Current Report Filing (8-k)

June 26 2014 - 6:02AM

Edgar (US Regulatory)

___________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 24, 2014

EQUUS TOTAL RETURN, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

814-00098 |

76-0345915 |

| (State or Other Jurisdiction |

(Commission File |

(IRS Employer |

| Of Incorporation) |

Number) |

Identification No.) |

|

Eight Greenway Plaza, Suite 930, Houston,

Texas |

77046 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (713) 529-0900

N/A

(Former Name or Former Address,

if Changed Since Last Report)

Check the appropriate box below if the Form 8-k filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Item 5.07 Submission of Matters to a Vote of Security Holders.

At the Annual Meeting of Stockholders held on

June 24, 2014 (“Annual Meeting”), the stockholders of Equus Total Return, Inc. (“Equus” or the “Fund”)

voted on three proposals, which are described in detail in the Fund’s Proxy Statement filed with the Securities and Exchange

Commission on April 30, 2014: (i) to elect nine director nominees, each for a term of one year (“Proposal 1”), (ii)

to ratify the appointment of UHY LLP as the Fund’s independent auditor for the fiscal year ended December 31, 2014 (“Proposal

2”), and (iii) to approve on a non-binding advisory basis, the compensation paid to the Fund’s named executive officers

in 2013 (“Proposal 3”).

A voting report was produced by a representative

of Georgeson, Inc., serving as Inspector of Elections for the Annual Meeting, certifying the following results:

Proposal 1 (election of directors):

| Board of Directors Nominees |

For |

Withheld |

Broker Non-Votes |

| Fraser Atkinson |

5,426,685 |

1,782,486 |

0 |

| Alessandro Benedetti |

2,464,050 |

4,745,121 |

0 |

| Richard F. Bergner |

5,396,747 |

1,812,424 |

0 |

| Kenneth I. Denos |

5,417,953 |

1,791,218 |

0 |

| Gregory J. Flanagan |

5,425,430 |

1,783,741 |

0 |

| Henry W. Hankinson |

5,400,096 |

1,809,075 |

0 |

| John A. Hardy |

5,426,951 |

1,782,220 |

0 |

| Robert L. Knauss |

5,397,057 |

1,812,114 |

0 |

| Bertrand des Pallieres |

2,443,751 |

4,765,420 |

0 |

There were no votes against or abstained with

respect to any director nominee.

Proposal 2 (ratification of auditors):

| For |

Against |

Abstained |

Broker Non-Votes |

| 7,092,589 |

841,712 |

977,453 |

0 |

Proposal 3 (non-binding approval of executive compensation

in 2013):

| For |

Against |

Abstained |

Broker Non-Votes |

| 5,270,268 |

1,796,517 |

144,120 |

0 |

Brokers did not have discretionary voting authority

on Proposal 2.

Item 8.01 Other Events.

On June 25, 2014, the Fund issued a press release

announcing the results of the Annual Meeting described in Item 5.07 above. The text of the press release is included as Exhibit

99.1 to this Current Report and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release issued on June 25, 2014 by Equus Total Return, Inc.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Equus Total Return, Inc. |

| Date: June 25, 2014 |

|

|

| |

|

By: /s/ Kenneth I. Denos |

| |

|

Name: Kenneth I. Denos |

| |

|

Title: Secretary |

Exhibit 99.1

Contact:

Patricia Baronowski

Pristine Advisers, LLC

(631) 756-2486

EQUUS ANNOUNCES RESULTS OF

ANNUAL SHAREHOLDER MEETING

HOUSTON, TX – June 25, 2014 – Equus Total Return,

Inc. (NYSE: EQS) (“Equus” or the “Fund”) announced the results of the Fund’s Annual Meeting of Stockholders

which took place on Tuesday, June 24, 2014. The purpose of the meeting was to: (i) elect nine director nominees, each for a term

of one year; (ii) ratify the appointment of UHY LLP as the Fund’s independent auditor for the fiscal year ended December

31, 2014; and (iii) approve on a non-binding advisory basis, the compensation paid to the Fund’s named executive officers

in 2013.

Holders of 70.32% of the Fund’s outstanding shares were present

in person or represented by proxy at the Annual Meeting and approved the election of the nine director nominees, the appointment

of UHY for fiscal year 2014, and the compensation paid to the Fund’s named executive officers in 2013. The specific voting

results of the Annual Meeting are set forth in the Fund’s Current Report on Form 8-K filed today with the Securities and

Exchange Commission.

About Equus

The Fund is a business development company that trades as a closed-end fund on the New York Stock Exchange, under the symbol "EQS".

Additional information on the Fund may be obtained from the Fund’s website at www.equuscap.com.

This press release may contain certain

forward-looking statements regarding future circumstances. These forward-looking statements are based upon the Fund’s current

expectations and assumptions and are subject to various risks and uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements including, in particular, the risks and uncertainties described in the

Fund’s filings with the SEC. Actual results, events, and performance may differ. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as to the date hereof. The Fund undertakes no obligation to release

publicly any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof

or to reflect the occurrence of unanticipated events. The inclusion of any statement in this release does not constitute an admission

by the Fund or any other person that the events or circumstances described in such statements are material.

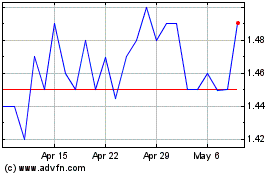

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

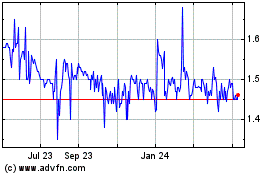

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024