differ materially from those expected, including, but

not limited to: the risk that the assets acquired by Morgan do not

perform consistent with our expectations, including with respect to

future production or drilling inventory; conditions in the oil and

gas industry, including supply/demand levels for crude oil and

condensate, NGLs and natural gas and the resulting impact on price;

changes in expected reserve or production levels; changes in

political or economic conditions in the U.S., including interest

rates, inflation rates and global and domestic market conditions;

actions taken by the members of the Organization of the Petroleum

Exporting Countries (OPEC) and Russia affecting the production and

pricing of crude oil and other global and domestic political,

economic or diplomatic developments, capital available for

exploration and development; voluntary or involuntary curtailments,

delays or cancellations of certain drilling activities; well

production timing; liabilities or corrective actions resulting from

litigation, other proceedings and investigations or alleged

violations of law or permits; drilling and operating risks, lack

of, or disruption in, access to storage capacity, pipelines or

other transportation methods; availability of drilling rigs,

materials and labor, including the costs associated therewith;

difficulty in obtaining necessary approvals and permits, the

availability, cost, terms and timing of issuance or execution of,

competition for, and challenges to, mineral licenses and leases and

governmental and other permits and rights-of-way, and our ability

to retain mineral licenses and leases; non-performance by third

parties of contractual or legal obligations; hazards such as

weather conditions, a health pandemic (including COVID-19), acts of

war or terrorist acts and the government or military response

thereto, security threats, including cybersecurity threats and

disruptions to our business and operations from breaches of our

information technology systems, or breaches of the information

technology systems, facilities and infrastructure of third parties

with which we transact business, changes in safety, health,

environmental, tax and other regulations, requirements or

initiatives, including initiatives addressing the impact of global

climate change, air emissions, or water management; impacts of the

Inflation Reduction Act of 2022, and other geological, operating

and economic considerations.

This press release may contain certain forward-looking

statements regarding future circumstances, including statements or

assumptions about actual or potential production, hydrocarbon

reserves, recovery rates and amounts, drilling locations, capital

expenditures, or operating results. In some cases, readers can

identify forward-looking statements by words such as “may,” “

will,” “should”, “expect,” “objective,” “plan,” “intend,”

“anticipate,” “believe,” “Management believes,” “estimate,”

“predict,” “project,” “potential,” “forecast,” “continue,”

“strategy,” or “position,” or the negative of such terms or other

variations of them or by comparable terminology. These

forward-looking statements are based upon the Company's current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the performance of the Company, including

our ability to achieve our expected financial and business

objectives, changes in crude oil and natural gas prices, the pace

of drilling and completion activity on properties or acreage rights

owned by Morgan or other of the Company's subsidiaries,

infrastructure constraints and related factors affecting such

properties, cost inflation or supply chain disruptions, ongoing

legal disputes, the Company's ability to acquire, whether through

Morgan or other of the Company's subsidiaries, additional

development opportunities, changes in reserves estimates or the

value thereof, general economic or industry conditions, nationally

and/or in the communities in which the Company or its subsidiaries

conduct business, changes in the interest rate environment,

legislation or regulatory requirements, conditions of the

securities markets, increasing attention to environmental, social

and governance matters, Morgan's ability to acquire additional

acreage and development rights (including the transactions

described herein), and the other risks and uncertainties described

in the Company's filings with the SEC. Actual results, events, and

performance may differ. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

to the date hereof. Except as required by law, the Company

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Company or any

other person that the events or circumstances described in such

statements are material.

Contact:Patricia BaronowskiPristine Advisers, LLC(631)

756-2486

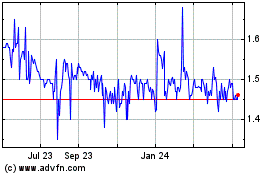

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

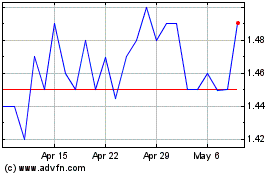

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Feb 2024 to Feb 2025